What Are Other Health Insurance Options If Your Employer Doesnt Offer Coverage

Recent changes in healthcare have made it more difficult for some employers to offer health insurance for employees.

The coronavirus pandemic and rising healthcare costs have made many cash-strapped businesses scale back employee benefits to save costs. Health insurance costs are always increasing every year, as new technologies and medicines become available at a higher price tag than before.

Many businesses today are passing the responsibility of healthcare to their employees. Many employees today have been left to fend for themselves, with companies either paying half or none of group health insurance costs.

If your company doesnt offer employer health insurance, you still have options as an employee.

Section : Worker And Employer Contributions For Premiums

In 2019, premium contributions by covered workers average 18% for single coverage and 30% for family coverage.16 The average monthly worker contributions are $103 for single coverage and $501 for family coverage . Compared to covered workers in large firms , covered workers in small firms have a lower contribution, on average, for single coverage but ahigher average contribution for family coverage .

- In 2019, covered workers on average contribute 18% of the premium for single coverage and 30% of the premium for family coverage .17 The average percentage contributed for single coverage has remained stable in recent years. While estimates of the average contribution percentage for family coverage have shown small changes in recent years, the differences are not statistically significant.

- Covered workers in small firms on average contribute a much higher percentage of the premium for family coverage than covered workers in large firms .

DIFFERENCES BY FIRM CHARACTERISTICS

In America How Much Do Employees Pay For Health Insurance

From the insurance plan your company chooses to your employees health conditions, many factors affect how much employees pay for health insurance. Before detailing these items, lets take a look at some facts that reflect, on average, what these payments look like in America. This data is from the 2020 National Compensation Survey by the U.S. Bureau of Labor Statistics :

- The average cost for health care per employee-hour worked was $2.64 for private industry workers.

- 86% of workers participated in medical care plans with an employee contribution requirement, where employees paid $138.76, and employers paid $459.70 per month.

- 72% of workers participating in single coverage medical plans with contribution requirements had a flat-dollar premium, and the median amount was $120.06.

Kaiser Family Foundation reported in their 2020 Employer Health Benefits Survey: In 2020, the average annual premiums for employer-sponsored health insurance are $7,470 for single coverage and $21,342 for family coverage.

In terms of premiums, the report found that most covered workers contribute to the cost of the premium for their coverage .

Specifically, for covered employees at small firms, the average premium for single coverage is $7,483 and $20,438 for family coverage. The average annual dollar amounts contributed by covered workers for 2020 are $1,243 for single coverage and $5,588 for family coverage, the report continues.

Also Check: Starbucks Benefits For Part Time Employees

Do Employers Have To Cover Family Members

With a group insurance plan, employers usually offer coverage to legal spouses and dependent children.

The ACA requires you to provide dependent coverage to age 26. If you do not, you might have to pay a penalty. You can choose to cover dependents over 26 years old, but you are not required to.

Employers are not obligated to pay premiums for dependents. However, you can contribute towards premiums for dependents. Or, you can require employees to pay the full premium cost for dependents.

You are not required to cover your employees spouses. Some companies decline coverage when a spouse can receive insurance from their own employer. Or, they might charge the employee more to cover the spouse.

According to the Kaiser Family Foundation, most small businesses pay part of their employees family plans. Compared to single plans, small employers usually pay the same amount or more:

- 45% provide the same dollar contribution for single and family plans

- 45% make a higher dollar contribution for family plans than single plans

- 3% vary their approach with the class of the employee

- 7% take a different approach

On average, small businesses contribute more to single coverage but less for family coverage than large companies do. Employees of small firms pay $1,021 for single coverage vs. the large firm cost of $1,176. Small firm employees pay $6,597 for family coverage vs. the large firm cost of $4,719.

Can Employers Receive A Tax Credit For Paying Premiums

As a small business owner offering health coverage, you might be eligible for a small business health insurance tax credit. The percentage of health insurance you pay plays a role in whether you can receive the credit.

To be eligible, you must meet the following requirements:

- Pay premiums under a qualifying arrangement

- Have fewer than 25 full-time equivalent employees

- Pay average annual wages of less than $50,800 per full-time employee

- Buy coverage through the SHOP Marketplace

The maximum credit amount is 50% of your contribution towards the employee premiums . The credit is available for a maximum of two years.

The size of the tax credit is based on a sliding scale. Those with lower employee wages get a larger credit.

The SHOP Marketplace can calculate an estimated credit that is paid to your insurance company. The advanced tax credit lowers the amount you pay on monthly premiums. You can also choose to receive the entire tax credit when you file your tax return.

If the credit amount is more than your tax liability, you receive a refund for the difference. If you received an advanced tax credit and your allowable credit is less than estimated, you pay the difference or subtract it from your refund.

Patriots online payroll software helps you accurately deduct premiums from employee paychecks. Take advantage of our free setup and support. Then, complete payroll in three easy steps. Try it for free today!

Donât Miss: Starbucks Health Insurance Cost

You May Like: Starbucks Health Insurance Plan

What Percent Of Health Insurance Is Paid By Employers

Written by: Elizabeth WalkerSeptember 24, 2021 at 9:37 AM

When youre considering a new health insurance program, your organization’s contribution strategy is an important decision. In simple terms, how much will employees pitch in for coverage, and what percentage will be paid by the employer?

With traditional group health insurance plans, the organization must contribute a minimum percentage, leaving the employees to pay the remaining amount, usually through a payroll deduction. So just what percent do employers typically pay in the United States?

Across the country, a Kaiser Family Foundation survey found that the average percent of health insurance paid by employers is 83% for single coverage and 73% for family coverage. Lets dive into these stats a little deeper.

How Much Does Health Insurance Cost A Company Per Employee

Health insurance costs vary widely but the average annual premiums for employer-sponsored coverage in 2020 were $7,470 for single coverage and $21,342 for family coverage. When you take into account the average contributions by workers, that brings the employer costs to $6,227 and $15,754 respectively.

The actual amount youll pay is based on a number of different factors, which well cover next.

You May Like: Evolve Health Insurance

Don’t Miss: Starbucks Health Insurance Cost

Small Employers Contribute Significantly Less To Family Coverage

While large employers contribute a significant amount to employees healthcare, small employers tell a different side of the story. 27% of covered workers in small firms are in a plan where the employer pays the entire premium for single coverage, compared to only 4% of covered workers in large firms. Similarly, 28% of covered workers are in a plan where they must contribute more than half of the premium for family coverage, compared to 4% of covered workers in large firms.

A likely reason for this is that small businesses simply cant afford to make the kind of contributions larger employers can. After all, even a 50% contribution may be more than whats available in a small employers benefits budget.

Considering that only 48% of firms with three to nine workers offer coverage compared to virtually all firms with 1,000 or more workers that offer coverage, small employers may also feel that they dont have enough employees to make investing in health benefits worth it at all. in order to offer a health benefit at all.

Read Also: Does Aarp Offer Health Insurance

Long Term Care Insurance

The Federal Long Term Care Insurance Program provides long term care insurance to help pay for costs of care when you can no longer perform everyday tasks for yourself like eating, dressing and bathing, due to a chronic illness, injury, disability or aging. If youre eligible for the Federal Health Benefits Program, then youre also eligible to apply for FLTCIP. Certain medical conditions, or combinations of conditions, will prevent some people from being approved for coverage. You must apply to find out if youre eligible to enroll.

Learn more about the long term care insurance plan.

Recommended Reading: Do Part Time Starbucks Employees Get Benefits

How Is The Premium Paid

You pay the health premium if you are a resident of Ontario and your employment or pension income is more than $20,000 a year. In most cases the premium is automatically deducted from your pay or pension. It is included as part of the income taxes deduction on your pay stub.

If you dont have taxes automatically deducted from your pay or pension, the premium is paid when you file your annual personal income tax and benefit return with the Canada Revenue Agency .

If your income is $20,000 or less, you dont need to pay the health premium.

What Percentage Of Health Insurance Do Employers Pay

You decide what you want to contribute to your employees health insurance. You can choose a FixedPercentage of a specific plan and/or benefits. Or, you can select a Fixed Dollar Amount for each employee. Your employees can then apply your generous contribution to the health plan and benefits they like best.

You or an employee might pick choose from several options:

- An HMO plan from Anthem Blue Cross, Health Net, Kaiser Permanente, UnitedHealthcare, or a regional plan like Sharp Health Plan, Sutter Health Plus, or Western Health Advantage

- A PPO (Preferred Provider Organization plan from Anthem

- An EPO plan from Cigna + Oscar or Anthem

- An HSA qualified plan

With CaliforniaChoice, its the employees choice. If the plan an employee prefers costs more than your contribution, the employee pays the difference. Its that simple.

CaliforniaChoice offers greater access. You can choose from more doctors, specialists, and hospitals than any other health benefit option in the state. Our provider networks include 80,000+ doctors and 400+ hospitals.

Recommended Reading: Starbucks Benefits Part Time

Individual And Family Plans

Kaiser health insurance plans can be purchased through the Health Insurance Marketplace or directly from the insurance company. However, buying insurance through the marketplace does give you access to health insurance tax credits, which can reduce how much you pay each month for insurance.

All plans conform to health insurance regulations, giving you access to free preventive care and screenings, as well as having financial protections like an out-of-pocket maximum. Plans are divided into the metal tiers of Bronze, Silver, Gold and Platinum. They’re also classified into the three insurance categories below, so you can choose a Bronze Deductible plan, a Gold Copayment plan or another combination.

Do I Live In The Medical Plan’s Service Area

In most cases, you must live or work in a medical plans service area to join the plan. Use the tables below to make sure you live in the plan’s service area. If you move out of your plan’s service area, you may need to change plans. you must report your new address to your payroll or benefits office no later than 60 days after your move.

Recommended Reading: How Long Do Health Benefits Last After Quitting

Factors That Determine Your Employer Health Insurance Costs

Many factors go into determining a business health insurance cost. Employers must take these factors into account when researching different employee health plans.

Average Employee Age: An older workforce will command higher premiums. This is simply because younger people are less likely to make a significant claim for healthcare costs.

Location: Healthcare costs differ by state, as does the general cost of living. However, geographical healthcare costs cannot be determined by the general health of a town, city, or states population.

Tobacco Usage: In most states, insurers can add tobacco surcharges for those employees who smoke. There are just a few states that outright ban tobacco surcharges on employer health insurance plans.

Family Size: When family plans are offered, employer health care costs rise as insurers are permitted to increase premiums based on family size. The larger your family, the more youll pay under these plans.

Under the terms of the Affordable Care Act , insurers are not able to factor in the medical histories of enrollees, gender, medical claims history, or the industry the business operates in.

Dont Miss: Who Qualifies For Health Insurance Subsidies

Employer Shared Responsibility Payment

Certain businesses with 50 or more full-time and full-time equivalent employees that dont offer insurance that meets certain minimum standards may be subject to the payment. Learn more about the Employer Shared Responsibility Payment from the IRS.

IMPORTANT: No small employer, generally those with fewer than 50 full-time and full-time equivalent employees, is subject to the Employer Shared Responsibility Payment, regardless of whether they offer health insurance to their employees.

Also Check: Is Umr Insurance Good

Find Cheap Health Insurance In Your Area

The cost of Kaiser health insurance also changes by location. On the West Coast, California, Washington and Oregon have similarly priced plans, with Oregon having the cheapest rates of the three.

On the East Coast, there is a significant cost difference between the neighboring states of Virginia and Maryland. A 40-year-old could pay 54% more each month to get Kaiser insurance in Virginia than they would in Maryland. Some of this difference is due to overall pricing trends in the two states.

Where is Kaiser Permanente the cheapest?

| State |

|---|

Average cost for a 40-year-old purchasing a Silver plan.

Health Reimbursement Arrangements Are Another Way To Control Costs

Instead of purchasing a group health insurance policy and paying premiums set by the insurance company, an alternative strategy is to use a health reimbursement arrangement to reimburse employees for premiums and out-of-pocket medical expenses. With this strategy:

- The employer sets an annual or monthly allowance they will agree to reimburse employees for medical costs.

- Employees purchase their own health insurance plan on a private exchange or the health insurance marketplace. A key advantage is they get to choose a plan from a provider of their choice that has the features they need most.

- As employees pay premiums and associated medical costs, the employer reimburses the employee up to their allowance balance.

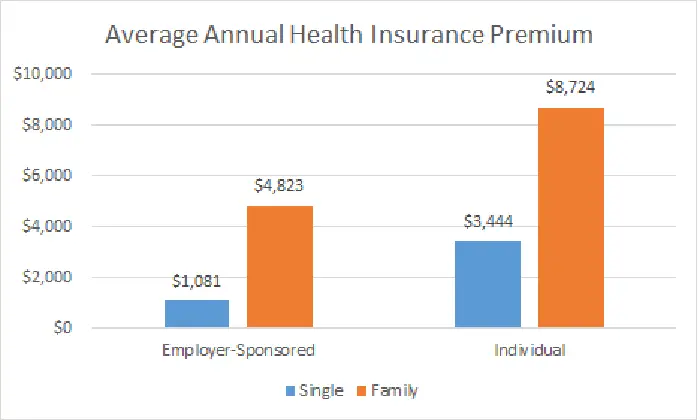

For example, a young employee might opt for a higher deductible plan to eliminate or minimize out-of-pocket spending on premiums, while an older employee might choose a plan with a lower deductible and maximum out-of-pocket maximum. Learn why individual health insurance is more affordable than group health insurance.

The cost savings from providing health benefits with a reimbursement strategy can be significant. First, the employer is in control of the amount they spend. The cost of the health benefit is the amount of reimbursement they choose to offer and can afford.

Dont Miss: How Much Is Health Insurance Usually

Don’t Miss: How Much Does Starbucks Health Insurance Cost

What You Can Expect

Preventive Care

Preventive care visits are always no-cost they help keep you healthy by screening for and preventing serious medical issues. Annual check-ups, flu shots, immunizations, and some tests and screenings are all examples of preventive care.

Many preventive medications, including insulin, diabetic supplies, some cardiovascular drugs, antidepressants, and more, are available at no cost to you.

Preventive and diagnostic colonoscopies are covered at 100% with all medical plans, whether or not polyps are removed.

Outpatient Mental Wellness

Outpatient mental health services include treatment that takes place in a clinical setting, office, or hospital, but does not involve an overnight stay. These services are 100% covered by the copay medical plans. Kaiser Permanente High-Deductible Health Plan members must meet their deductible before 100% coverage. Cigna HDHP members receive three no-cost visits per issue, per year.

Virtual Visits & Telemedicine

Skip the waiting room and speak with a board-certified physician over the phone or on your computer. Phone consultations and online video visits give you direct access to a licensed medical professional who can:

- Treat common medical conditions, such as colds, flu, bronchitis, allergies, rashes, etc.

- Provide specialist referrals

Cigna members: To schedule an appointment, visit mycigna.com or download the myCigna mobile app. Kaiser Permanente members: Visit kp.org or download the Kaiser Permanente mobile app.