Can You Buy Catastrophic Health Insurance If You Have A Pre

If you have a pre-existing health condition, you may still be able to purchase a catastrophic health insurance plan. However, there are some things you need to know before you sign up for a plan.

- First, youll likely be charged higher premiums if you have a pre-existing condition.

- Second, your coverage may be more limited than if you didnt have a pre-existing condition.

- And finally, you may have to undergo a medical underwriting process to qualify for coverage.

If youre interested in buying a catastrophic health insurance plan but have a pre-existing condition, there are a few things you need to know.

- First, youll likely be charged higher premiums.

- Second, your coverage may be more limited than if you didnt have a pre-existing condition.

- And finally, you may have to undergo a medical underwriting process to qualify for coverage.

What Kind Of Medical Care Is Covered By Catastrophic Health Insurance

Once you meet your plan deductible, catastrophic coverage would pay for accidents, unexpected injuries, sudden emergency illnesses, etc. These plans also provide 100% coverage for certain preventive care servicesannual check-up, flu shot, certain types of routine screenings, and more.

Most catastrophic plans also cover you for at least three visits to a PCP.

Buy Health Insurance Where To Buy Catastrophic Health Insurance

You might have heard about the Special Enrollment Period, which is really a time when folks can enroll in health insurance. It occurs once a yr, from November 1 to January 31. This really is your only opportunity to buy health insurance. However, particular life events may qualify you for any Special Enrollment Period that allows you to change your protection or obtain a cheaper one. Listed below are a number of the benefits of Special Enrollment Periods and how you are able to use them to your advantage.

The governments Health Insurance Market does not consist of every plan, so you might locate a cheaper plan elsewhere. However, it really is really worth checking out other choices. For example, if you dont have an employer-sponsored plan, you can visit eHealth to compare large protection plans and qualify for premium tax credits. Additionally, youll find several state marketplaces that allow you to compare plans side by side, and also you can shop directly with health insurance companies. > > > Where To Buy Catastrophic Health InsuranceAccess Professional Support Or Otherwise Read On > > >

Recommended Reading: How To Retire Early And Get Health Insurance

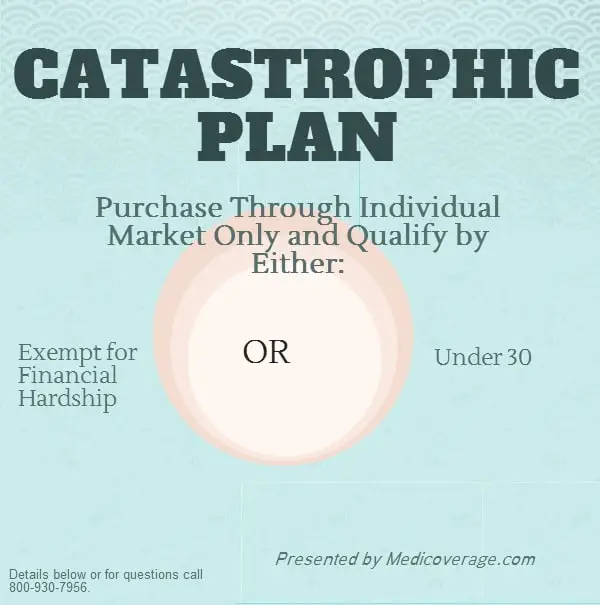

Who Can Buy A Catastrophic Plan

In general, only young adults under the age of 30 are eligible to buy a catastrophic plan. However, older adults can buy a catastrophic plan if no other qualified health plan offered through the Marketplace in 2023 would cost less than 8.17% of income.

While we have made every effort to provide accurate information in these FAQs, people should contact the health insurance Marketplace or Medicaid agency in their state for guidance on their specific circumstances.

The Henry J. Kaiser Family Foundation Headquarters: 185 Berry St., Suite 2000, San Francisco, CA 94107 | Phone 650-854-9400Washington Offices and Barbara Jordan Conference Center: 1330 G Street, NW, Washington, DC 20005 | Phone 202-347-5270

www.kff.org | Email Alerts: kff.org/email | facebook.com/KaiserFamilyFoundation | twitter.com/kff

Filling the need for trusted information on national health issues, the Kaiser Family Foundation is a nonprofit organization based in San Francisco, California.

How Much Does Catastrophic Health Plans Cost

The average cost of a catastrophic health plan in 2020 is $195. Thats signficantly less than the usual monthly costs in an employer-sponsored plan or an individual health plan.

One downside to catastrophic health plans is the deductible. Catastrophic health plans deductibles, which you have to pay for health care services before the plan chips in money, are much higher than other health plans. Catastrophic health plans deductible is $8,150. Thats significantly higher than other plans. For instance, high-deductible health plans average deductible is about $2,500 for single coverage. The deductibles in health maintenance organization and preferred provider plans are even lower.

However, once you reach your deductible in a catastrophic plan, the plan covers the rest of your health care costs for the year.

Recommended Reading: What Is Employer Group Health Insurance

Catastrophic Health Insurance And High

Itâs easy to make the mistake of thinking that a catastrophic health insurance plan is the same thing as a high deductible health plan . After all, a catastrophic plan has a high deductible, so it must be a high deductible health plan, right?

Wrong.

A qualified HDHP is a very specific type of health insurance designed to be used with a health savings account. Learn the difference between an HDHP and a catastrophic plan, and what might happen if you buy a catastrophic plan when you thought you were buying an HDHP.

How To Get A Catastrophic Health Plan

If you qualify, you can get a catastrophic health plan through your states ACA marketplace, also called the exchanges. You can start by going to healthcare.gov, which will help you find your states page.

If you are applying based on hardship, you can fill out an application requesting a hardship exemption and submit it to your state.

Read Also: Can You Get Supplemental Health Insurance Through Obamacare

If I Qualify For An Exemption Can I Get Catastrophic Health Insurance

If you are approved for either a hardship or affordability exemption, it means you may then get a catastrophic health insurance plan, if you choose.

Catastrophic health plans can help protect you from high emergency medical costs, while also covering some essential health benefits like an annual check-up, certain preventive services, and at least three primary care visits before you have met your deductible. However, if you anticipate costs associated with managing a chronic health condition, you may save more with another type of health plan.

What Do Catastrophic Health Plans Cover

Catastrophic insurance coverage helps you pay for unexpected emergency medical costs that could otherwise amount to medical bills you couldnt pay. It also covers essential health benefits, including preventive services like health screenings, most vaccinations, your annual check-up, and certain forms of birth control.

You May Like: Can You Buy One Month Of Health Insurance

What Other Types Of Catastrophic Health Coverage Are Available

There are other types of events that one can deem as out of the ordinary and may have a significant impact on your health and financial accounts. Catastrophic health insurance coverage helps you to account for certain risks but other insurance plans help you to meet other needs.

ther types of health coverage options that can help you meet emergency situations are:

- Critical illness insurance: If you are diagnosed with a stroke, cancer, a heart attack, or other terminal illnesses, this plan will pay you a lump sum for your treatment and maintenance.

- Accident insurance: If you have an insured accident, you do not need to worry. An accident insurance plan will reimburse your cash.

- Fixed-benefit indemnity medical insurance: If you contract one of the predetermined illnesses or injuries covered by your policy, this plan will pay you a cash reward.

What Is Supplementary Health And Dental Insurance

If you live in Ontario, you are probably covered under the government-funded Ontario Health Insurance Plan . When you are approved for OHIP, youll get an Ontario health card which enables you to go to a doctor, clinic, hospital or emergency room, and receive medical attention, tests and surgeries at no cost to you.

But OHIP only partially covers or doesnt cover some medical services like prescription drugs and vision care, and it does not cover dental care. To pay for medical needs and dental care that OHIP doesnt cover, you may want to consider purchasing supplementary health insurance also known as extended health insurance, or private health insurance, and supplementary dental insurance.

You might have supplementary health and dental insurance through your employer, known as group insurance, or you may decide to buy your own policies, known as individual insurance. Supplementary health and dental insurance is a way to get the medical services you need, at an affordable price. To find out more about the different types of supplementary health and dental insurance, visit Types of Supplementary Health and Dental Insurance.

Read Also: Where Do You Go If You Have No Health Insurance

Alternatives To Catastrophic Health Plans

Catastrophic health plans have low premiums, but those might still be too much for some people. Plus, the deductible means huge out-of-pocket costs when you need care, which isnt ideal for everyone.

There are other options to catastrophic health plans:

Catastrophic health plans are an option for young people and those who are facing hardships. However, make sure to compare the pros and cons of each of your options to find a plan that best meets your needs.

Who Qualifies For Catastrophic Medical Insurance Plans

Only a few groups of people are eligible to purchase catastrophic health insurance on the individual market. Either you must be under 30 or qualify for a hardship exemption.

A hardship exemption is a financial circumstance that precludes you from purchasing health insurance with greater coverage.

If youre eligible for the exemption, you might be able to buy catastrophic insurance for the following reasons:

- An unexpected eviction notice

- The passing away of a family member

- Victim of natural disaster

You May Like: How Much Is The Fine For Not Having Health Insurance

The Best Way To Select The Most Effective Health Insurance

In case you are trying to find the best health insurance, you may have numerous questions. The health care market could be difficult, and you also can really feel overcome through the several alternatives available. Luckily, there are many sources to assist you navigate the industry and locate the very best health insurance plan for you personally. In the following paragraphs, we will include a number of the most crucial queries that buyers ought to ask prior to they purchase a health insurance plan. We will look at A.M. Very best Score, S& P Rating, BBB Ranking, number of plans offered, personal out-of-pocket expense, mobile app and much more.

What Does Catastrophic Health Insurance Not Cover

A catastrophic plan wont cover anything other than the requirements listed above until your deductible is met.

In addition, exclusions on catastrophic plans are similar to any other health insurance plan. Plans may vary by provider, but most dont cover elective procedures, such as cosmetic surgery. Experimental treatments are also commonly excluded.

You May Like: How To Get Health Insurance For My Small Business

What Defines A Catastrophic Health Plan

Catastrophic health insurance offered on the Affordable Care Actâs health insurance exchanges :

- Limits who can enroll. Not everyone is eligible to buy a catastrophic plan.

- Premium subsidies can’t be used to help pay the monthly premiums.

- Has a very high deductible, equal to the maximum allowable out-of-pocket limit.

- Covers all of the essential health benefits, including certain preventive care with no out-of-pocket costs.

- Covers three non-preventive primary care office visits each year with a copay .

The deductibles on catastrophic health plans tend to be much higher than the deductibles on other plans, although it’s common to see bronze plans with similar out-of-pocket maximums and deductible that are nearly as high .

Once youâve paid enough out of your own pocket to meet the deductible, your catastrophic health insurance plan will start paying for 100% of your covered health care expenses, as long as you stay in-network and follow the plan’s rules for things like referrals and prior authorization.

How To Compare Health Insurance Companies

There are numerous options to find affordable catastrophic health insurance plans depending on your needs and location. Here are a few ways to get started:

- Determine which insurers are active in your area: Coverage options vary widely by county and state.

- Check coverage: When youre shopping, include information about preferred health providers and prescription medications to get a realistic cost estimate.

- Compare premiums, copays, and deductibles: Catastrophic health insurance plans have high deductibles with lower premiums but higher out-of-pocket costs. Catastrophic Health Plans sold on the Marketplace pay for 100% of covered expenses after the deductible, so copays rarely apply.

- Research industry ratings to measure the companys financial stability: Customer reviews are also helpful for gauging the companys efficiency and member satisfaction.

- Get help: If you need additional help to select an affordable catastrophic insurance plan, reach out to an independent insurance agent or counselor. Resources may be available through various state agencies in your area.

Also Check: How To Understand Health Insurance Plans

Whats Covered On A Catastrophic Health Insurance Plan

Catastrophic plan coverage is limited to essential health benefits, which include preventive care, hospital and emergency services, maternity, mental health, prescription drugs, and labs:

- Catastrophic plans have a fixed deductible of $8,550 for individuals and $17,100 for families

- Coverage includes three primary care visits and a limited number of preventive health screenings

- All other services are paid for out-of-pocket and count toward your deductible

Although catastrophic health plans must comply with the ACA, the plans arent eligible for tax credits. Youll have to pay the full cost and may spend more than you would with a bronze or silver plan with a tax credit.

How To Buy An Individual Health Insurance Plan

If you dont have employer-sponsored healthcare, you can buy individual or family coverage from the Affordable Care Act health exchange or directly from a health insurer.

Most Americans get health insurance through their employer, Medicare, or Medicaid. However, individual health insurance is another way to get coverage if youre not eligible for any of these plans.

Individual plans provide similar benefits to most employer plans. Depending on your income, individuals and families may pay even less for individual health coverage than one through an employer.

Individual health insurance is available through the Affordable Care Act federal and state exchanges, as well as directly from insurance companies. If you are eligible for an ACA plan, you cant be denied coverage. Depending on your income, you may also be eligible for ACA plan subsidies.

- You can buy individual or family coverage from the Affordable Care Act marketplace or directly from a health insurance company.

- ACA plans qualify for government subsidies that can reduce the cost of health insurance. No other plans qualify for those subsidies.

- Individual health plans offer comprehensive coverage, including emergency room and doctor visits, maternity care, prescription drug benefits and mental health care.

- You can enroll in an ACA plan during open enrollment or during a special enrollment period if you face a qualifying event.

You May Like: How To Find Personal Health Insurance

Catastrophic Health Insurance Reviews In Comparison With Other Health Plans

A catastrophic health plan is just like any other health plan and is most similar to the various metal tiers. Each of these metal tiers has its properties, advantages and disadvantages.

To help you access the catastrophic health plans better, we would do a Catastrophic Health Insurance Review and a brief comparison between all the other health plans.

The Platinum Plan

This is the highest insurance plan in terms of medical coverage. Unlike the catastrophic plan, this plan has a very high monthly premium and so it is more suitable for financially stable people with high medical expenses. The deductibles for this plan are very low because the Catastrophic insurance covers almost everything.

The Gold Plan

The gold plan is another high-monthly-premium plan. Similar to the platinum plan, the out-of-pocket expenses are very low with high insurance coverages. This plan differs greatly from the catastrophic plan and is very suitable for high-income earners with high medical bills.

Silver Plans

The silver plan is similar to the catastrophic plan in that it is very cost-effective and there are many cost-reducing service promos available time. But, it is very different from the catastrophic plan in terms of a monthly premium. This plan offers higher coverage than the Bronze and Catastrophic plan and is more suitable for average earners with fair medical expenses.

The Bronze Plan

The Catastrophic Plan

How Do I Qualify For An Exemption So That I Can Get Catastrophic Health Coverage

There are two main types of exemptions that would help you qualify for catastrophic insurancepersonal hardship and affordability exemptions. You could qualify for either exemption depending on the details of your specific situation.

Some common hardship qualifications include:

- Death of a close relative

- Utility services being shut off

- Home foreclosure

- A fire, or a natural- or human-caused disaster that results in substantial property damage

There are also affordability exemptions. This means that your income is not enough to be able to afford regular health care coverage. If you qualify for an exemption, you would claim it on your annual tax return and get money back.

Read Also: Does Starbucks Offer Health Insurance

What Is The Difference Between Major Medical And Catastrophic Coverage

major medical coverage in the ACA exchanges is tiered by metals Bronze, Silver, Gold and Platinum. Bronze tiers have lower premiums and higher deductibles. As you work your way up toward Platinum, premiums increase and deductibles decrease.

On the flipside, catastrophic health plans dont have tiers. It has one large deductible that needs to be met before the plan pays for care. However, once that deductible is met, there are no more charges to the insured for that year.

How Much Catastrophic Plans Cost

- Monthly premiums are usually low, but you cant use a premium tax credit to reduce your cost. If you qualify for a premium tax credit based on your income, a Bronze or Silver plan is likely to be a better value. Be sure to compare.

- Deductibles the amount you have to pay yourself for most services before the plan starts to pay anything are very high.

- After you spend the deductible amount, your insurance company pays for all covered services, with no copayment or coinsurance.

Read Also: Do You Get Health Insurance When You Retire