Preventive Services Must Be Provided For Free

Federal law requires health plans to cover many preventive services at no cost to you. You might be able to get free check-ups, blood pressure and diabetes testing, contraceptives, mammograms, cancer screenings, and flu shots. Visit HealthCare.gov’s Preventive Health Services page to see the full list of free services. You must go to a doctor in your network to get the free services.

How Do I Pay For Health Care In Retirement

According to data from the Fidelity Retiree Health Care Cost Estimate, the average 65-year-old retired couple in 2022 would need roughly $315,000 to cover all their health care expenses in retirement. That’s a lot of money, and it doesn’t factor in the possibility of retiring early. Start saving for retirement early and consistently to cover those costs. Max out a health savings account if you have one and be proactive to stay healthy and active.

How Does Health Insurance Work In The United States

Its no secret that the cost of healthcare in the United States is higher than what most Americans can afford on their own. Health insurance helps shoulder some of the financial burden that comes from being a human who, from time to time, needs medical treatment. However, its hard to see how health care coverage benefits you when healthcare policies are filled with dry, technical language that youd need hours to decode.

Over 90% of Americans have a health insurance plan to help cover the expense of healthcare, but most people arent taught a lot about how insurance really works. Knowing exactly how something works gives you a lot of power, so you can see when youre getting the best dealor not. Youre used to making informed decisions about what you buyeverything from your car, to your cell phone, to your mealswhy should health insurance be the exception to that rule?

Weve created this breakdown to help you navigate health insurance in the United States, including where to get it, what it covers , and how insurance companies process payments.

Weve created this breakdown to help you navigate health insurance in the United States, including where to get it, what it covers , and how insurance companies process payments.

Recommended Reading: What Insurance Does Health First Accept

What Is A Deductible In A Comprehensible Medical Insurance Plan

A deductible is an amount you must pay out-of-pocket for covered medical expenses before your insurance services plan begins to pay. For example, if your deductible is $1,000 and you have $1,500 in covered medical expenses during the year, you will only have to pay $1,000. The other $500 will be paid by your insurance policy. Some plans also have a family deductible, the total amount you and your family would have to pay out-of-pocket. For example, if your family deductible is $3,000 and you have $2,500 in covered medical expenses, your spouse has $500 in covered medical expenses, your family would only have to pay $3,000.

What Is A Small Business Hra

Small business HRAs are health care plans designed for small businesses to offer to their employees. This type of health reimbursement arrangement is specially designed for organizations with smaller profit margins and less capital to provide insurance coverage for their employees. As mentioned above, the more people who have health insurance, the less of a burden it is on the taxpayers. Therefore, it is in the interest of the public purse for these types of plans to exist.

Today, Qualified Small Employer HRAs are increasingly popular as a solution that works well for proprietors and their employees and families. These types of plans are an excellent resource for employers who see the value of investing in a healthy, secure workforce.

Don’t Miss: Does Health Insurance Cover Ambulance Rides

How Can Medical Bills Impact Your Credit

Having a health insurance plan can save you money on medical expenses and help you better stay current on your bills. But you’ll likely still have to pay for copays, coinsurance, deductibles and potentially out-of-network providers.

Unpaid medical bills won’t appear on your credit reports until after they’re sent to collections, which can happen once the bill is 60, 90 or 120 days past due. During this time, you’ll hopefully be able to work out payment details with the provider and your insurance. Even after medical debt is sent to collections, the three major consumer credit bureaus wait 365 days before adding it to your credit report. Paid-off medical collection accounts do not appear on your credit report at all.

If you want to keep an eye on your credit, you check and monitor your Experian credit report for free.

Find A Group Health Insurance That Suits Your Business

Around half of the nations population enjoys the benefit of employer-sponsored health insurance. Even though Americans have health coverage from a variety of different sources, group health insurance provided by their companies and businesses forms a major part of the countrys health care landscape.

If you are considering offering employer-sponsored health insurance to your employees, then you have come to the right place. eHealth can help you find small business health insurance that best fits the needs of your company. Visit ehealthinsurance.com or speak with one of our registered insurance agents today.

This article is for general information and may not be updated after publication. Consult your own tax, accounting, or legal advisor instead of relying on this article as tax, accounting, or legal advice.

Don’t Miss: What Area Of Group Health Insurance Is Regulated Under Erisa

What Are The Different Kinds Of Health Insurance Plans

When you sign up for health insurance, you may be able to choose from several health care providers and different types of insurance plans. Before you do, it’s important to understand the concept of a provider network.

A provider network can be made up of doctors, hospitals, clinics, pharmacies and other service centers that the health insurance company either contracts with, employs or runs. Your health insurance plan might not cover any of the cost if you receive care from out-of-network providers. However, there are generally exceptions for emergencies and urgent care.

Health insurance plans usually fall into one of the following types:

If you already have doctors, specialists or facilities you prefer, you may want to see which network or networks they’re part of before signing up for a health insurance plan. Otherwise, you may need to switch medical service providers if you want your health insurance to help cover the cost.

What Major Innovations And Reforms Have Recently Been Introduced

Medicare and Medicaid Innovations. The Affordable Care Act ushered in sweeping insurance and health system reforms aimed at expanding coverage, addressing affordability, improving quality and efficiency, lowering costs, and strengthening primary and preventive care and public health. The most important engine for innovation is the new Center for Medicare and Medicaid Innovation. The ACA allocated $10 billion over 10 years to the agency with the mandate to conduct research and development that can improve the quality of Medicare and Medicaid services, reduce their costs, or both.

If initiatives undertaken by the Center for Medicare and Medicaid Innovation are certified by federal actuaries as improving quality of care at the same costor maintaining quality while reducing health care coststhe U.S. Secretary of Health and Human Services has the authority to spread these initiatives, without congressional approval, throughout the Medicare and Medicaid programs.

The Trump administration has rolled out several other changes to the Medicare and Medicaid programs. These include the 2019 announcement of Primary Care First, a new voluntary payment model intended for launch in 2021 that aims to simplify primary care physician payments. In addition, since 2018, several states have instated a requirement for able-bodied individuals to document that they are meeting minimum work requirements to qualify for or keep their Medicaid coverage.

34 Ibid.

Recommended Reading: How Much Does Health Insurance Cost Per Employee

Types Of Health Insurance Plans In The Us

As mentioned before, when choosing your plan, you can

- opt for insurance plans that comply with government standards

- choose short-term plans offered by insurers.

If opting from the government-regulated plan, you will be able to choose between the following networks of the marketplace:

- Preferred Provider Organizations : allows the members to visit doctors inside and outside of the network. The costs for specialists outside of the network might be higher. Allows members to visit any doctor without a referral.

- Point of Service Plan : allows the members to visit doctors inside and outside of the network, with higher costs for out-of-network specialists. Members need a referral to visit providers that are outside of their network.

- Health Maintenance Organizations : covers healthcare services provided by specialists and hospitals in the network and out-of-network emergency services. The members usually have their primary doctors who refer them to specialists.

- Exclusive Provider Organizations : covers healthcare services provided by specific specialists and hospitals that are a part of the network.

As a lot of insurers are in the marketplace, you will see the appropriate acronym of each network indicated in the description of the plans they are offering.

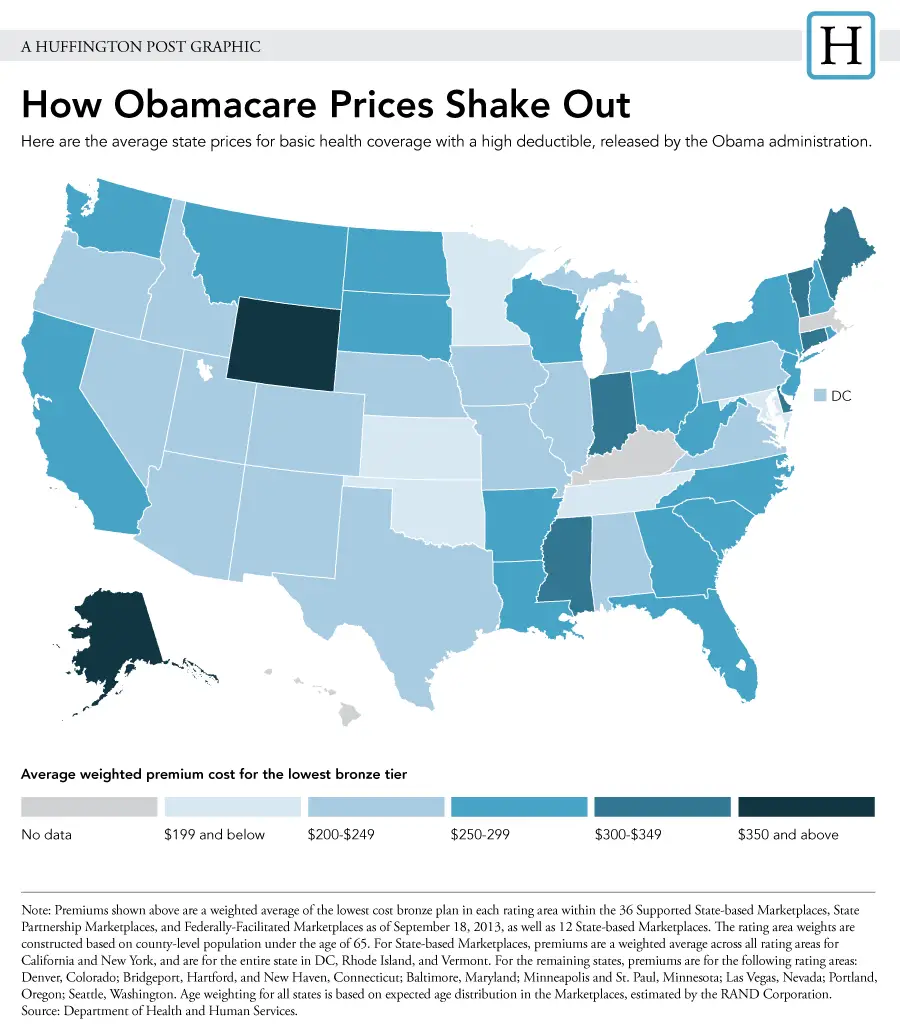

Most insurers in the marketplace also allow you to choose between plans categorized into metal types:

Plan typeWhat you payWhat your insurer paysBronze40%60%Silver30%70%Gold20%80%Platinum10%90%

What Health Plans Cover

Coverages vary by plan. Coverage requirements are different for plans you get at work and those you buy directly from an insurance company. Even among plans you get at work, the requirements are different depending on whether you work for a small employer or a large one. If you ask, your plan must give you a Summary of Benefits and Coverages.

Federal law requires individual and small-employer plans to cover 10 types of health care services, called essential health benefits. In addition, Texas requires some plans to include certain health benefits. Some plans might cover more services, like adult dental and vision care and weight management programs.

Learn more: How to get help with a mental health issue | Watch: How to get help with a mental health issue

You May Like: Can I Have Two Health Insurance

Guidelines For Long Term Care Coverage Eligibility Under Medicare

Medicare long term care eligibility is attainable under the following conditions when hospitalized:

- You must be an inpatient at an approved hospital for at least three days

- After being admitted to a Medicare-certified nursing facility within 30 days of your inpatient hospital visit

- You must require additional therapy such as physical or occupational

- Your condition medically demands skilled nursing services

Medicare long term eligibility starts after meeting these requirements and pays for a maximum of 100 days during each benefit period.

Which European Country Is Best For Retirement

Switzerland. The Alpine country ranks high on the lists of best retirement places for expats for its high standard of living, low taxes, excellent health care and safety. It’s also full of picturesque locations with peaceful and relaxing mountain landscapes, and a wealth of outdoor activities not least, skiing.

Also Check: What Is Covered California Health Insurance

How Do I Reduce My Health Care Costs In Retirement

Apart from working to stay healthy, there are other ways you can manage your health care costs in retirement. Doing so requires carefully planning your income so you don’t bring in too much to qualify for subsidies for a health plan. Putting money in a health savings account is a great way to stow away tax-free money for retirement health expenses. You might also consider getting a part-time job that includes health benefits.

Do You Need Private Health Insurance In The Us

All in all, yes, you do need private health insurance in the US. And that is not only because according to the current laws you can still be fined for not being insured. Getting insured is in your best interest because healthcare in the US is expensive and any unexpected bills can cost a fortune for you and your family.

Read Also: Who Is The Best Health Insurance Company

How Much Will It Cost

Understanding what insurance coverage costs is actually quite complicated. In our overview, we talked about paying a premium to enroll in a plan. This is an up front cost that is transparent to you .

Unfortunately, for most plans, this is not the only cost associated with the care you receive. There is also typically cost when you access care. Such cost is captured as deductibles, coinsurance, and/or copays and represents the share you pay out of your own pocket when you receive care. As a general rule of thumb, the more you pay in premium up front, the less you will pay when you access care. The less you pay in premium, the more you will pay when you access care.

The question for our students is, pay now or pay later? Either way, you will pay the cost for care you receive. We have taken the approach that it is better to pay a larger share in the upfront premium to minimize, as much as possible, costs that are incurred at the time of service. The reason for our thinking is that we dont want any barrier to care, such as a high copay at the time of service, to discourage students from getting care. We want students to access medical care whenever its needed.

What Is The Long Term Care Partnership Program

Four original states pioneered the Long Term Care Partnership Program terms are different in California, Connecticut, New York, and Indiana. The program is protection for your lifestyle, income, and assets.

Although conventional long-term care insurance is the only type to qualify for Partnership asset protection, without long-term care insurance, family or personal assets and income likely pay the hefty medical bills. The Partnership Program helps keep some of your finances in order when receiving care. However, requirements or Long-Term Care Partnership Program eligibility varies among states.

Recommended Reading: Do Any Real Estate Companies Offer Health Insurance

Extending Help For The Uninsured And Underinsured

Better health coverage is essential to the U.S. recovery from the pandemic. Uninsurance and underinsurance leave Americans vulnerable to high medical costs, at a time when millions still lack jobs and are experiencing reductions in income. Efforts to address recent coverage changes should also consider the needs of the 30 million people who lacked coverage before the pandemic or who otherwise struggled with the cost of care.31 President Bidens American Rescue Plan, the $1.9 trillion stimulus package the president is expected to sign into law this week, contains crucial provisions for rapidly extending coverage and improving affordability by building upon the Affordable Care Act to close gaps in Medicaid eligibility and boost subsidies for private coverage through the marketplace.32

Close the Medicaid coverage gap

Some states that have yet to expand their Medicaid programs continue to cite costs associated with enrolling the newly eligible population, which would be large in states such as Texas and Florida.39 Evidence from states that have already expanded, however, shows that their net cost of Medicaid expansion can be less than the 10 percent state match for expansion enrollees because Medicaid expansion reduces uncompensated care and increases state revenues by boosting economic activity.40

Improve health insurance affordability

Half Of Americans Get Health Insurance Through Their Employer

Over 50% of Americans get health insurance through their employers, according to the U.S. Census Bureau. When you can get insurance through your work, its usually cheaper than buying from somewhere else because your employer pays part of your monthly premium. If youre one of the almost ten million self-employed Americansor you dont have access to job-based insurance because youre a part-time employee or unemployedyoure stuck finding your own coverage .

You can buy health insurance online from state and federal marketplaces, like HealthCare.gov. Youll even potentially have lower monthly paymentsthanks to federal tax creditsif you meet certain income requirements. If you make too much to qualify for lower monthly premiums, you can also get coverage directly from health insurance companies, private enrollment websites, and in-person agents and brokers. For a breakdown of how to choose who to buy your insurance from, check our post on getting health insurance after open enrollment.

Read Also: How To Apply For Low Cost Health Insurance

Final Thoughts On Getting Health Insurance In The Usa

Insurance provides comfort, knowing your expenses will be covered should you become ill or need emergency medical treatment. The peace of mind that health insurance plans in America bring come at a price though. However, the cost of an insurance policy is usually lower compared to out-of-pocket hospital bills you have to pay for without coverage.

To help you make a better decision on which policy to get, view our list of the top international health insurance companies and look at the benefits and exclusions of each provider.

If you need assistance, we have licensed insurance agents who are always available to walk you through the process and explain the differences of each provider. We will make the application process easier and more seamless for you, so you can worry less about getting the right health insurance in the USA.

How To Find A Family Doctor In The Us

When looking for a suitable medical practitioner, start by contacting your insurance company. They should provide you with a list of local doctors that are available under your plan. Then, browse online databases for more information on practitioners that you prefer. Do consider recommendations from friends and colleagues â their first-hand experience can assure you about whether or not you are making the right choice regarding a physician. The next step is contacting the doctor of your preference and arranging your first appointment.

You May Like: How Much To Budget For Health Insurance In Retirement