How We Chose The Health Insurance Companies

We looked at short-term health insurance plans through insurance companies and independent health insurance marketplaces to discover what options exist. We investigated the waiting periods, qualifications, coverage types, common exclusions, maximum limits, deductibles, and copays across the different plans. Our goal was to highlight some of the best short-term health insurance options offered through reputable insurance companies to help you compare and decide if short-term health insurance is a good idea for you.

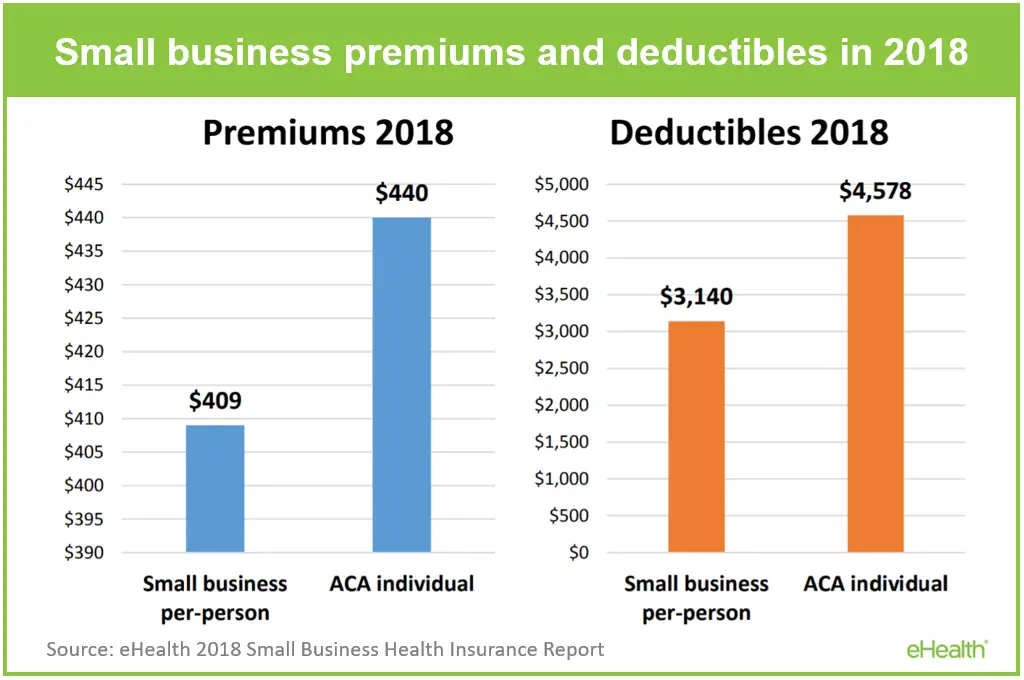

What Is A Deductible

A deductible is how much you have to pay toward your health insurance costs before your health plan will begin to pay for covered services in a given year. For example, if your deductible is $2,000 for the year, you have to pay for the first $2,000 in medical services. Some plans will pay for certain costs, like preventive services, before you’ve met your deductible.

Choose A Health Insurance Plan That Suits Your Needs

You should choose a health insurance plan based on your medical needs. You have to remember that some plans have high premiums and low out-of-pocket costs and vice versa.

For example, if you have a medical condition and anticipate that you may have regular visits to the doctor, you can go for a Gold plan that has high premiums but low out-of-pocket costs. On the other hand, you can go for the bronze plan if youâre young and healthy and do not anticipate regular visits to the doctor during the year.

Don’t Miss: Is Health Insurance Required In Indiana

Finding Your Best Health Insurance Coverage In Texas

Determining which health plan is the best for you and your family will depend on a number of factors. The primary factors to consider are:

- expected health care costs in a given year

- household income and the amount of savings you have in case of emergency

Gold plans are best for high expected costs

Consumers with higher expected medical care needs, especially those who have routine prescription needs, should tailor their choices toward higher coverage. This can include the Gold-tiered plans, which come with a higher premium but also reduce your out-of-pocket expenses should you need medical care.

Gold plans will have much lower copays, coinsurance and deductibles, meaning each additional visit to a provider will be cheaper than a lower-tier plan.

It is especially important to consider the copays and coinsurance for prescription medication, as this is typically the one area of plan benefits that has the highest routine use.

Silver plans are best for the average or low-income consumer

Silver plans are the only plans that come with a cost-sharing reduction variation, which allows lower-income households to benefit from cheaper copays, deductibles and coinsurance compared to a standard plan.

Silver health plans are a good middle ground for most consumers since they balance out-of-pocket costs and monthly premium payments. Silver plans also have a huge advantage for low-income households.

Bronze and Catastrophic plans are best for the young and healthy

You Both Have Employer

If youre both employed by a company or companies that contribute to your health insurance premiums, maintaining your individual coverage with your respective employers is almost always the cheapest way to go.

Thats because employers typically require very low contributions from their employees to the plan cost even if it feels like a lot coming out of your paycheck. According to the Kaiser Family Foundation , employees pay only 17% of the premiums on individual plans on average, which you can do if you both have that option, and 27% on family plans.

In 2020, that breaks down the average health insurance costs you can expect to pay for an individual or family plan:

Again, the cost of a family plan may vary depending on how many people youre adding to the plan. Also, its important to note that the cost of your premium will also depend on where youre located and the amount to which your employer is able and willing to contribute to your health insurance costs.

In some cases, an employer may pay the full amount, but most employees can pay at least some of the cost.

Speak with your human resources representative about how much it would cost to combine health insurance coverage with your partner into a single plan, and have your spouse do the same. Note that you can add your spouse to your plan within 60 days of getting married. Otherwise, youd need to wait until open enrollment.

Read Also: How To Find The Best Private Health Insurance

Plus Potential Ways To Reduce Your Premium

Open enrollment for health insurance planswhether it’s an employer-sponsored plan or an Obamacare plan you buy through a federal or state healthcare exchangegenerally takes place in the last two or three months of the year. Unless you have a qualifying life event such as getting married or losing your job at a different time of the year, open enrollment is the time to shop around to ensure that youre paying the best price for the right coverage.

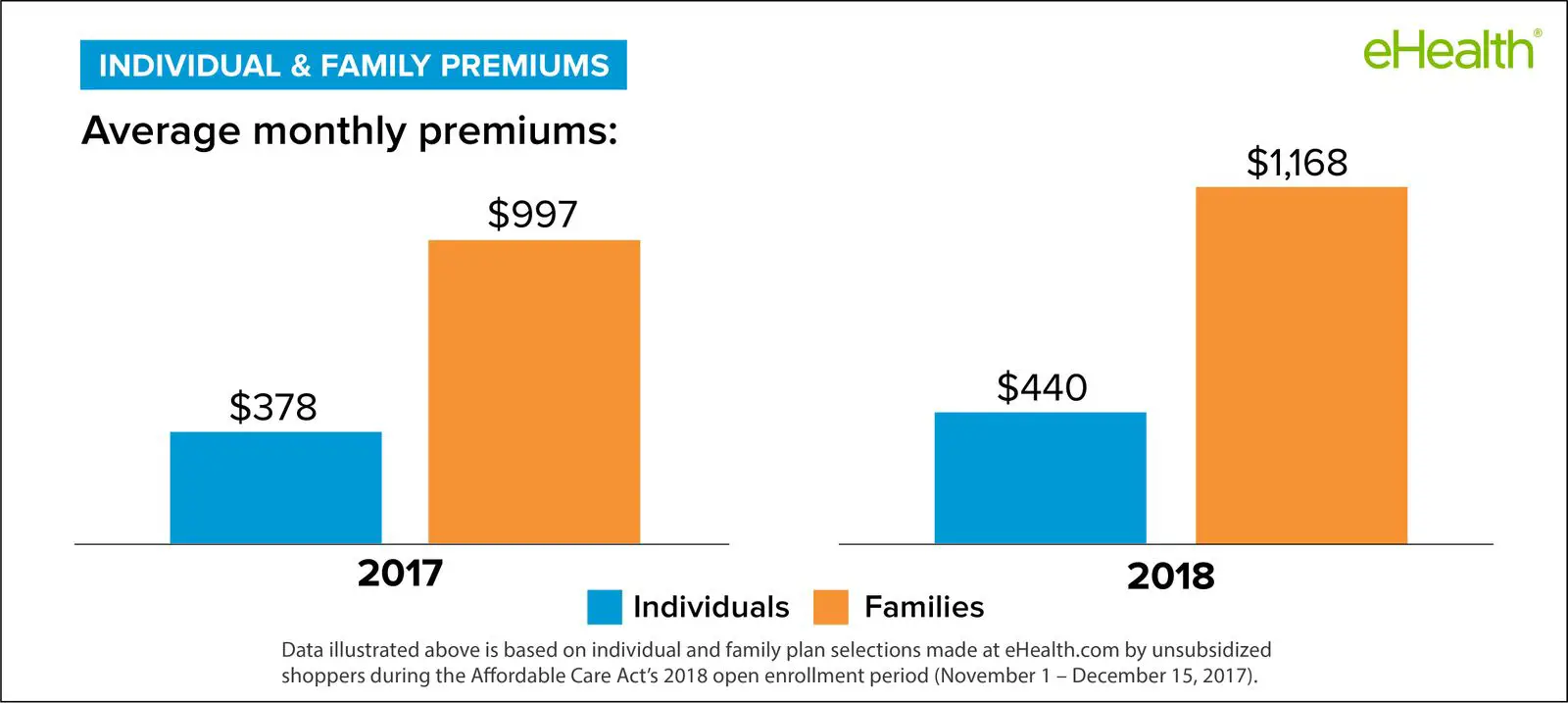

It helps to first understand what average premiums are, how the rates have changed over the past few years, and ways you can reduce your monthly premium.

How Much Is Health Insurance

The average American spent $3,667 on health insurance in 2020, according to the Bureau of Labor Statistics. And per to the Kaiser Family Foundation, the average person’s monthly premium for plans made available through the Affordable Care Act during open enrollment for 2019 was $612, before subsidies. Thats 1.5% less than 2018 but about 29% more than 2017 .

Read Also: Is Student Health Insurance Cheaper

Let Ehealth Help You Find The Right Plan For You

eHealth offers the same plans and prices available at healthcare.gov, as well as other affordable alternatives that arent available through the federal marketplace. We also have a prescription drug tool that can help you identify a plan that offers the best prices for your medications. In addition, our licensed agents are available to answer any questions you may have. Get started today by using our free comparison tool and checking out all individual and family health insurance plans in your area!

Texas Dental And Vision Plans

Dental and vision insurance plans, underwritten by Golden Rule Insurance Company, have no age limit restrictions.4 They offer coverage for the dental and vision services many medical insurance plans dont include.

From Houston to Austin, Dallas to San Antonio, explore these Texas health insurance options and more that may be available now.

You May Like: What Is The Donut Hole In Health Insurance

Hospital & Doctor Insurance

Health ProtectorGuard fixed indemnity insurance,3 underwritten by Golden Rule Insurance Company, can supplement your major medical plan by paying cash for eligible, covered medical services, like a doctor visit, a trip to urgent care or a surgical procedure.

- No deductibles or copays to pay first

- Benefits paid regardless of other insurance

- Money to pay costs not covered by major medical plans, like a deductible

Get Help Paying For Your Health Insurance Costs

Did you know that under the Affordable Care Act, you might be able to get assistance paying for your health insurance costs? You may qualify for one or both of these options:

- Cost-sharing assistance. This is a discount that reduces the amount you have to pay toward your deductible, copays and coinsurance. To use this discount, you must buy a Silver plan.

- Premium tax credit.This credit goes toward your premium and reduces the amount you pay every month.

To get help paying for your health insurance costs, you must:

- Not qualify for a government-sponsored program or an employer-sponsored health insurance plan.

- Not be claimed as a dependent on someone else’s tax return.

- Purchase a plan on the Health Insurance Marketplace.

- Have an income within a certain range for your household size.

See if you qualify for thepremium tax credit. You can alsoapply online to get your official results.

Don’t Miss: What Is The Best Health Insurance For College Students

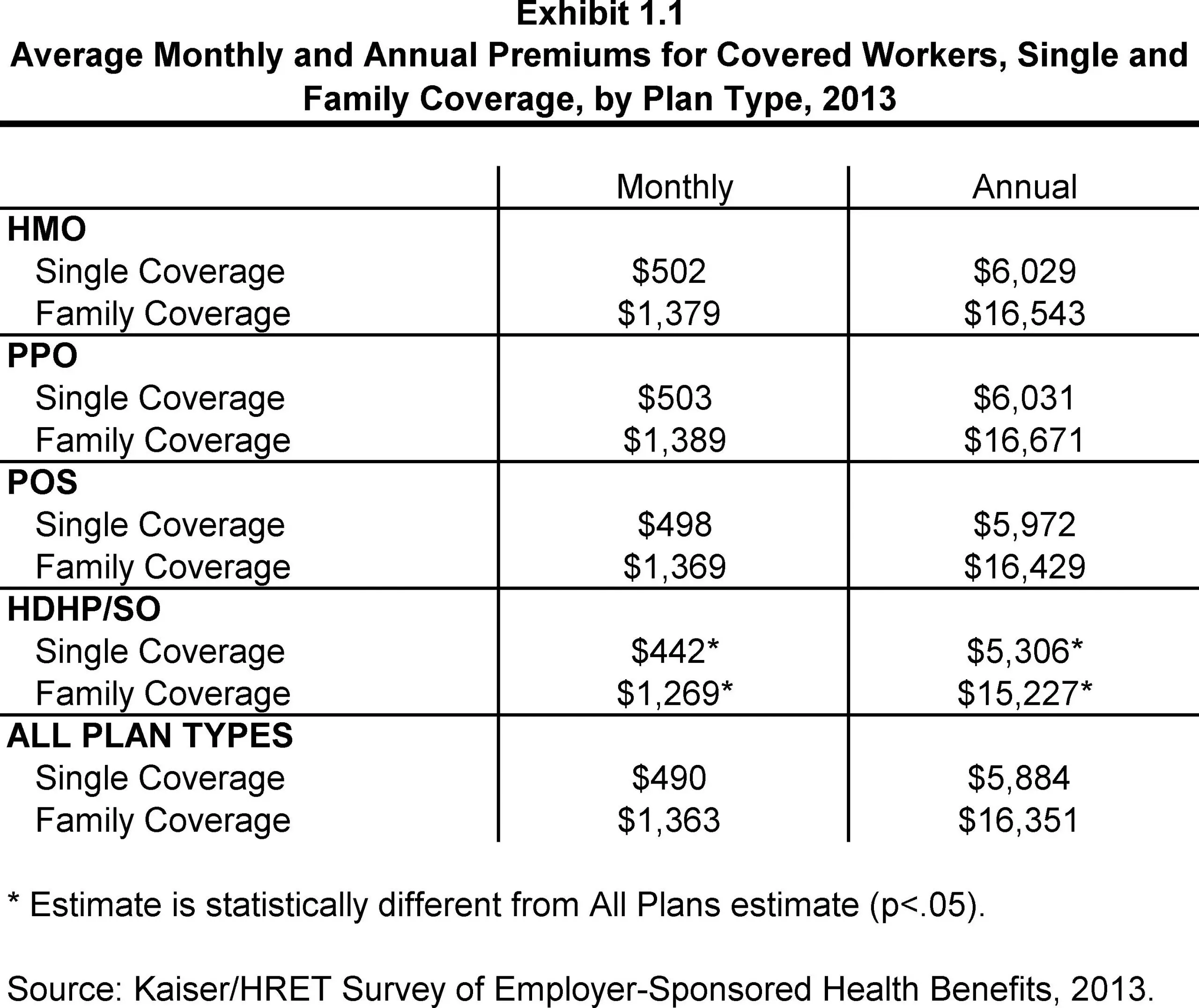

Group Coverage Also Known As Employer

Companies that provide health insurance to employees as a benefit provide an insurance type known as group insurance. The cost of this type of health plan is based on total premiums paid to the insurance company. Premiums include payments from both employers and employees. Premiums do not include payments for services such as deductibles, co-pays or other out-of-pocket costs. Group coverage includes: Health Maintenance Organizations , Preferred Provider Organizations , Point-of-Service Plans and High-Deductible Health Plans.

Can I Buy Health Insurance That Is Not Obamacare

There are a very limited number of non-Obamacare health plans offered off the Health Insurance Marketplace. These health insurance plans are only available for purchase through agents, brokers, or directly though some insurance companies. They are also available through some online health insurance sellers.

You May Like: What Is The Health Insurance For Low Income

The Cost For You Will Depend On A Number Of Factors From Age To The State You Live In

How much is health insurance per month for one person? Your health insurance, being month. It allows you to change the benefit amount and monthly payment to fit your needs over time. The average home insurance cost per month in texas is $286, based on an insurance.com rate analysis. I am on both medicare and also have private insurance at a cost of $400.00 a month the average cost of health insurance in the united states is $36,000 per year per household. Health insurance is a major cost for most americans. People looking for the best health insurance options in texas can find cheap, subsidized policies offered on the texas health insurance exchange. Health insurance can be expensive. Use our life insurance cost calculator to see how your rate could vary based on your health. Find individual health insurance in texas. You pay the fee for every month you and your dependents don’t have. Texas health insurance cost per person. Wondering how much health insurance costs per month in texas?

How much is health insurance per month for one person? What does health insurance cost on the exchange? You pay the fee for every month you and your dependents don’t have. As employers research health insurance coverage options, it is common for them to evaluate different strategies and their associated costs. It’s monopolistic price gouging mandated by the obama administration and enforced essentially at to clarify:

Plus Cigna Makes It Simple To Get The Care You Need

Access Your Benefits Anytime, Anywhere

The myCigna® website and mobile app let you easily search in-network providers, estimate out-of-pocket costs, view prescriptions, and more.4

Proactive, Personalized Support

Cigna One Guide® delivers personalized recommendations through one-on-one support and digital technology. Connect by phone, online, or via the app for guidance about your plan.

Save on Diabetes-related costs

Pay no more than $25 out-of-pocket for a 30-day supply of covered, eligible insulin. Plus, our new Diabetes Care plans offer many additional benefits with $0 out-of-pocket cost.5

Estimate Your Costs

Find out your estimated out-of-pocket costs for doctor visits, lab tests, medical treatment, and more using our online directory.

You May Like: Do You Need Health Insurance To Go To Planned Parenthood

What Is The Average Cost Of Health Insurance

Maybe youre wondering, How much does individual health insurance cost? Heres what you can expect. The average individual in America pays $452 per month for marketplace health insurance in 2021.2 The average family pays $1,779 per month.3

But the cost of health insurance varies widely based on a bunch of factors. Some things are in your control, some arent. Things like your age, how many people are on your plan, how much coverage you need, where you live and who your employer is all play a role in the price of your coverage.

Heres a breakdown showing the average costs depending on your state:

Kaiser Family Foundation, 2021.

People Looking For The Best Health Insurance Options In Texas Can Find Cheap Subsidized Policies Offered On The Texas Health Insurance Exchange

The average premium for family coverage was $1,778.50 per month or $21,342 per year. In this guide you will find everything you need to know about texas. Apply for coverage and learn more about health plans in texas. You pay the fee for every month you and your dependents don’t have. Health insurance is a major cost for most americans. As employers research health insurance coverage options, it is common for them to evaluate different strategies and their associated costs. Texas health insurance cost per person. Wondering how much health insurance costs per month in texas? $1,356.60 per month is not affordable health care. It allows you to change the benefit amount and monthly payment to fit your needs over time. The average home insurance cost per month in texas is $286, based on an insurance.com rate analysis. The average national monthly health insurance cost for one person on an affordable care act plan in 2019 was $612 before tax subsidies and $143 after tax subsidies are applied. What does a full health coverage plan cost in the us given that i looked up health plans on my state’s obamacare exchange website and a comparable plan through the government now i work for a health based company and pay about $300 per month for insurance.

Also Check: Does Health Insurance Cover Birth Control Pills

Whats The Best Pet Insurance In Tx For My Dog Or Cat

It depends on your pets breed, age, zip code, your financial standing, and the kind of coverage you need.To better understand how the chart above relates to your dog or cat’s breed-specific risks in Texas, use Pawlicy Advisor to instantly analyze top-rated plans across “The Lone Star State”. In 5 minutes or less youll understand which waiting times, coverage exclusions, and therapies are ideal for your pets breed and age.

For example, if you have a larger breed, having a policy with a long waiting period on knee injuries might not be ideal – but that same policy could be perfect for a small lap dog. Pawlicy Advisor will scan the fine print to show a custom

Finding Affordable Health Insurance In Texas

Healthcare costs in Texas haverisen in the past few years, so it makes sense that Texas has one of the highest rates of uninsured people in the country, with almost 20% of people under 65 lackinghealthcare. The numbers go up if you never finished high schoolalmost half ofnon-high school graduates dont have insurance.

These are scary numbers.Having healthcare is important not only because it can protect you fromexorbitant doctors bills in case of a catastrophic health issue, but alsobecause those who are uninsured must pay an extra tax.

Heres what you need to know to find the best, affordable health insurance in Texas if you dont want to be one of those 20%.

Cheap health care in Texas

What Texas Healthcare Looks Like Right Now

Presently, Texas has 8 healthcare providers in the state. This is the same amount as 2018, but one provider, Sendero, is leaving the state while Oscar Health is entering it.

If you live in a city like Houston or Texas, you probably have a lot of options for both carriers and plans, including Ambetter, Christus, Molina, and Bright Health. Outside one of these bustling urban centers, Blue Cross Blue Shield is the most popular choice for consumers but other providers are planning to expand into these areas.

to know more.

How Much Does HealthInsurance Cost in Texas?

How much you pay for healthinsurance in Texas can depend on a lot of different factors, including:

The Best Way To Find aGreat, Affordable Health Insurance Carrier in TX

Recommended Reading: How Much Does Health Insurance Cost In Ct

When Buying Texas Medicare Supplement Insurance May Be Right For You

With Medicare Supplement, you pay a flat monthly premium in exchange for the plan covering some to all of your Medicare Part A and Part B out-of-pocket costs .

A Texas Medicare Supplement plan may be right for you if:

- You Need Frequent Medical Care: Medicare Supplement helps cover the costs of your copay, coinsurance, and deductible each time you visit your doctor or are admitted to the hospital.

- You Have Health Problems: You can buy Medigap without going through a health screening during your Medigap Open Enrollment Period . This is a 6-month period that starts when you turn 65 and enroll in Medicare Part B. You cant be charged more for a policy because of your health if you enroll during this time. Outside of your Medigap OEP, companies can deny you coverage because of your health.

- You Travel Out of State or Overseas Often: Standard Medigap plans can be used at any provider across the country that accepts Medicare. Some plans even pay up to 80% of the approved costs for the emergency care you receive in a foreign country.21

- You Want Access to Multiple Options to Fit Your Needs and Budget: Texas offers a multitude of standard Medigap plans.

There are more than 60 carriers that offer Medicare Supplement plans in Texas. Heres a list of Texas Medicare Supplement insurance companies.

What Our Client Think About Us

The process was easy and seamless. My contact person was very supportive and patient with me. He took time to respond to all my queries, and explained the options at my disposal. I got all the information I needed to choose and sign up for my current insurance plan. I would definitely recommend National Health Connect!

Linet W.

Finding the right plan for you doesnt have to be complicated. Get an affordable insurance solution for you in just a few clicks. Just fill in the form with details of the health plan you need and well offer you a quote that matches those details.

Read Also: How To Set Up Small Business Health Insurance