Small Business As Employees

If you work for small businesses and your employer does not offer New York health insurance benefits, you can enroll in an Individual/Family plan on the NY State of Health Marketplace. Keep in mind that most people are required to have a health plan in place under the Affordable Care Act. Just like an individual, you may qualify for a lower premium based on your income.

New York Connects Aged & Disability Resource Center

This center provides assistance and benefits counseling to the elderly and disabled adults of New York as well as their families and caregivers. Read More

The centers staff members receive training and knowledge about programs/agencies that are specifically for older adults and the disabled. Potential issues that may involve this population group include health issues related to nutrition management of long-term medical conditions adaptive equipment assistive technology long term care options low-income housing assisted living financial issues elderly and disability benefits resources related to community and adult protective services.

Help in completing applications for public and private benefits programs such as Social Security, SSI, Medicare, Medicaid can also be provided. ADRC-NY is a federal/state program.

For Additional Information on this New York Health Insurance service be sure to call TEL: 800-342-9871

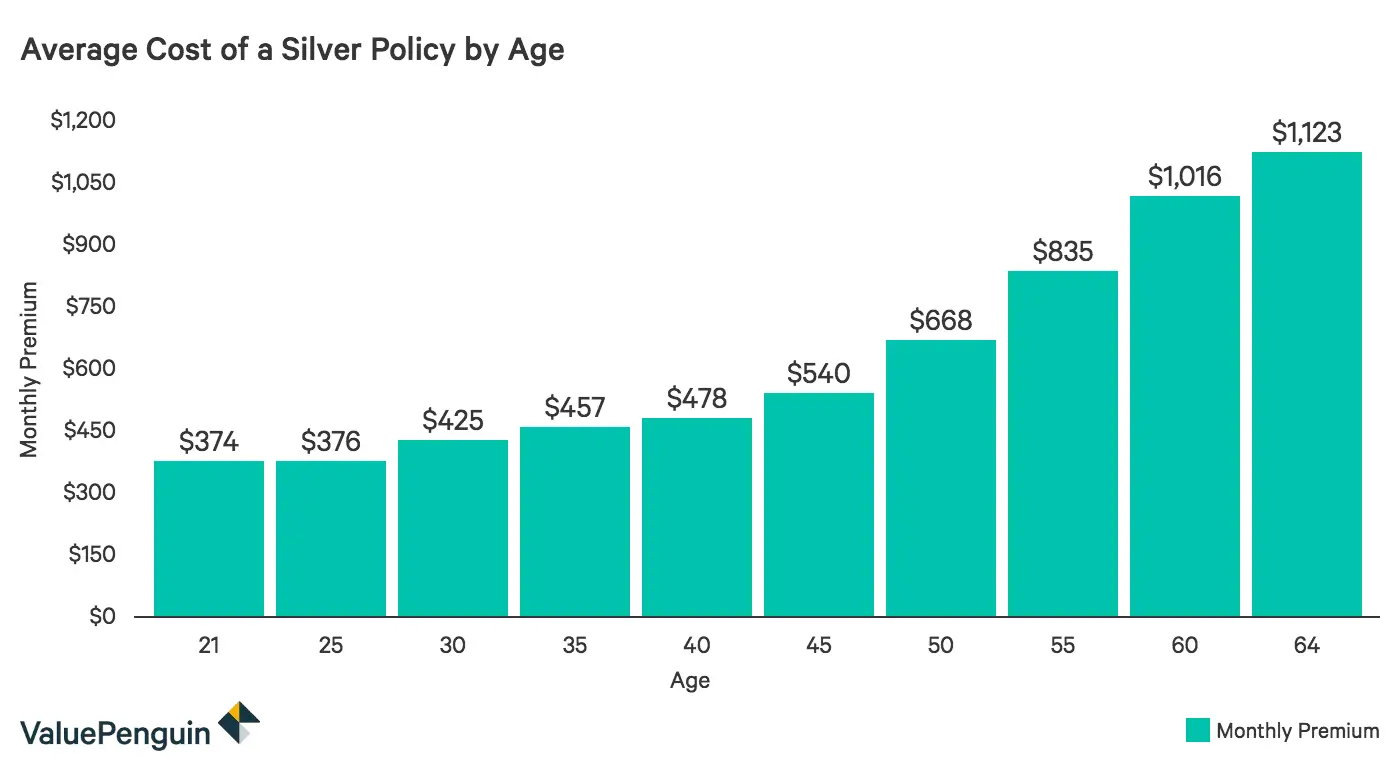

How Much Is Family Health Insurance Per Month

The average premium for a family of 4 in 2020 is was $1,437, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use, and number of plan members.

Don’t Miss: Kroger Associate Discounts

Icanconnect New York State

This New York health insurance program is managed by the Helen Keller Services for the Blind and it provides support which allows Read More

Assistance provided by iCanConnect in New York State includes:

- Telephones

- Computers and access to the Internet

- Possible installation and training of essential equipment

See iCanConnect New York State for further details.

What Is The Aca Health Insurance Marketplace

Established by the Affordable Care Act , the Health Insurance Marketplace is a platform that offers medical insurance plans to individuals, families, and small businesses. Fourteen states and the District of Columbia offer their own marketplaces, also known as exchanges, while the federal government manages a marketplace open to residents of other states. Marketplace plans are divided into four categories that range in cost and coverage. Though offered by private companies, all must meet certain criteria established by the state or federal government.

Read Also: What Is Evolve Health Insurance

How Does Medicaid Coverage Work In New York

If you apply for Medicaid in New York, you will be asked to select a health plan managed by an insurance carrier, such as UnitedHealthcare or Empire BlueCross BlueShield. These insurance companies also sell individual health insurance policies and small-business coverage, and the plans themselves operate similarly.

Each Medicaid plan will come with a network of doctors and health care providers that accept the insurance.

However, health plans offered as part of the Medicaid program may have a different network of doctors when compared to other plans offered by the same insurance carrier. If you have a physician you prefer, it’s important to make sure they are covered in the new network.

Catastrophic Health Insurance Plans

For qualifying Americans under the age of 30, catastrophic plans are available to provide what can be considered last-resort health insurance. Catastrophic plan premiums are lower than even Bronze tier plans. However, you pay more for visits and prescriptions due to high deductibles, which are $8,550 for the year in 2021.

Read Also: Starbucks Pet Insurance

Qualified Small Employer Hra

With a QSEHRA, employees purchase their own health insurance and get reimbursed for medical expenses, health insurance premiums, and other qualified costs with tax-free dollars from their employer. To qualify, a company must have fewer than 50 full-time employees and cant offer a group health insurance policy to any employee.

Individual and group health insurance premiums and deductibles typically vary on a yearly basis, but the QSEHRA has annual contribution limits that the IRS sets annually. This means that employers are limited in how much tax-free money they can offer their employees through the benefit.

Can I Combine Health Plans

You can try mixing indemnity insurance, designed to pay a set daily benefit if youre hospitalized or in an accident, with a short-term medical plan that can let you go to the doctor a few times a year for more minor ailments.

In her former role as senior vice president of advisor services at Manning & Napier, Shelby George noticed people trying to rig these set-ups on their own, sometimes with poor results. They had to file every claim with all insurers so that every dollar could be recouped. That was complex, so the company rolled out combo plans with single insurers to make the claims process smoother.

Still, eHealth’s Nate Purpura notes that you have to take heed of two things when choosing health plans: Is the plan underwritten based on your health, or is it guaranteed issue, so it must enroll you regardless of your age, health status, or other factors? What does the plan cover if you have to be hospitalized?

Always make sure you know what youd get, before choosing a health plan.

Correction: Jan. 6, 2022. This article has been corrected after it misrepresented eligibility for the premium tax credit and mischaracterized the Health Insurance Marketplace. In 2021 and 2022, individuals making over 400% of the federal poverty level may qualify for the credit. The Health Insurance Marketplace is the federally run health insurance exchange.

Also Check: Does Starbucks Provide Health Insurance

Average Monthly Obamacare Premiums Per State

While $612 was the national average monthly premium for ACA plans, its important to understand that the majority of people enrolled get subsidies in the form of advance premium tax credits .

The table below shows the state-by-state average premium for Obamacare plans in 2019, the most recent year for which data is available. It also gives the average monthly premium after the average advance premium tax credit is applied, as well as the average monthly premium after APTC for consumers who received an APTC.

| Obamacare Average Premiums for 2019 |

|---|

| Location |

| $62 |

New York Health Insurance Cost Per Person

Average cost calculations for comprehensive group and individual insurance is based on data reported to the state department of insurance. Group insurance is based on 2,978,330 enrollees and individual insurance is based on 339,909 enrollees. Supplementary vision and dental insurance contracts sold as riders to comprehensive insurance are not included. Medicaid costs are based on data from Macpac.gov divided by the number of people covered based on Kaiser Family Foundation data. Medicaid data includes both state and federal spending. Medicare costs are based on data from CMS.gov divided by the number of people covered based on Kaiser Family Foundation data. CMS data are from 2014, adjusted for health insurance cost inflation rates.

Don’t Miss: How To Keep Health Insurance Between Jobs

The Cheapest Health Insurance In New York By County

Since New York and other states have rating areas that they use to calculate health insurance premiums, health insurance rates can vary depending on where you live. New York has 62 counties which are divided into eight rating areas. Counties in one rating area typically calculate their health insurance premiums the same way.

In Kings County, the most populous county in New York, the cheapest Silver plan is Healthfirst Silver Leaf, ST, INN, Pediatric Dental, Dep25, Fitness & Wellness Rewards offered by Healthfirst for an average of $611 monthly.

You can use the table below to find the cheapest plan in New York for all metal tiers in your respective county.

These plans are for a sample profile of a 40-year-old male in New York purchasing a health plan in that county.

Cheapest Health Insurance Plans in New York by County

Sort by county:

Average Cost Of Health Insurance In Ny

The average individual on a private health insurance plan pays around $440 each month for coverage. The average family plan holder pays around $1,168 per month. However, the specific amount youll pay depends on a number of factors, including your location, the people on your plan and your deductible.

Also Check: 8448679890

How The American Recovery Plan Act Makes Health Insurance Cheaper

Signed into law on March 11, 2021, the new $1.9 trillion COVD-19 stimulus package will have a major impact on the healthcare premiums of millions of Americans.

Officially known as the American Rescue Plan Act, this stimulus is expected to reduce healthcare premiums on some plans by as much as 20%. This will ultimately save millions of Americans hundreds of dollars on healthcare.

The stimulus plan reduces healthcare costs by expanding tax credits on many healthcare plans. Healthcare costs vary based upon an individualâs age, income and chosen plan but consider the following examples.

Stimulus impact for

What Kind Of Low

Low-income residents of New York may qualify for Medicaid. Residents whose incomes are too high for Medicaid but too low to afford individual insurance may qualify for an Essential Plan for adults or Child Health Plus for children. There arent any set enrollment periods for any of these programs, so you can apply anytime.

Don’t Miss: Uber Driver Health Insurance

Medicaid Health Insurance Coverage In New York

New York’s Medicaid program is a form of health insurance for those with low incomes. Qualifying for Medicaid is primarily a function of how much you earn and your household size. Through the state’s expansion of Medicaid, most households with a modified adjusted gross income under 138% of the federal poverty level are eligible for Medicaid coverage in New York.

The income limits for children and pregnant women are slightly higher than those for adults. Children up to the age of 19 are eligible for a special type of Medicaid if the household income is under 154% of the FPL, while pregnant women and infants up to the age of 1 are eligible if the household earns less than 223% of the FPL.

The following table illustrates the maximum yearly income a family can have in order to qualify for the Medicaid thresholds in New York.

| Family size |

|---|

| $59,398 |

How To Find An Affordable Plan That Meets Your Needs

Among eHealth customers who bought ACA individual health insurance, more than 75% chose Bronze or Silver plans. Your state may host an exchange for comparing and purchasing ACA plans or it may use the federal exchange at Healthcare.gov. Keep in mind, you arent limited to the exchange.

The licensed insurance brokers at eHealth can help you find the best health plan to meet your health coverage needs and your budget. They will listen to your priorities in health coverage and use their expertise to match your needs with health insurance options both on and off the exchange.

Recommended Reading: Starbucks Health Insurance Benefits

Can You Get A Health Plan For Free

Many people pay nothing if they qualify for the Affordable Care Acts premium tax credit subsidy. This tax credit is taken in advance to lower the amount of each monthly health premium you must pay, although it goes straight to the insurer.

You must apply for a plan through the Health Insurance Marketplace to be eligible for the premium tax credit. If your state has its own exchange, check the website to see which tax credits are available.

The amount you receive will depend on the household income that you disclose when you apply. If you make between 100% and 400% of the federal poverty level , you’ll qualify for subsidies on health plans that you can buy through the Health Insurance Marketplace, the federal government’s program for buying ACA plans. If you make over 400% of the FPL, you may qualify for subsidies in 2021 and 2022, thanks to the American Rescue Plan. Even if your income was too high in prior years. you may be eligible for tax credits for 2021 and 2022.

You must file a tax return at the end of the year to reconcile your income with the tax credit you received. You may have to pay back some of the tax credit that lowered your costs if you ended up with more income than you thought you would have when you first applied.

You won’t have to pay back any excess tax credit you received in 2020, because the IRS has waived this rule for just this one tax year.

Rules and costs can vary by state, but this option bears looking into before you settle on any other.

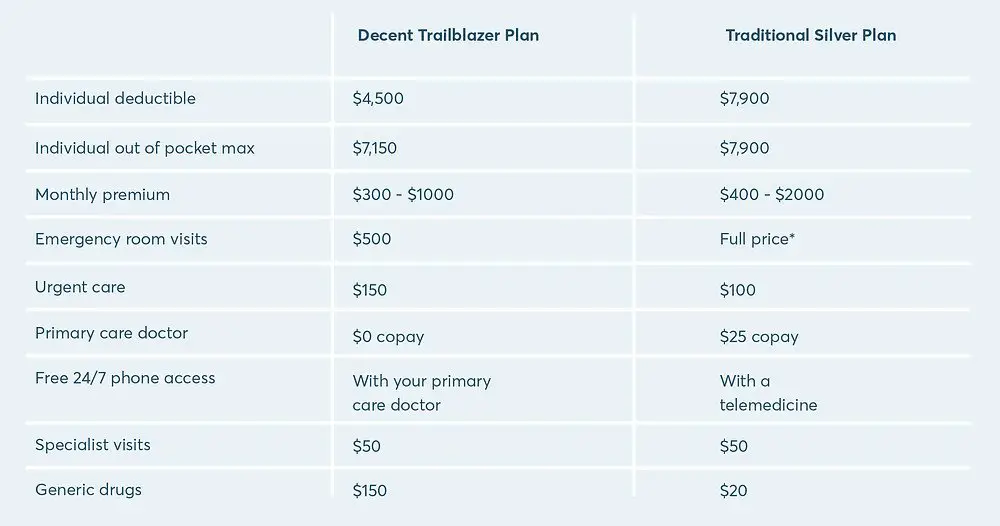

Breaking Down Health Insurance Expenses In New York

A premium is the monthly payment you need to make to be covered by health insurance in New York. Your insurance carrier does not refund your premiums irrespective of whether you are using the insurance or not.

Deductibles are the additional payments you are supposed to make to a primary care physician before your insurance provider begins paying for your medical expenses. A deductible is an annual financial obligation you have to commit to prior to receiving medical benefits from your insurance carrier. Out-of-pocket expenses refer to the amount of money you are required to spend before your insurance provider pays your whole bill.

Deductibles and your out-of-pocket expenses start a fresh at the beginning of the year. For example, if you have a $5,000 deductible, and your out-of-pocket expenses amount to $2,500, and you have the same insurance coverage at the beginning of a new year, your deductibles and out-of-pocket expenses will start at $0. However, there are some packages in New York, that enable you to roll over any paid deductibles to the next year.

Copayments, also known as coinsurance, are the payments you make for medical visits. For example, if your coinsurance when visiting a doctor is $30, each time you visit your primary care doctor, you will be expected to pay $30. The insurance will cater for the balance if any services rendered are featured on your plan. Copayments are usually not subject to a deductible.

Also Check: Does Kroger Offer Health Insurance To Part Time Employees

Allowing Dependent Coverage Through Age 29

Under the Affordable Care Act, young adults can be covered under their parents’ health insurance plans up to the age of 27. Because of the way insurance is priced in New York, it is preferable for young adults to stay on their parents’ plans until the legal age limit since the additional cost for a dependent is cheaper.

New York also allows health insurance companies to offer an age 29 coverage option. Parents pay a little more for their health insurance in exchange for having their children stay on the family plan until the age of 29.

For example, say your young adult child has passed the age of 27 but does not have a job or sustainable income to pay for their own insurance. In this case, you could pay a small extra premium along with your normal health insurance rate that would allow your coverage to support your son or daughter. To qualify, the young adult must:

- Be unmarried

- Not be insured or eligible for insurance through their employer

- Live, work or reside in New York state or the insurance carrier’s coverage area

Health Services Use By New York Residents

The tables below show the frequency with which residents use health services. The data are collected from insurance company filings with the state insurance department. The number of enrollees on which data was collected is as follows: Group insurance, 2,978,330 Individual insurance, 339,909 Medicaid managed care, 1,259,808 and Medicare Advantage, 1,026,734.

You May Like: Does Medical Insurance Cover Chiropractic

Average Cost Of Health Insurance By Family Size In New York

The average cost of health insurance in NY is$701, which is around $200 more than the national average.

According to the health insurance quotes in NY, the average monthly cost of a premium family health insurance plan is$1,894. This is considered to be the cheapest low-income health insurance in NY.

If you are considering opting for a family health insurance plan, you must bear in mind that the size of your family and the ages of all family members will have an effect on the monthly premium.

In the table below, you can see the average monthly premium on health insurance plans in New York according to the family size.

How Cobra Affects Your Taxes

If you decide to continue your current health insurance with COBRA, there is another expense you may not be aware of: higher taxes.

While you’re employed, your insurance premium is deducted from your paycheck before taxes along with other pretax deductions such as your 401 retirement plan and group term life insurance. These deductions make your net income look smaller and, by doing so, lower your income tax.

When you lose job-based health coverage and switch to COBRA, you have to pay your COBRA premiums with after-tax money. This means that you lose the tax-free benefit you enjoyed while being employed.

In some cases, you may be able to deduct part or all of your COBRA premiums from your taxes. But not everybody is eligible for this deduction. Speak with an accountant or tax advisor.

You May Like: Umr Insurance Arizona

Dual Eligible Plan And D

Dual-eligible s are persons enrolled in both a New York health insurance Medicare and Medicaid programs at the same time. Read More

These New York health insurance enrollees are commonly broken into two groups:

- Full benefit dual eligibles are those who have Medicare but also receive benefits under Medicaid

- Partial duals are those that have Medicare and qualify for Medicaid help in paying for medical expenses such as Medicare premiums and/or cost-sharing

Additionally, if you are a New Yorker with special needs, you can enroll in a Dual Special Needs Plan that includes Medicare and Medicaid benefits. These plans may pay for expenses that the two types of coverage do not cover individually, including some over-the-counter items. They could also offer extra coverage for things like hearing aids, vision, and dental care.

Beneficiaries who are dual-eligible can change between Original Medicare and Medicare Advantage or switch to Part D plans at any time.