What Should I Know About A Family Floater Insurance Cover

- A family floater works out cheaper when the age of the members covered are lower. The premium for a floater is decided based on the age of the eldest member. This means that the premium for including senior citizens in the policy is quite high.

- The policy can be renewed till any member of the policy reaches a age. Most insurance companies have this age as either 60 years or 65 years. When anyone in the family reaches that age, the floater policy lapses.

- The policy includes children up to an age. Beyond that age, they are treated as adults, and will have to get their own health insurance policies.

We’re Doing More Than Providing Insurance Coverage For North Carolinians

We put diversity, equity and inclusion at the heart of everything we do. And we live that mission in our diverse and inclusive workforce.Learn how we are supporting DEI everyday.

No community can be truly healthy until racism no longer exists. We stand together. We stand against racism.Read our full statement.

The COVID-19 crisis has affected more than just health. It’s also created food insecurity, homelessness and job loss for thousands of North Carolinians.We’re donating to combat the affects of COVID-19.

Medical Insurance For 55 And Older Senior Citizens

Health insurance is similar to other forms of health insurance for 50 to 55 and older contracts that people have the risk of meeting future medical costs and requirements in the future.

Medical health insurance policies can be used not only by private concerns but also under state and government. Different nonprofit organizations manage the benefits of medical insurance contracts under the organization.

Health insurance is again two types of personal health insurance and group health insurance. Group health insurance is provided by a company that is available under the organization or provides employees with benefits of that medical policy under health insurance. In exchange, the government provides specific tax incentives to the organization.

Recommended Reading: Starbucks Insurance Enrollment

How Do I Qualify For Health Insurance Subsidies Within The Aca

The ACA also introduced healthcare subsidies that make insurance premiums more affordable for eligible Americans. To be eligible for a subsidy, your family unit must earn between 100% and 400% of the federal poverty limit, which is based on family size.

In 2021, the federal poverty limit for a family of five in most states is $31,040, and four times that amount is $124,160. This means a family of five can qualify for ACA subsidies if their income falls within this range. Note that the federal poverty limit changes over time to reflect inflation and other economic changes.

How Much Does Health Insurance Cost A Small Business

The cost of small business health insurance depends on several factors. These may include the location of your company, number of employees, coverage details, deductibles, and more. The average annual premiums are $7,470 for individuals and $21,342 for family coverage, according to a 2020 survey from the Kaiser Family Foundation.

Recommended Reading: Does Uber Have Health Insurance

How Are Premiums Calculated

Premiums go up for everyone when healthcare costs more, and premiums rise for you specifically when you are riskier to insure.

There are limits to how widely companies can charge different people for the same plan, and as to how much profit insurers can make from a plan.

Premiums are generally based on your:

- Age

- All children aged 14 or younger add the same amount to ACA premiums. Monthly costs increase from age 15 onward.

Individual states can limit how much premium prices depend on this information , and how much your premium will change each year. Some states only allow price differences based on ZIP code, or require premiums to be based largely on age.

Premiums are unique to every person, and can seem almost random. Health insurers dont disclose their exact methods, but we know what tools they are allowed to use.

This is why websites like HealthCare.com must collect a certain amount of information to show you an accurate list of prices.

Some premiums may also be based on your:

- Health history

- Gender

Short-term plans and supplemental Medicare coverage may consider this information when setting monthly premium rates. Affordable Care Act plans cannot change your monthly premiums based on these items.

Donât Miss: Insurance Lapse Between Jobs

How Do I Purchase Private Dental Insurance In Ontario

Private dental care is often included with private health insurance plans, but you can also find dental-only plans.

We highly recommend private health and dental insurance coverage to make sure you are protected for all of your medical needs. If you chip a tooth in Toronto, need a root canal in Richmond Hill or an orthodontist in Ottawa, dental insurance gives you peace of mind to know that your dental problem wont also become a financial problem.

In order to purchase dental insurance in Ontario, use our comparison tool to see what plans and providers are available. Request a quote to be put in contact with an expert who can help balance your needs with your budget.

Note that these services will only be covered if they are performed in a hospital.

Recommended Reading: How To Enroll In Starbucks Health Insurance

What Is The Patient Protection And Affordable Care Act

The Patient Protection and Affordable Care Act was signed into law in March of 2010, and it ushered in a range of reforms that changed the American healthcare system. Specifically, this law brought about a new range of rights and protections for consumers, as well as a health insurance marketplace and subsidies to make health insurance more affordable for some Americans.

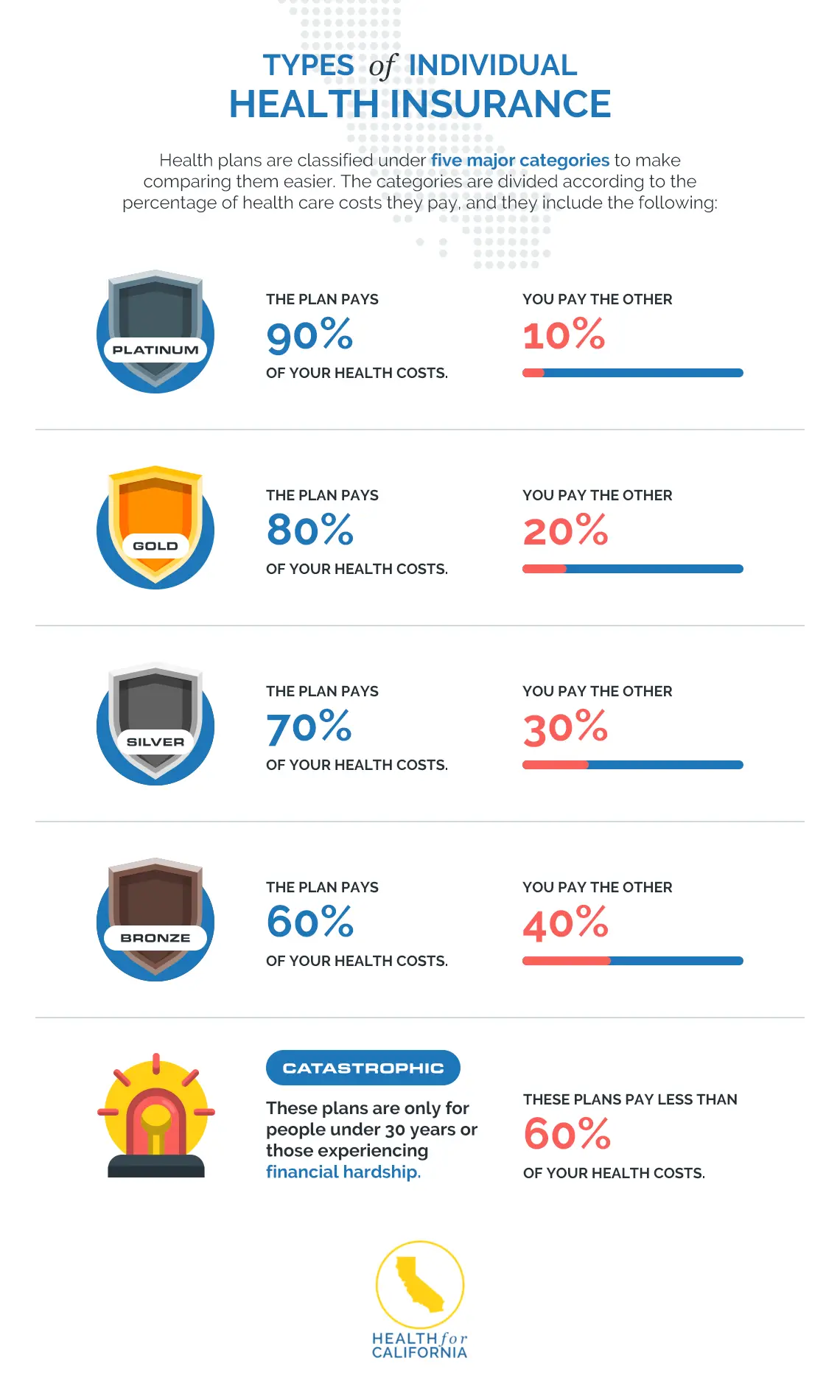

Once the ACA was implemented nationwide, health insurance customers had the chance to pick coverage among four different âmetalâ categories: Bronze, Silver, Gold, and Platinum. Each metal descriptor is used to explain how your plan splits the cost of healthcare across the customer and the provider.

Generally speaking, Bronze plans have the lowest monthly premiums yet they also cover the least amount until your deductible is met. Platinum plans, on the other hand, have more expensive premiums but come with higher levels of coverage.

Meanwhile, Silver plans are considered the “benchmark” plan. This type of plan is required for customers who are eligible for cost-sharing reductions that can push down the cost of healthcare even further.

Average Cost Of Health Insurance

Health insurance premiums are the monthly amount you pay for coverage. Your premiums will vary depending on your age and where you live. Marketplace health insurance plan prices are the same regardless of your gender.

The Marketplace classifies health insurance plans using metal tiers. Bronze plans are the cheapest, Silver plans are more expensive than Bronze plans and Gold plans are more expensive than Bronze or Silver plans. Bronze plans have the lowest premiums and the highest deductibles. Your deductible is the amount you pay for covered services before your plan starts paying.

According to the Kaiser Family Foundation, the average lowest-cost premium for a Marketplace plan is:

- $328 for Bronze tier

- $436 for Silver tier

- $481 for Gold tier

Your costs for a Marketplace plan may be higher or lower, however. You may also be eligible for tax subsidies that lower your premiums. When you apply for a plan, you enter your financial information. That information determines whether you qualify for a tax subsidy. You can also decide how much of the tax subsidy you use.

| Plan category | |

|---|---|

| 90% | 10% |

Monthly premiums increase as you move up in category level as does coverage share. The more affordable bronze category covers a lower share of medical expenses, potentially leading to large out-of-pocket expenses. If you are expecting significant medical needs or cannot afford a surprise bill, the lower metal categories may not be a good fit.

Read Also: Starbucks Health Insurance Benefits

Consider Whether You Want A Referral System Of Care

Plans that require referrals

If you choose an HMO or POS plan, which require referrals, you typically must see a primary care physician before scheduling a procedure or visiting a specialist. Because of this requirement, many people prefer other plans. However, by limiting your choices to providers they’ve contracted with, HMOs do tend to be the cheapest type of health plan.

A benefit of HMO and POS plans is that theres one primary doctor managing your overall medical care, which can result in greater familiarity with your needs and continuity of medical records. If you do choose a POS plan and go out-of-network, make sure to get the referral from your doctor ahead of time to reduce out-of-pocket costs.

Plans that don’t require referrals

If you would rather see specialists without a referral, you might be happier with an EPO or a PPO. An EPO may help keep costs low as long as you find providers in-network this is more likely to be the case in a larger metro area. A PPO might be better if you live in a remote or rural area with limited access to doctors and care, as you may be forced to go out-of-network.

Annual Costs And Premiums

The first thing youll likely notice when purchasing insurance is the annual cost, or the sum of your monthly premiums. The principal cost associated with coverage is the premiumthe amount you pay every month for the coverage, which could be subsidized by your employer or the government, says White.

Don’t Miss: Does Starbucks Provide Health Insurance

How Do I Obtain A Health Insurance Quote

If your employer does not offer an affordable health insurance option and you do not qualify for subsidized insurance or Medicare, you can shop the open market for medical insurance. The health insurance companies we reviewed will allow you to request a quote online rather easily. Premium rates vary significantly by multiple factors. You’ll learn that the monthly rates increase quite a bit as you age. Smoking also increases the premium rate. In most cases you can select non-smoking if you have not smoked in over six months.

Services such as eHealthInsurance are simple to use and provide a variety of quotes but may not always show every option available. You may find more plan options by requesting plan information directly from the insurance company’s website. Before purchasing new insurance it is always a good idea to ensure that your preferred doctor accepts the insurance you are looking to purchase. While your doctor may be listed on the insurance company’s website, it is smart to call your doctor’s office directly to verify.

Even if the open-enrollment period has passed for signing up for insurance via one of the exchanges, you might still be able to purchase subsidized insurance if you’ve had a qualifying life event. Qualifying events include moving to a new state, change in income, change in family, loss of coverage and others.

Best For Health Savings Plan Options: Kaiser Permanente

Kaiser Permanente

Kaiser Permanente was the top performer in California, Colorado, and the Northwest and South Atlantic regions, according to the 2021 J.D. Power & Associates Commercial Member Health Plan Study. Kaiser Permanente is ranked the number one overall health insurer on Insure.com. In the study, 49% of people surveyed said they would definitely recommend it, and an additional 38% said they would probably recommend it. Also, 90% of customers plan to renew their policies.

-

Variety of health plans available

-

Limited coverage areas

Kaiser Permanente is a trusted name in health insurance. It offers medical care through its managed care organization and network of Kaiser Foundation hospitals and medical centers. It has won numerous customer service awards from J.D. Power & Associates.

Kaiser Permanente offers private health insurance to residents of California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, Washington, and Washington D.C. Its network includes more than 23,000 participating physicians.

If you live in one of Kaiser Permanentes coverage areas, you have access to several plan options, including bronze, silver, gold, and platinum plans. Bronze, silver, and gold plans offer the option to add a health savings account .

The HSA options through Kaiser Permanente are available for high-deductible plans. The contributions are tax-free and can be used to help pay for qualifying expenses, including:

Also Check: Starbucks Benefits For Part Time Employees

Health Insurance For Students And Young Adults

Tips to get started with the right health insurance plan.

Whether you’re a student or out of school, you’re on your own and making choices for yourself. But how do you choose the right health insurance plan? If you’ve turned 261, youre no longer covered by your parents’ plan. So it’s time to choose the plan thats right for you.

Wondering where to start? Let’s start by looking at the basics of a quality health insurance plan.

Is Health Insurance Worth It

Its very rare to find a scenario where health insurance isnt worth the cost. You never know when youll become sick or get injured, and its significantly cheaper to pay for health insurance than to incur large medical bills. Doctors visits, hospital stays, and ambulance rides can add up to hundreds of thousands of dollars. Its better to pay for health insurance than risk getting stuck with those bills.

Also Check: Evolve Health Insurance Company

Best Large Provider Network: Blue Cross Blue Shield

Blue Cross Blue Shield

BCBS members have access to plans through health maintenance organizations , exclusive provider organizations , and preferred provider organizations .

BCBS health care organizations offer nationwide coverage, and six of its companies were included in the top 15 best health insurers by Insure.com. Of those six, the ones that have AM Best ratings for financial strength received an A or better.

-

No matter where you live, there is a health care facility provider who accepts BCBS in your state.

-

There are many policy options and there is a plan available no matter how much coverage you may want.

-

Customers have rated various BCBS companies less than 3.5 stars on Consumer Affairs. The complaints include difficulty in getting medical procedures approved, coverage denials, and limited PPO choices.

The Blue Cross Blue Shield Association offers private health insurance coverage in the United States and over 170 countries. Over 110 million Americans have their health insurance through a BCBS organization. There are 35 BCBS independent health insurance companies in the U.S., and most have an AM Best financial strength rating of A .

The HMO plans offer the most comprehensive plans at the greatest savings but limit doctor choices to those inside the HMO. The EPO plan uses select provider networks and incorporates policies that promote and manage member health care. On the other hand, the PPO plans offer more flexibility with a great number of participating doctors.

How Much Health Insurance Coverage Do You Need

CNBCTV18.com

While buying health insurance, one is often in a fix about the amount of coverage one should go for. A conservative estimate should be at least Rs 5 lakh, considering the rising medical costs.

Given the rising medical costs and inflation, it is important to be prepared for any unforeseen expenses due to medical emergency. The best way to do so is by purchasing a health insurance policy. However, when it comes to getting a policy, the biggest question is how much should be the size of the health cover. Similarly, its always confusing to select a medical insurance that meets all your requirements apart from covering critical diseases.

Here are a few things to help you decide on a suitable insurance policy for your medical emergencies.

How much health insurance do you need?

The coverage need and cost of your health insurance plan will depend on your needs. The cost of premium for the insurance policy could vary depending on whether you want to get an individual policy or a family floater that covers your loved ones as well. If you want to include senior citizens in the policy, then you will need to consider the cost of treatment for their existing ailments too before deciding the coverage.

Don’t Miss: Starbucks Health Insurance Plan

Difference Between Travel Insurance & Expat/international Health Insurance

There are a few key differences between travel insurance and expat/international health insurance.

First, travel insurance is typically shorter in duration, covering only the length of your trip. Expat/international health insurance, on the other hand, is designed to cover you for an extended period of time, usually a year or more.

Second, travel insurance is typically less comprehensive than expat/international health insurance, offering only basic coverage for things like medical emergencies and lost luggage.

Finally, expat/international health insurance typically costs more than travel insurance. This is because it offers more comprehensive coverage and is designed for a longer period of time.

National General: Best Health Insurance Company For Short

Reasons to avoid

National Generals financial clout and its history in the industry puts it in a good position, and specializing in short-term health insurance plans means that it has become one of the leaders in this field. Although its policies come in at above the industry average in terms of pricing, it’s backed up by excellent ratings, additional programs, discounts and flexibility.

National Generals plans are perfect for anyone temporarily without health insurance, whether it’s due to an employment situation or missing a sign-up window. Health insurance coverage is also good for routine doctor visits, labs, X-rays, ER visits, ambulance usage and urgent care facilities.

Don’t Miss: Starbucks Dental Coverage

Best For The Tech Savvy: United Healthcare

United Healthcare Services Inc.

Want to track your health on an Apple Watch? File claims, set up doctor appointments, and find doctors online? United Healthcare’s 2019 Annual Survey found that 37% of consumers shop for health care on a computer or with mobile apps. The company is pushing “consumer-driven digital health care,” which includes wearable technology for glucose management, smart baby monitors for high-risk infants, and activity trackers that allow fitness participants to win monetary awards.

Two private United Healthcare plans scored an impressive 4.5, while nine plans in D.C. and seven states scored 4.0 in overall NCQA ratings. An impressive 29 of its Medicare Advantage plans were highly rated, including several sold under the name Sierra Health and Life Insurance Company, Inc.

United offers the full spectrum of health benefit programs for individuals, employers, and Medicare and Medicaid beneficiaries. It contracts directly with more than 1.3 million physicians and care professionals as well as 6,500 hospitals and other care facilities nationwide. Both HMO and PPO plans are available with access to health savings accounts and flexible spending accounts . Its policies may cost a bit more than some of its competitors, but it may be worth it for the extra features.