Health Insurance Can And Should Be Affordable

Small businesses are stuck between a rock and a hard place when it comes to health insurance. Rising costs make it difficult for small businesses to carry health insurance coverage for their employees, even as healthcare coverage becomes increasingly important to have. Unlike large employers who can leverage economies of scale to offer customized, affordable healthcare, small businesses have few options.

The Average Cost Of Health Insurance By Metal Tier

Plans offered on the Health Insurance Marketplace are categorized into metallic tiers: Bronze, Silver, Gold and Platinum.

The tier corresponds to the value of the coverage, or how health plans and members split the costs. For example, in Bronze plans, the health insurer pays approximately 60% of the costs of care, and the individual typically pays 40%. The provider typically pays 90% in Platinum plans, and the individual pays 10%. These ratios are set by tier and based on expected spending for a typical health plan member.

In MoneyGeeks analysis, the lowest average premiums were $383 per month for Bronze plans. The average Platinum plan, by contrast, costs $782 per month.

Average Health Insurance Premiums by Metal Tier

Scroll for more

- $170$3,501

Are There Dental Insurance Plans Specific To Each Province

Each province provides different levels of care as a part of its public insurance offering, meaning private options also differ. Private insurance plans are designed to fill in gaps around public coverage. Pricing, reimbursements, and types of dental procedures covered change accordingly. Dental care is not well-covered by public insurance plans.

Provinces have schedules of suggested fees for dental care. Procedures can vary significantly from one to another. 30 minutes of cleaning is $86 in Nova Scotia, $91 in British Columbia, $115 in Ontario and $116 in Quebec and $140.20 in Alberta! That is a significant difference. Insurances adjust their pricing and offerings for this reality.

Also Check: Can I Add A Sibling To My Health Insurance

How Much Employers Should Pay For Health Care Benefits

In light of these recent trends, how much should employers be paying for health care now? And what can employers expect going forward?

A good rule of thumb in every economic climate is to keep your benefits costs within 10-20% of your annual revenue. As far as whats affordable for employees, aim to keep their premiums under 10% of their income. Of course, remaining a competitive and attractive employer may require that companies aim at keeping employee premiums much lower.

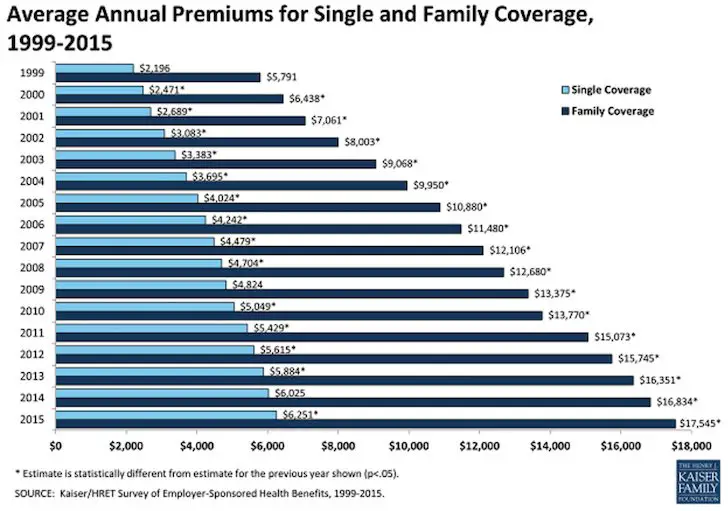

Looking at the historical trend data, we see a pronounced trend toward minimizing the impact of rising insurance costs on employees. KFF data from 2016 to 2020 shows that while annual premiums for a single individual increased from $6,101 to $7,470, employers have shouldered the bulk of the increase. During that time period, employer costs rose from $4,776 to $6,227, while employee contributions remained relatively flat. That trend will likely continue as employers seek to stabilize employee premiums.

Different Levels Of Coverage

Okay, stay with me here. I’m almost done with this marathon investigation into all things health insurance. I looked at the different types of plans, but theres a little more to it before we put a bow on all this.

When it comes to marketplace health care plans, there are four different levelsbronze, silver, gold and platinum. Think of them like medals at the Olympics. These tiers give you different options on how much your plan will actually pay out versus how much youll pay. Also keep in mind they dont reflect quality of care.14

Generally speaking, plans with a lower monthly premium will mean a higher deductible, and vice versa.

Bronze is one step up from a catastrophic plan. They give you lower monthly costs, but more out-of-pocket expenses.

Silver offers lower deductibles and out-of-pocket costs than Bronze, but youll pay more in monthly premiums. And depending on your income, silver plans also come with discounts called cost-sharing reductions where the provider could cover costs up to the 90% mark.

Gold plans have high monthly premiums but low deductibles, coinsurance and out-of-pocket costs.

Platinum is the highest monthly premium out there, with the lowest out-of-pocket costs. This type of coverage means youre really putting all your eggs in that big monthly premium basket! But having a lower deductible means your insurance company will start covering those crazy health care expenses a lot sooner.

Also Check: Does The Va Provide Health Insurance

Ready To Sign Up For Coverage With Decent

Individuals and businesses anywhere in the state of Texas can enroll in a Decent health plan. Your Personal Benefits Manger can walk you through the different plans that are available, as well as tell you more about the concept of Direct Primary Care.

Call 800-913-0172 to schedule a free, no-obligation consultation, or click the link below to run a Free Quote.

How Much Does Private Dental Insurance Cost In Canada

The cost of dental care generally depends on your province and desired level of coverage. Paying for dental insurance is a concern for Canadian families living on tight budgets. It is worth it! Regular preventive care is usually cheaper than waiting to have an emergency.

According to the Canadian Dental Association, annual per capita spending on dental services is more than $378! 94% of that spending is private.

You May Like: Does Colonial Life Offer Health Insurance

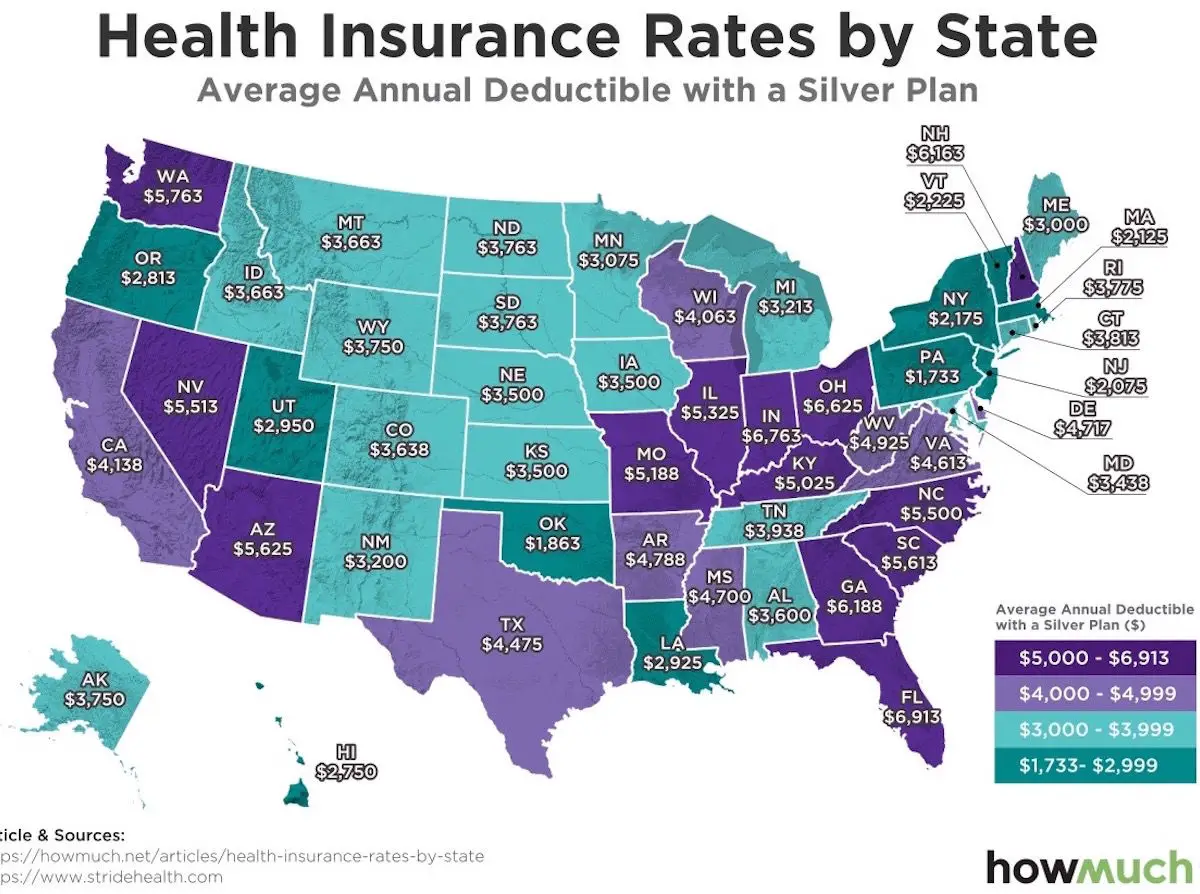

Healthcare Costs Based On Age And State

Healthcare costs vary based on your age and the state you live in. As you might expect, younger, healthier adults pay the least for healthcare coverage, but even for younger adults, the cost of coverage varies greatly based on location.

In 2021, the average cost of a monthly health insurance premium in the U.S. is $541 per month. The average annual deductible is $5,940. In some places, the cost varies greatly from the national average. In West Virginia, the average premium is $831 with a deductible of $8,540 in next-door Maryland, the average is only $344 with a $4,122 deductible.

Age is another big factor when it comes to the costs of health insurance. Take a look at this breakdown by age for the average monthly healthcare premium without subsidies:

- 18 and under: $224

- 55-64 years: $771

How To Estimate Your Yearly Total Costs Of Care

In order to pick a plan based on your total costs of care, youll need to estimate the medical services youll use for the year ahead. Of course its impossible to predict the exact amount. So think about how much care you usually use, or are likely to use.

- Before you compare plans when youre logged in to HealthCare.gov or preview plans and prices before you log in, you can choose each family members expected medical use as low, medium, or high.

- When you view plans, youll see an estimate of your total costs including monthly premiums and all out-of-pocket costs based on your households expected use of care.

- Your actual expenses will vary, but the estimate is useful for comparing plans total impact on your household budget.

Don’t Miss: How Much Is Health Insurance In Indiana

Find The Best Health Plans For Your Employees And Budget

There are endless ways to assemble health plans to ensure exactly the right balance of cost-effectiveness, quality and simplicity.

HealthPartners offers a range of health plan choices for employers in Minnesota, Wisconsin, Iowa, North Dakota and South Dakota, making it easy to find the right fit for your employees and your business.

What The Average American Spends A Year

According to the most recent data available from the Centers for Medicare and Medicaid Services , “the average American spent $9,596 on healthcare” in 2012, which was “up significantly from $7,700 in 2007.”

It was also more than twice the per capita average of other developed nations, but still, in 2015, experts predicted continued sharp increases: “Health care spending per person is expected to surpass $10,000 in 2016 and then march steadily higher to $14,944 in 2023.”

Indeed, average annual costs per person hit $10,345 in 2016. In 1960, the average cost per person was only $146 and, adjusting for inflation, that means costs are nine times higher now than they were then.

You May Like: What’s The Cheapest Health Insurance

What Is The Dental Care Cost Without Insurance

The cost of dental care procedures varies between provinces. For example, in Ontario, a dental check-up is $35. In British Columbia, it is $29.50, while in Alberta, it is a steep $67. Provinces publish a suggested fee guide, and insurance companies reimburse based on it. This means that providers within the same province usually have the same price.

To provide an example, see below for the suggested cost of common procedures in Ontario. Prices in British Columbia are generally slightly lower than this. Those in Alberta are generally slightly higher.

| Dental care |

|---|

| $4,500 – $5,500 |

Without insurance you will be paying these prices out-of-pocket. Oral surgery, implants and orthodontics are expensive. They can easily reach several thousand dollars. This is a difficult expense to cover with insurance.

How The American Recovery Plan Act Makes Health Insurance Cheaper

Signed into law on March 11, 2021, the new $1.9 trillion COVD-19 stimulus package will have a major impact on the healthcare premiums of millions of Americans.

Officially known as the American Rescue Plan Act, this stimulus is expected to reduce healthcare premiums on some plans by as much as 20%. This will ultimately save millions of Americans hundreds of dollars on healthcare.

The stimulus plan reduces healthcare costs by expanding tax credits on many healthcare plans. Healthcare costs vary based upon an individualâs age, income and chosen plan but consider the following examples.

Stimulus impact for

Don’t Miss: Can I Buy Dental Insurance Without Health Insurance

Health Insurance Spending Frequently Asked Questions

The amount you should spend on health insurance varies on a case-by-case basis. It depends on the level of coverage you need given your age and health status, but also on the amount you are able to pay. Regardless of the need, health insurance is extremely expensive, so we offer some cost-saving tips below.

Basic Health Insurance Terms

If youre just learning the ins and outs of health insurance, I feel your pain. Health insurance is complicated stufflike rocket-science complicated. You might not even know where to start.

Before we look at how much health insurance costs, lets break down some terms into plain English.

First, there are only two main kinds of health insuranceprivate and public.

Private coverage is health insurance through your employer, union or even the armed forces. You can also get it on your own through the governments marketplaceHealthcare.gov.

Public insurance is provided by the government. It includes Medicare , Medicaid or care from the Department of Veterans Affairs.

Your premium is the amount you pay monthly for your coverage.

The deductible is the amount you have to fork over before your insurance company starts chipping in.

Your maximum out-of-pocket costs are the limit to what you will pay in a year. For example, if your plans maximum out-of-pocket costs are $8,000, once you pay that amount, your insurance company will cover everything above that through the rest of the year. It acts as a financial safety net so you dont totally break the bank from medical costs.

Read Also: Can You Have 2 Health Insurance Policies

Private Health Insurance Plans

Private health insurance plans are sold both on and off of the Health Insurance Marketplace. If you qualify for subsidies from the government, you can use them towards the monthly premium of on-exchange plans.

Off of the Marketplace, private health insurance plans can be purchased from a private insurance company or broker. There are usually more options off of the exchange, but they can be more expensive. For unsubsidized, private health insurance plans, individuals aged 55 to 64 pay $799 per month on average.

If Your Employer Offers Health Insurance

Most people with health insurance get it through an employer. If your employer offers health insurance, you wont need to use the government insurance exchanges or marketplaces, unless you want to look for an alternative plan. But plans in the marketplace are likely to cost more than plans offered by employers. This is because most employers pay a portion of workers insurance premiums.

Read Also: How Much Do Kaiser Employees Pay For Health Insurance

The Average Cost Of Health Insurance By Plan Types

There are four types of health plans you can choose on the Marketplace, with varying degrees of flexibility and cost:

- Health Maintenance Organization : HMOs tend to have lower premiums but require you to use a specific set of providers and get referrals to specialists for covered services, except in emergencies. Silver HMOs average $473 per month.

- Exclusive Provider Organization : Somewhere between an HMO and a PPO, EPOs typically require that you use the health plans in-network providers, but you dont always need referrals to see specialists. EPO Silver plans average $508 per month.

- Preferred Provider Organization : PPOs tend to be more expensive than HMOs but typically offer a broader range of providers. You usually dont need to get a referral to see specialists for covered services. On the Marketplace, Silver PPO plans have an average premium of $517.

- Point of Service : POS plans tend to be the most flexible at an increased financial cost. You can usually get care outside of the health plans provider network, though youll likely pay more for those services. POS Silver plans have an average monthly premium of $534.

Average Health Insurance Premiums by Plan Type – Silver Plans

Scroll for more

Five Factors That Shape Health Insurance Premiums And Health Insurance Cost For Americans

Some Americans may pay significantly more or less for health cover due to factors such as:

What are the best places for American expats to live abroad?

Find out more here

Read Also: Do I Need Health Insurance In Texas

Different Types Of Plans

Shopping for a health insurance plan can sometimes feel like being in a grocery store and staring at rows of the same product for what seems like hoursonly its less exciting and way more expensive! But comparing plans could save you money. This is because the type of plan you choose also affects your health insurance costs.

Here are the plans and networks you can shop for in the health insurance marketplace:

How To Find An Affordable Plan That Meets Your Needs

Among eHealth customers who bought ACA individual health insurance, more than 75% chose Bronze or Silver plans. Your state may host an exchange for comparing and purchasing ACA plans or it may use the federal exchange at Healthcare.gov. Keep in mind, you arent limited to the exchange.

The licensed insurance brokers at eHealth can help you find the best health plan to meet your health coverage needs and your budget. They will listen to your priorities in health coverage and use their expertise to match your needs with health insurance options both on and off the exchange.

Recommended Reading: What Type Of Health Insurance Do I Need

The Average Cost Of Health Insurance By Company

What you can expect to pay for health insurance differs by the insurance company. Some insurers want to grow, so they offer more attractive rates. Others are more cautious and will charge more to be sure they can cover their members health care costs.

Among national carriers, rates can vary widely. For example, the average Silver plan premium for Kaiser Permanente plans is $427 per month. Anthem charges an average of $481, while UnitedHealthcares average rate is $641. Newer plans, such as Bright Health and Oscar, fall somewhere in the middle, with average monthly premiums of $488 and $492, respectively.

Premiums are not the only factor when choosing a health plan. Some of the most affordable plans can have coverage that falls short of your needs. The best health insurance companies can cost a bit more, but are surprisingly affordable and give you the best value for your money.

Consider the plan’s total cost by looking at things like deductibles, coinsurance and out-of-pocket maximums. Check that your preferred doctors and facilities are in-network to save money and hassle. Be sure to also review quality and customer satisfaction ratings available on the Marketplace to make sure youre not going to encounter more annoyances than a plan’s potential premium savings are worth.

Average Health Insurance Premiums by Company

Scroll for more

Can I Get Dental Insurance With No Waiting Period In Canada

Most insurance plans include a waiting period. The waiting period exists to prevent people from picking up insurance only when they have a health need.

Preventive care like cleaning and x-rays are usually available quickly without a long waiting period. Expensive procedures, including orthodontics and oral surgery, have a waiting period. Sometimes it can stretch to two or even three years.

For this reason, getting a plan now, when you do not yet need it, makes sense. It helps ensure that you are eligible once you have a claim.

Do not wait until you have a problem to start looking for dental insurance. Waiting periods can be long! Shop now so that you are covered when you have a need.

Also Check: How Much Is Private Health Insurance In Spain