What You Can Expect To Pay For Employees Health Insurance In 2022

Maybe youre in the market for the first time shopping for a health plan for your small business employees. Or, youre looking again because you want to compare prices to be sure youre getting the most value for your dollar. A great place to start is to talk with a broker.

An insurance broker can help you shop and compare local options. Using a brokers services does not cost you money but could deliver significant savings because of their expertise.

Worksite Wellness Is Here To Stay

With an expanding need for employee wellness programs, it makes sense to look at the reasoning behind these kinds of programs and the cost of having one.

There are three reasons why employee wellness programs are going to continue to grow in popularity:

1) There is a strong economy where wellness programs flourish.2) There is more obesity and diabetes now than in any other time in world history.3) The increasing cost of healthcare is only going to get worse.

Even if the US economy stumbles, the obesity epidemic and cost of medical care will continue to drive the need for wellness programs. At the present time, there is not sufficient political and cultural interest to do much about either one of these.

Virtually all large corporations and many mid-sized companies already have some form of employee wellness in place. These worksites will continue to provide wellness while the real growth in wellness programs will come from small businesses.

Regardless of size all worksites will need to ask these questions

- What questions should we ask before we start a wellness program?

- How much should a wellness program cost?

- Do I need help to run an effective wellness program?

Administrative And Reporting Costs

Depending on how your plans are funded, benefits administration can be a time-consuming, resource-heavy endeavor. And the more employees you have, the greater the administrative burden. Your responsibilities may range from shopping for plans and researching new benefits to managing daily operations such as enrollment, terminations and claims processing to conducting plan audits and meeting ongoing reporting requirements.

While it may be tempting to opt for plans with the cheapest administrative fees, make sure youre comparing apples to apples. Cheaper fees up front dont necessarily lead to long-term savings.

One way to save on these costs, and to reap savings across the board over the long run, is to integrate your health care benefits. Choosing one insurer for medical, dental and pharmacy benefits will lessen the administrative burden, simplify the reporting process and provide a better experience not to mention better health outcomes for your employees.

Also Check: How Do Small Business Owners Get Health Insurance

How Much Do Employers Pay For Health Insurance

Whether youre exploring cost-effective health plans for your organization, researching health reimbursement arrangements for the first time, or looking into health stipends, a common question business owners have is, how much does health insurance cost per employee?

Rising healthcare costs can make organizations second-guess offering an employer-sponsored health plan. However, the cost of losing employees by not offering health benefits can surpass the cost of supporting your employees well-being, so offering a comprehensive health benefit is vital.

This article will break down the average employer health insurance cost per employee and the average cost of employer-sponsored health insurance. Well also explain how you can use an HRA or health stipend to control your budget.

Use the table contents below to jump to a specific section:

Temporary Continuation Of Coverage

If the FERS determines that you are ineligible for health benefits, you and certain family members may have the option to enroll for up to 18 months of Temporary Continuation of Coverage . You should also look into TCC if you plan to stop working before you are able to retire but want to have FEHB during retirement. TCC may be able to serve as a bridge to cover you until your retirement, when you would then re-enroll into FEHB.

You will not be able to obtain TCC if you have been terminated for gross misconduct.

Also Check: Insusiance

Recommended Reading: How To Retire At 62 Without Health Insurance

Offering Health Benefits: A Competitive Advantage

According to the BLSs most recent Employment Situation Summary, the total of nonfarm payroll employment rose by 379,000, with the leisure and hospitality industries receiving the most positive impact.

It may seem a modest step forward towards recovery, especially after the COVID-19 pandemic. Still, it is a clear sign that, as the economy starts to recuperate, recruiters will start competing to gain the attention of talent who are looking to enter or reenter the workforce.

An attractive health benefits package is a magnet for top staff at any company and will also help you retain committed employees. Although health care is considered one of the most expensive benefits, it is undoubtedly an investment into your companys future.

Employer Health Insurance Cost: Group Vs Individuals

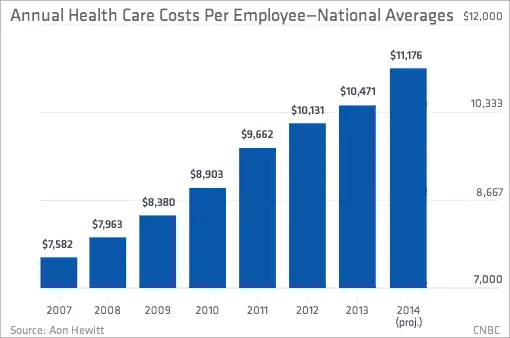

Looking at the above considerations, its no surprise that company health costs can vary widely. Still, lets take a look at some averages.

Were not going to ask you to do any math here the Kaiser Family Foundation has already done it for you. KFF estimates that in 2021 the average annual employer insurance cost across all plan types, industries, locations, etc. was $7,739 for single coverage, and $22,221 for family coverage thats an increase of 4% over 2020. As for how much the employees themselves were paying, covered workers in 2021 contributed 17% of the premium for single coverage and 28% of the premium for family coverage .

Also Check: Is Rehab Covered By Health Insurance

How Does Employer Health Insurance Work

Through employer health insurance, employees can receive substantial discounts on their health insurance premiums. Employers often subsidize the cost of the insurance plans they offer, making them significantly more affordable to their employees, who can usually sign up for the insurance plan through the companys HR department. Typically, employees have a limited range of employer health insurance plans, depending on the health insurance program chosen by the business owner. Companies can opt to provide health maintenance organization plans, preferred provider organization plans or both.

Health And Worker Productivity

The existing studies found little evidence that workers with health coverage are absent less often than are workers without coverage. For example, the Rand Health Insurance Experiment found that the effect of insurance coverage on work loss days was small and insignificant . Similarly, despite years of research outside mainstream economics , there is almost no direct evidence regarding the effect of health insurance coverage on morale and worker productivity and the firms performance. In those fields, although the link between employment practices and productivity is widely recognized, the linkages between productive behavior and psychosocial job structure have remained unclear in the eyes of many observers . However, there is compelling research demonstrating that health insurance has a powerful influence on access to health care, the timeliness of care, the amount and quality of care received, and fundamental health . People without health insurance are less likely to seek medical care, less likely to get it, and, as a result, more likely to be in worse health and have higher death rates than are people with insurance coverage . Uninsured persons have a much greater risk of health decline and death, with several studies showing them to be 1.2 to 1.5 times more likely to die than are insured persons .

Recommended Reading: What Is The Deadline For Health Insurance Open Enrollment

The Cost Of Offering Employees Health Insurance

The cost of providing health insurance to your employees depends on factors such as:

- Insurance carrier

- Type of plan

- Location

- Features

- Demographics of your employees

- Network of providers in the plan

- Your contribution amount

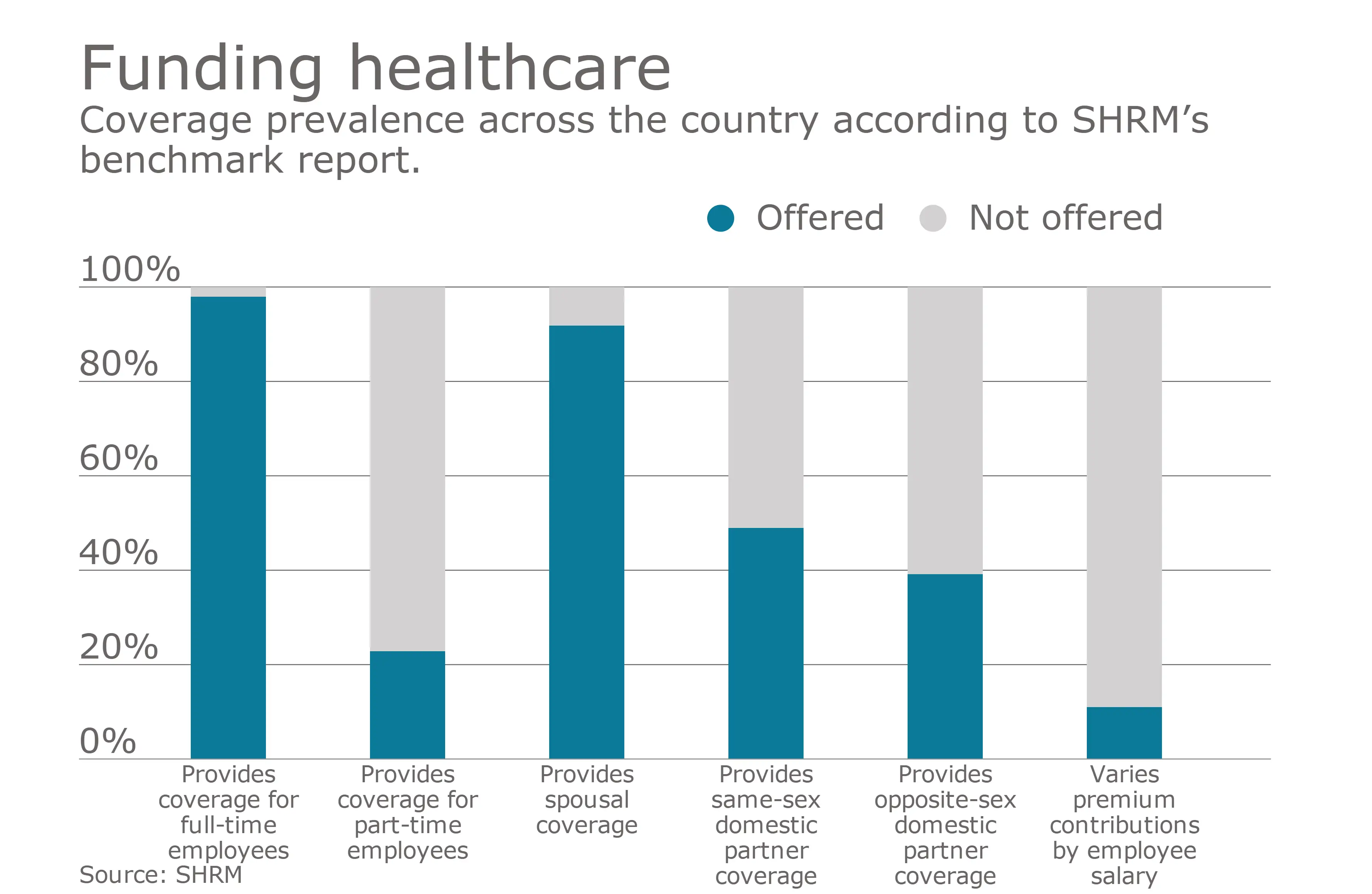

In 2020, the average annual premiums for employer-sponsored coverage were $21,342 for family coverage and $7,470 for individual coverage. After taking into consideration the costs that workers pay, the average cost of group health insurance becomes about $15,754 for an employer to cover a family and $6,227 for an employer to cover one employee.

| Year | Average Cost for Employer of Single Individual | Average Cost for Employer of Group |

|---|---|---|

| 2020 | ||

| $19,616 |

How Much Does Health Insurance Cost For A Small Business Per Employee

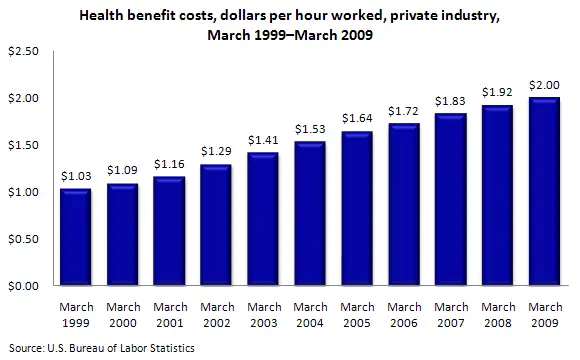

When you consider their total compensation, the average hourly wage for all workers is $37.73 in the United States of America.

According to the study, the average cost for an employer who pays employee benefits for government and state employees is about $19.82 per hour.

In addition, the average salary and wage they pay were about $32.62 an hour.

Also Check: How To Cancel Oscar Health Insurance

Why Is Health Insurance Important

Almost 2/3rds of bankruptcies in the United States were caused by medical bills. Health insurance is not just insuring your health it insures your wealth. Even after the passage of the Affordable Care Act, most people in the US receive their health care through their employer. Insurance can be difficult to obtain if you retire before youre eligible before Medicare. The ability to have access to any sort of coverage between retirement and Medicare is a huge benefit. Not just for federal employees, but also their spouses, and family members.

Small Employers Contribute Significantly Less To Family Coverage

While large employers contribute a significant amount to employees healthcare, small employers tell a different side of the story. 27% of covered workers in small firms are in a plan where the employer pays the entire premium for single coverage, compared to only 4% of covered workers in large firms. Similarly, 28% of covered workers are in a plan where they must contribute more than half of the premium for family coverage, compared to 4% of covered workers in large firms.

A likely reason for this is that small businesses simply cant afford to make the kind of contributions larger employers can. After all, even a 50% contribution may be more than whats available in a small employers benefits budget.

Considering that only 48% of firms with three to nine workers offer coverage compared to virtually all firms with 1,000 or more workers that offer coverage, small employers may also feel that they dont have enough employees to make investing in health benefits worth it at all. in order to offer a health benefit at all.

Dont Miss: Can I Put My Wife On My Health Insurance

Don’t Miss: What Job Has The Best Health Insurance

The Importance Of Subsidies

The good news is that many who purchase marketplace plans will pay lower premiums through what the government calls advanced premium tax credits, otherwise known as subsidies. In 2019, 88% of people who enrolled at HealthCare.gov were eligible for advanced premium tax credits.

What are these subsidies? They are credits the government applies to your health insurance premiums each month to make them affordable. Essentially, the government pays part of your premium directly to your health insurance company, and you’re responsible for the rest.

As part of the American Rescue Plan Act passed in March 2021, subsidies have increased for lower-income Americans and extended to those with higher incomes. The ARPA expanded marketplace subsidies above 400% of the poverty level and increased subsidies for those making between 100% and 400% of the poverty level.

You can take your advance premium tax credit in one of three ways: equal amounts each month more in some months and less in others, which is helpful if your income is irregular or as a credit against your income tax liability when you file your annual tax return, which could mean you owe less tax or get a bigger refund. The tax credit is designed to make premiums affordable based on your household size and income.

A Sample Wellness Budget

With this information you can now create a very accurate budget of what your wellness program will cost. First, you have to answer a few questions. Do you want to offer biometric screening to all your employees? Do you want to make health coaching available to all your employees or just a subset?

Are you going to implement a benefits-based incentive plan? These are important questions that you will need to answer before you can complete your budget. Here are some more really important questions you must consider before you start your wellness program.

number of employees= 350

Wellness platform cost per employee per year= $30

$30 x 350 = $10,500

Add in any additional costs for biometric screening, health coaching, incentives, or a benefits-based incentive.

You May Like: How Do You Find Health Insurance

What Is The Cost In Retirement

One of the advantages of having FEHBas compared to private health insuranceis that the cost of health insurance remains the same for federal employees after they retire. The government keeps paying a portion of your health insurance for you. This can amount to big savings on health care costs, since FEHB pays 72-75% of the cost.

This is a big advantage over private employer coverage. For example, a private employer will often pay for part of your health benefit costs while youâre employed, just like the FEHB. However, once you retire in the private sector, you most often can not keep your employee health benefits. Instead, you must transition to an individual health insurance plan or to Medicare if you are old enough. This change could mean that your cost of health insurance will increase after you retire.

One primary difference for those with FEHB is that because your retirement annuity is paid monthly, you might see a shift in the payment frequency or amounts. However, you should not pay more in total.

Your spouse, domestic partner, or other family members could also save money on their health insurance if they are also eligible for coverage under your FEHB. If you have been divorced and are on good terms with your ex-spouse, you could check to see whether they might be able to get access to your FEHB.

Private Industry Compensation Costs $3596 Per Hour Worked Health Insurance Cost $273 June 2020

Compensation costs for employers in private industry averaged $35.96 per hour worked in June 2020. Wages and salaries averaged $25.18 and accounted for 70.0 percent of employer costs, while benefit costs averaged $10.79 and accounted for 30.0 percent.

For major industry groups, compensation costs were highest for employers in the utilities industry. Total compensation costs averaged $66.63, for this industry, with wages and salaries accounting for 61.7 percent and total benefits accounting for 38.3 percent of total compensation costs. Compensation costs were lowest for employers in the leisure and hospitality industry, with total compensation costs averaging $16.11. Of the total compensation costs, 79.0 percent were costs associated with wages and salaries and 21.0 percent were costs associated with total benefits .

Read Also: What Insurance Does Novant Health Accept

Shop Around With An Insurance Agent Or Broker

With so many different options, understanding and ultimately choosing the right health insurance plan can be confusing, Stahl said. The key is to work with an agent who is unbiased and can show you all the options.

These options may include group health-sharing plans, traditional group plans, ACA marketplace plans or even level-funded plans, which provide rebates at the end of the year if employees have made few health insurance claims.

By having the opportunity to learn and compare from multiple carriers, you can be sure you are getting the best benefits structure with the best rates available, Stahl said.

How Health Stipends Can Be A Cost

While HRAs are an excellent option for organizations looking to lower their health benefit costs, they arent always the best choice for some employers.

If youre looking to add an HRA as your first health benefit or cancel your group health insurance policy, youll need to consider premium tax credits eligibility. Some of your employees might become eligible for premium tax credits without an employer-sponsored group health insurance plan.

With a QSEHRA, your employees must reduce their advance premium tax credit by the amount of their QSEHRA allowance. Meanwhile, employees who are offered an ICHRA must choose whether to waive their APTC and take the ICHRA or keep their tax credits and opt-out of the health benefit. This is based on affordability.

These employees cant take advantage of their employer-sponsored health benefits and receive premium tax credits simultaneously.

Health stipends can help to alleviate these concerns. Employee health stipends are like an HRA, except theyre taxable, more flexible, and have fewer regulations. This allows stipends to be a flexible option for all types of organizations.

If your employees receive tax credits, they can keep those credits and take advantage of your employee health stipend.

Whats more, health stipends are also a great option for organizations with employees in other countries.

Recommended Reading: What Is The Best Health Insurance

What Is The Minimum Employer Contribution For Health Insurance

There is no national rule governing the minimum employer contribution for health insurance. Many state legislatures have passed regulations that require employers to contribute at least 50% of employee health insurance costs, but in 2021, the Kaiser Family Foundation found that the average employer contributed 83% of the premium for individual coverage and 73% for family plans.

Sean Peek and Katharine Paljug contributed to the writing and reporting in this article. Source interviews were conducted for a previous version of this article.

What Is The Typical Overhead Cost For An Employee

This includes the dollars and cents over and above the basic wage or salary you agree to pay. Theres a rule of thumb that the cost is typically 1.25 to 1.4 times the salary, depending on certain variables. So, if you pay someone a salary of $35,000, your actual costs likely will range from $43,750 to $49,000.

You May Like: Is It A Law To Have Health Insurance