Types Of Health Coverage

There are multiple types of health insurance plans. Understanding the difference between each plan type can help you select the best provider depending on your needs. Lets take a look at 4 of the most common types of health insurance plans.

Keep in mind that not every health insurance provider offers every type of plan. Some providers only offer 1 plan type, while others offer all 4. Make sure you consult with your plan provider and understand the plans structure before you lock yourself into health insurance.

What About Healthcare Cost Sharing Ministries

A health care sharing ministry is an organization that facilitates sharing of health care costs among individual and families who have common ethical or religious beliefs. A health care sharing ministry is not actual insurance, is not regulated by the Department of Insurance, does not use actuaries, does not accept the risk or make guarantees, and does not purchase reinsurance policies on behalf of its members.

While members of these plans are exempt from paying the tax penalty for not having health insurance, there is still a significant risk to these plans. Because these plans are not actual insurance and because of the significant risk we do not endorse these plans.

What To Do If You Get Furloughed

If you get furloughed, some of these same options may apply. First, though, talk to your employer about what the furlough means for you. Generally, a furlough signifies the employers intention to rehire, but not the specifics of wages or health benefits.

Will they continue to pay for your health insurance during the furlough? If not, perhaps they would consider paying for part of the costs it cant hurt to ask. If they cant or wont contribute to your health insurance costs, get documentation to prove you lost your benefits. Then, explore whether COBRA, a marketplace plan or Medicaid might work.

Even in the best of times, navigating health insurance options can be overwhelming. There are options available to protect you and your family financially. Finding the right coverage while you are unemployed can help you weather this uncertain time.

Read Also: Where To Go For Health Insurance

What Kinds Of Health Insurance Plans Are Available On The Marketplace

There are four levels of health plans that you can buy on the Marketplace: Bronze, Silver, Gold, and Platinum. Each level pays a different portion of your health care bills.

You will also pay a portion of your health care expenses through your monthly premium, copays, deductible, and coinsurance. The amount you pay depends on your plan.

The right plan to choose will depend on many factors, which vary from one person to another.

Will My Family Members Qualify For The Same Health Plan That I Do

It depends. You can enroll as a family. But in some cases, some family members may also be eligible for subsidies or other programs, depending on age, income and disability, or caregiver status. This guide, published on June 22, was updated on July 19 with additional resources for non-English speakers.

You May Like: What Is The Best Health Insurance In Philippines

Explore Health Care Sharing Programs

Health care Sharing Programs are a very new phenomenon. These programs are defined by a group of like-minded people banding together to help pay each others medical expenses.

The most well-known health care sharing programs are Christian-based and a belief in the Christian faith is required to participate.

Dr. Jim Dahle, the White Coat Investor, describes the programs like this: One option that one of my partners has used is to use one of the Christian health sharing ministry kind of options. This isnt really health insurance but its similar to it, in that you can use it to help decrease the burden of unexpected health care costs.

The real benefit is its dramatically cheaper. Now, it doesnt cover some things that health insurance covers. So, theres some risk there but his theory is, if you develop something thats terrible or some chronic condition, within a few months, youll be able to go on the exchange and buy an Affordable Care Act eligible policy and kind of hedge bets that way.

Here are some of the more popular Christian health care sharing programs:

AlieraCare may be more flexible and only require a statement of belief. You can be Christian, Jewish, Muslim, or non-denominational to participate.

Individual And Family Health Plan Guide

This guide will help compare differences between ACA compliant plans and Non-ACA plans. Non-ACA plans can save you a great deal of money and offer greater access to providers. Having said that, Non-ACA plans arent for everyone. If you have significant health issues and very specific needs you may need to stay in an ACA plan. Keep reading for more information.

Non-ACA Short Term Medical plans

Cost* Those whose incomes are within the sweet spot can obtain sizable subsidies making their ACA plan little to no money.

Don’t Miss: Where To Get Short Term Health Insurance

How Does Medicaid Coverage Work

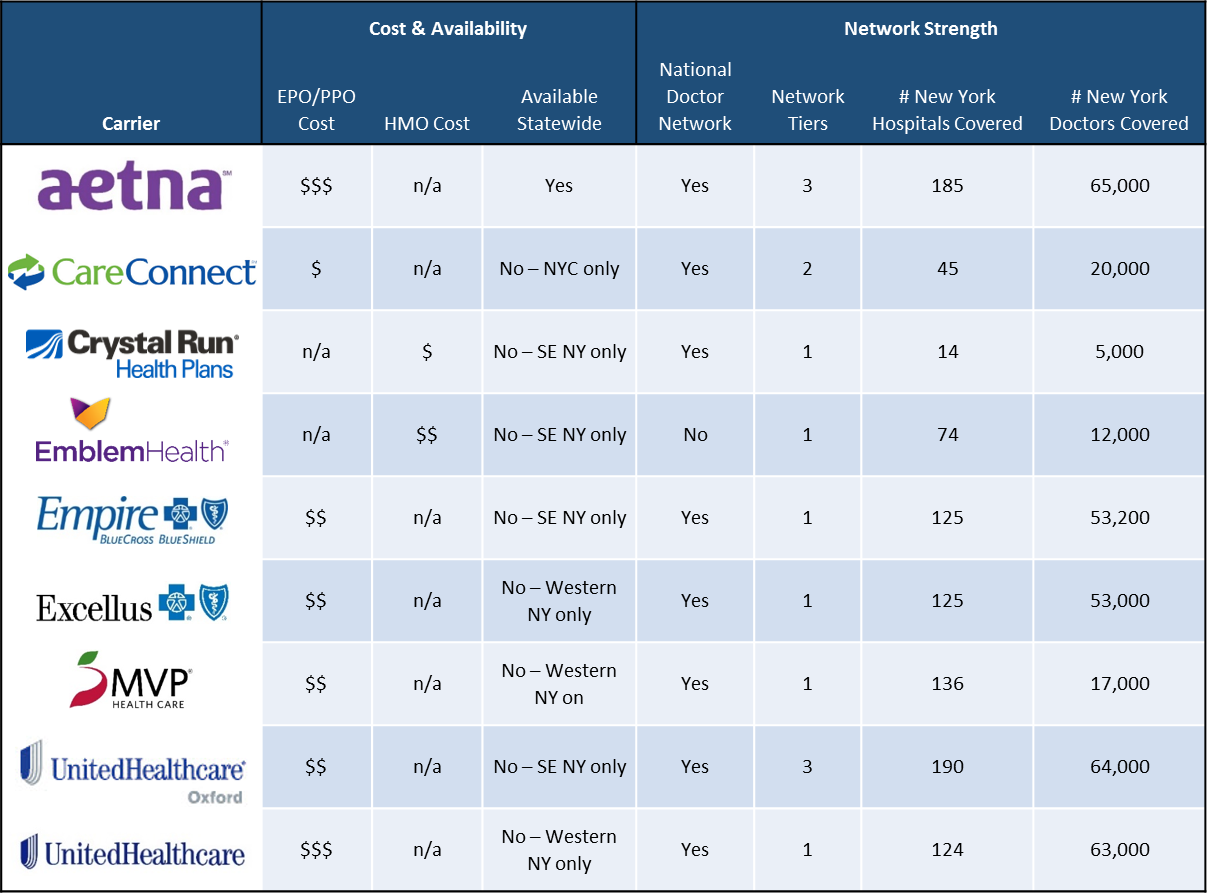

If you apply for Medicaid in New York, you will be asked to select a health plan managed by an insurance carrier, such as UnitedHealthcare or Empire BlueCross BlueShield. These insurance companies also sell individual health insurance policies and small-business coverage, and the plans themselves operate similarly.

Each Medicaid plan will come with a network of doctors and health care providers that accept the insurance.

However, health plans offered as part of the Medicaid program may have a different network of doctors when compared to other plans offered by the same insurance carrier. If you have a physician you prefer, it’s important to make sure they are covered in the new network.

Find Affordable Healthcare That’s Right For You

Answer a few questions to get multiple personalized quotes in minutes.

HealthCareInsider.com is owned and operated by HealthCare, Inc., a privately-owned non-government website. The government website can be found at HealthCare.gov.

This website serves as an invitation for you, the customer, to inquire about further information regarding Health insurance, and submission of your contact information constitutes permission for an agent to contact you with further information, including complete details on cost and coverage of this insurance.

HealthCareInsider.com is not affiliated with or endorsed by any government website entity or publication.

If you are experiencing difficulty accessing our website content or require help with site functionality, please use one of the contact methods below.

For assistance with Medicare plans dial 888-391-5203

For other plans please dial 888-380-0672

Read Also: What Is A Gap Plan Health Insurance

What Are My Obligations As A Small Business After Enrolling In A New York Group Plan

According to New Yorks Department of Financial Services, in order to participate in HealthyNY, a small business must meet all of the following criteria:

- As the employer, you contribute at least 50 percent to paying for monthly employee premiums.

- 50 percent of your eligible employees participate in the group health insurance program. Employees who have health insurance through another source can count toward the 50 percent participation requirement.

- The plan is offered to all employees who work 20 or more hours per week and are paid $43,000 or less .

- At least one employee who earns wages of $43,000 or less enrolls in the plan.

Once you offer group health insurance coverage and meet New York State requirements, your business may have access to significant tax advantages.

For example, the monthly employee premiums that your business pays are usually 100% tax deductible. Offering small business health insurance can also mean reduced payroll taxes.

Do I Have To Use The Marketplace To Get A Marketplace Plan

The only way to get a marketplace plan or cost assistance is through your states Health Insurance Marketplace. That being said, some major brokers and providers can help you find out if you qualify for subsidizes and some can help you enroll in a marketplace plan. So in some cases you have your choice between getting help from your states marketplace or from an outside broker or agent. The benefit to choosing an agent outside the marketplace is that they can present other non-marketplace plan options too.

Recommended Reading: Do Employers Pay For Health Insurance

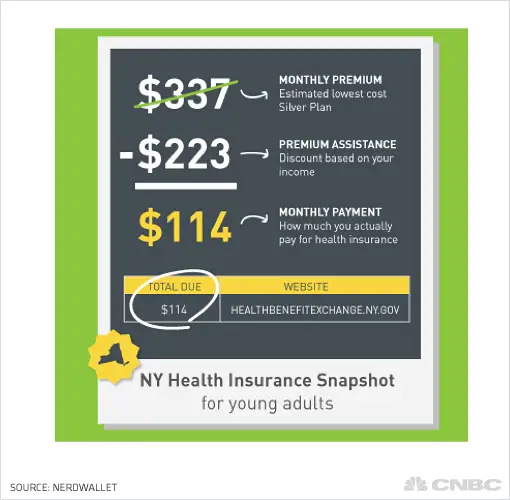

New York Health Insurance

Finally, the ability to compare New York health insurance plans side by side with the top-rated carriers in the country. We at Vista Health Solutions specialize in making New York health insurance shopping simple and convenient for individuals, families, the self-employed, small businesses, and groups. You will get the best rates of the most comprehensive medical insurance in New York right at your fingertips.

Looking for NY health marketplace plans? Visit our New York Health Benefit Exchange Guide for more information.

Unlike other NY health insurance sites on the web, we at Vista Health Solutions allow you to shop anonymously for health plans in New York without entering personal information. Get quotes with full search results for health insurance in New York instantly after answering a few short questions. Well return the best New York Health insurance policies for you. Like what you see? Complete our online application in minutes and one of our Health Insurance Specialists will work to get your policy approved.

And were not just New York-exclusive. Residents from all 50 states can use our quote engine to get matched with the leading health insurance companies across the country. Simply type in your ZIP code above and youre on your way to comparative health insurance quotes in minutes. Want more information about health care and Health Care Reform in your state? Visit our Health Insurance by State directory.

What If I Already Have Health Insurance

If you already have coverage through your employer or directly through an insurance provider but are eligible for lower premiums, you can switch to New York State of Health. But you may not qualify for tax credits if you opt out of your employers plan unless those premiums exceed a certain portion of your household income. The premiums would need to be more than 9.83 percent of your household income for individual coverage or more than 8.27 percent for family coverage in order for you to qualify for the tax credits. If you get coverage through the Consolidated Omnibus Budget Reconciliation Act of 1985 because you were terminated from a job or were put on reduced hours, you should be receiving a temporary COBRA premium subsidy that covers 100 percent of your monthly premium cost. This premium assistance, made possible through the American Rescue Plan, runs through the end of September or the end of your last month of COBRA eligibility, whichever comes first. If youre on COBRA, you may want to sign up for a marketplace plan that starts as soon as your COBRA coverage ends. If youre not sure about whether making this switch makes sense for you, you can ask for free advice from a certified insurance broker.

Recommended Reading: Do You Have To Have Health Insurance In Arizona

Child Health Plus Coverage For Children

In New York, Child Health Plus is a health insurance program for children in households that have incomes too high to qualify for Medicaid but are less than 400% of the federal poverty level. Like Medicaid, Child Health Plus plans are managed by the same insurance carriers on the individual and small-business market.

For families with multiple children, the maximum contribution is three times the per-child premium. For example, if you fall into the $9-per-child threshold group, then the maximum you would pay for all your children would be $27, even if you purchase coverage for more than three children.

Maximum monthly income to be eligible for Child Health Plus: By number of children

| Cost per month |

|---|

What Metal Tier Of Health Insurance Should I Purchase

The best metal tier of health insurance will depend on your health, insurance needs, age and family situation. Generally, younger and healthier individuals will not require a higher metal tier such as Gold or Platinum since they will not use the insurance as frequently.

On the other, families with children may want to consider Silver health insurance as this policy will have considerably more coinsurance benefits compared to Bronze or Catastrophic. Individuals with monthly drug prescriptions or personalized health care will want to consider a Gold plan or higher since these provide the most benefits. Read more

Don’t Miss: Does Health Insurance Cover Gynecologist

How To Apply For Health Coverage In Your New State

- Moving to a new state makes you eligible for a Special Enrollment Period. This means you can enroll in new coverage or change plans even though the annual Open Enrollment Period is over.

- How you apply depends on whether your new state uses HealthCare.gov or its own website. If your new state appears on this list, your state has its own website where youll apply.

- If your state uses HealthCare.gov, follow these instructions to start a new application.

Note: If you move within the same state but new coverage options and savings arent available to you, update your HealthCare.gov profile anyway with your new address. This way, the correct one is on file.

Use Obamacare For Early Retirement

Whether you love the program or hate it, for a few years, Obamacare did make early retirement health insurance costs much more affordable.

One of the ideas behind Obamacare was that everyone could get insurance preexisting conditions were not a factor. This was especially useful for people in their 50s and 60s most of whom have had or are facing some kind of health issue.

While you can still get coverage if you have a preexisting condition, Obamacare insurance has gotten a lot more expensive and the future of the program is in flux.

Many insurers have significantly raised premiums, in part because the Trump administration decided to stop payments to insurers that cover the discounts they are required to give to some low-income customers to cover out-of-pocket costs.

Nonetheless, if you are retiring early, it is still worth it to explore your Obamacare health coverage options on healthcare.gov.

Recommended Reading: How To Understand Health Insurance Plans

How To Buy An Affordable Ny Individual Health Plan

Lets begin with the simplest and most basic rule of buying any insurance, dont buy more insurance than you need.

Heres what I mean:

When it comes to insuring your car, you probably dont choose a deductible of $250 because you know the premium would be too expensive, right? You would probably choose a deductible of $750 or $1000 because you know that in the event of an accident, you could pay some money out of pocket.

Well, this same concept applies to buying health insurance and making your coverage more affordable. If you want the insurance company to pay every time you go to the doctor for a sniffle or ache, your premiums are going to be very expensive.

On the other hand, if you have a policy with a deductible where you pay, lets say the first $2500 for medical care and then the insurance company pays 100%, you will save a lot of money on your premiums.

In other words, the higher the deductible you can afford, the lower your insurance premiums will be. Its a balancing act between how much you can afford in monthly premiums and coverage that fits your lifestyle and needs.

The mistake that most people make is they dont do the math of how much they can pay out of pocket if they have a major medical expense. We have all been conditioned over the years to think the insurance company is going to cover every procedure, every exam, every pill and every medical bill.

Tips On Buying An Individual Or Family Health Plan

Purchasing an individual health insurance policy has never been easier. There are four simple tips to follow:

1. Policies can be purchased through a licensed health insurance agent such as our company, Healthplansny. Just go to our individual health insurance page to download our rates and plans. Then call us at 914-633-1717 to discuss your options. .

2. You can purchase a plan through the New York Health Insurance Marketplace. This can be a bit time consuming or overwhelming for many people. However, the State claims they have licensed agents available to help by phone if you run into problems. Expect long hold times.

3. Research your desired coverage level that you can afford. There are 4 metallic tiers to choose from: Platinum, Gold, Silver and Bronze. The Platinum plans have the least out of pocket expenses but the highest premiums. The Bronze plans have the lowest premiums but the highest out of pocket expenses for medical care.

4. Once you found a health plan that fits your needs and budget, complete the application and pay the first months premium. You are on your way to owning an individual health plan!

Recommended Reading: What Is Employer Group Health Insurance

Short Term Medical Insurance Stm

Due to recent changes in the law, these plans are now able to be purchased for 36 months at a time in many states.

STM plans are low-cost alternatives to the expensive ACA options. They are 100% real health insurance with large PPO networks. There are many benefit levels available to suit all budgets. While these plans do not cover pre-existing conditions and typically offer very little in the way of prescription coverage, they provide maximum premium savings.

Unitedhealthcare Senior Care Options Plan

UnitedHealthcare SCO is a Coordinated Care plan with a Medicare contract and a contract with the Commonwealth of Massachusetts Medicaid program. Enrollment in the plan depends on the plans contract renewal with Medicare. This plan is a voluntary program that is available to anyone 65 and older who qualifies for MassHealth Standard and Original Medicare. If you have MassHealth Standard, but you do not qualify for Original Medicare, you may still be eligible to enroll in our MassHealth Senior Care Option plan and receive all of your MassHealth benefits through our SCO program.

You May Like: Does Health Insurance Cover Daycare