Average Number Of Days Hi Residents Spent In The Hospital

The number of days in the hospital are counted starting with the day the patient is admitted. The last day is not counted, unless the first and last day are the same day.

Hawaii residents with group, individual and Medicare insurance all spent more days in the hospital than the national average. Only Medicaid patients spent fewer days in the hospital than the national average.

Hospital & Doctor Insurance

Health ProtectorGuard fixed indemnity insurance,1 underwritten by Golden Rule Insurance Company, can supplement your major medical plan by paying cash for eligible, covered medical services, like a doctor visit, a trip to urgent care or a surgical procedure.

- No deductibles or copays to pay first

- Benefits paid regardless of other insurance

- Money to pay costs not covered by major medical plans, like a deductible

Compare Affordable Health Insurance Plans And Save Money

Get free insurance quotes now. Its easy.

Make sure you know your options while shopping for a plan on the health insurance marketplace in Hawaii.

Almost 17,000 Hawaiians enrolled in a health plan from the Hawaiian healthcare exchange in 2018. Of that number, 84 percent were eligible for a tax credit that reduces costs, making affordable healthcare possible.

Find out if you qualify before purchasing a health insurance plan.

Recommended Reading: Can You Put A Boyfriend On Your Health Insurance

What Do You Mean By Better Health Better Life

We believe good health is one of the keys to living the best life possible. Thats why we were the first health insurer in Hawaii to provide 100% coverage for wellness and preventive medicine, including annual physical exams, seasonal flu vaccines and a variety of health screenings. Better health leads to a better life.

What Happens When My Group Health Coverage Ends

You can apply for individual health coverage under the federal law Health Insurance Portability and Accountability Act . This type of policy is issued on a guaranteed issue basis if you meet the qualifying criteria. However, there is no limit on the maximum premium the insurance company can charge. Care for preexisting conditions may not be excluded from coverage.

Read Also: What Is New Health Insurance Marketplace Coverage

Health Insurance Companies In Hawaii

Before 2016, Hawaii had a state-run health exchange, but then the state decided to use the federal system instead. On the federal exchange, you will find two health insurance companies for Hawaii: Hawaii Medical Service Association and Kaiser Permanente. Although both companies offer health insurance plans in each of the five counties in Hawaii, Kaiser does not offer any Catastrophic plans in the state.

Medicare And Medicare Advantage

The charts showing the cost the the number of enrollees includes people covered by all types of Medicare and Medicare Advantage. The cost of this type of health coverage includes participation from employers, individuals, federal, state and local government. Excluded from the costs are any form of co-pay or a deductible the individual must pay to receive care.

How enrollees use their health care services is based on enrollees in Medicare Advantage plans only. Medicare Advantage plans are Medicare health plans offered by private companies that contract with Medicare. Medicare Advantage plans include Health Maintenance Organizations , Preferred Provider Organizations , Private Fee for Service Plans, Special Needs Plans and Medicare Medical Savings Account Plans .

Read Also: How To Get Health Insurance After Being Laid Off

What Factors Influence The Cost Of Hawaii Individual Health Insurance

Under the new health care law, insurance companies are only allowed to consider five factors when determining rates: for Hawaii residents, your location, age, tobacco use, plan type, and whether the policy covers dependents.

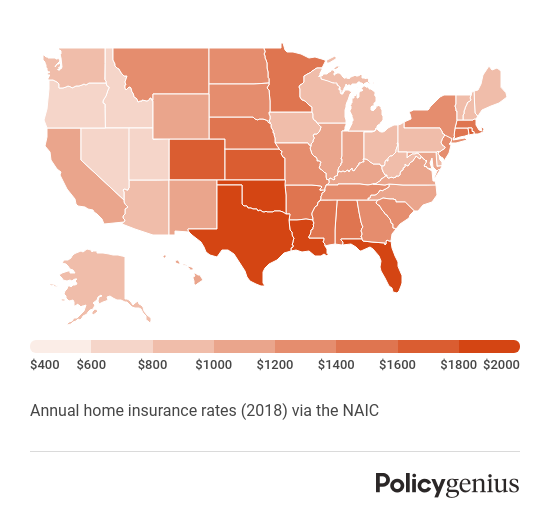

Where You Live – Yes, health insurance premiums vary from one state to the next and even neighborhood to neighborhood. The cost of living and the typical wage are two elements that influence how much you will pay for a health plan.

Your Age – Your age will impact your premiums, just like most insurance. When you get health insurance, the younger you are, the lower your rates will be.

Tobacco Use – The use of tobacco is very likely the one thing on this list that will cause you to pay more for insurance. Regarding health insurance, premiums can rise by upwards of 60% per month.

Individual vs. Family enrollment – Plan Category – Bronze, Silver, Gold, Platinum, and Catastrophicthe essential health benefits have to be the same in all Marketplace health plans

What To Know About Health Insurance In Hawaii

While prices gathered and used in MoneyGeeks analysis were taken from private plan data in Hawaiis marketplace, you might be able to find cheaper plans since rates depend on your unique situation. For qualified residents with low incomes, health insurance in Hawaii can be attainable through Medicaid or Medicare, which is cheaper than any other marketplace plan.

Also Check: What Health Insurance Does Cvs Accept

How Did Uha Get Its Name

In 1996, a group of physician teachers at the University of Hawaii John A. Burns School of Medicine decided to make a difference. They created the University Health Alliance to bring a simpler, more caring approach to employee health insurance. Since then, UHA has grown to offer the largest physician network in Hawaii.

The Cheapest Health Insurance In Hawaii With Low Out

Individuals in Hawaii who often have expensive medical costs will benefit from getting a higher plan with a low out-of-pocket max. Frequent visits to the doctor or needing expensive prescription drugs will help reach the out-of-pocket maximum quickly, letting insurance coverage kick in sooner.

The most affordable health insurance in Hawaii with low out-of-pocket maximums is the KP HI Platinum 0/10 offered by Kaiser Permanente at an average of $586 per month for a 40-year-old.

Plans with an out-of-pocket maximum below $4,250 are considered to be low. However, the state of Hawaii does not have a plan with out-of-pocket maximums below this threshold. Despite this, Kaiser Permanentes KP HI Platinum 0/10 plan has the cheapest premiums in the state with the lowest out-of-pocket max.

Kaiser Permanente

Kaiser Permanentes KP HI Platinum 0/10 plan falls under the Platinum tier, which is the highest in the state. Metal tiers such as Platinum and Gold often come with higher premiums, but being able to reach the low out-of-pocket max means medical costs will be covered sooner. This is beneficial for those who frequent the doctor.

Also Check: Can Parents Be Added To Health Insurance

You Have More Insurance Options For Your Health Than You Think Hawaii

If youre self-employed or without insurance from your employer in other words, youre looking for individual or family health insurance in Hawaii you might be looking for Affordable Care Act insurance, what’s often called Obamacare. However, we want to make you aware of the whole range of individual and family insurance products we have available in your state.

How Do I Enroll In The Hawaii Health Insurance Marketplace

If you want to buy coverage through the federal Health Insurance Marketplace, you can apply directly at healthcare.gov. The website lets you compare plans, purchase coverage and find out if you qualify for subsidies that will help you pay your monthly premium.

When you apply through the Marketplace, youll also find out automatically if youre eligible for Medicaid or coverage for your children through CHIP.

Read Also: What Level Of Health Insurance Do I Need

Can I Buy Short

In 2018, Hawaii passed a law prohibiting an insurer from renewing or re-enrolling a person into a short-term health policy or contract if he or she was eligible to buy insurance on Hawaiis Health Insurance Marketplace during the prior calendar year.28 The law also limits these temporary plans to a maximum duration of 90 days.

Because virtually everyone is eligible to purchase coverage on the Marketplace in any calendar year, the new law essentially eliminated the market for short-term plans in the state and insurers no longer offer them.

The Cheapest Health Insurance In Hawaii By Metal Tier

The cost of health insurance in Hawaii for an individual looking in the private market depends on the metal tier chosen. The different tiers allow you to have higher deductibles to lower your monthly costs or lower your deductibles for a higher monthly cost.

There are six metal tiers in Hawaii, including Catastrophic, Bronze, Expanded Bronze, Silver, Gold and Platinum. The average costs of each metal tier in Hawaii are:

- Catastrophic: $197 per month

- Gold: $476 per month

- Platinum: $555 per month

In certain markets, like Hawaii, a lower tier may cost more than the level above it, such as with Silver and Gold. Those who often have to visit the hospital should consider paying for higher levels such as Gold or Platinum. This can help them save on medical costs in the long run since youll pay less out of pocket.

The table below showcases the most affordable health insurance in Hawaii for each metal tier. Note that the premiums, deductibles and out-of-pocket max expenses vary by tier.

For people with a low income, health insurance in Hawaii is still attainable. Low income individuals may be qualified for cost-sharing reductions , which can reduce deductibles, copays and coinsurance. While this is only allowed for individuals getting a Silver plan, taking advantage of the cost-sharing subsidy can make it easier to get and more cost-effective.

Cheapest Health Insurance in Hawaii by Metal Tier

Scroll for more

Also Check: Can You Pay Your Health Insurance Deductible Upfront

How Do I Enroll In Hawaii Individual And Family Insurance

When youre shopping for affordable health insurance, there are some important considerations to keep in mind, such as how often you receive health care services and how much you can afford to pay for coverage. These factors are the same whether youre looking for an individual or family plan, but shopping for family coverage is a little more complicated because you have to account for the needs of multiple individuals.

Better Value But We Didnt Stop There

Were dedicated stewards of your premium dollars, and deliver maximum benefits and services to our members.

Were dedicated stewards of your premium dollars, and deliver maximum benefits and services to our members.

As a smaller company were more accessible. Were quick to respond when you need us.

As a smaller company were more accessible. Were quick to respond when you need us.

Because were physician-founded, we put the doctor patient relationship first.

Because were physician-founded, we put the doctor patient relationship first.

No health insurance company in Hawaii has a bigger statewide network of medical providers.*

No health insurance company in Hawaii has a bigger statewide network of medical providers.*

From choosing the right plans to providing timely claim resolution, we make health insurance easier.

From choosing the right plans to providing timely claim resolution, we make health insurance easier.

We keep decisions about your medical care right here in Hawaii, not the Mainland.

We keep decisions about your medical care right here in Hawaii, not the Mainland.

* Based on UHA physician count as of January 2022. Subject to change.

Also Check: How Much Does Supplemental Health Insurance Cost

Health Insurance Rate Changes In Hawaii

In Hawaii, health insurance providers update their premiums, deductibles and out-of-pocket maximums on a yearly basis. These changes are then submitted to federal regulators to be approved for the following plan year.

For 2023, the cost of Bronze health insurance plans increased the most, by 17% over the previous year. The average quote for Gold and Platinum plans also increased, while premiums for Catastrophic and Silver plans decreased from 2022.

| Plan tier |

|---|

Monthly rates are based on a 40-year-old adult.

My Rates Keep Going Up At Hmsa Do Your Rates Go Up Every Year Too

It is an unfortunate fact of life in the current healthcare industry that costs tend to increase from year to year. That said, weve done our best over the last several years to keep our rates as low as possible, even as factors out of our control such as the cost of prescription drugs have gone up.

Also Check: How Much Do You Pay For Health Insurance

Hawaii Affordable Healthcare Insurance

If you live in Hawaii, you have a few options for health insurance. If youre buying a plan for yourself or for a family, youll want to make sure you get the coverage you need. Thats why its important to understand how health insurance works. We want to help you make informed decisions by going over everything step-by-step. First, its important to buy a plan during Open Enrollment because, unless you have a qualifying event, youll have to wait another year to get insured.

When Is Open Enrollment in Hawaii?

How to Get Health Insurance in Hawaii

Before you begin shopping for a plan, you should decide how much insurance you need and how well your plan last year worked for you. Its important to look beyond the premium price when comparing health plans. Its also important to understand the different tiers. Begin by looking at last years out-of-pocket expenses. Would a higher tier plan have saved you money despite costing more each month? Create a projection of the upcoming years medical needs and expenses to see what works best.

Next, youll want to compare health insurance companies and health insurance quotes. After you submit a form to SmartFinancial youll get several competing health insurance rates. You also have the option of speaking with an agent about the plan youre considering.

What Types of Health Insurance Are Available in Hawaii?

Does Health Insurance Cover Pre-existing Conditions?

Compare Health Insurance Plans in Hawaii

Why Should I Have Health Insurance

The cost of health care has risen drastically over the past few decades. If you do not have medical insurance to help pay bills, a serious injury or illness can be financially devastating to you and your family. If you dont have coverage you can be exposed to high health care bills or, if you have too little or the wrong kind of coverage, you wont have enough protection.

Don’t Miss: What Is Employer Group Health Insurance

The Cheapest Health Insurance In Hawaii By Age And Metal Tier

The cost of health insurance in Hawaii is affected by a number of factors. Aside from location and metal tier, a policyholders age can influence rates as well. Case in point, the difference between a Silver HMO plan for a 26-year-old and a 60-year-old can average around $637 per month, with the former paying a monthly average of $386 and the latter paying roughly $1,023.

Health Insurance Costs in Hawaii by Age and Metal Tier

As you age, the rate of health insurance goes up due to the likelihood of you needing more medical care. While low-deductible plans have smaller monthly premiums, you may have to pay more out-of-pocket in case your medical bills are high.

Prices gathered by MoneyGeek are based on sample ages and do not take into account your unique situation, such as your income or age. For instance, senior Hawaiians may find themselves eligible for cheaper plan options due to tax premiums or other regulations. However, you wont get a precise quote until you apply for a plan.

The following table shows how costs can change between metal tiers and ages. To better understand what metal tier is best for you, check out our extensive guide on how to get health insurance in Hawaii.

Cheapest Health Insurance in Hawaii by Age And Metal Tier

Sort by Metal Tier:

The Cheapest Health Insurance In Hawaii By County

The cost of health insurance in Hawaii can vary based on where a policyholder lives. Places in the state are divided into rating areas, which can consist of counties, metropolitan statistical areas or postal codes. These are then used by insurers to calculate premiums.

The state has five counties and one rating area, which means rates will not change by county but instead will be based on other factors like age and income. The most populous county in Hawaii is Honolulu, with the cheapest Silver plan being the KP HI Silver 4000/45 offered by Kaiser Permanente at an average of $467 per month.

Check out the table below to find the cheapest plan in your county based on the metal tier that suits your needs.

The rates above are based on a sample profile of a 40-year-old male residing in Hawaii purchasing a health plan in each respective county.

Cheapest Health Insurance Plans in Hawaii by County

Sort by county:

Read Also: What Qualifies For Self Employed Health Insurance Deduction

The Cost Of Health Insurance In The Hawaii

The average cost of health insurance in the state of Hawaii is $6,000 per person based on the most recently published data. For a family of four, this translates to $24,000. This is $981 per person below the national average for health insurance coverage. However, health insurance costs vary significantly based on the cost of care and the population insured. The chart below shows the four major insurance types available in Hawaii. The dollar amounts shown on the chart are the average cost in Hawaii to insure people for each type of insurance.

What People Are Saying About Uha

Hear what employers have to say about their experiences with UHA.

Healthcare is becoming more complex and we dont have the time to figure it all out. Customer service is very important to us and we have found we can always count on the expertise of the friendly team at UHA to walk us through their health plans and show us

As a leading engineering and architectural firm, its important that each of our 115 employees be in optimal health to offer our clients top quality service. UHA has collaborated with us toward a proactive approach to prevention and enhanced our cultur

Don’t Miss: What Does Long Term Health Care Insurance Cover