Can I Enroll In Marketplace Health Insurance If My Employer Offers Insurance

The Affordable Care Act ensures that almost all Americans can buy individual and family health insurance from the online Marketplace. To qualify to shop on the Marketplace, there are just a few general requirements. You need to live in the U.S., not be incarcerated, and be a U.S. citizen or hold a number ofpermitted immigration statuses that include being a refugee, a green card holder, a survivor of domestic violence, and more. If you meet these general criteria, you can shop for Obamacare plans during the annual Open Enrollment Period . You can also shop on the Marketplace during aSpecial Enrollment Period if you have aqualifying life event like a marriage, birth, or move.

Many people like to shop on the health insurance Marketplace for its comprehensive, affordable health insurance plans. Want to compare prices to see if Marketplace coverage might be less expensive than opting into your employer-provided plan? Youll need to consider a few things, especially when it comes to your bottom-line costs.

To see plans and prices in your area, enter your zip code below.

Update: How Many Americans Have Lost Jobs With Employer Health Coverage During The Pandemic

-

Professor of Economics, Michigan State University

-

Professor of Economics, Michigan State University

-

Many employers continue to help workers laid off because of the COVID-19 pandemic afford their health insurance premiums.

-

However, as pandemic shutdowns persist, it is unclear how long employers can continue providing health insurance to laid-off workers.

Lockdown orders during the early phases of the COVID-19 pandemic led to a massive increase in unemployment, which peaked in April at 14.7 percent. Early estimates suggested that the job losses may have left millions of workers without employer-sponsored insurance . The Employment Policy Institute estimated that 16.2 million workers had lost ESI as of May 2020, and a Kaiser Family Foundation study estimated that 27 million workers and their dependents lost ESI.

But subsequent estimates, including ours for the Commonwealth Fund, pointed to more modest losses. We concluded that between February and June 2020, 7.7 million workers lost jobs with ESI, and the ESI of these workers covered 6.9 million dependents, for a total of 14.6 million affected individuals. Based on evidence from a Commonwealth Fund survey published in June, we suggested that perhaps one-half of these affected individuals would lose ESI. Similarly, an Urban Institute report in July concluded that, on average from April to December 2020, 7.3 million workers and their dependents would lose ESI as a result of the recession.

Can Employers Receive A Tax Credit For Paying Premiums

As a small business owner offering health coverage, you might be eligible for a small business health insurance tax credit. The percentage of health insurance you pay plays a role in whether you can receive the credit.

To be eligible, you must meet the following requirements:

- Pay premiums under a qualifying arrangement

- Have fewer than 25 full-time equivalent employees

- Pay average annual wages of less than $50,800 per full-time employee

- Buy coverage through the SHOP Marketplace

The maximum credit amount is 50% of your contribution towards the employee premiums . The credit is available for a maximum of two years.

The size of the tax credit is based on a sliding scale. Those with lower employee wages get a larger credit.

The SHOP Marketplace can calculate an estimated credit that is paid to your insurance company. The advanced tax credit lowers the amount you pay on monthly premiums. You can also choose to receive the entire tax credit when you file your tax return.

If the credit amount is more than your tax liability, you receive a refund for the difference. If you received an advanced tax credit and your allowable credit is less than estimated, you pay the difference or subtract it from your refund.

Patriots online payroll software helps you accurately deduct premiums from employee paychecks. Take advantage of our free setup and support. Then, complete payroll in three easy steps. Try it for free today!

Recommended Reading: How Much Is Travel Health Insurance

What Are Contribution And Cost

Since group health insurance plans are a form of employer-sponsored coverage, this means that a business is required to share the cost of health insurance with employees. Typically, this cost-sharing element of health insurance requirements refers to a small business splitting monthly premium costs with workers.

In most states, employers are required to contribute or pay for at least 50 percent of each employees health insurance premiums, although this depends on the state the business is located in.

How Can I Lower My Companys Health Insurance Costs

If youre like most employers, the high cost of insurance premiums is a big concern. You may be wondering if theres anything you can do to help control your expenses. Fortunately, there are some strategies that can lead to lower costs:

- Encourage those 65 and older to enroll in Medicare. By having qualified workers secure Medicare coverage, it will lower the average age of your group.

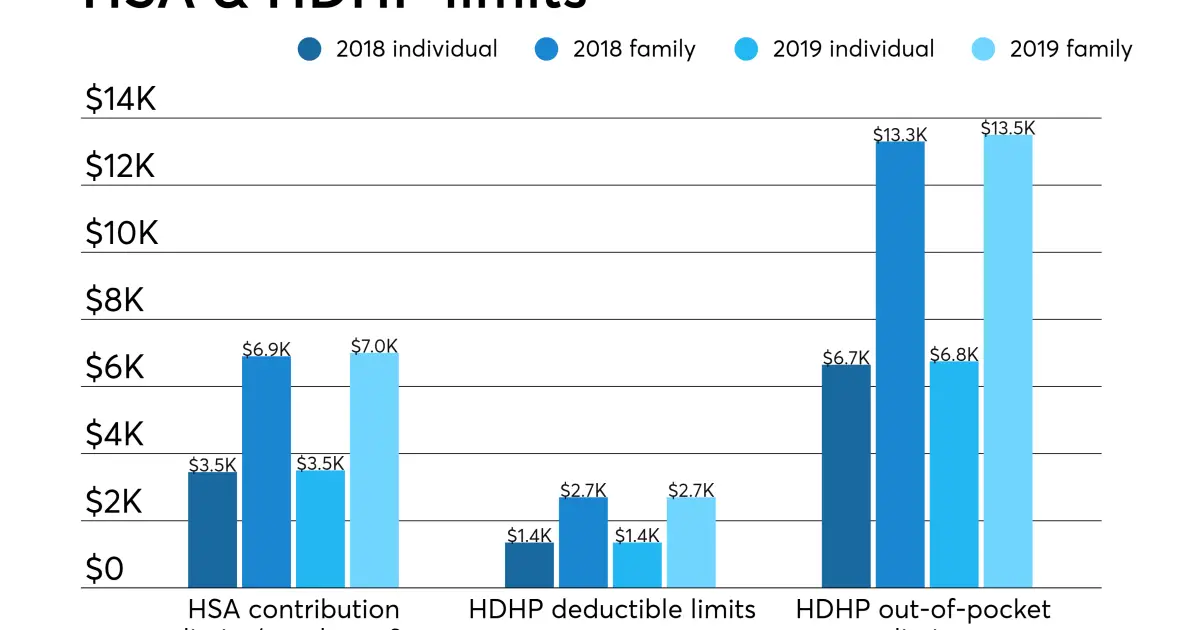

- Increase deductibles. To lower your premiums, shifting more costs to employees by raising deductibles can lower the employer portion of health insurance costs.

You May Like: How Much Is Independent Health Insurance

Claiming The Health Care Tax Credit

You must use Form 8941, Credit for Small Employer Health Insurance Premiums, to calculate the credit. For detailed information on filling out this form, see the Instructions PDF for Form 8941.

If youre a small business, include the amount as part of the general business credit on your income tax return. If youre a tax-exempt organization, include the amount on line 44f of the Form 990-T, Exempt Organization Business Income Tax Return PDF. You must file the Form 990-T in order to claim the credit, even if you don’t ordinarily do so. If you are a small business employer, you may be able to carry the credit back or forward. And if you are a small tax-exempt employer, you may be eligible for a refundable credit.

The 10% Temporary Wage Subsidy For Employers

In response to Covid-19, certain income tax measures have been enacted to provide relief to employers. The 10% Temporary Wage Subsidy is one of these measures that will allow eligible employers to reduce the amount of the payroll deductions required to be remitted to the Canada Revenue Agency. The subsidy is equal to 10% of the remuneration you paid from March 18 to June 19, 2020, up to $1,375 for each eligible employee. The maximum total is $25,000 for each eligible employer. For more information on the TWS, go to 10% Temporary Wage Subsidy for Employers.

You May Like: How To Get Life And Health Insurance License In Texas

Do You Give Your Employee A Benefit An Allowance Or An Expense Reimbursement

Your employee has received a benefit if you pay for or give something that is personal in nature:

- directly to your employee

- to a person who does not deal at arms length with the employee

A benefit is a good or service you give, or arrange for a third party to give, to your employee such as free use of property that you own. A benefit includes an allowance or a reimbursement of an employees personal expense.

An allowance or an advance is any periodic or lump sum amount that you pay to your employee on top of salary or wages, to help the employee pay for certain anticipated expenses without having them support the expenses. An allowance or advance is:

- usually an arbitrary amount that is predetermined without using the actual cost

- usually for a specific purpose

- used as the employee chooses, since the employee does not provide receipts

An allowance can be calculated based on distance, time or something else, such as a motor vehicle allowance using the distance driven or a meal allowance using the type and number of meals per day.

A reimbursement is an amount you pay to your employee to repay expenses they incurred while carrying out the duties of employment. The employee has to keep proper records to support the expenses and give them to you.

Rate And Comment On The Answer

This site uses Akismet to reduce spam. .

The question is what amount is an employer required to pay.Th8s does not answer the question.

To clarify the answer: For the purposes of the ACA and the mandate the employer must cover at least 50% of the employee premium.

From the IRS website: A qualifying arrangement is one where an eligible small employer pays premiums for each employee enrolled in health care coverage offered by the employer in an amount equal to a uniform percentage of the premium cost of the coverage. See the How is the uniform percentage requirement satisfied?

This still does not answer the question. The link you provided demonstrates what a small employer must pay in order to obtain a tax credit. The question is really, what is the minimum percentage amount an employer is required to pay, under the ACA, toward employee premiums, regardless of whether or not they wish to receive tax credits? Can you answer that question, and do so for both large and small employers? Thank you.

So this isnt citing a law, but typically plans require that 50% of the premium is paid by the employer. This just happens to be the same as the max amount an employer can get in tax credits .

The way it is worded on the IRS, in retrospect, leads me to believe that some employers can get away with less and that this is generally discouraged. This has me curious and ill look for an actual rule on this.

Lance,

Mike

Also Check: Can You Put Boyfriend On Health Insurance

Employer Mandate Penalty Amounts And Processes

Examples of employer penalties

| Employer |

|---|

|

1,200 full-time employees Employer offers coverage, but coverage is not affordable and/or doesn’t provide minimum value |

The penalty is triggered if one employee purchases coverage on the Marketplace and receives a federal premium subsidy 250 employees purchase coverage on the Marketplace and are eligible for a subsidy |

Lesser of $2,570 per full-time employee, minus the first 30 employees, or $3,860 per full-time employee receiving a federal premium subsidy 1,170 x $2,570 = $3,006,900 penalty 250 x $3,860 = $965,000 penalty |

Here is a snapshot of the penalty assessment process:

|

Employer offers health coverage compliant with the employer mandate

|

|

Employer reports coverage offer and respective data during the applicable tax season |

|

IRS sends Letter 226J, with an Employer Shared Responsibility Payment assessment based on the data they have processed

|

|

IRS sends Notice 220J, confirming the final penalty amounts owed, which could state no amount is owed after final audit review. |

Read more about employers’ options on the IRS web page, Employer Shared Responsibility Payment Q& As, questions 55-58.

- I want to…

The Coverage Offered By My Employer Doesnt Cover My Spouse What Can I Do

If you spouse still needs health insurance coverage, they can shop on the Marketplace for an Obamacare plan. And if they dont have insurance through their job or your job, they might be able to qualify for a subsidy. If your spouse has a subsidized Marketplace plan and you have insurance through your employer, that might be the most cost effective.

Even if your spouse is eligible for coverage through your employer, they still can elect to shop on the Marketplace. And even if they dont qualify for subsidies, they still might be able to find more affordable coverage for just themselves when compared to coverage through your employer-provided plan.

You May Like: How To Apply For Hip Health Insurance Indiana

How The Applicable Percentage Is Calculated Its Changed A Bit In Recent Years

The general idea behind the adjustment to the applicable percentage table is to keep up with changes in premium growth as they relate to changes in income. If health care costs increase faster than income, we all have to pay a larger chunk of our income for health care. But if the economy does well and the ACAs efforts to curb healthcare spending are successful, its also possible for the applicable percentage to decrease as was the case for 2018 and for 2020.

The formula for the adjustment to applicable percentage is just premium growth since 2013 divided by income growth since 2013. But the methodology for calculating each of those numbers has changed over time.

Premium growth used to be based on average per-enrollee premiums for employer-sponsored plans, in terms of how much those premiums had changed since 2013. But for 2020, HHS finalized a methodology change that incorporates premium changes in the individual market, as well as premium changes for employer-sponsored plans.

This was widely expected to result in an increase in applicable percentages for 2020, but when the numbers were published in July 2019, the applicable percentages for 2020 were lower than they had been for 2019 .

Property Acquired Before 1991 Or From A Non

If you acquired property before 1991, you did not pay the GST/HST. Also, you do not generally pay the GST/HST when you acquire property from a non-registrant. As a result, you cannot claim an ITC under these circumstances. However, if you make this property available to your employee and the benefit is taxable for income tax purposes, you may still be considered to have collected the GST/HST on this benefit.

Example

You bought a passenger vehicle from a non-registrant and made it available to your employee throughout 2020. The passenger vehicle is used more than 90% in the commercial activities of your business. You report the value of the benefit, including the GST/HST and if applicable, the PST, on the employee’s T4 slip. For GST/HST purposes, you will be considered to have collected the GST/HST on this benefit even if you could not claim an ITC on the purchase of the passenger vehicle.

Examples for remitting GST/HST on employee benefits

The following examples will help you apply the rules for remitting the GST/HST on employee benefits.

Automobile benefit See examples in the section on Automobile benefits standby charges, operating expense benefit, and reimbursements.

HST considered to have been collected on the motor vehicle benefit = $5,100 × 14/114 = $626.32

Note

The calculation of the amount of GST/HST you are considered to have collected on the motor vehicle benefit differs from that of an amount calculated on an automobile benefit.

Read Also: Which Health Insurance Covers Ivf

Are Employers Required To Offer Health Insurance To Employee Dependents

Health insurance plans generally allow qualified dependents to be added to any plan. However, for group health insurance plans, it is optional for employers to pay for the health insurance coverage of employee dependents. In most cases, employees can still add qualified dependents to their health plan, regardless of whether their employer decides to contribute to dependents premiums.

Barbers And Hairdressers Taxi Drivers And Drivers Of Other Passenger

If these workers are your employees, you have to deduct Canada Pension Plan contributions, employment insurance premiums, and income tax as you would for regular employees.

When the workers have an interruption in earnings, you generally have five calendar days after the end of the pay period in which an employees interruption of earnings occurs to issue an electronic Record of Employment .

Note

A different deadline may apply if you file the ROE on paper.

If these workers are not your employees, the following special rules apply and you have to report the gross earnings of barbers and hairdressers, taxi drivers, and drivers of other passenger-carrying vehicles on their T4 slip. For reporting instructions, see Guide RC4120, Employers Guide Filing the T4 Slip and Summary.

Barbers and hairdressers

This class of workers is restricted to barbers or hairdressers who provide their services in an establishment that offers barbering and hairdressing services.

CPP contributions and income tax

For CPP and income tax purposes, we consider individuals who are not employed under a contract of service to be self-employed. They are responsible for paying their CPP contributions and income tax when they file their income tax and benefit returns. Do not deduct CPP or income tax from these workers.

EI premiums

There are two ways to determine the insurable earnings for a week, depending on whether you know the workers actual weekly earnings and expenses:

CPP contributions and income tax

Read Also: Is Health Insurance Really Worth It

In A War For Talent Employers Hold The Line On Health Benefit Costs

Companies may be picking up more of the expense while also emphasizing cheaper remote care. Some are offering perks like lifestyle stipends.

- Read in app

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

By Ann Carrns

Home delivery of food and snacks, to replace workplace cafeterias. Health club memberships and lifestyle stipends. Doulas for pregnant workers and breast milk services for new mothers.

Those are some of the perks that employers are offering as open enrollment season gets underway for workers with job-based health benefits. Most employers let workers choose or change benefits once a year, typically for several weeks in the fall.

But while workers may see more perks, they also may find that their health plans offer narrower doctor networks and emphasize less-costly telehealth care, as employers seek to rein in health care costs without making workers pay more out of pocket.

Behind the trends are two major changes a shift to remote work and a challenging labor market. So employers are enhancing some offerings, while also limiting big health premium increases and higher co-payments that might sour employees and give them a reason to seek jobs elsewhere.

There is a war for talent, said James Bernstein, a partner at the benefits consultant Mercer.

Given all the moving parts, employers are taking different tacks to manage costs next year.