What Does Not Impact The Amount You Pay For Health Insurance

Gender: health insurance companies cant charge more or less based on your gender.

Pre-existing conditions: all health plans must cover treatment for pre-existing conditions once coverage starts.

Learn more about what impacts the cost of your health insurance.

Need an individual and family health insurance plan?

The Costs Of Individual Vs Family Plans

The Affordable Care Act offers some subsidies to make health insurance more affordable, but not everyone qualifies.

In 2021, health insurance premiums for unsubsidized individual customers were $645 per month on average, while family premiums averaged $1,852 per month. The average individual deductible is individuals was $4,490 the family deductible averaged $8,620.

Over the course of a year, the average health spending for a family of four in the U.S. was $22,221 in 2021. This figure includes spending on monthly premiums. It also includes meeting the deductible.

What Is The Average Cost Of Health Insurance

Maybe youre wondering, How much does individual health insurance cost? Heres what you can expect. The average individual in America pays $452 per month for marketplace health insurance in 2021.2 The average family pays $1,779 per month.3

But the cost of health insurance varies widely based on a bunch of factors. Some things are in your control, some arent. Things like your age, how many people are on your plan, how much coverage you need, where you live and who your employer is all play a role in the price of your coverage.

Heres a breakdown showing the average costs depending on your state:

Kaiser Family Foundation, 2021.

Read Also: How Much Does Starbucks Health Insurance Cost

Average Health Insurance Cost By Plan

Less surprising, though, is how the cost will differ based on the plan you use. After all, different plans offer different services, and those with more services and flexibility come at the price of a higher premium.

The four types of plans you may be able to get for your health insurance are a health maintenance organization , point-of-service , preferred provider organization and exclusive provider organization . Per ValuePenguin, the average monthly rate for a 21-year-old on each plan is:

- HMO: $230

How To Reduce Costs

The amount and the speed at which premiums for health insurance in Canada are rising have individuals and families looking for ways to reduce their costs. While some may be tempted to drop their private insurance and just rely on their provincial plan, most people do recognize the benefits of health insurance.

If you’ve been looking for a way to reduce your costs, you should read Insurdinary’s article on how to tell which insurance company is the best for you.

Recommended Reading: Kroger Associate Discounts

How Much Will Individual Health Insurance Cost

Your own individual health insurance premiums will depend upon several factors, such as the number of people that require coverage under your plan. Will the insurance be for you alone, you and your spouse, or your entire family, including your children? Premiums generally increase the more dependents you add to your plan.

Insurers also consider age, tobacco use, your ZIP code, and the type of individual health insurance you choose. Whatever kind of plan you decide upon, eHealth has options for you. With eHealth, you can easily compare individual and family health insurance quotes to find a plan that fits your needs and budget.

How To Estimate Your Yearly Total Costs Of Care

In order to pick a plan based on your total costs of care, youll need to estimate the medical services youll use for the year ahead. Of course its impossible to predict the exact amount. So think about how much care you usually use, or are likely to use.

- Before you compare plans when youre logged in to HealthCare.gov or preview plans and prices before you log in, you can choose each family members expected medical use as low, medium, or high.

- When you view plans, youll see an estimate of your total costs including monthly premiums and all out-of-pocket costs based on your households expected use of care.

- Your actual expenses will vary, but the estimate is useful for comparing plans total impact on your household budget.

Read Also: Does Insurance Cover Baby Formula

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

Can My Small Business Pay For My Health Insurance

In case of plans for a shop marketplace plan , one of your employees must first be enrolled in an insurance plan issued by you before you enroll yourself in the plan. The general rule is that your insurance plan cannot start with you, but not that you cannot take part as an equal member of your company.

If, however, you own an LLC , meaning that the loss and income of the entire business are reported on the personal income tax of the employer/owner, then you cannot enroll in the plan.

If, however, you have no employees then you could be considered both the owner and the worker but not an employer, in which case you may be seen as a small group of one in the eyes of the law.

Also Check: How To Keep Insurance Between Jobs

Is Group Insurance Taxable

Life insurance premiums are not taxable in most cases, meaning that no sales tax is charged or added. An employer can pay insurance premiums on behalf of their employee, which counts as a deductible. This means that you as an employer can deduct your employees premium cost from their paycheck before the deductible of any federal taxes.

The result is that your employees have lower taxable income meaning that their take-home pay increases, which essentially means that this kind of insurance plan also benefits the financial situation of your employees and ensures greater satisfaction.

Should You Get Single Premium Life Insurance

Most people should not get a single premium policy. The financial regulations around modified endowment contracts mean theyre best used for specific wealth planning purposes with the guidance of a certified financial professional.

Youll spend much less on term life insurance, which lasts only as long as you need it. If you need lifetime coverage or a cash value account, its simpler to manage a permanent policy with monthly or annual premiums.

Also Check: 8448679890

Average Cost Of Health Insurance

One of the primary factors in your individual health insurance costs is your location, as prices will vary depending on the state and county in which you live. In this first table, we look at health insurance premiums for 2022 and how they differ by state.

| State |

|---|

Policy premiums are for a 40-year-old applicant on a silver plan.

Why Is Life Expectancy In The Us Lower Than In Other Rich Countries

The graph below shows the relationship between what USA as a country spends on health per person and life expectancy in that country between 1970 and 2015 for a number of rich countries.

The US clearly stands out as the chart shows: Americans spend far more on health than any other country in the world, yet the life expectancy of the American population is shorter than in other rich countries that spend far less.

What are the best places for healthcare globally?

You May Like: Is Umr Insurance Good

Is Group Insurance Mandatory

While every company should offer a health insurance plan to its employees, it is not mandatory by the law and you as an employer can choose not to offer a group plan for your business. If you have a small company and/or are just starting out, maybe group health plans are the least of your worries.

Having said that, most working-class citizens of the 21st century will not agree on taking a job position if there isnt some sort of health insurance included, and around 70% of Canadians have some sort of supplementary health insurance plans, so keep that in mind when deciding whether or not its worth it.

Regardless of who pays the premium, group health benefits can be compulsory and voluntary. In case of a compulsory plan, no member of the company can opt-out of the plan, while in the case of a voluntary plan the eligible employee can decide if they want to be included or not.

How Age Factors In

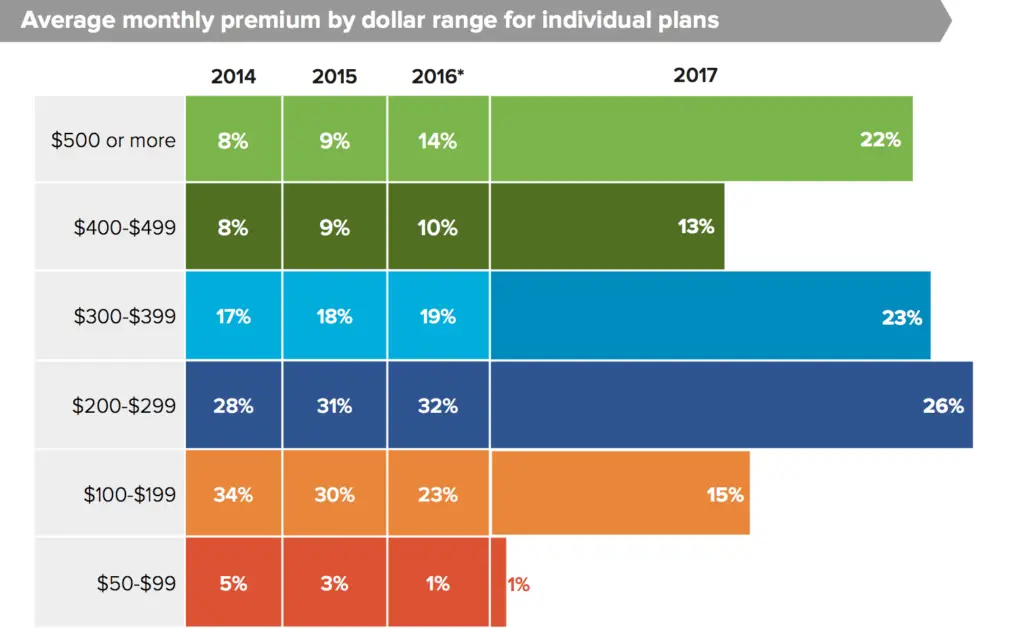

Young people, who are expected to benefit from lower premiums should the GOP repeal-and-replace efforts succeed, already pay the least. But even their costs can be considerable, depending on where they live. In 2016, the financial data siteValuePenguin found that the average costs for coverage for a 21-year-old go from $180 a month in Utah, plus a $2,160 deductible , to $426 a month in Alaska, with a $5,112 deductible .

As a reminder, 72 percent of young millennials, aged 18-24, have less than $1,000 in their savings accounts and 31 percent have nothing saved at all.

You May Like: What Benefits Does Starbucks Offer Employees

Individual Health Insurance And Health Reimbursement Arrangements

Group and individual health insurance plans are popular choices but theres another option that can benefit employees and employers called a health reimbursement arrangement that is growing in popularity and works in conjunction with individual health insurance.

HRAs allow employers to reimburse employees, tax-free, for healthcare, including individual health insurance premiums and qualifying out-of-pocket medical expenses.

With an HRA, employers set their own budgets by offering an allowance amount for each employee. Employees win big on flexibility by being able to choose their own individual health insurance plan thats tailored to their specific needs.

Lets take a look at two of the most popular HRAs which are the qualified small employer HRA and the individual coverage HRA .

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates: For instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in southern Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County, in the Florida Panhandle.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

Read Also: Is Umr Good Insurance

Factors For Your Health Insurance Rate

Health insurers look at many factors when figuring out how much your premium will cost. These include:

The Kaiser Family Foundation offers a Health Insurance Marketplace Calculator that can help you figure out roughly how much your plan will cost.

What Are Average Health Insurance Costs

In the U.S., 55% of people receive health insurance through their employer, and 20% receive insurance coverage through government assistanceeither through Medicaid or Medicare according to the U.S. Census Bureau. Some peoplesuch as those who are self-employedchoose to purchase insurance privately, says Peter Kongstvedt, M.D., a health care expert and author based in Virginia. There are also 8% of people in the U.S. with no health insurance coverage at all.

The average health insurance cost for a single person who received health insurance through their employer in 2020 was $7,040 a year, according to data compiled by the Kaiser Family Foundation. The average cost of health insurance for a family in 2020 was $21,342 a year. These numbers represent what someone pays for a health care premium. A premium is the amount you pay each month to the health insurance provider, Dr. Kongstvedt says.

A premium is different from a deductible. A premium is what you pay up front , regardless of if you get health care or not. A deductible is something you pay in plans if you actually receive health care, Dr. Handel explains. For example, if the deductible for your health insurance plan is $1,000 a year, youll need to cover the other medical bills beyond that amount, he adds.

You May Like: Starbucks Health Insurance Part-time

Total Out Of Pocket Costs

What people do see is their out-of-pocket expenses. Changes to supplemental insurance programs over the past years have impacted deductible rates as well as items covered.

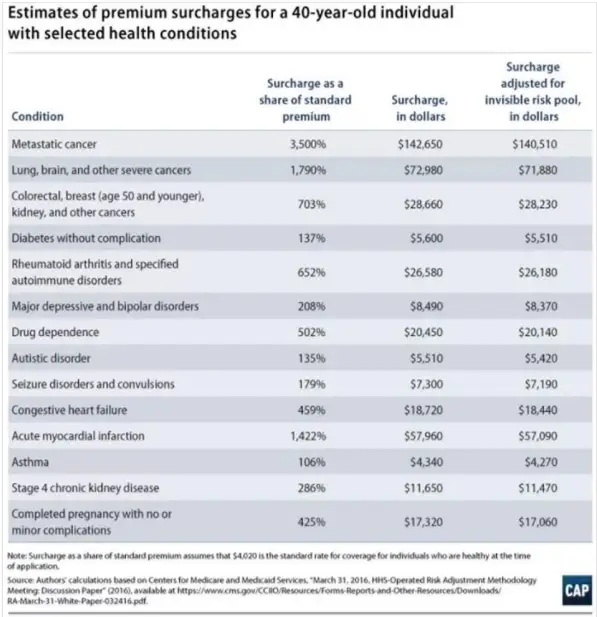

Pre-existing conditions can also play a big part in how much you pay for health care. Your condition may prevent you from being able to get supplemental coverage. Most often, however, it means there are exclusions in your health plan or higher deductibles. Both of these mean higher costs to you.

What Does Health Care Cost America Now

One widely respected source of information about the current cost of all health care in the US is the Centers for Medicare and Medicaid Services , an agency within the US Department of Health and Human Services. Its estimate of the total amount that was spent by everyone for all health care in the US last year is nearly $3.5 trillion, with that amount projected to rise each year under our current health-care system until it reaches $5.7 trillion for 2026, the last year for which CMS has produced a projection. Total 10-year cost of the current system: $45 trillion.

The current system is funded primarily from American households , the federal government through taxes , private businesses and state and local governments through taxes .

Also Check: Starbucks Dental Coverage

How Much Does Health Insurance Cost

In 2022, the average cost of health insurance is $541 a month for a silver plan. However, costs will vary by location. Insurance is expensive in West Virginia and South Dakota, averaging more than $800 a month. States with cheaper health insurance include Georgia, New Hampshire and Maryland, averaging less than $375 a month.

Canadian Costs Versus The World

So where does this leave our average family of four? In their 2015 report, the Canadian Institute of Health Information noted that Canadians were among the highest health care spenders in the world. They estimated the average spend at $5,782 per person.

That put the personal spending above the average but nowhere near the biggest spenders. As it has for years, the average American spent twice as much as $11,916. An average family in Sweden spent slightly more at $6,601 and the same family in the UK spent $5,170.

Read Also: How Long Insurance After Quitting

Average Cost Of Health Insurance For A Single Male

The average cost of health insurance for men in 2020 was $438 per month without a subsidy, per eHealth data. Note that this research focuses on those who buy insurance through the marketplace.

The premium you pay for health insurance will also depend on the type of plan you select. Consider options like HMO vs. PPO when you make your choice.

How The American Recovery Plan Act Makes Health Insurance Cheaper

Signed into law on March 11, 2021, the new $1.9 trillion COVD-19 stimulus package will have a major impact on the healthcare premiums of millions of Americans.

Officially known as the American Rescue Plan Act, this stimulus is expected to reduce healthcare premiums on some plans by as much as 20%. This will ultimately save millions of Americans hundreds of dollars on healthcare.

The stimulus plan reduces healthcare costs by expanding tax credits on many healthcare plans. Healthcare costs vary based upon an individualâs age, income and chosen plan but consider the following examples.

Stimulus impact for

Also Check: Does Starbucks Provide Health Insurance

How To Get The Best Health Insurance

If youre looking to purchase health insurance on your own, you can just go to the websites of major health insurance companies in your area and see what plans they provide. You can compare plans on your own, although quotes will vary pretty widely.

But lets face it. This is a ton of work. Choosing the right health insurance plan for you or your family is a daunting task. And you probably have better things to do with your time than sifting through endless health insurance quotes.

Thats why I recommend using our trusted and independent insurance agents for your health insurance needs. Theyll look at your situation and compare the best rates so you can get the coverage you need. Theyll help you understand the marketplace or even what your employer is offering. And the best thing? Theyre free!

Connect with one of our insurance agents today.

About the author

George Kamel

George Kamel is a personal finance expert and host of The Fine Print Podcast. Since 2013, George has served at Ramsey Solutions where he teaches on how to spend less money, save more, and avoid consumer traps. He is also the host of The EntreLeadership Podcast.