What If I Have A Preexisting Condition

A preexisting condition won’t keep you from getting health coverage. As of January 1, 2014, no insurance company can exclude you from coverage because you have a chronic or disabling illness or injury because you’ve received recent treatment for a medical condition. An insurance company also can’t charge you more if you have a preexisting condition.

That said, if you currently have an individual plan that excludes preexisting conditions, that plan is “grandfathered” and doesn’t have to change its rules.

Do You Have To Pay Back Marketplace Insurance

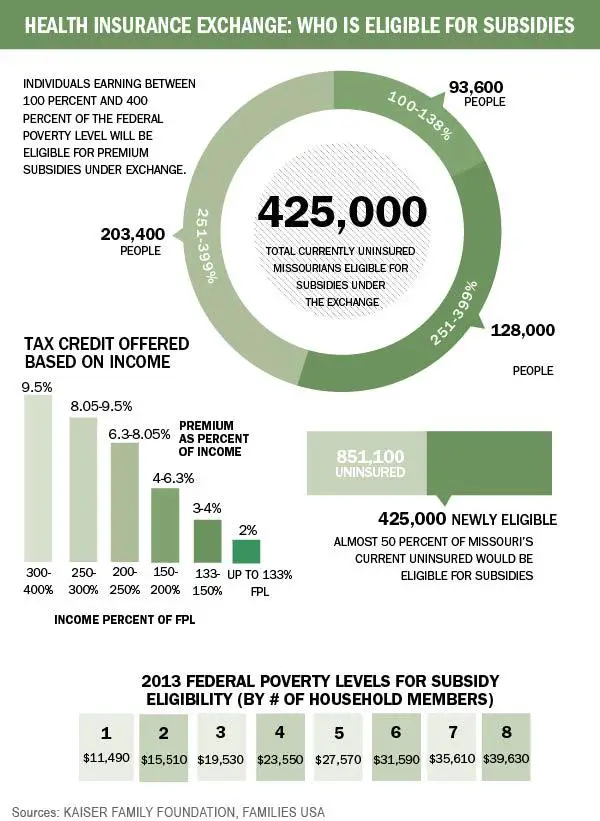

Theres been some confusion regarding premium tax credits for policies purchased on the health insurance marketplace. If you qualify, you can claim this income-based credit on your tax refund if you wish. However, you can have the insurance provider receive the credit directly during the year instead. That will reduce your insurance premiums.

Because the credit is based on your income, you need to be as accurate as possible when estimating your earnings. If you underestimate your earnings, youll owe a balance when filing your taxes. That means you will have to pay back the amount that the government overpaid.

Are My Family Members Eligible For Assistance To Purchase Health Insurance

Your family members who are not enrolled in a VA health care program should use the Marketplace to get coverage. They may get lower costs on monthly premiums or out-of-pocket costs. They could be eligible for free or low-cost coverage through Medicaid or the Childrens Health Insurance Program . For more information, visit www.healthcare.gov.

Recommended Reading: Do I Need Pet Health Insurance

How Do I Know If I Should Buy From The Public Marketplace

There are a number of similarities and differences between major medical plans sold on and away from the public Marketplace. Heres how the plans are alike.

First, all sold through the public ACA Exchange and off the Exchange are considered ACA-qualifying individual health plans.

These plans include all of the Affordable Care Acts consumer protections and benefits including:

- Coverage for healthcare services in the 10 essential health benefits categories

- No-cost preventive care certain preventive care screenings, tests and services at no additional cost beyond your premium

- Coverage for children up to age 26

- coverage you cannot be denied, have your coverage canceled or be charged more based on your health history or gender

- No lifetime and annual dollar limits for coverage of essential health benefits

Second, whether you buy an ACA-compliant major medical plan from the ACA Exchange or away from it, insurance companies can only use the following five factors to calculate your major medical premium rate:

So whats the difference between plans sold through the Health Insurance Marketplace and those sold elsewhere?

What About People With Very Low Income

Open enrollment is the best time to sign up for coverage, but starting next year, people with low incomes up to about $19,000 for a single person and about $33,000 for a family of three will have more flexibility to enroll in A.C.A. plans throughout the year. The change is expected to benefit millions of people.

You can also qualify for a special enrollment period if you lose your job-based coverage, have a child or experience other life changes.

Also Check: Is Health Insurance Really Worth It

When Can I Buy A Plan On The Marketplace

You can shop for health insurance during Open Enrollment or a Special Enrollment Period. The Open Enrollment period starts each year on November 1, and ends December 15. 1 A Special Enrollment Period is open to people for 60 days after certain life changes such as moving, getting married, or having a baby. 2

What’s The Difference Between On

If you’re buying a health insurance plan in the individual market, you’ll probably hear people referring to “on-exchange” plans versus “off-exchange” plans. An “on-exchange” plan is simply one that’s purchased through the exchange. People can shop for exchange plans on their own, or they can have help from a broker or navigator .

“Off-exchange” plans, on the other hand, are purchased without going through the ACA exchange in your state. They can be purchased directly from an insurance company, or with the help of a broker. Premium subsidies and cost-sharing subsidies are not available if you buy an off-exchange plan, even if you’d otherwise be eligible. And you can’t go back and claim the premium subsidy on your tax return if you bought an off-exchange plan, whereas you can if you buy an on-exchange plan and don’t take the premium subsidy upfront.

But in many cases, the plans themselves are identical or nearly identical, on- and off-exchange. All individual major medical plans with effective dates of January 2014 or later are required to be fully compliant with the ACA, regardless of whether they’re sold in the exchange or off-exchange. That part is important: Insurance companies cannot sell non-compliant major medical health plans in the individual market, even if they sell them outside the exchange.

Some insurers choose to only offer their plans for sale on-exchange, others only offer them off-exchange, and others offer plans both on- and off-exchange .

Recommended Reading: When Do I Have To Sign Up For Health Insurance

Quick Summary Of The Health Insurance Marketplace

- The Marketplace is an easy place to shop online, apply, and enroll for minimum essential coverage health insurance that helps you avoid the tax penalty.

- You can view and compare benefits between plans and insurance carriers all in one place.

- It is the only way you can receive the Premium Tax Credit if you qualify.

- You can see if you or any family members qualify for Medicaid all on one application.

Not sure how Obamacare affects your health care plans in California? Learn how the ACA works in California, including benefits, costs and enrollment.

How To Get Cobra

Group health plans must give covered employees and their families a notice explaining their COBRA rights. Plans must have rules for how COBRA coverage is offered, how beneficiaries may choose to get it and when they can stop coverage. For more COBRA information, see COBRA Premium Subsidy. The page links to information about COBRA including:

You May Like: What Is The Average Monthly Cost Of Health Insurance

Economics Of Health Insurance Exchanges: The Individual Mandate

The health insurance advocacy group America’s Health Insurance Plans was willing to accept these constraints on pricing, capping, and enrollment because of the individual mandate: The individual mandate requires that all individuals purchase health insurance. This requirement of the ACA allows insurers to spread the financial risk of newly insured people with pre-existing conditions among a larger pool of individuals.

Additionally, a study done by Pauly and Herring estimates that individuals with pre-existing conditions in the 99th percentile of financial risk represented 3.95 times the average risk . Figures from the House Committee on Energy and Commerce would indicate that approximately 1 million high-risk individuals will pursue insurance in the health benefits exchanges. Congress has estimated that 22 million people will be newly insured in the health benefits exchanges. Thus the high-risk individuals do not number in high enough quantities to increase the net risk per person from previous practice. It is thus theoretically profitable to accept the individual mandate in exchange for the requirements presented in the ACA.

What Is The Health Insurance Marketplace

The Health Insurance Marketplace is a resource where individuals, families, and small businesses can:

- Compare health insurance plans for coverage and affordability.

- Get answers to questions about your health care insurance.

- Find out if you are eligible for tax credits for private insurance or health programs like Medicaid or the Childrens Health Insurance Program .

- Enroll in a health insurance plan that meets your needs.

The Marketplace is available online at: Healthcare.gov.

You can also contact the Health Insurance Marketplace by telephone, 24 hours a day, 7 days a week at:

1-800-318-2596

Read Also: Do Employers Pay For Health Insurance

How The Inexpensive Care Act Impacts Medical Health Insurance For Freelancers

Youve in all probability heard of the Inexpensive Care Act or Obamacare. The ACA was handed in 2010 and was meant to make healthcare extra accessible to tens of millions of uninsured People.

Previous to the Inexpensive Care Act, 13.3% of the US population was uninsured. Should you didnt qualify for insurance coverage out of your mother and father, partner, employer, or a authorities program, you didnt have many choices.

Insurance coverage is a numbers recreation. A bunch of individuals pay right into a plan, some find yourself not utilizing it, and a few find yourself utilizing a variety of it.

Youre pooling collectively your danger by investing in an insurance coverage plan. And the insurance coverage firm makes use of the pooled money to pay for the healthcare prices that come by within the type of claims from suppliers.

Thats the place the Healthcare.gov market is available in.

In 2010, the ACA created a federal insurance coverage market. Now those that are self-employed or didnt qualify for insurance coverage earlier than might pool their danger collectively by shopping for into plans individually by Healthcare.gov.

And the ACA offers premium tax credit that assist decrease the price of insurance coverage for lower-income households.

Within the course of, it additionally mandated that every one People enroll in some type of medical health insurance.

Why Would Freelancers Need Medical Health Insurance

If in case you have continual ache, pre-existing situations, or prescriptions youll in all probability need insurance coverage. However what if Im wholesome and dont have any cause to suppose that I gainedt keep wholesome?

Its a typical query for freelancers, particularly once they simply start freelancing and are price range aware.

In fact nobody desires issues to go improper, and we dont at all times count on the issues that do go improper. Insurance coverage is your security internet to guard towards unexpected accidents, sicknesses, and so forth.

And if you take care of different dependents , thats a good greater danger you run by not having insurance coverage.

Read Also: Does Health Insurance Cover Funeral Costs

Where Can I Get Help Choosing A Plan

After years of cutting funding, the federal government has restored support for navigators, trained enrollment advisers who provide free help to people seeking coverage through HealthCare.gov. The Biden administration said there are more than 5,500 assisters, including navigators and other certified counselors, and 48,000 agents and brokers who can guide shoppers through their options. Contact information can be found on HealthCare.gov or by calling 800-318-2596.

Forms Of Medical Health Insurance Plans For For Freelancers

Your insurance coverage plan kind determines which docs youll be able to see and the way a lot you must pay for care. When evaluating plans, youll wish to take note of how they cowl in-network and out-of-network care.

Well being Upkeep Group plans require you to pick out a Major Care Supplier . This supplier serves as a gatekeeper for all extra care you obtain. Your Major Care Supplier should refer you to a specialist, lab, or medical facility even for preventative screenings.

There are a few exceptions: emergencies and OB-GYN.

HMO plans should not very versatile and wont cowl out-of-network suppliers. Stated one other means, be sure that any supplier you see is roofed by your HMO earlier than seeing them, or youll doubtless be caught with the entire invoice.

Most popular Supplier Group plans normally present protection for suppliers each in-network and out-of-network. You should not have to decide on a PCP and referrals should not required.

These plans are a good suggestion for those who journey loads and should end up needing medical care outdoors of your property state. Nonetheless, out-of-network care remains to be going to be costlier than in-network care.

This helps each greenback stretch additional on your healthcare, however are normally connected to higher-priced premiums.

Don’t Miss: Do You Need Health Insurance To See A Dermatologist

Qualifying For Medicare Medicaid Or Chip On The Obamacare Marketplace

When you fill out your information, you will also be made aware if you or any members of your household qualify Medicare, Medicaid or CHIP . If you qualify for any of these programs, you will not be able to purchase insurance through the exchange. Please use the resources found on this site to ensure that you understand the parameters that you or your family member will need to meet to qualify for Medicare, Medicaid or CHIP. Understanding some of the variables could be the difference between getting in the program and not.

Postponement Of Tax Penalty

On October 23, 2013, The Washington Post reported that Americans with no health insurance would have an additional six weeks before they would be penalized. That deadline was extended to March 31, and those who do not enroll by then may still avoid incurring penalties and getting locked out of the healthcare enrollment system this year. Exemptions and extensions apply to:

- Those living in states that use federal exchange, who may avail themselves of a “special entrollment period” that allows individuals to avoid penalties and enroll in a health plan by checking a blue box by mid-April 2014, stating they tried to enroll before the deadline . The New York Post reports: “This method will rely on an honor system the government will not try to determine whether the person is telling the truth”. State-run exchanges have their own rules several will be granting similar extensions.

- Members of the Pre-Existing Condition Insurance Program, who were given a one-month extension until the end of April 2014.

- Those who have successfully applied for exemption status based on criteria published by HealthCare.gov, who are not required to pay a tax penalty if they don’t enroll in a health insurance plan.

Don’t Miss: What Is The Best Travel Health Insurance

About The Marketplace: What Is Affordable Insurance

Affordable health insurance is health insurance that costs less than 8% of your familys income. Please note that if insurance is obtained through an employer, it can cost up to 9.5% of your income and still be considered affordable. If you cant get affordable coverage, you will most likely be exempt from having to purchased health insurance.

Comparable Tiers Of Plans

Within the exchanges, insurance plans are offered in four tiers designated from lowest premium to highest premium: bronze, silver, gold, and platinum. The plans cover ranges from 60% to 90% of bills in increments of 10% for each plan. For those under 30 , a fifth “catastrophic” tier is also available, with very high deductibles.

Insurance companies select the doctors and hospitals that are “in-network”.

Proponents of health care reform believe that allowing comparable plans to compete for consumer business in one convenient location will drive prices down. Having a centralized location increases consumer knowledge of the market and allows for greater conformation to perfect competition. Each of these plans will also cap liabilities for consumers with out-of-pocket expenses at $6,350 for individuals and $12,700 for families.

Read Also: Can I Go To The Er Without Health Insurance

How Will I Know If Im Eligible For Assistance To Purchase Health Insurance Outside Of Va

VA cant make this determination. If you use the Marketplace, you will find out if you can get lower costs on your monthly premiums for private health insurance plans. Remember, if you are enrolled in a VA health care program, you dont need to take additional steps to meet the health coverage requirements under the health care law.

Getting Prepared To Enroll

- Gather information regarding your household income. To help determine health savings youre eligible for, the Marketplace will need income information from your W-2, current pay stubs or your tax return.

- Start setting a budget to spend on your premiums each month. You will need to determine which health plan meets your families health needs, but also meets your budget requirements.

- Find out if your employer plans to offer health insurance. If your employer offers you health coverage, you will not qualify for marketplace coverage, however your family is still eligible for marketplace coverage. For questions or concerns please fill out a form above to have a Certified Application Counselor contact you.

Recommended Reading: Does Health Insurance Cover Esthetician

The Impact Of States Regulatory Actions On Health Insurance Marketplaces

Although GOP lawmakers and the Trump Administration were unsuccessful in their efforts to repeal the ACA, there are ongoing threats to the stability of the individual health insurance markets. This includes the Texas v. U.S./Azar lawsuit , but it also includes the elimination of the individual mandate penalty in 2019, the expansion of short-term plans, and the reduced federal funding for enrollment assistance and exchange marketing under the Trump administration.

Although premium increases were modest for 2019 and essentially flat for 2020, average rates would have decreased nationwide in 2019 if not for the aforementioned factors that drove premiums higher. And enrollment in the exchanges nationwide ended up about 2.6 percent lower in 2019 than it had been in 2018, with another slight reduction from 2019 to 2020. If we look at effectuated enrollment, however, it was higher in early 2020 than it had been in early 2019.

Several states are implementing or considering various actions designed to stabilize their insurance markets, while others are taking actions that could lead to further instability in the ACA-compliant markets . You can click on a state in the map above to see more details, but heres an overview of the changes states have made or are considering: