Healthinsuranceorg Outlines Four Reasons Not To Wait

Minneapolis, MN An extended deadline can encourage procrastination, but this is no year to wait to compare your health coverage options for Affordable Care Act plans. Healthinsurance.org released today four reasons why for many its best to enroll by Dec. 15.

The longer open enrollment period may seem like extra wiggle room during the busy holiday season, but for most marketplace buyers, Dec. 15 is still the deadline you want to keep in mind, said Louise Norris, a licensed agent and analyst with healthinsurance.org.

The enrollment window is longer this year through Jan. 15 in nearly every state. However, in most states, Dec. 15, 2021, is still the last day to enroll if you want your ACA coverage to take effect Jan.1, 2022. And this year, its more important to compare plans early, since this open enrollment includes unprecedented changes in the marketplace that affect the cost, availability and coverage of available health plan options.

Its never in your best interest to let your ACA coverage auto-renew from one year to the next, Norris said. Its one thing if you do your homework and actively decide to stay with the same plan. But you cant just count on your plan costs and coverage to stay the same, especially in 2022.

Here are some of the top reasons people should evaluate their health plan options for 2022 and do so before Dec. 15.

What A Life Insurance Medical Exam Entails

A life insurance medical exam doesnt require you to give up an entire day. It can take just 15 to 45 minutes, depending on what tests are included.

Youll generally be asked questions about your medical history during a phone interview before your exam, and the examiner will review them again in-person. Heres a sample of the type of information you should have on hand:

Names and dosages of medications, for past and current conditions.

Names, addresses and phone numbers of doctors visited in the past five years.

List of medical conditions, dates of diagnoses, treatment, treatment outcome and treating physician contact information.

Drivers license number and expiration date.

During the exam, your height, weight, pulse and blood pressure will be recorded. You likely will have to provide a urine sample and have blood drawn to test for health issues such as elevated cholesterol or blood sugar levels, and to screen for nicotine and drug use.

If youre over age 50 and applying for a high amount of life insurance, such as $1 million and up, you might be required to take an electrocardiogram which is painless. Electrodes will be placed on you to record the electrical activity in your heart. The guidelines for who needs an EKG will vary by insurer.

You wont have to undress during the exam, but its good to wear loose clothing if your test involves an EKG.

If youre age 70 or older, you might have to take an additional test of your cognitive ability.

Oregon Pharmaceutical Representative License Applicants

Effective the state of Oregon will require all individuals marketing or promoting pharmaceutical products to health care providers to obtain and maintain a valid license issued by the state’s Department of Consumer and Business Services. While the requirement does not go into effect until January 1, 2022, the state will begin accepting applications for the license via NIPR on . Please to review additional information related to this requirement and for information on how to submit your license application.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

What Do Health Insurance Agents Do

Health insurance agents are responsible for finding clients and selling them health insurance plans. Additional duties of health insurance agents can include:

- Forming relationships with clients and meeting with them to develop strategies.

- Helping clients settle claims by communicating with the insurance company.

- Using marketing strategies to attract new clients and promote insurance policies.

- Calculate premiums, present quotes to clients and maintain client records.

Customer service and communication are two key skills for health insurance agents, as they frequently meet with clients and work with them to solve problems and find the right insurance plans. Additionally, health insurance agents possess skills in sales as well as computer skills. Health insurance agents should also have a strong grasp of tax and healthcare laws to understand the details of their jobs fully.

Agents Help You Navigate Your Choices

Nothing can be more frustrating than trying to understand health insurance benefits and their costs. Unless you enjoy going through the fine print, a licensed health insurance agent can help you understand the terminology and what it means for your business.

A licensed insurance agent has a professional obligation to help small business owners obtain the appropriate insurance coverage. The agent should go over which coverages are available, and make recommendations based on the number of employees you have and what type of coverage you prefer.

Working with an insurance agent also allows someone who understands your business to match you with the right policies that meet your needs. When you dont work with an agent directly, you lose the benefits of personalized service.

Local agents also know the risks and issues that are specific to your area. This allows you to better understand how the choices in front of you are impacted by the type of business you operate and where you operate your business.

When helping you navigate your options, health insurance agents will take into consideration:

-

Local climate

Bottom Line: Licensed agents help you understand your insurance options and provide personalized service.

Don’t Miss: Starbucks Part Time Health Insurance

What Is A Health Insurance Agent

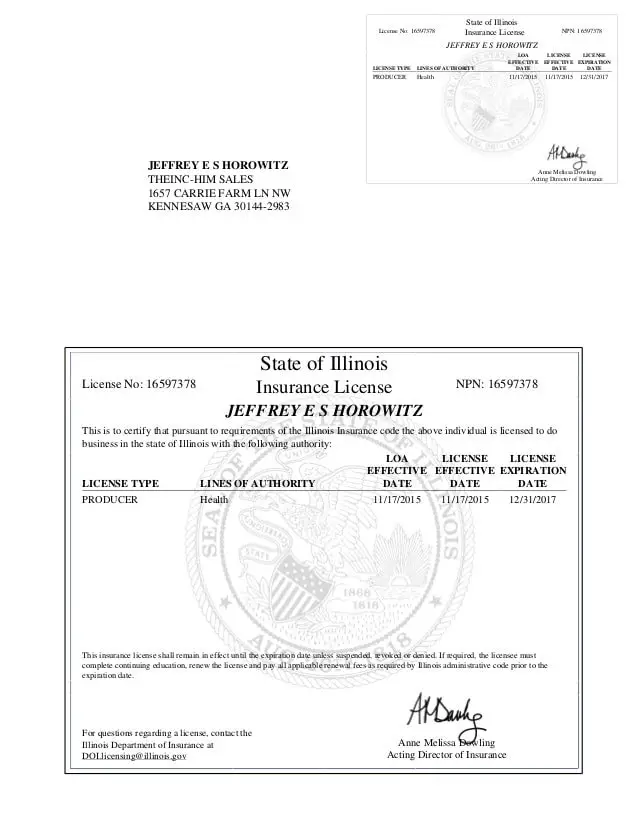

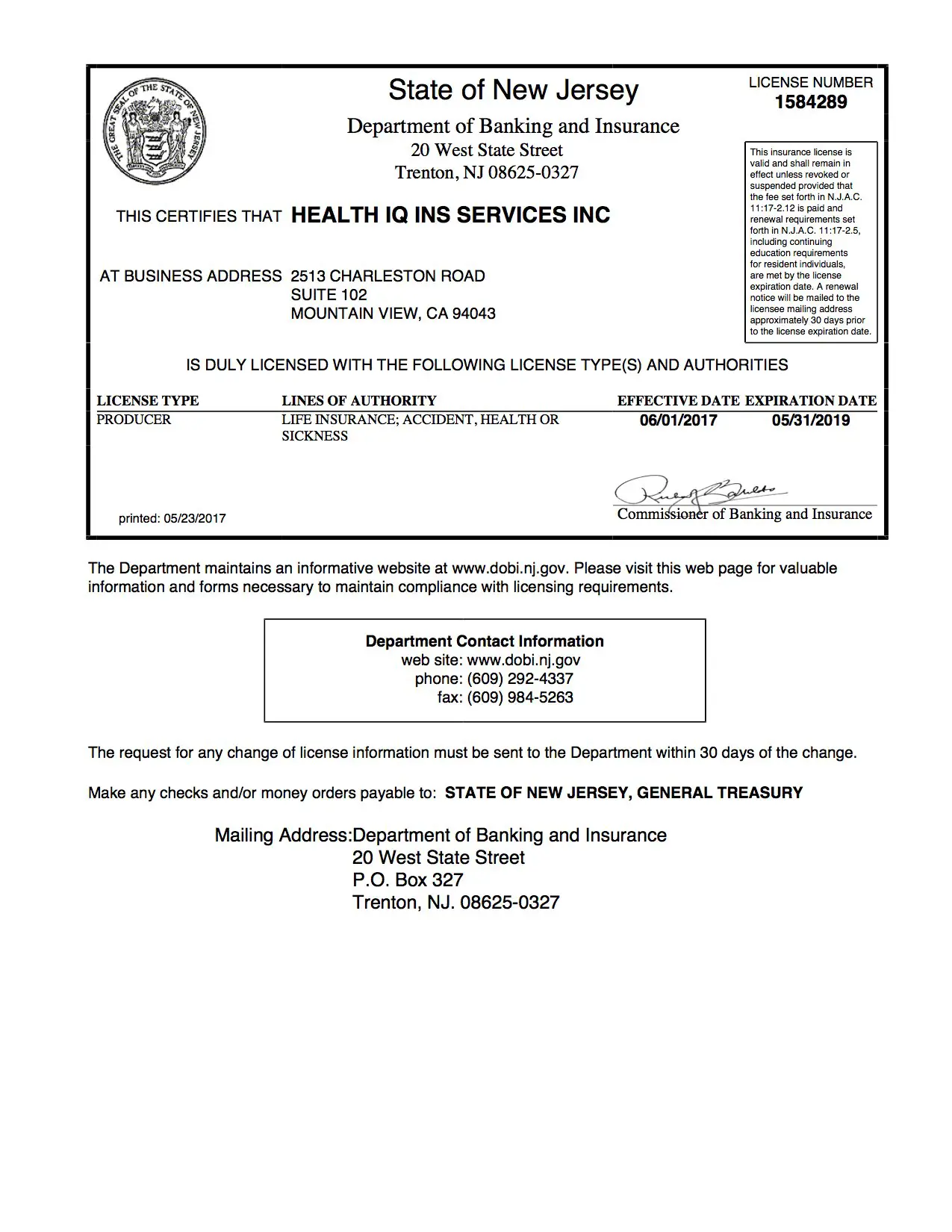

An agent is a licensed salesperson who represents one or more health insurance companies and presents their products to consumers. Agents are licensed by each state, and must complete continuing education in order to keep their licenses active. If they work with the health insurance exchange, they must also be certified by the exchange and complete the exchanges annual training process.

Although many agents represent more than one carrier , some are captive agents, which means that they work exclusively with one carrier.

Some insurance companies only use captive agents to sell their products, although this is fairly uncommon in the individual major medical market now that the Affordable Care Act has been implemented and agents/brokers help people select from among a variety of plans available in each states exchange.

About our health insurance quote forms and phone lines

We do not sell insurance products, but this form will connect you with partners of healthinsurance.org who do sell insurance products. You may submit your information through this form, or call to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

If you have questions or comments on this service, please contact us.

What Is On The Life And Health Insurance Exam

The content of your exam is contingent on the states specific regulations and the line of products you are looking to sell. There are examination content outlines available per state, and while there will be some variation, there is a shared basic structure.

You are asked to understand the concept of the insurance, how it can vary or become customized with policy riders or tax considerations, and how it is fulfilled to the insured.

For this example, we are looking at life insurance.

First, you will be expected to understand and differentiate the types of life insurance policies, such as:

Traditional Whole Life Insurance

- Limited-pay and single-premium whole life

- Return of premium

Next, you will also be expected to understand the types of policy riders, provisions, options and exclusions that can modify a policy.

Variables like accidental death, certain beneficiary designations, and dividend options require agents to get flexible about their understanding of the product.

Lastly, prospective producers will have to demonstrate an understanding of the application and the underwriting practices needed to deliver the policy.

You May Like: Starbucks Perks For Employees

What Do I Need To Know To Pass The Life And Health Insurance Exam

To become licensed as a Life and Health insurance producer, you will need to demonstrate entry-level knowledge of the industry by passing a state licensing exam. The testable topics include types of life insurance policies, annuities, qualified and nonqualified retirement plans, medical expense and managed care plans, disability income and long-term care insurance, Medicare, Medicaid, and Social Security benefits, group life and health insurance, policy provisions and applicable riders, the application and underwriting process, federal tax considerations and federal initiatives under the Affordable Care Act. You will also be tested on general insurance concepts, insurance contract terminology, and state-specific regulations based on the state where you are applying for a license.

How Can I Keep Enhancing My Knowledge After Completing The Posp Certification

We have another extensive training program conducted for our POSPs after certification. They help in enhancing your insurance knowledge and improving your sales and servicing skills. These training programs and events will cover the following:Advanced insurance knowledge to handle complicated casesKeep abreast with the latest insurance products and how to pitch themFun and interesting ways to learn various selling techniques which help in increasing your sales volumes.

We have another extensive training program conducted for our POSPs after certification. They help in enhancing your insurance knowledge and improving your sales and servicing skills. These training programs and events will cover the following:

- Advanced insurance knowledge to handle complicated cases

- Keep abreast with the latest insurance products and how to pitch them

- Fun and interesting ways to learn various selling techniques which help in increasing your sales volumes.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

What To Look For In A Good Health Insurance Broker

Youll be relying on your broker to find the best plan for your team, so its important to find an insurance expert who truly understands your business and employees needs. But once youve hired a broker to help you navigate plan selection, what should you expect from their services? Lets take a closer look.

What to Expect When Working with a Health Insurance Broker:

There isnt anything secret about your health insurance plan. All the information is available, but it may not be easily accessible or understandable. A health care insurance broker already knows these things from how to choose the right physician and how to file claims to how to pick the right plan for your family he or she will be able to guide you through the entire process.

Completing The Criminal Background Check

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Can I Work As A Pos Person From Home

At Digit Insurance, we primarily sell insurance policies online. This means, you as a POSP can work from home and use our online processes to sell and issue policies. Apart from having a smartphone, a good internet connection, and the required 15-hours training, theres nothing else you need to become a POSP.

At Digit Insurance, we primarily sell insurance policies online. This means, you as a POSP can work from home and use our online processes to sell and issue policies. Apart from having a smartphone, a good internet connection, and the required 15-hours training, theres nothing else you need to become a POSP.

Ehealth: Your Guide To Exchange And Off

As an insurance brokerage firm, eHealth is committed to helping you find affordable health insurance that meets your personal circumstances. Working with an eHealth health insurance agent or broker can help get you the insurance you need at the best price. We deal with a wide range of types of health insurance and services. And we have the qualifications needed to recommend the policies that best suit your needs ACA medical coverage through the government-run exchange, ACA- compliant coverage off the exchange, short-term policies, medical indemnity plans, and more.

Take a closer look. We invite you to explore some of the many types of plans available through eHealth and our licensed health insurance agents and brokers. Simply click here: Individual & Family Health Insurance.

Read Also: Starbucks Insurance Part Time

How Much Time Do People Spend Preparing

Many states require a pre-licensing education course, which can take between 20 and 40 hours to complete. It is best to space out your education modules, allowing time to master the material and take practice tests.

You should give yourself one month to prepare for the insurance licensing exam. Some may require more time, and some less. This ensures that you have time to study the material, take practice tests, and review any areas that you find you need to study again.

Tip:

Recommended Course

For insurance pre-license education, StateRequirement recommends:Kaplan Education Company

How To Get Your Insurance License

If youre interested in becoming a health insurance agent, one of the first things you need to do is take the licensing exam required by your state regulator. In California, thats the California Department of Insurance . In Nevada, its the Nevada Division of Insurance .

Below are six steps that put you well on way to your new career.

Also Check: Is Starbucks Health Insurance Good

Be Exemplary With Customer Service

Professionals working in the industry make sure their name and job title is remembered long after they talk to or introduce themselves to potential clients. An agent’s personality needs to be large enough to be kept current in the mind of a client without being offensive. Interpersonal skills and relationship-building, on top of competency with products and stamina, are extremely important. Successful agents show themselves as being capable, trustworthy and stable in addition to being experts in their field.

The agent who meets a potential client should bring something important and urgent to the client’s attention without placing too much pressure or appearing aggressive. This is a difficult talent to master when gauging interactions with future clients, be tasteful, use common sense and be sympathetic to others’ needs and emotions. Do not be offensive or pushy.

How To Become An Insurance Agent In Alabama

: Ethan Peyton

Getting your Alabama insurance license is the first step to becoming an insurance agent in Alabama. Whether youre interested in selling property and casualty insurance, life insurance, health insurance, or any combination of those lines of authority, this article has the information you need to get started.

The Alabama Department of Insurance has a 7-step process to getting your insurance license. Well walk you through step-by-step from the license application to insurance test prep, to the Alabama insurance exam, and beyond.

This guide has everything you need to know to get your Alabama insurance license quickly and easily.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Best Insurance Licensing Courses

If you are ready to begin your path as an insurance agent, your first major milestone will be to pass your states insurance exam. While the specific content on the exam is unique to each state, there are a lot of common elements that are tested, such as the types of insurance and how to develop and recommend a plan to new clients.

As you prepare for this critical step in the insurance licensing process, you may wonder just how difficult it is to pass the state exam. Fortunately, with some preparation, you will be able to demonstrate your knowledge of the insurance career path and pass the exam.

How Do Consumers Buy Health Insurance Coverage

If you dont have access to coverage provided by an employer, youll need to obtain your own health insurance in the market for individuals and families. You can visit your states marketplace/exchange to see the options that are available to you and how much the monthly premiums would be. If youre not eligible for premium subsidies or cost-sharing reductions , you might want to also check with a broker to see if there are additional plans available outside the exchange in your area.

If you feel that you can confidently manage your own enrollment and health coverage, you can enroll on your own. But the services of brokers and enrollment assisters are available free of charge, and they can help you manage the process.

Depending on your income and where you live, your state may provide you with Medicaid coverage. If youre eligible, your states marketplace will direct you to the application portal for Medicaid, and there are people available in your state who can help you complete the enrollment and answer any questions you may have.

If youre eligible for Medicare and dont have supplemental coverage provided by a current or former employer, youll also likely need to seek out supplemental coverage on your own, via Medicare Advantage or Medigap plus Medicare Part D.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees