Kansas Health Insurance: Find Affordable Plans

See how you can get cheap health insurance in KS, including marketplace plans, Medicare, and Medicaid.

- IX.

Kansans have a wide range of options when its time to choose affordable health insurance. Depending on your circumstances, you can join your employers plan, enroll in Medicaid or Medicare, or purchase a plan from an insurer. This guide has detailed information about all your Kansas cheap health insurance options.

Average Health Insurance Premiums By Metal Tier

Health insurance plans are separated into metal tiers based on the proportion of health care costs the insurance plan is expected to cover.

The silver plan falls around the middle, with moderate deductibles, copays and coinsurance. The catastrophic and bronze plans offer the smallest amount of coverage, while platinum plans offer the greatest.

The average rates paid for health insurance plans are inversely related to the amount of coverage they provide, with platinum plans being the most expensive and catastrophic and bronze plans being the cheapest. The following table shows the average rates a 40-year-old would pay for individual health insurance based on the tier. Older consumers would see their rates increase according to the age scale set by the federal guidelines.

| Metal tier |

|---|

Policy premiums are for a 40-year-old applicant.

Frequency Of Using Medical Services Other Than A Doctor Or Hospital

Non-doctor health care visits is a measure of how often people receive medical care without seeing a doctor. This type of care excludes patients that have been admitted to hospitals or other institutions. Examples of non-physician health care includes appointments or walk-in clinics to see a nurse, physical therapist, counselor for mental health appointments or other non-physician medical personnel.

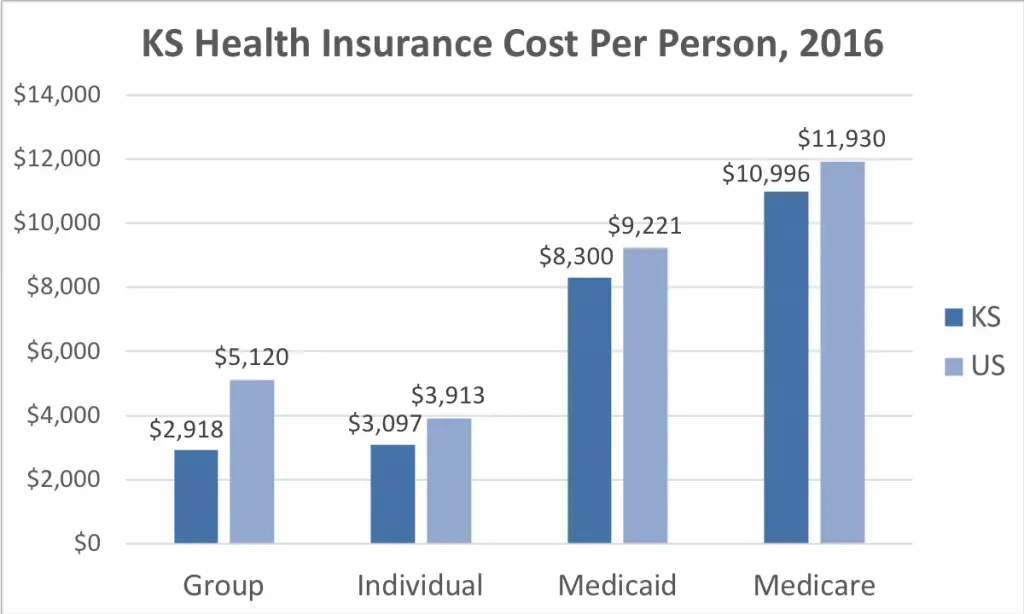

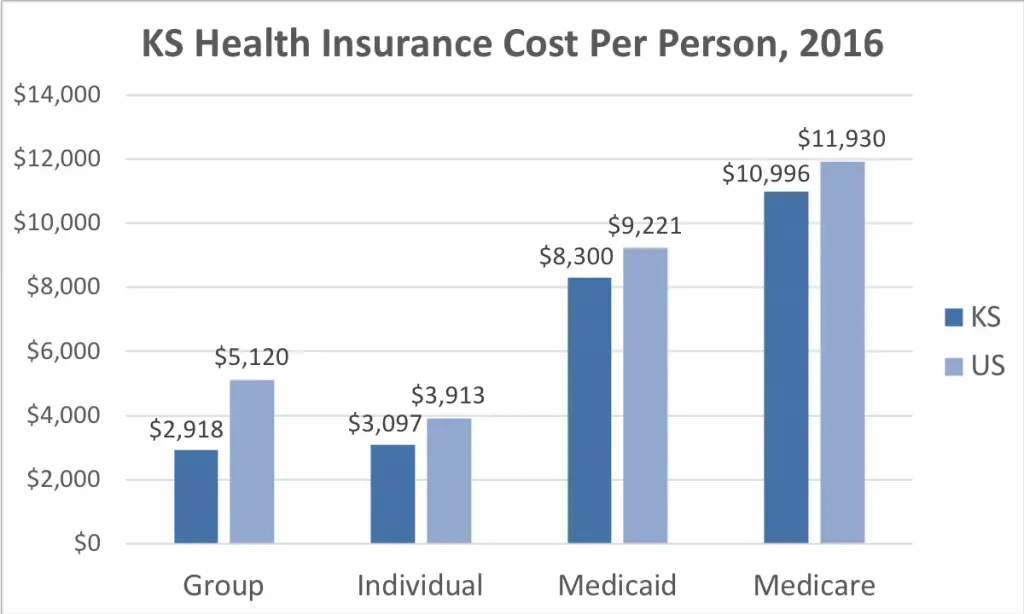

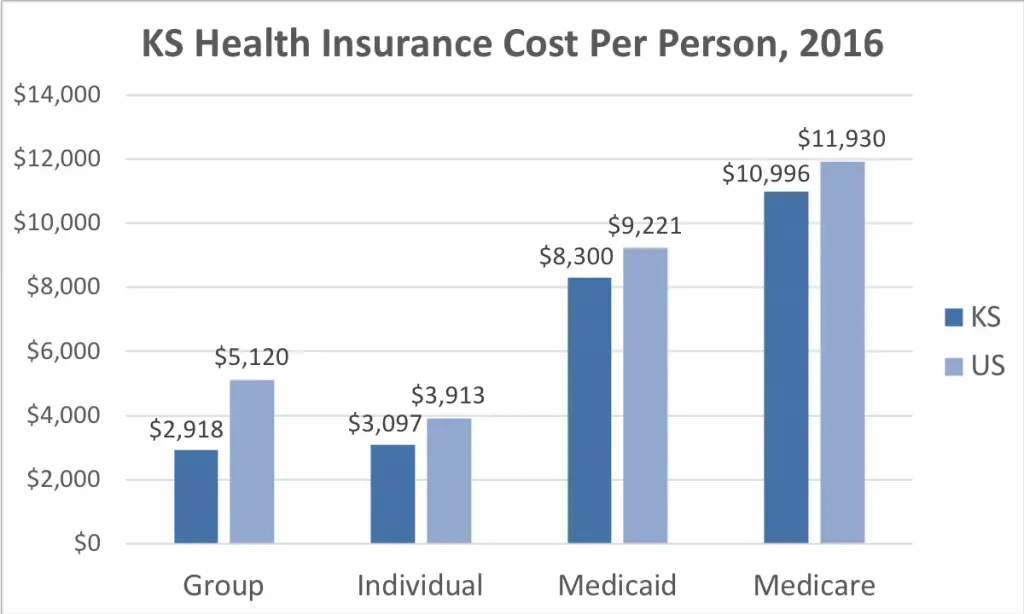

Both group and individually insured patients have a low rate of use for non-physician care in Kansas. People with Medicaid managed care used non-physician services at a rate three times that of the national average. Medicare Advantage patients also had a high rate of usage of non-doctor visits.

Non-physician care tends to be an expensive form of treatment. The reason non-physician visits are expensive is that many times these are visits to outpatient facilities. Most outpatient facilities are owned and operated by hospitals. While hospital owned and operated medical facilities are less expensive than a hospital, oftentimes they are more expensive than a doctor visit.

Don’t Miss: Is It Worth To Have Health Insurance

You Have More Insurance Options For Your Health Than You Think Kansas

If youre self-employed or without insurance from your employer in other words, youre looking for individual or family health insurance in Kansas you might be looking for Affordable Care Act insurance, what’s often called Obamacare. However, we want to make you aware of the whole range of individual and family insurance products we have available in your state.

Shopping For Health Insurance Coverage

Hidden

What types of plans are available through the Health Insurance Marketplace?

Health plans sold through the Health Insurance Marketplace are required to meet comprehensive standards for items and services that must be covered. To help consumers compare costs, plans available through the Health Insurance Marketplace are offered in four tiers, or four levels of the generosity of the cost-sharing that each plan includes:

- Bronze level The plan must cover 60% of expected costs across a standard population. This is the lowest level of coverage.

- Consumers may purchase Expanded Bronze plans. Expanded Bronze plans either cover and pay for at least one major service, other than preventative services before the deductible, or meet the requirements to be a high deductible health plan. Covered major services could include primary care visits, specialist visits, emergency room services, inpatient hospital services, generic drugs, preferred brand drugs or specialty drugs.

How do the tiers help consumers compare plans?

What is actuarial value?

What insurance companies offer coverage through the Health Insurance Marketplace? How can I get a list of companies and plans available?

Don’t Miss: Does Allied Universal Offer Health Insurance

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you need to do in order to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

Shopping For A Health Plan

- Know what youll have to pay.Plans with higher deductibles, copayments, and coinsurance have lower premiums. But youll have to pay more out of pocket when you get care.

- Consider things other than cost.To learn a companys financial rating and complaints history, call our Help Line or visit our website.

- Get help.If you buy health insurance from the federal marketplace, you can get free help choosing a plan. You can visit HealthCare.gov, get free help from a Certified Navigator, or contact us at our toll-free number: .

- Buy only from licensed companies and agents.If you buy from an unlicensed insurance company, your claim could go unpaid if the company goes broke. Call our Help Line or visit our website to check whether a company or agent has a license.

- Get several quotes and compare coverages.Know what each plan covers. If you have doctors you want to keep, make sure theyre in the plans network. If theyre not, you might have to change doctors. Also make sure your medications are on the plans list of approved drugs. A plan wont pay for drugs that arent on its list.

- Fill out your application accurately and completely.If you provide false information or leave something out on purpose, an insurance company may cancel your coverage or refuse to pay your claims.

Recommended Reading: Where To Go For Health Insurance

How To Buy Short

If youre one of the 9% of Kansas residents without insurance,1short-term health insurance in Kansas could be a good alternative. A Kansas short-term plan might be a suitable choice if you missed the enrollment period for an Affordable Care Act plan. Or, you may just need coverage for a brief period until an employer-sponsored or Medicare plan begins.

Resolving Disputes About Your Health Plan

The insurance company should send you an explanation of benefits form that states how much the insurer paid or why it denied the claim. Call the insurer if you dont understand the explanation or disagree with a decision your health plan made. Many wrongful claim denials stem from coding errors, missing information, oversights, or misunderstandings.

You can appeal a decision, file a complaint, or ask for an external review of your case by working directly with your health insurance provider.

Don’t Miss: How To Switch My Health Insurance

How Do I Get Health Insurance

Getting sick can be expensive. Even minor illnesses and injuries can cost thousands of dollars to diagnose and treat. Major illnesses can cost many times that. Health care coverage helps you get the care you need and protects you and your family financially if you get sick or injured.

If you are asking how to get health insurance, the main ways you can get it is

- Through your job, if your employer offers it.

- Through a government program such as Medicare or Medicaid .

- Buying it through a membership association, union, or church.

- Buying it from an insurance company or agent.

- Buying it through the federal health insurance marketplace.

Average Cost Of Health Insurance By Family Size In Kansas

Depending on the size of a family, health insurance rates change based on the number of individuals who need coverage and their ages. Children below the age of 15 qualify for lower health insurance premiums, which remain flat. But once a child reaches the age of 15, the premium will increase each year as they grow older.

For example, the average cost of health insurance for a family of three is $1,387 in Kansas, assuming two 40-year-old parents and a child. For each additional child, the average cost of a Silver health plan increases by around $320, so a family of four would cost an average of $1,707 per month to insure.

| Family size | |

|---|---|

| Family of five | $2,026 |

Adults are assumed to be 40 years old. Children are assumed to be 14 or younger. Sample rates are based on the average monthly cost of a Silver plan in Kansas.

Read Also: Why Is Health Insurance So Expensive

Average Cost Of Health Insurance

The average monthly cost of health insurance in the United States is $541.

Find Cheap Health Insurance Quotes in Your Area

Health insurance premiums have risen dramatically over the past decade. In previous years, insurers would price your health insurance based on a multitude of factors. However, the number of variables have decreased significantly with the Affordable Care Act.

In 2022, the average cost of individual health insurance for a 40-year-old on a silver plan is $541. This represents an increase of nearly 1% from the 2021 plan year.

Health Insurance Via Healthcaregov

Healthcare.gov is the primary tool for learning about the Marketplace, and to shop for and enroll in plans.

Telephone assistance for the Health Insurance Marketplace is available 24/7 1-800-318-2596

- Missouri residents can find more information at Cover Missouri.

- Kansas residents can find more information at InsureKS.org.

- Residents of the Kansas City metro area can get more information at: Live Fearless from Blue Cross Blue Shield of Kansas City. CoverKC from the Mid-America Regional Council.

Recommended Reading: What Health Insurance Covers Birth Control

Visiting Scholar Insurance Rates

If you are a J-1 research scholar or J-1 short-term scholar and you will have a Visiting Scholar appointment at KU, then you will purchase the United Healthcare policy directly from United Healthcare. You will submit an enrollment form and an email that includes a credit card payment link will be sent to you from United Healthcare. You can choose to enroll in the United Healthcare plan a single month at a time, or by selecting multiple months.Please note that these prices are based on the annual amount for a single person. There is no price discount between the monthly rate versus the semester or yearly rate.

2022-2023 Insurance Rates – Visiting Scholar – United Healthcare| Rates | ||

|---|---|---|

| Scholar and Two or more Children | $7974.00 | |

| Scholar, Spouse, and One Child | $7974.00 | |

| Scholar, Spouse, and Two or more Children | $10632.00 | $886.00 |

When Can I Enroll In Health Care Insurance

You usually must buy a plan during the open enrollment period. However, certain life events can qualify you for a special enrollment period at any time of the year.

The open enrollment period for and individual plans is from November 1 to December 15 each year. You can buy at other times only if you lose your coverage or have a qualifying life change. Life changes include things like getting married or divorced, having a baby, or adopting a child.

If you are getting health insurance through your job, you can sign up for a work health plan when youre first hired or have a major life change. You have 31 days to decide whether you want to join the plan. You might have to wait up to 90 days for your coverage to start. If you join your work plan, you must wait until the next open enrollment period if you decide to drop out or change your coverage. The open enrollment period for work plans might be different from the marketplace period.

Recommended Reading: Is Family Health Insurance Cheaper Than Individual

Finding Your Best Health Insurance Coverage In Kansas

Available insurers change by county, so the best cheap health insurance plan available to you in Kansas will depend on where you live and the level of coverage you choose.

Higher metal tier health plans, like Gold policies, have monthly premiums that are not as cheap as Silver policy premiums but have significantly lower out-of-pocket expenses, like deductibles, copays and coinsurance. So, if you have costly prescriptions or are worried about the high costs of an unexpected illness, a higher metal tier plan will probably be your best health insurance choice.

On the other hand, if you are young and healthy, or have no expected medical costs and want to keep your monthly rates down, a lower metal tier plan may be a good option.

Gold plans: Best for people who expect high medical costs

Gold health insurance plans have the lowest costs if you need to use your insurance often since Gold plans may have lower deductibles and copays. However, the monthly premium you can expect to pay may be higher. Therefore, these health plans are best if you have high expected medical costs, such as ongoing prescriptions, or you are concerned about being able to pay out of pocket for an unexpected condition.

The cheapest Gold plan in Kansas is the Ambetter Secure Care 20. Compare all tiers in Kansas above.

Silver plans: Best for people with average medical costs or low incomes

The cheapest Silver plan in Kansas is the Ambetter Balanced Care 12. Compare all tiers in Kansas above.

Prefered Provider Organization :

This type of health plan allows you to see both in and out of network providers.

- In-network services are covered at a higher rate, but coverage is still available out of network.

- Referrals are not required to see a specialist and you dont have to have a PCP

- Monthly premiums are generally higher than with an HMO

Read Also: Does Your Employer Have To Offer Health Insurance

What Is The Least Expensive Health Insurance

As you can see from the factors listed above, theres a lot that goes into determining the price of insurance. There isnt a single healthcare plan thats right for everyone. But finding the right plan for your needs can be easy with HealthMarkets. You can shop online, compare healthcare plans, and apply in minutes. You can also call 986-2752 to speak with a licensed insurance agent.

46698-HM-0222

Kansas Medicare Coverage For Seniors And People With Disabilities

More than a half-million Kansans have Medicare.6 Most who qualify are usually 65 or older. But younger adults with disabilities are also eligible. Nearly 87% of all Kansas beneficiaries have Original Medicare from the federal government.8 The rest are enrolled in private Medicare Advantage plans. Both options provide Part A hospital and Part B medical insurance. But Medicare Advantage offers extra benefits, such as Part D prescription drug coverage.

Part C plans are restricted to local and regional network providers whereas Original Medicare is accepted nationwide at participating providers. However, Original Medicare has coverage gaps, such as limited drug coverage. Because of this, many Kansas buy a separate Part D drug plan to get comprehensive benefits.7

Others also enroll in Medicare Supplement to help pay covered Part A and B costs. For example, theres 20% coinsurance for Part B. Most Medigap plans pay 100% of this cost. Kansas, like most states, offers 10 standard plans that cover some to all of your covered out-of-pocket expenses.

Don’t Miss: Do I Qualify For Health Insurance Subsidy

The Cheapest Health Insurance In Kansas By Age And Metal Tier

In any state, age is a significant factor that determines the cost of health insurance. Case in point, a Silver plan in Kansas for a 26-year-old costs an average of $428 per month, while for 60-year-olds, it costs roughly $1,134.

Health Insurance Costs in Kansas by Age and Metal Tier

As you grow older, health insurance premiums go up as the likelihood of needing medical services increases. Sticking to low-premium plans may be tempting, but note that youll have to pay more out-of-pocket if your medical costs are high.

The costs mentioned by MoneyGeek are averages based on sample age profiles and do not take into account age and income level combinations. As such, your health insurance quotes may be far cheaper as you may qualify for discounts or tax premiums, but you wont know your exact quote until you apply for a plan.

Look at the table below to view the average cost of each metal tier for each age group. If you want to learn more, read our guide on how to get health insurance in Kansas.

Cheapest Health Insurance in Kansas by Age And Metal Tier

Sort by Metal Tier:

Private Health Insurance On The Kansas Marketplace

In Kansas marketplace, health insurance plans are classified into five metal tiers. These do not dictate the quality of healthcare instead, they determine the actuarial value of each plan, which is the split of costs between the insurer and the policyholder.

The metal tiers available in Kansas are Catastrophic, Bronze, Expanded Bronze, Silver and Gold. Each tier has varying degrees of premiums, deductibles and out-of-pocket maximums.

Note that your unique age and income combination can help you qualify for cheaper plans through discounts or even increased coverage. For instance, if your income falls between 100% and 400% of the federal poverty level, you can qualify for premium tax credits. This can apply to a two-person household in Kansas making between $17,420 and $69,680 annually. To find out if you are eligible and how much you can save, use Healthcare.govs calculator.

The private market in Kansas has a set time where interested individuals can apply for open enrollment. This typically falls between November and December, but the COVID-19 pandemic has expanded enrollment dates to allow for more flexibility.

You May Like: How Do I Get Health Insurance If I M Unemployed