Currently You’re Allowed 30 Day Blocks Up To 90 Days

We can cancel month to month.

The easiest approach is a signed/dated request to cancel the your plan submitted prior to the next 30 day block .

For example:

What Are Alternatives For Immediate Health Insurance In California

Since short-term health plans arent available in California, you will need to consider other options. These include an ACA plan or COBRA coverage. You can also look into whether youre eligible for Medicaid.

When choosing any plan, you should consider all plan costs, including deductibles, co-payments, and coinsurance, not just the premium.

Covered California is the states own ACA health insurance exchange. The advantage of an ACA plan is you may qualify for a subsidy. You can only enroll in these plans at certain times of the year. In certain situations, though, you may be able to apply outside of the Open Enrollment Period.3

If you lost your job and the employer-provided plan, you may be able to continue coverage under COBRA. You will have to pay the entire plan premium under COBRA so it can be expensive. It might be a good option if you need coverage while you wait for Medicare eligibility, for plan coverage with a new employer, or for Covered Californias Open Enrollment Period.4

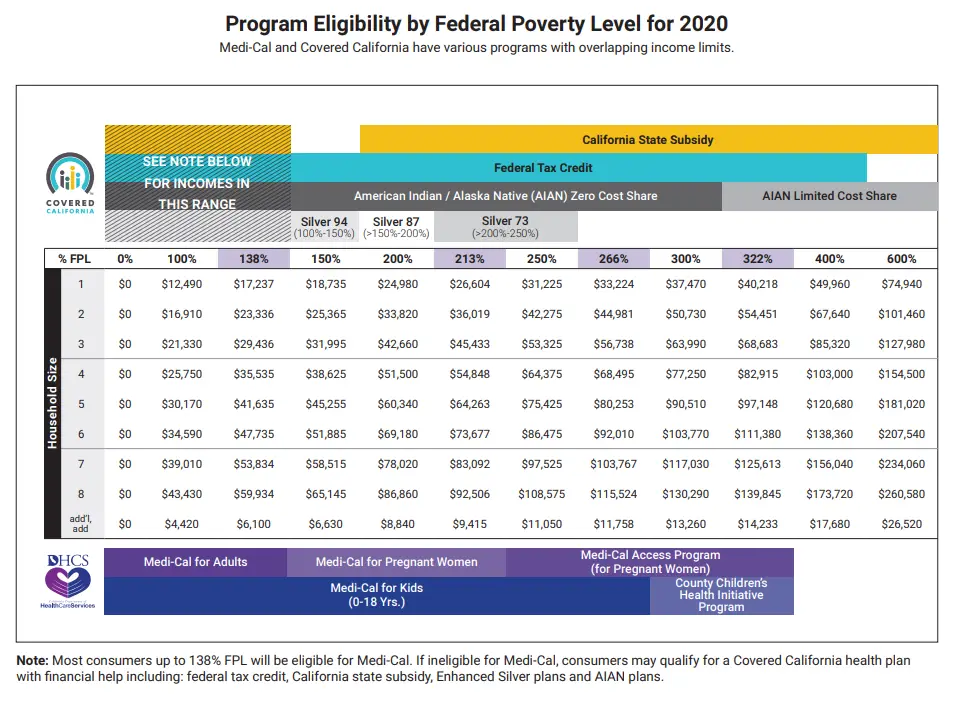

Medi-Cal is Californias Medicaid program. You may qualify if you meet income guidelines. For example, a household of one may have an annual income of up to $16,395 and be eligible for coverage. It also covers people with a disability, those in a nursing home, refugees living in the U.S. temporarily, people over 65, and people under 21.5

Bridging the gap

Affordable Health Insurance For California Consumers

With approximately 39 millions people, California ranks as the most populous state in the United States. Keeping a diverse group of people healthy with affordable health care options has been California’s ongoing challenge. That is why the Marketplace for private and small group medical insurance in California plays a significant role in maintaining happy, healthy individuals.

The California Health Exchange

Under the Affordable Care Act , Obama Care California brought a new solution of affordable California medical insurance to the golden state through the state-based exchange, Covered CA. Through the Covered California website, qualified individuals and families can sign up and receive subsidies through the form and up-front tax credit to help them pay for their medical coverage. This enables thousands of qualified Californians to obtain inexpensive, if not the cheapest health plan available from some of the best insurance companies in the state.

Purchasing California health insurance through the State Exchange is like going to an online shopping mall. State approved Obama Care California health plans include carriers such as Blue Shield of California, Anthem Blue Cross, Kaise Permanente and others. Benefit packages include Bronze, Silver, Gold and Platinum levels of coverage that can be viewed in an apples-to-apples comparison. Premiums range from cheap to more expensive depending on the level of coverage desired.

The Covered Californa Website

Who Requires Coverage?

Don’t Miss: What Is The Best Health Insurance Coverage

How Do I Get Cheap Health Insurance In California

The best way to find the cheapest health insurance in California is to compare policies from multiple health care providers. By getting quotes from several companies, you’ll be able to understand which company has the most expensive rates and why. Finally, by evaluating what you need in a health plan, you will be able to select a policy that fits your needs at an affordable rate.

The California Health Insurance Exchange

Covered California is where eligible people throughout the state can find subsidized ACA plans. Open Enrollment for 2022 in California begins November 1, 2021 and ends January 31, 2022. Lucky youthis sign up window is significantly longer than the window given on the federal exchange.

When your coverage will begin depends on how early you sign up:

-

If you sign up by December 15, your coverage will start January 1.

-

If you sign up between December 16 and January 15, you will have to wait until February 1 to use your plan.

-

If you sign up from January 16 to January 31, your coverage will start March 1.

Covered California uses an active purchaser model for their exchange. This means that Covered California negotiates with health insurance carriers directly to get the best rates, networks, and benefits possible for you. Covered California is unique in that it is the only exchange that requires all plans within a metal tier to offer all the same benefits.

Like all other state exchanges, all metal tiers on Covered California covers 10 essential health benefits. These include things like prescription coverage, maternity and mental health care, and laboratory services.

Recommended Reading: How To Apply For Health Insurance As A College Student

How Do I Buy Health Insurance

For some, buying health insurance can be a confusing and overwhelming process. First, you have to find a health insurance plan within your budget. Then you have to contact the company or an insurance agent in order to get a quote. Once you have all of that information, you can evaluate your options. It is a very personal and complicated process, but there are ways to simplify it.

Now that the Affordable Care Act is in place, it is much easier to find a health insurance plan based on your income and personal health needs. In most states, you may even qualify for financial subsidies. You can quickly and easily apply for coverage through the new Healthcare Marketplace.

Before you settle on a plan, you should first get a quote, find a price, and discover any out-of-pocket expenses your plan will expect you to pay . Once you have all of this information together, it will be easier to find coverage which fits your needs.

What Is The Average Cost Of Health Insurance In California

The average cost of health insurance in California in 2021 is $546 for a 40-year-old. However, rates may vary depending on the metal tier of health insurance you select and your age. For example, 40-year-olds have an average cost of health insurance that is 28% more expensive than that of 20-year-olds.

Recommended Reading: How To Stop Health Insurance

Will I Pay More If I Buy Insurance Outside Covered California

Without taking the government subsidy into account, you wont pay more for a health plan regardless of where you shop. In most cases, youll be reviewing the same health plans if you buy through Covered California or not.

Prices are highly regulated. The only factors that can affect the cost of your health plan are your age, family size, income and contributions from your employer. Your health history wont affect the price of the plan.

Health Insurance Rate Changes In The Largest California Counties

Health insurance rates are set by insurance providers and then provided to state regulators for approval. Therefore, it is vital to compare year-over-year rates to understand if your plan increased or decreased for the coming year.

For 2021, most of the seven largest counties in California experienced slight decreases in the average cost of a health insurance policy for a 40-year-old.

Santa Clara County saw the largest increase rising by over 3.24%. This amounted to a year-over-year increase of $19.

| County |

|---|

2019, 2020 and 2021 premiums are for a 40-year-old adult.

Read Also: Do You Need Health Insurance To Go To Planned Parenthood

How Do I Sign Up

You apply for coverage and choose your plan at the same time. Once youre approved for a plan, youll need to pay your first monthly premium for your coverage to begin. You can pay online or ask to receive a bill in the mail, which should arrive in about two weeks. To apply and enroll:

- Online: Go to Covered Californias website and click Apply Now.

- By phone: Submit your name and contact information online and a certified insurance enroller will call you back, usually within 15 minutes during normal business hours. You can also call Covered Californias service center at 800-300-1506.

- In person: Youll need to meet with a certified enroller or licensed insurance agent, whom you can find through Covered Californias website. Or visit a local enrollment center, although in-person access and hours may be impacted by COVID-19.

You can also call Covered Californias service center or visit a local enrollment center for help with exploring plans, to ask questions and to help determine if you qualify for financial assistance.

What To Do If You Have A Problem With Your Policy

Contact your health plan to resolve your problem.

- Talk to your doctor and call your health insurer. Sometimes talking solves the problem.

- You can file a complaint with your health plan. A complaint is also called a grievance or appeal.

- Generally, your insurance company must make a decision within 30 days.

- If your health problem is urgent, your health insurance must do an Expedited Review. It must be done as soon as possible, in 72 hours or less.

If you are not satisfied with your health plan’s review process or decision, call the California Department of Insurance . You may be able to file a complaint with CDI or another government agency.

If your policy is regulated by CDI, you can file a complaint at any time. The CDI reviews cases that involve:

- Disagreements about the services your health plan must cover.

- Termination or cancellation/rescission of your insurance policy.

- Exclusions and limits on services that are usually covered.

- Timely access to medical care.

My claim was denied. Now what?

Your health insurance policy tells you how to appeal if your plan denies your claim or pays less than you think it should.

You have a right:

- To receive an explanation of your plan’s grievance and appeal procedures.

- To file a complaint, also called a grievance or appeal, with your plan.

- To receive an easy-to-understand written decision on your appeal.

- To file a complaint with CDI, Call 1-800-927-4357 or visit www.insurance.ca.gov.

Independent Medical Reviews

Recommended Reading: What Is The Largest Health Insurance Company

Best Cheap Health Insurance In California 2021 Valuepenguin

https://www.valuepenguin.com/best-cheap-health-insurance-california

5 days ago Best cheap health insurance companies in California · Kaiser Permanente · Blue Shield · Health Net · Molina Healthcare · SHARP Health Plan · Anthem What is the average cost of health insurance in California?Which company has the most affordable health insurance in California?

Whats The Best Health Insurance Policy For A Baby

SPF Insurance is known for providing specific information and recommendations that you wont find anywhere else. This article provides our recommendations on the best child health insurance plans in Calfornia. We show you what were looking for, and then give you the plans that our analysis says are the best for each situation. This is a Dont Miss article.

Also Check: How Much Does It Cost To Get Health Insurance License

Other Types Of Health Coverage

Other types of health coverage are sold in California, but if it will be your main source of coverage, you should make sure that it meets minimum essential coverage requirements. If your policy does not meet these requirements, you might have to pay a tax penalty to the IRS as if you did not have coverage at all.

High-Deductible Plans

These plans have lower premiums but high deductibles. The deductible each year can be over $5,000 for an individual and over $10,000 for a family. This means that you must pay a lot of money each year before your plan covers anything except preventive care.

Usually a high-deductible plan is combined with a Health Savings Account . You or your employer can put tax-free money into a savings account and use this money to pay your deductible.

Limited Benefit Plans

Limited benefit plans are also called mini-meds. They provide very limited benefits. They are advertised on TV as low-cost health insurance. You should read the policy very carefully. If you have a serious illness, you might run out of coverage quickly. These plans do not count as full health coverage and you may end up paying a penalty at the end of the year if you don’t have other coverage.

Discount Plans

Supplemental Health Insurance Policies

- What are the limitations and exclusions?

- How does the policy coordinate benefits with your main health insurance?

Why is Minimum Essential Coverage Important

If You Lose Your Group Health Benefits

If you lose your job or your hours are cut, you may also lose your group health benefits.

- You may be able to buy continuation health coverage.

- Or you may be able to buy an individual policy .

- Or you may qualify for a public program .

- Or you may be able to get on your spouse or partner’s group insurance. Try to do this as soon as possible, to avoid a gap in coverage.

You can keep your employers health coverage

You and your dependents may be able to keep your existing health coverage even if you lose your group health benefits. These options are called continuation coverage.

If you lose your coverage, your employer must provide you with information on your options for continuing your existing coverage. You may see options with names like COBRA, Cal-COBRA, Conversion or HIPPA. If you choose one of these options:

- You have to pay all of the premium.

- After you use up one kind of continuation coverage, you may be eligible for another kind of coverage.

- There are deadlines and other requirements for each kind of continuation coverage.

If you have any questions about your options, contact the Consumer Hotline at the Department of Insurance 927-4357 for assistance.

Continuation Coverage or an Individual Policy?

Buying Individual Health Insurance on Your Own

People usually buy individual health insurance because they do not have group insurance through a job and they do not qualify for any public program.

Medi-Cal

Recommended Reading: What Type Of Insurance Is Health Partners

What You Need To Know About Child

There are several child-only health insurance plans in California. These plans cover baby check-ups, school screenings, sports and some immunizations. The best part about purchasing these plans is that the kids tend to be will be protected and illness spotted quicker which means they will be a lot healthier, and save you a lot of money.

The two most popular insurance plans being offered by most carriers include:

- HMO: In this plan, your child has to use the network to access covered services. Exceptions are made only for emergencies.

- EPO: In this plan, your child has to use the network to access covered services, but you dont need a referral from your primary doctor to see a specialist. Exceptions are made only for emergencies.

- PPO: In this plan, services are cheaper when your child goes to a network doctor, but you have the freedom to get services from an out-of-network physician.

HMO plans may also require that you select a primary care physician for your child, and that physician has to refer you in the event you need to see a specialist. With an PPO and EPO, you are free to see doctors and specialists without a referral. However, youll find that your child may receive more benefits with an HMO if you live in an area with wider network coverage.

How To Get Health Insurance In California

While parts of The Affordable Care Act have been repealed, California continues to uphold the $695 penalty for anyone without health insurance coverage. Throw in out-of-pocket expenses and going without a healthcare plan is no plan at all. If youre ready to pick up health insurance and save on medical expenses, then heres what you need to know.

Recommended Reading: Can I Have Two Health Insurance

How To Find Health Insurance In California

Looking for how to find health insurance in california? Get direct access to how to find health insurance in california through official links provided below.

Follow these easy steps:

- Step 1. Go to how to find health insurance in california page via official link below.

- Step 2. Find the official insurance at the bottom of the website.

- Step 3. If you still cant access how to find health insurance in california please leave a message below .

Health insurance in California. Californias open enrollment continues through January 31 each year COVID-related special enrollment period runs from February 1, 2021 through May 15, 2021. Californias state-run exchange is considered one of the most successful. California implemented an individual mandate and state-based premium subsidies in 2020.

Apply for California Health Insurance coverage at eHealthInsurance. We offer thousands of health plans underwritten by more than 180 of the nations health insurance companies. Compare California health plans side by side, get health insurance quotes, apply online and find affordable health insurance today. You can read more about the Affordable Care Act in our Obamacare Resource Center.

Find Cheap Health Insurance Quotes In California

We compared quotes for health plans and concluded that the Silver 70 EPO and Silver 70 HMO were the most affordable Silver plans in most counties of California. Note that in California, there are many companies where you can buy individual health insurance, but they may not all be available in your county.

Read Also: How To Get Life And Health Insurance License In Texas

Cobra Insurance In California

People who recently lost their employer-sponsored health insurance can sign up for a COBRA plan. COBRA allows you to extend your former employers plan for a limited time.

However, you have to pay for all the costs. The former employer doesnt contribute money to help pay premiums.

The federal COBRA law only pertains to employers with 20 or more employees. However, California has a so-called mini-COBRA law that pertains to smaller businesses. The law allows Californians who previously worked at a small business to keep COBRA coverage up to 36 months.