What Does 20% Coinsurance Mean

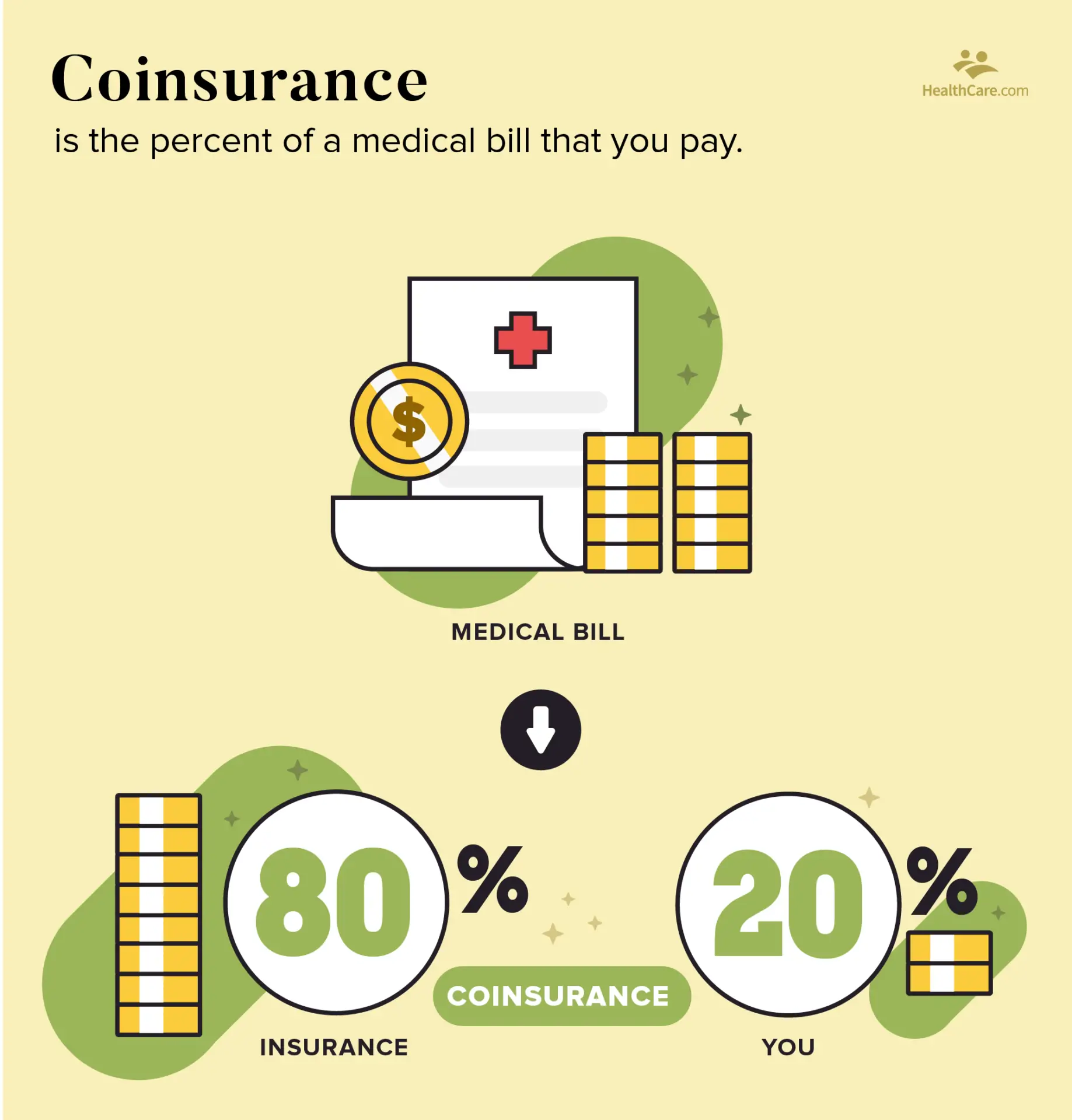

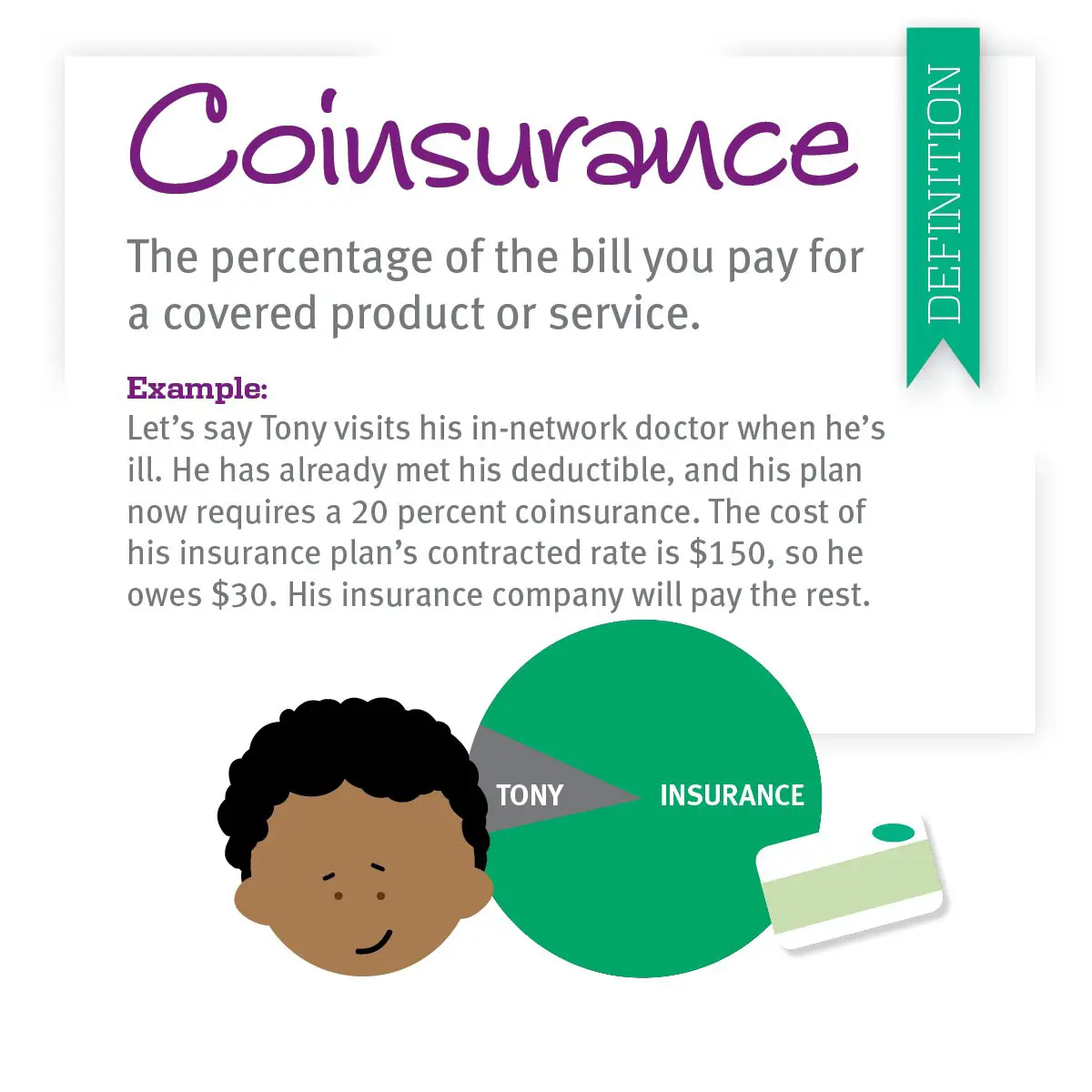

A 20% coinsurance means your insurance company will pay for 80% of the total cost of the service, and you are responsible for paying the remaining 20%. Coinsurance can apply to office visits, special procedures, and medications.

Lets say you visit a doctor because you have an eye infection.

Scenario #1: If the examination by your doctor cost $100, you would pay $20 out of pocket while your insurance company would pick up the tab for the remaining $80.

Scenario #2: Lets say your primary care physician couldnt provide the full treatment for your eye infection and had to refer you to an eye specialist. Your visit to the specialist cost $120 so you paid $24 , and your insurance company paid the remaining $96 of the bill.

The specialist prescribed you some medication for your eye, so you head to the pharmacy to pick it up. The prescription costs $60, so you are asked to pay $12 out of pocket , and your insurance takes care of the remaining $48.

While the equation may seem simple enough, its important to understand the terminology around coinsurance and what youre obligated to pay under your insurance plan. Many plans are different and cover a different percentage of cost. A licensed insurance agent can help you review your coinsurance options when youre ready to shop for a new plan.

What Is The Difference Between A Deductible And A Copay

Depending on your health plan, you may have a deductible and copays.

A deductible is the amount you pay for most eligible medical services or medications before your health plan begins to share in the cost of covered services. If your plan includes copays, you pay the copay flat fee at the time of service . Depending on how your plan works, what you pay in copays may count toward meeting your deductible.

Coinsurance And The Metal Tiers

Your coinsurance percentage depends on the details of your individual insurance policy. If you got a plan through the, then your plan falls into one of four tiers Bronze, Silver, Gold, Platinum. These are called the metal tiers. The tier a plan falls into depends on how the insurer will split all costs with you, which isnt the same as your coinsurance split.

With a Bronze plan, for example, insurers cover an average of 60% of your medical costs, leaving you to pay 40%. The 60/40 cost sharing factors in copays, coinsurance, and the costs you will pay before and after hitting your deductible. So the average cost-sharing value for the tier of your insurance plan may not be the same as your coinsurance percentage. In fact, its possible to have a plan with 0% coinsurance, meaning you pay 0% of health care costs, or even 100% coinsurance, which means you have to pay 100% of the costs.

Further reading: How metal tiers work

The following table lists the general cost-sharing percentages for each of the metal tiers. Bronze plans require you to pay the most while the Platinum plans require you to pay the least. At the same time, Bronze plans usually have the lowest monthly premiums and Platinum plans usually have the highest premiums.

| METAL TIER |

|---|

Don’t Miss: What Insurance Does Starbucks Offer

Cons Of High Coinsurance Plans

Costly Out-of-Pocket Medical Expenses. If you choose a high coinsurance health insurance plan, youll pay more for covered healthcare services out of your own pocket than if you chose a low coinsurance health plan. Its common for high-coinsurance plans to also have high deductibles and, if so, you may find that you are paying 100% of medical care expenses far into the year until you have met your deductible. In addition, you could incur substantial expenses if you frequently see your primary care doctor and specialists for treatment of a chronic condition or if you are hospitalized for an unexpected illness or injury. With a high coinsurance health plan, predicting and budgeting for the healthcare expenses you will likely pay during the year is more challenging because your cost-share is greater.

Its important to consider your personal health needs and financial circumstances before deciding on a high-coinsurance or a low-coinsurance health plan.

Below Are Other Health Insurance Terms You Might Come Across:

Allowed Amount / Allowed Charge: A dollar amount contractually negotiated between the insurance company and the provider for services rendered. The allowed amount is typically lower than the providers standard rate and is the maximum an in-network provider is allowed to charge for a covered service.

Benefits: The health related services or items covered by a health insurance policy . Obama care plans must all cover 10 minimum essential health benefits.

Catastrophic Plans: Low premium health insurance plans for those under 30 years of age with limited co pays and higher deductibles.

Claim: A request sent to the insurance company detailing the health services rendered and requesting payment from the company for those services. Claims may be submitted directly by the healthcare provider to the insurance company or by the patient.

Covered services: Health care services, prescription drugs and medical equipment that are covered by your healthcare plan.

Exclusions: Medical procedures, health services or items not covered by a health insurance plan, such as cosmetic surgery.

Essential Health Benefits: A set of 10 healthcare benefits established by the Affordable Care Act that all insurance carriers must offer on all insurance plans.

Federal Poverty Level: An income level set each year by the Federal government that is used as a threshold when determining eligibility for certain government services.

You May Like: Does Starbucks Provide Health Insurance

What Is A Deductible In Simple Terms

Your deductible is the amount that you must pay out of pocket before your insurance kicks in and starts to cover your costs.

There will be no charge after a deductible and your out-of-pocket maximum have been reached. The health insurance company will cover the rest of your care for the year once you have hit those limits.

How Do Coinsurance And Deductibles Work

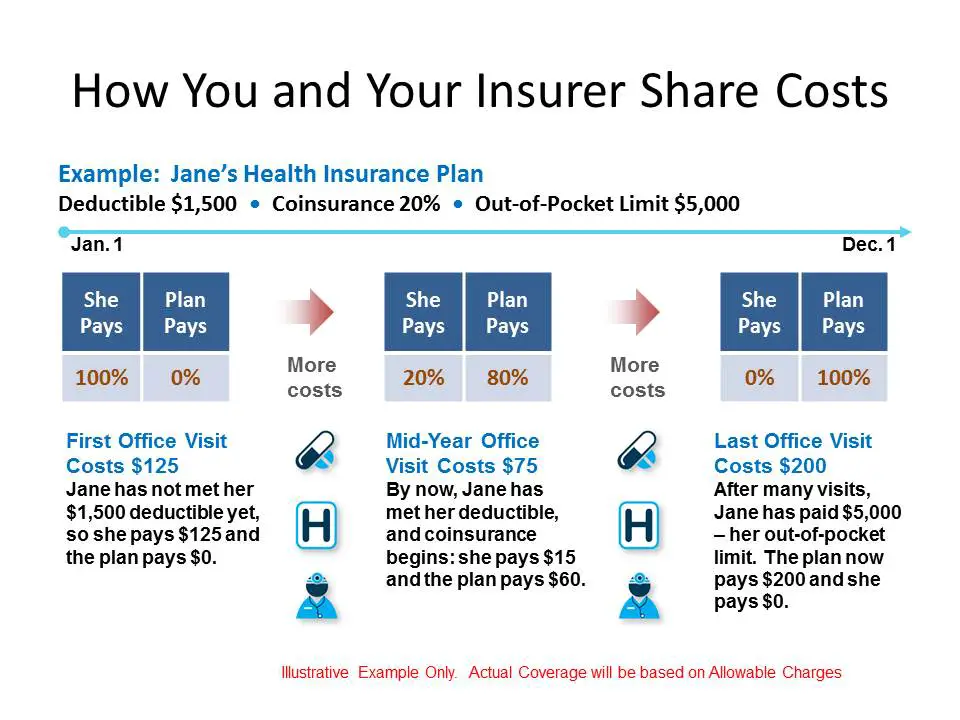

A deductible is the amount set by your insurance plan that you must pay on your own, out-of-pocket, before the insurance company starts helping you pay for costs. For example, if you have a deductible of $1000, this means that you must pay for $1000-worth of services before your insurance company starts covering your costs.

A deductible encompasses all medical costs, so you can reach your deductible by seeing various providers or by paying for your prescriptions or medical equipment. Often, coinsurance rates begin after you meet your deductible or pay the deductible amount – so if you see that your coinsurance rate for therapist is 50%, check the details to see if this is before or after the deductible.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

What Is A Premium

A premium is the amount of money you pay an insurance provider for health care coverage under a particular health insurance policy. In most cases, premiums do not count towards meeting your deductible. ForExample: If the annual premium is $2,700 for the plan you select, you will pay $225 per month to the insurance provider for the healthcare coverage offered under the policy.

Do All Health Insurance Plans Have Copays And Coinsurance

No. Some healthcare plans might not require customers to pay a copay for medical services, although these plans will typically come with high premiums. On the other end, a catastrophic health plan with a very high deductible might pay as much as 100% of many preventive expenses, without coinsurance.

You May Like: Does Uber Have Health Insurance

How Does A Copay Work

A copay is a fixed amount you pay for a service. Many health care providers require you to pay this amount at the time of your visit.

Plans with lower monthly premiums typically have higher copayments and vice-versa.

Copay amounts may vary depending on the nature of the service you receive. For example, there may be one copay for lab testing and another for seeing a specialist. Or, you may pay one copay to see a doctor and a higher copay to go to the emergency room.

Here is an example of a potential copay structure:

- Primary care visit $20

- Prescription drug $10

- Emergency room visit $100

Kelly Fristoe, president-elect of the National Association of Health Underwriters, says certain copays such as those for emergency room visits tend to be higher than copays for standard office visits to your primary physician. Health insurance companies charge higher copay to discourage people from using emergency rooms when cheaper care, such as at an urgent care center or a primary physicians clinic, would suffice. Those plans often waive the emergency room visit copay if you wind up getting admitted to the hospital.

The most expensive place that you could ever go to receive health care is going to be the emergency room, Fristoe says. He says insurers want to discourage people from looking at that emergency room as being a place to go for things that maybe arent an emergency.

For that reason, a copay for a regular doctors office visit will be lower.

Which Health Insurance Plans Have Copays

Many health insurance plans have copayments. Theres a good chance that your plan is among them.

Copayments most often pop up in managed care plans, such as HMOs. Insurers that offer these plans negotiate fixed fees for essential health care services with health care providers. Because these fees are fixed, its easier for the insurer to forecast actual costs and to zero in on a copay that works.

Other types of plans such as PPO plans also may have copays.

Fristoe says many people have gotten used to paying a copay. But choosing a health insurance plan based solely on copays isnt always in the consumers best interest. This is especially true for people who rarely use health care services.

It doesnt make sense to pay an extra $50 a month in premiums so you can have a $20 copay when you go to the doctors office, Fristoe says.

Some people who dont need many health care services may benefit from a plan with higher deductibles and lower premiums.

There are certain things that arent appropriate to try to transfer to a health insurance contract, and that may include two or three simple office visits per year, Fristoe says. Buy insurance for the reason it was meant to be purchased, and thats for the catastrophic health care event that is going to be multiples of thousands of dollars.

Read Also: Kroger Employee Discount Card

How Can You Use Coinsurance In A Sentence

If you feel comfortable with the word coinsurance, its time to put your knowledge to the test and practice using the term in a sentence. To get you going, weve provided a few example sentences below:

Only some companies require coinsurance from the people they cover, so be sure to do your research when picking a healthcare plan!

My agent told me that after I meet my deductible, the coinsurance benefits will finally apply.

John said if we go with his insurance company, everything from co-pays to coinsurance percentages will be less.

I know it can be a little pricey, but per your plan, coinsurance charges must be paid before you get any benefits.

I always compare insurance companies by reviewing their coinsurance benefits and deductibles.

To get the coinsurance benefits offered by Beccas medical plan, she has to pay a high deductible which honestly may make the total cost of the policy not worth it, if you ask me.

Did you know that coinsurance is basically just a form of cost-sharing?

The health insurance plan offered at my work requires a pretty hefty coinsurance charge before I can reap any benefits, so I decided to use a different health care service to cover my annual medical expenses.

Costs Are What People Dislike Most About Health Insurance

Not surprisingly, health insurance costs arent popular. A recent Insurance.com survey of 1,000 people found that out-of-pocket costs, including deductibles, coinsurance and copays, barely edged out premiums as what they dislike most about their health insurance.

Out-of-pocket costs and premiums easily topped other health insurance headaches, such as surprise medical bills, prior authorizations, limited provider choices and referrals to see specialists.

Females and people under 55 dislike out-of-pocket costs the most men and people 55 and over chose premiums.

Heres what people disliked most about their health insurance:

- Out-of-pocket costs — 35.4%

Don’t Miss: Why Do Doctors Hate Chiropractors

Finding And Calculating Your Coinsurance

Youll need two things to calculate your coinsurance payment for a specific medical visit.

The more complex that a medical procedure is, the less likely you are to know an estimated bill before going in. Hospitals should be able to give you price estimates, but final prices will be determined by a billing department over weeks or months. This is especially true for inpatient care or emergency room treatment.

Some medical conditions will come with a mix of copayments, coinsurance, and even free preventive care. Coinsurance is still a good way to estimate your full costs in these situations, since larger bills tend to be paid with coinsurance.

Your health insurance plan can tell you whether a procedure will be subject to coinsurance or a fixed copayment.

What Does 40% Coinsurance After A Deductible Mean

If your plan has 40% coinsurance, thats the percentage of the costs you pay once you reach your deductible.

So, lets say you meet your deductible and you need a minor outpatient procedure. The costs total $1,000 and you have 40% coinsurance. In that case, youd owe $400 and your insurance company would pick up the rest of the costs.

Bronze plans in the ACA marketplace have 40% coinsurance.

You May Like: What Benefits Does Starbucks Offer

Your Writing At Its Best

Compose bold, clear, mistake-free, writing with Grammarly’s AI-powered writing assistant

If youve ever had health care, youve likely come across the term coinsurance but what exactly does it mean, and how does it work? Is it any different from copay?

You have questions, and we have answers. Read on to discover our complete guide on coinsurance, where youll learn our word of the days definition, usage, and more.

What Is A Copayment

A copay, which is a flat fee the policyholder pays for a health care service, is one way insurers share the cost of medical services. Fees are determined by the insurer and depend on the plan, medical service or prescription drug.

Copays listed in health insurance plans can take effect either before or after the policyholder has reached an annual deductible. After you’ve reached this amount, you’ll pay a copayment.

Alternatively, the insurer may waive the deductible and immediately implement cost sharing. In most health plans, for example, the deductible is waived for a certain number of visits to a primary care physician typically, the first three in a year. Once a member has used their allotted number of copay visits to their primary care physician, they must pay for any additional visits out-of-pocket, up to their deductible amount. At this point, the copayments again apply.

Health plans that apply copays before the deductible or waive them for certain services are generally preferable. It means the insurance company begins picking up some of the costs early on, which is especially important when you’re comparing medical expenses. The copay amounts might look very similar on paper, but one type of copay could cost you money when they begin kicking in.

Read Also: Part Time Starbucks Benefits

Related Words You Should Know

Before we bring this article to an end, we want to leave you with a small homework assignment to help further your understanding of the term coinsurance.

Below, weve compiled a word list of related words that are commonly associated with coinsurance. By learning them, youll not only deepen your knowledge of our word of the day, coinsurance, but youll expand your English vocabulary, too!

Research and learn the following terms:

- Medicare

- Pocket maximum

- Premiums

Pro Tip: If youre not sure where to start, we suggest heading over to Healthcare.gov.

How Do I Decide What Deductible Amount To Choose

If you’re mostly healthy and don’t expect to need costly medical services during the year, a plan that has a higher deductible and lower premium may be a good choice for you.

On the other hand, let’s say you know you have a medical condition that will need care. Or you have an active family with children who play sports. A plan with a lower deductible and higher premium that pays for a greater percent of your medical costs may be better for you.

Recommended Reading: How To Enroll In Starbucks Health Insurance

What Is A Deductible

A deductible is the amount you pay for health care services before your health insurance begins to pay.

How it works: If your plans deductible is $1,500, youll pay 100 percent of eligible health care expenses until the bills total $1,500. After that, you share the cost with your plan by paying coinsurance.

Should You Opt For A Health Insurance Plan With Copayment Coinsurance And Deductible Clauses

Well, even though on paper your premium payment will be reduced if you opt for a policy with such cost-sharing terms but your liability towards the policy will increase. You will have to take care of a portion of the expenses every time a medical emergency arises. This can lead to difficulties if you do not have readily available cash in hand.

It is, thus, more beneficial to avail a health insurance plan that does not impose such cost-sharing terms. With the plethora of health insurance policies provided by insurance companies in India, you can easily find a policy that can suit your requirements effectively.

Make sure to check all the terms and conditions put forth under each policy to avail the one best-suited to your requirements!

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees