How We Conducted This Study

The Commonwealth Fund Biennial Health Insurance Survey, 2018, was conducted by SSRS from June 27 to November 11, 2018. The survey consisted of telephone interviews in English and Spanish and was conducted among a random, nationally representative sample of 4,225 adults ages 19 to 64 living in the continental United States. A combination of landline and cellular phone random-digit-dial samples was used to reach people. In all, 725 interviews were conducted with respondents on landline telephones and 3,500 interviews were conducted on cellular phones.

The sample was designed to generalize to the U.S. adult population and to allow separate analyses of responses of low-income households. Statistical results are weighted to correct for the stratified sample design, the overlapping landline and cellular phone sample frames, and disproportionate nonresponse that might bias results. The data are weighted to the U.S. adult population by age, sex, race/ethnicity, education, household size, geographic region, population density, and household telephone use, using the U.S. Census Bureaus 2017 Annual Social and Economic Supplement.

Loss Of Medicaid Behind Decrease In Coverage Census Bureau Data Shows

by Dena Bunis, AARP, September 12, 2019

En español | For the first time in nearly a decade, the percentage of Americans without health insurance grew in 2018, including a 1 percentage point increase in the uninsured rate for people 45 to 64 years old, according to a new report from the U.S. Census Bureau.

Overall, the rate of uninsured Americans grew from 7.9 percent of the population in 2017 to 8.5 percent in 2018. The decrease in insurance coverage was almost entirely the result of fewer people being covered by Medicaid, the federal-state program that insures low-income individuals and people with disabilities.

There were 639,000 fewer adults ages 45 to 64 on Medicaid in 2018 than in 2017, according to Laryssa Mykyta, chief of the Census Bureau division that studies health and disability statistics and one of the authors of the health insurance coverage report. At the same time, we don’t see any change for that population in private health insurance, Mykyta says, and more people were enrolled in Medicare, driven by the continuing increase in people over 65.

Experts say an initial look at the data suggests the decrease could be caused by policy changes in some states that made it more difficult for people to maintain and renew coverage. Some states are now requiring Medicaid recipients to verify their income more often. And some states have adopted expanded work requirements for maintaining Medicaid eligibility.

More on Health Insurance

How Do I Get Affordable Coverage

If cost is what is keeping you from purchasing coverage, youwill be happy to know that there are Affordable Care Act subsidies that you mayqualify for.

Qualification for subsides is based off your yearly income andhow it compares to the federal poverty line . If you make between 100% ofthe FPL and 400%, you may qualify for some assistance in paying your monthlyinsurance premium.

You can still qualify for subsides if you choose to buy through an online brokerage like eHealth, as long as youre choosing an ACA-compliant plan that includes the 10 essential benefits required under the federal law. eHealth also allows you to compare plans that arent on the government exchanges, so that you can find the best health insurance for your budget and your needs.

At eHealth, we are committed to ensuring everyone gets the best health care coverage for their needs and budget. We feature licensed brokers in every state and once you are enrolled in a plan, we offer 24/7 support to help you manage and renew your plan as needed. Contact eHealth today to begin comparing plans in your state.

Don’t Miss: Starbucks Partner Health Insurance

Affordability Remains A Barrier To Coverage And Care

Although the ACA extended insurance coverage to 20 million Americans, affordability remains a barrier to obtaining and maintaining coverage. According to a 2020 poll by the Commonwealth Fund, one-third of uninsured adults who previously had nongroup coverage said they could not afford the cost of their health plan.

Affordability problems also prevent some Americans from seeking care and ultimately have negative consequences on health. Prior to the pandemic, nearly 1 in 10 of adults reported not getting care due to cost during the past year. Throughout the pandemic, other factors such as canceled medical appointments, social distancing requirements, scarce appointment availability, and fear of health care settings contributed to about 30 percent to 40 percent of adults reporting that they delayed or forwent care sometime in the past four weeks. For example, a Centers for Disease Control and Prevention report documented a sharp drop in routine pediatric vaccinations. Concerningly, research by the Urban Institute found that people with chronic disease, Black Americans, and low-income children were among the populations more likely to have delayed or forgone care during the pandemic. Without policy interventions to address gaps in coverage, affordability, and care, these trends could widen existing disparities in care and health.

Profile Of The Uninsured

![22 Million More Americans Could Be Uninsured By 2026 [Infographic] 22 Million More Americans Could Be Uninsured By 2026 [Infographic]](https://www.healthinsurancedigest.com/wp-content/uploads/22-million-more-americans-could-be-uninsured-by-2026-infographic.jpeg)

So who were the uninsured? They tended to be 19 to 64 years old, male, have less than a high school education and/or have lower incomes. This profile is fairly different from the profile of the overall U.S. population.

The large sample size of the American Community Survey provides a detailed look at the characteristics of populations such as the uninsured.

To find out more about the uninsured population, such as employment characteristics, disability status, nativity and residence, or about the uninsured population in smaller geographic areas , see Table S2702 “Selected Characteristics of the Uninsured in the United States.

Edward Berchick is a demographer in the U.S. Census Bureaus Social, Economic, and Housing Statistics Division.

Recommended Reading: Can You Add A Boyfriend To Your Health Insurance

Trends In Uninsured Rates By Race/ethnicity 2010

Prior to the ACA, people of color were more likely to be uninsured compared to their White counterparts. In 2010, when the ACA was enacted, 46.5 million people or 17.8% of the total nonelderly population were uninsured. People of color were at much higher risk of being uninsured compared to White people, with Hispanic and AIAN people at the highest risk of lacking coverage . The higher uninsured rates among people of color reflected more limited access to affordable health coverage options. Although, the majority of individuals have at least one full-time worker in the family across racial and ethnic groups, people of color are more likely to live in low-income families that do not have coverage offered by an employer or to have difficulty affording private coverage when it is available. While Medicaid helped fill some of this gap in private coverage, prior to the ACA, Medicaid eligibility for parents was limited to those with very low incomes , and adults without dependent childrenregardless of how poorwere ineligible under federal rules.

Figure 1: Uninsured Rates for the Nonelderly Population by Race and Ethnicity, 2010-2019

How Geographic Differences Affect Coverage

The decentralized labor and health services markets in the United States, and the distinct public policies in each state and locality, together create unique contexts for the patterns already described for individuals and population groups. Differences among states with respect to population characteristics, industrial economic base, eligibility for public insurance, and relative purchasing power of family incomes shape the geographic disparities in insurance coverage rates .

Read Also: Can Substitute Teachers Get Health Insurance

Lack Of Insurance Is Tied To Higher Death Rates New Study Shows

As the Senate debates and amends its Obamacare replacement bill projected to leave 22 million without insurance, a new report found that those with insurance live longer than the uninsured. The report, published Monday in the journal Annals of Internal Medicine, highlights the influence insurance can have on mortality. Read More

What Impacts The Rate Of Uninsured People In The Us

At the moment, it is widely believed that Government-sponsored policies represent the main factor of influencing health insurance rates both in the US, but also in most of the worlds countries.

4. An overview of the Affordable Care Act, or Obamacare

With this in mind, its worth noting that the overall number of uninsured Americans first started improving back in 2011. As such, the most recent and most significant policy change was made in 2010 when President Obama fought to get the Affordable Care Act signed into law. The official version of the act is 906 pages long hence why we will try to offer a brief overview of the law, outlining its main goals, how it plans to achieve them, while also offering several Obamacare statistics. Before anything else, it is important to keep in mind that Obamacare was incredibly successful in increasing the rates of insured Americans and it has managed to achieve such an impact within only a few years.

5. The main goals of Obamacare

Don’t Miss: How Long Do Health Benefits Last After Quitting

Emergency Medical Treatment And Active Labor Act

EMTALA, enacted by the federal government in 1986, requires that hospital emergency departments treat emergency conditions of all patients regardless of their ability to pay and is considered a critical element in the “safety net” for the uninsured. However, the federal law established no direct payment mechanism for such care. Indirect payments and reimbursements through federal and state government programs have never fully compensated public and private hospitals for the full cost of care mandated by EMTALA. In fact, more than half of all emergency care in the U.S. now goes uncompensated. According to some analyses, EMTALA is an unfunded mandate that has contributed to financial pressures on hospitals in the last 20 years, causing them to consolidate and close facilities, and contributing to emergency room overcrowding. According to the Institute of Medicine, between 1993 and 2003, emergency room visits in the U.S. grew by 26%, while in the same period, the number of emergency departments declined by 425. Hospitals bill uninsured patients directly under the fee-for-service model, often charging much more than insurers would pay, and patients may become bankrupt when hospitals file lawsuits to collect.

Characteristics And Coverage Options Of The Uninsured Population In 2019

Many of the estimates in this report are drawn from the CBOs health insurance simulation model, HISIM2, which CBO uses to estimate the major sources of health insurance coverage and associated premiums for noninstitutionalized U.S. residents under age 65.1 Most of the data in HISIM2 come from the Annual Social and Economic Supplement of the Current Population Survey . Those data provide reliable, timely, and detailed information on many of the key variables needed to model health insurance coverageincluding income, employment, and self-reported health status.

To improve the accuracy of the CPS data, CBO adjusts variables that are likely to be reported with some error, such as the number of people enrolled in Medicaid and the amount of income reported on tax returns, so that the distributions of characteristics of people in the HISIM2 sample match those found in administrative data.

Read Also: Minnesotacare Premium Estimator

Uninsured Rates By State

The United States Census Bureau regularly conducts the Current Population Survey , which includes estimates on health insurance coverage in the United States. The data is published annually in the Annual Social and Economic Supplement . The data from 1999 to 2014 are reproduced below.As of 2012, the five states with the highest estimated percentage of uninsured are, in order, Texas, Nevada, New Mexico, Florida, and Alaska. The five states/territories with the lowest estimated percentage of uninsured for the same year are, in order, Massachusetts, Vermont, Hawaii, Washington, D.C., and Connecticut. These rankings for each year are highlighted below.

Percent uninsured by state, 1999â2014| Division |

|---|

| 12.0 |

The Impact Of The Coronavirus Pandemic On The Uninsured Population In 2020 And Beyond

Since the end of 2019, the spread of the novel coronavirus has resulted in increases in unemployment, substantial changes in household income, and increasing strains on the health care delivery system. Recent legislation in response to the pandemic has included federal funding for testing for COVID-19 , treatment for uninsured people, and tax credits for employers that continue contributing to the health insurance premiums of furloughed employees it has also required health insurance plans to cover COVID-19 testing with no cost sharing.

Against the backdrop of those changes, in the Congressional Budget Offices estimation, the number of people without health insurance will increase to about 31 million in 2020.1 That uninsured population in 2020 will include most of the approximately 30 million people who would have been uninsured in the absence of the coronavirus pandemic, plus additional people who lose health insurance coverage on account of the pandemic and do not obtain alternative coverage. Therefore, understanding the people who lacked insurance before the pandemic remains relevant even in a rapidly changing economy.

1. For further discussion of CBOs estimates of the number of uninsured people in 2020, see Congressional Budget Office, Federal Subsidies for Health Insurance Coverage for People Under 65: 2020 to 2030 , www.cbo.gov/publication/56571.

Recommended Reading: Starbucks Open Enrollment 2020

Nearly One In Five Americans With A Pre

The number of people who both have a pre-existing condition and are uninsured ranges from 9 to 25 million or as much as 46 percent of the uninsured. Among non-elderly people with some type of pre-existing condition, about one in five, or 19 percent, is uninsured. Although the lack of affordable coverage remains the primary reason why Americans are uninsured, getting rid of discrimination against people with pre-existing conditions is critical to the success of the tax credits and State-based Exchanges that take effect in 2014.

Health Insurance Can Make A Life Or Death Difference Study Says

In the midst of the complex, politically-charged health care debate unfolding in Washington, medical researchers say the science is clear: being uninsured increases one’s risk of dying. That’s the headline out of a new big-picture analysis of existing research that explores the relationship between insurance coverage and mortality. Read More

Recommended Reading: Does Starbucks Offer Health Insurance To Part Time Employees

Access Quality And Equity Implications

The hidden consequences of failure to ensure universal coverage in the US are well documented.5 The Institute of Medicine estimates that 18000 lives are lost annually as a consequence of gaps in coverage. It calculates the annual cost of achieving full coverage at $34bn- $69bn, which is less than the loss in economic productivity from existing coverage . Expanding coverage would disproportionately help people on low incomes, who make up two thirds of the uninsured, thus increasing equity in access to health care and health outcomes.5

In the US market based system, gaps in health cover contribute to underuse of effective services.6 People who are uninsured or underinsured are more than twice as likely to report going without needed care because of costs.7 When they do receive medical care, they often spend a high fraction of income on out of pocket medical expenses and face financial difficulties.7 Uninsured people are often the only ones charged full price for health care they do not benefit from discounts from providers negotiated by managed care plans, further raising access barriers and debt burdens for those who become sick.

Estimates Of The Number Of Uninsured

Several public and private sources report the number and percentage of the uninsured.The Congressional Budget Office reported the actual number of uninsured at 28.3 million in 2015, 27.5 million in 2016, 27.8 million in 2017, and 28.9 million in 2018.The CBO May 2019 ten-year forecast reflected the policies of the Trump administration and estimated the number of uninsured would rise from 30 million in 2019, to 34 million by 2026, and to 35 million by 2029. In a previous March 2016 ten-year forecast reflecting the policies of the Obama administration, CBO forecast 27 million uninsured in 2019 and 28 million in 2026. The primary reason for the 6.5 million increase in uninsured from 2016 to 2029 is the repeal of the ACA individual mandate to have health insurance, enacted as part of the Trump tax cuts, with people not obtaining comprehensive insurance in the absence of a mandate or due to higher insurance costs.

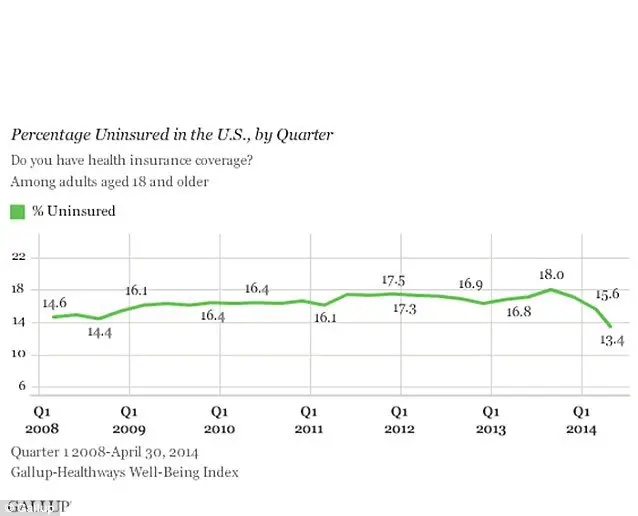

Gallup estimated in July 2014 that the uninsured rate for adults was 13.4% as of Q2 2014, down from 18.0% in Q3 2013 when the health insurance exchanges created under the Patient Protection and Affordable Care Act first opened. The uninsured rate fell across nearly all demographic groups.

The Commonwealth Fund reported that the uninsured rate among adults 19-64 declined from 20% in Q3 2013 to 15% in Q2 2014, meaning approximately 9.5 million more adults had health insurance.

You May Like: Do Starbucks Employees Get Health Insurance

Immigrant Status And Nativity

Most uninsured people are U.S. citizens by birth . The relatively small proportion of the general population comprised of naturalized citizens and noncitizens is significantly more likely than U.S.-born residents to be uninsured, although immigrants’ uninsured rates decline with increasing length of residency in the United States.

Residency status, family income, and length of residency in the United States are important influences on the likelihood that a person will lack insurance coverage . Foreign-born residents of the United States are almost three times as likely as U.S.-born residents to be uninsured, and among the foreign-born, noncitizens are more than twice as likely as citizens to be uninsured . Foreign-born residents are a relatively small proportion, about 10 percent, of the general population under age 65. The declining uninsurance rate for immigrants with longer residence in the United States means that they contribute a relatively modest number and proportion to the overall growth in the uninsured population .

Hispanics

American Indians and Alaska Natives

African Americans

Asian Americans and Pacific Islanders