Integrate Health Insurance Premiums Into Payroll

Health insurance premiums can either be deducted from an employees salary pre-tax or post-tax. Pre-tax saves the employee money in the long run, as the healthcare costs are removed from gross payroll and not subject to any federal, state, social security or Medicare taxes.

In most cases, employees who participate in employer health insurance plans have their deductions taken pre-tax. In order to make sure that you are in compliance with federal law, your employee health benefits plan must be compliant with IRS Code Section 125.

Post-tax deductions are normally calculated for employees who choose their own health insurance plans and opt-out of their employers pre-tax option.

The Best Health Insurance For A Small Business With One Employee

While an individual plan or a group plan for one are both options to consider, we believe there’s a better way, thanks to recent regulatory rule updates that increase the accessibility of health reimbursement arrangements. As advocates of small businesses of all kinds , we like to help fellow business owners sort out the best health insurance option for them and cut through all the jargon and confusion.

The best strategy for you depends on whether or not you’re married . If you are self-employed and are single, just take the self-employed tax deduction and purchase an individual health plan .

If you are a sole proprietor and work for yourself and have no plans to hire, and you are married, then we can explore a few more options. Recall that HRAs only work for employees. Although as a proprietor you generally are not eligible for an HRA because youre not an employee, your spouse can be an employee and eligible for an HRA and health plan that covers you.

Heres the strategy if youre a sole proprietor with no employees and youre married:

- Hire your spouse as a W-2 employee:

- Your spouses salary can just be the amount you want to reimburse through the HRA, but it must be a fair wage for what they are doing

- Its a good idea to have an employment contract and timesheet for record-keeping purposes

What Can I Do If I Am Experiencing Issues With An Insurance Carrier

Our department is tasked with overseeing the insurance industry in our state. Our goal is to evaluate a carrier or agents compliance with policy provisions and Missouri insurance laws. One of the ways we accomplish this goal is through our consumer complaint process. If a consumer is experiencing an issue with an insurance carrier or an insurance agent, and the issue is related to a product or agent subject to state regulation, the consumer may file a complaint with our department. You may file a complaint by downloading our Consumer Complaint Form and returning it to our office, or by filing a complaint online through our website. To file a written or online complaint, or to obtain additional information regarding our complaint process , click HERE. If your question is of a general nature, or you are seeking some other type of insurance-related assistance, you may contact our Consumer Hotline at 800-726-7390.

Also Check: Does Starbucks Offer Health Insurance

Health Insurance For Massachusetts Small Businesses

If youre a small business owner, you might think that providing health insurance for employees is a luxury you just cant afford. But according to the Centers for Disease Control and Prevention , U.S. employers lose $225.8 billion each year in productivity because of employees personal or family health problems. By buying health insurance through the Small Business Health Options Program , administered by the Massachusetts Health Connector, you can offer your employees affordable coverage and potentially benefit financially at the same time.

Can Business Owners Buy A Plan On The Marketplace

As a small business owner, you have two health insurance options through Healthcare.gov, a.k.a. The Marketplace. If you are a sole proprietor, you may purchase an individual health insurance plan. Your options may include bronze, silver, or gold plans with a range of monthly premiums, deductibles, and coverage.

You may also qualify for the Small Business Health Options Program if you have one to 50 full-time equivalent employees. If your company has fewer than 25 full-time employees who meet the maximum income threshold , you may be eligible for the Small Business Health Care Tax Credit. In this situation, you must offer SHOP to all of your full-time employees and pay at least 50% of their premium cost.

This tax benefit credits 50% of all premiums paid on company tax returns. Since these are IRS guidelines with amounts changing annually, based on inflation and other factors, it is best to check with your tax advisor on eligibility.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

How Many Healthcaregov States Have Shop

There are SHOP-certified plans available for purchasedirectly from an insurer or with the help of a brokerin ten states that use HealthCare.gov in 2021.

According to Public Use Files published by CMS , there are quite a few dental-only SHOP plans. But if we limit it to medical SHOP plans, theyre only available in the following states as of 2021 :

- Alabama

- Georgia

- Maine

- Montana

- New Hampshire

- New Jersey

- Ohio

- Virginia

- Wisconsin

- Wyoming

In addition to the nine states where there are SHOP-certified plans available in 2020, there are still SHOP-certified plans in most of the states that run their own exchanges . This includes California, Colorado, Connecticut, DC, Idaho, , Massachusetts, New Mexico , New York, Rhode Island, and Vermont.

So if a business is in an area that still has SHOP plans available, the small business health care tax credit is still available to newly-enrolling businesses. And the tax credit is also still available to a business that began its two-year tax credit window under a SHOP plan but then had to transition to a non-SHOP plan because SHOP plans were no longer available. But businesses trying to claim the tax credit for the first time might be out of luck if theyre in an area where there arent any SHOP plans available.

What Are Small Business Health Insurance Requirements Related To Tax Reporting In 2021

If you decide to offer group health coverage to your employees, be mindful of certain tax reporting requirements for small businesses in 2021.

- You must report the value of the insurance provided to each employee. This information goes on the employees Form W-2 using the code DD, as per IRS requirements.

- IRS requires your business to withhold and report an additional 0.9 percent on employee compensation that is greater than $200,000, as per the ACA.

- Your small business also must pay a fee toward funding the Patient-Centered Outcomes Research Trust Fund. You are required to report this fee through Form 720.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

The Type Of Industry In Which Your Business Operates

The construction industry, for instance, is fairly expensive to insure due to the high risk to its workers and third parties on site. Thereâs also the expensive equipment they use, which must also be insured. A private piano teacher, on the other hand, who teaches out of their home, wonât face the same potential hazards and will ultimately have to pay less for their insurance.

Types Of Commercial Insurance Policies

There are many types of available business insurance coverages and the more you have, the more it will cost. Most businesses begin with general liability coverage to protect themselves against third-parties. As you grow, you may want to add more coverage for specific risks or perils, which would increase the amount it costs in exchange for more protection.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

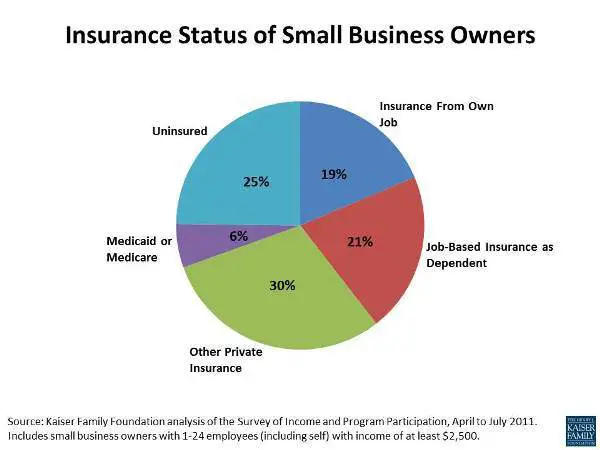

As A Small Business Owner Are You In Need Of Health Insurance

As a small business, it’s important to assess your needs for health insurance plans for employees. Many times, providing access to coverage is a big benefit to employees and one they appreciate. If your company has 50 or more employees, finding affordable health insurance options is essential, especially if you plan to cover some or all of the costs for employees. Even companies with fewer than 50 employees benefit from health insurance coverage, especially if employees want it.

How To Get Cheap Small Business Insurance Online

Compare commercial insurance quotes from multiple providers online

Different business insurance products will vary in price from insurer to insurer. To give yourself the best chance at finding a great rate, we recommend shopping around to find the best price for the product you want.

Bundle your products

Bundling all your commercial insurance products with one insurer has the potential to save you money. You should comparison shop for bundled quotes – ask any prospective insurer to create you a quote that includes all the coverage you need. There may even be an option to have your personal insurance and commercial insurance policies with a single insurer that could lead to an even greater discount.

Understand your needs.

No two businesses are created alike, so each business insurance policy should be tailored to meet your needs. If your business is closer to water, you may consider commercial property insurance that includes overland water & flood coverage. Should most of your business activities happen online, you might want to think about cyber security insurance. Make sure to only get the insurance coverage you need.

Manage your business risks

There are always risks, but the more you can do to prevent them from becoming a reality, the more you can save. Consider installing cameras to prevent potential thieves or asking your drivers to take a drivers education course to reduce threats to your business.

Read Also: Can I Go To The Er Without Health Insurance

I Run A Funeral Home With Six Employees Can I Get Any Help From The Government For Paying Their Premiums

Yes, you can get tax credits to help pay for premiums, but you have to meet certain conditions.

You can get tax credits if:

- Your business has fewer than 25 full-time employees.

- Your workers’ average wages are less than about $54,000 per year. (this is indexed for inflation

- Your business contributes at least 50% of the cost of a premium for an individual plan in a Marketplace.

You can get a tax credit for up to 50% of the amount your business pays toward insurance premiums for employees.

Best Overall: Blue Cross Blue Shield

Blue Cross Blue Shield

- No. Policy Types: Varies from state to state

- No. States Available: 50

As one of the largest health insurance providers in the country, Blue Cross Blue Shield offers ample coverage options for most small business owners. It also offers data-driven healthcare solutions to enable cost-effective options for many companies. It’s the insurance company for those who need flexible options.

-

Limited health plan details on BCBS website

-

Must contact a sales representative

-

Mixed reviews on ConsumerAffairs

Blue Cross Blue Shield is a nationwide association of 36 independent insurance companies. The association has been around since 1929, and most of its companies have received high ratings from AM Best. The companies earned overall ratings of 2.5 to 4.5 on a scale of 1 to 5 from NCQA.

BCBS companies also ranked highest on eight of the 21 award-eligible regions on the J.D. Power 2021 U.S. Commercial Member Health Plan Study.

BCBS provides coverage in all 50 states, plus Washington, D.C., and Puerto Rico, and works with over 90% of the nation’s hospitals and doctors. The company also underwrites international coverage in over 190 countries through BCBS Global. The company’s large network seeds the data for innovative healthcare solutionslike the ability to compare costs for over 1,600 proceduresmore than any other insurer.

Also Check: Starbucks Partner Health Insurance

Why Should You Offer Small Business Health Insurance

It’s no secret that starting and running a small business is expensive, and it can be easy to dismiss health insurance as an unnecessary cost to help stay within your budget. However, health insurance is a vital part of running a successful business that people want to work for.

Here are a few reasons why you should offer health insurance to your employees:

How Does Small Business Health Insurance Work

The Affordable Care Act defines a small business as a group of no more than 50 full-time employees , though some states define it differently. California, for instance, categorizes small businesses as employers of no more than 100 FTE. Small business owners arent legally required to provide health insurance to their workers, but there are rules for those who do.

A small business owner enrolls in a group health insurance plan offered by a private insurance company and then offers their employees the opportunity to enroll in that plan. The employer pays part of their employees monthly premiums, and the employees are typically responsible for their deductibles, copays and services not covered by the plan.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Are Businesses Required To Offer Health Insurance

You must provide health insurance if you have 50 or more full-time employees. If you have fewer than 50 employees, you may be exempt from this federal rule. But some stateslike Hawaii, for examplemay have stricter requirements where you must offer health insurance regardless of business size. You need to be familiar with both the state and federal guidelines for small business health insurance.

How Many Employees Do You Need To Qualify For Group Health Insurance

Group health insurance is a cost-effective way for small businesses to offer health insurance, as its cheaper than buying individual plans.

A company has to have fewer than 50 employees to qualify for group health insurance. You also have to have an office of some sort in the state where youre applying for coverage, and you need to enroll at least 70% of your uninsured employees.

If youre a family-run business, you need to check your eligibility for group health insurance, as you need to have workers who are not related to or the spouse of the owner of the company. If you only employ family members, youll need to apply for a family health insurance plan instead. Sole proprietors also cannot apply for group health insurance.

Part-time employees and seasonal workers do not count as part of the group, but you can still choose to offer them group health insurance. You can also provide individual health insurance to specific workers alongside your group plan.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

How Do Business Owners Get Health Insurance

As a sole proprietor, you can get life insurance that includes critical illness and disability insurance from any life insurance provider. If you have multiple employees, and want to get group coverage, speak with your broker to tailor your plan to fit your needs. You can include options like extended health care , dental and short-term and long-term disability insurance.

How To Get Health Insurance For A Small Business

You have several options when it comes to searching for the right plan options for your small business:

- Do your own footwork. Small business owners can sort through options from different insurance companies to compare prices and services and enroll in a plan that meets their needs. Most health insurance companies offer a number of plans for small businesses. By plugging a minimal amount of information into forms on their websites , you can see plan choices and costs.

- Work with an insurance broker. Insurance brokers know the ins and outs of health insurance plans, as well as state and federal requirements. We can compare the plans and figure it all out for you, says Jugan. Its an administrative burden and we can alleviate that. Insurance is complicated, and a lot of small business owners dont want to think about it. He adds that you dont pay any fees for using insurance brokers, as their costs are covered by insurance companies. Just be sure youre working with an independent or agnostic broker who will show you all plans available to you to best meet your needs.

- Explore the SHOP Marketplace at healthcare.gov for expert guidance, helpful calculation tools and clear choices for high-quality group insurance plans.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

What Health Benefit Options Are Available For Small Businesses

Although small businesses dont need to offer health insurance, many opt to do so to keep their employees happy and healthy and to attract new workers. Here are some of the most popular health benefits options available to small businesses:

- Traditional group health insurance: The federal government offers SHOP, the Small Business Health Options Program, which gives small employers the option to provide health and dental coverage to their employees. SHOP is available to businesses with one to fifty employees you can apply online.

- QSEHRA: The Qualified Small Employer Health Reimbursement Arrangement is a health benefit plan funded by employers that reimburses employees for their health care expenses from a monthly tax-free health care allowance. It allows businesses to set their own budgets but still offer coverage.

- Integrated HRA: With an integrated HRA, small businesses offer employees a group plan in combination with a monthly allowance for health care expenses. The group plan for an integrated HRA usually involves a high-deductible policy.

- Health insurance purchasing co-op: Health insurance purchasing co-ops are regulated at the state or local level. These co-ops allow small businesses to come together and collectively purchase health insurance for their employees. The regulation and availability of purchasing co-ops varies from state to state.