Finding Your Best Health Insurance Coverage In New Jersey

Your cheapest options for health care coverage will depend on your income level. The state of New Jersey has expanded its Medicaid coverage as part of the Affordable Care Act , which means people whose income is under 138% of the federal poverty level may qualify for subsidized coverage at reduced or no cost.

If you don’t qualify for Medicaid, then your best options for cheap health insurance coverage will be a Bronze or Silver plan through the New Jersey health insurance marketplace. These plans have lower rates, and those with low or moderate incomes can qualify for tax subsidies to reduce monthly costs.

When it comes to the cost of health care, you should take both premiums and out-of-pocket costs into account. Getting the best health plan for your situation is about finding the right balance between the two.

Plans with lower premiums will generally have higher deductibles, copays and coinsurance, which means you will be responsible for a larger portion of costs before the plan’s benefits kick in.

For those people with higher expected medical costs, the best health insurance plan would usually have a lower deductible and a higher monthly premium. Those who are healthier and rarely use medical care should look for the opposite type of plan: low monthly costs with a higher deductible.

Silver plans: Best if you have standard medical expenses

Healthier and younger consumers should consider cheap Bronze plans

What Is The Best Healthcare In New Jersey

Best Health Insurance NJ Provider Reviews Best Overall: AmeriHealth. Best for Newly Insured: Horizon Blue Cross Blue Shield. Best for Affordable Plan Options: Oscar Health. Best for Dental and Vision Coverage: Humana. Ameritas. Best for No Enrollment Period: Sidecar Health. New Jersey Short-Term Health Insurance.

New Jersey Health Insurance Cost Per Person

Average cost calculations for comprehensive group and individual insurance is based on data reported to the state department of insurance. Group insurance is based on 967,294 enrollees and individual insurance is based on 338,589 enrollees. Supplementary vision and dental insurance contracts sold as riders to comprehensive insurance are not included. Medicaid costs are based on data from Macpac.gov divided by the number of people covered based on Kaiser Family Foundation data. Medicaid data includes both state and federal spending. Medicare costs are based on data from CMS.gov divided by the number of people covered based on Kaiser Family Foundation data. CMS data are from 2014, adjusted for health insurance cost inflation rates.

Also Check: Does Starbucks Offer Health Insurance To Part Time Employees

What To Know About Health Insurance In New Jersey

The rates mentioned in MoneyGeeks study are based on plans from New Jerseys private insurance market. However, its still possible to get cheaper premiums based on your unique income and age combination. For instance, older residents or those with a low income may qualify for Medicaid or Medicare, which are cheaper alternatives compared to any other plan on the marketplace.

Number Of People Covered By Type Of Health Insurance

Data from the Kaiser Family Foundation.

Trends identified in the above data include an increase in the number of people with group, Medicaid and Medicare coverage. Conversely, there was a decline in the number of people covered by group coverage. The largest increases were individual and Medicaid coverage with increases of 251,700 and 229,800 people respectively.

Read Also: Does Insurance Cover Chiropractic

What Is The Aca Health Insurance Marketplace

Established by the Affordable Care Act , the Health Insurance Marketplace is a platform that offers medical insurance plans to individuals, families, and small businesses. Fourteen states and the District of Columbia offer their own marketplaces, also known as exchanges, while the federal government manages a marketplace open to residents of other states. Marketplace plans are divided into four categories that range in cost and coverage. Though offered by private companies, all must meet certain criteria established by the state or federal government.

Health Services Use By New Jersey Residents

The tables below show the frequency with which residents use health services. The data are collected from insurance company filings with the state insurance department. The number of enrollees on which data was collected is as follows: Group insurance, 967,294 Individual insurance, 338,589 Medicaid managed care, 1,832,339 and Medicare Advantage, 379,896.

Recommended Reading: Kroger Health Insurance Part-time

What Factors Contribute To The Cost Of An Aca Plan

The cost of your ACA health insurance plan depends on many factors, including:

-

Your household size whether you apply as an individual or a family

-

Your income

-

Where you live often down to the county

-

The type of plan you choose among the metal tiers or a catastrophic plan

-

The subsidies, also known as tax credits, you receive

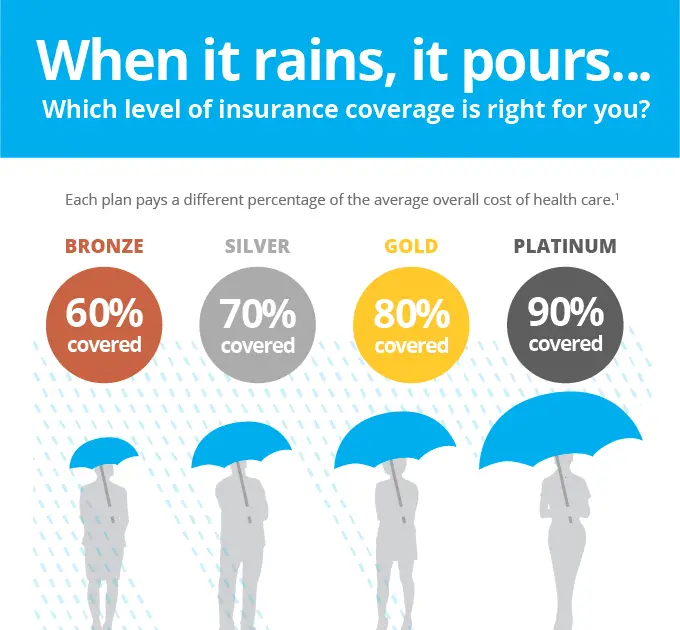

ACA plans are organized into 4 metal tiers: bronze, silver, gold, and platinum.

Bronze plans have the lowest monthly premiums but the highest out-of-pocket costs when you receive care. Platinum plans have the highest monthly costs but the lowest expenses when you access care.

Do Us Citizens Living Abroad Have To Buy Health Insurance

Americans who live abroad, or who spend a large proportion of their time overseas, often find theyll need a separate health insurance policy for this.

One option is to buy local insurance, but this wont cover you for trips home and you may find there are language barriers if you need to make a claim.

International health insurance is a popular alternative for American expats living overseas. With William Russell, English-speaking customer service representatives handle every stage of your claim from our UK offices, so youre in safe hands.

Read more about the difference between travel, local and international health insurance with our FAQ guide.

Also Check: Why Do Doctors Hate Chiropractors

Why Do Us Health Insurance Costs Keep Going Up

The cost of US health insurance has almost doubled in a decade, as the table shows:

| 2010 | ||

|---|---|---|

| Average employer health insurance costs for family coverage | $9,773 | |

| Average employee health insurance costs for worker coverage | $3,997 | $5,588 |

Whats behind this trend is the subject of debate some argue government programmes, such as Medicare and Medicaid , have relieved providers of pressure to keep insurance affordable.

However, its likely that some factors driving up the cost of healthcare in the USA may be similar to those in other countries, including population ageing and an increase in chronic illness. Check out eight main reasons healthcare costs are rising globally.

At the same time, a shift towards high-deductible health plans is increasing the out-of-pocket costs for Americans. Under such plans, families can be asked to pay for their first $14,000 of medical costs, so the impact may be greater even if their insurance package costs the same overall.

Irene Papanicolas

Visiting assistant professor in the Department of Health Policy and Management at Harvard Chan School

Individual Health Insurance Tax Penalties

The Individual Mandate requires most individuals to purchase health insurance, or else pay a penalty on their tax return each year. The intention of the individual penalty is to reduce the “Free Riding” effect in the health insurance market (a free rider is someone who is healthy and does not purchase health insurance until they need it.

Recommended Reading: Part Time Starbucks Benefits

How Do I Enroll In New Jersey’s Health Insurance Marketplace

To enroll in New Jerseys health insurance marketplace, visit the GetCoveredNJ website. If its your first time visiting the site, follow the instructions to create an account. Youll need to provide some basic details, such as your name and contact information. If you already have an account, log in with your username and password.

If youre applying during open enrollment, you can simply fill out the application, compare plans, and sign up for the plan that best meets your needs. Youll also have an opportunity to see if you qualify for help paying your health insurance premiums. If youre applying outside of open enrollment, youll need to select a qualifying life event from the list provided. Qualifying events include marriage, loss of coverage, and loss of eligibility for Medicaid or NJ FamilyCare.

To compare plans, enter your ZIP code, your date of birth, and your annual household income. If other people in your household need coverage, enter their dates of birth. Youll be able to review available plans, check their monthly premiums, and explore the services each plan covers.

If you need local assistance, you can use the Find Local Assistance tab in the portal to find a Certified Navigator. The following companies offer health

The following companies offer affordable health insurance in New Jersey:

- AmeriHealth HMO

- AmeriHealth Insurance Company of New Jersey

- Horizon Healthcare of New Jersey

- Oscar Garden State Insurance Corporation

- Oxford Health Insurance

How Much Is Health Insurance

The average American spent $3,667 on health insurance in 2020, according to the Bureau of Labor Statistics. And per to the Kaiser Family Foundation, the average person’s monthly premium for plans made available through the Affordable Care Act during open enrollment for 2019 was $612, before subsidies. Thats 1.5% less than 2018 but about 29% more than 2017 .

Recommended Reading: Starbucks Part Time Insurance

How To Get The Best Health Insurance

If youre looking to purchase health insurance on your own, you can just go to the websites of major health insurance companies in your area and see what plans they provide. You can compare plans on your own, although quotes will vary pretty widely.

But lets face it. This is a ton of work. Choosing the right health insurance plan for you or your family is a daunting task. And you probably have better things to do with your time than sifting through endless health insurance quotes.

Thats why I recommend using our trusted and independent insurance agents for your health insurance needs. Theyll look at your situation and compare the best rates so you can get the coverage you need. Theyll help you understand the marketplace or even what your employer is offering. And the best thing? Theyre free!

Connect with one of our insurance agents today.

About the author

George Kamel

George Kamel is a personal finance expert and host of The Fine Print Podcast. Since 2013, George has served at Ramsey Solutions where he teaches on how to spend less money, save more, and avoid consumer traps. He is also the host of The EntreLeadership Podcast.

Which Aca Health Insurance Plan Costs The Least

There are four metal tiers of plans for Obamacare: bronze, silver, gold, and platinum. Looking at the most common tiers , the average Marketplace premium decreased in each between 2018 and 2020.

- The average lowest-cost premium for bronze coverage was $340 in 2019, $331 in 2020, and $328 in 2021.

- The average lowest-cost premium for silver coverage was $454 in 2019, $442 in 2020, and $436 in 2021.

- The average lowest-cost premium for gold coverage was $516 in 2019, $501 in 2020, and $482 in 2021.

Those average numbers can be deceiving. Your total costs may vary, depending on factors such as how much the out-of-pocket costs are for each category of plan, whether you qualify for a subsidy, and the actual cost of each tier in your area.

According to the Kaiser Family Foundation, insurers have lowered the cost of gold plans in recent years more than they’ve dropped the cost of silver plans, so that in some cases, the monthly cost of a silver plan is equal to or above that of a gold plan. Insurers generally load extra costs entirely onto the silver tier. That is known as silver loading and could impact your choice of a plan if you are unsubsidized.

Get quotes for all metal tiers when comparing coverage options.

Also Check: What Insurance Does Starbucks Offer

Insurance For Families In New Jersey

If youre shopping for coverage for multiple people, you need to consider your choices even more carefully. A single person without any health problems has a lot more flexibility than a consumer with a spouse or multiple dependents. For example, if you have kids, youll want to look for a plan that offers coverage for pediatric care. If your spouse has diabetes, then youll want to look for a plan that covers endocrinology care and has reasonable copays for insulin and other diabetic medications.

The type of plan you select is also important, especially if anyone in your household has a chronic health problem. If one of your dependents has kidney disease, for example, you may want to choose a PPO plan so you dont have to ask for a referral every time they need to see a specialist. If everyone is in good health, then it may make sense to choose an inexpensive HMO plan to save money on your monthly premiums.

You Have More Insurance Options For Your Health Than You Think New Jersey

If youre self-employed or without insurance from your employer in other words, youre looking for individual or family health insurance in New Jersey you might be looking for Affordable Care Act insurance, what’s often inaccurately referred to as Obamacare. However, we want to make you aware of the whole range of individual and family insurance products we have available in your state.

Read Also: Starbucks Health Insurance Deductible

Your Situation Can Help You Determine The Right Plan

Our health insurance plans are as different as the people they protect, so its important to understand what kind of plan best fits your needs. We offer a variety of family and individual health plans so whatever your situation, AmeriHealth New Jersey can meet your needs. To learn about and compare AmeriHealths individual health insurance plans, you can go straight to Individual health insurance plans explained.

To start, tell us a little bit about yourself, and we can help you pinpoint the things you should pay attention to when picking a health plan.

How Does Health Insurance Work

Every month, youll pay your health insurance company a premium that keeps your health insurance NJ coverage current. Youll also pay a set dollar amount out-of-pocket toward your own medical care costs this is your plans deductible. Once you meet your deductible, you only need to pay a set percentage of your medical bills called a coinsurance percentage. Your plan will also include an out-of-pocket maximum that limits the total amount of money you can spend per year on healthcare.

Health insurance plans can cost hundreds of dollars per month are they really worth the cost? Its always a good idea to maintain some type of coverage. Here are just a few of the benefits of having health insurance:

- Insurance helps you pay your medical bills. If you dont have health insurance, you must pay for 100% of your medical care costs. This can mean spending upwards of $4,000 per day you spend in the hospital and upwards of $170,000 for a major, life-saving surgery.

- An illness can strike at any time. You shouldnt wait for a new job or upcoming marriage to get coverage. An illness or accident can hospitalize you at any time and you need to be protected.

- You might be breaking the law. As a resident of New Jersey, youre required to have some form of long-term health insurance unless you qualify for an exemption.

Don’t Miss: How Much Does Starbucks Health Insurance Cost

How Do Health Insurance Subsidies Work In The Usa

A health insurance subsidy provides government assistance to contribute to the cost of cover in the USA, the Affordable Care Act provides a sliding scale of support to US citizens and legal residents earning four times the federal poverty level or less.

In 2021, the federal poverty level is $12,880 for an individual, so individuals earning less than $51,520 may be entitled to subsidised health insurance.

Applications are made through the government-run health insurance marketplaces in each state. Changes to incomes may affect eligibility, so applicants sometimes need to pay subsidies back if circumstances change.

Average Health Insurance Cost By Plan

Less surprising, though, is how the cost will differ based on the plan you use. After all, different plans offer different services, and those with more services and flexibility come at the price of a higher premium.

The four types of plans you may be able to get for your health insurance are a health maintenance organization , point-of-service , preferred provider organization and exclusive provider organization . Per ValuePenguin, the average monthly rate for a 21-year-old on each plan is:

- HMO: $230

Read Also: Do Substitute Teachers Get Health Insurance

Change In Average Health Insurance Cost For 2022

From 2021 to 2022, health insurance rates across the nation increased by less than 1%. South Dakota saw the largest year-over-year jump in health insurance costs for a 40-year old on a silver plan increasing just over 23%. Including South Dakota, 27 states had their rates increase on average from 2021 to 2022.

Year-over-year rates decreased the most in Georgia, South Carolina and Nebraska, which all fell by more than 10% . Overall, 21 states experienced a decrease in health insurance premiums. Two states Idaho and Virginia saw no year-over-year change.

| State |

|---|

Policy premiums are for a 40-year-old applicant on a silver plan.

Average Cost Of Health Insurance

One of the primary factors in your individual health insurance costs is your location, as prices will vary depending on the state and county in which you live. In this first table, we look at health insurance premiums for 2022 and how they differ by state.

| State |

|---|

Policy premiums are for a 40-year-old applicant on a silver plan.

Recommended Reading: Starbucks Employee Health Insurance

Cheapestepo/hmohealth Insurance Plan In New Jersey

Your medical needs are a significant factor to consider when choosing your healthcare plan. In New Jersey, there are two plans you can choose from: a Health Maintenance Organization plan and an Exclusive Provider Organization plan.

If you need a more affordable option, you may opt for an HMO plan. Note that this comes with limitations, as you need to stick to your provider network and get a referral to see a specialist. For more flexibility, EPOs let you go out of your provider network in case of an emergency, and you wont always need a referral to see a specialist.

For residents looking for cheap health insurance in New Jersey, MoneyGeek identified the most affordable options in the state for all plan types within the Silver tier:

- HMO: The IHC Select Silver HMO Local Value $50/$75 by AmeriHealth HMO, Inc., which costs an average of $387 per month for a 40-year-old.

- EPO: The IHC Select Silver EPO HSA AmeriHealth Hospital Advantage $50/$75 by AmeriHealth Ins Company of NJ, which costs an average of $377 per month for a 40-year-old.