Is Short Term Insurance For Me

Short term insurance may be for you if youre:

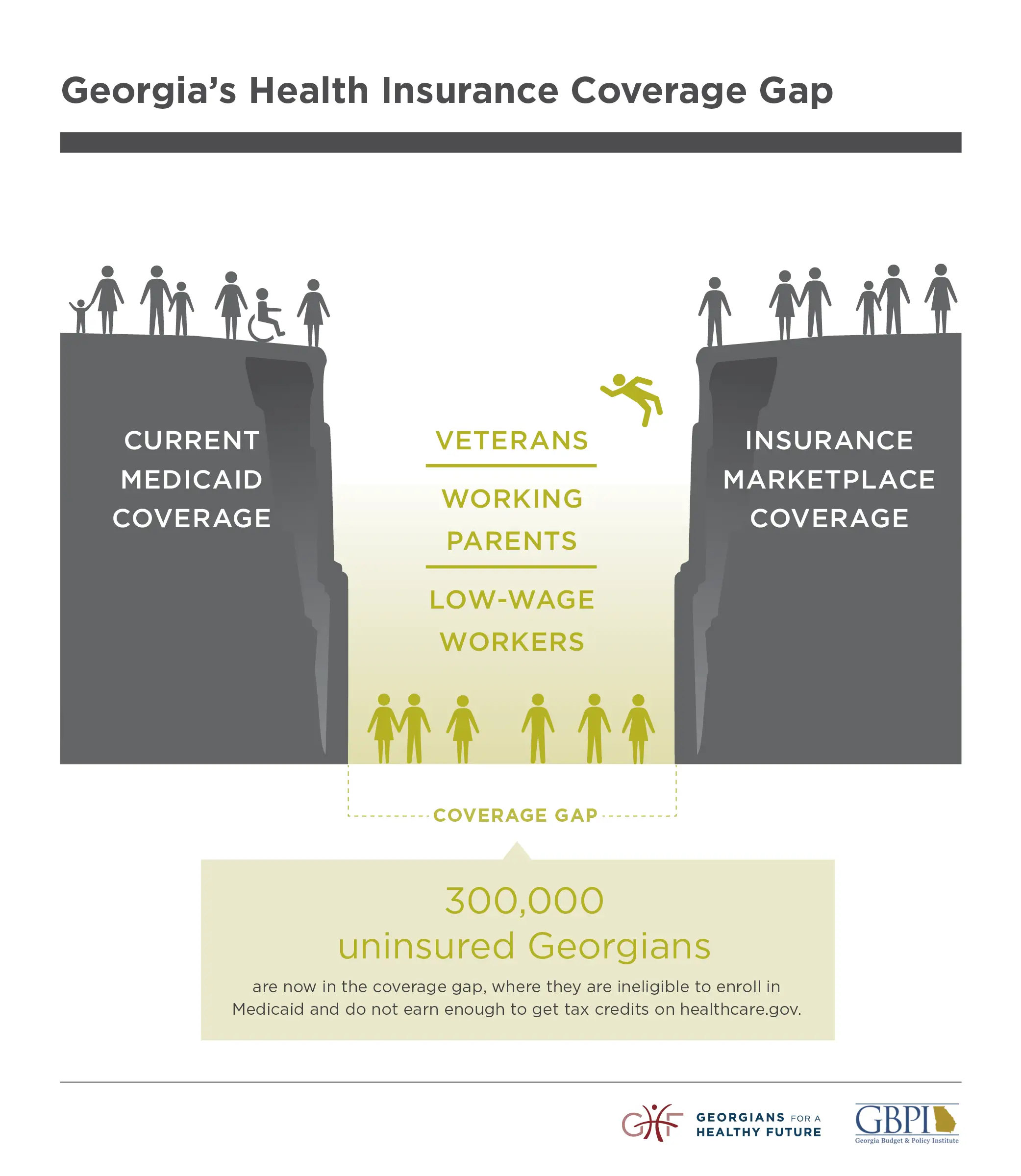

- Unable to apply for Affordable Care Act , also called Obamacare, coverage because you missed Open Enrollment and you dont qualify for Special Enrollment

- Waiting for your ACA coverage to start

- Looking for coverage to bridge you to Medicare

- Turning 26 and coming off your parents insurance

- Between jobs or waiting for benefits to begin at your new job

- Healthyand under 65

For these situations and many others, Short term health insurance, also called temporary health insurance or term health insurance, might be right for you. It can fill that gap in coverage until you can choose a longer term solution.

Dont Miss: Why Is Us Health Insurance So Expensive

Top Tips For Managing Gap Payments From Our Health Insurance Expert Anthony Fleming

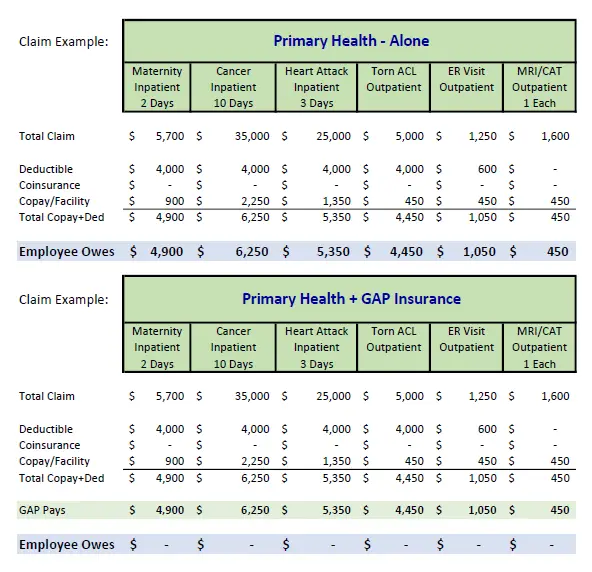

With Kemper Health Gapinsurance

The amount Joe would normally pay toward his deductible and coinsurance is reduced or covered completely by his GAP policy benefit which may help with costs related to either inpatient or outpatient medical care.

- Joes policy will cover the deductible and coinsurance, up to the maximum benefit amount his combined benefit Kemper Health GAP policy includes for the policy year.

- Joe may have benefits left in his Kemper Health GAP policy. If so, his benefit is used to help cover coinsurance costs for inpatient or outpatient services, until the entire GAP plan benefit maximum has been paid for that policy year.

- Once Joes Kemper Health GAP policy benefit is entirely used, hell be responsible for any remaining amount.

*Some policies may not include outpatient services. Ask your employer for a copy of the plan certificate for policy and benefit details or see a Kemper Health agent for details.

This case study is a fictional example based on estimated costs. Please see Kemper Health voluntary worksite Kemper Health GAP insurance Features and Benefits before making a decision.

Recommended Reading: How To Get Affordable Health Insurance

The Bupa Medical Gap Scheme Fee

- Where a doctor has signed up to the Bupa Medical Gap Scheme, and agrees to use it for your treatment, the costs you pay are reduced. Your doctor agrees to only charge up to a certain fee. We then pay a much higher amount than what we normally would so that:

- You pay nothing or,

- You pay up to $500 out of pocket for medical treatment, for that doctor.

Remember, you may have to see multiple doctors for one procedure.

To confirm what we’ll pay, check your policy information, and ask your doctor whether they’ll use our gap scheme for your treatment.

How To Compare Gap Health Insurance And Supplemental Health Insurance Companies

When youre ready to shop for coverage, it pays to compare gap health insurance and supplemental insurance plans. Typically, you need to weigh the cost of coverage against the benefits youll receive if a covered event occurs. To find the right plan for your company, follow these tips:

- Find plans available in your area: Not every insurer offers coverage in every state, so be sure to limit your search to your state or even your ZIP code.

- Research the network: You dont want to miss out on a cash payment because you went to an out-of-network hospital. When comparing plans, look for those that include your preferred hospitals and providers.

- Compare monthly premiums: Its crucial to find a gap or supplemental plan you can afford. Review each plan carefully to determine how much you can expect to pay each month.

- Research supplemental coverage: Insurers offer several gap and supplemental plans, including critical illness, cancer protection, and accidental death and dismemberment. Check the details of each plan to find out which type of coverage is offered.

- Check insurer ratings: Before committing to a plan, check the insurance companys reviews and overall ratings to see what customers have to say.

Read Also: How Much Does Visitor Health Insurance Cost

S To Cover The Gap In Your Health Insurance

Modified date: Mar. 4, 2021

Life hardly ever goes according to plan. While itd be nice if we were all able to take the easy path and get the best results, that usually isnt the case.

One particularly frustrating area of life is health insurance. Health insurance is important because an unexpected health emergency could easily bankrupt someone without health insurance. At the same time, sometimes its hard to stay covered.

For example, lets say youre changing jobs. You had health insurance at your old job. Youll also have health insurance at your new job. But maybe youre taking a three-month break between jobs or the new job has a waiting period before you can start using benefits, including health insurance.

What can do you do cover a gap in your health insurance? Thankfully, you have a few options.

Whats Ahead:

What Is Group Gap Health Insurance

Group Supplemental Health Insurance plans called GAP plans are used to fill in holes in high deductible health plans HDHPs now being offered to workers today. They are similar to the Medigap supplemental insurance plans millions of Seniors purchase each year to fill in holes in Medicare parts A& B.

You May Like: How To Get Health Insurance After Being Laid Off

Known Gap Cover Means Capped Extra Fees For You

If your doctor participates in a known gap scheme, youll have known out of pocket expenses for each procedure that he or she performs. Prior to the procedure, make sure the doctor gives you an informed financial consent, which lists all costs so youre aware of exact out of pockets.

Not all health funds offer a known gap option in their scheme. With that in mind, it pays to review a providers policy carefully before committing.

What Is Covered By Gap Health Insurance

Keep in mind that gap health insurance is not major medical insurance. Because of this, there are very limited benefits, which is why it is best used in tandem with a major plan. Some people refer to gap insurance as “insurance for your insurance” because of this, but some beneficiaries use STM in the case that they have no insurance at all. Before venturing in, it is important to know what is covered in your state.

To learn more about what is applicable in your unique situation or the circumstances of your client, be sure to check out healthinsurance.org’s extremely helpful map of short-term health coverage insurance rules and regulations in your state.

Don’t Miss: What Does Pcp Mean In Health Insurance

What Is Gap Health Insurance And How Does It Work

If youve noticed your healthcare costs rising lately, youre far from alone. Prices have been skyrocketing for years, and many people are feeling the pain most acutely in the form of higher deductibles. With deductibles rising, people are paying more than ever even for types of care that their insurance covers.

If your deductibles are so high you can barely afford to pay your bills, it might be time to consider supplemental insurance. Gap health insurance is one type of plan that can fill the gap between your expectations of what insurance should cover and the crazy-high prices youre paying for your care. In this overview, well explain what gap health insurance is and how it can help you reduce your health-related spending.

What Can I Expect If My Doctor Does Not Use The Bupa Medical Gap Scheme

Your doctor can only use the Bupa Medical Gap Scheme in:

- public hospitals, or

- private hospitals that have an agreement with Bupa.

Over 96% of all private hospital beds across Australia are in hospitals that have an agreement with Bupa.

If youre treated in a hospital that doesnt have an agreement with Bupa, or your doctor decides not to use our gap scheme for your treatment:

- Your doctor can decide what to charge you.

- Together with Medicare, we will cover 100% of the fee on the governments list, called the MBS.

- Its important to check what your doctor plans to charge, as youll need to pay any ‘gap’ yourself. Its called Informed Financial Consent.

Also Check: Can I Put My Boyfriend On My Health Insurance

Why Do I Require Gap Coverage

Many lenders mandate collision and comprehensive coverage on your auto insurance policy up until your automobile is paid off if youre leasing or financing a new vehicle.

The purpose of gap insurance is to supplement collision or comprehensive insurance. Your collision policy or comprehensive coverage will assist pay for your totaled or stolen vehicle up to its depreciated worth if you have a claim that is covered. The Insurance Information Institute claims that as soon as you drive a brand-new car off the lot, its value starts to fall. Additionally, the value of the majority of vehicles decreases by roughly 20% in the first year of ownership.

But what if your loan or lease balance is still higher than the cars depreciated value? Gap insurance could be useful in this situation.

Spotlight On: Medical Gap Insurance

Also known as medical gap insurance, gap health insurance is a supplemental protection designed to work in tandem with a group health plan, many of which have high out-of-pocket expenses when accessing certain types of care.

Fortunately, a supplemental gap insurance policy can help close this gap, paying for medical costs that occur before employees meet their deductible. These plans are often relatively affordable and help bring the total cost of health care down to a manageable level in comparison to similar low deductible coverage.

With Higginbotham, you get:

- A local broker who takes the time to get to know your needs

- A seasoned service team that delivers year-round value

- An insurance partner that puts you first

Everything we do is in the interest of you.

Thats why we start with listeningso we can end with customized solutions.

If you tell us that your group health plan has high out-of-pocket expenses for certain types of care that your employees need, we may recommend exploring medical gap health insurance.

If youre an individual looking to increase your medical coverage and reduce your financial risks, were standing by to answer your questions.

No matter what coverage youre considering, our approach to finding solutions is more individual and less institutional. By making our advice personal, we help you worry less and accomplish more. Because when our values lead, your business can succeed.

You May Like: How Much Is Health Insurance In Delaware

When To Consider A Medical Gap Insurance Plan

Gap insurance plans are supplementary insurance plans. If you already have health coverage, you may be wondering why you need gap insurance in the first place.

The answer is simple: in some cases, purchasing gap insurance can save you a lot of money on medical expenses by reducing extreme out-of-pocket costs. Knowing youre at least somewhat covered for very high medical costs also provides important peace of mind in your day-to-day life.

How Much Does Gap Insurance Cover

GAP insurance most of the time has very simple coverage: The difference between your insurance total loss payout and the existing loan balance.

It does NOT cover:

-

Aftermarket parts coverage or modifications to your car

-

Any expenses incurred that are NOT part of the vehicle loan

In some cases, also make sure that GAP insurance DOES cover your insurance deductible so in the event of a total loss you minimize your total out of pocket expenses. Check with your car insurance provider

Recommended Reading: Is Dental Insurance Health Insurance

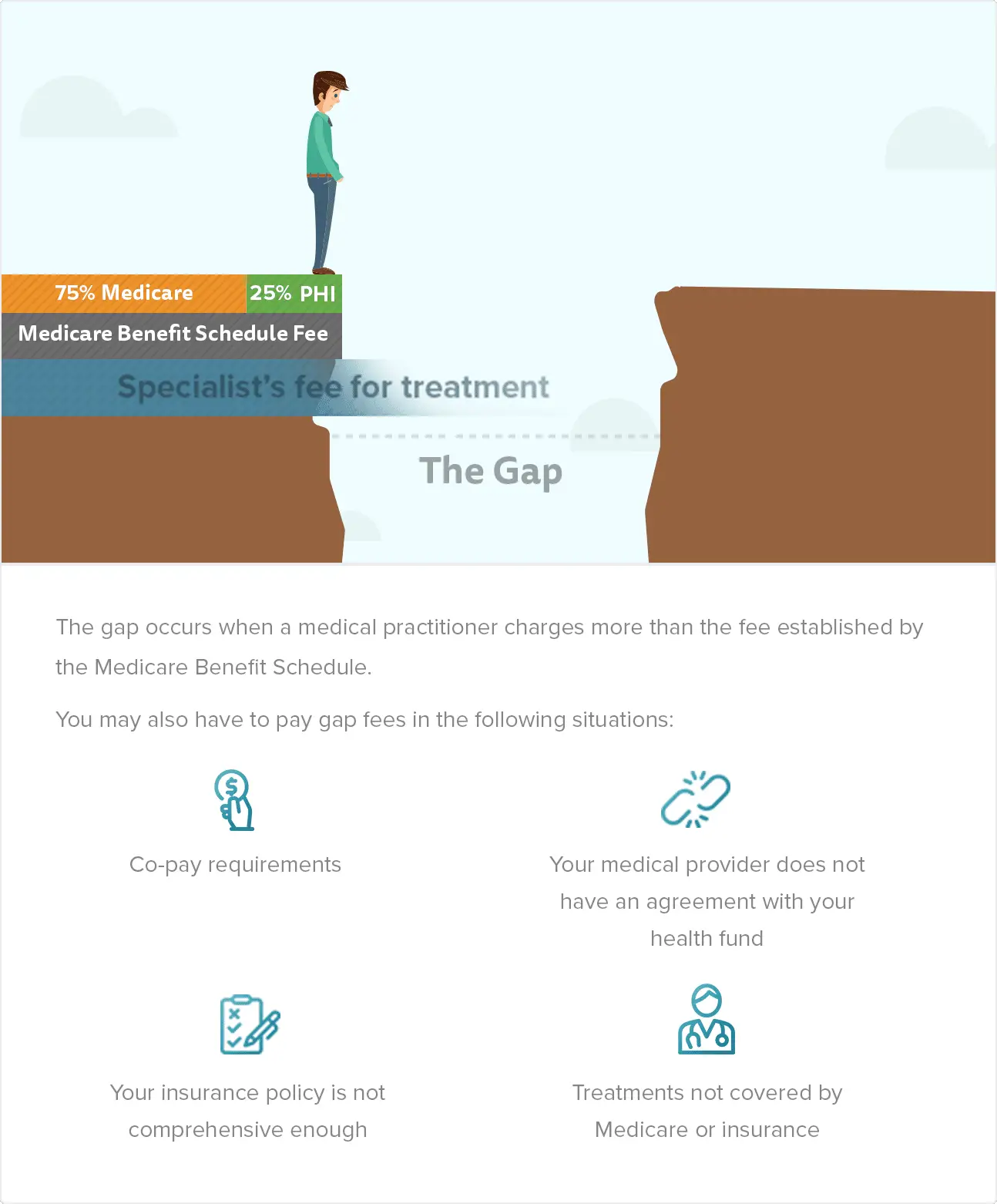

What Is A Gap Payment

A gap payment is the difference between what a doctor charges you and how much Medicare or your health fund will give you back. If you have private health insurance, contact your health fund to check that your treatment in hospital is covered and to ask about your gap cover.

Gap cover is the arrangement some health funds make with individual doctors about gap payments. It can insure you against some of the difference between what a specialist charges you and what Medicare will give you back. Choosing to use the doctors and hospitals that take part in your health insurers medical gap scheme can help reduce out-of-pocket costs.

Out-of-pocket costs are those additional costs that are not covered by Medicare or your health fund. Examples are listed here. You will have to pay these costs yourself.

Ways To Avoid Paying The Medical Gap

If you have private health cover, contact your health fund for a list of healthcare professionals with gap cover arrangements. If youre treated by anyone on the list and they agree to participate, therell either be low or no medical gap cost involved.

The gap shouldnt be confused with excess or co-payments . Depending on your policy, these payments may also be required.

There are three ways you may be eligible for access to gap cover doctors participating in the Medical Gap cover scheme.

Also Check: What Does Out Of Pocket Mean In Health Insurance

What Is The Bupa Medical Gap Scheme

The Bupa Medical Gap Scheme is all about reducing the medical costs you need to pay for treatment when you’re admitted to hospital. If your doctor uses our scheme, you’ll never pay more than $500 per doctor.

Each doctor involved in your treatment can choose to use the Bupa Medical Gap Scheme for your admission in a Public Hospital, or a Private Hospital with which Bupa has an agreement.

Is Secondary Health Insurance Worth The Cost

Many secondary insurance plans have affordable monthly premiums, but cost is just one of the factors. Consider the following to find out if this type of coverage is right for you:

- What does your primary medical plan cover and not cover?

- What type of medical care do you expect to need?

- Do you expect to need care that your medical plan doesn’t cover? For example, do you need prescription eyewear or have a chronic medical condition?

- No one expects accidents, but do you participate in risky sports or suffer regular injuries?

- Do you have a high deductible medical plan ? If so, would you have difficulties paying it if you needed to? Remember you must meet your deductible before your health plan kicks in to start helping share costs for coverage.

Answering these questions can help you decide if secondary coverage might be right for you.

Also Check: Does Health Insurance Cover Pre Existing Conditions

Where Should I Buy Gap Insurance

Luckily, our recommendation for where to buy GAP insurance is very easy.

Dont get it at the dealership

Get it anywhere else and youll end up with a much better deal

The car dealership is the most convenient way to buy GAP insurance . Buying from the dealership is the worst possible option because:

-

They are just a reseller themselves, so youll be paying additional margin on the insurance contract. Dealerships are likely to markup the GAP contract by 100% or more, and treat GAP like any other product add-on they can stuff into your car payments.

-

Theyll likely put the GAP insurance into the loan agreement, and so youll be paying interest on the GAP insurance in each car payment.

-

Getting a third party GAP contact often makes the process of being reimbursed in a total loss LESS convenient since you’ll need to coordinate your GAP provider, your collision insurance, and your loan or lease company.

If not from the dealership where should you buy gap?

-

Most insurance companies offer a GAP insurance or similar product. Call and ask your existing auto insurance coverage provider – most the time the costs is only incurred monthly, and it’s also cancellable at any time.

-

There are a number of speciality GAP insurers where you can purchase gap directly from the provider. Heres a brief list of vendors below:

Providers who offer GAP independently:

Where Can You Buy Secondary Health Insurance

These plans are sold through private insurance companies. There are many different kinds of plans, coverage, and terms.

- If you buy a medical plan on your ownthrough the Health Insurance Marketplace, you can purchase supplemental or secondary coverage through a private insurance company.

- If you get your medical plan through your employer, you may have the option to add one or more secondary or supplemental plans during enrollment. If not, you can still buy one on your own through a private insurance company.

Don’t Miss: How To Make Health Insurance More Affordable

What Gap Insurance Doesnt Cover

Gap insurance is designed to be complementary, which means that it does not cover everything. Gap insurance does not cover:

- Repairs. If a car needs repairs, gap insurance will not cover them.

- Carry-over balance. If a person had a balance on a previous car loan rolled into a new car loan, gap insurance would not cover the rolled-over portion.

- Rental cars. If a totaled car is in the shop, gap insurance will not cover a rental cars cost.

- Extended warranties. If a person chose to add an extended warranty to an auto loan, gap insurance would not cover any extended warranty payments.

- Deductibles. If someone leases a car, their insurance deductibles are not usually covered by gap insurance. Some policies have a deductible option, so it is wise to check with a provider before signing a gap insurance policy.

Also Check: Can Grandparents Add Grandchildren To Health Insurance