What Other Benefits Should I Consider

When you’re comparing health plans, look for useful tools and services that may come at no additional cost and help you save time and money, and support your health.

- Websites and mobile apps

- A health information phone line for help finding answers to your medical questions

- Discount programs to help save on health and wellness products and services

Conditions Of An Already Overseas Policy:

- Who can buy? â You must be an Australian citizen or resident in order to buy a policy. You can also normally buy it if you are on a 457 working visa, a spousal visa or skilled working visa. However cover is not available to those in Australia on working holiday visas.

- Homeward bound You must have a booked return trip and be travelling back to Australia in order to buy this type of cover.

- Waiting periodsâ You may not be able to claim for any medical incidents in the first few days of your cover â this is known as a waiting period. A waiting period exists to protect insurers from those whoâve not bought insurance and then decide they need it later. Usually due to accident or illness and not wanting to pay the expensive overseas medical fees that they incur.

- Age limits Just like a standard policy, already overseas policies have age restrictions saying who can and cannot buy. Check out the age limits in the table below.

- Pre-exiting medical conditions â Conditions that exist before you departed for your holiday are unlikely to be covered. Always read your insurerâs policy documentation to see what conditions they cover for free. You should always tell your insurer of any pre-existing conditions when you first purchase your policy however trivial they may seem.

Donât Miss: New Cures For Type 1 Diabetes

Planning For Healthcare Costs In Retirement

The best time to begin planning for retirement is right now. The sooner you start planning, the better off you’ll be.

The same is true when it comes to planning for healthcare costs in retirement. You may have some coverage through the public system or employer rollover benefits. You probably won’t have enough coverage in retirement.

How much does Canadian healthcare cost? The average Canadian household spends $2,000 out of pocket and $4,000 per year on private health insurance.

As you can see, the price of Canadian healthcare is higher than you might think. Without private insurance, Canadians would spend much more out of pocket.

When you’re planning for retirement, you’ll want to include different kinds of policies. Catastrophic illness insurance is a good idea. Dental care and vision care policies are also helpful.

Don’t forget to plan for inflation as well. As the numbers show, in Canada, health insurance costs have been going up. By planning for future cost increases, you can make sure you have enough.

Read Also: Kroger Associate Discounts

What Coverage Is Provided In Every Health Insurance Plan

As part of the ACA, all health insurance plans must cover “essential health benefits.” These covered benefits include:

- Outpatient care

- Preventive and wellness services

- Dental and vision care for children

Essential health benefits provide a coverage baseline for all plans. However, there are still many variations of health insurance plans depending on plan type, deductibles, copays, out-of-pocket costs and provider networks.

You can find out the specifics about each plan offered by reviewing the Summary of Benefits and Coverage on each plan’s website. Your employer or the ACA marketplace should also provide side-by-side comparisons of available plans.

What Is Short Term Health Insurance

Short term health insurance, also called temporary health insurance or term health insurance, may be right for you if you need to fill a gap in coverage until you can choose a longer-term solution. It might be a good option if youre in between jobs, waiting for coverage to start, looking for coverage to bridge you to Medicare, turning 26 and coming off your parents insurance or many other situations. Short term health insurance offers flexible, fast coverage for those dynamic times of change in your life.

Read Also: Kroger Health Insurance Part-time

How To Choose The Best Health Insurance Plan For Your Family

Nov. 1 is the beginning of open enrollment the period when people can sign up for new health insurance plans in the health insurance marketplace created by the Affordable Care Act . Many private employers hold their annual enrollment periods at the same time. On this date, millions of people all over the country begin shopping for insurance.

It can be a complicated process. There are many factors to consider when choosing a health insurance plan, including the monthly premium, the out-of-pocket costs, and the network of available providers, such as doctors and hospitals. Even experts sometimes find it hard to sort it all out.

To make sense of it all, you need to tackle the job systematically. Work your way through step by step, beginning with a grounding in the basics of how health insurance and health insurance marketplaces work. From there, you can move on to comparing different types of plans, costs, and coverage.

Why Is Health Insurance So Expensive

The driving factor for why health insurance is so expensive is that health care is so expensive, says Louise Norris, a licensed health insurance agent based in Colorado and author of The Insiders Guide to Obamacares Open Enrollment. The price of health care in this country is really high.

According to a 2020 report from the Kaiser Family Foundation, insurers said the reasons they had to increase premium costs included the continued cost of COVID-19 testing, the rebounding of medical services that had been delayed during the pandemic and morbidities related to foregone care.

Recommended Reading: What Benefits Does Starbucks Offer Employees

What Is Private Health Insurance

Private health insurance is insurance coverage available to an individual and family purchased either through the federal health insurance marketplace or individual health insurance from private insurance companies on the private marketplace.

“Policyholders purchase this type of coverage directly from the insurer rather than through a plan sponsored by an employer, trade association, union, or other group that solicits multiple potential policyholders, says Brian Martucci, the Minneapolis-based finance editor for Money Crashers.

Many employees and people who work for themselves but don’t qualify for government-run insurance like Medicare or Medicaid turn to private health insurance as their only opportunity to get health coverage.

Unless the plan is subsidized by the government, as with some ACA/Obamacare plans, “private health insurance plans are paid out of pocket by a person or family using a personal bank account with post-tax income. You can choose and customize a private health insurance plan based on your needs,” says John Bartleson, owner of Health Benefits Connect.

How To Enroll And Get Answers To Your Questions

You can learn more about and apply for ACA health care coverage in several ways.

-

Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or you’ll be directed to your state’s health insurance marketplace website. vary by state.

-

Find a local center to apply or ask questions in person.

-

Download an application form to apply by mail

Find the answers to common ACA questions about submitting documents, getting and changing coverage, your total costs for health care, tax options, and more.

Read Also: Do Substitute Teachers Get Health Insurance

What If You Need Medical Care But Not A Lot Of It

In general, people who know that they are going to need moderate medical treatment in the coming year might be better served by a traditional plan with a lower deductible and copays despite the fact that the premiums will likely be higher than theyd be for an HDHP.

This is because people with modest health care needs might not end up meeting their out-of-pocket maximum. The lower deductible means that their insurance plan will start to pay sooner, and the plan might cover a variety of services like office visits, urgent care visits, and prescriptions with copays instead of having the patient pay for them with the costs counting towards the deductible.

Again, theres no one-size-fits-all here, and modest health care needs means different things to different people. But if the care youre going to need isnt likely to put you near the out-of-pocket maximum on the plans youre considering, you might find that you come out ahead with a traditional plan, despite the higher premiums and loss of the tax advantages that go along with the HDHP/HSA combination.

The 5 Types Of Insurance Everyone Needs

Fact-checked with HomeInsurance.com

If youre an adult, a necessary financial protection youll need is insurance. Insurance protects you, your investments and most importantly, those close to you. Of course, there are many different types of insurance, but the good news is that you likely dont need every insurance product available on the market. This article explores the most common and necessary forms of insurance and what you need to know about each.

Read Also: What Benefits Does Starbucks Offer

Covered California: California’s Healthcare Marketplace

As part of the Affordable Care Act, California created a health insurance marketplace called Covered California. Through Covered California, individuals, families, and small businesses can purchase insurance products sold by private insurers. Covered California also helps individuals and families determine if they qualify for the Medi-Cal program and subsidies from the federal government toward purchase of a private insurance plan. Visit Covered California for more information about getting coverage.

Where Can I Get Health Insurance

If you or a family member has access to an employer-sponsored group health insurance plan through work, you may be able to sign up for a policy with them. Unfortunately, many small businesses don’t offer health insurance. If you work for a company that doesn’t offer health insuranceor you’re unemployed and not eligible for coverage through anyone else’s planyou can sign up for an individual health insurance plan yourself directly through a health insurance company’s website or on the Health Insurance Marketplace.

The Health Insurance Marketplace is the website developed as a result of the Affordable Care Actalso known as the ACA and Obamacarewhich overhauled the individual health insurance market and made individual plans more accessible and affordable.

Through the Marketplace, you can compare major health insurance companies, coverage options, costs, and more. You can generally sign up for health insurance on the Marketplace if you’ve experienced a qualifying life event, such as loss of coverage due to a layoff, or during open enrollment which is usually between Nov. 1 and Jan. 15 each year.

Other ways you may be able to get health insurance include Medicare, Medicaid, or the Children’s Health Insurance Program , or via membership in a labor union, professional association, club, or other organization that offers health insurance to members.

Read Also: What Insurance Does Starbucks Offer

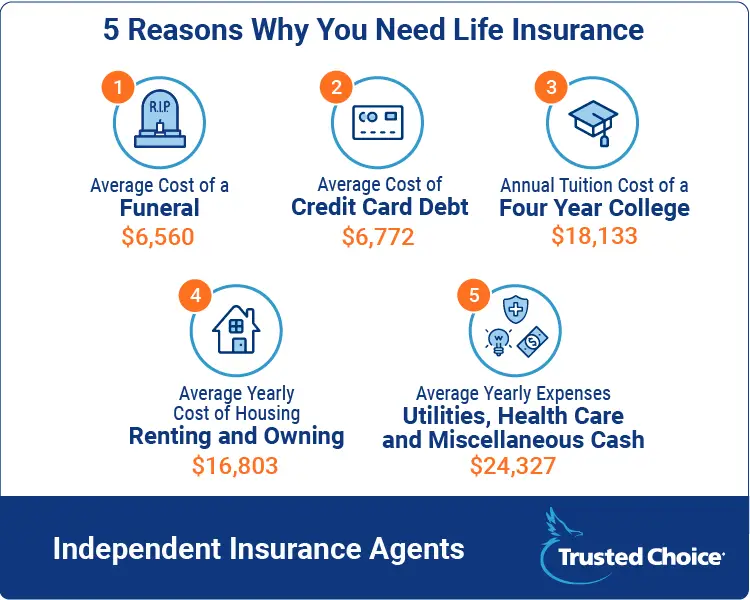

Life Insurance Should Be An Important Part Of Your Financial Plan However It Can Be Confusing To Know What Type To Purchase

Tags:Insurance

As with how much life insurance you need, the answer to which type of life insurance to purchase depends on your age, life stage and financial needs, according to Tom Nicoski, senior vice president and head of insurance for U.S. Bancorp Investments.

There are two main types of life insurance, term and permanent.

Health Insurance Plans For Your Family

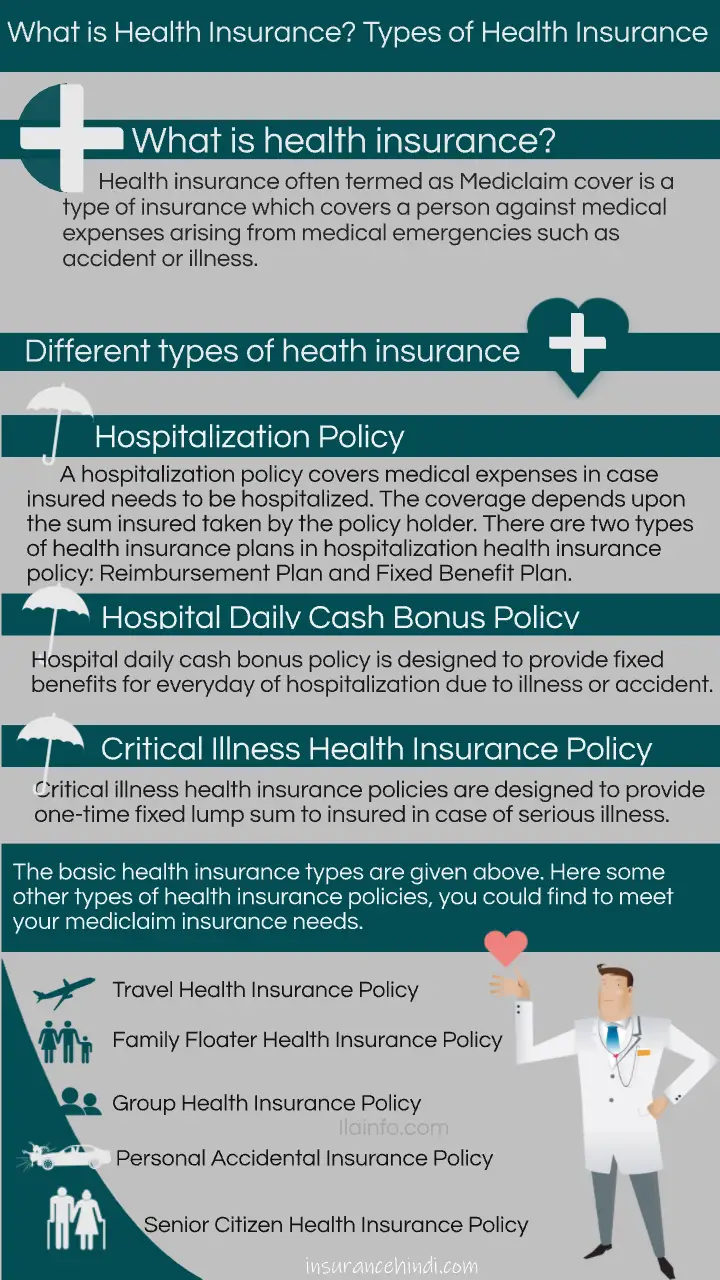

Medical emergencies might strike any member of your family. As such, you need a health insurance plan which covers all your family members so that if anyone falls ill, the policy comes to your financial rescue.

There are various types of health insurance plans in India with a variety of benefits attached to it. However, while buying a health insurance plan for your family, it should be chosen with utmost care. You need to consider various aspects before finalising the plan. This would ensure that the policy is comprehensive and it provides adequate coverage to your family.

If you need help with choosing the right health insurance plan for your family, given below is a guide to help you with the same.

Health insurance plans are offered as family floater health insurance plans. These plans cover multiple family members under a single policy. You can avail coverage for

- Yourself

- Dependent children

- Dependent parents

Moreover, there are some plans which extend coverage to include parents-in-law, siblings and other extended members of the family. So, if you are looking for coverage of your whole family, you can opt for family floater health insurance plans.

Recommended Reading: What Health Insurance Does Starbucks Offer

Avoiding A Financial Catastrophe

I didnt end up picking the high-deductible plan. One big reason to have insurance is to reduce the chance of a financial catastrophe. And on that score, I was worried the HSA plan would come up short.

There are three other plans listed.

Im pretty much ignoring the EPO plan it might be a good option for someone who needs to see a doctor regularly and is willing to stay within a more limited network of clinicians. The plan doesnt offer any coverage if you go to a doctor or hospital that isnt included in its network. Its a lot more expensive than the HSA plan and wouldnt make sense for me because I dont need much care.

The two PPO plans offer a broader selection of doctors than their less expensive counterparts. The “High PPO” plan has a lower deductible and out-of-pocket spending limit, but its upfront cost is much higher. Since Im hoping I wont end up needing much medical care, thats not a good option for me, either.

That leaves the “Low PPO” plan, which is the one I ended up picking.

The PPO plans, in addition to their broader networks, will also pay for out-of-network care, though it would be really expensive. The HSA and EPO plans dont cover any care provided by doctors or hospitals that arent in their network, except in an emergency.

Do You Need To Declare A Diagnosis Of Prediabetes

Suppose youve been diagnosed with prediabetes by your GP or a medical practitioner. In that case, youll still need to get that condition covered as it may lead to you requiring medical attention or treatment abroad. You may have been placed on blood pressure tablets due to the diagnosis, or you might have had a dosage changed due to prediabetes. This will affect the type of treatment and the cost of the treatment you may need while away.

Recommended Reading: Starbucks Benefits For Part Time Employees

How To Pick A Health Insurance Plan

Modified date: Mar. 23, 2022

Confused about buying health insurance? Youre not alone. Purchasing health insurance can be extremely complicated, especially if youre getting insurance for the first time on your own.

After I turned 26 and was dropped from my parents policy, I spent hours researching the various plans, benefits, prices, and companies. But ultimately, I ended up with more questions than answers and just settled on the cheapest policy I could find.

Fast forward to today. Ive had my own medical coverage for a few years, which has given me time to learn the ins and outs of health insurance. If you need help choosing the best health insurance plan, I can help you get started.

Whats Ahead:

Diabetes Travel And Holiday Insurance At A Fair Price

We dont feel its fair to charge high premiums to people with a diabetes diagnosis, when it can be very well controlled by diet, medication and insulin. Its important that you declare your condition whether you are applying online or over the telephone, so that we have it on record in the event of a claim.

Our team provide the best service to our customers and will endeavour to find the best policy for you. Our prices are based on a persons current state of health at the time of taking out a policy, so if you live with diabetes or have a history of repeated hospital admissions, we will tailor a policy that specifically meets your individual needs, making sure you have the best level of cover for your trip.

Looking for general travel tips and guidance? Click to see information about travelling with Diabetes, provided by Diabetes UK. .

Read Also: Proof Of Va Health Insurance For Taxes

How Will Diabetes Affect My Travel Insurance Policy

Depending on the nature and severity of your diabetes, you will find that the condition is likely to have an impact on your travel insurance policy. Because of the risk of complications potentially resulting from your diabetes, you may find that a higher premium will be required than someone travelling without the condition. Even so, it is always the wisest course of action to be honest when taking out a travel insurance policy. Declaring any medical conditions you have, will allow the insurer to issue a policy that wonât be rendered invalid.

Recommended Reading: Lesser Known Symptoms Of Diabetes

Your Options If Youre Not Eligible Through Your Employer

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

If your employer doesnt offer you health insurance as part of an employee benefits program, you may be looking at purchasing your own health insurance through a private health insurance company.

A premium is the amount of money that an individual or business pays to an insurance company for coverage. Health insurance premiums are typically paid monthly. Employers that offer an employer-sponsored health insurance plan typically cover part of the insurance premiums. If you need to insure yourself, youll be paying the full cost of the premiums.

It is common to be concerned about how much it will cost to purchase health insurance for yourself. However, there are various options and prices available to you based on the level of coverage that you need.

When purchasing your own insurance, the process is more complicated than simply selecting a company plan and having the premium payments come straight out of your paycheck every month. Here are some tips to help guide you through the process of purchasing your own health insurance.

You May Like: Shoprite Employee Benefits