How Much Is Health Insurance By Family Size

Not surprisingly, the more people in your family are covered by your health insurance plan, the more youre likely to pay in premiums.

The average cost for a 40-year-old couple is $954 per month or double the cost for an individual in that age range. But adding kids isnt quite as linear. A 40-year-old couple with one child under age 14 would pay an average of $1,230 per month, and a family of five would pay around $1,782.

To estimate the average family’s health insurance cost, MoneyGeek used national averages by age and added the premiums together. Actual family premiums may vary.

Average Health Insurance Premiums by Family Size

Scroll for more

- Couple w/ Three Kids $1,782

It seems logical that families would stick together on health insurance its convenient and easy to do so. And together, youre more likely to meet the out-of-pocket maximum, after which you shouldnt have to pay out-of-pocket costs for covered services.

But some families might be better off on separate plans.

For example, if one spouse can get low-cost coverage through their job, but that plan may not be open to family members , it may make sense for that spouse to use their employer-provided insurance while the rest of the family uses a Marketplace plan.

Or, if one partner has more medical needs and higher costs, they may benefit from paying more for more coverage. But if the other partner has few health needs, they may be better off in a high-deductible plan just for themselves.

How Much Is Life Insurance In British Columbia

The cost of life insurance in British Columbia is about $22 per month on average. The same as any other province or territory in Canada.

PolicyMe provides life insurance in Alberta, Ontario, B.C. and 8 other provinces and territories. Using our life insurance calculator can provide you with a monthly price for life insurance anywhere we offer our services.

How Do Premiums Deductibles Cost

Generally,the more benefits your plan pays, the more you pay in premium. But your medicalexpenses for care are lower.

Toillustrate how these costs may influence your choice of plans, consider the ACAplans.

Inaddition to the metallic plan categories, some people are eligible to purchasea plan with catastrophic coverage. Catastrophic plans have very low premiums andvery high annual deductibles . However, they pay for preventivecare regardless of the deductible. These plans may be a suitable insuranceoption for young, healthy people. To qualify for a Catastrophic plan, you mustbe under age 30 or be of any age with a hardship exemption or affordabilityexemption . Learnmore about Catastrophic coverage.

Recommended Reading: Does Starbucks Have Health Insurance

How Much Is Family Health Insurance Per Month

The average premium for a family of 4 in 2020 is was $1,437, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use, and number of plan members.

Ways To Lower Health Care Costs

So, we talked about how much health insurance costs monthly. Now, lets look at five ways that you can keep health care costs in check:

How much you pay for health insurance varies by plan, but by doing your research and conducting best practices to contain health costs, you can find a plan that works for you and health insurance that doesnt break the bank.

Don’t Miss: Starbucks Open Enrollment

Where Can You Buy Small

- Directly from an insurance provider in your state.

- Using an insurance broker. The broker will shop for policies tailored to your business. Theyll charge a commission , and may also charge a brokers fee. Some payroll products, such as Gusto and QuickBooks Payroll, allow you to buy health insurance from brokers on their platforms.

- Using the Small Business Health Options Program: SHOP is the federal government’s insurance option for businesses with fewer than 50 full-time equivalent employees . Most states require at least 70% of your eligible employees to participate in the SHOP health plan you offer.Businesses with fewer than 25 employees may qualify for a small-business health care tax credit worth up to 50% of premium costs.

- Using a Professional Employer Organization. A PEO is a company you can hire to administer benefits on your behalf. PEOs can legally become the co-employer of your employees. By serving as co-employer for multiple small companies, PEOs have a combined employee pool equivalent to that of a larger company. This gives them access to more competitive insurance rates than small businesses can typically get on their own.

- Qualify for QSEHRA.This is an arrangement for small businesses that offers employee reimbursement for qualified health expenses. Employees are not allowed to contribute through their paychecks and employer contribution terms to each employees QSEHRA must be the same.

The Average Cost Of Health Insurance By Company

What you can expect to pay for health insurance differs by the insurance company. Some insurers want to grow, so they offer more attractive rates. Others are more cautious and will charge more to be sure they can cover their members health care costs.

Among national carriers, rates can vary widely. For example, the average Silver plan premium for Kaiser Permanente plans is $427 per month. Anthem charges an average of $481, while UnitedHealthcares average rate is $641. Newer plans, such as Bright Health and Oscar, fall somewhere in the middle, with average monthly premiums of $488 and $492, respectively.

Premiums are not the only factor when choosing a health plan. Some of the most affordable plans can have coverage that falls short of your needs. The best health insurance companies can cost a bit more, but are surprisingly affordable and give you the best value for your money.

Consider the plan’s total cost by looking at things like deductibles, coinsurance and out-of-pocket maximums. Check that your preferred doctors and facilities are in-network to save money and hassle. Be sure to also review quality and customer satisfaction ratings available on the Marketplace to make sure youre not going to encounter more annoyances than a plan’s potential premium savings are worth.

Average Health Insurance Premiums by Company

Scroll for more

- $641

Don’t Miss: 8448679890

What Is The Aca Health Insurance Marketplace

Established by the Affordable Care Act , the Health Insurance Marketplace is a platform that offers medical insurance plans to individuals, families, and small businesses. Fourteen states and the District of Columbia offer their own marketplaces, also known as exchanges, while the federal government manages a marketplace open to residents of other states. Marketplace plans are divided into four categories that range in cost and coverage. Though offered by private companies, all must meet certain criteria established by the state or federal government.

What Are The Costs Of Not Having Healthcare

There was once a penalty tax imposed on those without healthcare, known as the “.” However, that tax was effectively repealed by the Tax Cuts and Jobs Act, so there are no longer any upfront costs to forgoing healthcare coverage. It’s important to understand that medical debt is among the leading causes of bankruptcy, and you never know when a costly medical emergency will arise, so being uninsured comes with serious financial risks.

You May Like: Does Medicare Pay For Maintenance Chiropractic Care

The Difference Between Extras Policy Types

- Basic: Generally, the most affordable option covers essential treatments with a lower annual limit. For example, general dental, physio and optical

- Mid: A medium-level policy with increased annual limits for a long list of treatments.

- Top: The most comprehensive Extras option, covering an extensive list of general treatment and services, generally, provides the highest benefit limits

What Is The Average Cost Of Life Insurance In Canada

The average cost of term life insurance in Canada is $22 per month for a non-smoking, 40-year-old woman. This is an average rate for $250,000 in coverage over a 20-year policy.

For a non-smoking 40-year-old male, the average cost of term life insurance in Canada is $28 per month with the same policy length and coverage amount.

Keep in mind that these average costs are for PolicyMe as of Oct 2021. By cutting out unnecessary admin and processing costs, weâre able to provide coverage at a better price than our competitors.

And as a general rule, the younger and healthier you are, the lower your premiums will be. But remember, what you pay for life insurance depends on your situation and needs.

Some of the major factors that go into life insurance premiums include your:

- Age

- Coverage amount

- Policy length.

Coverage amount refers to the payout your beneficiaries would receive if you passed away during your policy length. Policy length is the amount of time you are covered for they usually range from 10 to 30 years.

You May Like: Kroger Employee Discount Card

The Cost Of Life Insurance For Children In Canada

The cost of life insurance for children at PolicyMe is free for a coverage amount up to $10,000. Policyholders with children between the ages of 6 months and 18 years old will receive a $10,000 lump-sum payment in the event of their childâs death. Itâs free because weâre focused on protecting Canadian families with the coverage they deserve.

If you would like to get more than $10,000 of coverage, life insurance plans are available for children in Canada. Plans work similarly to life insurance for adults and include term life insurance, whole life insurance and a child term rider.

However, for the average Canadian family, weâd recommend against purchasing further coverage until the child is 18 and can have their own policy. Why? There are a few reasons:

- Kids rarely have their own dependents, so it rarely makes financial sense for them to have a âtraditionalâ life insurance policy.

- Most parents would be better off taking the money theyâd spend on extra child coverage and investing it in other areas to benefit the child.

A child term rider is a plan that adds a fee to their parent’s existing plan and provides coverage until the child is an adult. With PolicyMe, children are covered under their parent’s term life insurance policy for free up to $10,000. We make kids’ coverage effortless, because we know that parents donât have time to waste. So this coverage is applied automatically to each new policy.

How Much Does A Family Health Insurance Plan Cost

BY Anna Porretta Updated on January 21, 2022

Protecting your familys health is important, but so isprotecting your wallet from unexpected healthcare costs. Family healthinsurance keeps both your family and your finances healthy.

If a member of your family has a medical emergency and they are uncovered, you could end up paying the hospital bills and various related costs all out of pocket, which could have the potential to break anyones bank.

Recommended Reading: Insusiance

How To Estimate Your Yearly Total Costs Of Care

In order to pick a plan based on your total costs of care, youll need to estimate the medical services youll use for the year ahead. Of course its impossible to predict the exact amount. So think about how much care you usually use, or are likely to use.

- Before you compare plans when youre logged in to HealthCare.gov or preview plans and prices before you log in, you can choose each family members expected medical use as low, medium, or high.

- When you view plans, youll see an estimate of your total costs including monthly premiums and all out-of-pocket costs based on your households expected use of care.

- Your actual expenses will vary, but the estimate is useful for comparing plans total impact on your household budget.

What Determines The Cost Of A Health Plan

Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each persons age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

Read Also: How To Enroll In Starbucks Health Insurance

What Is Cosmic Inflation And Why Does It Matter

During this period, the universe inflated by a factor of 10^26 in a mere 10^-32 seconds a lifetime compared to the then-age of the universe, but the tiniest sliver of a moment to our more mature eyes. This transformative event, known as cosmic inflation, handily explains some perplexing features found in astronomical observations.

What Other Factors Affect Long

Many factors play a role in the overall costs associated with long-term care coverage, which makes it hard to know what youll pay until you ask for a quote. Keep in mind that the costs associated with this type of care range widely. The type of coverage and your location are important variables. Gender, marital status and provider are the other factors that matter most.

- Gender: Women pay more

- Women tend to have a higher premium cost for long-term care insurance. Thats because women typically live longer. As a result, they may need to use their insurance for a longer period of time than men do. Long-term care insurance claims are more common among women than men.

- Carrier policies: Rates vary by provider

- Every carrier sets its own rates for long-term care policies, creating a large range of rates among providers, based in part on the cost of care in each location and the policy coverage. The best long-term care insurance companies are upfront about both their rates and the factors that play a role in their costs.

Don’t Miss: Starbucks Open Enrollment 2020

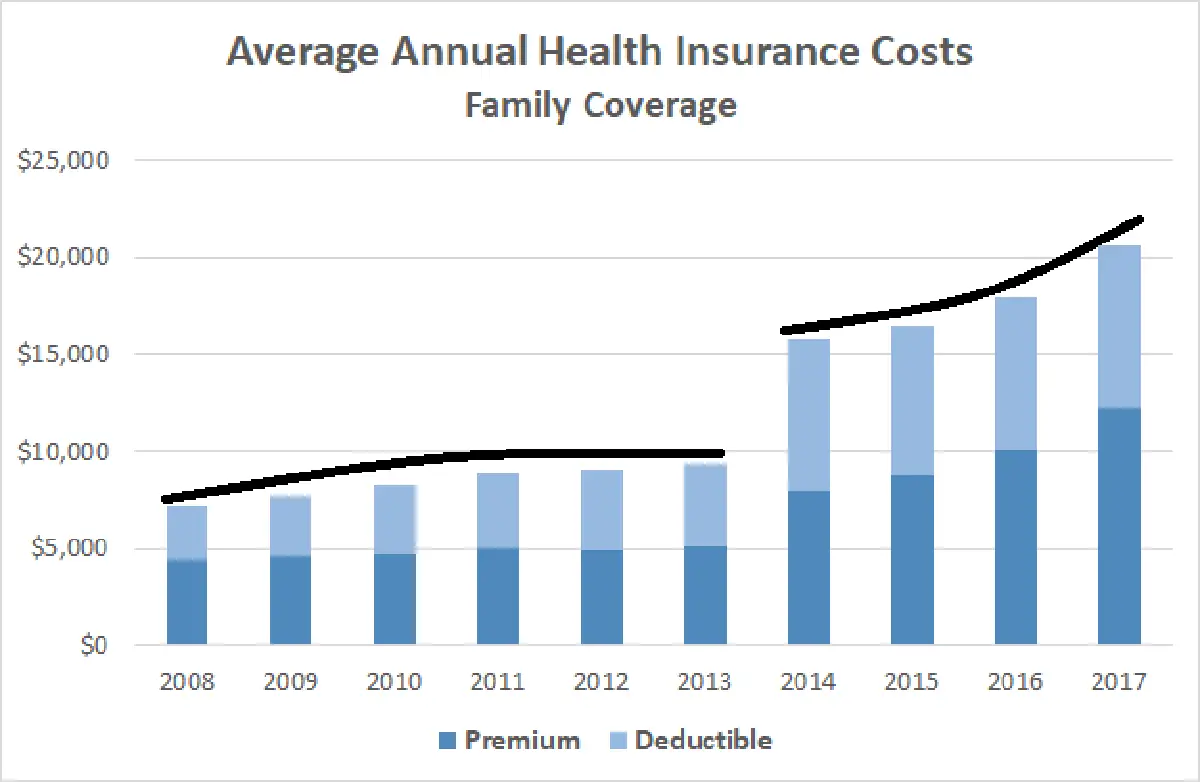

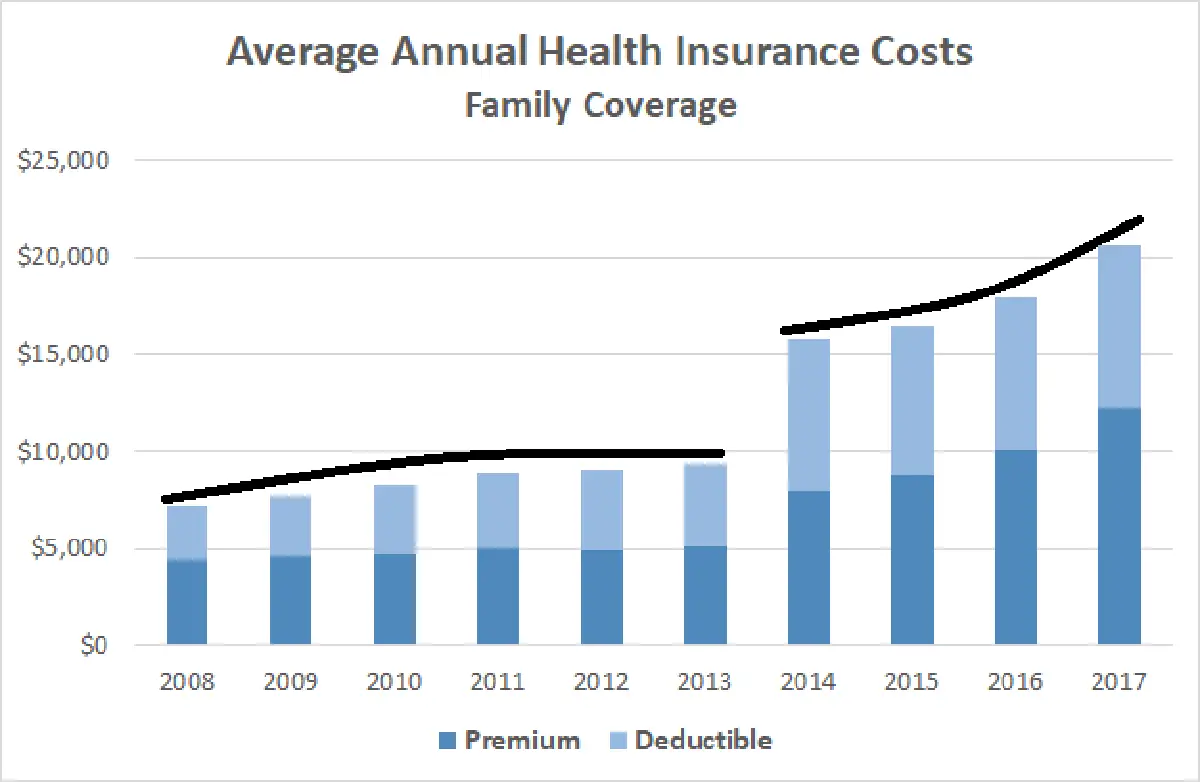

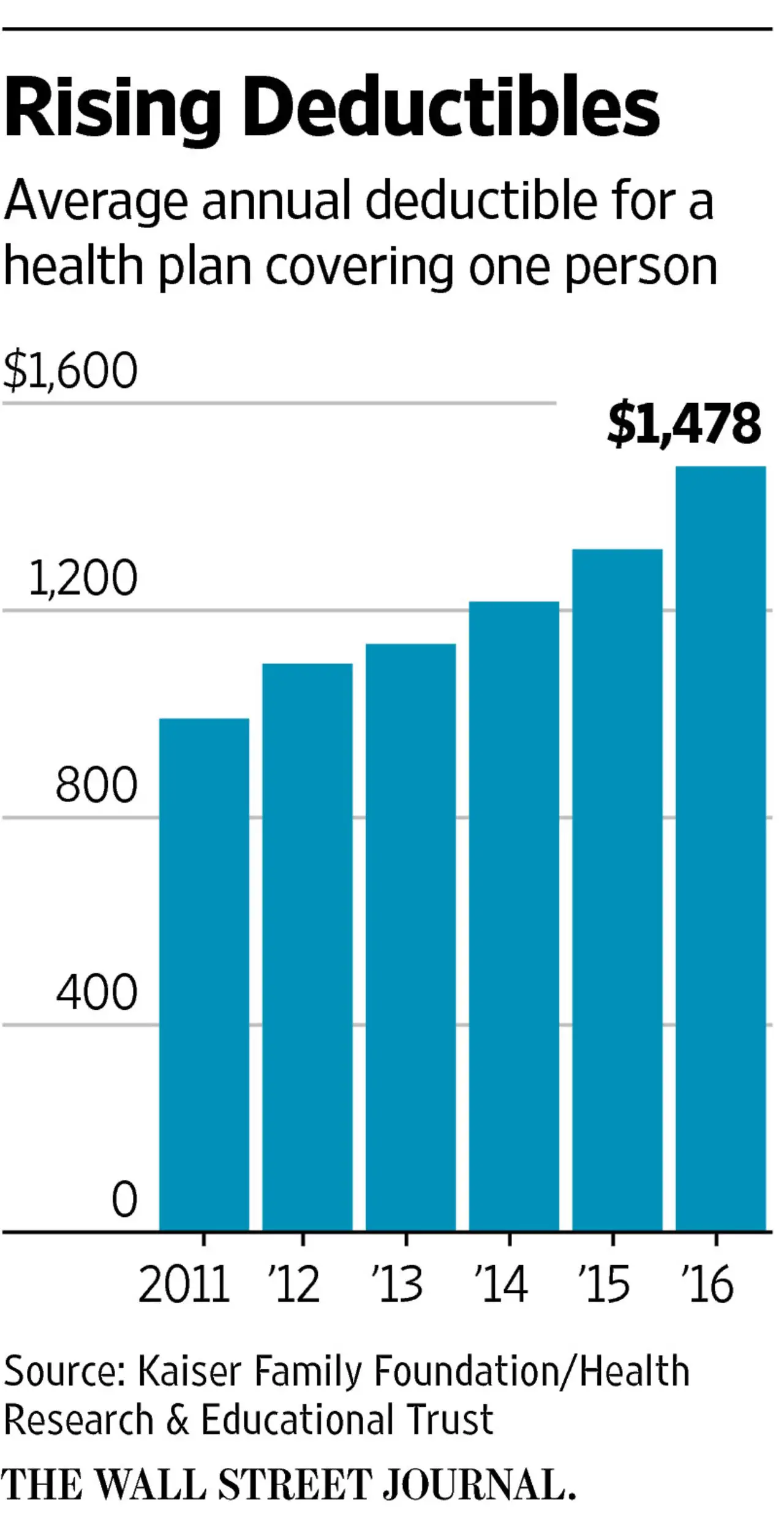

How Premium Costs Have Changed In Recent Years

In recent years, healthcare costs have kept rising for both individuals and families in the U.S. This is also true for monthly and annual insurance premiums. The average yearly premium for a family has increased by more than 25% since 2015, and it’s increased by over 60% since 2010.

Healthcare spending in the U.S. grows each year. Projections estimate yearly annual spending of nearly $6 trillion by 2027, 50% increase compared to the $4.1 trillion spent in 2020.

The Difference Between Hospital Policy Tiers

- Gold: Most comprehensive policy, covering 38 clinical categories. Generally, the most expensive hospital plan that includes pregnancy and birth-related services. Monthly, you can expect for monthly premiums to start at $195.

- Silver: A mid-level hospital policy covering 29 clinical categories, including dental surgery and heart-related services. Premiums for a Silver Hospital policy usually begin at $139 monthly.

- Bronze: An affordable policy covering 21 clinical categories. Generally, excludes joint replacements, as well as services for the back, neck and spine. Policies in this tier usually start at $112 per month.

- Basic: The cheapest hospital plan that covers you for accidents and helps you avoid paying the Medicare Levy Surcharge and LHC loading. Typically you can expect to pay around $101 per month for a Basic policy.

Read Also: Umr Insurance Arizona

The Cost Of Term Vs Permanent Life Insurance In Canada

The type of life insurance you pick will factor into your monthly cost.

There are two main types of life insurance policies available: permanent and term life insurance. Term life insurance tends to be more affordable than permanent life insurance .

- Permanent life insurance policies provide coverage for your entire life and sometimes collect cash value through investments, but the premiums are much pricier. Permanent life insurance policies cost 5 to 10 times more than term.

- Term life insurance policies provide coverage for you during the years you really need it, like when the kids are young or while youâre paying off debt. Terms typically come in the 10, 20, 30 year time frame. Unlike permanent life insurance, term life insurance doesnât have an investment component.

But life insurance is best used to replace your income if you pass away. It’s not necessarily well-designed to help you invest your money. So the cash benefits from a permanent life insurance policy are inefficient at best.

There are many more profitable ways to invest your money other than through a whole life insurance policy. Investment options like RRSPs and TFSAs will make more money for your loved ones after you’re gone.

Below, youâll see a breakdown of how whole life insurance investment measures up against having a term life insurance policy and making regular investments to your RRSP and TFSA.

Additional Family Health Insurance Costs

In addition to your premium and deductible, you can expect other costs with family health insurance, including the following:

- Copayment: A copayment is a fixed amount thatyou pay for a covered service. A copayment may come into effect before or afteryou have reached your deductible.

- Coinsurance: Coinsurance is a percentage you payfor covered service after reaching your deductible. You can expect to paycoinsurance until you have reached your out-of-pocket maximum.

- Out-of-Pocket Maximums: Out-of-pocket maximumsare limits on how much money you are required to pay for coverage. Once youhave reached your out-of-pocket limit, your insurance will pay for 100% of thecost of your covered benefits for the rest of the coverage year.

Don’t Miss: Kroger Associate Discounts

The Average Cost Of Health Insurance By Metal Tier

Plans offered on the Health Insurance Marketplace are categorized into metallic tiers: Bronze, Silver, Gold and Platinum.

The tier corresponds to the value of the coverage, or how health plans and members split the costs. For example, in Bronze plans, the health insurer pays approximately 60% of the costs of care, and the individual typically pays 40%. The provider typically pays 90% in Platinum plans, and the individual pays 10%. These ratios are set by tier and based on expected spending for a typical health plan member.

In MoneyGeeks analysis, the lowest average premiums were $383 per month for Bronze plans. The average Platinum plan, by contrast, costs $782 per month.

Average Health Insurance Premiums by Metal Tier

Scroll for more

- $170$3,501