What To Do If You Dont Have Health Insurance

If you live in a state that requires you to have health coverage and you dont have coverage , youll be charged a fee when you file your 2019 state taxes. Check with your state or tax preparer. You will NOT get Form 1095-A unless you or someone in your household had Marketplace coverage for all or part of 2019.

The Cost Of Not Having Health Insurance

There are multiple reasons why people think they dont need health insurance. Perhaps they are healthy and dont see the need. Maybe they think their premiums are too high. When it comes down to it, the cost of not having health insurance is too high. Discover the price comparison of insured and uninsured health care below:

Broken Tailbone Treatment CostWith Insurance: $10 to $40+Without Insurance: $250 to $700+

ACL Reconstruction CostWith Insurance: $800 to $3,000Without Insurance: $20,000 to $50,000

Mammogram CostWith Insurance: No Charge or CopayWithout Insurance: $80 to $212

Brain MRI CostWith Insurance: $20 to $100+ CopayWithout Insurance: $1,000 to $5,000

Cardiac MRI CostWith Insurance: $20 to $100+ CopayWithout Insurance: $1,000 to $5,000

Hernia Repair CostWith Insurance: $700 to $2,000Without Insurance: $4,000 to $11,000

Emergency Room Visit CostWith Insurance: $50 to $150 CopayWithout Insurance: $150 to $3,000+

Human Papillomavirus Vaccine CostWith Insurance: $30 to $120Without Insurance: $400 to $500

Well Baby Doctor VisitWith Insurance: Copays typically $10 to $30 per visitWithout Insurance: Around $95 per visit

Even if you dont plan on using your health insurance regularly, your ten essential health benefits are covered by any qualified health plan. If an accident lands you in the emergency room, you can rest assured knowing your health insurance has you covered.

Note: all data comes from Cost Helper.

The Fee For Not Having Health Insurance In 2022

There is no penalty for not having ACA mandated coverage in 2022 unless you live in a state like New Jersey or Massachusetts where it is mandated by the state. Because of this, short-term medical plans will be extremely popular in 2022 because they provide access to larger PPO networks at lower prices than ACA Bronze plans.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

What Is The Penalty For Not Having Obamacare

Heres what you need to know style=default]

- The individual mandate of the Affordable Care Act requires insurance coverage or payment of a healthcare shared responsibility fee.

- The tax occurs for each month, or any part of a month that an individual lacks coverage

- Individuals can meet the mandate by buying a policy that has the essential health benefits required for health insurance policies under the Affordable Care Act

- To meet the requirements of the mandate, one can purchase a qualified health plan during open enrollment and maintain it throughout the year

- The law provides for exemptions from the penalty for reasons that include financial hardship.

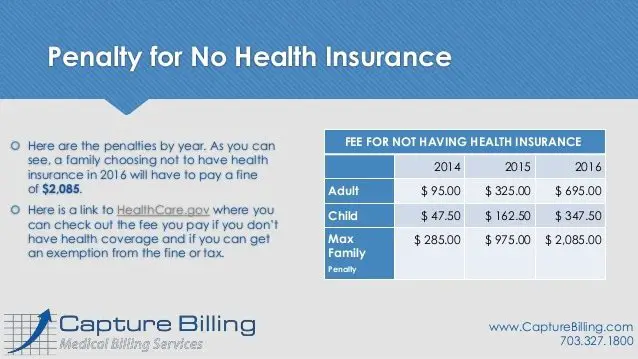

- The ACA sets the penalty as a maximum amount per year beginning in 2014

- The annual penalties for adults are $95 in 2014, $325 for 2015, and $695 for 2016.

The Importance Of Health Insurance

Health insurance provides regular, preventive care for you and your family to stay healthy and prevent illness. Medical bills are the number one cause of bankruptcy and can reach into the millions of dollars. Having quality health coverage gives you peace of mind knowing that if an accident or illness strikes you and your family are protected from a lifetime of financial burden.

You May Like: Starbucks Health Care Benefits

Have A Valid Exemption

There are a few circumstances in which you may be exempt from paying a tax penalty. The following are some common exemptions:

- Coverage is considered to be unaffordable: Coverage through your employer or through a health benefit exchange may be considered unaffordable if it costs more than 8.13% of your total household income.

- You had a short coverage gap: A short coverage gap means you are uninsured for less than three consecutive months during the year.

- Your income is lower than the state threshold for tax filing: If your income is lower than the state tax filing requirement, you may not be required to file taxes or pay a penalty for not having health insurance.

- You were incarcerated: You may be exempt from the tax penalty if you were incarcerated.

- You are a member of an Indian Tribe: You may be exempt from the tax penalty if you are a member of an Indian Tribe that is federally recognized.

- You experienced general hardship: You could be exempt if you experienced circumstances that did not allow you to obtain qualified insurance, such as eviction, homelessness, foreclosure, unpaid medical bills, domestic violence or the death of a close family member.

- You are a member of a certain religious sect: You may be exempt from the tax penalty if you are a member of a certain religious sect or a healthcare sharing ministry.

Speak with a tax professional about the details of valid exemptions to determine whether an exemption may apply to your situation.

Penalty For No Health Insurance 2020 In California

There are lots of reasons to consider investing in health insurance. Health insurance can:

- help pay for expenses from unexpected accidents and injuries

- make regular and long-term care more affordable

- promote well-being as trips to the doctor are often covered

But this year Californians have a new reason to add to that list the upcoming health insurance penalty. 2020 marks a change in Californias laws that could impact you if you dont have health coverage. Know your options to avoid facing a penalty for not having insurance.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Washington Dc Individual Mandate

- Effective date: January 1, 2019

- Requires individuals and their dependents have ACA-compliant health insurance

- Imposes a penalty on residents who go without health insurance but can afford it

- Provides exemptions to the tax penalty for circumstances such as financial hardship, pregnancy, or eviction

Individuals who go without qualifying health coverage for a full year and dont file for an exemption may owe a tax penalty. The penalty amount is either 2.5% of the gross family household income or $695 per individual and $347.50 per child youll pay whichever amount is greater.

According to dchealthlink.com, the maximum penalty for not having coverage in DC is based on the average premiums for bronze level health plans available on DC Health Link. In 2020 this amount is $3,448/year per person and, for households with more than one person without coverage, it is multiplied by the number of people in the household without coverage up to a maximum of five household members. So, potentially, a household of five or more that went the entire year without health coverage would have a penalty cap of $17,240 in 2020.

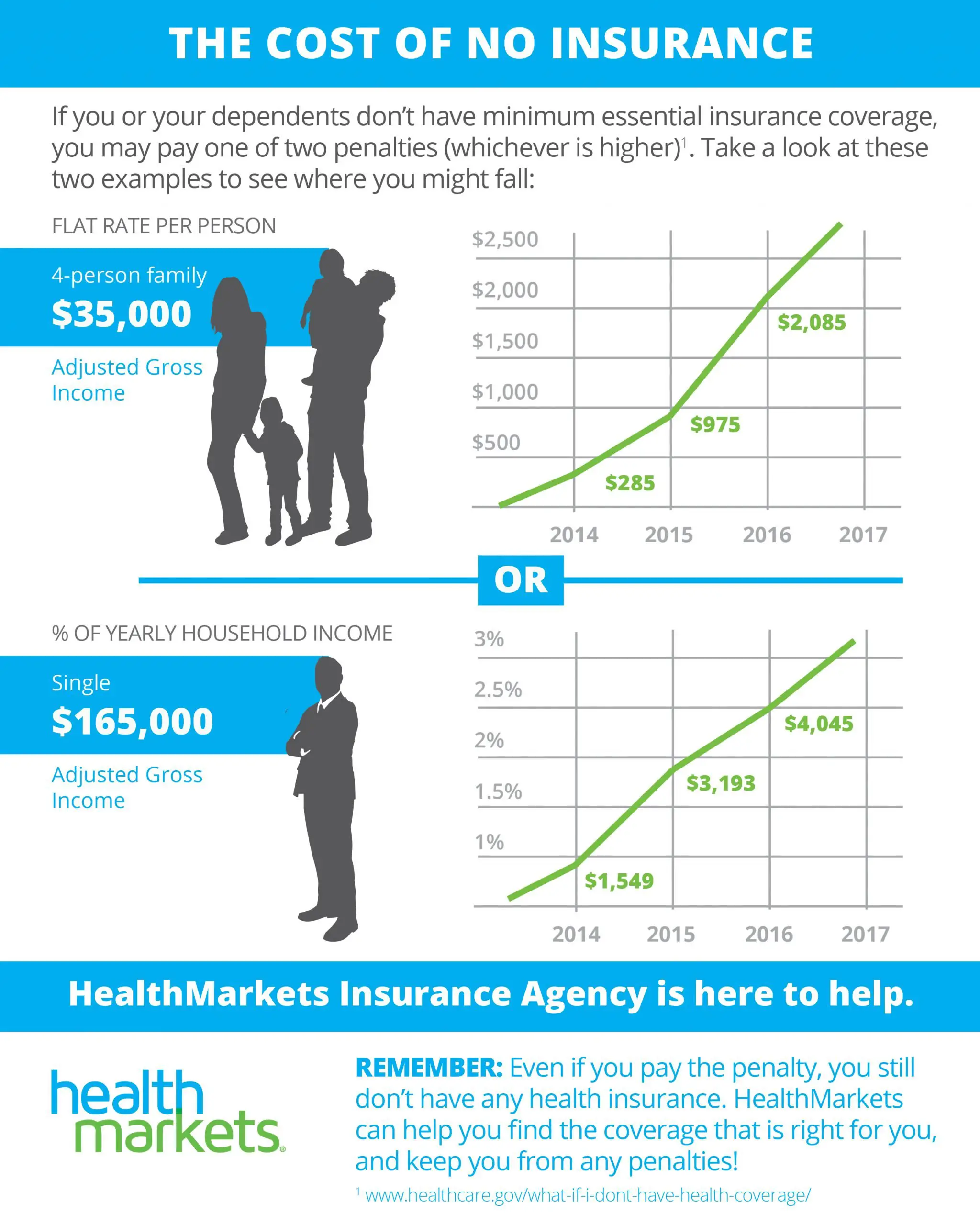

How To Calculate The Fee For Each Plan Year

The fee is calculated 2 different ways as a percentage of your yearly household income, and per person. Youll pay whichever is higher.

- Using the percentage method, only the part of your household income that’s above the yearly tax filing requirement is counted.

- Using the per person method, you pay only for people in your household who don’t have insurance coverage.

If you have coverage for part of the year, the fee is 1/12 of the annual amount for each month you don’t have coverage. If you’re uncovered only 1 or 2 months, you don’t have to pay the fee at all. Learn about the “short gap” exemption.

Fee amounts for 2017| Per person method |

|---|

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

If I Dont Qualify For An Exemption How Do I Avoid The Penalty For No Health Insurance 2020

The best way to avoid the health insurance penalty is to obtain coverage as soon as possible during the open enrollment period, which began on October 15, 2019 and will continue through January 15, 2020.

If you already have a plan, the open enrollment period is still a good time to review your current policy and compare coverage options in case you discover an option that better suits your needs.

Is There A Fee For Not Having Health Insurance

You wont owe a fee on your federal tax return. Check with your state or tax preparer to find out if there is a fee for not having health coverage. You may owe the fee for any month you, your spouse, or your tax dependents dont have qualifying health coverage . See all insurance types that qualify.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Who Has To Pay The Penalty

For tax years 2014 to 2018, almost everyone needed to have qualifying health insurance coverage to avoid paying the individual mandate. You were also required to have coverage for your dependents.

You only needed to pay the individual mandate penalty if went for a period of three months or more without qualifying health coverage. There was no penalty for coverage gaps that were less than three months long.

Because the penalty is suspended for future years, you do not need to worry about it unless you have back taxes. Back taxes are any taxes from previous years that you havenât paid in full. When you don’t file your tax return on time, you have to pay a late fee plus interest.

The Future Of Individual Health Insurance Mandates

Over the past year, a few additional states have considered or are considering individual mandates, including:

- Connecticut

- Washington

However, so far, none of these states havemanaged to ultimately pass state individual mandates.

Lawmakers who push for individual mandate laws argue that its needed to incentivize people to get health insurance. The argument is that if not enough healthy people sign up for coverage, the pool of insured individuals will be made up mostly of sick people, and health premiums will rise for everyone. However, many states have attempted and failed to pass individual mandate legislation, and these laws remain politically controversial.

According to Forbes.com, the new Biden administration is expected to bring back the federal tax penalty for going without ACA-compliant health coverage. Its unclear yet whether he would do this through an executive order or legislative reform.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

What Qualifies As Minimum Essential Coverage

“Insurance plans that qualify under provisions of the ACA must include coverage of a minimum of 10 categories,” says Mac Schneider, retired certified public accountant. This amounts to comprehensive coverage for most health insurance needs, improving access to health care services and preventing financial hardship often caused by illness or hospitalization.Health plans sold to individuals and small groups must cover:

- Ambulatory patient services

- Mental health and substance use disorder services

- Prescription drugs

- Pediatric care, including vision and dental services

Understand And Avoid Health Care Reform Tax Penalties

OVERVIEW

The Affordable Care Act has brought new options for health care coverage to millions of previously uninsured Americans. While you can still choose not to purchase health insurance, that decision may come at a cost, for tax years 2014 through 2018. Eligible taxpayers who remain without insurance may be required to pay penalties, though there are exemptions for which you may qualify.

Don’t Miss: Starbucks Medical Insurance

How Do I Avoid The Individual Mandate Tax

To avoid this penalty and protect yourself from the potential financial burden of unexpected medical expenses, you can enroll in a health insurance plan during the open enrollment period. For 2021 coverage, the national open enrollment period will take place from November 1st 2020 through December 15th 2020. Some states have extended this period. To learn about your states open enrollment period, read our article, 2021 Obamacare Open Enrollment Dates by State.

If you lose your insurance in the middle of the year, you may qualify for a special enrollment period to purchase an ACA-compliant plan on the public exchange. You may buy an ACA-compliant plan outside the public exchange anytime. Depending on which state you live in, you may be able to enroll in short-term health insurance to help fill any coverage gaps you may experience throughout the year.

Your health and financial well-being are important to us. As the largest online health insurance broker, eHealth offers a variety of health insurance plans to fulfill your coverage needs, wherever you live in the United States. These include on and off exchange ACA-compliant plans, major medical insurance, and short-term health insurance. Let us help you explore your coverage options now. Simply click Individual & Family Health Insurance to find affordable insurance. Our licensed insurance agents are here to help you and share their expertise as you consider your choices.

Qualify For An Exemption

All DC residents must have health coverage or pay a tax penalty for the months that they do not have coverage. Some people qualify for an exemption from the tax penalty. You can claim most exemptions on your tax return.

Find an Exemption

Answer a few questions to see if you may qualify for an exemption. We’ll tell you how to apply for or claim each one that applies to you.

Types of Exemptions

Exemptions you claim on your tax return

You qualify to claim an exemption on your tax return if any of the situations listed below applied to you during the months you didn’t have health coverage:

- Income low enough that you aren’t required to file a DC tax return . Tax filing thresholds increase a bit each year. The tax filing thresholds for 2019 were:

- Single: $12,200

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Why Have An Individual Mandate

These states have an individual mandate for the same reason the ACA originally did. Without an individual mandate, people would only buy insurance if they knew they were going to need it. Most often, this means the elderly and people with pre-existing conditions.

But those who use their health insurance the most are also the most expensive to insure. Before the Affordable Care Act, insurance companies would evaluate all applicants before enrolling them. Based on peoples age and medical history, the insurance companies would then deny them health care coverage, or charge them more for it. But the ACA made that kind of discrimination illegal. And then it took things one step further. An individual mandate is an incentive for everyone to get health insurance, even healthy people. That meant there was now a larger pool of people applying for health insurance. And with more healthy people getting health insurance, health insurance companies could lower premiums for everyone.

In other words, the individual mandate was meant to be one of the of cost-savings and consumer protections we associate with the ACA. It allows more people to be insured at a lesser rate per person. Even though there is no national individual mandate anymore, some states have passed their own mandates to help keep more people insured at lower costs per person. If the mandates help more people get insured, taxpayers in these states will have lower monthly premiums on average.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Proof Of Coverage Provided By Your Health Plan

Health insurance plans will provide documentation to clients to prove they have the minimum coverage required by law. When you file your tax return you will have to enter information about your coverage status, or if you were eligible for an exemption, on your tax return. Insurers will provide a notice to you by January 31 that describes your coverage status during the previous year.

Connect for Health Colorado customers can review the Taxes Frequently Asked Questions to learn more about the form they will receive as proof of insurance.

The federal government oversees the enforcement of the mandate. Please contact the Internal Revenue Service for more information.

© 2021 colorado.gov/health All rights reserved

Do I Need To Show Proof Of Health Insurance For My Taxes

Youll need to show documentation that you had health insurance in 2018 to avoid paying a penalty. Depending on how you get your insurance, this documentation will be one of the following: Form 1095-A , Form 1095-B , or Form 1095-C . Past 2018, you no longer need to show proof of health insurance on your taxes.

However, if you received a federal tax credit, you will need to file your tax returns with the right documentation. Form 1095-A is provided to anyone with Marketplace coverage. Your insurance company will issue Form 1095-B, listing everyone who was covered and when during a calendar year. You can also submit this form as part of your documentation when preparing your taxes. Form 1095-C is provided to employees by employers who provide health insurance benefits, when an employee opts into those benefits.

If you want to be extra careful you can keep documentation that shows you had coverage for 2018 and earlier. This can include insurance cards, explanation of benefits , or statements from your insurer. This may also be a W-2 or payroll statements reflecting health insurance deductions.

Grab our free guide to see what you need to know about Marketplace insurance and your taxes.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees