Digging Deeper For Pricing Information

However, it’s not universally good news. For more details, we consulted the CMS’ 2020 Health Insurance Exchange Premium Landscape Issue Brief. It indicates that 27-year-olds buying silver plans saw their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In 2021, that trend continues. The 2021 edition of the CMS Brief notes that, for example, while Wyomings average benchmark plan premium decreased 10% from PY20 to PY21, the average 27-year-old PY21 benchmark plan premium is $648the highest in the U.S. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Hampshire’s benchmark plan premium for a 27-year-old is the lowest in the nation at $273.

What Is The Average Cost Of Health Insurance

Maybe youre wondering, How much does individual health insurance cost? Heres what you can expect. The average individual in America pays $452 per month for marketplace health insurance in 2021.2 The average family pays $1,779 per month.3

But the cost of health insurance varies widely based on a bunch of factors. Some things are in your control, some arent. Things like your age, how many people are on your plan, how much coverage you need, where you live and who your employer is all play a role in the price of your coverage.

Heres a breakdown showing the average costs depending on your state:

Kaiser Family Foundation, 2021.

Should You Get Singles Health Insurance If You Are Young

If you are tossing up whether to get health insurance, it could be worth considering some of the benefits of going private over public.

For example, with a private health insurance policy, you may be able to:

- Skip hospital waiting lists

- Select a doctor or surgeon of your choice

- Claim rebates on some non-Medicare covered extras services

There may be other financial incentives to getting private health insurance too. These benefits mainly include:

- Not paying Lifetime Health Cover loading: if you have not taken out a hospital policy by the time you turn 31 years old, you are charged a premium loading if you decide to take out cover in the future. You are charged an extra 2% on your premiums for every year you are over 30.

- Not paying the Medicare Levy Surcharge: a tiered charge is applied to Australian taxpayers who earn above a certain income and dont have private hospital cover. According to the Australian Taxation Office , this can be up to 1.5% for people on the highest income bracket.

- Policy discounts: some health insurers offer young Australians aged between 18 and 29 a private health insurance discount. Insurers can offer a discount of 2% for every year before the person turns 30, up to a maximum discount of 10% if they first took out their policy aged 25 or younger.

- Government rebates: you might be given a rebate for having private health insurance if you earn less than a certain threshold amount.

Don’t Miss: What Is New Health Insurance Marketplace Coverage

The Average Cost Of Health Insurance By Company

What you can expect to pay for health insurance differs by the insurance company. Some insurers want to grow, so they offer more attractive rates. Others are more cautious and will charge more to be sure they can cover their members health care costs.

Among national carriers, rates can vary widely. For example, the average Silver plan premium for Kaiser Permanente plans is $427 per month. Anthem charges an average of $481, while UnitedHealthcares average rate is $641. Newer plans, such as Bright Health and Oscar, fall somewhere in the middle, with average monthly premiums of $488 and $492, respectively.

Premiums are not the only factor when choosing a health plan. Some of the most affordable plans can have coverage that falls short of your needs. The best health insurance companies can cost a bit more, but are surprisingly affordable and give you the best value for your money.

Consider the plan’s total cost by looking at things like deductibles, coinsurance and out-of-pocket maximums. Check that your preferred doctors and facilities are in-network to save money and hassle. Be sure to also review quality and customer satisfaction ratings available on the Marketplace to make sure youre not going to encounter more annoyances than a plan’s potential premium savings are worth.

Average Health Insurance Premiums by Company

Scroll for more

- $641

Average Health Insurance Cost By Plan

Less surprising, though, is how the cost will differ based on the plan you use. After all, different plans offer different services, and those with more services and flexibility come at the price of a higher premium.

The four types of plans you may be able to get for your health insurance are a health maintenance organization , point-of-service , preferred provider organization and exclusive provider organization . Per ValuePenguin, the average monthly rate for a 21-year-old on each plan is:

- HMO: $230

You May Like: Does Health Insurance Include Dental And Vision

What Is The Least Expensive Health Insurance

As you can see from the factors listed above, theres a lot that goes into determining the price of insurance. There isnt a single healthcare plan thats right for everyone. But finding the right plan for your needs can be easy with HealthMarkets. You can shop online, compare healthcare plans, and apply in minutes. You can also call 986-2752 to speak with a licensed insurance agent.

46698-HM-0222

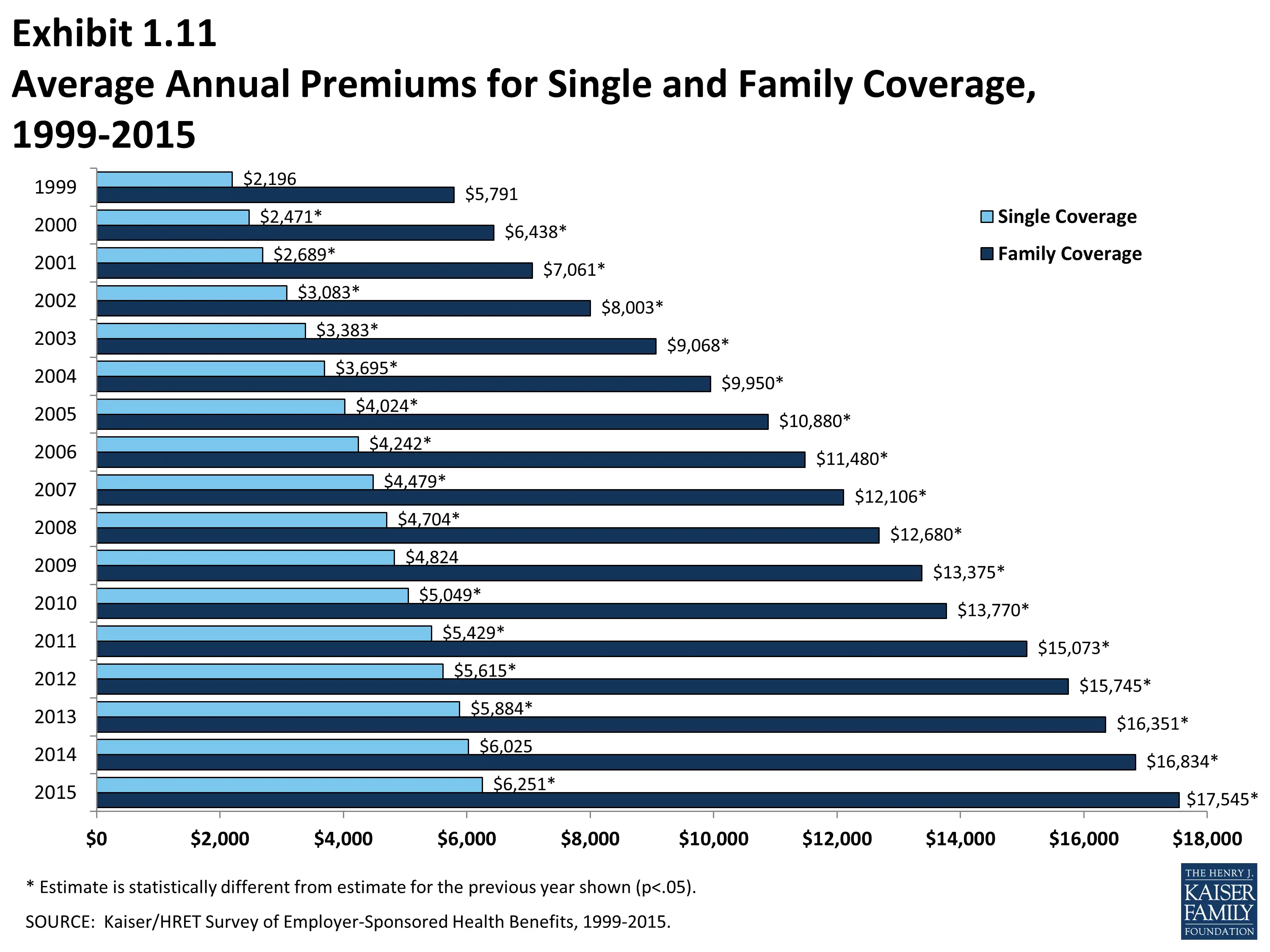

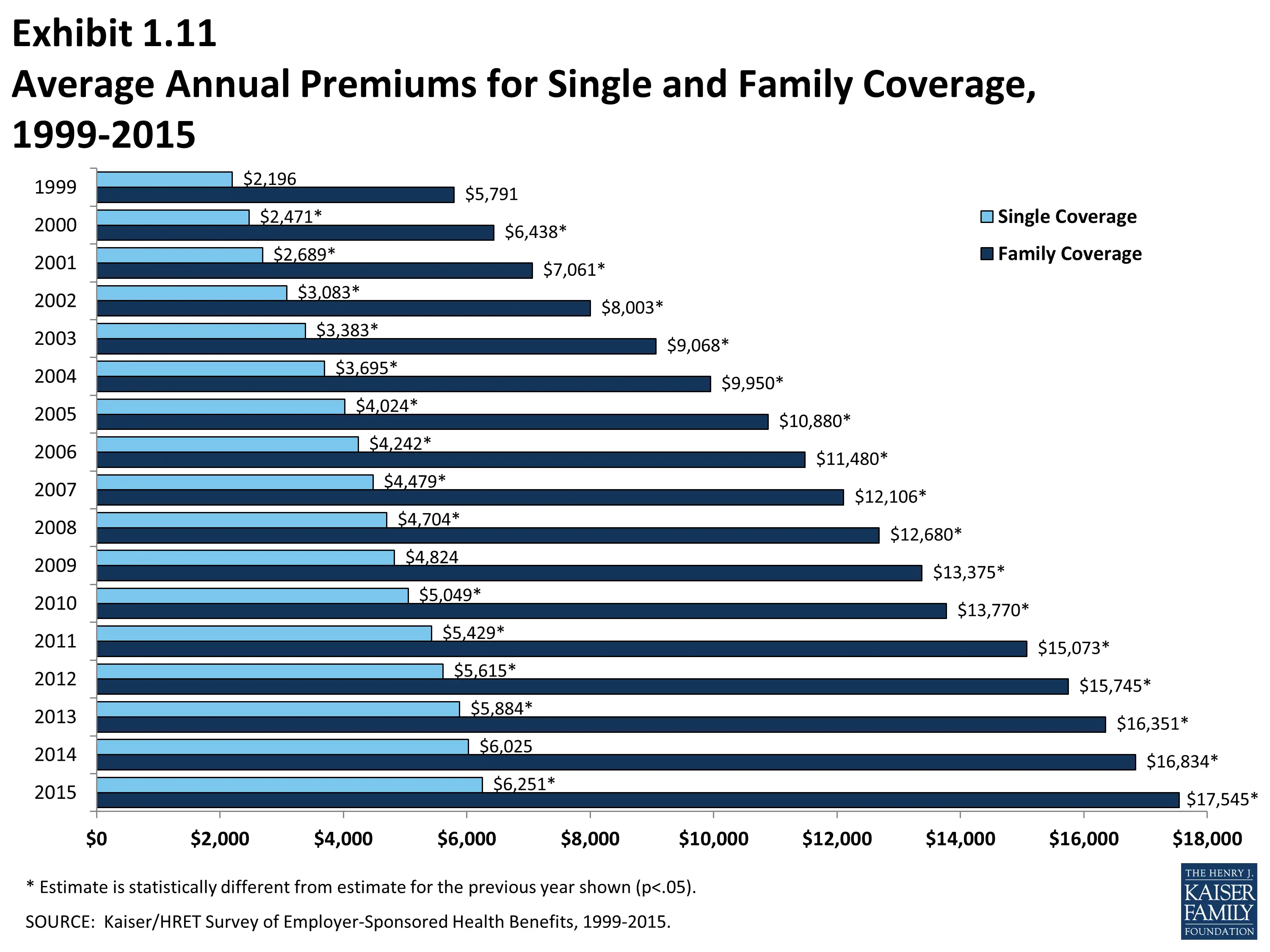

How Premium Costs Have Changed In Recent Years

In recent years, healthcare costs have kept rising for both individuals and families in the U.S. This is also true for monthly and annual insurance premiums. The average yearly premium for a family has increased by more than 25% since 2015, and it’s increased by over 60% since 2010.

Healthcare spending in the U.S. grows each year. Projections estimate yearly annual spending of nearly $6 trillion by 2027, 50% increase compared to the $4.1 trillion spent in 2020.

Also Check: Can Non Immigrants Get Health Insurance

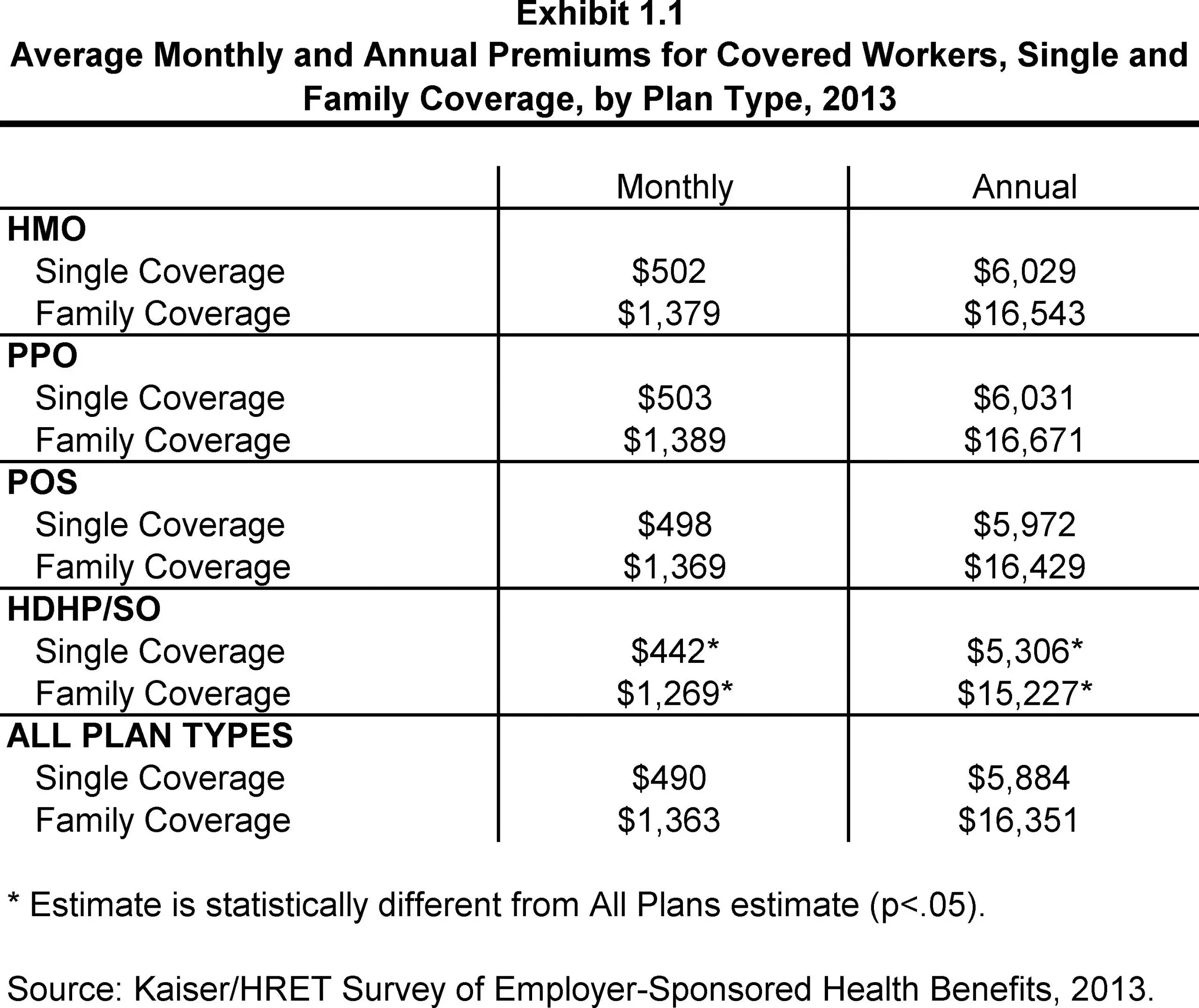

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you need to do in order to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

How Much Do You Pay For Health Insurance

How much are your health benefits?

How much are you paying into your companys health care plan? The answer is not always obvious. Thanks to the wonders of automated payroll processing, we dont concern ourselves with the details. All we know is monies are transferred directly into accounts, deductions occur at source and income slips are indecipherable tables heavily coded with strange acronyms.

The notion that health care in Canada is free or paid by taxes might also be responsible for lulling us into a deeper state of complacency. But this too is a false comfort. About 28% of annual Canadian health care costs are either from private coverage or paid out of pocket 60% of Canadians have some form of private health insurance most often provided through their employers.

Insurance plans vary in quality and price just like any product in a free market. Health plan and provider are selected at the discretion of employer. As the employee youre stuck paying for it out of your salary. The difference to your bottom line could be hundreds of dollars every month. Inquire on these points when youre going over the contract and before you sign. As with anything predetermined for you, it is in your best interest to avoid the rude awakening I just experienced doing recon for this article. Apparently my last jobs health benefits cost $409 per month and my former employer contributed only 10%.

Read Also: Does Health Insurance Cover Everything

How Much Is Health Insurance Per Month For One Person

Monthly premiums for Affordable Care Act Marketplace plans vary by state and can be reduced by subsidies. The average national monthly health insurance cost for one person on an Affordable Care Act plan without subsidies in 2022 is $438.1

Wondering how insurance premiums are decided? The Affordable Care Act ensures that insurance companies cannot discriminate based on gender, current health status, or medical history. Here are factors that determine health insurance premiums.

Would Insurance Be Cheaper Through An Employer

It’s no surprise that employer-sponsored health insurance is often cheaper than marketplace plans.

According to the Kaiser Family Foundation, covered workers kick in 17% of the cost of single coverage. That works out to an average of $101 for HMO plans and $111.25 for PPO plans. Compare that to the eHealth data, which showed that the average cost for a single person of any gender was $456.

Costs vary from state to state. For instance, in Hawaii, the average is $718 per year for the worker, but in Massachusetts, the worker may pay $1,793 per year. This is at the high end of the cost scale. Below is the state-by-state breakdown from the Kaiser Family Foundation to see the differences by region.

Per the Census, 55.4% of Americans got their insurance through their employer in 2019.

You May Like: Can I Get Health Insurance Without Ssn

Find Cheap Health Insurance Quotes In Your Area

Health insurance premiums have risen dramatically over the past decade. In previous years, insurers would price your health insurance based on a multitude of factors. However, the number of variables have decreased significantly with the Affordable Care Act.

In 2022, the average cost of individual health insurance for a 40-year-old on a silver plan is $541. This represents an increase of nearly 1% from the 2021 plan year.

What Is Singles Health Insurance

Singles health insurance is a policy that covers one person. It differs from couples and family health insurance policies, which cover multiple people.

Unlike a couples or family policy, where all people are covered for the same things, a singles policy can be chosen based on one persons specific needs. If you are a couple, there is also the option to consider taking out two separate singles policies so that each policy can be tailored to each persons needs and desired level of coverage.

Recommended Reading: Is Health Insurance Required In Florida

What Influences Employer

Most people get their health insurance through an employer.

When determining health insurance premium quotes, health insurers gather information from employers, including employee ages, the employers industry and the past year of employee medical claims.

“They generally consider the average age and gender of the employee, says Gary Franke, owner of Achieve Alpha Insurance in Bellevue, WA. For example, women in their childbearing years are more expensive to insure but so are older men in their 50s or 60s, who are more prone to having a heart attack, stroke or other major issues.

Employees often wonder — why did my health insurance go up? Employer plan premiums tend to increase year-over-year based on the prior year’s expenses.

So if your employer group is healthier than average in the prior year, the monthly price you and your employer will pay will go up by less,” adds Franke.

Group plans are also commonly priced using “composite rate quoting,” according to Marshall Darr, vice president of marketing and a licensed broker with Decent, an Austin, TX-based health insurance administrator.

“An employer submits the ages for all employees and their dependents. The carrier then provides a single rate that averages out the risk across the company, so that everyone pays the same,” Darr explains. “But companies that skew older will have more expensive premiums.”

The type of health plan also influences costs, including premiums and deductibles.

Types Of Health Plans

Because there are many different types of health plans, you should be sure to look for the one that fits your needs. Comprehensive health insurance provides benefits for a broad range of health care services. These health plans offer a detailed list of health benefits, may limit your costs if you get services from one of the providers in the plans network, and typically require co-payments and deductibles.

Here are some of the types of plans offered in Massachusetts

Health Maintenance Organization

HMO plans cover hospital, medical and preventive care. You are only covered if you get your care from HMO’s network of providers . With most HMO plans you pay a copayment for each covered service. For example, you pay $30 for an office visit and the HMO pays the rest of the cost.

Preferred Provider Plans

Preferred provider plans usually cover hospital, medical and preventive care. These plans have a network of preferred providers that you can use, but they also cover services for out-of-network providers. PPP’s will pay more of the cost if you use a provider that is in the network. Example: After copays and deductibles, the plan pays 100% of a service for a network provider but 80% for an out-of-network provider. Note that if you choose to go OON when you are in a PPP, your provider may balance bill you directly for the entire cost of the procedure.

Major Medical Plans/ Indemnity Plans

Also Check: How To Apply For Free Health Insurance

Who Needs Individual Health Insurance

Individual health insurance is for anyone who doesnt have access to employer-sponsored or government-run health coverage. This includes people who are employed by a small business that doesnt provide health benefits, people who are self-employed, and people who retire before theyre eligible for Medicare and have to get their own personal health coverage until they reach age 65.

Average Annual Health Insurance Premiums For Singles

Mobile/tablet users, scroll sideways to view full table

| Hospital | |

|---|---|

| $636 | $2,756 |

The cost of hospital cover generally increases as you age, while the cost of extras cover generally stays the same, based on this analysis. In addition to your age, another factor that can influence the cost of private health insurance is where you live. We also calculated the average annual cost of hospital and extras cover for singles across Australia.

Recommended Reading: Does Mcdonald’s Have Health Insurance

Factors For Your Health Insurance Rate

Health insurers look at many factors when figuring out how much your premium will cost. These include:

The Kaiser Family Foundation offers a Health Insurance Marketplace Calculator that can help you figure out roughly how much your plan will cost.

Change In Average Health Insurance Cost For 2022

From 2021 to 2022, health insurance rates across the nation increased by less than 1%. South Dakota saw the largest year-over-year jump in health insurance costs for a 40-year old on a silver plan increasing just over 23%. Including South Dakota, 27 states had their rates increase on average from 2021 to 2022.

Year-over-year rates decreased the most in Georgia, South Carolina and Nebraska, which all fell by more than 10% . Overall, 21 states experienced a decrease in health insurance premiums. Two states Idaho and Virginia saw no year-over-year change.

| State |

|---|

Recommended Reading: What Is The Health Insurance For Low Income

Cheap Health Insurance: Find Low

In 2022, the cheapest health insurance is Kaiser Permanente, which costs an average of $338 per month for a Bronze plan.

The cheapest individual health insurance for most people is a Bronze plan, which provides basic coverage at affordable rates. But the plans with the cheapest premiums may cost you more in the long run if they have a limited network of doctors or lower cost sharing benefits. To find the best cheap health insurance for you, start with the health coverage you need and then compare the cheapest quotes.

The Average Cost Of Health Insurance By Plan Types

There are four types of health plans you can choose on the Marketplace, with varying degrees of flexibility and cost:

- Health Maintenance Organization : HMOs tend to have lower premiums but require you to use a specific set of providers and get referrals to specialists for covered services, except in emergencies. Silver HMOs average $473 per month.

- Exclusive Provider Organization : Somewhere between an HMO and a PPO, EPOs typically require that you use the health plans in-network providers, but you dont always need referrals to see specialists. EPO Silver plans average $508 per month.

- Preferred Provider Organization : PPOs tend to be more expensive than HMOs but typically offer a broader range of providers. You usually dont need to get a referral to see specialists for covered services. On the Marketplace, Silver PPO plans have an average premium of $517.

- Point of Service : POS plans tend to be the most flexible at an increased financial cost. You can usually get care outside of the health plans provider network, though youll likely pay more for those services. POS Silver plans have an average monthly premium of $534.

Average Health Insurance Premiums by Plan Type – Silver Plans

Scroll for more

- $534

Recommended Reading: Can I Decline My Employer’s Health Insurance