Dental And Vision Premium Increases Remain Minimal

Average premium rate increases under the Federal Employees Dental and Vision Plan are relatively minimal for 2022.

Premiums will rise for FEDVIP dental plans by 0.81% on average, while vision plans will go up by 0.95%, according to OPM.

Participants will have access to 23 dental plans, including 14 nationwide options, from a total of 12 carriers.

They can choose from 10 nationwide vision plans from five carriers in 2022, OPM said.

Participants can find more information about these FEDVIP plans in October or November ahead of open season on Benefeds.com.

In addition, federal employees must reenroll each year in the Federal Flexible Spending Account Program if they want to set aside pre-tax dollars for their health or dependent care costs.

Special COVID-19 flexibilities allow employees who had a health or dependent care FSA this year can carry over all unused funds at the end of 2021 to use for the following year if the participant reenrolls.

Carryover flexibilities will be more limited for 2023, which federal employees should consider when deciding how much to contribute in 2022, OPM warned.

How To Reduce Costs

The amount and the speed at which premiums for health insurance in Canada are rising have individuals and families looking for ways to reduce their costs. While some may be tempted to drop their private insurance and just rely on their provincial plan, most people do recognize the benefits of health insurance.

If you’ve been looking for a way to reduce your costs, you should read Insurdinary’s article on how to tell which insurance company is the best for you.

Compare Investment Options For 2021

The 2022 biweekly maximum government contribution for most employees and annuitants is $244.86 for Self Only, $524.63 for Self Plus One, and $574.13 for Self and Family. The monthly maximum government contribution is $530.53 for Self Only, $1,136.70 for Self Plus One and $1,243.95 for Self and Family.

For 2022, the biweekly program-wide weighted average premiums for Self Only, Self Plus One, and Self and Family enrollments with a government contribution are $340.08, $728.65, and $797.40, respectively. The monthly program-wide weighted average premiums for Self Only, Self Plus One, and Self and Family enrollments with a government contribution are $736.84, $1,578.74, and $1,727.70, respectively.

More information on 2022 FEHB premium rates can be found on OPMs website here.

You May Like: How To Apply For Health Insurance With No Income

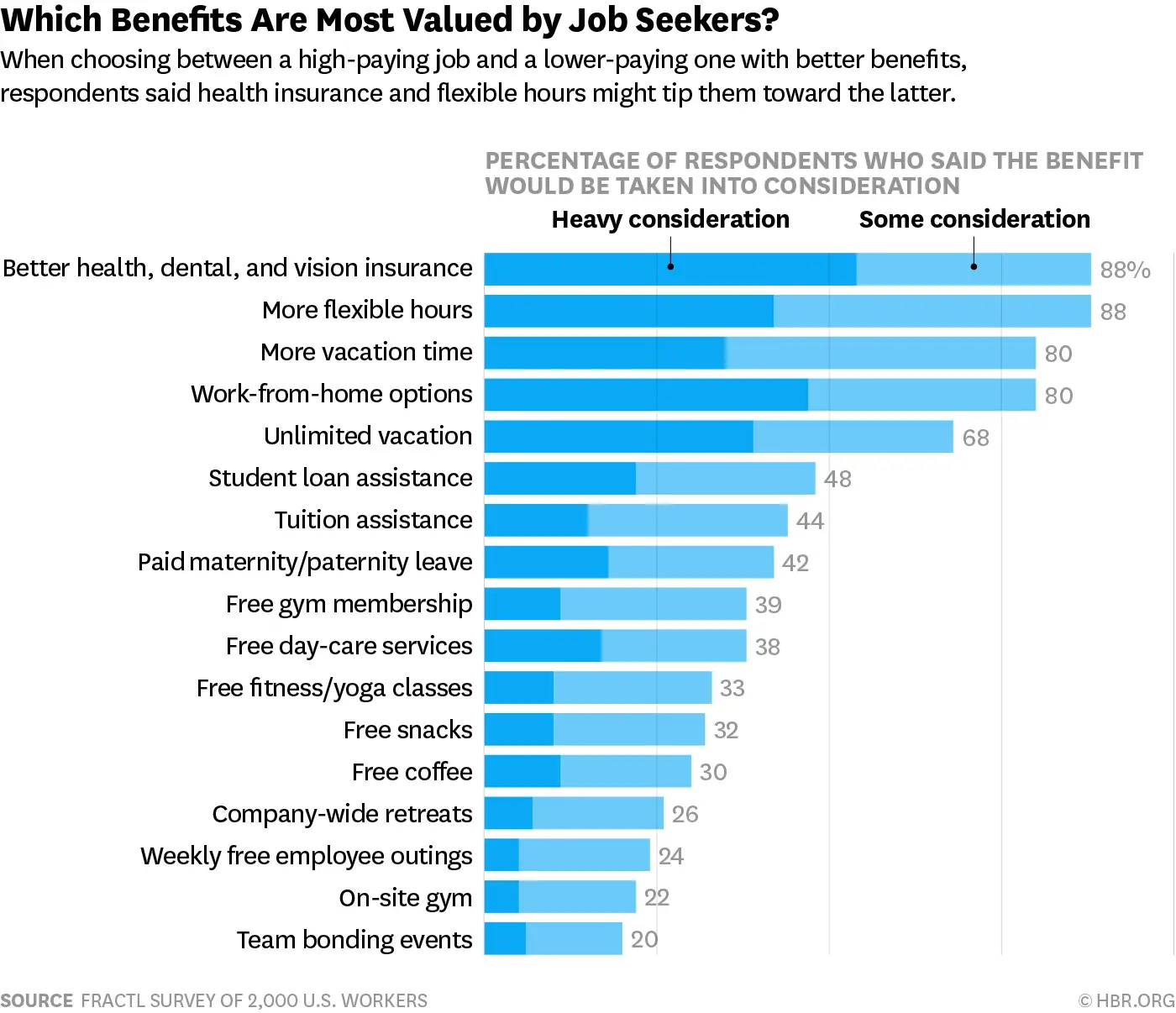

Offering Health Benefits: A Competitive Advantage

According to the BLSs most recent Employment Situation Summary, the total of nonfarm payroll employment rose by 379,000, with the leisure and hospitality industries receiving the most positive impact.

It may seem a modest step forward towards recovery, especially after the COVID-19 pandemic. Still, it is a clear sign that, as the economy starts to recuperate, recruiters will start competing to gain the attention of talent who are looking to enter or reenter the workforce.

An attractive health benefits package is a magnet for top staff at any company and will also help you retain committed employees. Although health care is considered one of the most expensive benefits, it is undoubtedly an investment into your companys future.

How Much Do You Pay For Health Insurance

How much are your health benefits?

Monster Contributing WriterPrivate Health Insurance

Recommended Reading: Can You Get Supplemental Health Insurance Anytime

What Insurance Do Postal Employees Get

Newly hired postal employees are covered under Social Security and Medicare. The Postal Service offers coverage through the Federal Employees Group Life Insurance Program. The cost of Basic coverage is fully paid by the Postal Service, with the option to purchase additional coverage through payroll deductions.

A Break In Service Vs A Break In Coverage Rules

If there is a break in your coverage due to a break in service, the earlier years of coverage will likely still count. However, if there was a lapse in your coverage because you canceled it, then you would likely not be able to retire with FEHB. A couple of examples may help better illustrate this point.

You May Like: Does Idaho Have Free Health Insurance

Avoid Surprises In Retirement

The bottom line is that no one wants to be surprised in retirement, especially with financial surprises. Too often those surprises either leave us under protected, or the protection we do have costs us much more than we expected. FEHB is one of the golden gems of your federal benefits. I want you to know how valuable this program is so youre sure to protect your eligibility to have it and to keep it in retirement.

Should You Providegroup Health Insurance To Your Restaurant Employees

According to the Affordable Care Act , an employer is not required to offer health insurance if it has less than 50 full-time or full-time equivalent employees. However, although restaurants may not be obligated to provide medical benefits to their workers, offering a group health plan may help business owners through contributing to a key strategic priority: the retention of restaurant employees and staff.

Due to the unique nature of the restaurant industry,restaurant owners have faced significant challenges that often prevent themfrom being able to offer health insurance benefits to their employees. Inparticular, the primary problem is that restaurants tend to be high-turnoverbusinesses, which can create labor issues for employers because of frequentlyneeding to look for and train new staff.

Offering popularbenefits to your restaurant employees, such as group health insurance coverage, may be an effective way to reduce turnover and increase loyalty and retention. Workers may be more likely to stay at a restaurant if they know that their employer cares about their long-term well-being. From the restaurant owners perspective, additional benefits of providing health insurance may include less employee absences and less sick days due to workers having more access to medical resources.

Also Check: What Is The Donut Hole In Health Insurance

Federal Employees Pay Social Security Taxes

All federal employees hired in 1984 or later pay Social Security taxes. This includes the president, the vice president, and members of Congress. It also includes federal judges and most political appointees.

They all pay the same amount of Social Security taxes as people working in the private sector.

Average Costs For Health Insurance In Canada

When you add it all up, health care costs quite a bit. The Fraser Institute’s 2016 report broke down the cost of public health insurance for a family of two adults and two children on an income scale.

The 10% of Canadian families with the lowest incomes, earning an average of $14,028, paid an average of $443 in premiums. The 10% of families at the top end of the scale earned $281,359 and paid an average of $37,361.

It’s the middle ground that has created a bit of controversy over the Fraser Institute’s numbers. In 2016, they pegged that average on that scale as being a family earning $60,850 who paid $5,516 in premiums. An individual earning $42,914 paid $4,257 in premiums.

A year later they said the average family of four earning the average 2017 salary of $127,000 would pay nearly $12,000 in premiums. The actual math on the two figures was not that far off, but there was a lot of political posturing and controversy over whether a median income or average income was a more meaningful measure and more representative of the country and actual spending.

Also Check: What Is The Cost Of Supplemental Health Insurance

Qualified Small Employer Hra

A qualified small employer HRA is a health benefit for employers with fewer than 50 full-time equivalent employees who dont want to offer employees group health insurance. With a QSEHRA, employers reimburse employees tax-free for their medical expenses, including individual health insurance premiums up to a maximum contribution limit. Check out our latest QSEHRA annual report to see how a QSEHRA helped our customers last year.

Does A Federal Employee Get Free Health Insurance After Retirement

Unfortunately, federal employees do not receive free health insurance upon retirement. However, federal employees can keep their current federal employee health benefits plan upon retirement. Employees continue to pay the employee portion of the premium. The government pays the remainder of the retirees premium at the same rate as they do for current employees. .

Also Check: How Much Is Health Insurance Usually

Enroll In Or Change Federal Benefits

-

If you are a current employee, you can only enroll in or change your federal employee benefits during the annual Open Season.

-

You may enroll in or change your plans outside Open Season only if you experience a qualifying life event, such as marriage.

New employees can enroll in benefits outside of Open Season.

Open Season does not include FEGLI. Outside of FEGLI’s infrequent open seasons, you can enroll or increase your coverage if:

You take a physical exam or

You have a qualifying life event

Learn more about enrolling in, changing, or cancelling FEGLI benefits.

Fehb Premium Rate Charts Now Available

September 29, 2021My Federal Retirement

Federal employees and retirees share of 2022 Federal Employees Health Benefits premiums will increase on average by 3.8% according to the Office of Personnel Management.

This is a lower increase than in previous years when the FEHB health care plan premiums went up by 4.9% in 2021 and 5.6% in 2020.

Quality health insurance has never been more important, and OPM is ensuring all eligible enrollees have the information they need to make informed decisions about their coverage, OPM Director Kiran Ahuja said. The global pandemic underscores the responsibility an employer has to provide their workforce with quality, affordable, and dependable health care options. As the largest employer in the United States, the federal government is proud to lead by example with a wide choice of health insurance plans from the FEHB and FEDVIP that deliver the quality coverage every employee deserves.

The governments share of 2022 FEHB premiums will go up by an average of 1.9%. On average, the governments share of the of the total cost of an employees health insurance premiums is 70%. FEHB premiums will go up an average of 2.4% overall next year when combining both the employees and governments shares.

It is important to note that the specific amount of the 2022 FEHB premium rate change will vary based on the plan an enrollee chooses.

You May Like: Does Cigna Health Insurance Cover International Travel

How Can A Federal Employee Keep Their Health Insurance After Retirement

OPM states that federal employees can keep their health insurance after retirement as long as you meet the following conditions:

- You retire on an immediate annuity or postponed retirement if you have reached your minimum retirement age and have 10 years of service. This means that you cannot take a deferred retirement and expect to retain your FEHB coverage. Importantly, the requirements to maintain FEHB upon retirement are different from those pertaining to voluntary retirement. To receive a full pension, you need to have 30 years of federal service and meet your minimum retirement age . You may also qualify for an immediate annuity at age 62 with 5 years of service or at age 60 with 20 years of service. However, FEHB is governed by the MRA+10 rule. In general, you need to be at your MRA and have 10 years of service to be eligible. Note: you may be able to get a waiver in certain instances, please check the OPM guidance.

- In addition to MRA+10 you also must have participated in the FEHB for the 5 years prior to your retirement. If you retire with less than 5 years of service in the federal government, you may still be eligible to continue your FEHB if you were enrolled in FEHB for your whole government career. Note that the 5 year coverage window applies to your federal career. If you took a career intermission, you would not need to work an additional 5 years before retiring, so long as you had been enrolled in FEHB before leaving the government.

The Truth About Federal Employee Health Insurance After Retirement

As Ive written before, your FERS retirement benefit is more than just your pension. In fact, if you do your retirement planning correctly, you can take your federal employee health benefits, or FEHB, with you into retirement. I strongly believe that being able to keep your FEHB coverage after you retire is the best of the many retirement federal employee retirement benefits. In this article I explain how federal employee health insurance changes upon retirement. I have a passion for helping feds understand their benefits package so that they can make informed decisions. Note however, that I am speaking in my personal capacity. If you have specific questions, please contact your human resources department or a certified financial specialist.

Don’t Miss: Can You Get Medicaid If You Have Health Insurance

Temporary Continuation Of Coverage

If the FERS determines that you are ineligible for health benefits, you and certain family members may have the option to enroll for up to 18 months of Temporary Continuation of Coverage . You should also look into TCC if you plan to stop working before you are able to retire but want to have FEHB during retirement. TCC may be able to serve as a bridge to cover you until your retirement, when you would then re-enroll into FEHB.

You will not be able to obtain TCC if you have been terminated for gross misconduct.

Federal Employee Health Coverage

UnitedHealthcare works with federal agencies to provide members and annuitants with quality health coverage and access to health care. Health plans for federal employees may include:

- A Health Savings Account

- Lower premiums compared to traditional plans

- Access to UnitedHealthcare’s broad national physician and hospital network without the need for physician referrals

- Coverage of most network preventive care, including screenings and checkups

Also Check: How To Qualify For Government Health Insurance

Myth #: You Cannot Add Family Members To Your Fehb Plan Once Youve Retired

Retirees are allowed to add family members during open seasons , or at other times during the year if they experience a qualifying life event like getting married, divorced, the death of a spouse, or the birth or adoption of a child.

An important note: Family members are only permitted to be added to FEHB while the retiree is still living. Occasionally, we will find that the spouse of a federal employee has a great employer-sponsored health plan that ends up being better than FEHB maybe for a period of time.

For example, some employer-sponsored plans are free while that spouse is still working for that employer. But oftentimes the premiums are expensive for that employer-sponsored plan once that person no longer works for that employer, or its even possible that the employer wont allow the coverage to continue once that person no longer works for them.

While it might seem reasonable to be on two separate health plans the federal employee under the FEHB program and the rest of the family on another plan if the ultimate goal is for the spouse and any eligible children to be covered under FEHB long-term, we would want to make sure that they are added prior to the federal employees death. Again, family members cannot be added to the FEHB plan after that retiree dies.

Dropping or Cancelling FEHB Coverage

How Can You Add Family Members

As long as you are eligible and have met your requirements, you can add a new spouse or a child after you have retired at any time because of a life change event. You may also switch your type of plan from a Self Only to a Self and Family plan during a Federal Benefits Open Season. An FBOS typically runs from early November to mid-December of a given year.

Don’t Miss: How To Get Your Parents On Your Health Insurance

What Are The Us Federal Governments Retirement Benefits

Federal employees receive generous retirement benefits. Many people know that federal employees receive a pension. However, few people understand the full complement of federal retirement benefits. Employees in the federal employee retirement system, also called FERS, receive three benefits. A retirement annuity . A supplemental pension from ages 57-62. A continuation of their FEHB plan into retirement. Previously, I have written extensively about all of the benefits of federal employment. Today Ill try to explain federal employee health insurance benefits after retirement.

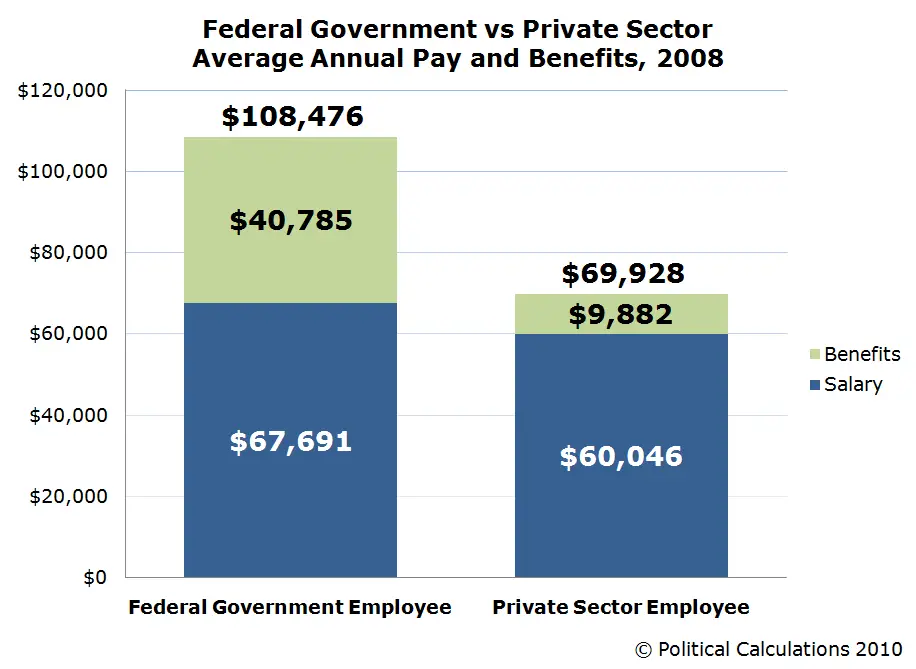

Federal Health Retirement And Other Benefits

The government provides its employees with a first-class benefits package. In fact, studies conducted by the Bureau of Labor Statistics reveal that the gap concerning benefits between the private and public sectors has been growing-in favor of the public sector.

Once youve been selected to be a part of the government team, youll have access to first-class health care benefits.

Health Care Benefits

Health Insurance

Through the Federal Employees Health Benefits Program , federal employees, retirees, and their families enjoy the widest selection of health insurance plans in the country. More than 200 plans participate in the program, so you can choose the plan that best fits your individual healthcare needs.

Specific benefits vary by plan, but no plan requires a waiting period or a medical exam to enroll. There are no restrictions based on age or physical condition, and the program provides guaranteed protection that cannot be canceled by the health plan.

Your federal agency will cover the majority of the health care costs, usually between 70 and 75 percent.

Flexible Spending Accounts

A flexible spending account allows you to put aside some of your pre-tax salary to pay for common out-of-pocket expenses. The federal government offers a Health Care Flexible Spending Account of up to $5,000 annually. You can use it to pay for any eligible health care expenses not covered by the Federal Employees Health Benefits Program, such as over-the-counter medications or plan premiums.

You May Like: Can I Cancel My Health Insurance