Association Health Plans Faqs

Q-1. Does the recent U.S. Department of Labor Association Health Plan Rule, 83 FR 28912, preempt New Yorks regulation of associations or multiple employer welfare arrangements ?

A. No. The AHP Rule has no impact on, and does not preempt in any way, state regulation of insurance coverage issued to or by associations or MEWAs, or to individuals therein. For more information on the regulation of AHPs in New York, see Insurance Circular Letter No. 10 , available at https://www.dfs.ny.gov/insurance/circltr/2018/cl2018_10.htm.

Q-2. Does the Department of Financial Services regulate insurance coverage sold to MEWAs?

A. Yes. DFS regulates the insurance coverage sold to MEWAs.

Q-3. Is an AHP considered a MEWA under the Employee Retirement Income Security Act ?

A. Yes. The AHP Rule expressly states that an AHP is a type of MEWA.

Q-4. May an AHP sponsor fully-insured coverage to its members in New York?

A. Only under certain specified circumstances. For a group or association of employers to sponsor a group health plan in New York, the group or association must meet specific requirements to be a recognized group under the Insurance Law. For example, Insurance Law § 4235 and require that an association be in active existence for at least two years and be formed principally for purposes other than obtaining insurance coverage for its members. In addition, the insurance coverage issued to the association is subject to DFS approval and oversight.

How Do Association Health Plans Work

Organizations in small group coverage all pay a similar rate for a similar arrangement. Large group coverage, then again, permits you to arrange the rates. Since AHPs qualify as a “large group,” this implies private companies could possibly get less expensive plans and give those reserve funds to their workers.

AHPs are coordinated and overseen under ERISA and they should follow guidelines of the Affordable Care Act that safeguards workers in employment-based group health plans.

What Are Association Health Plans For Small Businesses

Association Health Plans are a way for small businesses and individuals to band together to purchase health insurance. We explore the pros and cons in this article.

No account yet? Register

To reduce health insurance costs, some small employers are banding together to offer coverage through an Association Health Plan . But before you jump on the AHP bandwagon, its important to know what youre getting into.

Recommended Reading: How To Cancel Evolve Health Insurance

What Is Changing About Association Health Plans

The big change with these plans is that they will now be regulated the same as large employer policies. Most importantly, this means that association health plans do not need to adhere to Obamacare rules, such as the requirement to offer plans with the ten essential benefits.

According to former Labor Secretary Alexander Acosta, AHPs are about more choice, more access, and more coverage. These plans will probably benefit enrollees by having lower premiums, and might even mean the difference between offering coverage or not for some small employers who struggle to afford Obamacare prices.

But at what cost does access to more choice and cheaper premiums come at?

Although being part of a larger group does often come with price reduction due to a larger risk pool, there are more reasons why these plans will likely be a lot cheaper.

As stated before, these plans do not have to offer the ten essential benefits. If youre a young woman looking for maternity benefits, or someone with a chronic illness, you might not be getting everything you need by getting coverage from an association health plan.

Also differing from ACA policygender, age, and industry could affect prices of individuals being covered under association health plans. Health status is not included in this list though, so just as with the ACA, pre-existing conditions will not affect prices for those covered under association health plans.

Understanding The Basics Of Association Health Insurance

Simply stated, association health insurance is just a group health plan where multiple employers join together to offer medical benefits. By joining together and increasing the number of participants to the point where the association qualifies as a âlarge groupâ health plan, the association can:

- Take advantage of less-expensive health plans that have a lower percentage of premiums spent on insurer profit and administrative costs

- Design plan benefits according to best practices among large businesses & explore the value of digital health program innovations

- Negotiate better rates from healthcare providers and insurers

- Consider self-insuring to lower plan administration costs further and avoid health insurance tax

For a more detailed overview of association health insurance, read our article âWhat Is an Association Health Plan?â or you can explore our book-length treatment Association Health Plans & the Future of American Health Insurance.

Also Check: Starbucks Partner Health Insurance

Association Health Plans Explained

Association Health Plans are health plans sponsored by groups of employers with a common purpose to provide health care coverage to their employees. They are one alternative for small businesses to give health care coverage to their employees.

Many small businesses cant afford to pay for health insurance for employees, leaving many U.S. workers without coverage. The U.S. Department of Labor says that up to 11 million people nationwide who work for small businesses or are self-employed dont have employer-sponsored insurance for health care.

Learn how you may be able to offer AHPs to your employees and more.

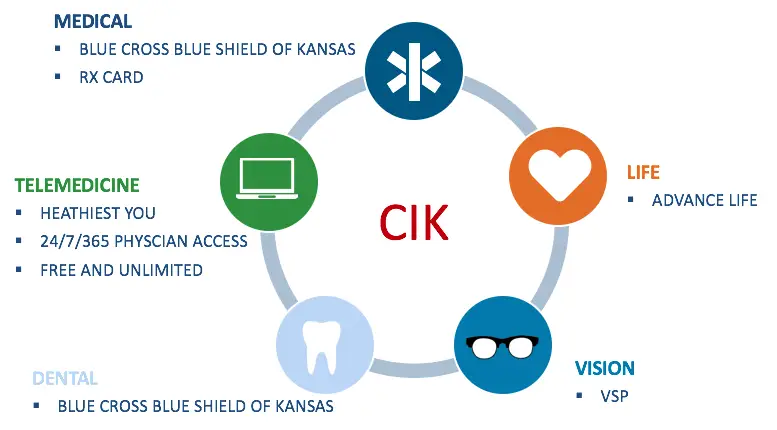

Ahps Include Health Insurance Basics

Association health plans work like traditional, major medical health insurance. When you join, you should expect to receive a familiar membership card.

Most association plans partner with a larger health insurersnetwork of doctors. You may be familiar with how smaller cell phone companies rent and resell minutes from AT& T. Similarly, your association plan can provide low rates by paying for members care in bulk.

Recommended Reading: Sidecar Health Dental

Insuranceopedia Explains Association Group Insurance

If an insurance company can sell bulk amounts of policies at once, instead of selling each policy individually, it can save time and money. These savings on the insurer’s side translates into the discounts offered on group insurance plans.

However, to purchase association group insurance, the group must be a recognized and official organization, such as the AARP. People cannot form an association with the sole purpose of purchasing insurance. In contrast, these policies are meant to be a form of membership benefits. Without this exclusion, insurance companies would be susceptible to adverse selection.

Ahp Regulation After Federal Court Decision

The DOL has appealed Judge Batess ruling. It has not, however, asked that the effectiveness of his ruling be stayed. Instead, it has issued two guidances describing its enforcement policy under the courts decision. Pending resolution of the appeal, the DOL will not take enforcement action against a pathway 2 AHP for acting in good faith on the rule prior to the courts decision. AHPs are responsible for meeting their obligations under their existing contracts for the remainder of the contract or plan year. After that, new coverage must comply with the appropriate market rules for example, coverage sold to individuals must conform to individual market rules.

The enforcement guidelines preclude further sales of coverage by plans based on geographic proximity . They also would prohibit further sales to working owners of plans that do not conform to individual market rules. In a letter to the DOL, New York argues that the DOL should go further and require AHPs to cover all essential health benefits immediately.

Publication Details

Don’t Miss: How To Enroll In Starbucks Health Insurance

Key Elements Of Final Ahp Regulation

Under the U.S. Department of Labors final regulation on AHPs, associations would be allowed to:

- Form an association for the sole purpose of offering health insurance, although it must have at least one substantial business purpose unrelated to providing benefits

- Form an association without a common interest other than a shared industry or a shared location

- Offer health insurance that qualifies as large-group coverage to all of its employer members regardless of their size and including self-employed and sole proprietors

- Offer health insurance that does not have to comply with many of the Affordable Care Acts consumer protections and

- Charge higher rates based on factors such as age and gender so long as the association does not use the health status of member groups to determine eligibility, premiums, or benefits.

Although the new rule loosens federal minimum standards for AHPs, the final rule confirms that states retain broad authority over these plans, regardless of whether they are marketed by an in-state or out-of-state association. This includes the ability to regulate financial solvency and set marketing and insurance standards, including rating rules and mandates to cover benefits.

Trump Administrations Ahp Rule

In June 2018, the Department of Labor greatly expanded the circumstances under which an aggregation of small groups could be considered a large group, creating what are now called pathway 2 AHPs. Under DOLs new regulations, an AHP could pass muster as a single employer plan if:

- it served at least one substantial business purpose other than providing health coverage, even though its primary purpose was offering health coverage

- its member employers were either in the same trade or business or in the same geographic area, which could span several states, and

- the employer members in some sense controlled the AHP and health plan.

Under the new regulations, AHPs could also cover individual working owners, even though the working owners had no employees other than themselves. The rule prohibited AHPs from discriminating against enrollees on the basis of health status but allowed AHPs to exclude or charge higher premiums to employers on the basis of age, gender, occupation, or other factors.

Although AHPs continue to exist under the pathway 1 rules, a number of entities in particular, chambers of commerce have moved quickly to take advantage of the new rule. The Congressional Budget Office projects that more than 3 million people will be covered by an AHP under the new rule. Some states have taken legislative or regulatory actions to encourage or to discourage AHP formation under the new rules.

Also Check: Starbucks Benefits Package

How Can I Enroll In An Association Health Plan

The changes that will make association health plans easier to join should soon be finalized.For now, your employer will probably let you know if they offer an AHP. AHPs arent available to self-employed people or to small groups that dont have a common industry or interest.

If youre looking forward to joining an association health plan, it may be easy to get one in the future. In the meantime, youll want to compare Affordable Care Act coverage or temporary health insurance options from a trustworthy national site like HealthCare.com.

Editors Note: This article was updated on July 19, 2018 to reflect the Department of Labors final rules on AHPs, instead of the draft rules and in April 2019 to reflect a federal court preventing some AHP rules from taking effect. It was updated again on June 2, 2021 t reflect the hold request from the Biden administration.

*Though AHPs count as minimum essential coverage for federal purposes, a few states are considering laws that decertify most or all AHPs as minimum essential coverage within their borders. As of writing, only New Jersey has passed this law.

Who Your Health Insurance Policy Covers

Your health insurance policy covers you if the policy is in your name.

Your spouse or partner and children under 19 years old may also be eligible for coverage under your insurance policy. Children over 19 may be eligible for coverage under your policy if they are still in school or if they are disabled.

Also Check: How To Keep Health Insurance Between Jobs

How Does The New Final Regulation Interact With Ohio Law

Because all AHPs are comprised of multiple employer groups, AHPs are Multiple Employer Welfare Associations under Ohio law. Therefore, Ohios laws pertaining to MEWAs continue to apply to groups that are providing benefits through a self-insured MEWA. Other insurance laws, such as those requiring insurance companies to file forms and rates, will continue to apply to insurance products offered through a fully-insured MEWA.

Expand Your Range Of Healthcare Options

AHPs should have significant and considerable member representation. Employers should effectively practice control over the planâs advantages and administration, regardless of whether they run the everyday workings of the plan.

It’s critical to have more options in the unfriendly medical coverage market. In principle, making AHPs bigger can effectively distribute risk and cut down costs for everybody. Truly, that is something we’ve heard in each round of American health reform, with little achievement.

Read Also: 8448679890

Don’t Pay For Unnecessary Care

Association health plans don’t need to cover Obamacare’s fundamental medical advantages. Most health plans in individual and small group markets have needed to cover every one of these 10 significant kinds of care – like rehabilitation and emergency services- started around 2014.

Rivals of mandatory essential health benefits dislike that the advantages are one-size-fits-all. For example, EHBs expect men to pay for unused maternity care. Furthermore, fundamental medical advantages are not generally covered well – they’re essentially covered. A large part of the expense sharing weight can in any case be on the plan member and not the plan, for services that are not entirely covered with few physicians available.

New Ahps Offer More Protections

Despite fears that AHPs would result in fewer consumer protections, a report by AssociationHealthPlans.com found that the new plans provide comprehensive benefits and double-digit cost savings.

Coleman said the new AHPs are offering similar coverage to regular health insurance plans. Many are providing coverage for doctor visits, hospitalization, emergency care, prescription drugs, maternity, preventive and mental health care.

Most of the AHPs were set up by regional associations, such as chambers of commerce. Coleman found that AHPs usually offer multiple plan options.

Coleman added that nearly half of the new AHPs are available to sole proprietors and self-employed people. About half are limited to businesses with between two and 50 employees.

Nearly half also offer medical savings accounts, such as Health Savings Accounts . HSAs allow people to save money tax-free for health expenses.

Major insurers are involved in AHPs, such as UnitedHealthcare and Blue Cross Blue Shield plans. That list could grow depending on how many people sign up for AHPs.

One example of an AHP is provided by Land OLakes. The Land O Lakes Cooperative Farmer Health Plan provides ACA-compliant plans with an extensive network of doctors and hospitals. The AHP is available in Minnesota and Nebraska to farmers in participating co-ops and individual dairy farmers in those states.

Don’t Miss: Does Starbucks Have Health Insurance

What Does Independent Practice Association Mean

An independent practice association is a type of health maintenance organization composed of health professionals who have formed a partnership or forged a contract to make their services available to insurance companies and other third parties. This arrangement allows physicians to keep their individual practices and treat other patients, but to also be a part of an insurance network and gain access to patient referrals from the insurance company or third parties.

Physicians that are part of an IPA are compensated by the referring partner on a per-patient fee, a discounted fee schedule or even paid a flat retainer fee to cover all the various medical services they may provide.

Independent practice associations are beneficial to physicians and health professionals because they get a steady flow of customers from the network. This arrangement is also beneficial to insurance companies and third parties because they get to pay less on medical claims since they pre-negotiate discounted rates versus sending insureds to get treatment with out-of-network providers and paying market rates.

An independent practice association is also known as an individual practice association.

Ahps Expand Your Range Of Healthcare Options

AHPs must have meaningful and substantive member representation. Employer members must actively exercise control over the plans benefits and governance, even if they dont run the day-to-day workings of the plan.

Its important to have more choices in the unfriendly health insurance market. In theory, making AHPs larger can efficiently distribute risk and bring down costs for everyone. Granted, thats something weve heard in each round of American health reform, with little success.

Don’t Miss: Starbucks Benefits For Part Time

Overview And Key Concepts

By Kev Coleman – Health Insurance Industry Expert & Author

In its simplest sense, an association health plan is a type of group medical insurance for employers that allows smaller companies to access the health insurance savings associated with large group medical coverage. Association health plans have been around for decades but recent regulation has made it easier for businesses to band together and sponsor an AHP based on a shared profession, line of business, or geographical region . Strictly speaking, association health plans arenât a new category of health insurance but an instrument by which small employers can access the existing large company health insurance market. For insurance industry insiders, large company health insurance is known as âlarge groupâ and, in most states, would require at least 51 eligible employees. In a few states, the threshold to be considered a large group is higher at 101 eligible employees. Large group health insurance already covers around 100 million people within the United States.

How To Join An Association Health Plan

To join an AHP, your association should share a “commonality of interest” with its individuals. By and large, this has implied that you are in a similar exchange, industry, line of business, or profession. Under the new rule, an AHP could likewise be made in light of organizations in a similar region, like a state, province, or metro region.

For instance, an AHP should be a “bona fide group or association of employers.” Under the standard, its main purpose can be to give medical coverage to its individuals. Nonetheless, it should have no less than one communicated business purpose irrelevant to giving medical care. While the rule didn’t unequivocally characterize “business purpose,” models referred to include:

- To participate in advertising exercises like promoting, advertising, and distributing on business issues important to association individuals.

- To set business norms or practices

- To offer classes on business issues important to its individuals

An AHP should be constrained by its individuals, however, those individuals don’t need to run the everyday tasks of it and can rather choose directors, legal administrators, and such to do as such. One significant exemption for note is that an AHP can’t be possessed or constrained by an insurance issuer or a subsidiary or affiliate of one.

Track down an AHP by checking with your trade association to check whether they have an arrangement.

A few different spots to check:

Also Check: Do Starbucks Employees Get Health Insurance