How Do I Find Affordable Health Insurance

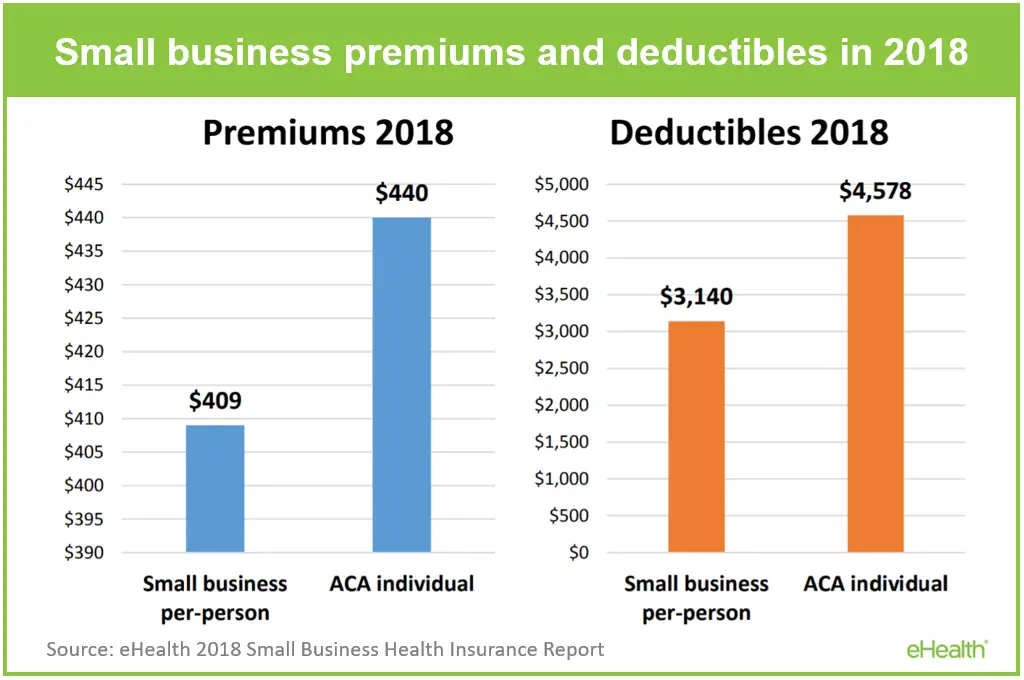

Group plans are generally cheaper than individual plans. So if you are eligible for onethrough your employer, your union, or some other associationthat’s your best bet, in terms of coverage for the money. If that’s not an option, the public health marketplaces established by the Affordable Care Act offer affordable health insurance for individuals. In most of the U.S., you can sign up for a plan offered through the federal government via the HealthCare.gov site. However, 12 states run their own marketplaces, and residents sign up via their sites.

Healthcare Costs Based On Age And State

Healthcare costs vary based on your age and the state you live in. As you might expect, younger, healthier adults pay the least for healthcare coverage, but even for younger adults, the cost of coverage varies greatly based on location.

In 2021, the average cost of a monthly health insurance premium in the U.S. is $541 per month. The average annual deductible is $5,940. In some places, the cost varies greatly from the national average. In West Virginia, the average premium is $831 with a deductible of $8,540 in next-door Maryland, the average is only $344 with a $4,122 deductible.

Age is another big factor when it comes to the costs of health insurance. Take a look at this breakdown by age for the average monthly healthcare premium without subsidies:

- 18 and under: $224

- 55-64 years: $771

How Much Does Health Insurance Cost Average Health Insurance Costs By Us State

Health insurance costs vary a lot between states. According to a 2019 report by the Commonwealth Fund:

- Hawaii has the cheapest individual health insurance contributions of any US state, at $755 annually.

- Texas, Tennessee, South Carolina and Michigan all see personal health insurance costs close to the US national average $1,427.

- Massachusetts was the most expensive state for health insurance. Here, individual contributions stood at $1,903.

You May Like: How To Keep Health Insurance Between Jobs

How Much Is Aflac Health Insurance

Aflac offers the following variety of health insurance coverage options and types:

- Hospital confinement indemnity pays benefit for hospital stays when 23 hours or more is required due to a sickness or injury covered by the plan.

- Hospital confinement sickness indemnity pays benefit for the fees related to doctor visits, diagnostic exams, surgery, and hospitalization.

- Hospital intensive care pays for associated costs of stays in an intensive care unit.

- Specified health event payment in the event of a stroke, heart attack, coma, or other covered event.

- Cancer / specified disease pays benefit for treatment, including chemotherapy, radiation and hospital stays.

Contact Aflac at:

American Health Insurance Vs International Cover: Whats The Cost Difference

International health insurance is a product designed to offer cross-border coverage. Many Americans are surprised by how affordable health coverage can be when they spend time overseas so how does this product compare to domestic cover?

At William Russell, our most comprehensive international health plans provide standard coverage in every country except the USA. Weve published a full guide on how we calculate premiums for health insurance. By comparing our typical premiums to U.S. averages, its possible to get an idea of the cost difference between health insurance in the USA and other nations.

| Typical US health insurance costs in 2020 | The average William Russell international health insurance premium in 2020* |

|---|---|

| Individual cover | |

| $8,419.90 |

*Based on William Russell premiums in Thailand and Vietnam

We have a full guide on how much expat health insurance can cost in different countries, together with a list of most expensive and cheapest countries for health insurance.

You May Like: How Long Do Health Benefits Last After Quitting

How To Find Better More Affordable Health Insurance

When it comes to drastically lowering your health insurance premium or deductible costs, experts say there arent many simple answers. However, among factors to consider are quitting any tobacco use and opting into a Health Savings Plan .

Handel says that an HSA is a type of savings account that allows a person to set aside money pre-tax, specifically to be used on health care costs now or down the road.

HSAs are useful, especially if you are higher income, Handel says. HSAs make the most sense for people in a higher income bracket because their marginal tax rate is higher, he adds. People in a lower income bracket, meanwhile, will not be saving as much because their tax rate is lower.

Some examples of how an HSA can be used include for doctor visit copays, dental expenses, vision expenses and for prescriptions. An individual can decide how much they want to contribute monthly or yearly to their HSA, which comes out of their paychecks, but the IRS caps the amount of how much someone can contribute to their HSA.

There are multitudes of variables that affect how much health insurance costs. And, while its not an easy expense to weigh or pay, the benefits of health insurance can outweigh the cost when it comes to routine care and medical emergencies.

How To Get The Best Health Insurance

If youre looking to purchase health insurance on your own, you can just go to the websites of major health insurance companies in your area and see what plans they provide. You can compare plans on your own, although quotes will vary pretty widely.

But lets face it. This is a ton of work. Choosing the right health insurance plan for you or your family is a daunting task. And you probably have better things to do with your time than sifting through endless health insurance quotes.

Thats why I recommend using our trusted and independent insurance agents for your health insurance needs. Theyll look at your situation and compare the best rates so you can get the coverage you need. Theyll help you understand the marketplace or even what your employer is offering. And the best thing? Theyre free!

Connect with one of our insurance agents today.

About the author

George Kamel

George Kamel is a personal finance expert and host of The Fine Print Podcast. Since 2013, George has served at Ramsey Solutions where he teaches on how to spend less money, save more, and avoid consumer traps. He is also the host of The EntreLeadership Podcast.

Don’t Miss: Do Substitute Teachers Get Health Insurance

Financial Value And Ratings

Aflac is a leading supplemental insurance company with excellent financial ratings. The organization has an A+ rating with Better Business Bureau and an A+ rating from A.M Best. In 2017, Aflac earned the 126th spot on the Fortune 500. In addition, they were also ranked number 91 on the Fortune list of Best Companies.

Different Levels Of Coverage

Okay, stay with me here. I’m almost done with this marathon investigation into all things health insurance. I looked at the different types of plans, but theres a little more to it before we put a bow on all this.

When it comes to marketplace health care plans, there are four different levelsbronze, silver, gold and platinum. Think of them like medals at the Olympics. These tiers give you different options on how much your plan will actually pay out versus how much youll pay. Also keep in mind they dont reflect quality of care.14

Generally speaking, plans with a lower monthly premium will mean a higher deductible, and vice versa.

Bronze is one step up from a catastrophic plan. They give you lower monthly costs, but more out-of-pocket expenses.

Silver offers lower deductibles and out-of-pocket costs than Bronze, but youll pay more in monthly premiums. And depending on your income, silver plans also come with discounts called cost-sharing reductions where the provider could cover costs up to the 90% mark.

Gold plans have high monthly premiums but low deductibles, coinsurance and out-of-pocket costs.

Platinum is the highest monthly premium out there, with the lowest out-of-pocket costs. This type of coverage means youre really putting all your eggs in that big monthly premium basket! But having a lower deductible means your insurance company will start covering those crazy health care expenses a lot sooner.

Recommended Reading: Insusiance

How Do You Choose A Plan That Meets Your Budget And Needs

To settle on the right plan, think about how you typically use healthcare services. For example, ask yourself:

- How often do you usually visit the doctor? Once a year for a checkup, or monthly to monitor a health condition? Was last year typical, or unusual?

- Are you expecting larger-than-average health expenses next year or do you only expect to use preventive care services? For example, are you having a baby? Were you recently diagnosed with a condition that will require regular treatment?

- What prescriptions do you take regularly?

- How many healthcare providers do you typically see? Just a primary care doctor, several specialists over the year, or just the provider at your local retail or urgent care clinic?

- Do you and your family have one or more chronic health conditions?

- Have you or any of your family members been diagnosed with COVID-19 in the past year?

- Have you postponed healthcare services because of COVID-19?

It may be helpful to add up what you spent last year, just as a general guideline.

Make sure you look at all costs, not just the premiums. For example, a high-deductible plan can work out to your advantage if you are relatively healthy and only expect only to use preventive care services, since those services are at 100%. These types of plans typically have lower premiums. However, if you have a chronic condition that requires a lot of care, you might consider a plan that has a higher premium but lower out-of-pocket costs.

Dont Forget to Shop Around

How Do I Find Exact Pricing For Health Insurance

The great news is that you have options, and there are now many independent health insurance agents selling these policies in Texas. Insurance For Texans, as an independent insurance agent, can help you evaluate the pros and cons of each of these options. With some quick information, we can get preliminary pricing so that you can quickly evaluate if these options will work for you and how to best maximize your situation. To get exact pricing, you will need to do some underwriting. But that is one of the things that we excel at!

Read Also: How Long Do I Have Insurance After I Quit

International Health Insurance For Us Citizens Living Abroad Whats Covered

How much youll pay for health insurance isnt a number you can guess. Its affected by many factors, few of which you control.

With William Russell, international health insurance can cover US citizens for:

- Doctor visits, consultations, hospital care and mental health treatment in multiple overseas territories .

- Up to $100,000 for unexpected elective medical care and $250,000 in emergency treatment costs during short visits back to US soil, for reassurance when you visit family or head home for the holidays .

How Much Is Individual Health Insurance In 2022

Individual health insurance ranges from $221 to $839 per month, depending on multiple factors. Your insurance plan varies by metal tier and plan type. Millions of people are without insurance or pay out of pocket for healthcare services, so obtaining a plan from the Marketplace can be an excellent option for many. There is a federal Marketplace, but many states also offer their individual health insurance.

Don’t Miss: How Much Does Starbucks Health Insurance Cost

Other Aflac Perks Worth Considering

For those unsure of their life insurance needs, Aflac has two online calculators that could help with estimating coverage. The primary life insurance calculator has eight questions to get an understanding of how much life insurance coverage is needed, while the supplemental insurance calculator can provide a picture of how much medical costs might be associated with different procedures.

How Much Is Family Health Insurance Per Month

The average premium for a family of 4 in 2020 is was $1,437, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use, and number of plan members.

Don’t Miss: Starbucks Health Insurance Eligibility

How Much Does Aflac Insurance Cost Per Month

The monthly cost of Aflac insurance is influenced by many factors including the type of policy that you want to sign up for, the applicant, the annual salary, and the deductible. However, the average cost of the majority of the Aflac insurance policies is anywhere between $10 and more than $30 per month.

For example, an applicant who is 55 years old and makes around $75,000 per year would have to pay anywhere between $70 and $100 per month, while an applicant who is 24 years old and makes $30,000 per year would have to pay $30 to $45 per month.

In the table below you will find the price estimates for short-term disability insurance.

| Salary | |

|---|---|

| $12-$21 | $15-$25 |

The #1 selling product for the company is the personal cancer indemnity plan. It protects in the unfortunate situation of cancer, stroke or heart attack. The monthly premium costs are anywhere between $9 and $15 per individual, depending on its age. Also, if there is another applicant added the costs would increase at $10 to $25 per month.

Another product designed to cover the health problems is the personal sickness indemnity plan, which costs anywhere between $8 and $14 per month, per individual, depending on the age of the applicant.

For instance, according to a member of the Disboards.com forum, the monthly costs are around $20 and the policy covers any health problems such as coma or heart attack.

Also, a member of the WhattoExpect.com forum claims that the monthly costs of a policy are around $50.

Health Insurance Deductibles: What Can You Expect

On top of premiums, everyone who carries health insurance also pays a deductible. This means you pay 100% of your health expenses out of pocket until you have paid a predetermined amount. At that point, insurance coverage kicks in and you pay a percentage of your bills, with the insurer picking up the rest. Most workers are covered by a general annual deductible, which means it applies to most or all healthcare services. Here’s how general deductibles varied in 2020:

- $1,644: average general annual deductible for a single worker, employer plan

- $2,295: average annual deductible if that single worker was employed by a small firm

- $1,418: average annual deductible if that single worker was employed by a large firm

| Median Individual Deductible, Qualifying Health Plan Without Subsidies from HealthCare.gov., Plan Year 2020 |

|---|

| Bronze |

| $95 |

Individuals who are eligible for cost-sharing reductions are responsible for deductibles as low as $115 for those with household incomes closest to the federal poverty level.

Read Also: Starbucks Health Insurance Part-time

How Much Does Individual Health Insurance Cost

BY Anna Porretta Updated on January 21, 2022

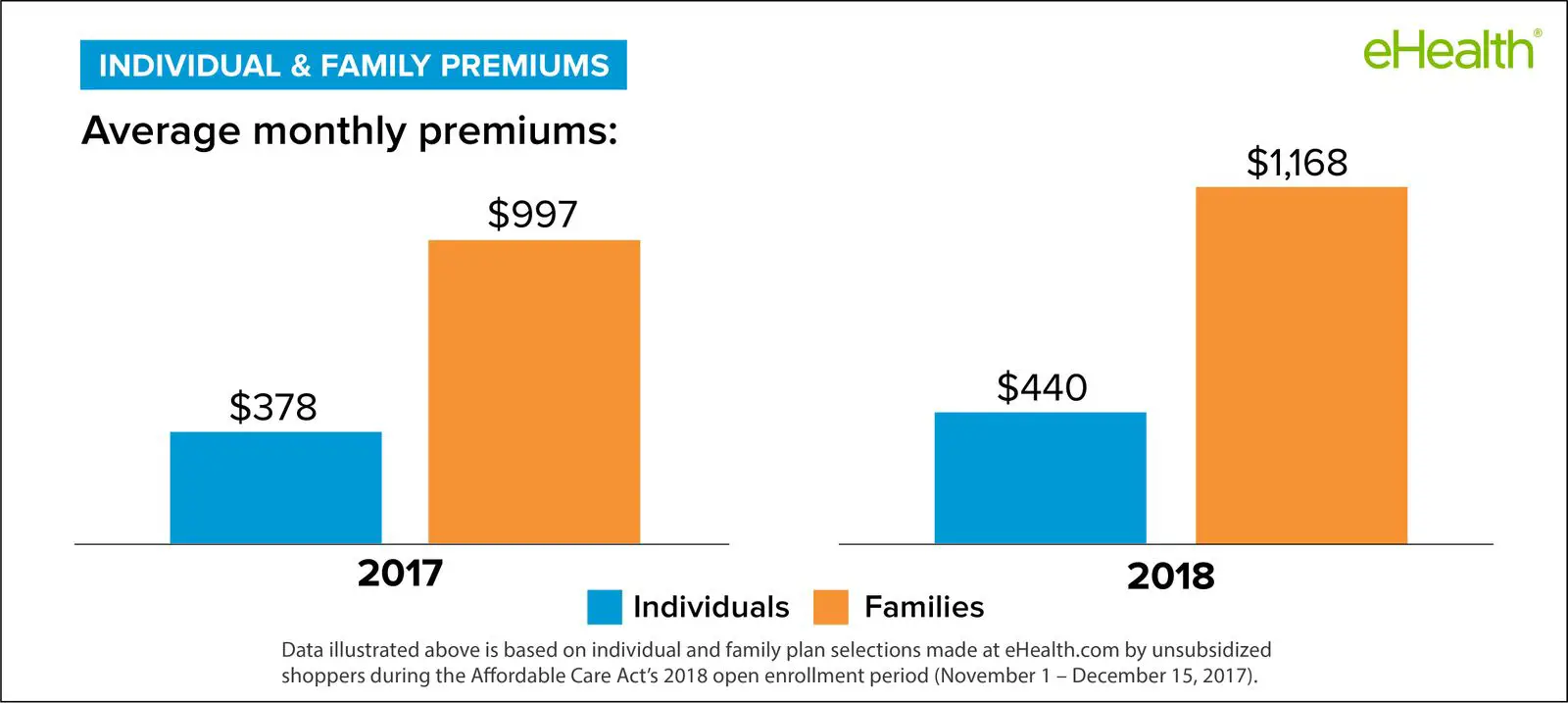

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.

To see personalized quotes for coverage options available in your area, browse health insurance by state. If you already know which health insurance carrier youd like to purchase from, check out our list of health insurance companies.

Traditional Health Insurance Plans

Traditional insurance is usually the most expensive option. Most traditional insurance plans require the patient to pay a portion of the costs, which is the deductible.

For example, if your insurance requires a $500 deductible per person, you will have to pay the first $500 of your costs for yourself and each family member before the insurance company will contribute.

Once the deductible is reached, your health insurance policy will pay a percentage of the costs from then on, usually 80 or 90 percent of covered expenses.

Some expenses may not be covered and your insurance company may refuse to pay for certain treatments or procedures.

Don’t Miss: Starbucks Health Insurance Benefits

If You Get Your Own Insurance There Are Several Categories You Can Choosefrom In The Marketplace Often Called The Metal Categories: Bronze Silver And Gold

Gold will pay more of your total costs of healthcare, butyoull usually pay a higher monthly premium. Bronze andSilver usually pay less of your total costs, but youllusually have a lower monthly premium.

When looking at the plans, consider these three things:

- How often you get regular medical services .

- How many prescription medications you take .

- If you qualify for a premium tax credit or extra savings, youll choose the Silvercategory or you may find out youre eligible for Medicaid. The federalgovernments healthcare website has a greatcalculatorto help you decide if this is for you.

Find Cheap Health Insurance Quotes In Your Area

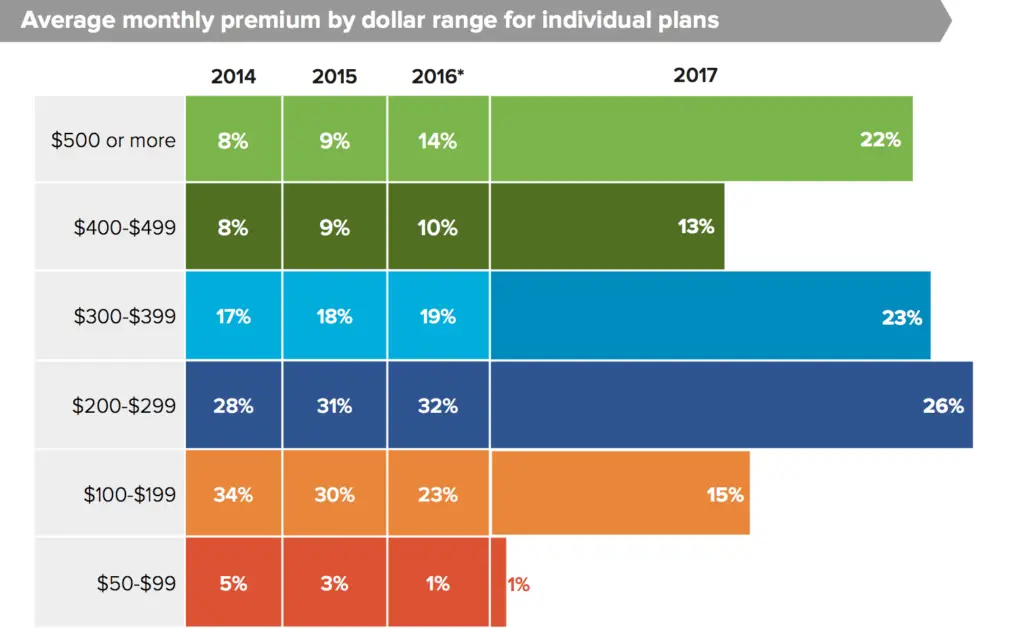

Health insurance premiums have risen dramatically over the past decade. In previous years, insurers would price your health insurance based on a multitude of factors. However, the number of variables have decreased significantly with the Affordable Care Act.

In 2022, the average cost of individual health insurance for a 40-year-old on a silver plan is $541. This represents an increase of nearly 1% from the 2021 plan year.

Read Also: Starbucks Health Insurance Part Time

Why Blue Cross May Not Be Right For You:

- Hospital benefits are not automatically included

- Dental cover waiting periods vary between plans

Before signing up for a health insurance plan with Blue Cross, compare rates and coverage offerings from the best health and dental plans using our comparison tool. Shop the best plans in seconds without giving up personal details.

Compare coverage and rates ofCanada’s best health insurance plans