How Do I Find Affordable Health Insurance

Group plans are generally cheaper than individual plans. So if you are eligible for onethrough your employer, your union, or some other associationthat’s your best bet, in terms of coverage for the money. If that’s not an option, the public health marketplaces established by the Affordable Care Act offer affordable health insurance for individuals. In most of the U.S., you can sign up for a plan offered through the federal government via the HealthCare.gov site. However, 12 states run their own marketplaces, and residents sign up via their sites.

Who Can Consider Taking Out Family Health Insurance

Anyone who is a resident of the UAE and has a spouse and three children or more, for annual premiums below AED 10,000 can take up this type of policy. These are considered to be standard family covering criteria in many countries worldwide. Newer policies may vary slightly in terms of deductibles and coverage levels however, the basic structure remains the same.

For example, some insurers allow you to include parents if their age is less than 90 years old . Under this plan, they will pay lower premiums compared to insuring them separately. There are also additional options available such as expanding the plan to include childrens children. This way, your grandkids can also be covered by the same insurance policy.

How Do I Choose The Best Health Insurance For My Family

How to Select Best Health Insurance Policy Choose Adequate Sum Insured Amount. Choose the Right Coverage Type. Check the Flexibility to Increase the Total Amount You Are Insured For. Check the Pre-existing Disease Waiting Period. Check the Maximum Renewal Age. Insurer with High Claim-settlement Ratio.

Also Check: Starbucks Benefits For Part Time Employees

Average Health Insurance Cost By State

Residents of different states can see some pretty stark differences in the average cost of health insurance. Which states have the highest premiums, and which ones have the lowest?

Using ValuePenguin data on certain states, the state with the highest monthly rates is Alaska at $426 for a 21-year-old. Multiplying for someone who is 30, that becomes $483.51. It becomes $544.43. for a 40-year-old, and a whopping $1,156.16 for a 60-year-old. The second-highest rate is in Wyoming at $366. Doing that math again, for those who are 30, 40 and 60 that figure turns into $415.41, $467.75 and $993.32, respectively.

These are particularly extreme examples, but even states that arent quite as high compared to the average rates can have monthly premiums not everyone can afford. The average health insurance premium for a 21-year-old in Florida is $285 not as large as Alaska or Wyoming, but still a lot, especially as a person gets older .

Still, there are states where premiums arent as expensive as these. Utah, for example, has an average cost of $180. While $180 can still be quite a lot of money per month for someone working in Utah at 21 , it is still a lesser figure than other states. In Montana, the average health care premium for someone at 21 is $210 per month. Check your state for more details, because the range of premiums can vary even more wildly than you may expect. ValuePenguins list did not include every state, such as Massachusetts.

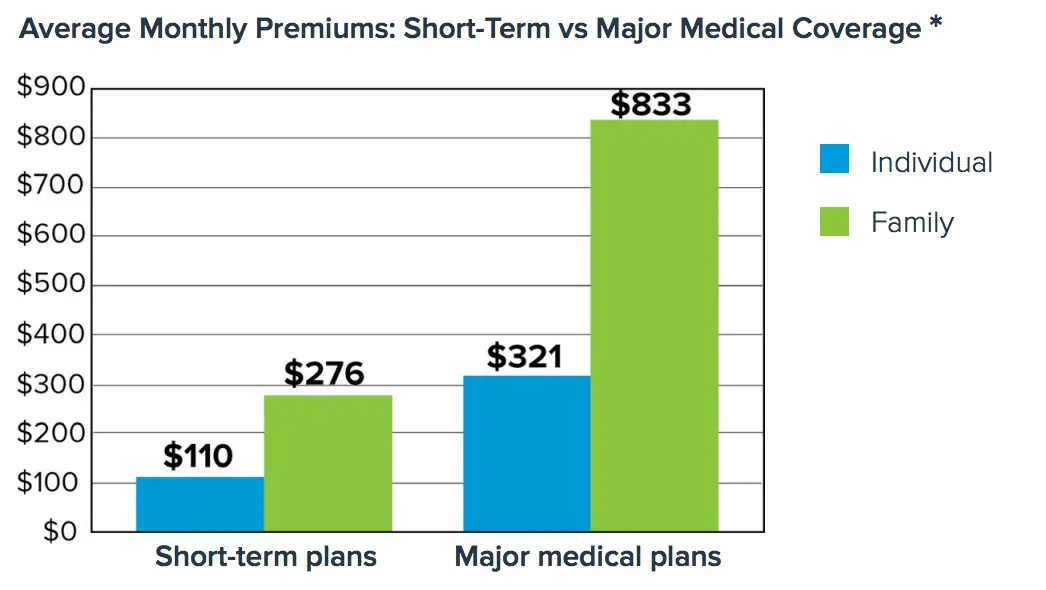

Group Coverage Vs Individual Health Insurance Cost

Many people assume that individual health insurance is more expensive than group health insurance, but is that really true? How exactly do individual health insurance premiums compare to group health insurance premiums?

In this article, well compare the cost of group health insurance and individual health insurance, as well as discuss another budget-friendly health insurance option to make your insurance even more affordable.

Also Check: Can You Add A Boyfriend To Your Health Insurance

Beyond Your Monthly Premium: Deductible And Out

- Deductible: How much you have to spend for covered health services before your insurance company pays anything

- Copayments and coinsurance: Payments you make each time you get a medical service after reaching your deductible

- Out-of-pocket maximum: The most you have to spend for covered services in a year. After you reach this amount, the insurance company pays 100% for covered services.

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

Don’t Miss: Starbucks Medical Insurance

How Much Is Family Health Insurance Per Month

The average premium for a family of 4 in 2020 is was $1,437, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use, and number of plan members.

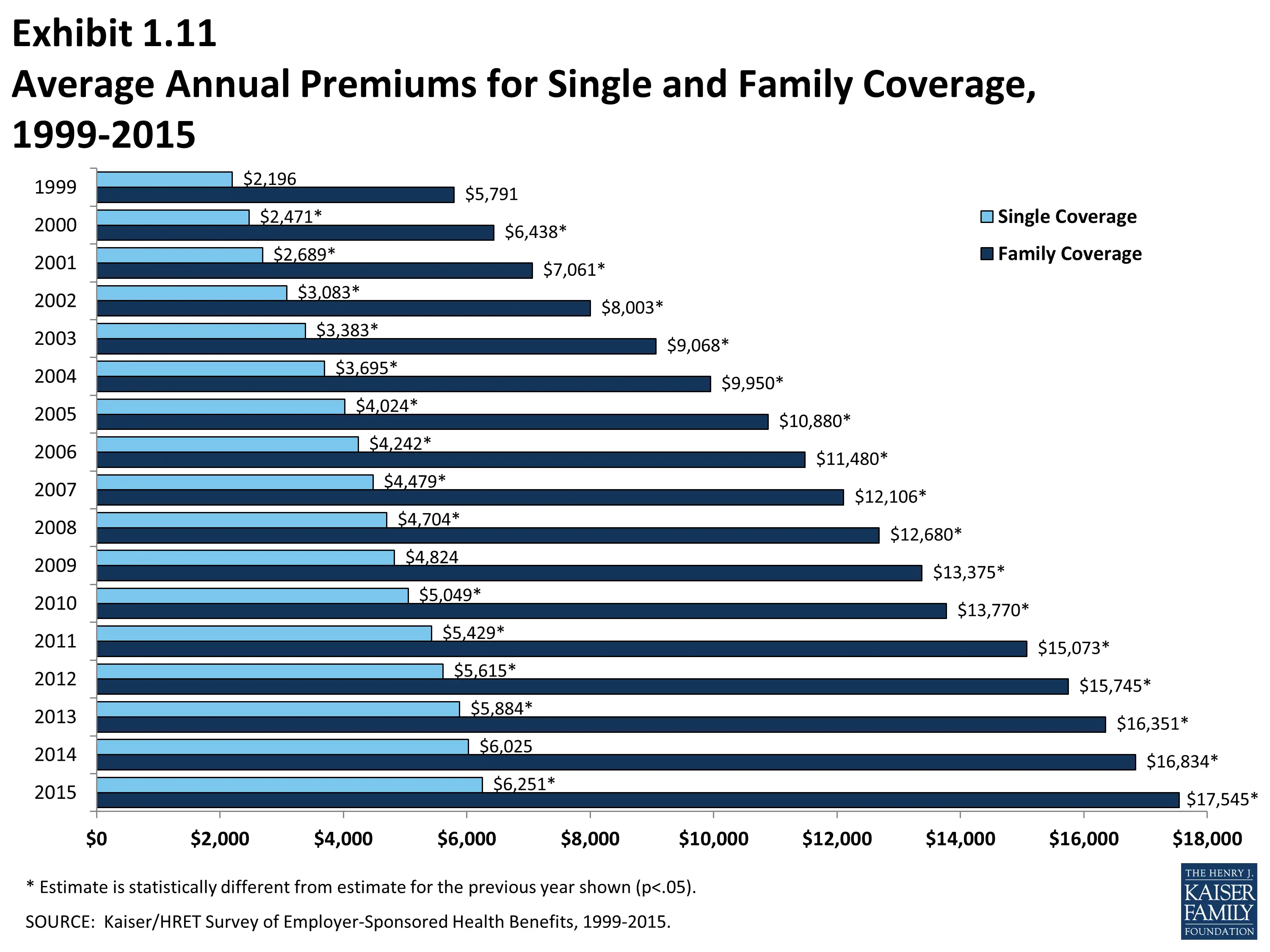

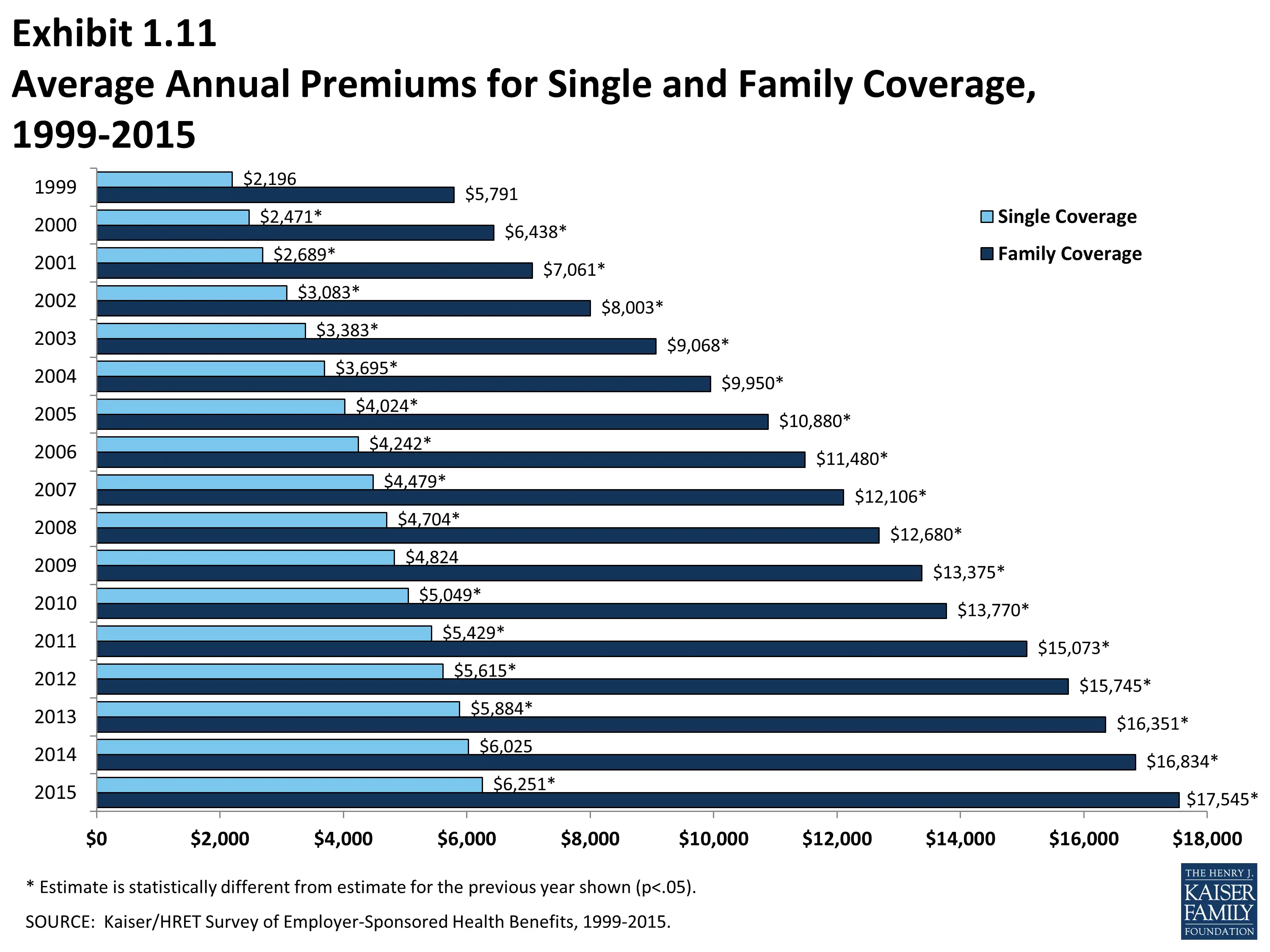

Us Family Health Insurance Premiums Surpass $21000

The average premium for family coverage in employer health plans is up about 4% this year to more than $21,000 and employers are picking up more of the tab.

Workers on average arent being asked to pay more in premiums for family coverage and those with individual coverage through their work arent seeing increases in deductibles, according survey results Thursday from the California-based Kaiser Family Foundation.

The findings speak to the stability of health benefits in the pre-pandemic economy when employers were competing for talent in a tight labor market, said Matthew Rae, an associate director at the foundation, which has surveyed employers on health plan costs for 22 years. Obviously, the current labor market is vastly different, Rae noted, with last months unemployment rate roughly twice the comparable figure last year.

The premiums and health plans that we were asking about were plans that employers were setting a year ago when we had historically low unemployment, Rae said.

I would expect that not that many employers are going to make huge changes in the generosity of their plans over the next couple of months, he said. But the economic situation is really hard to put your finger on. It could be that employers will have to think about the generosity of their plans if they are really facing a lot of other costs.

Twenty-one thousand dollars each year just to cover a family of four its an unbelievable amount of money, Rae said.

Recommended Reading: Starbucks Health Insurance Cost

Total Costs & Metal Categories

When you compare plans in the Marketplace, the plans appear in 4 metal categories: Bronze, Silver, Gold, and Platinum. The categories are based on how you and the health plan share the total costs of your care.

Generally speaking, categories with higher premiums pay more of your total costs of health care. Categories with lower premiums pay less of your total costs.

So how do you find a category that works for you?

- If you dont expect to use regular medical services and dont take regular prescriptions: You may want a Bronze plan. These plans can have very low monthly premiums, but have high deductibles and pay less of your costs when you need care.

- If you qualify for “cost-sharing reductions” : Silver plans may offer good value. If you qualify, your deductible will be lower and youll pay less each time you get care. But you get these extra savings only if you enroll in Silver. If you dont qualify for CSRs, compare premiums and out-of-pocket costs of Silver and Gold prices to find your right plan. See if your income estimate falls in the range for cost-sharing reductions.

- If you expect a lot of doctor visits or need regular prescriptions: You may want a Gold plan or Platinum plan. These plans generally have higher monthly premiums but pay more of your costs when you need care.

How Much Health Insurance Coverage Do You Need

CNBCTV18.com

While buying health insurance, one is often in a fix about the amount of coverage one should go for. A conservative estimate should be at least Rs 5 lakh, considering the rising medical costs.

Given the rising medical costs and inflation, it is important to be prepared for any unforeseen expenses due to medical emergency. The best way to do so is by purchasing a health insurance policy. However, when it comes to getting a policy, the biggest question is how much should be the size of the health cover. Similarly, it’s always confusing to select a medical insurance that meets all your requirements apart from covering critical diseases.

Here are a few things to help you decide on a suitable insurance policy for your medical emergencies.

How much health insurance do you need?

The coverage need and cost of your health insurance plan will depend on your needs. The cost of premium for the insurance policy could vary depending on whether you want to get an individual policy or a family floater that covers your loved ones as well. If you want to include senior citizens in the policy, then you will need to consider the cost of treatment for their existing ailments too before deciding the coverage.

Don’t Miss: Starbucks Pet Insurance

Factors Affecting The Health Insurance Costs

What amount does medical coverage cost? Over the United States, Americans pay extremely high expenses month to month or yearly for medical coverage. While these charges are not controlled by sexual orientation or prior medical issue, on account of the Affordable Care Act, various different components sway what you pay. Numerous components that influence the amount you pay for medical coverage are not inside your control. In any case, its acceptable to have a comprehension of what they are. Given below are these factors to assist you with figuring out the amount you may pay for medical coverage in 2020 and why. Here are some key factors that influence how much medical coverage charges cost:

The Average Cost Of Health Insurance By Company

What you can expect to pay for health insurance differs by the insurance company. Some insurers want to grow, so they offer more attractive rates. Others are more cautious and will charge more to be sure they can cover their members health care costs.

Among national carriers, rates can vary widely. For example, the average Silver plan premium for Kaiser Permanente plans is $427 per month. Anthem charges an average of $481, while UnitedHealthcares average rate is $641. Newer plans, such as Bright Health and Oscar, fall somewhere in the middle, with average monthly premiums of $488 and $492, respectively.

Premiums are not the only factor when choosing a health plan. Some of the most affordable plans can have coverage that falls short of your needs. The best health insurance companies can cost a bit more, but are surprisingly affordable and give you the best value for your money.

Consider the plan’s total cost by looking at things like deductibles, coinsurance and out-of-pocket maximums. Check that your preferred doctors and facilities are in-network to save money and hassle. Be sure to also review quality and customer satisfaction ratings available on the Marketplace to make sure youre not going to encounter more annoyances than a plan’s potential premium savings are worth.

Average Health Insurance Premiums by Company

Scroll for more

- $641

Recommended Reading: Does Medicare Pay For Maintenance Chiropractic Care

How Much Does Family Health Insurance Cost Per Month

During COVID-19, protecting yourself and your familys health is important but so is protecting your wallet from unexpected medical costs. A comprehensive family health insurance, also known as a family floater plan, keeps both your family and your finances healthy.

If a member of your family meets a healthcare emergency and they are not covered under a policy, you could end up paying the expensive hospital costs and many other related expenses all out of pocket, which would have the potential to break your bank.

A family floater plan covers yourself, your spouse, dependent children, parents and in other cases even your parents-in-law. Each member of your family can be eligible for making a claim up to the total sum insured. In addition to the basic cover, family insurance includes cover for hospitalization bills, expenses related to coronavirus and other diseases.

However, the question arises How much does family health insurance cost per month?

To give the answer, below is a list of the best family floater policies in India along with their key features and approximate annual premium costs.

The premium is subject to change depending on no pre-existing diseases, family members, no smoking or alcohol habits, and the sum insured amount. For complete details about these plans as well as other family floater plans, .

Primary Reasons Why You Should Buy Family Health Insurance

In Simple Words

Informed Choices Confident Decisions

Choosing the right health insurance for you and your family is an important decision. We understand, and we want you to feel confident in your choice. Let us help you find the insurance plan that’s right for you.

Were Here to Help

Sometimes talking over the phone is easier. Were here to listen to your questions and help you get answers. Call us at 888.630.2583.

You May Like: Does Medical Insurance Cover Chiropractic

Choosing Health Insurance For Large Families

Choosing health insurance for large families can be more complex and more expensive. The specific price you pay depends heavily on how many people are in your family and what your specific health needs are. Generally, if everyone in your family is in good health, your premiums and deductibles will be lower. This makes it wise to invest in a family health insurance plan that covers preventative care, as that will help you stay healthy and achieve lower prices over the long haul.

If you are considering health insurance for large families, youre likely to pay more in total, but less per person. You are also likely to pay less if you get your family health insurance plan from your employer, since employer-sponsored health insurance often covers larger numbers of people and faces less risk per person.

Does Affordable Care Act Apply To Expats

Unfortunately, not anymore. Today, the US Government does not require anyone to subscribe to an ACA-compliant health insurance policy. However, a handful of states still impose a penalty on people who do not comply with the ACA. These are:

- California

- Massachusetts

- New Jersey

Other states are also currently processing legislation that will make health insurance compulsory, so before you move to the USA, check your new states laws.

Also Check: How Much Is Temporary Health Insurance

You May Like: Starbucks Health Insurance Part Time

What Does Ohip Cover

OHIP provides full coverage for many medical necessities.

OHIP covers part or all of:

- Doctor visits

- Cosmetic procedures

- Immunizations for travel

Services not covered under OHIP are expensive and can bring on a massive financial burden when you are least able to deal with them. We highly recommend getting a private insurance plan.

It can help you not only access better care when you need it but also offer peace of mind that you will be covered for large, unexpected expenses that will avoid out-of-pocket costs.

The Qualified Small Employer Hra

With a QSEHRA, employees purchase their own health insurance and get reimbursed for medical expenses, health insurance premiums, and other qualified costs with tax-free dollars by their company. To qualify, a company must have fewer than 50 full-time employees and cant offer a group health insurance policy to any employee.

Read Also: What Causes Health Insurance Premiums To Increase

Read Also: Do Starbucks Employees Get Health Insurance

Public Marketplace Family Plans

If you have a low income and a large household size, the public marketplace can offer you financial assistance, covering the cost of a certain percentage of your monthly premiums. However if youre not qualifying for a subsidy then the marketplace can be very costly for a family of any size, increasing in rates as the family size becomes larger.

Additionally, public marketplace have higher deductibles which are often required to be met in order to start using benefits. Similarly, if a deductible needs to be met in case of any major illnesses or injuries, a higher deductible means more money paid out of pocket to provide treatment. In this case, private insurance plans may be more cost effective.

Nonetheless if you have multiple family members who require treatment for major medical conditions then the public market will offer superior coverage as legally they cannot deny people based on health

The Average Cost Of Health Insurance For Job

The health insurance marketplace is just one way to get health insurance coverage. According to the Kaiser Family Foundation, most Americans get health insurance through a job or from the government via Medicare, Medicaid or military benefits.

Job-Based Insurance

In 2021, the Kaiser Family Foundation reported that the total cost of family coverage through employers averaged $22,221, with employees paying $5,969 of that. Individual deductibles averaged $1,669, though employee costs vary by type of plan, family or individual coverage and size of the company.

Medicare

Medicare is the government-run insurance program that covers nearly all Americans 65 and older. Original Medicare also known as Medicare Parts A and B covers hospital stays and medical care, respectively, and has set costs. Most people pay no premium for Part A but do pay a deductible and coinsurance, or a share of costs for longer-term facility stays. Part B premiums are $170.10 per month , and the 2022 Part B deductible is $233. Once you meet that deductible, you typically pay 20% of the bill for Medicare-approved charges.

Some Medicare enrollees choose to get prescription drug coverage or join a comprehensive managed care plan that combines all their Medicare benefits . Parts C and D are optional. Offered by private companies, costs for these coverages vary by carrier, plan and geography.

Medicaid

Read Also: Starbucks Dental Insurance