How Can I Get More Information

For more information about your coverage offered by your employer, please check your open enrollment materials, which include the annual Health Benefits Decision Guide and the online health planâs summary plan description . You may also contact your health plan or your benefits/payroll/personnel office. Retirees may contact ETF.

The Marketplace can help you evaluate your coverage options, including your eligibility for coverage through the Marketplace and its cost. Please visit HealthCare.gov for more information, including an online application for health insurance coverage and contact information for a Health Insurance Marketplace in your area.

Donât Miss: How To Get Health Insurance As A Real Estate Agent

Average Cost Of Health Insurance

One of the primary factors in your individual health insurance costs is your location, as prices will vary depending on the state and county where you live. In this first table, we look at health insurance premiums for 2021 and how they differ based upon the state you reside in.

| State |

|---|

Recommended Reading: How Much Is Health Insurance When You Retire

Will I Be Penalized If I Don’t Have Health Insurance

You won’t be fined by the IRS for not having health coverage in 2022but there are several disadvantages to being uninsured. The tax penalty under Obamacare vanished in 2019, so if you don’t have health insurance, you won’t be penalized.

However, some states have passed their own health insurance requirements, resulting in a state-level tax fine if you go without coverage.

Massachusetts, New Jersey, Vermont, California, Rhode Island, and Washington D.C are among the states that have enacted their own health insurance rules.

You May Like: How Do I Find Health Insurance

Wisconsin Health Insurance Companies

- Compcare Health Services Insurance Corp.

- Dean Health Plan

- Group Health Cooperative of South Central Wisconsin

- HealthPartners

- Molina Healthcare of Wisconsin, Inc.

- Network Health Plan

- Quartz Health Benefit Plans Corporation

- Security Health Plan of Wisconsin, Inc.

- WPS Health Plan, Inc.

Although there are 14 companies across the state, most counties only have two or three health insurers to choose from, and no health insurance company is available in every county. When possible, we recommend starting your search with either Common Ground Healthcare Cooperative or Dean Health Plan, as they usually offer the cheapest Silver plans in a given county.

What Are Wisconsins Medicare Options For Seniors And People With Disabilities

The Medicare program is a federally funded program for retirees and those with qualifying disabilities. Wisconsinites can choose from the original Medicare program and Medicare Advantage plans through health insurance companies.

- Original Medicare is Medicare Part A, which covers inpatient care, and Part B, which provides coverage for preventive care, medical transportation, testing, medical equipment, and supplies. You can enroll in Medicare Part D, which covers prescription medications.

- Medicare Advantage Plans provide Wisconsin residents with the option to customize their coverage. Some Medicare Advantage Plans offer a prescription drug plan, plus vision and dental coverage not provided through Medicare Part A or B.

You can enroll in a Medicare Supplement Insurance plan to offset your out-of-pocket expenses. Wisconsin requires more coverage for Medigap policies than other states, such as copayments for nursing care and limited home health care. These plans usually cover 25% or 50% of your out-of-pocket expenses. You can choose a deductible that suits your needs.

Medicare Resources

For further assistance or if youve got more questions about Medicare enrollment, you can contact the Wisconsin Department of Health Services by calling 608-266-1865.

Read Also: What Causes Health Insurance Premiums To Increase

You May Like: How Much Does Single Person Health Insurance Cost

Apply For Your License

Once you pass the exam, you have 180 days to apply for your license. If you want to apply for your license online, you can do it 48 to 72 hours after you pass by visiting the NIPR website. The application fee is $10, and theres an additional NIPR fee of $5. The state of Wisconsin has some helpful tips you can use when applying. Generally, applications are processed 2 weeks after theyre received. Youll receive an email notice from the licensing department with verification.

Complete All Prelicensing Education Requirements

Before you can apply for your Wisconsin insurance license or take the exam, you need to complete prelicensing education: classroom, self-study, or a combination of both. There are different requirements for the different types of licenses, but all require 8 hours of education on the principles of insurance, general Wisconsin insurance laws, and ethics. The intermediary license requires 12 additional hours for the major and limited insurance lines: life, accident and health, property, casualty, personal, variable life/variable annuity, credit, and title. You can get more details here.

After you finish your courses, you will receive a certificate of completion from your education provider. Hang onto ityoull need to bring it with you when you take your licensing exam.

Also Check: What Is Employer Group Health Insurance

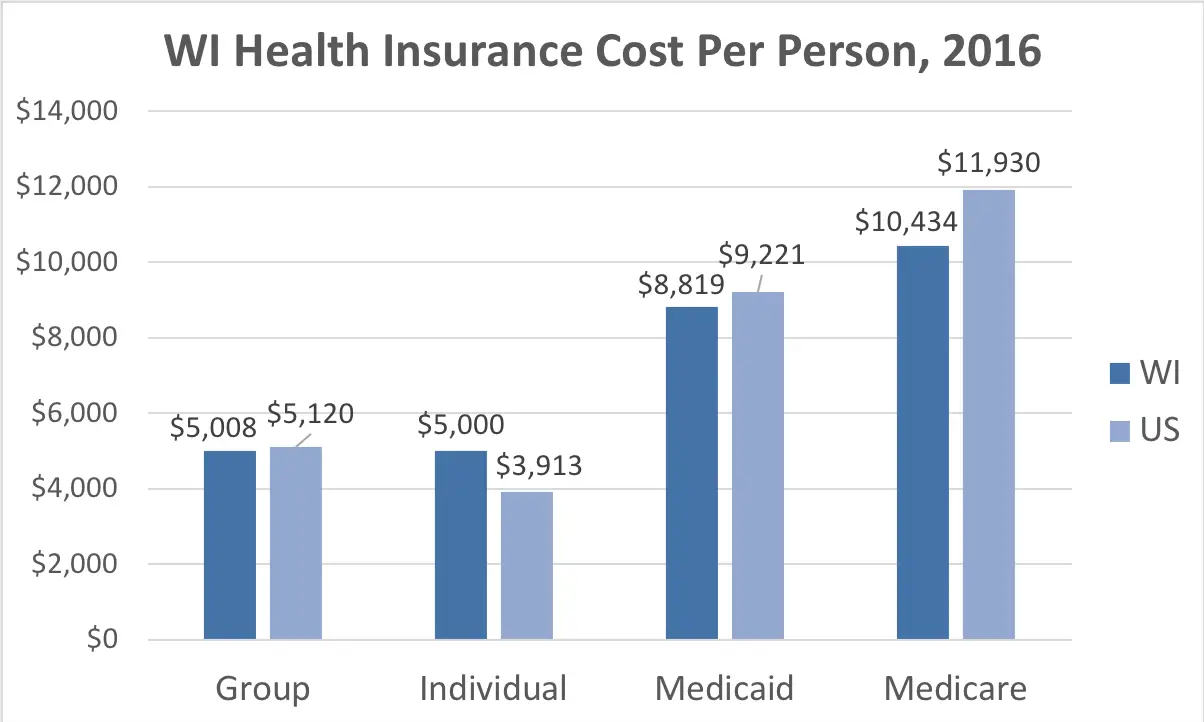

The Effect Of Insurance Deductibles On The Cost Of Health Care

WI residents insured through group, individual and medicare health plans generally have a deductible. Deductibles define the amount of the medical expenses the insured person must pay before the insurers coverage begins to pay the medical bills. The deductible amount depends on the insurance plan. Generally speaking, individual insurance has larger deductibles than other plans. Deductibles have the effect of increasing the cost of the insurance for people that file insurance claims. For example, a person on an individual plan paying the average price of $5,000 with a relatively common $6,000 deductible has an effective price of approximately $11,000, if they use their insurance.

Recommended Reading: How Much Do Federal Employees Pay For Health Insurance

How Much Does Health Insurance Cost Per Month In Each State

The national average health insurance premium for a benchmark plan in 2021 is $452, according to the Kaiser Family Foundation. A benchmark plan is the average premium for each states second lowest cost silver plan.

The following data reflects the national average, and each states average, but does not include any reduction in cost from subsidies. Rates will vary by area.

Recommended Reading: How To Add Dependent To Health Insurance

Read Also: How Long Can My Dependent Stay On My Health Insurance

Cheapest Plan In Wisconsin With An Hsa

A Health Savings Account could be a good solution for someone in Wisconsin who is in good health and doesnt anticipate needing to go to the doctor a lot. HSA plans are cheaper and allow you to make pre-tax contributions. However, they have high deductibles, meaning youll need to pay more out-of-pocket if you have a major medical expense.

Based on MoneyGeek, the most affordable health insurance plan in Wisconsin with an HSA costs the following for each tier:

- Bronze: Anthem Bronze Pathway X 0 for HSA from Anthem Blue Cross and Blue Shield, costing $377 per month.

- Expanded Bronze: Dean Focus Network Bronze HSA-E 6850X by Dean Health Plan with a price of $291 per month.

- Silver: Dean Focus Network Silver HSA-E 4500X from Dean Health Plan at $408 per month.

- Gold: MercyCare HMO Gold Option C from MercyCare Health Plans at $371 per month on average.

The rates outlined above are the average rates for a 40-year-old.

Students Are Strongly Encouraged To Carry Health Insurance Since Student Health Services Is Not Health Insurance Please See Below For Information On The Affordable Care Act

If students are currently covered by health insurance, they should check with the carrier to see what arrangements need to be made so coverage continues while at college. All students should carry health insurance cards with them. Participation in the University of Wisconsin System Student Health Insurance Plan is required for international students.

From UW-River Falls Risk Management web page:âUWRF does not provide any type of compensation for injuries that occur on campus. Each student and visitor is expected to have their own health insurance to cover personal medical costs.â

Read Also: Can You Change Your Health Insurance Plan Mid Year

When Do You Need Short

Many situations can leave you in a coverage gap. For example:

- You may have left a job and need health insurance until your new job starts

- Missed the open enrollment period for Obamacare.

Short-term health insurance offers temporary coverage to fill these gaps.

Wisconsin allows you to have short-term health insurance for up to 364 days. But unlike many states that allow renewals for up to 36 months, Wisconsin limits them to 18 months.13

Short-term health plans offer basic benefits that can help you pay for care, such as doctors visits. However, these plans are not the same as ACA health insurance that offers comprehensive coverage. This means short-term plans arent required to cover pre-existing conditions or include essential health benefits.

Short-term health insurance may not work for everyone. Getting comprehensive coverage may have a higher monthly premium but could save you more money out of pocket in the long run. This summary about Wisconsin health insurance can help you decide whats best.

Recommended Reading: Starbucks Insurance Benefits

How To Shop For Health Insurance

Whatâs in this article?

Note: Some parts of the Affordable Care Act are being changed or eliminated via government policies and laws. It is likely that some of the rules and regulations affecting the health insurance marketplace will continue to change over time. To stay up to date on Obamacare and other health insurance issues, visit healthcare.gov and the website of the health commissionerâs office in your state.

In America today, we all need health insurance. You do. Your kids do. Itâs not a ânice to haveâ anymore itâs a âmust-have.â And thatâs the law. In most cases, parents who arenât covered by health insurance might have to pay a fine each year. Going without also means that if someone gets sick or is injured, a family might have to pay all the bills for care received. That can cost a whole lot more than paying for coverage.

To help people get health insurance, the federal and state governments set up a health insurance marketplace . This makes it easier than ever to get coverage, but the process can seem a bit confusing.

Hereâs what to do to get health insurance.

Read Also: Does Health Insurance Cover Tooth Extraction

Recommended Reading: Can My Fiance Be On My Health Insurance

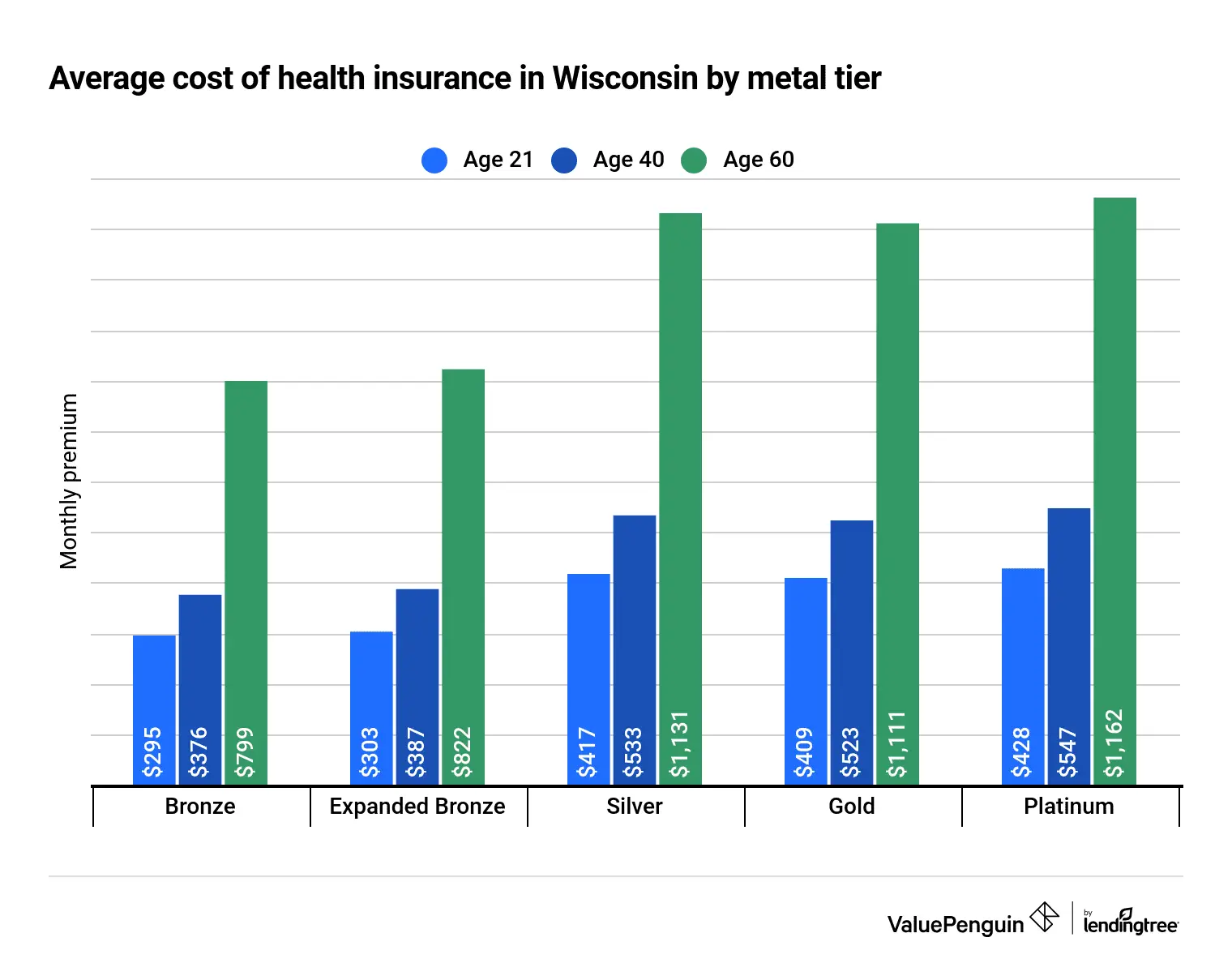

The Cheapest Health Insurance In Wisconsin By Age And Metal Tier

Several factors influence how much you pay for health insurance in Wisconsin. One of these is your age. As you grow older, your premiums will increase. For instance, the cost of a Silver plan in the state is roughly $418 for a 26-year-old and about $1,107 for a 60-year-old. This is a difference of $689 and is for an EPO plan.

Health Insurance Costs in Wisconsin by Age and Metal Tier

For this study, MoneyGeek used a sample profile for a 40-year-old male. That means the costs are averages that do not represent your actual premium and may vary due to various factors. While older people pay more for some marketplaces, they may get better rates on other health insurance marketplaces that support tax premiums and other regulatory services. Youll be able to tell the exact cost of your coverage once you apply for a plan.

Use the table below to see how prices differ across the different tiers and ages. You can also use the MoneyGeek health insurance guide for Wisconsin to determine the right tier for your needs.

Cheapest Health Insurance in Wisconsin by Age And Metal Tier

Sort by Metal Tier:

Private Health Insurance On The Wisconsin Marketplace

In Wisconsin, health insurance plans are categorized according to several metal tiers. Plans that are associated with cheaper metals, such as Bronze, cost less per month, but you will need to pay more out-of-pocket costs.

Before selecting a health insurance plan in any of these tiers, ensure that you understand its pros and cons. Here are some advantages and disadvantages of the six tiers available in Wisconsin.

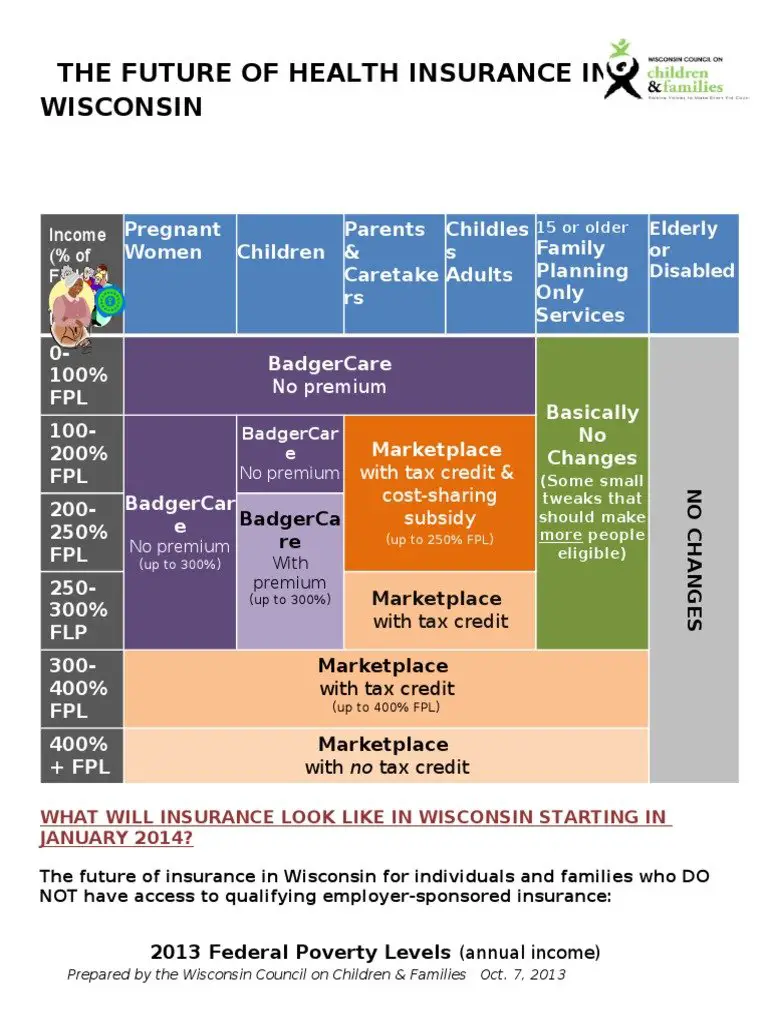

The cost of health insurance in Wisconsin is also based on your income level. If you have an income level thats between 100% and 400% of the federal poverty level, you may qualify for premium tax credits. Typically, this range is between $17,420 and $69,680 per year. For more details on this, check out the Healthcare.gov calculator.

Open enrollment refers to the period in a year where buyers enroll in health insurance plans on the states insurance marketplace or renew existing ones. This mostly happens between November and December, although dates have been extended because of COVID-19.

Health insurance buyers with incomes ranging from 138% to 250% of the federal poverty level may be eligible for cost-sharing reductions. Typically, two-person households with an income between $24,040 and $43,550 are eligible. To qualify for this, however, you will need to purchase a Silver plan.

Recommended Reading: How Much Do Businesses Pay For Health Insurance

What To Do Now:

Start by making a list of things that will be important in your coverage decision, for example:

-

Know how your current health insurance plan works, whether it will continue, and when it will renew.

-

Know about your insurance coverage in a given area, since many health insurance plans provide more limited benefits when you are away from your home or “out-of-area.”

-

When purchasing a health insurance plan, you should not consider premium cost alone. Plans with higher out-of-pocket expenses may have lower premiums, but a high deductible and high member coinsurance can make members reluctant or financially unable to receive necessary medical treatment.

Many benefits of the ACA may vary from state to state. Some states have opted for the federal government to run their exchanges , while other states are running their own . Expansion of the Medicaid program also varies by state.

For More Information:

Average Health Insurance Cost By Plan

Less surprising, though, is how the cost will differ based on the plan you use. After all, different plans offer different services, and those with more services and flexibility come at the price of a higher premium.

The four types of plans you may be able to get for your health insurance are a health maintenance organization , point-of-service , preferred provider organization and exclusive provider organization . Per ValuePenguin, the average monthly rate for a 21-year-old on each plan is:

- HMO: $230

You May Like: What Is The Fee For Not Having Health Insurance

Cheapest Health Insurance By Metal Tier

For 2022 plans, the average health insurance premium is $428 in Wisconsin for a 40-year-old.

We compared policies in Wisconsin by metal tier to find the most affordable health insurance policy at each level of coverage on the state exchange. Although availability depends on the county you live in, the table provides a good starting point to compare the costs and benefits you can expect from a given metal tier.

| Metal tier | |||

|---|---|---|---|

| Dean Focus Network Bronze Value Copay 8650X | $255 | ||

| Dean Focus Network Bronze Copay Plus 8650X | $263 | ||

| CGHC Value 1 Silver $7500 Deductible | $368 | ||

| MercyCare HMO Gold Option B | $354 | ||

| Select Platinum 500 Ded/1500 MOOP | $470 | $500 | $1,500 |

As you can see above, health plan rates vary widely depending on the metal tier. Although the cheapest options for health insurance plans in Wisconsin offer low rates, they are limited in availability by location.

Find Cheap Health Insurance Quotes in Wisconsin

In addition to a policy’s metal tier, your age is an important factor in determining the cost of a health insurance plan. As age increases, health insurance premiums across all metal tiers rise.

For example, the average price difference between a 21-year-old and a 40-year-old ranges from $61 to $112 in Wisconsin, depending on the metal tier of health plan you choose. A 40-year-old would pay $112 more per month than a 21-year-old for a Silver plan, but only $61 more on average with a Catastrophic plan.

Whats The Best Pet Insurance In Wi For My Dog Or Cat

It depends on your pets breed, age, zip code, your financial standing, and the kind of coverage you need.To better understand how the chart above relates to your dog or cats breed-specific risks in Wisconsin, use Pawlicy Advisor to instantly analyze top-rated plans across The Badger State. In 5 minutes or less youll understand which waiting times, coverage exclusions, and therapies are ideal for your pets breed and age.

For example, if you have a larger breed, having a policy with a long waiting period on knee injuries might not be ideal but that same policy could be perfect for a small lap dog. Pawlicy Advisor will scan the fine print to show a custom

Also Check: When Does Health Insurance Start

You May Like: How Many Americans Are Without Health Insurance

How To Become An Insurance Agent In Wisconsin

: Ethan Peyton

Getting your Wisconsin insurance license is the first step to becoming an insurance agent in Wisconsin. Whether youre interested in selling property and casualty insurance, life insurance, health insurance, or any combination of those lines of authority, this article has the information you need to get started.

The Wisconsin Department of Insurance has a 6-step process to getting your insurance license. Well walk you through step-by-step from the license application to insurance test prep, to the Wisconsin insurance exam, and beyond.

This guide has everything you need to know to get your Wisconsin insurance license quickly and easily.

Also Check: How To Get Health Insurance For My Family

Wisconsin And The Affordable Care Act

The Affordable Care Act gave individuals and families access to buy coverage through the Health Insurance Marketplace, starting in 2013. Since then, Wisconsins uninsured rate has remained in the single digits.

Six percent of Wisconsins population has no health insurance compared to 9% across the rest of the country. Even before the Marketplace was implemented, Wisconsins uninsured rate has been lower than the national average.

Also Check: Does Allied Universal Offer Health Insurance