What Are The Aca Requirements For Aflac Insurance

Aflac’s insurance contracts do not meet the Patient Protection and Affordable Care Act’s requirement for minimum essential coverage, and they are not designed to meet any of the essential health benefit requirements mandated by the ACA or federal law, such as pediatric oral or vision care services. An individual who purchases an Aflac policy will be able to select an effective amount of medical coverage. However, under federal law, if an individual wants his or her insurer to cover a specific essential health benefit, he or she must allow the insurer to require proof of eligibility for that benefit. If an individual is found ineligible for that benefit, he or she can still keep his or her policy but would not be able to claim it provides essential health benefits.

For more information on the ACA’s essential health benefits requirement, see Healthcare.gov‘s page on the Essential Health Benefit Requirement.

An Aflac representative said the company does not comment on ongoing litigation.

How Much Does Cancer Treatment Without Insurance Cost

Some cancer treatments are more expensive than others, but they almost always come with considerable fees. Cancer costs can range depending on the stage and location of the disease.

The National Cancer Institute found the average cost of medical care and drugs to be over $42,000 in the year after a cancer diagnosis.2Supplemental cancer insurance can help protect your income from the out-of-pocket expenses that may still arise with a primary insurance plan.

Also, receiving cancer treatment without insurance can add emotional stress on top of the physical stress your body is already enduring. For example, getting a breast cancer screening with no insurance may be costly, and the results could cause emotional disturbance. Mental health services like therapy and support groups may also be beneficial during this time, and cost money.

Its not uncommon for cancer patients to have a hard time paying medical bills, let alone everyday bills like groceries and utilities. Our cancer insurance pays out lump-sum cash benefits upon a covered claim that you can use however you see fit whether it be for lost wages or paying rent.

Having cancer without health insurance can be stressful, but having primary and supplemental cancer insurance can help protect your savings and emotional well-being.

What Is Supplemental Insurance And How Does It Work

So Aflac revolves around supplemental insurance. What is that, exactly?

Supplemental insurance is designed to work alongside your primary insurance coverage to fill in gaps. For example, if you get injured or sick, your health insurance policy might not cover everything, or you may not get paid if youre not working.

Some kinds of supplemental insurance offer very specific coverage: If youre diagnosed with cancer, cancer insurance would pay you a cash benefit.

But theres a wider range of payout options. If you suffer a stroke, maybe you want an up-front lump sum or maybe you want smaller payments as you go through therapy.

Money expert Clark Howard says supplemental insurance is not a scam, but he thinks that getting good health, life and disability insurance is a much bigger priority.

There are competitors in the supplemental insurance market, but Aflac is the leader.

You May Like: What Type Of Health Insurance Do I Need

Other Ways To Use Supplemental Insurance

Another effective use of supplemental insurance is for dental and vision care, which sometimes isnt included in an employers medical plans.

For example, the deductibles for major dental and vision operations can sometimes be quite high. A supplemental plan can help you pay for a high-deductible operation, especially when you believe one may be in your near future.

Does Aflac Cover Pre Existing Conditions

Pre-Existing Conditions Limitation: Aflac will not pay benefits for any period of disability that results, directly or indirectly, from Sickness or Injury for which you, during the 12 months prior to the most recent Effective Date of your insurance, incurred expenses, received medical treatment, took prescribed drugs …

Recommended Reading: How Much To Employers Pay For Health Insurance

When Is Open Enrollment 2021

The 2021 open enrollment period starts Sunday, November 1, 2020, and closes Tuesday, December 15, 2020. If you dont purchase health insurance by the December 15 deadline, you cant get 2021 coverage unless you qualify for a special enrollment period. Insurance plans purchased during open enrollment take effect on January 1, 2021.

Contact Us

I Don’t Have Health Insurance Should I Get Aflac

I don’t have health insurance, should I get AFLAC?

My company sent an AFLAC representative to us today. I heard it was supplemental health insurance and it costs $35/month for accidents and sickness. I don’t have any insurance at …show more

ANSWER: I recommend you to try this internet site where you can compare quotes from different companies: QUOTESDEAL.NET

RELATED FAQS:

Does my insurance go up after I get a ticket in someone else car? Or the owner of the car insurance goes up?

I got pulled over for speeding and the officer never asked for the insurance card. Since he didn’t ask for the insurance card, does that mean my pay rate will be the same? Or can the insurance company find out by the tag number? Please inform me because this is my first time. Thanks! Also remember I was in someone else car.”

How to get cheaper car insurance for a new young driver?

I passed my test the other day but ive been looking for hours trying to find some cheap car insurance on a 1.2 ford ka but all the quotes im getting are minimum 3-4 thousand pound and some are even quoting up to 8 thousand ! Im 17 and male does anyone know where to get relatively cheap insurance something between 1000-2000 pound? or any methods that are used to get cheaper car insurance?

How can I get my car insurance cheaper?

Hi am 31 and got 8 years no clams I drive a corsa vxr and am finding it hard to get it cheap

Pay out of pocket for my car or go through my insurance company?

How does car insurance work?

Recommended Reading: Is Community Health Choice Good Insurance

When Can You Buy Supplemental Insurance

- When the health coverage you may get through an employer doesn’t include supplemental insurance optionsyou can buy your own.

- When you have to buy health coverage on your own and want to add a supplemental policy.

- If you have a Medicare Supplement plan and want to add a supplemental policy.

- You can buy supplemental insurance policies at any time of the year. Shop our policies online, anytime.

New To Be Completed By Applicant

Posted: Application for Accident Insurance base plan New Application to American Family Life Assurance Company of Columbus Conversion Worldwide Headquarters: Columbus, Georgia 31999 Policy Number Please print in black ink. Job Duties Job

Posted: Broker Sales. Broker Coordinator- Portland, Oregon. Job Summary Under general supervision, provides dedicated administrative support to assigned Broker Sales Professionals and their respective book of business consistently represents the department as a liaison for any unresolved concerns between the Broker Sales office, internal departments, external contacts, and the BSPs

You May Like: Can I Go To The Er Without Health Insurance

Long Term Care Quotes

Also try: The Aflac Benefits Estimator can help you find the cost of an illness or injury so you can make smarter choices when it comes to your insurance benefits. Aflac provides supplemental insurance for individuals and groups to help pay benefits major medical doesnt cover. Aflac V8.16 Death Benefit Claim Instructions ⢠The . Statement of Physician. section must be completed by the deceasedâs primary care physician, ONLY. if the death occurred within the first two years from the effective date of the policy. ⢠A . Beneficiaryâs Statement. must be completed by the person to who the insurance is payable.

Do I Have To Pay Taxes On Aflac Money

No, generally. The proceeds of an accident and health policy, like AFLAC are not reportable as income so long as you did not deduct the premiums, and so long as this is not an employer provided fringe benefit.

Does Aflac get reported on w2?

Aflac itself states that premiums paid by or through the employer for certain Aflac policies should be reported in box 12 using code DD on the W-2.

Is Aflac a pyramid scheme?

All they ever talk about is how they want you to sign more people up to sell insurance so you get 5% of what they make. Its a pyramid scheme. They act accepting at first but that quickly changes to them expecting you to conform to their look.

Will I get a tax form from AFLAC?

The proceeds of an accident and health policy, like AFLAC are not reportable as income so long as you did not deduct the premiums, and so long as this is not an employer provided fringe benefit. Therefore, you may receive a W-2 form from your employer that will include the taxable benefits amount you received.

Does AFLAC get reported on w2?

Also Check: Can I Apply For Medicaid If I Have Health Insurance

Can Individuals Purchase Aflac

Aflac supplementary insurance plans provide a comprehensive range of products to individuals, families, and corporations. Our insurance assist with anything from normal preventative care to life-threatening diseases. Affiliated Companies include: Aflac, Nationwide, Empire, Hartford, Cigna, MetLife, Ameriprise.

Individuals can purchase Aflac policies by going through an agent or directly from us. There are three types of policies: Life, AD& D, and Long-Term Care. These policies can also be sold with Group Life and Health Insurance Company status. In addition to these assisted living facilities, an individual can buy coverage for their own personal care services needs. This is often referred to as Personal Care Assistance .

A person can only be insured by one Aflac company at a time. However, they can switch insurers any time without penalty. When an individual switches insurers, they will need to notify the new insurer immediately so that they do not have a lapse in coverage.

It is important to read your policy documents carefully before you sign on the dotted line. There may be situations where you are not eligible for certain discounts or promotions if you sell other insurance products. Make sure that you ask about all limitations when applying for a policy.

What If I Get Cancer Without Insurance

Having cancer without insurance can be risky. Below are some of the factors you may want to consider when deciding if you need supplemental cancer insurance:

- Cancer treatments can be expensive. The costs of drugs, private nursing, therapy, transportation, and experimental treatments are a few typical expenses that quickly add up, even with the help of insurance.

- In an already demanding situation, financial stress may negatively impact ones physical and emotional health.

- The focus shifts to mitigating costs rather than healing.

Getting tested for cancer without insurance can start the journey in a stressful place. Getting Aflac Cancer Insurance before a diagnosis takes place is crucial to receive coverage. These are all things to consider when deciding whether to apply for supplemental cancer insurance.

You May Like: What Type Of Health Insurance Plans Are There

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How Are Aflac Plans Different From Health Insurance

I agree with Davidmy idea of the AFLAC plans is that they are not health insurance, but pay a certain amount of money if you are in the hospital, get cancer, or are wounded in an accident, so they are not covering medical expenditures per se, but are more like disability insurance. The difference between the two types of policies is that health insurance pays what’s called “actual expenses,” while disability insurance pays a fixed amount, no matter how much care you receive.

The reason I say this is because it seems like many people think that health insurance has something to do with doctors’ offices and hospitals. It doesn’t. Health insurance pays for medically necessary services, which can include physical examinations, tests, treatments, and prescriptions. It can even cover surgeries and alternative medicine practices such as acupuncture and massage therapy. However, health insurance does not cover activities that are not medically necessary, such as beauty treatments or counseling sessions.

You May Like: What Is Colonial Health Insurance

Aflac Life Insurance Review 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Bottom line: Aflac only sells life insurance through the workplace, but you can buy a supplemental policy if you need more coverage.

You may hear a duck sound in your head when you think of Aflac, but the companys position in the insurance industry is no quacking matter. Aflac is a top seller of insurance benefits at work, such as supplemental life insurance, which you can purchase on top of your employer-provided coverage. Availability varies among employers.

Why you can trust NerdWallet: Our writers and editors follow strict editorial guidelines to ensure the content on our site is accurate and fair, so you can make financial decisions with confidence and choose the products that work best for you. Here is a list of our partners and heres how we make money.

What Is Supplemental Insurance

Supplemental insurance, sometimes called secondary insurance or specialty insurance, helps pay for out-of-pocket expenses your health insurance does not cover. You can buy one supplemental insurance plan or several small plans to complement your main health insurance plan to pay for different things under different circumstances.

Something to note: There is a difference between supplemental health insurance for people under 65 with health insurance and Medicare supplement plans for people 65 and over. This article does not address Medicare or medigap supplements.

While supplemental insurance products do not replace someones major medical health insurance coverage, they do offer an additional layer of financial protection which can really go a long way in helping people focus on their recovery and not paying their bills, says Wendy Herndon, second vice president of Product Launch and Adoption at Aflac.

Most supplemental insurance plans pay you, the policy holder, directly instead of paying a provider, as regular health insurance does. Payments are either periodic or in a lump sum up to a plan maximum.

Supplemental insurance can help pay for out-of-pocket medical costs like copayments, co-insurance, and deductibles and much more that has nothing to do with medicine.

Many companies sell supplemental insurance, so you do not need to purchase plans from the same insurer as your health insurance.

You May Like: Can I Pay My Employees Health Insurance Premiums

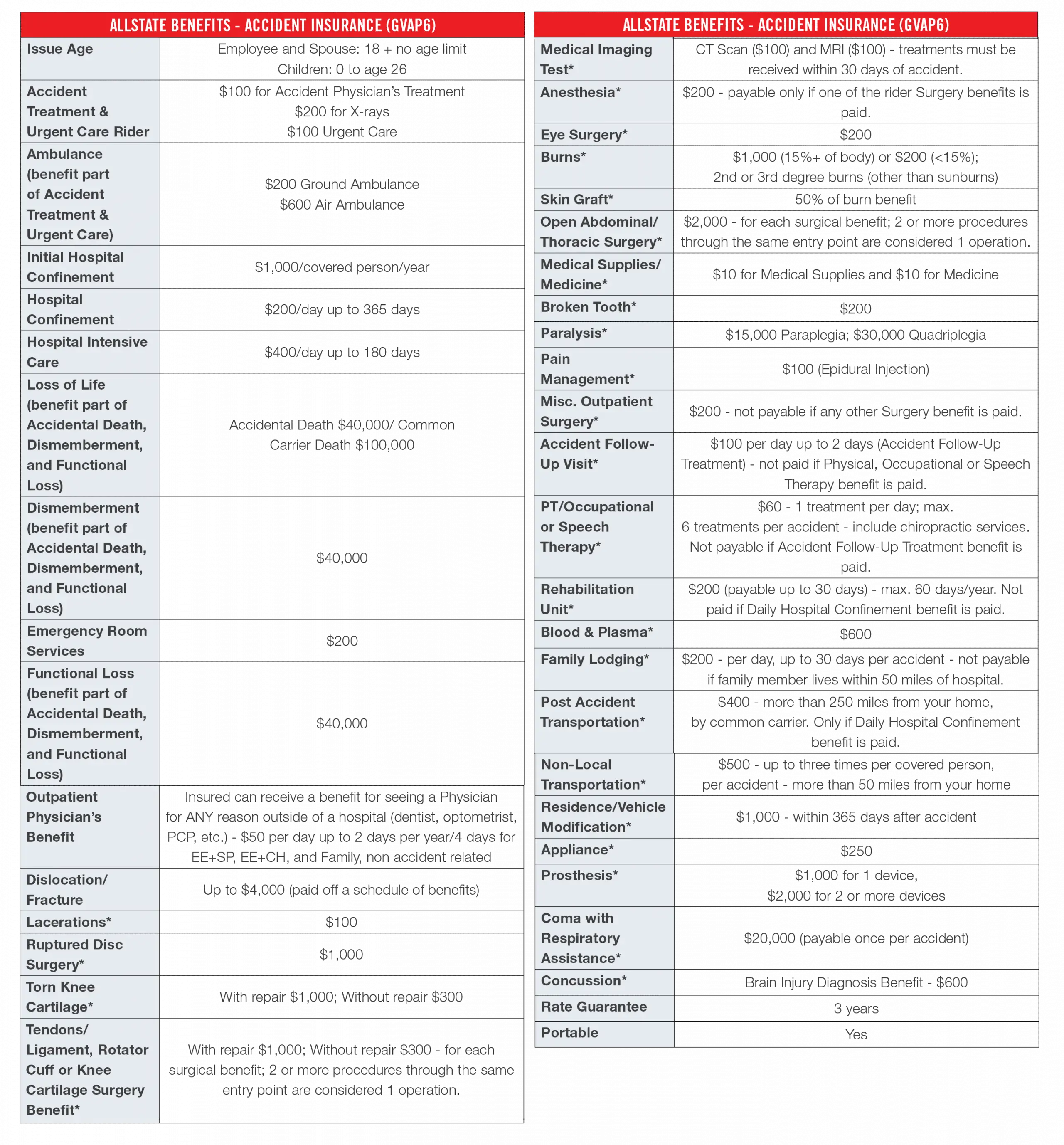

Accident Insurance Vs Other Supplemental Health Plans

Supplemental plans work well with medical health insurance but can also be used to protect you outside the Open Enrollment Period when you cant enroll in a major medical health plan. It is important to understand your options in supplemental coverage and how they differ from one another so you can choose the best plan for you.

Read Also: How To Get Your Parents On Your Health Insurance

Aflac Term Life Insurance

Here are the types of term life insurance available from Aflac:

- Fixed term. Lasting 10, 20 or 30 years, premiums for a fixed term life insurance policy stay the same throughout the level term period.

- Increasing term. This kind of term life insurance policy boosts the value of the death benefit over the course of the policy term. Premiums can go up during the policy period, but they can deliver a bigger payout to your beneficiaries.

- . Aflacâs decreasing term life policy has premiums that go down over time, along with a decreasing death benefit.

- Annual renewable. This type of policy supplies coverage that must be renewed each year. Premiums go up every time the policy is renewed, so this short-term coverage is best suited for filling short gaps between other life insurance policies.

In some states, Aflac offers term life insurance without the need for a medical exam.

Rates for Aflacâs term life insurance policies are primarily based on age, lifestyle, medical history and desired coverage. Coverage up to $500,000 is available for those age 50 and under. For people ges 51 to 68, Aflacâs term life coverage is limited to $200,000.

You May Like: Will Health Insurance Pay For Weight Loss Surgery

Accident Critical Illness And Hospital Indemnity

UC offers three supplemental insurance options Accident, Critical Illness and Hospital Indemnity plans. These plans pay cash benefits directly to you when you or an enrolled dependent experiences a qualifying injury, critical illness, or hospital stay.

Supplemental health plans are not substitutes for medical or disability coverage, but they can provide an extra layer of financial protection against the unexpected.