Getting Health Insurance Through An Employer

Where Can I Find Healthcare Insurance Are There Low Cost Health Care Facilities In My Area

The U.S. Department of Human Services administers three free or low-cost health insurance programs:

The Affordable Care Insurance Marketplace provides four basic ways to apply for health coverage through the Marketplace:.

- Apply online. Visit HealthCare.gov to get started.

- Apply by phone. Call 1-800-318-2596 to apply for a health insurance plan and enroll over the phone.

- Apply in person. Visit a trained counselor in your community to get information and apply in person. Find help in your area at LocalHelp.HealthCare.gov.

- Apply by mail. Complete a paper application and mail it in. You can download the paper application form and instructions from HealthCare.gov.

Medicare insurance is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . For information about Medicare, go to . On this site you can learn if you are eligible for Medicare.

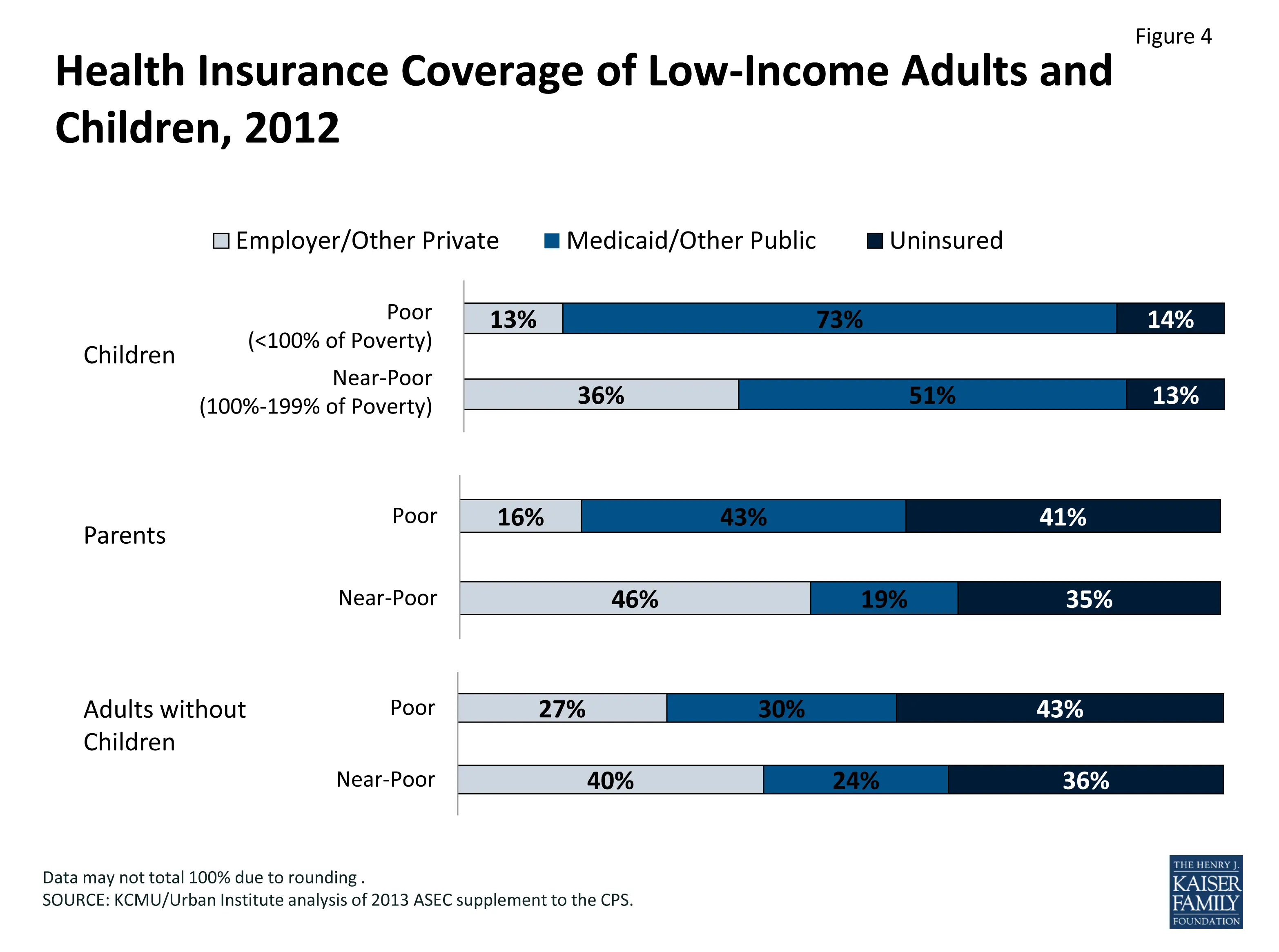

Medicaid is for certain individuals and families with low incomes and resources. Eligibility and benefits vary considerably from State to State. To find information about Medicaid, go to.

State Children’s Health Insurance Program provides free or low-cost insurance for children in working families, including families with individuals with a variety of immigration statuses. For more information on SCHIP, visit your State’s SCHIP website.

If Your Employer Offers Health Insurance

Most people with health insurance get it through an employer. If your employer offers health insurance, you wont need to use the government insurance exchanges or marketplaces, unless you want to look for an alternative plan. But plans in the marketplace are likely to cost more than plans offered by employers. This is because most employers pay a portion of workers insurance premiums.

Recommended Reading: How Much Is Average Health Insurance A Month

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as

How To Enroll And Get Answers To Your Questions

You can learn more about and apply for ACA health care coverage in several ways.

-

Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or you’ll be directed to your state’s health insurance marketplace website. vary by state.

-

Find a local center to apply or ask questions in person.

-

Download an application form to apply by mail

Find the answers to common ACA questions about submitting documents, getting and changing coverage, your total costs for health care, tax options, and more.

Also Check: Can Health Insurance Not Cover Pre Existing Conditions

Option : Use The Governments Health Insurance Marketplace

The Health Insurance Marketplace is often referred to as the health insurance exchange. Depending on your income and your eligibility for other health insurance coverage, you may qualify for subsidiesalso called premium tax creditswhen you buy health insurance through the marketplace.

You can buy a marketplace policy even if you are eligible for insurance through your employer, and it doesnt hurt to see if you can find a better plan for your situation. You probably wont be eligible for subsidies if you have access to job-based coverage, though.

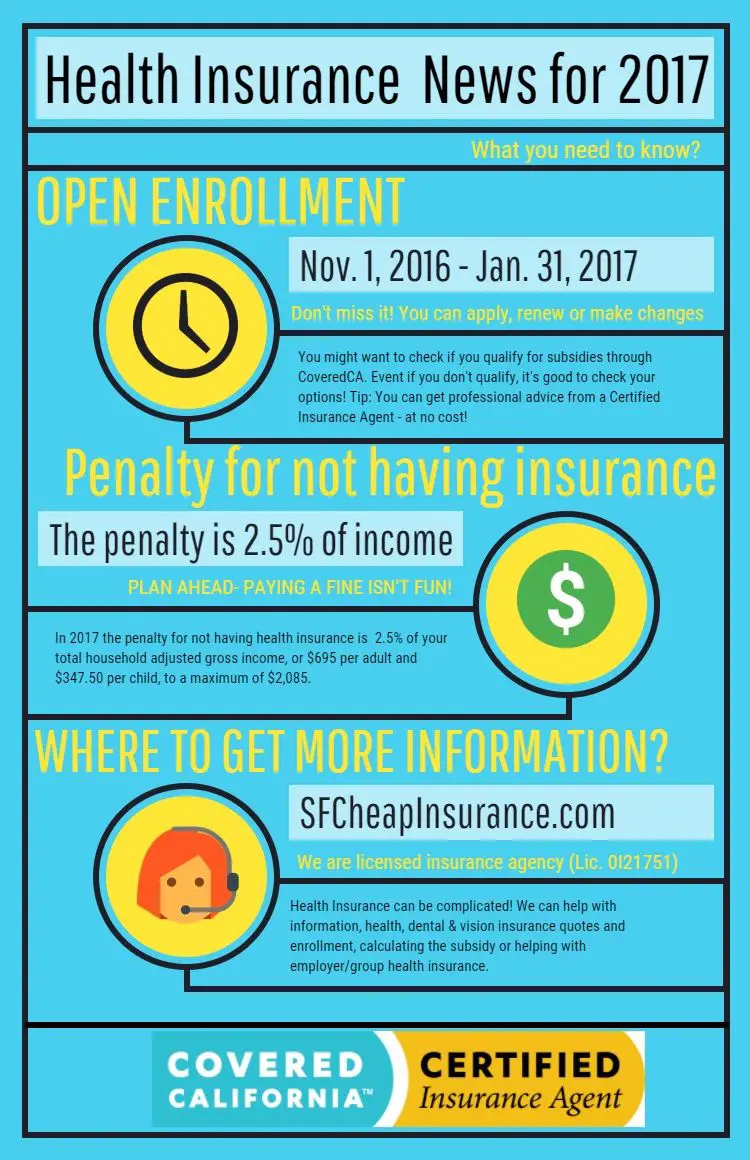

Open enrollment for 2022 coverage began Nov. 1, 2021. You had to enroll by Dec. 15 for coverage that began Jan. 1, 2022. In 2021, amid the ongoing COVID-19 pandemic, the open enrollment period was extended from Feb. 15 to May 15.

State exchanges may have slightly different enrollment dates. Its important to buy a policy during this annual enrollment period because you wont be able to buy a policy for the rest of the year unless you have a qualifying life event like moving, getting married, or having a child.

You can apply online, by phone, or in person. If you need help applying, you can work with a marketplace navigator in some states, a certified application counselor, or in-person assistance personnel. You must be a U.S. citizen or lawfully present in the country to buy a marketplace plan.

Can I Buy A Short

Short-term health insurance is notsold on ACA health insurance exchanges such as HealthCare.gov.

Short-term health plans are not considered minimum essential coverage.

If you experience a qualifying event that would typically trigger a special enrollment period where you could get an ACA-compliant plan, you would not be able to do so if the rules require you to have had minimum essential coverage in place before the qualifying event.

For example, even though the involuntary loss of coverage is a qualifying event that normally lets a person enroll in an ACA-compliant plan, the loss of a short-term plan does not.

You May Like: When Are Employers Required To Offer Health Insurance

How To Find Health Insurance If Youre Retiring Early

Medicare, the government healthcare program for retirees, doesnt kick in until youre 65. But what if you want to retire a little earlier, or have been forced into an early retirement?

Stephanie Faris

Key Takeaways

- Retiring early is possible, but Medicare doesnt kick in until youre 65.

- Government marketplaces can be a great option for medical insurance if you arent covered by an employer.

- A part-time job or spouses employer-provided insurance will likely provide the best benefits.

Medicare, the government healthcare program for retirees, doesnt kick in until youre 65. But what if you want to retire a little earlier, or have been forced into an early retirement?

The good news is, early retirement health insurance isnt as elusive as it seems. There are plenty of options available, from state marketplaces to employer insurance. Youll likely also be eligible for COBRA to cover you in the months immediately following your employment termination. This guide will help you get started on early retirement planning.

How Much Does Health Insurance Cost

The average annual premiums in 2021 were $7,739 for single coverage and $22,221 for family coverage, according to research from the Kaiser Family Foundation. Prices for 2022 are expected to increase, as they do most years: For instance, 2020 saw a 2.1% increase. Premiums in 2019 jumped 4% from the year prior. For 2022, Willis Towers Watson projected a 5.2% increase in healthcare premiums.

In 2021, the average premium for single coverage increased by 4%, and the average premium for family coverage increased by 4%. The average family premium has increased 47% since 2011 and 22% since 2016, according to KFF.

You May Like: Can I Get Health Insurance At Any Time

Health Insurance Without Phone Calls

Online health insurance quote tools let you compare health insurance companies and costs for individual health plans. Shopping for health insurance requires you to be truthful. Otherwise, you could wind up not benefiting from the best rates.

To get accurate quotes, youll have to provide personal information, including your ZIP code, phone number, your household income and your family size. You must provide accurate income and family size information especially if youre looking for an ACA plan. ACA plan members are eligible for subsidies, but you need to enter the right information in order for the tool to provide accurate quotes that takes into account subsidies.

You could provide an incorrect phone number to avoid getting potential phone calls. However, youll likely have to provide an accurate number in order to complete choosing a plan.

How To Track Old Insurance Policies

This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.There are 8 references cited in this article, which can be found at the bottom of the page. This article has been viewed 53,062 times.

Knowing how to track old insurance policies can mean a windfall of funds for you or your family if you know how to access the information and are the rightful beneficiary. Whether you had a parent or other family member pass away or you have simply misplaced your own insurance policies, you need to be aware of what is required of you to track down the policy information to claim the benefits that are rightfully yours.

Read Also: How Hard Is It To Get Health Insurance

What To Do When Your Insurance Company Ends Your Coverage

Your insurance company may not renew your policy because of:

- your claims history

- non-payment of premiums

If your insurance company tells you that it wont renew your policy, ask the company to explain the reason for its decision. Ask for the explanation in writing.

You may also want to shop around for another insurance provider.

Also Check: Health Insurance For Substitute Teachers

Check Your Health Insurance Enrollment Materials

- Your plan will send you a membership package with enrollment materials and a health insurance card as proof of your insurance.

- Carefully review these, and look through your planâs provider directory to see where you can get care.

- Youâll use the card when you get health care services, so keep it in a safe place.

- If you didnât receive a card, call your insurer to see if you should have received one already and to make sure your coverage is effective. You can find your insurerâs phone number on their website.

Want to change your health insurance plan? If youâd like to change your plan, you can do so now only if you experience a qualifying life event â like losing other coverage, having a baby, or getting married â and apply with a Special Enrollment Period.

Also Check: What Is The Cheapest Health Insurance In Florida

I’ve Tried To Get On Medicaid In The Past But Couldn’t Will My Chances Be Better Under The Affordable Care Act

Possibly, but a lot depends on what state you live in.

Health reform called for more people to be able to get Medicaid. However, it’s up to each state to decide whether to expand the program.

To find out if you can get on Medicaid now, go to HealthCare.gov. If the federal government is running the Marketplace in your state, you can fill out an application there. If your state is running its own Marketplace, you will be directed to another website where you can fill out an application. You can fill out one application to see if you qualify for Medicaid or for a tax credit to buy insurance on the Marketplace.

How Much Does It Cost To Buy Health Insurance On Your Own

Generally, the less you pay out of pocket for the deductible, copays and coinsurance, the more you spend on premiums.

Platinum plans charge harmer premiums than the other three plans, but you wont pay as much if you need health care services. Bronze, meanwhile, has the lowest premiums but the highest out-of-pocket costs.

When deciding on the level, consider the medical services you used over the past year and what you expect next year. For instance, if you plan on starting a family, consider how much out-of-pocket costs youll have to pay if you go with a Bronze plan.

eHealth reported the average monthly premium by metal level:

- Bronze $448

- Gold $569

- Platinum $732

Bronze and Silver are the most popular plans 39% have Silver plans and 36% have Bronze plans. Only 17% have Gold plans and 1% have Platinum plans.

Also Check: What To Do If Health Insurance Claim Is Denied

Option : Buy Directly From An Insurer

The Health Insurance Marketplace does not include every health insurance plan available. Some people might be able to find a plan that better meets their coverage needs or their budget outside the marketplace. When youre shopping for a policy on a single insurers website, you will, of course, only see options available from one insurer. Youll need to visit several insurers’ websites to see all your options if you want to buy direct.

Affordable Care Act -compliant plans sold outside federal and state exchanges must meet the minimum essential coverage standards of the ACA, such as covering pre-existing conditions, providing essential benefits, and offering preventive care at no cost before you meet your deductible.

You can also buy non-ACA-compliant short-term plans outside the exchanges that may have more exclusions and fewer benefits. People who are between insurance carriers might think that having some insurance is better than having none at all. Short-term health insurance plans market their perceived coverage as an excellent alternative to ACA-compliant insurance that comes with lower premium costs.

How Do I Find Health Insurance

From the U.S.: My son has ADD ADHD and is 22 and is having a lot of trouble with anger issues, anxiety, etcHe was on Vivanse and now is on Adderol because we cant afford the VivanseHe really needs counseling. He is helping me take care of my wife who has Alzheimers and had a pizza delivery job at night and weekends, but quit that. He just doesnt want to do anything and gets in fits of rage and depression. He is also on an anti-depressive.

He needs an insurance after not being on my works found one called Medical-Share, which later I found out does not cover any mental issues or prescriptions.

Do you know what kind of insurance we can get for him that is better and is under $150 per month? I have even looked in TexasHealth.gov and it is way over $230 per month.

I would appreciate helpit really is exhausting

Im sure this really is exhausting and frustrating and angry-making. You are already emotionally drained with taking care of your wife. It has to feel overwhelming to also be trying to sort out health insurance for your son. He deserves treatment. You deserve more peace of mind regarding his care.

I wish you well.

Recommended Reading: Does Your Employer Pay For Health Insurance

How Do I Get Health Insurance If I Am Self

If you own your own business, you can apply for health coverage through the Marketplace. Your income and household size may qualify you for premium tax credits and other insurance savings. There could also be free or low-cost coverage through CHIP or Medicaid programs in your state. Marketplace plans allow business owners to insure their children and spouses. Healthcare savings are based on an estimate of net earnings in the year you apply, not the previous years income.

What About An Hdhp With A Health Savings Account

A high-deductible health plan, or HDHP, can be any one of the types of health insurance above HMO, PPO, EPO or POS but follows certain rules in order to be HSA-eligible. These HDHPs typically have lower premiums, but you pay higher out-of-pocket costs, especially at first. They’re the only plans that qualify you to open a health savings account, or HSA, which is a tax-advantaged account you can use to pay health care costs. If youre interested in this arrangement, be sure to learn the ins and outs of HSAs and HDHPs first.

Recommended Reading: Can I Get Health Insurance Outside Of The Marketplace

Coverage Supports Appropriate Health Care Utilization

- Coverage can help direct individuals to the most appropriate site of care. Young adults who could stay on their parents health plan experienced decreases in non-emergent emergency department visits.33 Expansion populations in some states also experienced a decrease in ED visits and an increase in outpatient visits.34,35,36

- Coverage facilitates use of preventive care and management of chronic conditions. Individuals in expansion states saw significant increases in screening for diabetes, glucose testing among patients with diabetes, and regular care for chronic conditions.37

How To Buy Health Insurance On Your Own

Most Americans get health insurance through their employer or Medicare. However, you can buy health insurance on your own.

The Affordable Care Act created exchanges that allow people to compare individual plans in their area. You can see each plans design and what you would pay in premiums and out-of-pocket costs. There are also individual insurance plans outside of the exchanges that offer even more choices.

Buying your own health insurance can seem daunting, but it can also open up more possibilities. Lets take a look at how to get your own health insurance.

Don’t Miss: How To Apply For Low Income Health Insurance