Healthcare Is Not A Typical Market

Harvard economist N. Gregory Mankiw explained in July 2017 that “the magic of the free market sometimes fails us when it comes to healthcare.” This is due to:

- Important positive externalities or situations where the actions of one person or company positively impact the health of others, such as vaccinations and medical research. The free market will result in too little of both , so government intervention such as subsidies is required to optimize the market outcome.

- Consumers don’t know what to buy, as the technical nature of the product requires expert physician advice. The inability to monitor product quality leads to regulation .

- Healthcare spending is unpredictable and expensive. This results in insurance to pool risks and reduce uncertainty. However, this creates a side-effect, the decreased visibility of spending and a tendency to over-consume medical care.

- Adverse selection, where insurers can choose to avoid sick patients. This can lead to a “death spiral” in which the healthiest people drop out of insurance coverage perceiving it too expensive, leading to higher prices for the remainder, repeating the cycle. The conservative Heritage Foundation advocated individual mandates in the late 1980s to overcome adverse selection by requiring all persons to obtain insurance or pay penalties, an idea included in the Affordable Care Act.

The Average Cost Of Health Insurance By Metal Tier

Plans offered on the Health Insurance Marketplace are categorized into metallic tiers: Bronze, Silver, Gold and Platinum.

The tier corresponds to the value of the coverage, or how health plans and members split the costs. For example, in Bronze plans, the health insurer pays approximately 60% of the costs of care, and the individual typically pays 40%. The provider typically pays 90% in Platinum plans, and the individual pays 10%. These ratios are set by tier and based on expected spending for a typical health plan member.

In MoneyGeeks analysis, the lowest average premiums were $383 per month for Bronze plans. The average Platinum plan, by contrast, costs $782 per month.

Average Health Insurance Premiums by Metal Tier

Scroll for more

Affordable Care Act Marketplaces

Separate from the employer market are the ACA marketplaces, which covered an estimated 12 million persons in 2017 who individually obtain insurance . The law is designed to pay subsidies in the form of premium tax credits to the individuals or families purchasing the insurance, based on income levels. Higher income consumers receive lower subsidies. While pre-subsidy prices rose considerably from 2016 to 2017, so did the subsidies, to reduce the after-subsidy cost to the consumer.

For example, a study published in 2016 found that the average requested 2017 premium increase among 40-year-old non-smokers was about 9 percent, according to an analysis of 17 cities, although Blue Cross Blue Shield proposed increases of 40 percent in Alabama and 60 percent in Texas. However, some or all of these costs are offset by subsidies, paid as tax credits. For example, the Kaiser Foundation reported that for the second-lowest cost “Silver plan” , a 40-year old non-smoker making $30,000 per year would pay effectively the same amount in 2017 as they did in 2016 after the subsidy/tax credit, despite large increases in the pre-subsidy price. This was consistent nationally. In other words, the subsidies increased along with the pre-subsidy price, fully offsetting the price increases.

Read Also: Can I Buy Dental Insurance Without Health Insurance

How To Get The Best Health Insurance

If youre looking to purchase health insurance on your own, you can just go to the websites of major health insurance companies in your area and see what plans they provide. You can compare plans on your own, although quotes will vary pretty widely.

But lets face it. This is a ton of work. Choosing the right health insurance plan for you or your family is a daunting task. And you probably have better things to do with your time than sifting through endless health insurance quotes.

Thats why I recommend using our trusted and independent insurance agents for your health insurance needs. Theyll look at your situation and compare the best rates so you can get the coverage you need. Theyll help you understand the marketplace or even what your employer is offering. And the best thing? Theyre free!

Connect with one of our insurance agents today.

About the author

Aflac Supplemental Insurance To Complement Your Existing Plan

Once youve found a health insurance plan that works for you, its not uncommon to be left with large chunks of money expected to be paid out-of-pocket.

Aflac offers supplemental insurance that works with your primary health insurance plan to help pay for the costs associated with some surgeries, medication, treatment plans, hospital visits and therapy, depending on the plan you choose. Learn more about our insurance plans so you can maximize your coverage.

Still have questions?

Also Check: How Much Is Health Insurance Under Obamacare

How Do I Find Affordable Health Insurance

Group plans are generally cheaper than individual plans. So if you are eligible for onethrough your employer, your union, or some other associationthat’s your best bet, in terms of coverage for the money. If that’s not an option, the public health marketplaces established by the Affordable Care Act offer affordable health insurance for individuals. In most of the U.S., you can sign up for a plan offered through the federal government via the HealthCare.gov site. However, 12 states run their own marketplaces, and residents sign up via their sites.

Why Is Life Expectancy In The Us Lower Than In Other Rich Countries

The graph below shows the relationship between what USA as a country spends on health per person and life expectancy in that country between 1970 and 2015 for a number of rich countries.

The US clearly stands out as the chart shows: Americans spend far more on health than any other country in the world, yet the life expectancy of the American population is shorter than in other rich countries that spend far less.

What are the best places for healthcare globally?

You May Like: What Health Insurance Is Available In Nc

You May Like: How Much Does Health Insurance Cost In California

Why Increasing Healthcare Costs Matter

High healthcare costs put pressure on an already strained fiscal situation and are one of the primary drivers of the long-term structural imbalance between spending and revenues that is built into the countrys budget. Containing high healthcare costs is important for our nations long-term fiscal and economic well-being. For ideas on how to solve some of these issues, visit our Solutions page and the Peterson Center on Healthcare.

Image credit: Photo by Chip Somodevilla/Getty Images

What Is The Cost Of Cancer Treatment Without Insurance

Having cancer is enough to make anyone feel anxious about the uncertain road ahead. So any unwelcome medical costs will only add to those stress levels if you are uninsured. And, unfortunately, the costs for treatments in the U.S. \come with a high price tag. Nearly breaking the million-dollar mark is a bone marrow transplant. It could cost more than an eye-watering $900,000+. Prices start at a still pretty extortionate $638,000.

Brain cancer treatment costs anything from $50,000 to a lofty $700,000+, while breast cancer costs range from $48,500 through to $300,000+. The price it takes to tackle pancreatic cancer starts from $31,000 through to $200,000+. And melanoma treatment can be anywhere from $1,700 to $152,000+.

Also Check: Is There A Penalty For Cancelling Health Insurance

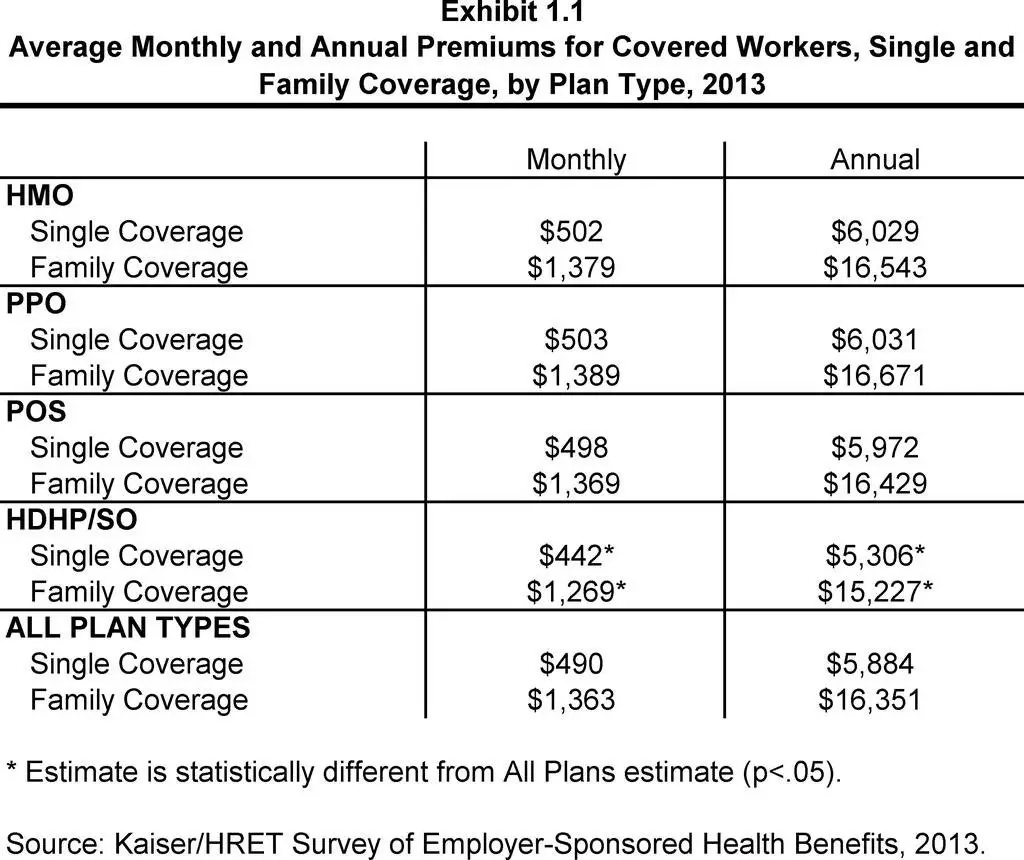

How Much Does Health Insurance Cost For Employers

According to Kaiser Family Foundation research, in 2021, the average annual employer healthcare insurance cost was $7,739 for single coverage, up 4% from the previous year, and $22,221 for family coverage, also up 4% from 2020. Survey data also showed that 58% of small firms offered their employees coverage while 99% of large firms offered coverage, averaging a total of 59% of all companies offering their employees some sort of health coverage. Exact costs depend on a variety of factors, such as the state where the business is located or whether the insurance plan is an HMO or PPO.

Health Spending Average By Gender

During time period of age 18 to 44, healthspending for females is 84% higher than men for years. Yes, much of this is dueto the expense of childbirth, but from age 44 to 64 spending for women is 24%higher than for men and even at age 65+ spending for women is 8% higher.

According to this data, women will need to budget more than men for health care expenses each year. Not only that but women tend to live two more years than men in the United States which requires additional savings. The MEPS data also reveals tremendous inequality in healthcare spending by race and demographic. The following chart shows average spending by demographic group for adults in America:

You May Like: Who Is Eligible For Health Insurance

How Much Does Health Insurance Cost Per Month For A Single Person

The average monthly health insurance cost for a Bronze plan is $356 for a single 30-year-old person. That same person pays an average of $468 for a Silver plan and $514 for a Gold plan.

A 40-year-old single person pays $401 on average each month for a Bronze plan, $526 for a Silver plan and $578 for a Gold plan.

Age is just one factor that health insurance plans use when setting rates on the ACA marketplace.

What Is The Income Limit For Obamacare 2021

To get assistance under the Affordable Care Act you must earn between 100\% 400\% of the poverty level. For 2021, that is $12,760-$51,040 for an individual and $26,200- $104,800 for a family of four.

Is Obama care free?

ObamaCare is Free Everyone is required to have insurance, so everyone is supposed to have affordable healthcare coverage. Employers are only required to pay up to 60\% of the cost of insurance premiums. Thus, youre still going to need to pay for the rest of the insurance cost.

Which health policy is best for family?

Best Health Insurance Plans for Family in India 2021

| Family Health Insurance Plans | |

|---|---|

| 3 lakh to 20 lakh | |

| United India Family Medicare Policy | 3 lakh to 25 lakh |

Don’t Miss: Can You Add Parents To Health Insurance

How Can You Cover Your Medical Costs In The Usa

So what can a frugal traveler or expat do? How do you reduce the cost of receiving proper health care without sacrificing quality or convenience?

Firstly, reassure yourself that common over-the-counter medications and first aid supplies are widely available and very affordable in the United States. Headache medication, mild heartburn medication, muscle cream, sinus decongestant pills, and skin ointments are all available for under $25 sometimes they’re as cheap as $5.

A chat with a pharmacist is always free and they can provide sound recommendations for treating non-urgent, minor conditions. A bad cold is no more costly in the United States than it is in most other countries.

Secondly, make sure that you have health insurance in the USA. As you’ve seen up above, if you are traveling and fall ill, a relatively uncomplicated problem like an inflamed appendix can cost several times more than the trip itself. For non-residents, there is health insurance in the USA for foreigners that can greatly reduce costs of medical services, especially when you need them.

You do not need to face a life-threatening problem and then get slammed with sanity-threatening costs after. There is a wide variety of insurance products and packages designed for travelers. They range from the extremely comprehensive and inclusive to the more streamlined option, with a focus on coverage for the most serious and expensive of emergencies.

Five Factors That Shape Health Insurance Premiums And Health Insurance Cost For Americans

Some Americans may pay significantly more or less for health cover due to factors such as:

What are the best places for American expats to live abroad?

Find out more here

Also Check: How Do I Meet My Deductible For Health Insurance

Look For Prescription Drug Discounts

Pharmacy and prescription coverage a tremendous impact on overall insurance premiums, Berzins said.

In addition to saving money on insurance costs by seeking generic drug alternatives within an insurance plan, Berzins recommends investigating whether the insured can get direct discounts. Contact the pharmaceutical company directly for possible coupons or discounts.

Tip: Check out our roundup of the best health insurance and employee benefit providers to find insurers for healthcare, dental and vision.

Healthcare Costs Have Risen To The Point Where They’re Devouring A Huge Percentage Of Many Americans’ Income

The cost of healthcare has risen much faster than inflation alone can explain. Healthcare spending in 2007 came to $7,700 per person in the U.S., and by 2015 that number had risen 29% to $9,990 per person. The Centers for Medicare and Medicaid Services project that health spending will continue to increase at an average rate of 5.6% per year for the next 10 years. How can the average American afford to spend that much on healthcare?

Read Also: What Type Of Health Insurance Should I Get

The Cost Of Health Insurance In The Usa

The USA has the most expensive healthcare in the world. A consultation with a doctor can cost between $200 and $300. A study shows the average cost of a visit to the ER is $2,168 and the cost of an ambulance can range between $400 to $1,200. Hospital stays cost around $3,000 per day on average. Data shows that, on average, an individual in the USA will have around $12,500 per year of healthcare costs.

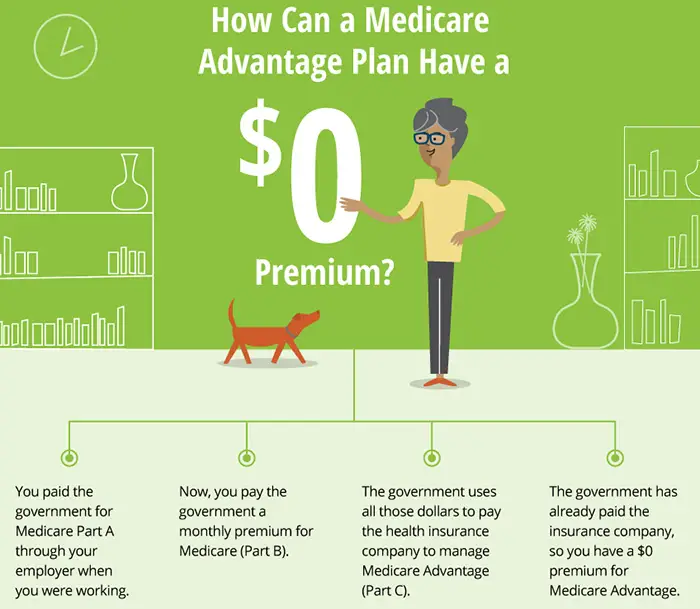

The US government has a few public health insurance programmes in place, but they only cover certain demographics. For example, Medicare covers US nationals aged over 65 and Medicaid provides support for people who have limited income. But these programmes do not extend to the whole population.

Its for this reason that most people in the USA have health insurance, to cover the costs of medical expenses. Health insurance in the USA is not mandatory but it is recommended, to save people paying out of pocket for expensive medical treatments. Many employers will include health insurance coverage as part of their benefits package for employees, but others will have to cover their own health insurance costs.

Take Out A Personal Loan

Instead of charging dental work to a high-interest credit card, look into borrowing a personal loan instead. These loans can be used for just about any purpose and come with relatively low interest rates as long as you have decent credit. Youll also enjoy fixed payments over a few years, which helps spread out the cost.

You May Like: How To Get Cheap Health Insurance In Texas

Are You Ready To Find The Right Individual Health Insurance For You

eHealth is here to help you. We have licensed insurance brokers who understand the various coverage options and can guide you through your individual insurance health insurance choices. Our service is quick and convenient and free of charge. Call us at 396-2521 , MonFri, 9am7:30pm ET, or email us at [email protected].

This article is for general information and may not be updated after publication. Consult your own tax, accounting or legal advisor instead of relying on this article as tax, accounting, or legal advice.

Change In Average Health Insurance Cost For 2022

From 2021 to 2022, health insurance rates across the nation increased by less than 1%. South Dakota saw the largest year-over-year jump in health insurance costs for a 40-year old on a silver plan increasing just over 23%. Including South Dakota, 27 states had their rates increase on average from 2021 to 2022.

Year-over-year rates decreased the most in Georgia, South Carolina and Nebraska, which all fell by more than 10% . Overall, 21 states experienced a decrease in health insurance premiums. Two states Idaho and Virginia saw no year-over-year change.

| State |

|---|

You May Like: Which State Has The Cheapest Health Insurance

How Do I Find An Affordable Health Insurance Plan

You can enter your household income information into the ACA marketplace website, which can help you find an affordable health insurance plan if your income qualifies.

ACA marketplace plans are eligible for premium tax credits and cost-saving subsidies, which can lower the cost of health insurance.

You may also qualify for Medicaid, which is a federal/state health insurance program that offers comprehensive, low- or no-cost coverage. The ACA marketplace site will let you know if you qualify for Medicaid in your state when you include your household income and family size into the exchanges website.

Total Costs & Metal Categories

When you compare plans in the Marketplace, the plans appear in 4 metal categories: Bronze, Silver, Gold, and Platinum. The categories are based on how you and the health plan share the total costs of your care.

Generally speaking, categories with higher premiums pay more of your total costs of health care. Categories with lower premiums pay less of your total costs.

So how do you find a category that works for you?

- If you dont expect to use regular medical services and dont take regular prescriptions: You may want a Bronze plan. These plans can have very low monthly premiums, but have high deductibles and pay less of your costs when you need care.

- If you qualify for cost-sharing reductions: Silver plans may offer good value. If you qualify, your deductible will be lower and youll pay less each time you get care. But you get these extra savings only if you enroll in Silver. If you dont qualify for CSRs, compare premiums and out-of-pocket costs of Silver and Gold prices to find your right plan. See if your income estimate falls in the range for cost-sharing reductions.

- If you expect a lot of doctor visits or need regular prescriptions: You may want a Gold plan or Platinum plan. These plans generally have higher monthly premiums but pay more of your costs when you need care.

Recommended Reading: How Much Is Health Insurance For A Single Person