Your Gender And Marital Status

Under the Affordable Care Act, insurance companies are no longer able to charge consumers more based on their gender.8 But other factors do make a difference. For instance, if youre married and have kids, you can expect to pay more to cover your familys needs. Note that if your familys income falls below a certain level, a tax credit could save you money.9

But marital status arent the only things that determine how much you could be shelling out. Here are some other things insurance companies look for.

American Health Insurance Vs International Cover: Whats The Cost Difference

International health insurance is a product designed to offer cross-border coverage. Many Americans are surprised by how affordable health coverage can be when they spend time overseas so how does this product compare to domestic cover?

At William Russell, our most comprehensive international health plans provide standard coverage in every country except the USA. Weve published a full guide on how we calculate premiums for health insurance. By comparing our typical premiums to U.S. averages, its possible to get an idea of the cost difference between health insurance in the USA and other nations.

| Typical US health insurance costs in 2020 | The average William Russell international health insurance premium in 2020* |

|---|---|

| Individual cover | |

| $8,419.90 |

*Based on William Russell premiums in Thailand and Vietnam

We have a full guide on how much expat health insurance can cost in different countries, together with a list of most expensive and cheapest countries for health insurance.

How Do Deductibles Work Under The Affordable Care Act

A deductible is the amount that you pay for covered medical services before your health plan starts pitching in.

Here are a few things to know about your deductible:

-

Generally, health plans with higher premiums have lower deductibles. Plans with lower premiums have higher deductibles.

-

After you meet your deductible, all covered medical services you receive should only require a copay or coinsurance . The insurance company will pay the rest.

-

When you access preventive services including well visits, certain screenings, and vaccinations you do not have to pay toward your deductible.

-

Your deductible will be reduced or eliminated if you qualify for cost-sharing reductions or a zero-cost-sharing plan.

Recommended Reading: Insusiance

What Is Extended Health Care Coverage

Extended health care coverage in BC refers to a supplemental plan that pays for dental cover, prescription drugs, vision, health care services and equipment beyond what the Medical Services Plan of British Columbia covers. Travel insurance is also often seen in an extended health care coverage plan.

Different Levels Of Coverage

Okay, stay with me here. I’m almost done with this marathon investigation into all things health insurance. I looked at the different types of plans, but theres a little more to it before we put a bow on all this.

When it comes to marketplace health care plans, there are four different levelsbronze, silver, gold and platinum. Think of them like medals at the Olympics. These tiers give you different options on how much your plan will actually pay out versus how much youll pay. Also keep in mind they dont reflect quality of care.14

Generally speaking, plans with a lower monthly premium will mean a higher deductible, and vice versa.

Bronze is one step up from a catastrophic plan. They give you lower monthly costs, but more out-of-pocket expenses.

Silver offers lower deductibles and out-of-pocket costs than Bronze, but youll pay more in monthly premiums. And depending on your income, silver plans also come with discounts called cost-sharing reductions where the provider could cover costs up to the 90% mark.

Gold plans have high monthly premiums but low deductibles, coinsurance and out-of-pocket costs.

Platinum is the highest monthly premium out there, with the lowest out-of-pocket costs. This type of coverage means youre really putting all your eggs in that big monthly premium basket! But having a lower deductible means your insurance company will start covering those crazy health care expenses a lot sooner.

You May Like: Do Starbucks Employees Get Health Insurance

Is Health Insurance Getting More Expensive

It certainly feels like it. And its true that over the last decade, health care costs have risen significantly. The average family is paying 55% more in their premium in 2020 versus 2010 according to the Kaiser Family Foundation.5 And that number is up 22% since 2015.6 But premiums have only risen 4% when comparing 2020 against 2019.7

Health care costs also change based on where you live. In some states theyre up, in other places theyre lower.

If you feel like youre drowning in sky-high health insurance costs, there are some ways to save money on health insurance. Dont give up hope. You always have options, even if it just helps your budget a little. There are also some ways to save on health care costs your insurance doesnt cover.

And if youre trying to cut costs while paying off debt, or youre just starting to budget and barely making ends meet, you might want to choose a high-deductible and lower-premium plan that will kick in if you have serious medical issues or an accident. This allows you to focus on your necessities before you tackle an expensive health care plan.

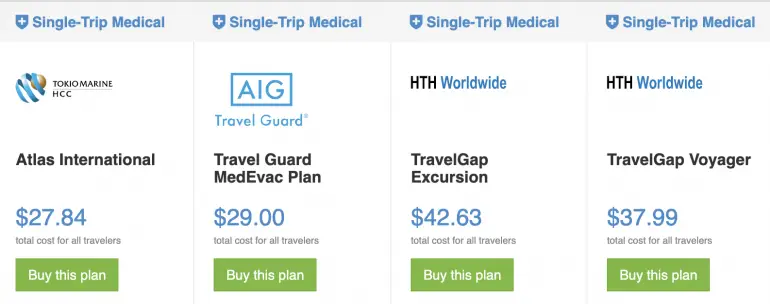

How Can I Purchase Travel Medical Insurance

You may be able to purchase travel coverage through your existing private insurer, a travel agent, or your credit card. If not, there are specialist companies.

If you are travelling, even for a short period, travel insurance is important. Outside of your province, your provincial medical plan may not cover your expenses. Outside of the country, it will not. Health care in other countries, like the neighbouring United States, can be extremely expensive. In some countries, you may even be denied critical care if you are unable to pay upfront.

Don’t Miss: Minnesotacare Premium Estimator

The Best Dental Care Plans Ontario 2022

| icons.feature1Icon | icontranslations.feature1 : item.feature1′ ‘ | helpicons.feature2Icon | icontranslations.feature2 : item.feature2’ ‘ | helpicons.feature3Icon | icontranslations.feature3 : item.feature3’ ‘ | helpicons.feature4Icon | icontranslations.feature4 : item.feature4 |

item.pdfBlock

When was the last time you had a visit to the dentist’s office? Routine dental maintenance is something that all too many of us neglect. However, preventative dental care can help prevent diseases such as gum disease which is linked to serious health problems.

While all Canadians receive universal healthcare through the province they reside in, routine and basic dental services are not covered through provincial plans. Or if there is dental coverage, it is not comprehensive.

Our summary will answer your questions about public and private dental insurance in Ontario. Find out what you need to know to pick the right dental insurance plan for you.

Additional Covers In Health Insurance

You can supplement your Health Insurance with exclusive additional cover options. For example, we cover physiotherapy expenses also as an alternative to surgery. In issues related mental health, Pohjola Health Insurance also covers the costs of psychotherapy. Health Insurance also covers expenses arising from a carer or home adaptations necessary to allow you to live at home despite your illness or injury.

Health Insurance always covers outdoor exercise and fitness training. If you practice sports in a sports club or take part in competitions or matches, you can receive coverage for competitive sports either by adding athletes covers to your Health Insurance or by taking out a separate Sports Cover through your club. Sports Insurance may also be necessary if you practise high-risk sports. In this case, check your Health Insurance coverage with our customer service.

Don’t Miss: Starbucks Health Insurance Deductible

How Much Is Health Insurance By State

Wondering how much private health insurance costs? The answer is that monthly premiums can vary significantly depending on where you live.

Variation in rates stems from factors like how much competition there is in a given state, forcing insurers to offer attractive rates. Expenses may also vary because of the expected health costs of a population. For example, in states where people tend to be less healthy or where doctors and hospitals charge more, insurance companies set higher rates to cover those costs.

Average Health Insurance Premiums by State for 40-Year-Olds

Scroll for more

- $7,646

Average health insurance rates are only part of the story. Your actual plan may cost you much more or less than the typical person pays.

Thanks to federal subsidies, many people find their premiums are much more affordable. More than 50% of people can find a Silver plan for less than $10 per month with federal cost-sharing adjustments.

Another way to save money on premiums is to opt for higher-deductible plans. You may pay less each month, but you are on the hook for more of the bill if you use health care services until you reach your deductible. If you dont use many services, this kind of trade-off may save you money in the long run.

How Us Health Insurance Works

Health care in the United States can be very expensive. A single doctors office visit may cost several hundred dollars and an average three-day hospital stay can run tens of thousands of dollars depending on the type of care provided. Most of us could not afford to pay such large sums if we get sick, especially since we dont know when we might become ill or injured or how much care we might need. Health insurance offers a way to reduce such costs to more reasonable amounts.

The way it typically works is that the consumer pays an up front premium to a health insurance company and that payment allows you to share “risk” with lots of other people who are making similar payments. Since most people are healthy most of the time, the premium dollars paid to the insurance company can be used to cover the expenses of the small number of enrollees who get sick or are injured. Insurance companies, as you can imagine, have studied risk extensively, and their goal is to collect enough premium to cover medical costs of the enrollees. There are many, many different types of health insurance plans in the U.S. and many different rules and arrangements regarding care.

Following are three important questions you should ask when making a decision about the health insurance that will work best for you.

Don’t Miss: Shoprite Employee Benefits

Reducing Your Hospital List

Many insurers have tiers of hospitals in which you can have treatment. If you want access to the best facilities, such as those in Central London, youll pay more for your policy.

However if you decide to have a restricted list you could reduce the amount you pay each month. For example when using the details of our 43 year old, by restricting the hospital list where you can have treatment premiums reduced by up to 7%.

If you consider this option it is important to check the hospitals in your area to make sure you are comfortable with the limited options.

|

Restricted Hospital List |

|---|

|

7% Decrease |

How Does Health Insurance Work In Bc

British Columbia has a publicly administered and funded health care system that allows its residents to receive access to medically-necessary hospital and health care services. Its plan is called the Medical Services Plan, which is commonly abbreviated as MSP. It covers health care costs such as medically-necessary physicians visits, maternity leave and diagnostic services like lab work and x-rays.

However, access to routine and preventative dental care, vision care and prescription medications are not covered by MSP.

In order to have these things covered and avoid what can be substantial out-of-pocket costs, we recommend purchasing supplemental private health insurance.

Private health insurance can protect you from paying significant health expenses yourself.

Don’t Miss: Health Insurance For Substitute Teachers

Whats A Coverage Gap And Could I Be Affected

Your employer arranges public health insurance in Austria. This means there could be a gap between you arriving in Austria and receiving insurance. EU nationals can get coverage with a European Health Insurance Card . However, non-EU nationals will need to purchase private insurance to cover any gap. Private health insurance covers you from the moment you take out the policy, so you can sort this out ahead of your move.

How Can I Get Catastrophic Health Insurance

You can purchase catastrophic health insurance plans through the Health Insurance Marketplace at Healthcare.gov, or you can purchase directly from a private insurance company.

To purchase a plan through Healthcare.gov, you need to be under 30. If you are over 30 and think you qualify for a catastrophic plan due to a hardship, you must apply for an exemption before selecting a plan. Applying through Healthcare.gov allows you to compare plans from multiple insurers so you can pick the best plan for your needs.

If you purchase directly through a company, you may purchase short-term insurancetemporary coverage against major accidents or illnesseswithout having to meet certain criteria or qualifying for an exemption. However, short-term plans dont cover pre-existing conditions.

Don’t Miss: How To Keep Insurance Between Jobs

Qualifying For A Canadian Healthcare Insurance Card

Thankfully, there is no requirement to have a family physician in order to receive a health insurance card in Canada. The insurance card is the identification you present on each and every appointment, clinic visit, or emergency room admission you make.

Canadian citizens and permanent residents do not pay any out-of-pocket costs to access healthcare services, provided the healthcare card is presented. If you happen to forget yours, you will be issued a bill for the service.

In general, to be eligible for a healthcare insurance card, you need to go to your nearest provincial or territorial services office. You will be required to present identification that proves that you are:

Sign Up For Your Group Plan With Loop

Many regular health insurance plans do not cover the numerous added costs that you incur in healthcare treatments. You, the individual, end up bearing the same from your pocket, which creates an added financial burden. Subsequently, this financial burden can exacerbate existing stress levels, which further deteriorates their health, mental wellbeing, and work performance.

Affordable health insurance does not need to come at the cost of quality service. Loop Health provides high-quality healthcare solutions to companies at competitive prices. Employers who want group health insurance premiums will always be given win-win options for the company and its employees. With an all-rounded, wellbeing-centric approach to medical insurance, you and your employees are sure to remain free of financial concerns that come with healthcare.

Read Also: Part Time Starbucks Benefits

Does The Type Of Underwriting Impact The Cost

When setting up up health insurance you can opt for Full Medical Underwriting or Moratorium Underwriting.

Full medical underwriting looks at your full medical history which can make the process of putting a policy in place a lot longer. However with Moratorium underwriting you only need to disclose medical conditions youve experienced in the last 5 years and no examinations are required.

Some insurers offer a 5% premium discount if you opt for Full Medical Underwriting. Even with this discount given moratorium is quicker to set-up and can allow existing conditions to be covered in the future many still opt for Moratorium underwriting.

How Does Private Health Insurance Work

The structure and cost of your private health insurance will vary by the insurance package and the hospitals and clinics. Some insurers will bill you once in a lump sum, while some will spread out the fees.

Similarly, some hospitals will ask you to pay any fees upfront while some will bill your insurance and you pay them afterward. However, some may not have any fees if you have certain insurance. Therefore, make sure to do your homework and ask questions about coverage, co-payments, and access throughout the country.

Also Check: Starbucks Insurance Cost

The 4 Best Catastrophic Health Insurance Of 2022

-

Cheaper plans have a higher-than-average deductible.

-

There are caps on total coverage.

-

Enrollment fees apply.

Pivot Health is a short-term insurance marketplace that connects customers to policies underwritten by insurers like The North River Insurance Company and Companion Life.

Short-term coverage differs from catastrophic health plans sold through the health insurance marketplace, and they tend to be much less expensive.

While other plans make you wait weeks before youve covered, Pivot Healths plans are generally effective the day after you apply for insurance. Most plans are PPO networks, so you can choose your own healthcare provider and see specialists without a referral.

Because short-term coverage is separate from catastrophic plans offered on Healthcare.gov, they have a higher deductible and can deny pre-existing conditions. Depending on the plan you choose, the deductible can be as high as $10,000 per month. There are also caps on how much your insurance company will cover for lower-tier plans, the limit is $100,000.

In addition to the monthly premium, youll also have to pay an enrollment fee of $19.95. Because Pivot Health is an insurance marketplace, its not included in the NAICs complaint index.

Pivot Health is best for people who have a temporary lapse in coverage and are looking for affordable short-term insurance. With low premiums, it can help you save money and still protect against major medical expenses.

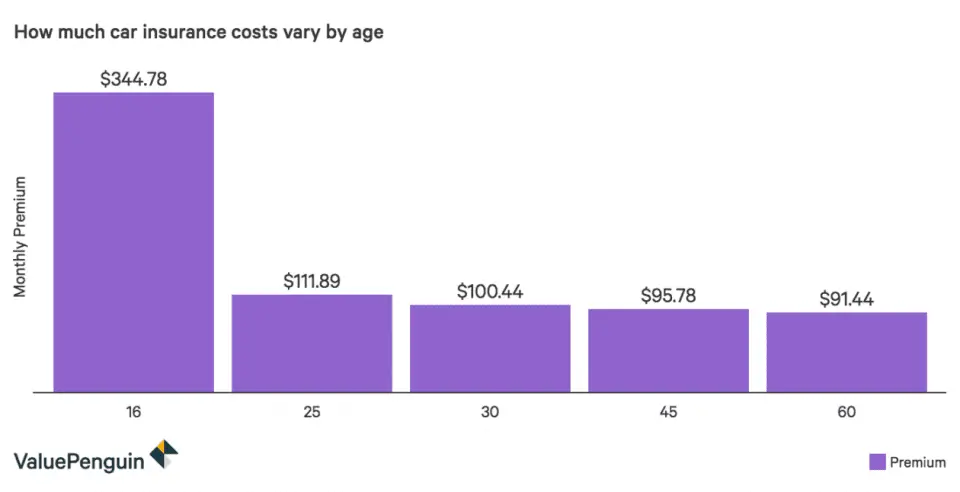

The Average Cost Of Health Insurance By Age

Most people need more health care as they age, and health insurance rates go up for older people to cover those expected costs.

In MoneyGeeks analysis which does not account for tax credits or other subsidies the average premium for an 18-year-old was $324 per month compared to $642 for a 50-year-old and $970 for a 60-year-old. However, older people may be eligible for higher subsidies if they have low incomes, such as if theyve retired or scaled back their working hours.

Average Health Insurance Premiums by Age

Scroll for more

- $970

Read Also: Starbucks Employee Health Insurance