Important: Update & Compare Plans For 2022

No matter what plan you want to enroll in, we strongly recommend that starting November 1, 2021 you update your Marketplace application with your expected income and household information and compare your current plan to whats available for 2022. Select a plan by December 15, 2021 for coverage that starts January 1, 2022.

- New, affordable plans may be available this year. Plans and prices change every year. Your situation may have changed too. You may find 2022 plans with coverage and features that better meet your needs especially if you have had or expect income or household changes.

- Update your application so your 2022 Marketplace savings are correct. Marketplace savings are based on your expected income for 2022 . If you don’t update your income and household information, your premium tax credit and other savings could be wrong for 2022. If this happens:

- You could wind up paying more for your monthly premium than you have to.

- You may use more advance payments of the premium tax credit than you qualify for. You’d then have to pay back some or all of the difference when you file your federal taxes.

Sign Up For Hsa Eligible Insurance During The Year

If you sign up for an HSA eligible health insurance plan during the year, you are on the right track to open a health savings account and begin contributing. You are allowed to make full contributions for a year if you are covered by HSA eligible health insurance on of that year. This is explained in detail in the post on the Last Month Rule. The summary is that when you start a new HSA eligible health insurance plan, you can contribute up to the maximum contribution limit during the first year if you had coverage on the first day of the last month of the year. In other words, if you have a plan opened by December 1st, you can contribute up to the max.

However, this is enforced by the Testing Period, which says that if you are going to take advantage in that first year and contribute more than your pro-rata share, you have to stay on an HSA eligible plan for a corresponding time during that subsequent year. If not, you have in fact over contributed and penalties / taxes occur. Thus, if you are going to sneak in a full year contribution during your first year on an HSA plan, make sure you are not just a flash in the pan and are planning on staying on that plan for a while.

In Order To Change Your Obamacare Health Plan You May Need To:

- Update your information to determine if you qualify for subsidies or tax credits to help pay for a new plan.

- Shop for a new plan that meets your insurance needs, and enroll in it before the end of the Open Enrollment Period .

- Qualify for a Special Enrollment Period .

HealthMarkets can walk you through the entire process and help find you an insurance plan that fits your needs.

We can help you compare Affordable Care Act health plans and find the right fit for you and your loved ones.

Get started with your FitScore® today.

47023-HM-0221

Don’t Miss: Is Medishare Considered Health Insurance

When Can I Renew Or Switch My Current Plan

Renewal usually starts in the fall right before the open-enrollment period. At that point, you’ll be able to switch your plan and make any changes. You can always report changes when things like your household size and income have changed. Sometimes these changes make you eligible for special enrollment, at which point you can change your plan.

When you renew your health insurance plan, you will be able to:

- Review and update your contact information and application.

- Compare different plans to get the best coverage for your needs and budget. All plans, Bronze to Platinum, offer the same level of high-quality health care. The only difference is you choose the best payment option for you!

- Find out if your costs have changed, or if you can receive financial help to lower your monthly premium. If you previously have not applied for financial help, you will be asked if you would like see if you qualify for help. If you select YES then Save & Continue, you will be guided through sections of your application to provide more information.

- Make sure the doctors or hospitals you want are included in the plans you are comparing by using Covered Californias Shop and Compare Tool, while shopping within your application or by contacting the health insurance companies directly.

For questions or additional help renewing your health plan, contact an expert in your area for free assistance or call Covered California at 300-1506 .

Switch From Individual To Family Coverage

Lets say you start the year with individual coverage, then you get married. You switch to family HDHP coverage on May 15. This means you spent the first five months of the year eligible for individual contribution limits and the rest of the year eligible for family contribution limits.

Heres how the math breaks down:

You May Like: How Do I Get Health Insurance If I Retire Early

Special Enrollment Periods For Health Insurance

Special enrollment periods are so named because thats exactly what they are: special. During a special enrollment period, only you and your family have the chance to decide on new coverage options.

Special enrollment periods are triggered by specific events, including:

- Getting married, divorced or legally separated

- Giving birth or adopting

- Starting, ending or losing a job

- Losing other health insurance coverage

- A death in the family

- Moving to a new ZIP code or county

- Certain other qualifying events

If one of these events applies to you, youll usually have 60 days to switch to a new plan or make changes to your existing one.

Just like with open enrollment, you can shop around and compare plans by talking to your existing health insurance provider, your broker or visiting your states health insurance marketplace. In some cases, youll need to provide evidence of your qualifying life event before enrollment is complete.

An Employer Offer To Help With The Cost Of Coverage

Gaining access to an individual coverage HRA or a QSEHRA from your employer to help with coverage costs doesnt limit your ability to choose a new plan during a Special Enrollment Period. However, make sure you enroll in a plan that starts by the date your individual coverage HRA or QSEHRA begins, unless your employer offers a later start date.

You May Like: How To Find Personal Health Insurance

Types Of Special Enrollment Periods With Limited Plan Category Choices

Enrollees and their dependents who qualify for the most common Special Enrollment Period types like a loss of health insurance, moving to a new home, or a change in household size will only be able to pick a plan from their current plan category.

For example, someone whos already enrolled in a Bronze health plan will only be able to select a new plan from the Bronze category.

How To Switch Health Insurance Plans After Open Enrollment

You participated in the ACA annual open enrollment period and are all set with your new health insurance policy for next year. But what if youre having second thoughts?

Maybe youve learned your preferred healthcare provider isnt in-network or your .

Can you change health insurance after open enrollment? Depending on your specific situation you may be able to:

Even though the , you may still owe a . Keep that in mind as you review the options here.

Want ACA, Supplemental, or Short Term Insurance?

Find Products Available for Me

You May Like: What Is The Best Affordable Health Insurance

The Unique Situation Of Deductibles For Commercial Insurance

Lets start with the basics: Business Insurance is Tax Deductible. An insurance deductible is a share of an insurance claim that must be paid before an insurer provides financial coverage to the insured. In other words, deductibles are a form of risk-sharing between insurers and their customers. They help to keep insurance costs affordable for small business owners while minimizing the number of small claims insurers must handle.

In industrial risks, it is also common for the deductible to be expressed as a percentage of the loss. This would be like co-insurance. With this coverage, a company pays a certain percentage of the losses, coupled with minimum and maximum payment thresholds.

Insurance deductibles have been part of insurance contracts for years. The bottom line is that you can change your deductible on your policy to fit your needs any time of the year. In order to make the process extra safe, its always a good idea to check with your insurer first.

If You Become Eligible For Another Form Of Minimum Essential Coverage

If its no longer open enrollment and you dont qualify for a special enrollment period, you cant switch to a different ACA plan. However, you can see if you are eligible for another form of minimum essential coverage such as or . You can enroll in many of these programs year-round if you qualify.

Still unsure? .

Don’t Miss: Can I Change My Health Insurance Plan Covered California

How To Change Your Obamacare Health Plan

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

Need to know how to change your Obamacare health plan? Many Americans who signed up for an Affordable Care Act plan have their plans set to automatically renew during the annual Open Enrollment Period .1,2

In addition to having your enrollment in your current health insurance plan automatically renewed, you may also have tax credits or subsidies automatically renewed.3 This can be a huge convenience to many Americans, as it means that they won’t have to go through the headache of trying to navigate the health insurance marketplace again.

Pay close attention to the letter you receive from your insurance company, as insurance premiums are rising.4 In this case, you may want to opt for a new plan to balance the rising costs of your insurance.

Don’t want to be automatically re-enrolled in your current plan? Perhaps your monthly premiums are expecting to go up, or it doesn’t provide you with the coverage you need for your personal health needs. Don’t worry. You can change your Obamacare health plan if you want, and you don’t have to stick with the same plan indefinitely.

You Move/change Your Address

You may not be thinking about qualifying life events as you load the moving van, but you should. Eligibility to enroll in Kaiser or Stanford Healthcare Alliance is based on your home address ZIP code. This means if you are leaving an eligible ZIP code, you may have to choose a new health plan. Update your address and contact information in StanfordYou if your address update results in you losing eligibility for either Kaiser or SHCA, you will receive an e-mail notification.

-

Moving is also a good time to revisit voluntary benefits such as home and auto insurance.

-

You should also review your commute with Parking & Transportation Services because you may have new biking, carpooling or transit options.

Don’t Miss: How To Get Health Insurance Self Employed

How To Get Out Of Your Employer’s Group Health Plan Mid

Written by: Josh MinerSeptember 15, 2020 at 9:01 AM

Employees have two options for getting out of their employers group health plan mid-year. IRS Notice 2014-55 outlines two ways employees covered by their employers health plan can change their health insurance plan elections during a plan year. Heres what you need to know about the rules:

Key Takeaways About Qualifying Life Events

The bottom line is, you might not need to wait for your employer or the government’s next open enrollment period to make changes to your health plan. Here’s what else you should know:

- To make changes to your health plan, you must be experiencing a qualifying life event. If youre not sure an event qualifies, visit Healthcare.gov or contact your current or future health plan sponsors for more specific information.

- Qualifying life events trigger a “special enrollment period” that typically lasts 30 to 60 days, depending on your plan, during which you can select a new plan or add a new dependent to your plan.

- To change your plan selections, notify your current or future health plan sponsor of the qualifying event in your life as soon as possible.

- Other qualifying life events include getting married, losing coverage due to divorce, losing eligibility for Medicaid, and exhausting your COBRA coverage.

- Different plans have different rules. Contact your plan administrator about any change in status that impacts your health coverage to find out your rights.

Recommended Reading: Does Progressive Do Health Insurance

Is Losing A Job A Qualifying Event

There are several different kinds of qualifying life events, many of them revolve around changes in job, location, income, or family status. This could include getting married, getting separated, gaining a dependent, losing a family member, and court-ordered family dependent changes, among other things.

How Do I Change An Individual Or Family Plan

Who is this for?

If you purchase your own health coverage and are wondering when and how you can change your plan, this explains your options.

Having health insurance is important. Having the right health insurance is just as important. When you need to change your plan, we’ll help you understand what you can do and when you can do it.

Note

You May Like: How Much Does It Cost For Health Insurance

During A Special Enrollment Period

You might be able to switch health insurance plans outside of open enrollment if you experience a qualifying life event that impacts your coverage such as getting married or divorced, having a child, moving to a new coverage area or losing job-based coverage.

Such events trigger what is called a , a limited period of time during which you can buy a new ACA plan. In most circumstances, special enrollment lasts 60 days from the qualifying life event.

What Is Special Enrollment

If you don’t sign up for health insurance during the allocated time, you must wait until the next open enrollment period unless you have a qualifying event that makes you eligible for a special enrollment period .

If you have a qualifying event, you can purchase health insurance or change your existing coverage without waiting until the next open enrollment. If you don’t have a qualifying event, you’re required to maintain your insurance as is until the following enrollment period.

Also Check: Does Amazon Have Health Insurance

Does A New Job Count As A Qualifying Event

Any enrollment outside of that time has to be triggered by a qualifying event . Although, many Americans find themselves in a rock in a hard place as they are outside of employment and believe that they can get coverage when they start their new job. Unfortunately a new job is not considered a qualifying event.

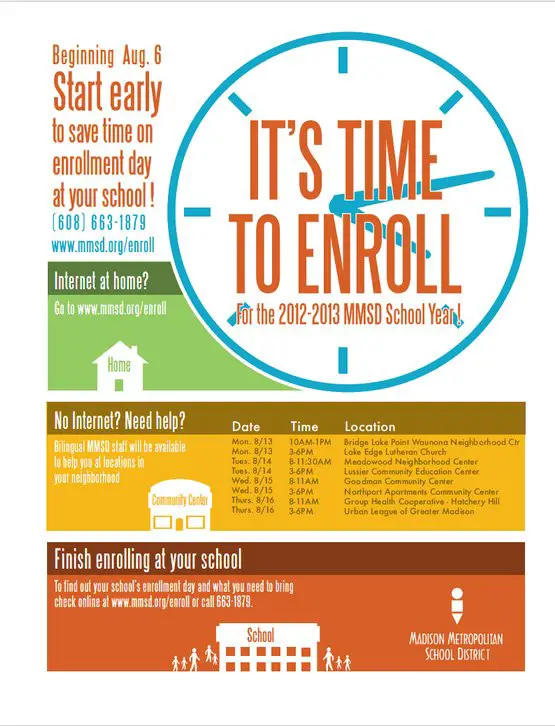

Switching Health Insurance During Annual Open Enrollment

Open enrollment is the time of year when anyone can change their health insurance plan, for any reason. The open enrollment period is every year from November 1 to December 15 .

During open enrollment, you can accept your current plans health insurance renewal, or you can shop around to find a better fit for you and your family. The new plan you choose will begin January 1.

Want to shop around? Here are a couple ways to make the experience a little simpler:

- If you want to look at new plans with your same insurance provider, you can usually compare plans online or call their team. At HealthPartners, its easy to review health insurance plans online or get personal help by calling .

- If you want to see options from different health insurance providers, you can either contact them directly, call your broker or use the health insurance marketplace. On the health insurance marketplace, you can see plan information from many different companies all at once. You can also find out if you qualify for financial assistance. In Minnesota, get started at MNsure.org. In Wisconsin, go to healthcare.gov.

Recommended Reading: Is Dental Insurance Included In Health Insurance

How Do I Change My Plan During Open Enrollment

How you change your plan depends on how you purchased the one you already have.

- If you purchased your plan on bcbsm.com, you can sign up for a new plan online, too. We’ll do the rest.

- If you purchased the plan you want to change through a health plan advisor or agent, contact them.

- If you purchased the plan you want to change on healthcare.gov, log in to your account there. See Changing health plans after you enroll to get started.

Multiple Plan Selections During Open Enrollment

As noted above, if you enrolled in a plan early in open enrollment and then changed your mind before open enrollment ended, you could log back into your exchange account and pick a different plan . In that case, the new plan would then take effect in February or March, depending on the date you enroll and replace the plan that had taken effect in January. If you need help or have questions about this, you can contact the exchange and follow its instructions for making a plan change. Make a note of who helped you, and get an incident number to keep track of the steps youve taken.

Be aware that the cancellation of your existing policy could take a while, especially during open enrollment when the exchanges and carries are very busy. Generally, if you enroll through the exchange, you have to initiate the cancellation request through the exchange, and theyll transmit it to the carrier.

If your premiums are automatically drafted from your bank account and youre switching to a different plan, you can request a change to paper billing in most cases, this can be done directly through the carrier. Then, if theres a delay in processing your cancellation request, you wont be inadvertently paying for two plans at the same time.

Make sure you pay any premiums due on the current plan to cover you until the new plan takes effect, so you dont end up with gaps in coverage.

Don’t Miss: Do Real Estate Brokers Offer Health Insurance