Shopping For A Health Plan

- Know what youll have to pay. Plans with higher deductibles, copayments, and coinsurance have lower premiums. But you’ll have to pay more out of pocket when you get care.

- Consider things other than cost. To learn a companys financial rating and complaints history, call our Help Line or visit our website.

- Get help. If you buy health insurance from the federal marketplace, you can get free help choosing a plan. Call the marketplace for more information.

- Buy only from licensed companies and agents. If you buy from an unlicensed insurance company, your claim could go unpaid if the company goes broke. Call our Help Line or visit our website to check whether a company or agent has a license.

- Get several quotes and compare coverages. Know what each plan covers. If you have doctors you want to keep, make sure theyre in the plans network. If theyre not, you might have to change doctors. Also make sure your medications are on the plans list of approved drugs. A plan wont pay for drugs that arent on its list.

- Fill out your application accurately and completely. If you lie or leave something out on purpose, an insurance company may cancel your coverage or refuse to pay your claims.

Use our Health plan shopping guide to shop smart for health coverage.

How To Use Your Ppo

- You may need to get prior authorization from BCBSNM before getting certain tests or services. Your doctor’s office will call the prior authorization number listed on your BCBSNM member ID card to confirm. You can also call before you go for care or to confirm your doctor’s office has gotten the needed authorization.

- For non-emergencies.For a common illness or injury, like a cold, flu, minor cut or burn, you have a few options to get care. These are less expensive than going to the emergency room.

- Visit a retail health clinic or urgent care center. Check Provider Finder to make sure the facility is in your plan’s network.

Helpful hint No matter which plan you have, before you need care, learn how your plan works, what’s covered and where you can go for care. Knowing how your plan works may save you time and money. Learn more about Making Insurance Work For You.

What Are The Differences Between A Ppo And Other Networks

All types of health insurance policies will provide coverage for services. The main difference will be where you can get those health services, which will be determined by the provider network of the health insurance plan.

In addition to where you receive care, different networks will also determine how much you will pay for those health services. This makes choosing a health policy with the right network for your needs extremely important. We have provided detailed descriptions of each provider network compared to a PPO below.

Don’t Miss: How To Get A Replacement Health Insurance Card

How Do I Get Insurance For My Family

You can add your family to a work health plan. If you buy from an insurance company or the marketplace, you can buy a plan that also covers your family.

You can keep your dependent children on your plan until they turn 26. They don’t have to live at home, be enrolled in school, or be claimed as a dependent on your tax return. You can keep married children on your plan, but you cant add their spouses or children to it.

If you have dependent grandchildren, you can keep them on your plan until they turn 25.

Pros And Cons Of Ppo Plans

PPO plans offer a lot of flexibility, but the downside is that there is a cost for it, relative to plans like HMOs. PPO plan positives include not needing to select a primary care physician, and not being required to get a referral to see a specialist. Furthermore, you’re still covered even if you see a provider that isn’t in the PPO network, though the coverage will be lower than if you see an in-network provider.

PPO plan cons include the aforementioned costs – premiums will generally be higher, and you’ll usually be responsible for paying the full cost of the medical services you use until you meet the plan’s deductible.

Also Check: How Much Do You Pay For Family Health Insurance

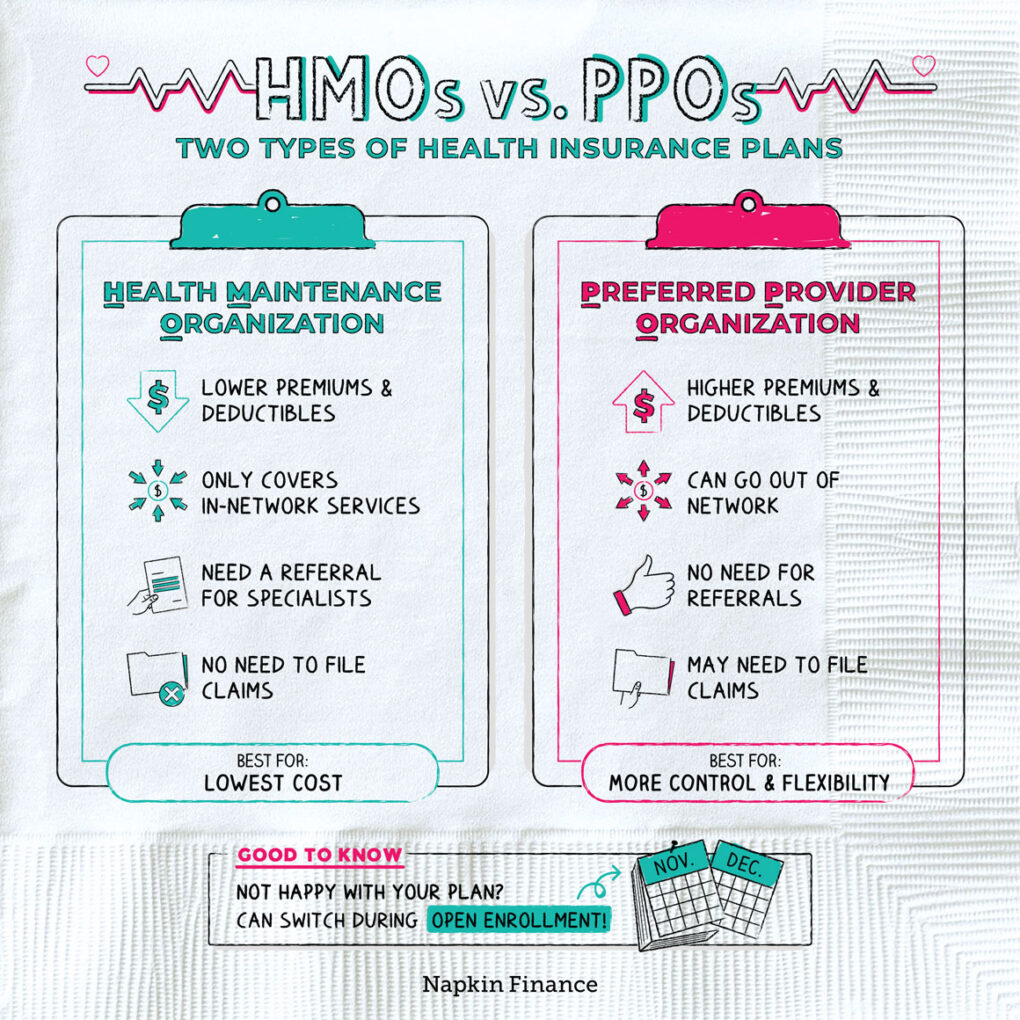

Ppos Usually Win On Choice And Flexibility

If flexibility and choice are important to you, a PPO plan could be the better choice. Unlike most HMO health plans, you won’t likely need to select a primary care physician, and you won’t usually need a referral from that physician to see a specialist. A PPO network will likely be larger, giving you a greater selection of in-network doctors, specialists, and facilities to choose from. Additionally, PPOs will generally have some coverage for out-of-network providers, should you want or need to see one. With HMOs, out-of-network coverage will usually be limited to emergencies non-emergency services are not usually covered at all.

What Can You Expect To Pay For Health Insurance Deductibles

The average health insurance deductible for an ACA marketplace plan is slightly more than $5,000.

Most ACA plans are either Bronze or Silver plans, which have deductibles that are often over $2,000. You may find a lower deductible plan, such as $1,000 or less, on the Gold tier, but those health plans come with higher premiums.

Also Check: Can I Use Health Insurance For Dental

Hmo Vs Ppo: What’s The Difference Between Them

Its good to have choices. When it comes to health insurance, you have your choice of several plan types. Two popular types you’ll frequently see are HMO and PPO.

Differences between HMO and PPO plans include network size, ability to see specialists, costs, and out-of-network coverage.

To learn more about these and other differences between these two plan types, lets take a closer look at each to learn more about how they’re alike, how they’re different, and how you can choose the type of plan that meets your needs.

Employee Health Insurance Premiums

If you work for a large company, health insurance might cost as much as a new car, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. Kaiser found that average annual premiums for family coverage were $21,342 in 2020, which was nearly identical to the base manufacturer’s suggested retail price of a 2022 Honda Civic$22,715.

Workers contributed an average of $5,588 toward the annual cost, which means employers picked up 73% of the premium bill. For a single worker in 2020, the average premium was $7,470. Of that, workers paid $1,243, or 17%.

Kaiser included health maintenance organizations , PPOs, point-of-service plans , and high-deductible health plans with savings options in arriving at the average premium figures. It found that PPOs were the most common plan type, insuring 47% of covered employees. HDHP/SOs covered 31% of insured workers.

| Average Employee Premiums in 2020 |

|---|

| Employee Share |

| $104 |

Of course, whatever employers spend on their workers’ health insurance leaves less money for wages and salaries. So workers are actually shouldering more of their premiums than these numbers show. In fact, one reason wages may not have risen much over the past two decades is because health costs have risen so much.

Which type of plan employees choose affects their premiums, deductibles, choice of healthcare providers and hospitals, and whether they can have a health savings account , among many choices.

Don’t Miss: What Insurance Does Aurora Health Care Accept

How Does Preferred Provider Organization Insurance Work

PPO plans have provider networks, but youre not required to stay within the networks. Youll pay less for in-network providers, but you can use out-of-network doctors and facilities, too.

You usually have to pay higher copayments and deductibles if you use health care providers that arent in the plans network, but the out-of-network care is still covered by the plan. Unlike an HMO, you dont need to select a primary care physician to manage your care, and you dont need a referral to see a specialist. However, you may have to receive prior approval from the plan before more expensive services are covered.

If you use an out-of-network provider, you may be responsible for extra paperwork, too. You may need to get preauthorization for certain services and have to submit the claim to the insurance company yourself. In-network providers generally complete this process themselves.

In a PPO, members are free to choose which providers they see, says Mark Hope, senior director, health & benefits consulting at Willis Towers Watson, an employee benefits consulting firm.

Hope says PPO members pay lower out-of-pocket costs and wont have to file claims themselves if they see a network provider. PPO network providers are also generally responsible for obtaining any pre-certification for services.

Hmo Health Insurance Plans

An HMO gives you access to certain doctors and hospitals within its network. A network is made up of providers that have agreed to lower their rates for plan members and also meet quality standards. But unlike PPO plans, care under an HMO plan is covered only if you see a provider within that HMOs network. There are few opportunities to see a non-network provider. There are also typically more restrictions for coverage than other plans, such as allowing only a certain number of visits, tests or treatments. Some other key points about HMOs:

- Some plans may require you to select a primary care physician , who will determine what treatment you need.

- With some plans, you may need a PCP referral to be covered when you see a specialist or have a special test done.

- If you opt to see a doctor outside of an HMO network, there is no coverage, meaning you will have to pay the entire cost of medical services.

- Premiums are generally lower for HMO plans, and there is usually no deductible or a low one.

Some HMO plans, including those offered by Medical Mutual, don’t require you to select a PCP or have a referral to see a specialist.

For more HMO specifics, read our About HMO Plans article.

Recommended Reading: What Is Tricare Health Insurance

Ppo Vs Pos: What Are The Main Differences

When you’re comparing health plans it’s important to understand what sets them apart from one another. This way you can make a decision based on your needs. Here are some main features that you can compare to find out what makes a PPO different from a POS:

- Primary Care Provider requirement

- In-network requirement

- Referrals to other providers

Ppo Health Insurance Plans

PPO plans provide more flexibility when picking a doctor or hospital. They also feature a network of providers, but there are fewer restrictions on seeing non-network providers. In addition, your PPO insurance will pay if you see a non-network provider, although it may be at a lower rate. Here are some key features:

- You can see the doctor or specialist youd like without having to see a PCP first.

- You can see a doctor or go to a hospital outside the network and you may be covered. However, your benefits will be better if you stay in the PPO network.

- Premiums tend to be higher, and its common for there to be a deductible.

Read a more detailed definition of PPO in our PPO Plans article.

Don’t Miss: Is There Any Affordable Health Insurance

Is It Better To Have A Copay Or Deductible

Copays are a fixed fee you pay when you receive covered care like an office visit or pick up prescription drugs. A deductible is the amount of money you must pay out-of-pocket toward covered benefits before your health insurance company starts paying. In most cases your copay will not go toward your deductible.

Change In Average Health Insurance Cost For 2022

From 2021 to 2022, health insurance rates across the nation increased by less than 1%. South Dakota saw the largest year-over-year jump in health insurance costs for a 40-year old on a silver plan increasing just over 23%. Including South Dakota, 27 states had their rates increase on average from 2021 to 2022.

Year-over-year rates decreased the most in Georgia, South Carolina and Nebraska, which all fell by more than 10% . Overall, 21 states experienced a decrease in health insurance premiums. Two states Idaho and Virginia saw no year-over-year change.

| State |

|---|

Don’t Miss: Can You Go To The Health Department Without Insurance

If Your Company Cant Pay Its Claims

Guaranty associations pay claims for licensed insurance companies that go broke. There are separate guaranty associations for different lines of insurance. The Texas Life and Health Insurance Guaranty Association pays claims for health insurance. It will pay claims up to a dollar limit set by law.

It doesn’t pay claims for HMOs and some other types of plans. If an HMO cant pay its claims, the commissioner of insurance can assign the HMO’s members to another HMO in the area.

Who Would A Ppo Plan Be A Good Fit For

If you need the flexibility to see both in- and out-of-network providers, then a PPO may be a good fit for you. With a PPO, youll have access to an extensive network of doctors and hospitals and the freedom to see any doctor or specialist without a referral. But youll pay lower costs when you use in-network providers and higher costs for out-of-network providers.

You May Like: How Much Aetna Health Insurance Cost

Get Help Paying For Your Health Insurance Costs

Under the Affordable Care Act, you may be able to get help paying for your health insurance costs through one or both of these options:

To get help paying for your health insurance costs, you must:

- Have an income within a certain range for your household size.

- Not be claimed as a dependent on someone else’s tax return.

- Purchase a Silver plan on the Health Insurance Marketplace.

- Be ineligible for a government-sponsored program or an employer-sponsored health insurance plan

See if you qualify for a tax creditor cost sharing assistance. Or, you canapply onlineto get your official results.

Comparing Costs Between Ppo And Pos

When it comes to the costs for PPO vs. POS plans, how do they stack up?

- Deductibles:PPO plans usually come with a deductible. This means you pay for care and services until the deductible is met. Then your plan starts sharing costs. POS plans typically do not have a deductible as long as you choose a Primary Care Provider within your plan’s network and get referrals to other providers, if needed.

- Copays:Both PPO and POS plans may require copays. This is a fee you pay to a doctor at the time of a visit or for a prescription medication.

- Coinsurance:You may be required to share some of the costs for your care with both a PPO and POS plan. For a PPO plan, your coinsurance kicks in once you’ve met your deductible. With a POS plan, coinsurance costs could kick in if you need out-of-network care or fail to get referrals to see other providers.

- Premiums:This is what you pay monthly for your plan. Typically you will have a higher premium with a PPO because it offers more options. The POS plans usually have lower premiums because they offer fewer options.

Read Also: Does Insurance Pay For Home Health Care

Premium Tax Credits Can Help You Pay For Coverage

Tax credits are amounts taken off what you owe in taxes. You can use this savings to pay your health insurance premiums. To get a tax credit, you must buy through the federal marketplace. Your income must be between 100% and 400% of the federal poverty level.

You can’t get a tax credit if your employer offers affordable health insurance or your income is below the poverty level.

For more information about tax credits, visit HealthCare.govs Saving Money on Health Insurance page.

How Do I Know If A Provider Is In My Network

To make sure a provider is in your plan’s network, search Provider Finder®, our online directory. Provider Finder allows you to see the doctors, hospitals and other providers who accept members in certain health plans. You can search by your plan name to see all the providers in your health plan’s network, or you can search for certain providers you want to use, to see which health plans they accept.

Provider Finder also includes a cost estimator to help you find costs for general health visits as well as specific procedures, surgeries, diagnostics and imaging, vaccinations/ immunizations and other services.

If you’re a Blue Cross and Blue Shield of New Mexico member, register or log in toBlue Access for MembersSM, our secure member website, for a personalized search based on your health plan and network.

Read Also: Do I Have To Have Health Insurance In Texas

Do You Stay Close To Home Or Do You Travel A Lot

If you travel frequently and are more likely to need care while away from home, especially if you are living with a chronic condition, or enjoy high-risk hobbies such as certain sports, you may need a PPO to provide the best coverage for your needs.

If you need a lot of specialist care, say you are managing a rare or chronic condition, you may also prefer the ease of choosing specialists and seeing them right away that you get with a HMO plan.

If you mostly get care in your home city or mostly from your family physician, an HMO is more likely to provide the right coverage for you.