Understanding Your 401 Retirement Plan

You wouldn’t expect to have to think about retirement from the minute you get your first full-time job but you do! A lot of companies will ask you to enroll in your 401 plan, where you contribute to your retirement account.

A 401 is a company-sponsored retirement savings plan where employees can contribute portions of their income, and their employers may match those contributions.

And as for making informed choices on which investments to choose, Bera, Boneparth and McKenna all recommended looking into your employer’s 401 plan, online portals and even working with financial advisors when making the decision to start investing into a 401.

It may not be fun for you to learn about investing but this is your money and your future so it’s critically important that you put in the effort to understand how much money you have, where it’s going and how much it’s growing .

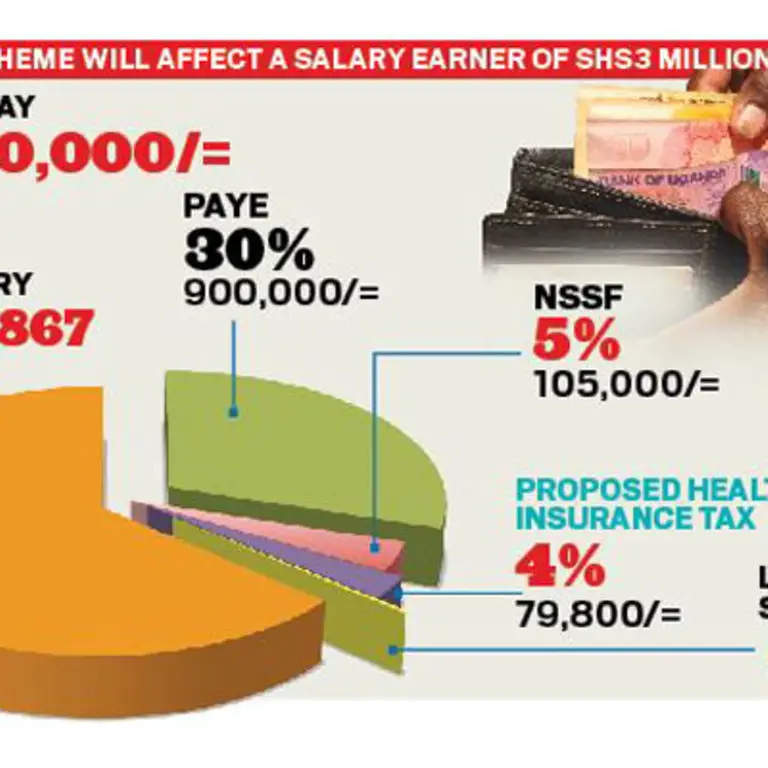

Insurance Payroll Deductions To Change For Biweekly Employees

Insurance payroll deductions to change for biweekly employees

Paychecks may look a little different in February for benefits-eligible employees who are paid biweekly.

Instead of having insurance deductions taken out of either the months first or second paycheck, all insurance deductions will be split evenly between the two. With this change, paychecks may be more even the first biweekly check each month may be smaller and the second check may be larger than in the past.

The mandatory change affects approximately 2,700 employees, or about one-third of the universitys staff. There is no opt-out.

Employees who are paid monthly, are not benefits eligible or are overtime exempt will not be affected.

The change comes as a result of increased health insurance premiums coupled with smaller paychecks due to the state-mandated furlough days.

Human Resources employees first became concerned about the health insurance check deduction over a year ago, when they noticed that some biweekly employees family health insurance deduction took up most of their check.

The primary reason for making this change was to make sure people could choose their health plans, said Lydia Lanier, senior director for the financial management and education center in Human Resources. Some employees were basing their choice in health plan on what their checks could support, she added.

Q2: How Do Wellness Programs Or Tobacco Surcharges Affect The Uniformity Requirement

A26. If an employers plan provides a wellness program, for purposes of meeting the uniform percentage requirement any increase in the employer contribution that may occur due to an employees participation in the wellness program is not taken into account in calculating the uniform percentage requirement. However, for purposes of computing the credit, the final regulations provide the employer contributions are taken into account, including those contributions made due to an employees participation in a wellness program. In SHOP Marketplaces where employers have the option of paying for some or all of any employee tobacco surcharges, these amounts are not included in premiums for purposes of calculating the uniform percentage requirement . If employers do not have the option of paying for any portion of employee tobacco surcharges through the SHOP Exchange, the uniform percentage requirement is applied without regard to any tobacco surcharges imposed upon the employee.

Also Check: How Does Health Insurance Work Through Employer

What Does It Mean When You Have A $1000 Deductible

A deductible is the amount you pay out of pocket when you make a claim. Deductibles are usually a specific dollar amount, but they can also be a percentage of the total amount of insurance on the policy. For example, if you have a deductible of $1,000 and you have an auto accident that costs $4,000 to repair your car.

Alternative Health Benefit Options For Employers

If you are an employer that is struggling to meet minimum health insurance contribution requirements, alternative health benefit options can be helpful.

For example, instead of paying for a group health insurance policy from an insurance company, employers can turn to an HRAan arrangement in which employers give employees an allowance toward an individual health insurance premium of their choosing.

Because these arrangements allow employers to personally define their contribution, organizations often find them to be the more predictable and affordable option.

The following four simple steps outline how an HRA works:

Below well go over three great health benefit options for employers who choose not to provide traditional group health insurance to their employees.

Recommended Reading: How Much Is Health Insurance A Month In New York

What If I Qualify For Federal Premium Subsidies

You may qualify for an income-based premium subsidy, also called an advance premium tax credit , for coverage you bought through the Health Insurance Marketplace. Any premium you pay that’s reimbursed by an APTC can’t be deducted from your taxes. But any remaining premium can be deducted.

For example, say your APTC is $300 and your tax return shows you can deduct $500 in premiums. In that case, you could claim the additional $200 on your return. If your eligible tax deduction is lower than your APTC amount, the difference is subtracted from your refund or added to your balance due.

Question: Does Health Insurance Come Out Of Every Paycheck

If you sign up for your employer-provided health insurance, the cost will come out of your paycheck. Typically, the company pays part of your insurance premium, though there are some companies out there that will cover it fully, leaving you with no monthly insurance premium deduction.

Read Also: Can You Switch Health Insurance At Any Time

Standard Vs Itemized Deductions

When you’re filing your taxes, you have the option to either itemize your deductions, where you catalog every deduction you qualify for , or take the “standard deduction” â a set dollar amount based on your family status. For the 2021 tax year, the standard deduction for single people or married people filing separately is $12,550. The 2021 deduction for a married couple filing jointly is $25,100, and if you’re filing as head of household, your standard deduction is $18,800.

You should always pick the option that reduces your adjusted gross income the most, and about 90% of taxpayers choose the standard deduction.

Unless you are self-employed, you can only deduct the cost of health insurance from your income if you itemize your deductions.

For example, if you are single with an AGI of $70,000 and take the standard deduction of $12,550, you’re lowering your taxable income to $57,450.

Additionally, in order to deduct medical expenses, including health insurance, from your taxes, your total medical expenses must exceed 7.5% of your AGI â and you can only deduct the amount above that 7.5%. For example, if your AGI is $100,000 and your medical expenses total $9,500, you’d be able to deduct $2,000 of medical expenses.

How much is the standard deduction?

The amount of money included in the standard deduction depends on the size of your family. For the 2021 tax year, the standard deduction amounts are:

| Filing status | |

|---|---|

| Single and married filing separately | $12,550 |

| $25,100 |

Making Up The Difference

While health insurance benefits through an employer are usually more economical than , the reduction in your paycheck can really take a toll on your financial situation. Though receiving a smaller check is certainly not desirable, its actually better to have your premiums taken out of your paycheck. Why? Because if you paid for those premiums out of your own pocket, the money you spend would be considered taxable income but, when you elect to have your premiums taken out via your paycheck, the cost isnt considered taxable income. In other words, when it comes time to pay your taxes, you will not owe more, but rather less in fact, you can deduct what youve paid for your premiums and may even receive a refund.

Read Also: Can I Change My Health Insurance Plan After Enrollment

Pay Stub Deduction Codes What Do They Mean

Below, you will find some of the most common deduction codes that appear on your pay stub. Common pay stub deduction codes include the self-explanatory 401K for retirement savings contributions and 401K ER, which refers to an employers contribution if the employee receives a company match. However, this is by no means an exhaustive list.

Many companies list codes on their paycheck specific to how they do business or the benefits they offer to employees. For example, some businesses may list health insurance as HS while others may call it HI. Unions, savings funds, pensions, organizations and companies all have their own codes too, any of which could appear on your paycheck, depending on your circumstances.

| Code |

|---|

Q12 What Expenses Count Toward The Credit

A12. Beginning in 2014, only premiums paid by the employer for employees enrolled in a qualified health plan offered through a Small Business Health Options Program are counted when calculating the credit. For taxable years 2010 through 2013, the employer may count premiums paid by the employer for health insurance coverage under a qualifying arrangement. See the What is a qualifying arrangement? question on this page. Employer contributions to health reimbursement arrangements , health flexible spending arrangements and health savings accounts are not taken into account for purposes of determining premium payments by the employer. In SHOP Marketplaces where employers have the option of paying for some or all of any employee tobacco surcharges , these amounts are not included in premiums for purposes of calculating the uniform percentage requirement, nor are they treated as premium payments for purposes of the credit.

You May Like: Do You Get Fine For Not Having Health Insurance

Understanding Your Pay Benefits And Paycheck

With any job, it can be difficult to decipher everything on your paycheck and figure out what various benefits provide for you. You might be wondering why money is being taken out of your pay and what exactly it’s going toward. If some of this is hard for you to understand, that’s completely normal! We’ll go over all of this and more in this lesson.

Watch the video below to learn about the basic parts of a paycheck.

It’s important to note that this lesson is focused primarily on paychecks in the United States. Not all of this information may be applicable or true for you if you live in another country.

Payment options

Businesses usually offer a few payment methods for obtaining your paycheck. The first is simply receiving a physical paper check. Just like any other check, it can be cashed or deposited to your bank account if you have one.

The other option that’s also used by many employers is direct deposit. This allows your employer to electronically transfer your paycheck directly to your bank account. In order to do this, you’ll need to provide your employer with a voided check from your bank account or your routing and account numbers.

What’s on your pay stub?

You’ll find any federal and state tax deductions in this section.

Everything Deducted From Your Paycheck Explained

Congratulations, youve earned your first paycheck! Youre probably excited, as you should beyou put in work, and have some cash in the bank to show for it. But if youre like many newly employed people out there, you might also be a little bit confused after running the numbers and noticing that your take-home pay isnt exactly as much as you thought it would be.

Whats up with that? Upon further examining your paystub at your first job, youll notice a few line items categorized as deductions. Deductions are all of the things that were taken out of your gross pay, leaving you with your net pay, or take-home pay. While there are some deductions you cant really control, others are part of your employee benefits package, so you can adjust them according to what works for you and your budget.

Its OK to be a bit baffled on your first payday. Weve all been there before. To help clear up the confusion, we broke down typical paycheck deductions, where your earnings are going, and how much control you have over it.

Also Check: How To Become A Health Insurance Agent In Texas

Why Only Half At A Time

When doing a monthly budget, all you are doing is identifying how much money comes in each month and assigning every dollar a place to be spent . Its no more than 5th grade math.

However, your monthly expenses arent paid out evenly throughout the month. In fact, there will usually be a 7 -10 day period inside each month where a majority of your money is spent in the form of your larger bills.

The rent, mortgage, car payments, and other larger monthly expenses often end up at the last few days or the first few days of each month. Ironically, this is also around the time your third paycheck arrives.

This is the reason why I only want you to take half of that third paycheck now, and the other half in two weeks. I dont want you to go without any income for a full four weeks and end up in what I refer to as paycheck shock.

The reason I know is because we have experienced it and it will throw you into a little bit of a two week panic. No Bueno.

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

You May Like: Does Aetna Health Insurance Cover International Travel

Deductions Paid With After

Tax-advantaged healthcare policies through your employer usually have dedicated enrollment periods during which you can sign up for or change your existing coverage. If you miss this period, its possible though not really likely that you might be paying your premiums with after-tax dollars. But this typically only happens when you go out and purchase your own policy and arrange for the premiums to be automatically debited from your pay. The good news is that you can claim a tax deduction for premiums you pay with after-tax money, subject to some limitations, if you itemize on your return.

So, how do you know whether youre paying the employee benefits premiums with pretax or after-tax dollars? Simply ask your employer or take a look at your W-2 form. If youre paying the premiums with after-tax dollars, that money will be included in box 1 of your W-2, Gross Wages. Otherwise, if youre paying with pretax dollars, it should not appear on your W-2. Compare box 1 with your pay records.

Another exception to the usual rule is when your employer actually pays for your health benefits. The premiums would not show up in box 1 of your W-2 in this case, either. The money that goes toward your coverage, even if its for your whole family, is not considered to be wages and is not subject to taxation because youre getting your health benefits for free.

Are Payroll Deductions For Health Insurance Pre

The answer to Is health insurance pre-tax or post-tax? is: it depends on the type of health insurance plan you have. Generally, health insurance plans that an employer deducts from an employees gross pay are pre-tax plans. But, thats not always the case.

While shopping for health benefits plans for your employees, you may consider either pre-tax or post-tax health insurance options. Pre-tax health insurance plans include:

Plans like health reimbursement arrangements offer similar pre-tax benefits .

Recommended Reading: Does Employer Health Insurance Cover Pre Existing Conditions

Expert Insights To Help You Make Smarter Financial Decisions

ValuePenguin has curated an exclusive panel of professionals, spanning various areas of expertise, to help dissect difficult subjects and empower you to make smarter financial decisions.

- Samuel Handwerger

The commentary provided by these industry experts represents their viewpoints and opinions alone. Responses were accurate at the time of publication but for specific instruction about your situation, contact an accountant.