Do Employers Have To Offer Health Insurance If So What Kind

Depending on company size, employers may or may not have to offer coverage to their workers. But if they do, the health plan must meet certain minimum requirements.

Companies with 50+ Employees

Companies with 50 or more full-time employees are required to offer healthcare to their full-time employees. Smaller companies have the option to do so, but theyre also able to pass the responsibility of finding healthcare on to you.

Affordable Coverage Under an Employer

The insurance that large companies offer must, at a minimum, pay for 60 percent of your covered healthcare expenses and require you to pay less than 9.78 percent of your household income for monthly premiums. The Affordable Care Act defines this as affordable coverage. But because the affordability percentage of 9.78 percent does not apply to your spouse, children, or other dependents, coverage for your dependents may be unaffordable.

Also Check: What Is The Cost Of Health Insurance In Usa

When Can You Get Employer

Once youre hired for a new job, you probably wont start work right away. Your employers health insurance may take even longer to come through. Health insurance typically wont start until youre hired, and even then, not all companies can offer it to you on the first day or even within the first month.

Waiting Period

The waiting period for health insurance from employers cant last more than 90 days. Thats a choice that your employer has to make when choosing and paying for insurance.

How Do I Disenroll From Medicare Part B

You cant disenroll online. If your employers coverage is primary and you decide to drop Part B, you need to submit Form CMS-1763 to the Social Security Administration. Thats because the agency processes both Medicare enrollments and cancellations for the Centers for Medicare and Medicaid Services , which administers the Medicare program.

You can submit the form in person at your local Social Security office. Or call the Social Security Administration at 800-772-1213 to request the form, and youll be told where to send it.

Two witnesses who know you and are willing to supply their names and addresses must see you sign it. You cant submit the form electronically, and it is processed manually.

Youll want Part B back eventually. To restore Part B when your new employers coverage ends, youll have to take action. Youll need to sign up again for Part B no later than eight months after your on-the-job insurance ends.

If you miss that special enrollment period, youll need to wait to reenroll until the next general enrollment period, Jan. 1 to March 31. Your coverage will start the first of the month after the month you enroll. But if you dont act quickly, you may have to pay a permanent late-enrollment penalty.

Also Check: Why Do You Need Health Insurance

Voluntary Code Of Conduct: Authorized Insurance Activities

Canadas banks have agreed to be bound by a voluntary code of conduct that obliges them to provide clear, understandable disclosure in the documents related to authorized insurance products, including mortgage life insurance. Each bank is responsible for ensuring that its representatives implement, understand and follow this code. Each bank has a designated officer responsible for compliance with the code.

Under the code of conduct, banks will provide each eligible customer who has been accepted for insurance coverage with disclosure documents that set out the following:

Recommended Reading: Does Aarp Offer Health Insurance

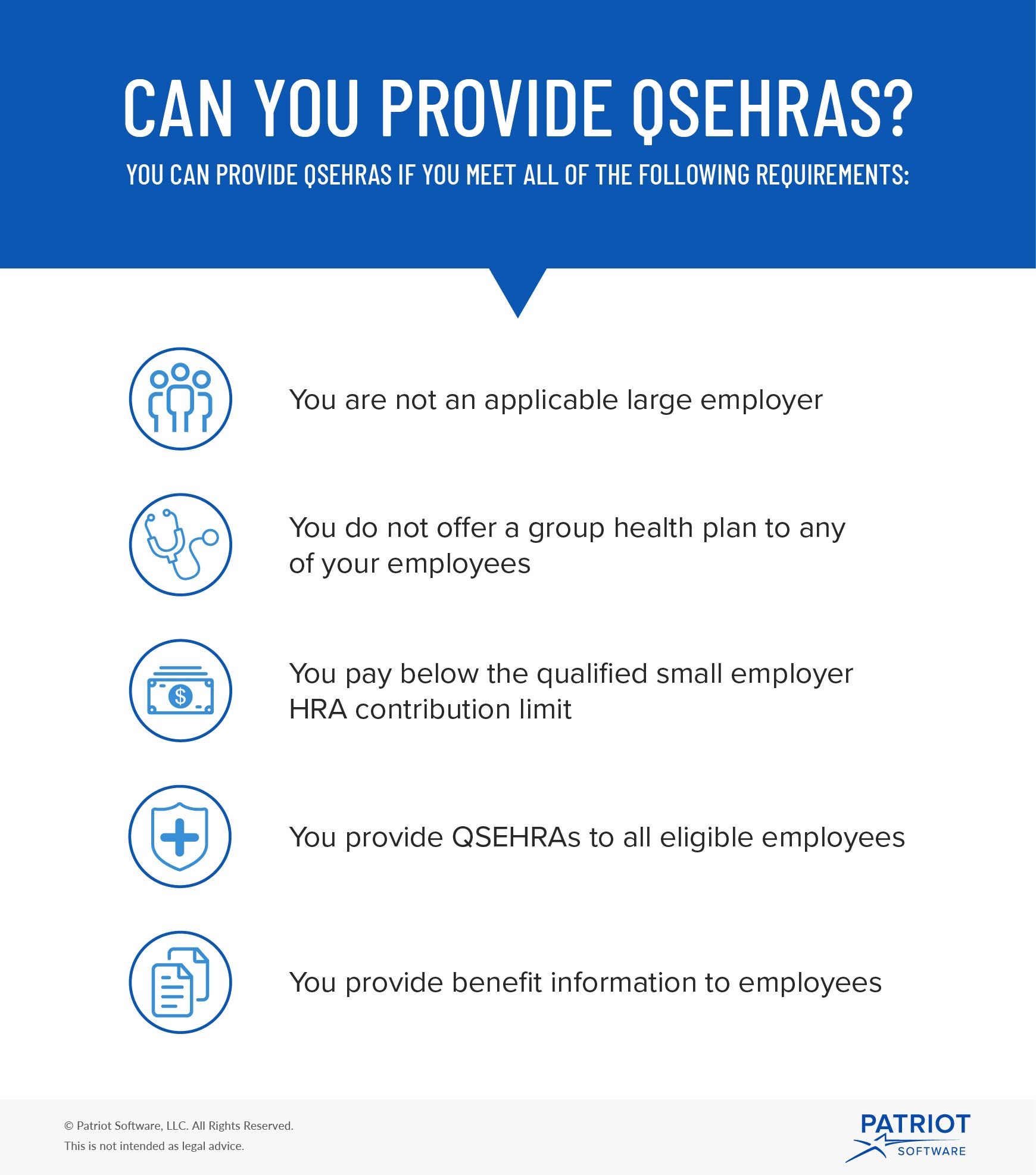

Can You Switch To A Spouses Policy During Open Enrollment

Switching to a spouses health insurance policy during an open enrollment period is easy. You can just cancel your current coverage and enroll in your spouses policy. Generally, the system employers send you through have a box you can check to opt out. It may ask follow-up questions. If you need more help, you can also call your insurance representative for any further questions about health insurance options. If you want to reduce group health insurance costs, switching during open enrollment means you can start saving right away.Most companies run their coverage with the calendar year. Enrollment opens in the fall for coverage beginning January 1. If youre switching from group health insurance to a qualified small employer health reimbursement arrangement or an individual coverage HRA, your spouse must be enrolled in a family policy before they can participate in the HRA on a tax-free basis.

Recommended Reading: How To See If You Have Health Insurance

Whats Considered An Affordable Individual Coverage Hra Offer

An individual coverage HRA is considered affordable for an employee and their dependents if the monthly premium the employee would pay for the self-only, lowest cost Silver plan available to them through the Marketplace in their area is less than 9.12% of 1/12 of the employees yearly household income.

- If your offer is considered affordable: The employee wont be eligible for the premium tax credit for the employees Marketplace coverage or the coverage of other household members who would be covered by the individual coverage HRA.

- If your offer isnt considered affordable: If theyre otherwise eligible the employee must decline the individual coverage HRA to claim the premium tax credit for the Marketplace coverage. The employee cant combine the individual coverage HRA with a premium tax credit.

Note: Affordability calculations for employer-sponsored coverage, including an individual coverage HRA offer, arent affected by savings and lower costs on Marketplace health insurance coverage that the American Rescue Plan Act of 2021 provides.

How To Shop For Individual Health Insurance Coverage

Shopping for individual health insurance coverage requires balancing several competing factors.

You ideally want to find an affordable plan that offers the coverage you need at the providers you want to use.

Unfortunately, the price usually increases with the more useful factors included with a health insurance plan. If you get a great network of providers with a low deductible and low copays, expect a very high monthly premium.

The reverse is also true. The more affordable plans usually have astronomical deductibles or a minimal network of providers. If you decide to use an out-of-network provider, you may have to pay even more.

To help you decide which plan might work best for you, you need to think about your medical needs.

Also Check: Does Health Insurance Cover Testosterone Therapy

Group Health Plan Opt

Group health plan opt-out arrangements are allowed under the law, but if employers want to offer them, they should offer them to all employees. Selectively offering opt-out arrangements can put an employer at risk of discrimination in a variety of ways, such as violating the Health Insurance Portability and Accountability Act nondiscrimination rules.

How Long Must An Employer Provide Health Insurance After Termination

There is no particular time frame when an employer must keep your health insurance coverage after a job termination. This decision is up to the company.

Some employers cancel health insurance on the day of termination. Others wait until the end of the month or a few months so that you can have extra time to seek new employment.

That being said, most employers are required to provide you access to its employer health insurance plan for at least 18 months after termination through COBRA . COBRA requires that private employers with at least 20 employees offer COBRA benefits to former employees, except those fired for gross misconduct. Many states also have mini-COBRA laws for small businesses.

Note that youll pay the full price of health insurance during this COBRA period, with no subsidies provided from your employer, so expect to pay costly premiums, adds Kronk.

Find out more about COBRA costs.

Don’t Miss: How Do Early Retirees Get Health Insurance

What If The Health Insurance Through My Employer Is Too Expensive

Many people run up against the problem of their employer-provided health insurance seeming way too expensive. Especially when it includes covering their entire family. Unfortunately, if the costs are still underneath approximately 9.5% of your annual household income, it is still affordable by legal standards, and you still arent eligible for subsidies through the Marketplace.

If you find it cost-prohibitive to ensure your children through your job-based health plan, you may have other options. Depending on your income level, you might be able to get them coverage separate from yours through the Childrens Health Insurance Program . CHIP is the federal program that matches federal dollars with state dollars to provide healthcare for low-income families who earn too much to qualify for Medicaid. Children who live in a household where the household income meets the qualifications can enroll in CHIP. And this is true even when parents get or accept an insurance benefits offer from their employer.

You can see if you or your family qualifies for Medicaid or CHIP by entering your zip code and income information here.

Am I Eligible For The Opt

- A limited-term employee? Yes, if you are eligible to participate in the State of Wisconsin Group Health Insurance Program, you are eligible for an employer contribution and you meet the other eligibility requirements. However, you must wait until your employer contribution would have begun until you are eligible to start receiving incentive payments.

- Graduate Assistants and Short-Term Academic staff? No, because you are not eligible for the WRS. If you are hired into a WRS eligible position with a state employer, you would be eligible for the opt-out incentive at a prorated amount.

- A less than half-time employee? Yes, as long as you meet the other eligibility requirements.

- On a leave of absence? Yes, if you are eligible to participate in the State of Wisconsin Group Health Insurance Program and you meet the other eligibility requirements. Once your health insurance employer contributions end, any opt out incentives also end.

- A Craftworker? Yes, effective January 1, 2022, if you are eligible . If you want to opt-out of coverage for 2022, file an application with your employer during open enrollment.

Recommended Reading: Can I Get Health Insurance Without Ssn

Employer Coverage And Medicare Part D

If your employer group insurance includes creditable prescription drug coverage, you can delay Medicare Part D enrollment with no penalty. In this way, it is similar to Medicare Part B.

Having Medicare with this coverage may not be helpful when you have prescription drug benefits through your employer, as the coverages will not work together. Always compare your group insurance to the benefits and cost of Original Medicare + a Medicare Supplement plan + Medicare Part D. Often, it is more cost-efficient and beneficial to leave group insurance and enroll in Medicare, adding a Medicare Supplement plan and a Medicare Part D plan.

The Psychology Behind Opting In And Opting Out

Psychologically, removing obstacles that make the desired behavior as easy as possible and obstacles in the way of unwanted behavior results in a performance of that desired behavior. Depending on the desired outcome, people will choose to opt-in or opt-out based on whichever action or option is easier.

The father of Social Psychology, Kurt Lewin, said, make the actions you want to encourage easier, akin to moving downhill and make the actions you want to discourage more difficult, aking to moving uphill

Also Check: Can I Pay For My Employees Individual Health Insurance

Other Potential Legal Issues To Consider

This article has assumed that the opt-out offer is made to all employees eligible for employer health plan coverage. Being more selective in that offering can lead to potential discrimination issues under a few different federal laws. Offering opt-out incentives only to employees who have a history of high health claims may violate nondiscrimination rules under the Health Insurance Portability and Accountability Act .

Depending on how an employer defines eligibility for the opt-out incentives, other federal laws, such as the Americans with Disabilities Act or the Age Discrimination in Employment Act , could be implicated. Opt-out incentives may violate the Medicare Secondary Payer rules for employers with Medicare-eligible employees .

World Observation CFOs are looking to any available option to reduce costs and may not be aware of the various nondiscrimination rules. In particular, Medicare-eligible employees and dependents seem to be a favorite target. Presumably since they are often high-cost and have other, affordable coverage, it seems like they would be easy to move off the plan. However, the MSP rules do prohibit targeting the incentives to that group, though, it is not illegal to provide information regarding Medicare or other options that might be more cost-effective. Employers just need to be aware of the potential issues.

How Does Medicare Work With Employer Insurance

When you have both Medicare and employer coverage, the size of your employer will determine how your Medicare benefits will coordinate with your employer coverage. If you become eligible for Medicare at age 65 while working for an employer with 20 or more employees, your group plan will be primary, and Medicare will be secondary.

In this scenario, most seniors choose to sign up for Medicare Part A because it is premium-free for those who pay Medicare tax for sufficient quarters. Additionally, if you are currently collecting Social Security Income, you will automatically enroll in Medicare Part A. After 24 months, you cannot collect Social Security Income benefits without signing up for Medicare Part A.

If you require care at a hospital, your Medicare Part A benefits will lower your costs. For example, imagine your employers group insurance has a $4,000 hospital deductible. In this case, it makes sense to enroll in Medicare Part A for a lower deductible.

For your outpatient and prescription drug coverage, a group health plan from an employer with 20 or more employees is creditable coverage. Coverage creditable for Medicare safeguards you from paying late enrollment penalties for Medicare Part B and Part D when you enroll in the future.

Read Also: Is Eye Surgery Covered By Health Insurance

Current Csea Pef Pbanys Nyscopba And M/c Employees

Current CSEA, PEF, PBANYS, NYSCOPBA, and M/C employees who can demonstrate and attest to having other employer-sponsored group health insurance may elect to opt out of NYSHIP’s Empire Plan or Health Maintenance Organizations.

Employees who elect to opt out of NYSHIP will receive $1,000 for waiving Individual Coverage or $3,000 for waiving Family Coverage. This amount will be credited to your bi-weekly paycheck as taxable income over the plan year.

Can You Decline Health Insurance For A Higher Salary

It may be possible to negotiate a higher salary if you decline coverage, as waiving this benefit could save your company thousands of dollars a year.

If you want minimum coverage and can negotiate a higher salary from your employer, you could save some money buying a low-cost plan on the ACA exchange, particularly if you are lower-income and can receive a premium tax credit, Kronk says.

However, due to tax discrimination laws, employee benefits are typically a take-it-or-leave-it option. Your employer may not legally be able to increase your income if you opt out of health benefits, cautions Neat.

Its wise to crunch the numbers on this strategy before declining your employers health insurance for a higher salary.

If you are going to turn down your employers coverage, youll need to get health insurance from somewhere else. If your employers payment in lieu of insurance is lower than your premiums would be elsewhere, its probably best to take your employers insurance. If not, take the money, Seuthe says.

Dorothea Hudson, a Clearwater, Florida-based health insurance expert, explains how a compensation bump-up might work.

If your part of the monthly premium would be $200, and your employer pays $100 toward your premium, then the cash in lieu of coverage amount should be $300, Hudson says.

Recommended Reading: Do Substitutes Get Health Insurance

What Happens To Medicare Advantage Or Part D If I Work

For Medicare Advantage, you also need to have both Part A and Part B, so you must drop that coverage if you stop Part B. After you leave your job, youll have two months to get a Medicare Advantage plan if you want a private plan rather than original Medicare. Otherwise, you can sign up during open enrollment, each year from Oct. 15 to Dec. 7.

For Part D prescription coverage, you can keep coverage as long as you have either Part A or Part B. But you may not need that coverage if your employer offers prescription drug coverage thats considered as good or better than Medicares, called creditable coverage. You wont pay a late-enrollment penalty as long as you sign up for Part D within two months of losing that coverage.

Bottom line: If you end up dropping either the Medicare Advantage all-in-one alternative to original Medicare or the Part D drug coverage that works with traditional Medicare, youll have two months after your job-based insurance ends to reenroll.

Keep in mind

When you return to work, be mindful of the high-income surcharge if you keep Medicare Part B or Part D. If youre single and your modified adjusted gross income is more than $91,000 or $182,000 if married filing jointly, youll have to pay higher premiums.

After you retire or experience certain other life-changing events, you can ask the Social Security Administration, which handles these surcharges, to use your more recent income to reduce or eliminate the surcharge.

How Is Affordability Determined

If applying for coverage through HealthCare.gov, employees will provide information about their individual coverage HRA offer when completing an application for Marketplace coverage, including the HRAs start date and their employer’s contribution amount. The Marketplace will determine if the offer meets requirements for affordability, which will help determine an employees eligibility for the premium tax credit. Prior to submitting a Marketplace application, employees can also use the HRA affordability tool for an estimate of their individual coverage HRAs affordability.

Don’t Miss: How Much Is Health Insurance A Year

Can I Decline Employer Insurance

Enrollment ended Jan 15th in most states. Find out what to do if you missed the deadline.

I am a recently retired teacher. I have been told by my district that I must have a 26 week break in service before I can substitute teach. Even though I have insurance their understanding is they have to offer me health insurance, and I cant decline it because I was employed full time from Oct. 1, 2014- July 1, 2015. Is it true that under the affordable care act, even though I would be working a few hours as a substitute, they still would have to offer me insurance? This is hurting the small income I would like to receive from substitute teaching.