Does Insurance Cover Lasik

The short answer is: not usually. Most health insurance companies dont cover LASIK, as they consider it to be an elective procedure. Some vision insurance plans do offer a one-time discount of $100 to $200 or a specific percentage off the total cost. Two vision plans that offer discounts, for example, are United Health Golden Rules, which offers an unspecified discount on laser eye surgery or laser vision correction and Direct Vision Insurance, which also offers an unspecified discount specifically on LASIK eye surgery. Plans like Aetnas Vision Preferred offer 15% off procedures performed using the U.S. Laser Network.

How Do I Buy An Aetna Medigap Policy

The best time to purchase a Medigap policy is when you are first eligible. During this time, you’ll have access to all of the insurance company’s plans, as well as access to the best prices and variety of policies. There is a six-month Medigap open enrollment period that starts on the first day of the month during which you are 65 or older and enrolled in Medicare Part B. You can still purchase a Medigap policy even after your Medigap enrollment period however, the insurance company will use medical underwriting, which may limit the policies you can purchase.

Here is a step-by-step guide to purchasing an Aetna Medigap policy:

Searching by state on Aetnas home page

Comparing Aetna Medigap plans and prices

Dental And Vision Insurance

Stand-alone dental insurance is available through Aetna Dental Direct. Dental insurance covers all preventive services such as dental exams, X-rays and flouride treatments, so there will be no additional out-of-pocket costs for these services.

Below are two examples of commonly offered Aetna policies that you can purchase. However, dental coverage isn’t available in every state. For example, residents of Connecticut and New York can’t access these plans. If this is the case in your state, we recommend looking for a different health insurer.

In other states, residents have additional purchasing options. Each plan typically has a different monthly premium, deductible and coinsurance levels.

| Aetna Dental Direct Preferred PPO | Aetna Dental Direct Core PPO |

|---|---|

| Deductible | |

| Depends on insured age and number of dependents | Depends on insured age and number of dependents |

Aetna also supplies vision insurance policies. However, these plans are only offered in conjunction with employer health insurance and thus cannot be purchased on a stand-alone basis.

You May Like: Can A Child Have 2 Health Insurance Plans

Final Thoughts On Aetna

With over 170 years in the industry and nearly 39 million customers, Aetna is a name you can trust in the insurance industry. The company offers seven Medigap plans to choose from, which is more than other providers we’ve reviewed, like Americo, whose plan offerings are more limited. We also appreciate their simple online enrollment process and large provider network.

- What is the eligibility for an Aetna Medigap Plan?

You are eligible to apply for a Medigap Plan if you are in a state that offers the policy, have Medicare Parts A and B, and are age 65 or older, or are under 65 with a disability or end-stage renal disease.

- What happens to my policy if I move states?

You can keep your policy even if you move states as long as you still have Original Medicare. However, Medigap policies may vary from state to state, so if you decide to switch to a different Medigap policy, you may need to contact your insurance company to know what is available in your new state.

Saving Your Insurance Card On Your Mobile Device

If you are enrolled in the UR Student Health Insurance Plan , you can save a copy of your insurance card on your mobile device by going to the Aetna Student Health web site and clicking on Get Your ID Card. You will be able to print your card and/or save it digitally. We recommend that you save your card on your mobile device. The instructions on the site will tell how to download the Aetna mobile app to view your ID card on your mobile device. Insurance cards are no longer being mailed to students by Aetna Student Health.

You May Like: Does Health Insurance Cover Plan B

How Does The Size Of My Family Impact My Insurance Cost

Who is this for?

If you purchase your own health coverage, this explains how the number of people covered by your insurance affects your monthly payment and other costs.

The size of your family doesnt necessarily determine what you spend on doctors and prescriptions. A healthy family of six could spend less than a married couple with chronic conditions. But when it comes to your health insurance costs, the number of people on a plan does affect what you pay. Well show you how.

Dont Miss: How To Get Health Insurance For My Small Business

Which Aetna Medigap Plan Is Right For Me

Choosing the right Aetna plan doesn’t have to be complicated. We’ve outlined our recommendations for the company’s various Medigap plans so you can find the one that’s right for your budget and lifestyle.

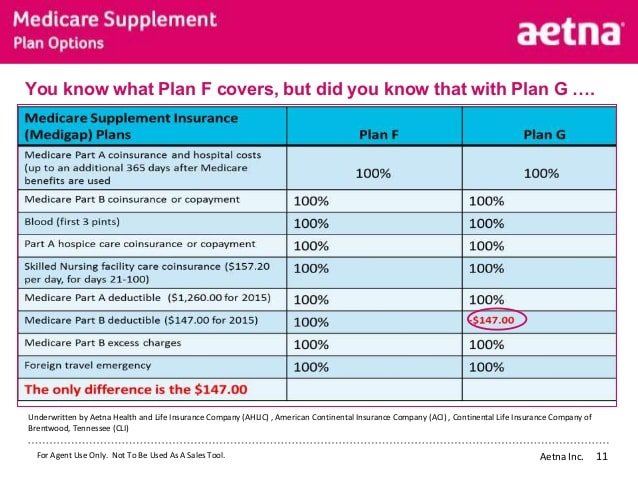

Pro Tip: For seniors enrolled in the Medicare Part A deductible plan, Aetna plans B, D, G, N, C, and F will provide the most benefits and coverage, while plans C and F are best for those enrolled in the Medicare Part B deductible plan.

Those who need basic, comprehensive coverage

In general, Aetna’s Medigap Plan A and Plan B provide comprehensive coverage for many seniors needs, including hospital coverage, hospice care, home healthcare, and assistance with copayments for routine appointments.

Seniors who travel frequently or are in need of highly skilled care

If you need more skilled care and currently live in or plan to move to a skilled nursing facility, plans D, G, N, C, and F will limit those additional costs. These plans also provide international emergency coverage, making them reliable options for seniors who travel frequently.

Seniors on a tight budget who don’t have frequent doctor’s appointments

For seniors who don’t need to visit the doctor as often, Plan N is one of the least expensive options however, you’ll be charged a $20 copay for every office visit and a $50 copay for emergency room visits. You should also know that Plan N copayments don’t count toward the annual Part B deductible.

Seniors with chronic health conditions or frequent appointments

Read Also: Does Health Insurance Cover Giving Birth

Changing From Family Plan To Single Plan

A single plan is simple enough to figure out with COBRA. It gets a bit more complicated if you need to switch from a family plan to a single plan. This can happen if you get divorced or turn 26 and are no longer eligible for coverage on your parents plan.

In instances like these, the HR officer will look up the rate for single coverage on the same health plan you are currently enrolled in. To calculate the COBRA cost, the HR officer will have to determine:

- What you would have been contributing to an individual plan. If you are a family member , your contribution would typically be higher than the employee . In some cases, dependents may be responsible for the entire amount if the employer does not contribute to family coverage.

- What the company would have been contributing toward that premium. If you are the employee , the amount should be clear-cut. If you are the dependent, the contribution can vary depending on the employer.

After adding these two figures together, you would add another 2% to calculate your total COBRA premium costs.

Take The Guesswork Out Of Your Costs

Everyone is feeling the squeeze of rising health care costs. Now, more than ever, you want to know what a doctor visit or medical test costs. Before you go, before the bill comes. And you don’t want to pay more than you have to.

Our cost-comparison tools can help you plan ahead and save money. Some tools may not be available for all health plans.

Don’t Miss: How To Apply For Kaiser Health Insurance

You Are Now Being Directed To The Cdc Site

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites.

You are now being directed to the Apple.com COVID-19 Screening Tool

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites.

You are now being directed to the US Department of Health and Human Services site

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites.

You are now being directed to the CVS Health COVID-19 testing site

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites.

You are now being directed to

The Fight Is In Us site

How Much Does Lasik Eye Surgery Cost How To Get It For Less

Are you tired of constantly adjusting your glasses? Would you like to turn back the clock to a time when you didnt have to wear contact lenses? If so, youve probably considered having laser eye surgery.

LASIK eye surgery has been FDA approved since 1999. LASIK standards continue to evolve as knowledge changes and new technologies develop, making it more popular than ever. To date, surgeons have performed over 20 million LASIK procedures.

But there is a lot of competing information on the internet about LASIK eye surgery costs. Its difficult to find the answers to all the questions in one place. In this article, well discuss what LASIK is, learn what to expect if you decide to go under the laser, and definitively answer questions like, How much does LASIK eye surgery cost? and Does insurance cover LASIK?

Read Also: How To Get Health Insurance For My Small Business

What Are The Alternatives To Cobra When I Leave My Job

COBRA isnt your only option when you lose your employer-sponsored plan. Depending on your situation, you may qualify for other health benefits:

- Join your spouse/partners employer-sponsored plan. Leaving your job triggers a special enrollment period that allows you to join your spouse/partners plan. Even if your spouse isnt enrolled in their employers plan, your job loss allows you both to sign up outside the usual open enrollment period within 30 days. Find out how qualifying life events, like marriage or having a baby, affect your health coverage.

- Choose a plan through the health insurance marketplace at healthcare.gov. You dont need to wait until Open Enrollment in the fall if you have a qualifying life event, such as leaving a job. You have 60 days to choose a plan, and your benefits will start the first day of the month after you lose your insurance.

- Enroll in a trade/professional group plan. You may be able to find plans with lower premiums through nationalorganizations that offer benefits for independent workers, such asthe National Association for the Self-Employed or the Freelancers Union . No proof of self-employed status is required.

- Low- and moderate-income families may be eligible for the Childrens Health Insurance Program . If you earn too much to qualify for Medicaid, you may be able to get your kids low-cost coverage through CHIP, which is jointly funded by states and the federal government. You can find more information on healthcare.gov.

What Is Aetna Known For

As one of the nations leading diversified health care benefits companies, Aetna provides people with information and resources to help them make better informed decisions about their health care and the financial side of health care. Our health insurance products include medical, pharmacy, dental, behavioral health.

Also Check: How Much Does Health Insurance Cost For Married Couple

Many Locations To Choose From

When you add Aetna Vision Preferred to your Aetna Dental Direct plan, you get access to one of the largest networks in the country. From your local eye care provider to national and regional retailers, youve got choices to fit your busy lifestyle.

You are now being directed to the Give an Hour site

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites.

You are now being directed to the CVS Pharmacy site

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites.

Available Medicare Advantage Plans

Aetna offers several different kinds of Medicare Advantage plans, and they vary in terms of structure, costs and benefits available. Most plans offer dental, vision and hearing benefits, worldwide emergency care, and fitness benefits through SilverSneakers.

In general, Aetna offers Medicare Advantage Prescription Drug plans, or MAPDs, as well as stand-alone prescription drug plans and Medicare Advantage Plans without drug coverage. New this year, the company is offering Aetna Medicare Eagle MA-only plans in 27 states, designed for veterans to complement their VA health care coverage.

Plan availability may vary by county. Other plan offerings may include the following types:

A health maintenance organization, or HMO, generally requires that you use a specific network of doctors and hospitals. You may need a referral from your primary doctor in order to see a specialist, and out-of-network benefits are usually very limited.

HMO point-of-service plans give you a bit more flexibility than traditional HMO plans. While you do have a primary doctor and you may still need a referral, you have more freedom to see out-of-network providers, although youll pay more for out-of-network care.

Also Check: How Much Do Health Insurance Agents Make

How To Get Aetna To Approve Your Treatments

Keep in mind that Aetna usually does not allow its members to just get whatever medical care they want and then request reimbursement afterward. If you want Aetna to assist you with coverage, you may need to get their approval first. There are a few different treatment approval methods used by Aetna. For most mental health coverage, the first type of approval you need is a referral. This will be where you meet with your primary care physician and get them to refer you to a mental health specialist.

You may also need pre-approval or pre-authorization for certain medications and procedures, and the healthcare clinic typically handles pre-approvals. They will take your insurance information and then contact Aetna to get approval for any care you need. Pre-approval, pre-authorization, and referrals are not required if you are in a mental health crisis though. If you need to seek emergency care because you feel you are a danger to yourself or others, you do not need to stop and get Aetnas permission beforehand. They will still cover emergency treatment even if you do not get it authorized in advance.

Understanding How Much Your Aetna Plan Will Pay For

The precise amount of coverage you get will depend on your Aetna plan. Some people have a plan with copays or coinsurance. A copay is a set amount of money you pay for each doctors visit or prescription medication. Coinsurance is similar, but instead of being a specific dollar amount, it is a specific percentage. Typically, you have to pay at least some of the cost for mental health care until you reach the deductible for your plan. Once all of your healthcare costs for the year reach the deductible amount, Aetna will cover the rest of your care.

Keep in mind that some Aetna plans may not have a copay or coinsurance for mental health care. In these cases, the costs still go towards meeting your deductible, and Aetna will cover costs after your deductible is reached. Furthermore, Aetna has special deals with many healthcare providers, so your out-of-pocket costs per visit is still less than an uninsured person would pay. Since costs vary so much depending on what plan you have, it is important to go over your plan carefully. To find out the exact cost of treatment, you should login to your Aetna account. They have anonline cost estimator tool that lets you know how much coverage your plan gives for various treatments.

Read Also: How To Sign Up For Health Insurance

How Much Does Cobra Cost

Most companies pay the majority of their employees health plan premiums, and the rest is deducted from your paycheck. On average, workers contribute 20% of the premium for individual coverage and 30% for family coverage. Under COBRA, youll be responsible for 100% of your premium, so your monthly COBRA payment may be 5 times higher than your payroll deduction.

Although that may seem like a lot of money, COBRA premiums are usually less than youd pay on the open market because youre still benefiting from your companys group discount.

If you have a health savings account , you can pay your COBRA premiums from those funds.

During the next open enrollment period, you may choose to switch to a less expensive plan. Premiums for high-deductible health plans , for instance, are considerably lower than other types of plans for both single and family coverage.