How Much Does Car Insurance Cost In Idaho

The average auto insurance premium in Idaho is $1,018 per year less than the national average by 28.7%. Car insurance premiums are affected by factors aside from geography. Car insurance rates price based on a number of factors, including ones marital status, driving history, credit rating, gender and age.

Idaho Health Insurance Information Resources And Access To Online Health Insurance Quotes

As an Idaho resident you can choose from health insurance plans offered to individuals and groups by private insurance companies. You may also purchase individual and family coverage from participating private insurers through Your Health Idaho, the state-run exchange. If you are self-employed with no employees, you can also use the state exchange to purchase coverage. You may also be entitled to certain state and federal programs such as Medicaid, CHIP or Medicare.

How Does Medicaid Provide Assistance To Medicare Beneficiaries In Idaho

Many Medicare beneficiaries also receive assistance through Medicaid. This can include help with Medicare premiums, cost sharing , and long-term care expenses.

Our guide to financial assistance for Medicare beneficiaries in Idaho details these programs, including Extra Help, long-term care Medicaid, and eligibility guidelines for assistance.

Recommended Reading: Is It Required By Law To Have Health Insurance

Insurance Complaints: All Data

The Texas Department of Insurance handles complaints against people and organizations licensed by TDI, such as companies, agents, and adjusters. To learn more, go to the TDI webpage, < a href=”https://www.tdi.texas.gov/tips/ways-we-can-help.html” target=”_blank”> < u> How to get help with an insurance issue or file a complaint< /u> < /a> .& nbsp This dataset includes a row for each person and organization named in a complaint. This means some complaint numbers are listed multiple times. To view a dataset that lists each complaint number once due to removing the Complaint filed against column, use < a href=”https://data.texas.gov/dataset/Insurance-complaints-One-record-complaint/jjc8-mxkg” target=”_blank”> < u> TDI Complaints: One Record / Complaint< /u> < /a> .

Who Is Eligible For Medicaid In Idaho

Compared to other states, Idaho has a more restrictive Medicaid program. As of 2021, Idaho Medicaid eligibility levels are as follows :

- Children ages 0-5 qualify with family income up to 142% of the federal poverty level

- Children ages 6-18 qualify with family income up to 133% of the FPL

- Pregnant women qualify with family income up to 133% of the FPL

- Low-income, able-bodied adults with income up to 133% of FPL

- Children qualify for CHIP with family income up to 185% of the FPL.

See the Idaho Medicaid website for eligibility criteria for individuals who are aged or disabled.

Recommended Reading: What To Do When You Lose Health Insurance

Does Idaho Have A State Exchange

Idaho exchange overview Idaho has a state-run exchange, Your Health Idaho. Open enrollment for 2021 health plans ran from November 1 through December 15, 2021. Outside of the open enrollment window, residents can normally only enroll or make changes to their coverage if they experience a qualifying event.

Nyc Health + Hospitals/options

NYC Health + Hospitals Options is a discount payment scale that determines fees for NYC Health + Hospitals services for New Yorkers who do not qualify or cannot afford any of the free or low cost health insurance plans available. The reduced fees are based on family size and income. This table shows a sample of the reduced fees available to eligible individuals in 2011.Update Frequency: As needed

Don’t Miss: Do I Have To Offer Health Insurance To All Employees

Managed Care Regional Consumer Guide

The Managed Care Consumer Guide data provides information about the quality of care for different health plans as well as people’s opinions about the care and services plans provide. This information will help consumers choose a managed care plan that meets their health care needs and the needs of his or her family.

Shop Health Insurance Plans

Individual & Family Medical Plans

We have lots of medical insurance plans designed to meet the needs of Idahos individuals and families. Whether you need affordable coverage for one person or your whole family, we’ve got a plan that will fit your needs and your budget.

Individual & Family Dental Plans

Blue Cross of Idaho offers a family of flexible and affordable dental insurance plans with varying degrees of coverage. Oral health is important part of overall health and our plans come with rich benefits and low monthly premiums.

Medicare Advantage Plans

Medicare Advantage plans are generally HMOs and PPOs that provide all the healthcare coverage you receive under Medicare and may include extra benefits like vision, eyewear and wellness education.

Medicare Supplement

Because most original Medicare health plans dont cover everything, Medicare Supplement helps fill in any gaps.

Employer Group Plans

Buying health insurance is a very important decision. We understand that you want to provide the best coverage for your employees and their families, but you also have to keep an eye on what your budget will allow. We offer a wide variety of health insurance plans designed to provide your employees with the coverage they deserve without breaking your budget — no matter the size of your business.

You May Like: How Do I Know Which Health Insurance I Have

Idaho And The Patient Protection And Affordable Care Act Of 2010

The Patient Protection and Affordable Care Act became law in 2010. Provisions of the law have continued to be phased in following passage. As of January 1, 2014, most U.S. citizens and legal residents are required by law to have qualifying health care coverage or pay an annual tax penalty for every month they go without insurance. This is called the individual mandate. There is a grace period through March 31, 2014. Beginning in 2014, the penalty for not having qualifying coverage is $95 per adult and $47.50 per child or 1% of your taxable income whichever is higher . The penalty increases annually through 2017 and beyond.

What Are The Disadvantages Of Medicaid

Disadvantages of Medicaid

- Lower reimbursements and reduced revenue. Every medical practice needs to make a profit to stay in business, but medical practices that have a large Medicaid patient base tend to be less profitable. …

- Administrative overhead. …

- Medicaid can help get new practices established.

Recommended Reading: Can You Buy One Month Of Health Insurance

History Of Idahos Medicaid Expansion Debate

For years, more than 75% of Idaho residents had been in favor of Idaho lawmakers coming up with a solution to allow the people in the Medicaid coverage gap to gain access to comprehensive health insurance. And by not expanded Medicaid, Idaho has been missing out on $3.3 billion in federal funding over the next decade, and federal tax revenue collected in Idaho had been used to expand Medicaid in other states.

Medical providers, the Idaho Association of Counties, consumer advocates, and some lawmakers have been pushing for years for Medicaid expansion in Idaho. The state had long considered the Healthy Idaho Plan, which would have eliminated the coverage gap in the state, albeit via a waiver from CMS that would allow for an Idaho-specific approach., and during the 2016 legislative session, lawmakers also considered Governor Otters new proposal to expand access to primary care for people in the coverage gap.

Lawmakers also considered much less robust solutions in 2016 and in 2017 , but neither solution was enacted.

In February 2016, the Senate Health and Welfare Committee heard public testimony for the first time regarding Medicaid expansion. But no agreements were reached in Idaho regarding health coverage for the states lowest-income residents.

During the 2016 legislative session, lawmakers considered three bills related to Medicaid expansion and care for people in the coverage gap, but none made it out of committee:

Rhode Island Individual Mandate

- Effective date: January 1, 2020

- Requires individuals and their dependents have ACA-compliant health insurance

- Imposes a penalty on residents who go without health insurance but can afford it

- Provides state subsidies to help lower income residents afford health insurance

The penalty for failure to have ACA-compliant health insurance is the same as it would have been under the federal individual mandate. It will cost a family $695 for each uninsured adult and $347.50 for each uninsured child or 2.5% of the household income, whichever amount is greater. Penalties also increase annually with inflation. However, the maximum a household can be penalized cant be greater than the total annual premium for an average bronze plan in Rhode Island.

Rhode Island allows for exemptions in certain situations. And, as of December 31, 2020, Rhode Island expanded its eligibility criteria to include a COVID hardship exemption. This new exemption recognized the impact that the pandemic may have had on residents ability to afford and get health insurance. If you live in Rhode Island, you may be eligible to file a hardship exemption if, as a result of the COVID pandemic:

- You lost minimum essential coverage in 2020, or

- You experienced a hardship that made you unable to get minimum essential coverage in 2020.

Read Also: Can I Buy Health Insurance After An Accident

Ambetter Health Insurance Overall Rating

Like many insurance companies, Ambetter health insurance has pros and cons that you need to weigh out to decide whether its the best option for you. It shines when it comes to the variety of plan options available and the low monthly premiums. The perks program and benefits including telehealth services and a mail-order pharmacy program also increase the appeal of using this health insurance provider.

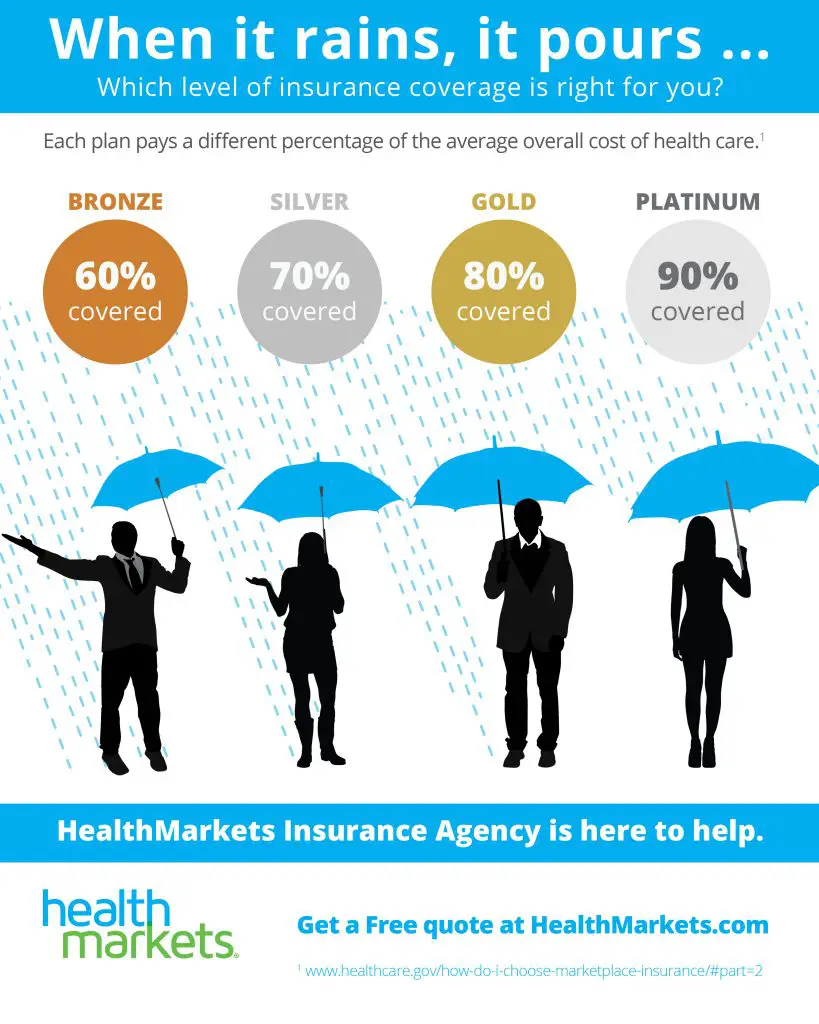

Ambetter Health Insurance Coverage Options

Ambetter offers three tiers of Marketplace insurance plans Gold, Silver and Bronze tier plans.

- Ambetter Secure Care is the Gold-tiered plan, and as such, this is the plan that has the highest monthly premium payments.

- Ambetter Balanced Care is the plan that Ambetter says is the best value. This Silver-tiered plan offers modest monthly premium payments with lower out-of-pocket costs. Its the perfect in the middle plan.

- Ambetter Essential Care has the lowest monthly premium payment. As the Bronze-tiered option, this is a good option for people who dont expect to need medical care often. This plan comes with the highest out-of-pocket costs to make up for the low monthly premium.

- Vision

- Adult Dental

Generally speaking, Ambetters coverage options are fairly standard. But, unlike some of its competitors, it offers the option to select a plan with vision and adult dental coverage. Choosing a plan like this is a great way to get full coverage all from one insurance provider.

Read Also: How To Apply For Low Cost Health Insurance

What Medicare Plans Are Required At 65

Medicare is a benefit available to you when you turn age 65, but you dont have to enroll if you have other insurance coverage, such as through an employer. You can defer your Medicare plan when you turn age 65 if you have other insurance. Medicare also requires you to have some form of prescription drug coverage. This is known as Medicare Part D, and it is available through private insurance companies in Idaho.

If you dont enroll in Medicare when you turn age 65 , you could face penalties. These are usually determined by how long you went without Medicare coverage. Penalties apply for delayed enrollment in Part B and Part D. Once you have a penalty, you must pay it for a lifetime thats why it is best to enroll in Medicare at the correct time.

Does Idaho Have Medicare

More than 340,000 people are enrolled in Medicare in Idaho. Of these individuals, an estimated 221,657 participate in Original Medicare, while another 122,947 are members of Medicare Advantage plans in Idaho.

When you qualify for Medicare in Idaho, you can choose to participate in Original Medicare or Medicare Advantage. Original Medicare lets you see any doctor or go to any facility that accepts Medicare. Original Medicare is divided into Parts. Each part is responsible for paying for different medical needs. For example, Medicare Part A in Idaho pays for mostly hospital coverage and long-term skilled nursing stays. Medicare Part B in Idaho pays for doctors visits, some immunizations, and durable medical equipment.

Another option for Medicare in Idaho is Medicare Advantage plans. Also known as Medicare Part C, these plans are when a person chooses a private insurance company to provide their Medicare coverage. Medicare Advantage provides additional benefits , and most offer prescription drug coverage.

Medicare Advantage plans in Idaho are usually region-specific. The plans will contract with doctors, hospitals, and other healthcare organizations to provide services. As a result, you will usually choose from a list of providers if you select a Medicare Advantage plan in Idaho.

Recommended Reading: How To Get Health Insurance Self Employed

Will My Family Members Qualify For The Same Health Plan That I Do

It depends. You can enroll as a family. But in some cases, some family members may also be eligible for certain subsidies or other programs, depending on age, income and disability, or caregiver status. Such families may choose to enroll separately. Family members may still be able to see the same doctor or go to the same medical practice, depending on the types of insurance plans accepted. This guide was updated on Nov. 1 with more information about open enrollment.

Medicaid Expansion In Idaho

Idaho expanded Medicaid as of January 2020. Enrollment began November 1, 2019, with coverage effective January 1, 2020. Nearly 109,000 people had enrolled by June 2021.

The state had initially expected total enrollment in expanded Medicaid to eventually reach 91,000 people, but that was before the COVID pandemic. The pandemic has increased Medicaid enrollment nationwide, due to the widespread job losses and the fact that the additional federal Medicaid funding is contingent on states not disenrolling anyone from their Medicaid rolls until the end of the COVID emergency period.

Idaho submitted a Medicaid work requirement waiver proposal to CMS in late 2019, but it was still pending federal approval when the Biden administration took office. Medicaid work requirements have been essentially a non-starter during the COVID pandemic, and the Biden administration began notifying states in early 2021 that work requirement waiver approvals could be revoked. So its unlikely that Idahos pending work requirement will be approved.

Federal

0.0%

of Federal Poverty Level

Medicaid expansion in Idaho was ultimately implemented without modifications, after state lawmakers unsuccessfully tried to make various changes to the way the expansion would work.

You May Like: Can I Pay For My Employees Individual Health Insurance

Who Has The Best Medicare Advantage Plan

The best Medicare Advantage plan in Idaho is the one that meets your distinct health needs. You must consider factors like monthly premium cost, out-of-pocket limits, network, prescription drug plan, and available services when selecting a Medicare Advantage plan.

The Centers for Medicare and Medicaid Services also have a star rating system. The highest rating is five stars, which 21 Medicare Advantage plans achieved in the United States in 2021. However, there were no Medicare Advantage plans in Idaho that received a 5-star rating. The average Medicare Advantage plan in Idaho has between a 3.5 and 4-star rating.

You can also ask friends and family about their Medicare plan, and if they would recommend it. Another way to evaluate the best Medicare Advantage plan in Idaho is to ask your preferred doctor or doctors what insurance types they accept. Doing so will help you choose a plan that allows you to continue seeing doctors you trust.

Idaho Open Enrollment For 2022 Health Insurance Plans Runs From November 1 2021 Until December 15 2021

This website provides information about getting health insurance under the Affordable Care Act , including new benefits available under The American Rescue Plan Act of 2021 and other essentials such as:

To begin, keep in mind these key points about health insurance in Idaho:

Read Also: Can I Go To The Er Without Health Insurance

What About New Federal Assistance For Premiums

Every eligible household that pays insurance premiums that exceed 8.5 percent of annual income now qualifies for federal tax credits for insurance premiums. For example, a single 64-year-old filer earning $51,000 per year could potentially save more than $8,000 with the new tax credits, according to the Kaiser Family Foundation.

What Is The Idaho Health Insurance Exchange

A health insurance exchange is a marketplace for people to shop for health insurance from different providers. The plan must offer certain essential benefits mandated by the ACA, and with multiple insurers participating, pricing is more competitive. Trained navigators through Your Health Idaho can help you determine if you qualify for subsidies and understand which health insurance plan is right for you.

Recommended Reading: What Is The Difference Between Life Insurance And Health Insurance

Do You Get Free Medicare When You Turn 65

Medicare is not completely free insurance coverage. If you paid Medicare taxes for 40 quarters of work , you will receive Medicare Part A premium-free. Medicare Part B or medical coverage requires you to pay a monthly premium, which Medicare sets each year.

Even if you choose a Medicare Advantage plan in Idaho, you will continue to pay a monthly Part B premium, plus a premium to your Medicare Advantage plan. Some plans offer premium-free coverage.

In addition to Medicare premiums, you will have co-payments and deductibles to pay with Medicare. However, Medicare negotiates with healthcare providers to keep these costs as low and consistent as possible.

Sample 2019 Iowa Individual Affordable Care Act

Sample premium information for individual ACA-compliant health insurance plans available to Iowans for 2019 based on age, rating area and metal level. These are premiums for individuals, not families. Please note that not every plan ID is available in every county. Please go to https://www.healthcare.gov/ to determine if your plan is available in the county you reside in.

You May Like: How To Apply For Health Insurance As A College Student