What You Need To Apply

- Social security numbers for applicants who have them

- Immigration document numbers for non-citizens

- The name, address, contact info, and birth date for applicants

- Employer and income information for everyone in your household. Examples include pay stubs or W2 forms.

- Other income information including Social Security Administration or Supplemental Security Income payments and mentions

- Information and policy numbers for health insurance plans covering members of your household, including Medicare

We may ask for more information if we cant verify what you tell us through our electronic data sources.

Apply now

Open Enrollment Season Guide

Because there are many more people than need help than can be helped individually, I created this easy to follow video guide for Open Enrollment to help people get health insurance through the exchange, understand what cost saving programs theyre eligible for and how to avoid pitfalls. Grab a cup of coffee and watch the video. Then simply follow the videos instructions, step by step. Please note the income levels to qualify for financial assistance change from year to year and are now higher than those shown in the video.

Thank you!!

Please watch the video and carefully read through the information below, as the information below answers most questions.

If you find this helpful, please share this page on Facebook.

Depending on household income levels, you may be eligible for subsidies that immediately reduce your health insurance premiums. Theses Federal subsidies are Advance Premium Tax Credits. They are NOT available to people eligible for Medicaid or Medicare or who have affordable coverage available through an employer.

The Advance Premium Tax Credits are based on the size of your household and your households estimated income for 2022.

Will I Need To Get A New Doctor

That depends. Connect for Health Colorado offers plans from a variety of insurance providers including Anthem Blue Cross Blue Shield, Bright Health, Cigna, Denver Health, Rocky Mountain Health Plans/UnitedHealthcare and others. However, insurance companies may have different networks of doctors or providers for different plans, so before you select a plan, you may want to check its provider network to see if your doctor is included. You can also contact the insurance company to learn more about in-network versus out-of-network providers and what that means for you and your costs.Connect for Health Colorados quick cost & plan finder tool shows you which medical providers or facilities accept which plans.

Recommended Reading: Does Health Insurance Pay For Abortions

Determine Size Of Your Household

| DO Include | |

|

|

What Plans Are Available

Most Connect for Health Colorado plans are organized into three categories:

- Bronze plans have the lowest monthly premiums, the highest deductibles and copays, and cover roughly 60 percent of care costs. These plans are designed for those who are healthy and rarely go to the doctor.

- Silver plans have moderate monthly premiums, deductibles and copays. They cover about 70 percent of care costs and potentially much more, if you come from a lower-income household and qualify for cost-sharing reductions a subsidy only available through silver plans.

- Gold plans have higher monthly premiums, lower deductibles and copays, and cover roughly 80 percent of care costs. These plans are intended for those with medical conditions that require ongoing attention.

Coloradans under 30 can also apply for a catastrophic health plan that offers a low monthly premium, a very high deductible and exists to protect customers in worst-case scenarios.Connect for Health Colorados Quick Cost & Plan Finder tool helps you estimate costs and benefits of various plans and check whether you might qualify for financial assistance. The site also offers tips for choosing the plan thats right for you.

Recommended Reading: How To Get Health Insurance In France

How To Become An Insurance Agent In Colorado

: Ethan Peyton

Getting your Colorado insurance license is the first step to becoming an insurance agent in Colorado. Whether youre interested in selling property and casualty insurance, life insurance, health insurance, or any combination of those lines of authority, this article has the information you need to get started.

The Colorado Division of Insurance has a 5-step process to getting your insurance license. Well walk you through step-by-step from the license application to insurance test prep, to the Colorado insurance exam, and beyond.

This guide has everything you need to know to get your Colorado insurance license quickly and easily.

What Does Cicp Cost

- You are responsible for co-payments for services you receive.

- Co-payments will vary depending on the medical services you receive.

Read Also: Can You Get Health Insurance Immediately

What Income Should I Include On My Application For Financial Help

| The income you report on your application that we use to determine how much financial help you can receive is called your Modified Adjusted Gross Income . In general, it is your estimated adjusted gross income plus any non-taxable Social Security, tax-exempt interest, or foreign income you have for the year for which you are applying. Remember to report income changes to Connect for Health Colorado to make sure youre getting the right amount of Premium Tax Credit during the year. Information about how to file taxes, including what incomes and allowances should be included, can be found on the IRS website. |

Connect For Health Colorados 3 Primary Paths

Path 1) Obtaining Advance Premium Tax Credits: In order to get an Advance Premium Tax Credit, you must first apply for Medicaid using the PEAK system and be denied. After you are denied, the PEAK system will provide you a denial code. It typically takes anywhere from an instant response to 2 weeks to get your Medicaid denial code from the PEAK system. You can call 800-359-1991 or 800-221-3943 between 8:00 a.m. and 6:00 p.m. Monday-Friday to check the status of your Medicaid application. Youll need to provide your Application Tracking Number, which was provided on the final screen of the PEAK systems online application.

After getting your Medicaid denial code from PEAK, then log into Connect for Health Colorado, click the blue Eligibility button, enter the denial code and complete your application for the Advance Premium Tax Credit. This takes about 20 minutes and once that is done then you will be able to browse plans and see the final premiums, for all plans offered, less the Advance Premium Tax Credits you qualified for. Then its a simple matter of adding the chosen plan to your shopping cart, checking out and paying the initial months premium.

Money Saving Reminder If your household income is between 138% and 250% of the Federal Poverty Level be sure to check the Silver plans, as they may have very attractive cost sharing reductions like lower deductibles and out of pocket maximums. Youll only find these on the Silver plans. Cha Ching!

Recommended Reading: Does Short Term Health Insurance Cover Pregnancy

Health Insurance Options In Colorado

Colorado health insurance costs decreased in 2020 and will remain low in 2021. In October 2019, the state announced that rates for healthcare plans on the state exchange would fall by an average of 20% in 2020. A year later it announced that low rate would dip even further , despite the economic upheaval brought about by the pandemic.2 For many, the rate reductions were significant. And, if you qualify for subsidies, your premiums can be even lower, making insurance more affordable.

In January 2014, Colorado expanded Medicaid coverage through the Affordable Care Act, including more adults and former foster children up to the age of 26. Thanks to the expansion, more than 400,000 Coloradans were covered.3

In Colorado, your healthcare coverage options are dependent on your age, employment status, and income.

One thing to note is that short-term insurance plans are not an option in Colorado. Recent regulations affected short-term policies, causing insurers to cease operations in the state.

Check a 2021 subsidy chart and calculator to see which subsidies you might qualify for.

Which Doctors Can I Visit

CHP+ works with Managed Care Organizations to provide health care to you or your child. Each MCO has their own network of doctors that you or your child can see on CHP+. The county you live in will determine which MCO you or your child enrolls with.

Your CHP+ MCO can help you find a doctor for you or your child.

Don’t Miss: Can You Have Double Health Insurance

Will My Family Members Qualify For The Same Health Plan That I Do

It depends. Some family members may qualify for subsidies to enroll in a private health insurance plan while other family members qualify for public plans like Health First Colorado or CHP+. Family members in the same household may qualify for different programs because of their age, income, disability, or caregiver status or immigration status. Such families may still be able to see the same doctor or go to the same medical practice, depending on the types of insurance plans accepted or whether their provider accepts Medicaid coverage.If you’re not sure what makes the most sense for your family, get free advice from a certified insurance broker.This guide, originally published on June 23, was updated on Oct. 1 to include information about open enrollment and COBRA.

Which Insurance Licenses Do You Need

The first step to getting your insurance license is choosing which licenses you need. The most common licenses new insurance agents get are the property & casualty license , life and health insurance license .

The types of insurance products and policies youll be selling will determine which licenses you need. Here are some examples of the types of policies you can market with each license:

- Life and Health Insurance License Life Insurance, Annuities, Medicare, Health Insurance, etc

Most insurance agents and producers choose to get both P& C and L& H licenses, but if you plan on specializing in only one category then you dont need every license.

Insurance adjusters require a separate license. You can find more information on becoming an insurance adjuster here: Colorado Insurance Adjuster License

Note:

You May Like: Are Daca Recipients Eligible For Health Insurance

What About New Federal Assistance For Premiums

Every eligible household that pays insurance premiums that exceed 8.5 percent of annual income now qualifies for federal tax credits for insurance premiums.For example, a single 64-year-old filer earning $51,000 per year could potentially save more than $8,000 with the new tax credits, according to the Kaiser Family Foundation.

What If I Need Immediate Care

You may qualify for a program called Presumptive Eligibility . PE is a way for children and pregnant women to receive care right away without having to wait to see if you are eligible. To apply, you must visit a PE Site and they will do a quick review. If found eligible you will get enrolled for up to 60 days while you wait to see if you qualify. Find a PE Site in your area.

Recommended Reading: How To Get Health Insurance For My Family

What Is A Special Enrollment Period

| A Special Enrollment Period is a period of time outside of the annual Open Enrollment Period during which you and your household can shop for and enroll in a health insurance plan. You might qualify for a Special Enrollment Period if you or someone in your household experiences a Life Change Event, such as losing health insurance coverage from a job, moving, getting married or having a baby. |

How Long Will It Take For My Health Insurance Application To Be Approved

I am often asked how long it takes to get an application for health insurance approved. The answer is always the same, it depends on how long the insurance company takes to review or underwrite the information you submit. Underwriting is a term insurance companies use that basically means background check. Individual health insurance companies have the ability to pick and choose to whom they will offer coverage. So, they require that you fill out an application form, answering a comprehensive list of personal medical and life style questions.

Once they receive this information from you, the underwriting begins. In addition to reviewing the information you have provided, they may plug your Social Security number into something called the Medical Information Bureau . The MIB is a sort of clearing house that collects patient information from doctors, hospitals, pharmaceutical companies and other insurance companies.

The underwriters may also call the applicant for clarification of details and, if need be, request records from your doctor before they are ready to make a decision on the application. The more information they need, the longer it takes for them to make an offer.

That is why it is important to work with a knowledgeable insurance broker to fill out an application properly to avoid misunderstandings and delays from the onset.

You May Like: What Jobs Give Health Insurance

Connect For Health Colorado Marketplace

Connect for Health Colorado may also help you meet the insurance requirement. Having health insurance can help protect your health and your financial future.

- If you dont have health insurance but make too much money for Health First Colorado, Connect for Health Colorado can help you learn if you qualify for federal financial assistance to help lower the costs of your insurance.

- If you do have health insurance, you still have the option to shop for a new plan at Connect for Health Colorado.

You may also be able to qualify for financial assistance through Connect for Health Colorado outside of open enrollment if you have experienced a qualifying life event such as losing your job-based coverage, getting married, or having a baby. Visit ConnnectforHealthCO.com for more information.

Health Insurance More Important Than Ever This Year

In todays world, more than ever, everyone should have the protection of health insurance. The current Covid-19 pandemic has demonstrated how major medical events can happen to any of us, old or young, strong or healthy. While health insurance cannot keep you from getting sick, it can make it easier and less expensive to get the care you need without jeopardizing your health or financial future. Given the challenges we know people are facing during COVID-19, San Juan Basin Public Health wants to help you get the protection you need during these trying times.

Fortunately, almost everyone who needs health insurance will soon be able to enroll in the plan of their choice with the help of Connect for Health Colorado and SJBPH. The majority of applicants will be eligible for financial help paying for their insurance. Connect for Health and SJBPH do not sell insurance but make it easy to find the best plan for you and your family and we help make sure you dont pay any more for it than you need to.

Recommended Reading: Do Colleges Offer Health Insurance

Where To Apply For Health Coverage

People in most states use HealthCare.gov to apply for and enroll in health coverage.

If your state appears on the list below, you wont use HealthCare.gov. Youll use your states website to enroll in individual/family or small business health coverage, or both.

Covered California is your state’s Marketplace. Visit Californias website.

Chp+ Managed Care Organizations

CHP+ members are enrolled into a Managed Care Organization . An MCO is a group of doctors, clinics, hospitals, pharmacies, and other providers who work together to help meet your health care needs. Each CHP+ MCO uses its own group of hospitals, pharmacies and doctors for the counties it serves.

There are five CHP+ MCOs in Colorado: Colorado Access, Kaiser Permanente, Rocky Mountain Health Plans, Friday Health Plans, and Denver Health. The county you live in will determine which MCO you or your child enrolls with. If more than one MCO is available in your county, a health plan will be selected for you, but you can change MCOs for up to 90 days after you qualify for CHP+.

If you have any questions, please contact your MCO or visit their website:

- Colorado Access -Customer Service 214-1101 – coaccess.com

- Friday Health Plans -Customer Service 589-3696 or 475-8466 – fridayhealthplans.com

- Denver Health Medical Plan -Customer Service 700-8140 – denverhealthmedicalplan.org

- Kaiser Permanente -Customer Service 338-3800 – kaiserpermanente.org

- Rocky Mountain MCO – Customer Service 346-4643 – rmhp.org

Also Check: What Is The Best Health Insurance For College Students

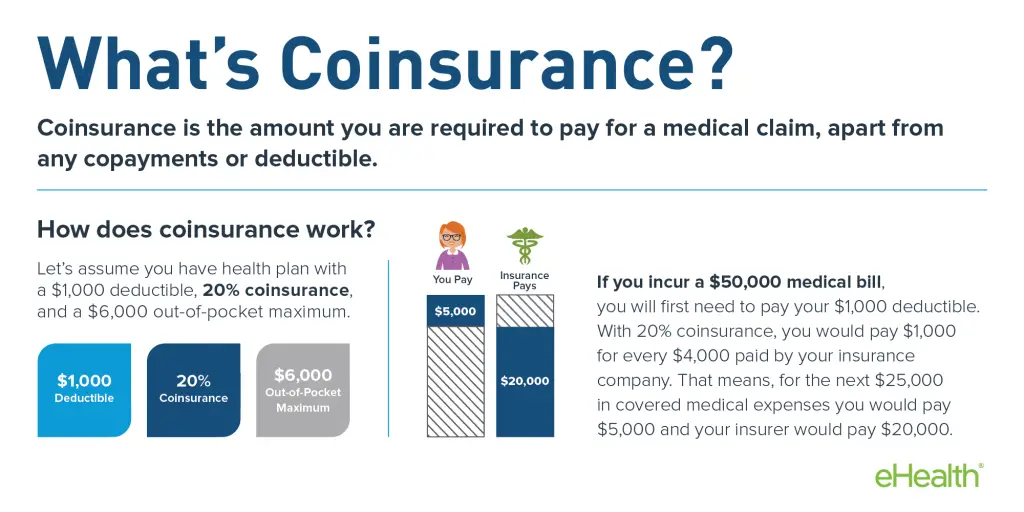

What Is A Premium Tax Credit

A Premium Tax Credit is a financial help program designed to lower the monthly cost of health insurance for individuals and families. To be eligible for a Premium Tax Credit, you must buy your health insurance plan through Connect for Health Colorado and meet the income requirements. You can take the Premium Tax Credit in advance and apply it to the monthly premium, or you can wait and take it when you file your federal income taxes.

If you qualify for a Premium Tax Credit, you may also qualify for additional financial help in the form of Cost-Sharing Reductions. You can determine which financial help programs you and your family qualify for by completing an application.