What To Keep In Mind While Shopping For Family Health Insurance

Family health insurance costs can vary significantly, depending on your circumstances and preferences. While there is no tax penalty for not having health insurance in 2020, it is still important to get your family covered to protect yourself from unexpected healthcare costs that can be substantial in some situations.

To find family coverage thats right for your family and your budget, take a look at eHealths family health insurance options by state. eHealth can help you navigate all of these cost variables and find an affordable plan for you and your family.

What Is Individual Health Insurance

Individual health insurance is just another term for private coverage as opposed to a group plan . Its simply the kind you get on your own, even if youre including family members on your plan.

You might be looking for individual health insurance for a couple different reasons. If your employer doesnt offer it, if its too expensive or if youre retiring before the age of 65. Youll also need it if you work part time, youre unemployed or self-employed.

Plans offered in the marketplace are also examples of individual health insurance.

Now . . . lets dig into the numbers.

Types Of Health Plans

Because there are many different types of health plans, you should be sure to look for the one that fits your needs. Comprehensive health insurance provides benefits for a broad range of health care services. These health plans offer a detailed list of health benefits, may limit your costs if you get services from one of the providers in the plans network, and typically require co-payments and deductibles.

Here are some of the types of plans offered in Massachusetts

Health Maintenance Organization

HMO plans cover hospital, medical and preventive care. You are only covered if you get your care from HMO’s network of providers . With most HMO plans you pay a copayment for each covered service. For example, you pay $30 for an office visit and the HMO pays the rest of the cost.

Preferred Provider Plans

Preferred provider plans usually cover hospital, medical and preventive care. These plans have a network of preferred providers that you can use, but they also cover services for out-of-network providers. PPP’s will pay more of the cost if you use a provider that is in the network. Example: After copays and deductibles, the plan pays 100% of a service for a network provider but 80% for an out-of-network provider. Note that if you choose to go OON when you are in a PPP, your provider may balance bill you directly for the entire cost of the procedure.

Major Medical Plans/ Indemnity Plans

Read Also: Do You Need Health Insurance For Chiropractor

How Do Us Health Insurance Costs Stack Up Globally

Voluntary healthcare payments including for private health insurance totalled more than $1,685 per capita in the USA in 2019.

This is lower than the figure in Switzerland, where voluntary payments were worth $2,745 per capita.

However, the USAs private spending continues to soar far above that in many other nations. American private health spending is five times higher than Canadas, for instance.

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

Also Check: Is Eye Surgery Covered By Health Insurance

How Can I Save Money On Healthcare

Bartleson says, “don’tI always suggest looking into a strategy that I call ‘stacking’ to save money on health insurance. First, start by selecting a high deductible health plan with a low monthly premium. Next, use some of the premium cost savings to purchase a secondary plan. The result is a lower overall monthly premium, lower overall out-of-pocket costs, and great coverage for the family/individual.”

Mira and other health insurance alternatives are great “secondary plans”. These memberships offer immediate, transparent benefits without the hassle.

The Importance Of Affordable Employer

Understanding the average cost of employer-sponsored health insurance can help small business owners explore coverage options for themselves, their families, and their employees.

According to an of small business owners, the top two most important factors for small employers when choosing a group health plan are affordable monthly premiums and out-of-pocket costs.

Source: eHealth 2018 Small Business Health Insurance Report

Also Check: How Much Does Health Insurance Cost Per Employee

Health Insurance Costs By Tier Of Plan

| Plan Tier | Percentage of costs covered by the plan | Who it’s best for |

|---|---|---|

| 100% after out of pocket maximum is reached | Those who only want coverage in case of an emergency | |

| Bronze | Healthy people who do not go to the doctor often | |

| Silver | People who qualify for tax credits | |

| Gold | People who often seek medical care | |

| Platinum | Those who use a lot of care and can afford a high monthly fee |

Average Family Health Insurance Cost Annually

Another family medical insurance cost you can expect to pay aredeductibles. A deductible is the amount of money that you pay out of pocket forhealthcare before your health insurance takes over payment. After youvereached this amount, your insurance will generally pay for the rest of anycovered care that you receive for the rest of the year.

Unlike individual plans, you may have two deductibles with family health insurance: an individual deductible and a family deducible. This is not true for all plans, so make sure to check your plan details before buying and educate yourself about how deductibles work for your chosen plan. You must reach either the individual or family deductible before your health insurance kicks in and starts paying toward care.

According to the recent eHealth study, family health insurance plans had an average annual deductible of about $8,439 in 2020.

Also Check: Who Is Eligible For Aarp Health Insurance

How Much Does Health Insurance Cost Per Month In Each State

The national average health insurance premium for a benchmark plan in 2022 is $438, according to the Kaiser Family Foundation.1 A benchmark plan is the average premium for each states second lowest cost silver plan.

The following data reflects the national average, and each states average, but does not include any reduction in cost from subsidies. Rates will vary by area.1

Health Insurance Costs Rising

All the noise pointed people away from the real meat of the Fraser studies. That was how much health costs had increased and how fast they were increasing.

For that average family, the cost of health insurance rose 1.4 times faster than their incomes did between 2006 and 2016. Incomes were up 26% in that time, but health insurance was up 37%.

To put it in perspective, the cost of shelter rose 36% during that time and the cost of food rose 30% during that time. Insurance costs rose 1.3 times as fast as these basic costs.

You May Like: How To Buy Health Insurance In Washington State

Total Out Of Pocket Costs

What people do see is their out-of-pocket expenses. Changes to supplemental insurance programs over the past years have impacted deductible rates as well as items covered.

Pre-existing conditions can also play a big part in how much you pay for health care. Your condition may prevent you from being able to get supplemental coverage. Most often, however, it means there are exclusions in your health plan or higher deductibles. Both of these mean higher costs to you.

How Premium Costs Have Changed In Recent Years

In recent years, healthcare costs have kept rising for both individuals and families in the U.S. This is also true for monthly and annual insurance premiums. The average yearly premium for a family has increased by more than 25% since 2015, and it’s increased by over 60% since 2010.

Healthcare spending in the U.S. grows each year. Projections estimate yearly annual spending of nearly $6 trillion by 2027, 50% increase compared to the $4.1 trillion spent in 2020.

Don’t Miss: How Much Does Health Insurance Cost In The United States

Employers Pay 83% Of Health Insurance For Single Coverage

In 2020, the standard company-provided health insurance policy totaled $7,470 a year for single coverage. On average, employers paid 83% of the premium, or $6,200 a year. Employees paid the remaining 17%, or $1,270 a year.

For family coverage, the standard insurance policy totaled $21,342 a year with employers contributing, on average, 73%, or $15,579. Employees paid the remaining 27% or $5,763 a year.

The Average Cost Of Health Insurance In 2022

Everyone knows that health care is expensive, but just how much is health insurance for one person? The average health insurance cost per month for a 40-year-old individual is $477, or nearly $6,000 per year. However, keep in mind that premiums vary widely based on where you live, along with your age, family size and type of insurance plan.

Compare Health Insurance Rates

Ensure you’re getting the best rate for your health insurance. Compare quotes from the top insurance companies.

This national average is for private health insurance you buy on the governments Health Insurance Marketplace created by the Affordable Care Act, often called Obamacare.

MoneyGeek researched national data and analyzed how health insurance rates change based on the type of insurance plan, the number of people covered and the location of that coverage, among other factors.

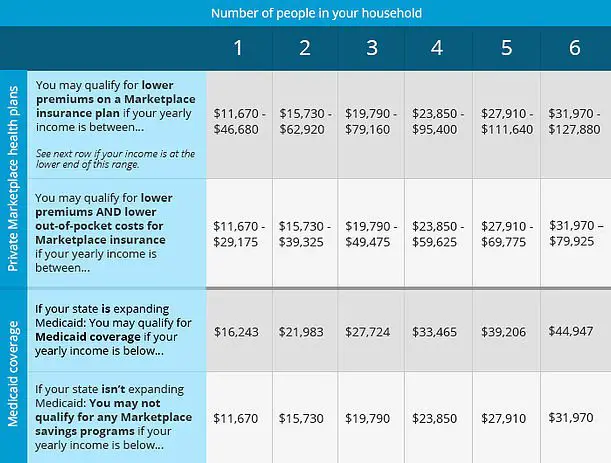

Many Americans qualify for subsidies that make buying health insurance on the Marketplace more affordable. You may also have lower-cost options if your employer offers health benefits or you’re eligible for government insurance programs such as Medicaid or Medicare, which offer comprehensive plans like Medicare Advantage for affordable prices.

Key Takeaways

The average health insurance premium for a 40-year-old is $477 per month.

Age, location, family size and plan type are all influential factors in the cost of health insurance.

You May Like: Is Christian Healthcare Ministries Health Insurance

Average Costs For Health Insurance In Canada

When you add it all up, health care costs quite a bit. The Fraser Institute’s 2016 report broke down the cost of public health insurance for a family of two adults and two children on an income scale.

The 10% of Canadian families with the lowest incomes, earning an average of $14,028, paid an average of $443 in premiums. The 10% of families at the top end of the scale earned $281,359 and paid an average of $37,361.

It’s the middle ground that has created a bit of controversy over the Fraser Institute’s numbers. In 2016, they pegged that average on that scale as being a family earning $60,850 who paid $5,516 in premiums. An individual earning $42,914 paid $4,257 in premiums.

A year later they said the average family of four earning the average 2017 salary of $127,000 would pay nearly $12,000 in premiums. The actual math on the two figures was not that far off, but there was a lot of political posturing and controversy over whether a median income or average income was a more meaningful measure and more representative of the country and actual spending.

Total Costs & Metal Categories

When you compare plans in the Marketplace, the plans appear in 4 metal categories: Bronze, Silver, Gold, and Platinum. The categories are based on how you and the health plan share the total costs of your care.

Generally speaking, categories with higher premiums pay more of your total costs of health care. Categories with lower premiums pay less of your total costs.

So how do you find a category that works for you?

- If you dont expect to use regular medical services and dont take regular prescriptions: You may want a Bronze plan. These plans can have very low monthly premiums, but have high deductibles and pay less of your costs when you need care.

- If you qualify for cost-sharing reductions: Silver plans may offer good value. If you qualify, your deductible will be lower and youll pay less each time you get care. But you get these extra savings only if you enroll in Silver. If you dont qualify for CSRs, compare premiums and out-of-pocket costs of Silver and Gold prices to find your right plan. See if your income estimate falls in the range for cost-sharing reductions.

- If you expect a lot of doctor visits or need regular prescriptions: You may want a Gold plan or Platinum plan. These plans generally have higher monthly premiums but pay more of your costs when you need care.

Dont Miss: What Causes Health Insurance Premiums To Increase

Recommended Reading: Does Shelter Insurance Offer Health Insurance

How Does The Size Of My Family Impact My Insurance Cost

Who is this for?

If you purchase your own health coverage, this explains how the number of people covered by your insurance affects your monthly payment and other costs.

The size of your family doesnt necessarily determine what you spend on doctors and prescriptions. A healthy family of six could spend less than a married couple with chronic conditions. But when it comes to your health insurance costs, the number of people on a plan does affect what you pay. Well show you how.

Also Check: How Much Is Private Health Insurance In Spain

How Much Does Individual Health Insurance Cost

BY Anna Porretta Updated on November 24, 2020

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.

To see personalized quotes for coverage options available in your area, browse health insurance by state. If you already know which health insurance carrier youd like to purchase from, check out our list of health insurance companies.

Recommended Reading: How Much Does It Cost To Get Health Insurance License

The Average Cost Of Health Insurance By Plan Types

There are four types of health plans you can choose on the Marketplace, with varying degrees of flexibility and cost:

- Health Maintenance Organization : HMOs tend to have lower premiums but require you to use a specific set of providers and get referrals to specialists for covered services, except in emergencies. Silver HMOs average $473 per month.

- Exclusive Provider Organization : Somewhere between an HMO and a PPO, EPOs typically require that you use the health plans in-network providers, but you dont always need referrals to see specialists. EPO Silver plans average $508 per month.

- Preferred Provider Organization : PPOs tend to be more expensive than HMOs but typically offer a broader range of providers. You usually dont need to get a referral to see specialists for covered services. On the Marketplace, Silver PPO plans have an average premium of $517.

- Point of Service : POS plans tend to be the most flexible at an increased financial cost. You can usually get care outside of the health plans provider network, though youll likely pay more for those services. POS Silver plans have an average monthly premium of $534.

Average Health Insurance Premiums by Plan Type – Silver Plans

Scroll for more

- $534

Applied Behavior Analysis Medical Necessity Guide

The Applied Behavior Analysis Medical Necessity Guide helps determine appropriate levels and types of care for patients in need of evaluation and treatment for behavioral health conditions. The ABA Medical Necessity Guide does not constitute medical advice. Treating providers are solely responsible for medical advice and treatment of members. Members should discuss any matters related to their coverage or condition with their treating provider.

Each benefit plan defines which services are covered, which are excluded, and which are subject to dollar caps or other limits. Members and their providers will need to consult the member’s benefit plan to determine if there are any exclusions or other benefit limitations applicable to this service or supply.

The conclusion that a particular service or supply is medically necessary does not constitute a representation or warranty that this service or supply is covered for a particular member. The member’s benefit plan determines coverage. Some plans exclude coverage for services or supplies that Aetna considers medically necessary.

Please note also that the ABA Medical Necessity Guide may be updated and are, therefore, subject to change.

Don’t Miss: What Does No Cost Share Mean In Health Insurance

What Is A Deductible

A deductible is the amount you must pay toward your health insurance costs before your health plan begins to pay for your covered services. For example, if you have a $1,500 deductible, your plan wont pay for some services until youve paid $1,500. Your premium and deductible costs are connected. Typically, the higher your deductible, the lower your premium. The lower your deductible, the higher your premium.

Read Also: Is Colonial Health Insurance Good

Offering Health Benefits: A Competitive Advantage

According to the BLSs most recent Employment Situation Summary, the total of nonfarm payroll employment rose by 379,000, with the leisure and hospitality industries receiving the most positive impact.

It may seem a modest step forward towards recovery, especially after the COVID-19 pandemic. Still, it is a clear sign that, as the economy starts to recuperate, recruiters will start competing to gain the attention of talent who are looking to enter or reenter the workforce.

An attractive health benefits package is a magnet for top staff at any company and will also help you retain committed employees. Although health care is considered one of the most expensive benefits, it is undoubtedly an investment into your companys future.

Read Also: What Is The Federal Health Insurance Marketplace