How Much Does Aca Health Insurance Cost

The cost of ACA health insurance depends on the type of plan you choose. They can range from catastrophic plans with low premiums and high deductibles. All the way to gold tier plans with higher premiums and more comprehensive coverage. Before subsidies, the average lowest-cost Bronze plan in 2020 was $331 per month and the average Silver plan was $$442 per month, according to the Kaiser Family Foundation. However, after subsidies, the average person in HealthSherpas study paid $47 because they received a subsidy of an average of $634. Although the sticker price of Obamacare plans can be high, 94% of people received a subsidy on HealthSherpa during 2020 Open Enrollment.

Enter your zip code below to find out how much you can save:

If you need help enrolling, you can call our Consumer Advocates at .

When Can I Enroll In Cobra Coverage

Typically you have at least 60 days after you lose your employer-sponsored health insurance to decide whether you want to enroll in COBRA health insurance.

COBRA coverage can also be retroactive, so no need to worry about a coverage gap during that enrollment window either. If you decide to pay for COBRA coverage and pay your premiums retroactively, your coverage will also be retroactive. That means any medical bills that would have been covered during your enrollment period will be reimbursed once youre enrolled.

Am I Eligible For Cobra If I’m Furloughed

Check with your employer to learn the details of your furlough. In general, here are some guidelines:

- You would not be eligible for COBRA if your employer is still offering your group medical benefits while you’re furloughed

- If your employer decided to discontinue offering group medical benefits to furloughed employees, then COBRA may be an option for furloughed, as well as laid off employees

In other words, if benefits are offered during furlough, COBRA is not an option. However, if your employer does not offer benefits to furloughed employees, COBRA would be an option.

Don’t Miss: How Much Coverage For Health Insurance

You May Be Eligible For Cobra Health Insurance

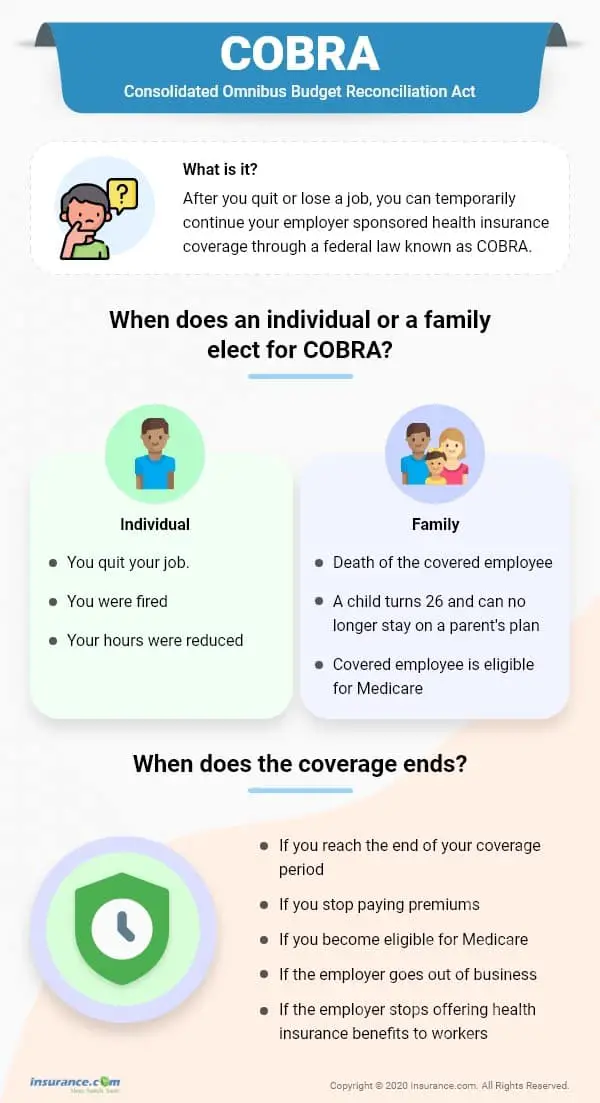

Continuation of workplace benefits requires an eligible qualifying event, such as job loss, temporary reduction in hours or a family-related event such as the death of the covered employee or divorce from a spouse. When a qualifying event occurs, a special open enrollment period opens where your past employer is required to offer a continuation of your medical insurance coverage. As long as you were enrolled in a qualified group health plan for one day, you can continue that same insurance.

QUICK CHECKCOBRA Eligibility

Is Cobra Coverage Expensive

COBRA can be significantly more expensive than what you paid under your employers plan. Why? Under COBRA, you pay 100% of the costs for the health plan. This includes any costs your employer previously helped pay. This extra cost can make this coverage more expensive for you, even though its the same health plan.

Read Also: Can Federal Employees Keep Their Health Insurance After Retirement

Who Qualifies For Cobra Health Insurance

You may qualify for COBRA if you experience a qualifying event that causes you to lose your employer sponsored health insurance. Some qualifying events include:

- Quitting

- Getting fired, unless it was for gross misconduct

- Having your hours reduced which made you ineligible for benefits

Dependents can qualify for COBRA too. Some qualifying events that would allow dependents to qualify for COBRA include:

- The death of a covered employee

- Losing dependent status as an adult child

- Divorce or legal separation

- A covered employee becoming eligible for Medicare

Do I Have A Qualifying Event

What qualifies as a life event depends on whether youre the employee losing coverage, or a spouse or dependent of that employee. Your life-event will qualify you for COBRA coverage if youre the employee and:

- Youre laid off.

- Youre fired, but not for gross misconduct like stealing or assaulting the boss.

- Your employment is terminated for any other reason.

- Youre still employed, but your hours are reduced to a level that causes you to lose your health insurance benefit .

Your life-event will qualify you for COBRA coverage if youre the spouse or dependent of the covered employee and youre losing coverage because:

- One of the above things happened to the employee.

- The employee is becoming eligible for Medicare. If this is your situation, discover your options about losing your health insurance because your spouse is getting medicare?“

- The employee died.

- Youre getting divorced or legally separated from the employee.

- Youre a young adult and youre losing your dependent status with the health plan. If this is your situation, discover your options about turning 26 & getting kicked off your parents health insurance.

Recommended Reading: Is Cobra Health Insurance Retroactive

What Is Cobra And How Does It Work

“COBRA” stands for the Consolidated Omnibus Budget Reconciliation Act. The Act is a federal law that has required private insurers for employer-sponsored group health plans to keep job-based health coverage in place after qualifying events since 1986.

These events include being laid off or terminated, except for “gross misconduct,” and losing coverage due to a divorce or as a dependent after the death of the primary beneficiary. They also include having your work hours cut.

What To Keep In Mind While Shopping For Family Health Insurance

Family health insurance costs can vary significantly, depending on your circumstances and preferences. While there is no tax penalty for not having health insurance in 2020, it is still important to get your family covered to protect yourself from unexpected healthcare costs that can be substantial in some situations.

To find family coverage thats right for your family and your budget, take a look at eHealths family health insurance options by state. eHealth can help you navigate all of these cost variables and find an affordable plan for you and your family.

Recommended Reading: How Much Does Usps Health Insurance Cost

How Do You Calculate Cobra Cost

Your former employer will send you a COBRA election notice. In that notice, you should see information about the cost you will pay for COBRA insurance.

COBRA insurance is the full cost of health insurance and an up to 2% administrative fee. So, once you see the full cost of the health plan, you can times that amount by .02 to figure out the administrative fee. Add that onto the cost of health insurance and you get what you should pay for COBRA coverage.

How To Calculate Your Cobra Premium

To estimate your monthly COBRA premium, you will add the amount that was deducted from your paycheck for health insurance to the amount that your employer was subsidizing. Typically, the employer portion is not known.

To get an exact quote on continuing your employer plan, you should contact the COBRA plan administrator or refer to the paperwork you received regarding enrollment.

Recommended Reading: Which State Has The Cheapest Health Insurance

If You Qualified For Cobra Premium Assistance

If you qualified for COBRA continuation coverage because you or a household member had a reduction in work hours or involuntarily lost a job, you may have qualified for help paying for your COBRA premiums .

COBRA premium assistance under the American Rescue Plan Act of 2021 was available April 1, 2021 through September 30, 2021. Since this help ended on September 30, you can enroll in a Marketplace plan with a Special Enrollment Period. To enroll, you can report a September 30 “loss of coverage” on your application. You cant qualify for a premium tax credit while youre enrolled in COBRA, so if you want to change to Marketplace coverage, make sure that your COBRA coverage ends on the last day before your Marketplace coverage can start. If you decide to keep COBRA without premium assistance, you can qualify for a Special Enrollment Period based on the end date of your COBRA coverage, which is usually 18 to 36 months after it started.

If you have questions about COBRA or COBRA premium assistance, visit the U.S. Department of Labor at DOL.gov or call 1-866-444-3272 to speak to a benefits advisor.

How Long Can You Stay On Cobra Coverage

How long you can stay on COBRA depends on the event that made you eligible for coverage. You can stay on COBRA for up to 18 months in most cases, as long as you can pay your premiums. You may be eligible for even more time if a second event occurs in your life.

You could qualify for 11 more months if you’re disabled when you become eligible or if you become disabled within the first 60 days of becoming eligible for COBRA. You may be eligible for up to 36 months if you become eligible for Medicare within 18 months of your event.

Recommended Reading: What Is Catastrophic Health Insurance

Concerning Your Health Plan Vision Dental Prescription Drug Plans And/or Health Care Flexible Spending Account

You and/or any individual dependent currently enrolled on your benefits may elect to continue each or all of your health plan coverages in the university’s group for as long as 18 months, if the qualifying event is due to termination or reduction in hours . An election of 36 months can occur if the qualifying event is due to the death of the employee, loss of dependent child status, employee’s Medicare enrollment while on COBRA, or divorce.

Extensions

The 18-month continuation period can be extended, if during the 18 months of continuation coverage, a second event takes place . The 18 months or continuation coverage will be extended to 36 months from the date of the original qualifying event. Upon the occurrence of a second event, it is your or your spouse’s or dependent’s responsibility to notify the Benefits Office within 30 days of the event and within the original 18-month COBRA period. COBRA coverage does not last beyond 36 months from the original qualifying event, no matter how many events occur.

The 18 months may also be extended to 29 months for all individuals covered under COBRA coverage from the date of the qualifying event, if it is determined that you and your spouse or dependent child, if any, were disabled during the first 60 days of COBRA coverage. In order to receive the extension you must notify the Benefits Office within 60 days of the disability determination and before the end of the original 18-month period.

Eligibility For Cobra Coverage For Dependents

COBRA also covers spouses, former spouses, and dependent children under certain qualifying events. Dependents may qualify for up to 36 months if the primary beneficiary enrolls in Medicare, if the covered worker dies or is divorced, or if they reach the age of 26 and are no longer eligible for the parent’s group insurance plan.

The cost of COBRA insurance can be high. Think about using your health savings account funds if you have one to pay or offset the higher premiums, as well as for medical expenses. HSAs can’t be used to pay regular insurance premiums.

Don’t Miss: How Much Is Kaiser Health Insurance

Why Are Cobra Insurance Premiums So High

COBRA insurance premiums are high because when you leave a job, you’re no longer part of an employer-sponsored health plan, which means you have to pay the full cost for the coverage. Usually, employers pay a significant portion of an employee’s healthcare premiums.

But even though COBRA premiums may be high, it’s still a good option for people who recently lost their jobs. That’s because COBRA allows you to keep your health insurance coverage for at least 18 months, which can be a big help if you have a pre-existing condition or need to see a specialist.

Total Out Of Pocket Costs

What people do see is their out-of-pocket expenses. Changes to supplemental insurance programs over the past years have impacted deductible rates as well as items covered.

Pre-existing conditions can also play a big part in how much you pay for health care. Your condition may prevent you from being able to get supplemental coverage. Most often, however, it means there are exclusions in your health plan or higher deductibles. Both of these mean higher costs to you.

Don’t Miss: How Much Does Individual Health Insurance Cost In Massachusetts

What Is My Deadline To Enroll In Cobra

Your employer has 44 days from your last day of work or last day of insurance coverage to send out COBRA information. But its a good idea to check in with your benefits manager a couple of weeks after you leave.

Youll have 60 days to enroll in COBRA or another health plan once your benefits end. But keep in mind that delaying enrollment wont save you money. COBRA is always retroactive to the day after your previous coverage ends, and youll need to pay your premiums for that period too. One advantage of enrolling right away is that you can keep seeing doctors and filling prescriptions without a break in coverage.

COBRA allows you to keep the exact same benefits as before. No changes can be made to your plan at this time. However, if youre still on COBRA during the next open enrollment period, you can choose another plan from those your former company offers to employees. The new plan will take effect on January 1.

The Difference Between Hospital Policy Tiers

- Gold: Most comprehensive policy, covering 38 clinical categories. Generally, the most expensive hospital plan that includes pregnancy and birth-related services. Monthly, you can expect for monthly premiums to start at $195.

- Silver: A mid-level hospital policy covering 29 clinical categories, including dental surgery and heart-related services. Premiums for a Silver Hospital policy usually begin at $139 monthly.

- Bronze: An affordable policy covering 21 clinical categories. Generally, excludes joint replacements, as well as services for the back, neck and spine. Policies in this tier usually start at $112 per month.

- Basic: The cheapest hospital plan that covers you for accidents and helps you avoid paying the Medicare Levy Surcharge and LHC loading. Typically you can expect to pay around $101 per month for a Basic policy.

Read Also: What To Do If You Lost Your Health Insurance

Read Also: How Much Is Health Insurance For Independent Contractors

How Cobra Affects Your Taxes

If you decide to continue your current health insurance with COBRA, there is another expense you may not be aware of: higher taxes.

While you’re employed, your insurance premium is deducted from your paycheck before taxes along with other pretax deductions such as your 401 retirement plan and group term life insurance. These deductions make your net income look smaller and, by doing so, lower your income tax.

When you lose job-based health coverage and switch to COBRA, you have to pay your COBRA premiums with after-tax money. This means that you lose the tax-free benefit you enjoyed while being employed.

In some cases, you may be able to deduct part or all of your COBRA premiums from your taxes. But not everybody is eligible for this deduction. Speak with an accountant or tax advisor.

Does Cobra Have Dental And Vision Insurance

Yes, COBRA covers dental and vision premiums for 18 months. It covers dental and vision coverage as a secondary insurance, which means that the employer pays first in order to cover these benefits.

If you are laid-off or quit your job, COBRA will pay your health care costs up until 18 months following termination of employment. However, you must have both dental and vision coverage while employed if you want them covered by Cobra after quitting.

For example, if you have a dental and vision plan through an employer, when leaving your job and becoming eligible for COBRA, you do not need to worry about losing the coverage. If your dental and vision is separate from your medical insurance, you can choose to keep one or the other through COBRA. If the dental or vision is bundled with your medical insurance, you should continue both.

You May Like: Why Do I Need Health Insurance

How To Get Cobra Health Insurance

While COBRA itself is an act meant to amend previous laws regarding healthcare and employee benefits under certain employers, COBRA health insurance is a blanket term used to describe this form of assistance. Depending on the scenario and the applicants employer, the term of COBRA insurance coverage can last either 18 months or 36 months.

People who qualify to apply for COBRA coverage include employees who:

- have left their jobs voluntarily or involuntarily

- have experienced reduced hours that no longer qualify them for employer-supplied health insurance coverage

- have suffered the death of a covered spouse or a divorce from the covered spouse

- have lost their employment due to the COVID-19 pandemic

These are the broad strokes with which eligibility is painted when it comes to COBRA health insurance other situations may apply, specific to each case.

Besides applying for assistance under COBRA, you can also reach out to your employers HR department to find a solution for minimized or lost healthcare coverage. Under the Affordable Care Act, the employee in need of health insurance may be able to find a cheaper solution with less red tape, and it is part of an effective HR departments job to be knowledgeable about this information so that they can provide it to employees.

How Do You Qualify For Cobra Health Insurance

COBRA health coverage can only be used in certain situations. These situations are sometimes called qualifying events. How do you know if you’re eligible? COBRA eligibility includes:

As an employee:

- You must have been employed and covered under an employer’s group health plan.

- You must have been laid off, fired, retired, or quit or had your work hours cut to the point that your employer is no longer required to cover you under a group health plan.

As a dependent:

- If you are a dependent of someone who qualifies for COBRA based on the above, you may be eligible, too.

- If you are a spouse who divorces or files for legal separation from the employee, you may qualify.

- A spouse of an employee who dies may also meet COBRA eligibility.

If you are unsure whether you meet COBRA eligibility requirements, you can contact your employers human resources department. You can also contact the insurance carrier for the health plan.

Also Check: Why Did My Health Insurance Go Down