Best For Telehealth Care: Cigna

Cigna

Cigna has excellent financial strength ratings, and out-of-network approvals are not required. It has excellent telehealth services available to members.

-

Out-of-network care available without a referral

-

Telehealth services

-

Limited coverage area

Cigna is a global health insurance provider and offers private health insurance in 13 U.S. states: Arizona, Colorado, Florida, Georgia, Illinois, Kansas, Mississippi, Missouri, North Carolina, Pennsylvania, Tennessee, Utah, and Virginia. It has an A financial strength rating from AM Best. Referrals for out-of-network care may or may not be required depending on your plan. The greatest savings are realized by using an in-network provider.

Plan options, deductibles, and co-pay options vary by state. High-deductible plans are available along with HSA plan options. Policyholders can search plan network doctors, estimate costs, check claims status, and get insurance ID cards all online.

There are several attractive member benefits, including access to a home delivery pharmacy, health information helpline, rewards programs, flu shot information, and the Cigna telehealth connection program, which allows you access to board-certified telehealth providers, including Amwell and MDLIVE.

Read the full Cigna insurance review.

What Is Ncb Or Cumulative Bonus In Health Insurance

Just like you have No Claim Bonus or NCB in vehicle insurance, there is cumulative bonus in individual health insurance plans too. But the working of NCB in case of health insurance is different from that of vehicle insurance. In case of vehicle insurance, you receive a discount on renewal premium based on the number of claim-free years.

In health insurance, the renewal premium is not reduced, but the sum insured of the policy is increased by a certain percentage for every claim-free year. However, there are a few insurance providers that follow the premium discount method for NCB in health insurance too.

For every claim-free year, the sum insured is increased by 5% to 10% based on the insurer you select. But note that insurers are not allowed to offer cumulative bonus of more than 50% irrespective of the total number of claim-free years of a policyholder.

How Adverse Selection Works

Heres a grossly simplified example. Lets say a health insurance company was selling a health plan membership for $500 per month. Healthy 20-year-old men might look at that monthly premium and think, Heck, if I remain uninsured, Im probably not going to spend $500 all year long on health care. Im not going to waste my money on $500 monthly premiums when the chance that Ill need surgery or an expensive healthcare procedure is so small.

Meanwhile, a 64-year-old person with diabetes and heart disease is likely to look at the $500 monthly premium and think, Wow, for only $500 per month, this health insurance company will pay the bulk of my healthcare bills for the year! Even after paying the deductible, this insurance is still a great deal. Im buying it!

This adverse selection results in the health plans membership consisting mainly of people with health problems who thought theyd probably spend more than $500 per month if they had to pay their own healthcare bills. Because the health plan is only taking in $500 per month per member but is paying out more than $500 per month per member in claims, the health plan loses money. If the health insurance company doesnt do something to prevent this adverse selection, it will eventually lose so much money it wont be able to continue to pay claims.

Don’t Miss: Evolve Health Products

According To Irdai The Policy Will Be Named As Arogya Sanjeevani Policy Succeeded By The Name Of The Insurance Company The Regulator Said No Other Name Is Allowed In Any Of The Documents

- Health insurance policy to take care of basic health needs of insuring public

- To have a standard product with common policy wordings across the industry

- To facilitate seamless portability among insurers

Also read:1. Minimum and maximum sum insured:2. Eligibility:3. Policy period:4. Modes of premium payment:5. Grace period for premium payments:6. Expenses to be covered:7. Free look period: 8. Co-pay:9. Cumulative bonus :10. Specific waiting period for certain disease:isease which will have a waiting period of 24 monthsB. Disease which will have a waiting period of 48 months:What you should do

Guaranteed Issue Outside Of The United States

While the Affordable Care Act has made getting health insurance in the United States a whole lot easier for people with pre-existing conditions, it has its limitations. The Affordable Care Act only impacts health insurance in the United States. Countries outside of the United States have different rules governing the selling of health insurance.

Also Check: How To Get Insurance Between Jobs

Rating Ratio For Older Applicants

Although premiums in the individual and small group markets cannot vary based on health status or gender, the ACA allows health insurers to charge older people up to three times more than they charge young people. Older people tend to have more medical expenses than younger people, and thus present a higher risk to the insurer.

There are a few states, however, that do not allow insurers to charge older people three times as much as younger people.

Who Needs Individual Health Insurance

Individual health insurance is for anyone who doesnt have access to employer-sponsored or government-run health coverage. This includes people who are employed by a small business that doesnt provide health benefits, people who are self-employed, and people who retire before theyre eligible for Medicare and have to get their own personal health coverage until they reach age 65.

You May Like: Does Insurance Cover Chiropractic

Where Can Consumers Buy Individual Health Insurance Coverage

Individual health insurance is available via the exchange/marketplace in every state . There are 36 states that use HealthCare.gov as their marketplace in 2021, while DC and the other 14 states run their own exchange platforms .

Individual health insurance is also available outside the marketplace nationwide, with the exception of the District of Columbia . But premium subsidies and cost-sharing reductions are only available if the plan is purchased through the marketplace.

In both cases on-exchange or off-exchange individual health insurance is only available during the annual open enrollment period or during a special enrollment period triggered by a qualifying event. In most states, the annual open enrollment period runs from November 1 to December 15, with coverage effective January 1. But the majority of the states that run their own exchange platforms tend to offer extended enrollment periods, some of which continue well into January.

Plan availability and coverage options vary considerably from one area to another. Some parts of the country have only a single insurer that sells individual health insurance, while other areas have several different insurers and dozens of healthcare plans from which to choose.

Guaranteed Issue For Large Employer Groups

Large employers are required to offer coverage to their employees under the ACA. To facilitate this, insurers are no longer allowed to impose minimum participation requirements when large employers seek coverage for their employees. Most very large group self-insure, however, making this a moot point.

Although insurers must offer large group coverage on a guaranteed issue basis , large group coverage does not have to follow the modified community rating rules that apply to small group and individual plans. That means that rates for large groups can still be based on the overall claims experience of the group, with discounted rates for healthier groups, and higher rates for less healthy groups.

For reference, “large group” typically means more than 50 employees, although there are four states where it applies to groups with more than 100 employees. In those states, groups with up to 100 employees are considered small groups, and the ACA’s small group rules apply to them unless they choose to self-insure.

Recommended Reading: How To Keep Health Insurance Between Jobs

Best For Online Care: Unitedhealthcare

UnitedHealthCare

UnitedHealthcare has excellent financial strength ratings and has a network of PPOs across the nation. Its online health care services are excellent.

-

Online health care services

-

Average or less-than-average overall customer satisfaction ratings in 2021 J.D. Power Commercial Member Health Plan Study

UnitedHealthcare has an A financial strength rating from AM Best and is a part of UnitedHealth Group, which is the largest health insurer in the U.S. It offers individual insurance that meets the Affordable Care Act requirements for essential care.

A real standout feature for UHC members is the access to online care, including the ability to order prescriptions online, speak with a nurse via a hotline, and participate in online wellness information. Members can also go online 24/7 to find doctors and set up appointments, file claims, and even speak with a doctor through a mobile device. It even has a mobile app, so you can use these resources on the go.

UHC is a great choice for people who want the option to manage their health care electronically. HMO and PPO plans are available with access to HSAs and FSAs. Member discounts are available for a variety of health related products and services including: hearing aids, vision services , and smoking cessation programs.

They also have an extensive preferred provider network of over 1.3 million physicians and other health care professionals. UHC also offers Medicare Advantage HMO and PPO plans.

Emergency Care Is Often Covered Although Patient And Insurer Definitions Of Emergency Aren’t Always Louise Norris Is An Individual Health Insurance Broker Who Has Been Writing About Health Insurance And Health Reform Since 2006

Find out how much private health insurance costs and where to find private health insurance companies. When a health insurance policy covers only one person it is an individual health plan. A guide to health insurance for people with medicare isn’t a legal document. When an insured purchased her disability income policy, she misstated her age to the agent. The insurance with other insurers provision in an individual health insurance policy allows an insurer to pay benefits to the insured. You can find more individual and family options by shopping directly through health insurance. If you have coverage through an individual marketplace plan , you may the medigap insurer can sell it to you as long as you’re leaving the plan. policy of accident and health insurance includes any individual policy or contract covering the kind or kinds of insurance described in paragraph three of in addition to the requirements of subparagraphs and of this paragraph, every insurer issuing a policy of hospital, medical, or. If you’re switching from an equivalent or lower level of cover with another insurer or with us, you won’t have any benefits already paid by your old policy will count towards lifetime limits and yearly limits on extras. A rule forcing health insurers to offer plans to consumers regardless of their health status, risks or history.

You May Like: Health Insurance For Substitute Teachers

Does Health Insurance Cover Therapy

Health insurance may cover therapy and counseling visits, but it depends on the specific policy. Check your insurance summary to see if mental health counseling is covered.

If it is covered, make sure the provider accepts your specific plan. Many therapists do not accept health insurance. If thats the case, you can submit receipts to your health insurance provider for reimbursement. They may provide some benefits for out-of-network therapists, but this also varies by policy.

What Does Health Insurance Cover

Health insurance typically covers the costs of medical, prescription, and surgical services. It pays for your care if you get sick or injured, as well as preventative care such as vaccines and wellness checkups with your doctor. It pays for most prescription drugs and medical devices.

Health insurance doesnt cover elective surgical procedures or beauty treatments, however, and its not the same as accident insurance. Health insurance will most likely cover your medical expenses if youre involved in an accident, but accident insurance is a supplemental policy that gives you a lump sum to help pay for your out-of-pocket accident-related costs.

Read Also: Can You Add A Boyfriend To Your Health Insurance

Types Of Marketplace Health Plans

Here are the health plan categories in the ACA marketplace, going from those with the least to most expensive premiums:

| Type of plan | |

|---|---|

| 90% | 10% |

Bronze plans have the lowest premiums, but the most out-of-pocket costs when you use health care service. Platinum has the highest premiums, but lowest out-of-pocket costs.

Keep in mind these are general categories. The projected out-of-pocket costs are averages. Plans in the same metal category might achieve the cost split in different ways. Two Bronze plans, for instance, might have different deductibles and co-insurance levels. However, their overall out-of-pocket costs are about the same.

Plans in the same metal level might also be structured differently. One Bronze plan might be a health maintenance organization, and another might be a preferred provider organization. Depending on the type of plan, you might have free access to any provider in your network or you might need to get a referral from a primary care physician.

Nearly half of individual health plans are health maintenance organization plans. Exclusive provider organization plans make up one-third of individual plans. PPOs, which are the most common type of plan in the employer-sponsored market, only make up a small portion individual plans, according to eHealth.

Here are the average monthly premiums for individual and family coverage by metal level, according to eHealth:

| Metal level | |

|---|---|

| $732 | $1,610 |

Do Your Research Before Open Enrollment

You can buy an individual health plan that meets government standards for coverage only during the annual open enrollment period, unless you have a special circumstance. For instance, losing your job, getting married or having a baby creates a special enrollment period. So, you can make changes at that time. However, if you dont have a qualified life event, open enrollment is the only time you can make changes.

Dont wait until the last minute. Give yourself plenty of time to research options and apply.

Recommended Reading: Starbucks Insurance Plan

Can I Buy Health Insurance On My Own

How much is individual health insurance? You can expect to pay a monthly premium of $225-$327 for one person.

If youre self-employed or unemployed, and dont have access to affordable health insurance through work. You can buy individual coverage from the open marketplace. Do your research beforehand to make sure you qualify for coverage and know the income limits and other requirements.

You might also find another source of health care coverage such as private insurer, but make sure to read all the terms so that there are no surprises at renewal time.

Benefits Of Individual Health Insurance Policy

As per recent reports, healthcare inflation in India is growing at twice the rate of overall inflation. Due to this, people not just in their 40s and 50s, but even early 20s, have started understanding the importance of purchasing health insurance.

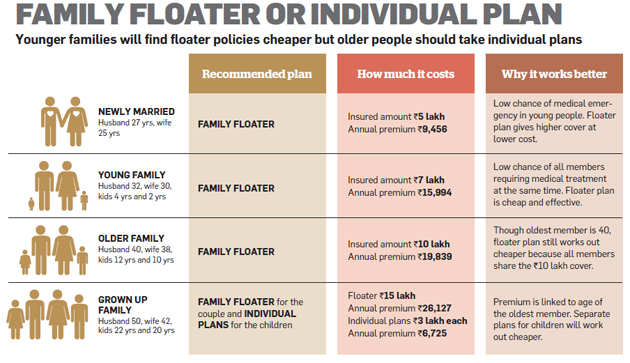

But while a family floater plan better suits someone in the 30s and 40s with a family, a single or individual health policy is ideal for unmarried people in their 20s. But what are individual health policies? How do they work? Should you consider purchasing one? Answers to all of these fundamental questions and more are discussed in this post.

Recommended Reading: Starbucks Health Plan

Are There Tax Benefits Available On Purchase Of Individual Health Insurance

Under Section 80D of the IT Act, you can claim a tax deduction of up to Rs. 25,000 on the premiums paid towards the health insurance policy. The limit is up to Rs. 50,000 for health insurance purchased for a senior citizen above the age of 60 years.

So, in case if your age is below 60 years and you purchase an individual health plan for yourself along with a separate individual plan for your senior parent, you can claim a deduction of up to Rs. 75,000. Similarly, if both of your parents are above 60 years of age and you have paid for their health insurance, then you can claim tax benefit of up to Rs 1,00,000.

Common Health Insurance Terms

A – B – C | D – E – F | G – H – I | J – K – L – M | N – O – P | Q – R – S – T – U – V – W – X – Y – Z

Affordable Care Act – The Patient Protection and Affordable Care Act the landmark health reform legislation signed into law by President Barack Obama in March 2010. The legislation includes multiple health-related provisions that would take effect over a matter of years. The key provisions are intended to extend coverage to millions of uninsured Americans, to implement measures that will lower health care costs and improve system efficiency, and to eliminate industry practices that include rescission and denial of coverage due to pre-existing conditions. See our Affordable Care Act page for more detailed information.

Agent – In the insurance industry, an agent is appointed by an insurance company to sell insurance policies. The agent represents the insurance company, not the consumer, and must be licensed by the California Department of Insurance.

Allowed Amount – The most that your insurance will pay for a service. If your provider charges more than the allowed amount, you may have to pay the difference

Broker – A person licensed by the State to sell insurance coverage with multiple health plans or insurers. The broker represents you and not the insurance companies. The broker helps you shop for the best policy. Note that no license is required to sell HMO products in California.

Claim – A request to your insurance company to pay for a health care service you received.

Recommended Reading: How To Cancel Evolve Health Insurance