Understanding The Medicare ‘donut Hole’

Although it may sound sweet, the “donut hole” in Medicare‘s prescription drug coverage can feel like a trap to those who fall into it. If you or a family member is covered by Medicare, and has prescription drug coverage, you should familiarize yourself with the coverage gap.

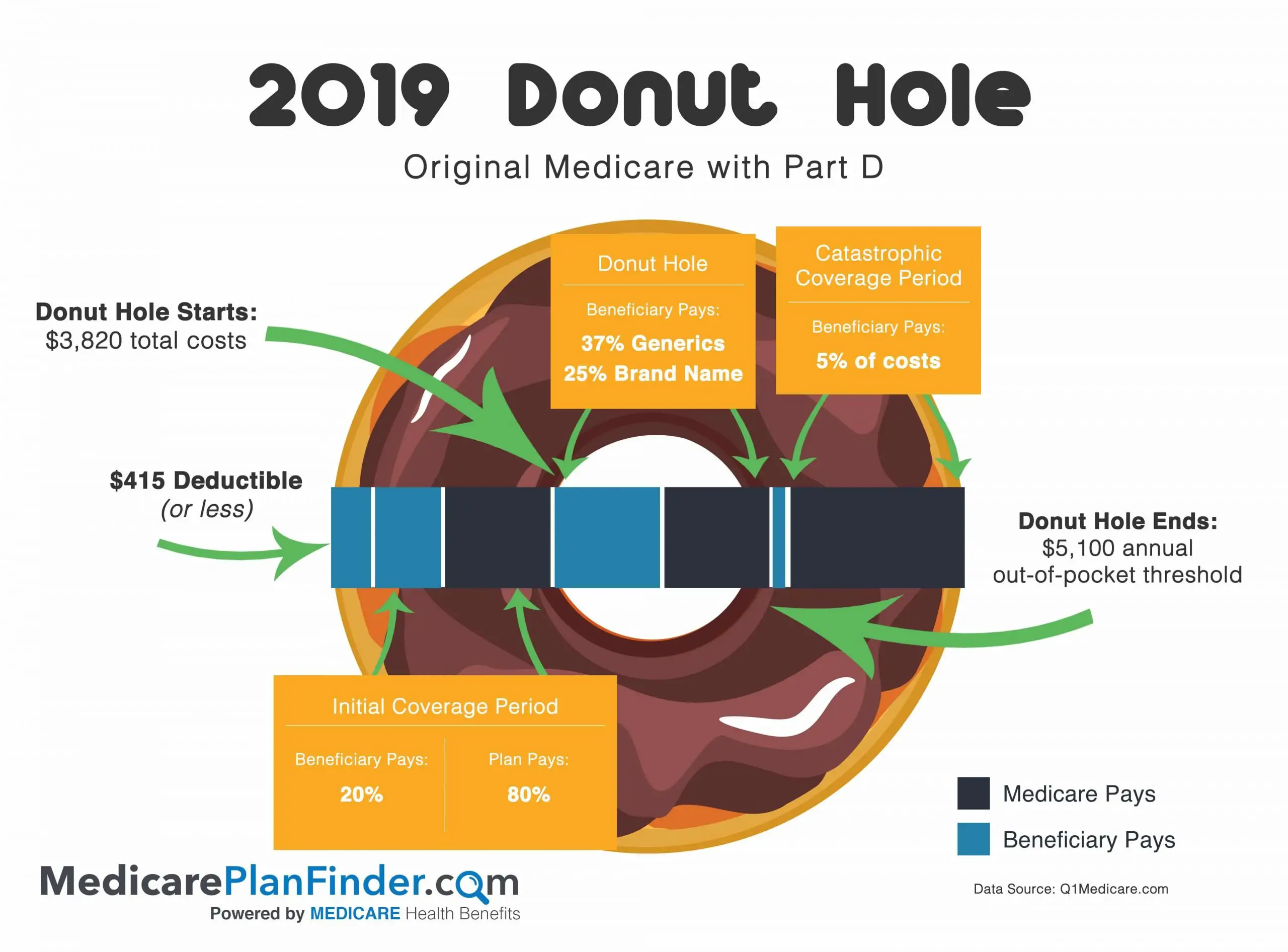

Visualize a donut: You have a left side, a hole in the middle and a right side.

Left side: You stay on the left side of the donut until your payments and your plan’s payments reach $4,020* on covered prescription medications. This is not only what you pay personally at the pharmacy this is the total of your covered drug costs plus your deductible and copays.

Hole in the middle: Once you reach $4,020 in drug costs this year, the coverage gap or “donut hole” phase of your Medicare plan begins. When in the “donut hole”, you may pay 25% of the total cost of brand name drugs and a maximum of 25% of the total cost of generic drugs until your total annual costs reach $6,350.

Right side: After you reach $6,350 in the year, you leave the gap, and catastrophic coverage kicks in. In this stage, most will pay only a small coinsurance amount or copayment for covered drugs for the remainder of the calendar year.

Get the most out of your prescription drug benefits

No one wants to spend unnecessary money on prescription drugs. If you want to maximize your prescription drug benefits, consider these tips:

How Much Am I Responsible For During The Medicare Donut Hole

You will be responsible for 25% of your drug costs while in the donut hole. It used to be more, but in 2020, a limit was set and now you wont have to pay an excess of 25%.

This doesnt mean you wont have to pay more for your prescription drugs than you did during your initial coverage, however.

Lets look at this example: If, during your initial coverage, your $200 drugs total cost came with a 20%, $40 copay, then, during the Medicare donut hole, you will have to pay 25%, $50 out-of-pocket.

How Can You Get Help Paying For Prescription Drug Coverage

If you qualify, Medicare and Social Security offer a program called Extra Help that lowers your drug costs to $3.95 for each generic covered drug and $9.85 for each brand-name covered drug.5

You may also be able to get help through state pharmaceutical assistance programs, through assistance programs from pharmaceutical companies themselves, or by choosing a Medicare drug plan that offers additional coverage during the gap.6

A Reminder

If you dont sign up for Medicare Part D when youre first eligible, you may have to pay a late enrollment penalty.

You May Like: Which Is The Best Health Insurance Company In Texas

When Does The Donut Hole Kick In

In 2022, once your total drug costs reach $4,430 for the plan year, you’re in the coverage gap. You’ll have to pay 25% of the cost for your generic drugs and 25% of the cost for your brand-name drugs until you’ve paid a total of $7,050 in out-of-pocket expenses.

Once your out-of-pocket expenses total $7,050, your Medicare Part D drug plan coverage begins again. You’re responsible for a small copayment or coinsurance and your Medicare drug plan covers the rest of your costs for the remainder of your plan year. This is known as catastrophic coverage.

How Do I Avoid The Medicare Part D Coverage Gap

Now that you know about the coverage gap , here is some good news:

Many Medicare beneficiaries wont have to pay the increased prices during the coverage gap because their prescription drug costs wont reach the initial coverage limit of $4,020 in 2020.

People who qualify for Extra Help will avoid the coverage gap. Extra Help is a federal program that helps eligible individuals with limited income pay for Medicare Part D costs such as premiums, deductibles, and copayments/coinsurance. If you qualify for this assistance, you wont enter the coverage gap. You can apply for the program through your states Medicaid department or the Social Security Administration.

Although most Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans have a coverage gap, some plans offer additional coverage during this phase. Costs for this additional coverage will vary by plan.

Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap. Here are some tips for how you can lower the amount you spend on medications:

Many expensive prescription drugs have a generic or lower-cost alternative. Switching to lower-cost drugs may help you avoid entering the coverage gap. Talk to your doctor or prescriber about whether there are lower-cost prescription drugs available that may be just as effective for your condition.

New To Medicare?

Read Also: Do Employers Pay For Health Insurance

When Does The Medicare Donut Hole End

The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year. That limit is not just what you have spent but also includes the amount of any discounts you received in the donut hole. So, your out-of-pocket will be somewhat less than that.

So how do you get out of the donut hole? Unfortunately, its by paying for medications through the donut hole until you reach catastrophic coverage level.

Phase 2 Initial Coverage

During this phase, your copayments and coinsurance come into play. You pay just your share of prescription costs and your plan pays the rest for covered drugs. For example, if your plan has a 25% copayment for a $200 prescription, you would pay $50 and your plan would cover the $150 balance.

If the combined amount you and your drug plan pay for prescription drugs reaches a certain level during the yearthat limit is $4,130 in 2021you enter the Part D coverage gap or donut hole.

Don’t Miss: Are Glasses Covered By Health Insurance

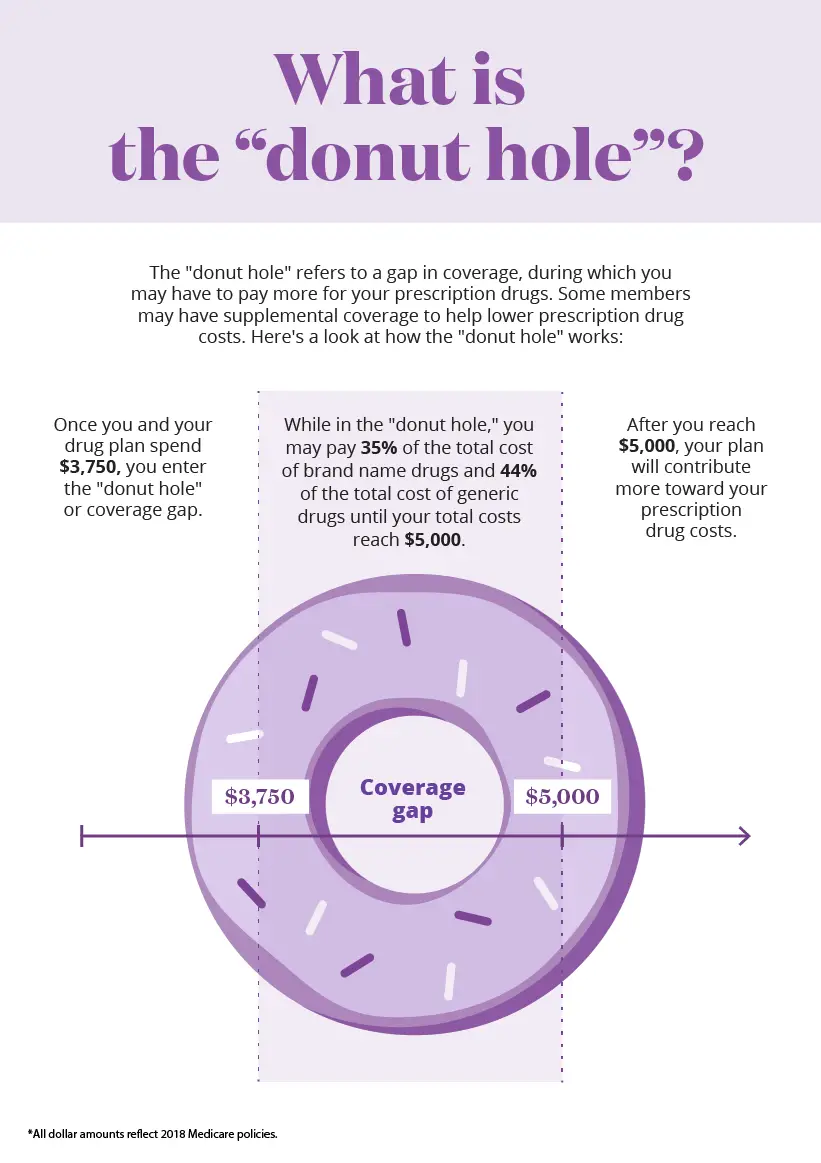

What Is The Coverage Gap

As mentioned before, the coverage gap is the Medicare term for the more commonly used description of the donut hole. Each year, Medicare sets the limit for out-of-pocket costs that you pay prior to reaching the donut hole.

For 2021, you enter the donut hole after you and your plans spending have reached a drug cost of $4,130 out of pocket, but catastrophic coverage does not take effect until your out-of-pocket spend is $6,550. Hence, the gap.

Some plans do offer additional discounts during this stage, and in many cases you will only pay 25 percent of the drug cost. But, it is important that you remain vigilant, because if you are taking several medications, or your medications are very expensive, its worth your time to consider what options are available to you.

The best thing to do is speak with Medicare directly, or to talk to a licensed insurance professional who can help you decide what to do if you enter the coverage gap.

Medicare Part D Coverage Gap

The Medicare Part D coverage gap is a period of consumer payment for prescription medication costs which lies between the initial coverage limit and the catastrophic-coverage threshold, when the consumer is a member of a Medicare Part Dprescription-drug program administered by the United States federal government. The gap is reached after shared insurer payment – consumer payment for all covered prescription drugs reaches a government-set amount, and is left only after the consumer has paid full, unshared costs of an additional amount for the same prescriptions. Upon entering the gap, the prescription payments to date are re-set to $0 and continue until the maximum amount of the gap is reached OR the current annual period lapses. In calculating whether the maximum amount of gap has been reached, the “True-out-of-pocket” costs are added together.”TrOOP includes the amount of your Initial Deductible and your co-payments or co-insurance during the Initial Coverage stage. While in the Donut Hole, it includes what you pay when you fill a prescription and of the 75% Donut Hole discount on brand-name drugs, it includes the 70% Donut Hole Discount paid by the drug manufacturer. The additional 5% Donut Hole discount on brand-name drugs and the 75% Donut Hole discount on generics do not count toward TrOOP as they are paid by your Medicare Part D plan.”

Provisions of the Patient Protection and Affordable Care Act of 2010 gradually phase out the coverage gap, eliminating it by 2020.:1

Recommended Reading: How Much Is Health Insurance In Costa Rica

Medicare Part D Donut Hole

Home / Original Medicare / Medicare Parts / Part D / Medicare Part D Donut Hole

Whether youre about to enroll in a Part D plan or youre currently enrolled in one, its important to understand how the Medicare donut hole works. Below, well explain the stages of the donut hole and how to prepare for it.

How You Can End Up In Medicares Donut Hole And How You Get Out

Medicare prescription drug plans can have a coverage gapcalled the “donut hole”–which limits how much Medicare will pay for your drugs until you pay a certain amount out of pocket. Although the gap has gotten much smaller since Medicare Part D was introduced in 2006, there still may be a difference in what you pay during your initial coverage compared to what you might pay while caught in the coverage gap.

When you first sign up for a Medicare prescription drug plan, you will have to pay a deductible, which cant be more than $445 . Once youve paid the deductible, you still need to cover your co-insurance amount , but Medicare will pay the rest. Co-insurance is usually a percentage of the cost of the drug. If you pay co-insurance, these amounts may vary throughout the year due to changes in the drugs total cost.

Local Elder Law Attorneys in Your City

City, State

Once you and your plan pay a total of $4,130 in a year, you enter the coverage gap, aka the notorious donut hole. Previously coverage stopped completely at this point until total out-of-pocket spending reached a certain amount. However, the Affordable Care Act has mostly eliminated the donut hole. In 2021, until your total out-of-pocket spending reaches $6,550, youll pay 25 percent for brand-name and generic drugs. Once total spending for your covered drugs exceeds $6,550 , you are out of the coverage gap and you will pay only a small co-insurance amount. For more from Medicare on coinsurance drug payments, .

Read Also: What Is A Gap Plan Health Insurance

What Is The Medicare Donut Hole Coverage Gap Explained

You may have heard of the donut hole in reference to Medicare Part D, Medicares prescription drug coverage.

The donut hole is a gap in prescription drug coverage during which you may pay more for prescription drugs. You enter the donut hole once Medicare has paid a certain amount toward your prescription drugs in one coverage year.

Once you fall into the donut hole, youll pay more out of pocket for the cost of your prescriptions until you reach the yearly limit. Depending on the type of coverage you choose, when you hit this limit, your plan may help pay for your prescriptions again.

Continue reading as we discuss more about the donut hole and how may it affect how much you pay for your prescription drugs this year.

So when exactly does the donut hole begin and end for 2021? The short answer is, that varies depending on the Part D plan you choose and how much you spend on prescription medications. Here are more facts about the Medicare donut hole.

Initial coverage limit

You enter the donut hole after you surpass the initial coverage limit of your Part D plan. The initial coverage limit includes the total cost of drugs what both you and your plan pay for your prescriptions.

After surpassing this limit, youll need to pay a certain percentage yourself until youve reached whats called the OOP threshold.

OOP threshold

This is the amount of OOP money that you have to spend before you exit the donut hole.

Lets see how this works in some examples below.

Generic drugs

Impact On Medicare Beneficiaries

| This section needs to be . The reason given is: it does not reflect benefit changes following passage of the Patient Protection and Affordable Care Act of 2010. Please help update this article to reflect recent events or newly available information. |

The U.S. Department of Health and Human Services estimates that more than a quarter of Part D participants stop following their prescribed regimen of drugs when they hit the doughnut hole.

Every Part D plan sponsor must offer at least one basic Part D plan. They may also offer enhanced plans that provide additional benefits. For 2008, the percentage of stand-alone Part D plans offering some form of coverage within the doughnut hole rose to 29 percent, up from 15 percent in 2006. The percentage of Medicare Advantage/Part D plans plans offering some form of coverage in the coverage gap is 51 percent, up from 28 percent in 2006. The most common forms of gap coverage cover generic drugs only.

Among Medicare Part D enrollees in 2007 who were not eligible for the low-income subsidies, 26 percent had spending high enough to reach the coverage gap. Fifteen percent of those reaching the coverage gap had spending high enough to reach the catastrophic coverage level. Enrollees reaching the coverage gap stayed in the gap for just over four months on average.

| 25% | 25% |

As of January 1, 2020, the coverage gap has closed.

You May Like: Which State Has The Cheapest Health Insurance

Understanding The Medicare Donut Hole

Summary: The Medicare Part D donut hole, also known as the coverage gap, is a stage in Part D prescription drug coverage that may temporarily limit what your Medicare prescription drug plan will cover. During this stage of coverage, you may start paying more for covered prescription drugs than what you paid earlier in the year.

The dollar amount when you enter the donut hole stage may change each year. Changes in the dollar threshold for the Medicare Part D donut hole, as well as the cost-sharing amount you pay during this coverage stage, result from the Affordable Care Act . The Medicare donut hole officially closed in the year 2020. You might still reach this threshold, also called the initial coverage limit, but you wont pay more than 25% of the cost for any covered prescription.

Medicare Donut Hole: What Is The Medicare Part D Donut Hole

The Medicare donut hole refers to a gap in out-of-pocket coverage of Part D prescription drug costs.

Medicare Part D policies are private insurance plans that cover the cost of prescription drugs you pick up in the pharmacy or have delivered. However, there may still be deductibles, premiums, coinsurance, and copayment costs to meet out of pocket. The Medicare donut hole that exists in the space between the initial coverage limit on Medicare Part D and the catastrophic-coverage threshold has shrunk considerably since 2010 due to a provision of the Affordable Care Act, but there is still a gap between those types of coverage. Here is our breakdown of what the donut hole means for Medicare Part D enrollees, how it changed through 2020, and some tips for saving money on your prescription drug costs.

What is the Medicare Part D donut hole?

Each year, Medicare has an initial coverage limit for Part D prescription drugs that the carrier of a Medicare Part D policy will pay for. In 2021, that limit is $4,130. This means if you require prescription drugs that cumulatively cost more than that limit amount within one year, your Medicare Part D policy used to cover only a minimal amount of the cost of your prescription medications. This used to mean that you would be paying the full cost of the drug. After 2020, you will be paying 25% of the total cost of the drug.

Did the Medicare donut hole go away in 2020?

Recommended Reading: Do You Have Health Insurance

What Are The Phases Of A Part D Plan

Your drug coverage will change throughout the year, depending on how much you spend. If you dont spend very much on drugs, or you have drug coverage from another source, you may never reach the donut hole phase.

Bear in mind that Medicare updates the maximum deductible and cost thresholds every year. Heres how Part D coverage breaks down in 2021:

-

Phase 1: Deductible: You start out the year paying full price for your medications until you reach your deductible. Deductibles vary by plan, but the maximum deductible allowed by Medicare in 2021 is $445.

-

Phase 2: Initial coverage: You pay your plans designated copay or coinsurance when filling your prescriptions until total medication expenses including the deductible but not including premiums reach $4,130.

-

Phase 3: Modified coverage : At this stage, you pay no more than 25% of the cost of your prescription drugs. For brand-name drugs, the manufacturers kick in 70% of the cost, and your insurer pays the other 5% . This payment structure lasts until the spending total reaches $6,550. How long it takes you to get there depends on whether youre buying generic or brand-name drugs.

-

Phase 4: Catastrophic coverage: Your copay drops substantially until the end of the year. For each drug, you pay whichever amount is larger:

-

5% coinsurance

-

copays of $3.70 for generics and $9.20 for brand-name drugs

When the year ends, you start over at Phase 1.