When You Want To Boost Your Employee Wellness And Productivity

Healthy and comfortable employees are more productive than those with wellness-issues. Therefore, its essential to keep your employees as happy and healthy as possible by providing coverage so that they can get care whenever its necessary. So, if your employees are not performing well on the job because of healthcare-related issues, its time you consider giving them health insurance coverage.

Boost Employee Job Satisfaction

Another great reason to offer small business health insurance is that it may play a significant role in helping maintain or increase employee job satisfaction.

According to a Glassdoor Economic Research survey, out of a list of 54 employee benefits, the following three basic employee benefits displayed the highest correlation with employee satisfaction:

Source: Glassdoor

Health insurance coverage came out as the number one benefit related to keeping employees satisfied, and its not surprising given its popularity as an employment perk.

The importance of satisfied employees cannot be overstated: when your staff is content with their job, they will probably be happier with their employment and more likely to remain at your company.

How job satisfaction may benefit business owners

Happy employees can also mean happy employers. Workers who are generally satisfied with their jobs might express this in all sorts of relevant ways, including:

- More helpful, enthusiastic, and improved interactions with customers and clients.

- Greater likelihood of effective teamwork within a positive workplace environment.

- Inspiring employees to improve their skill set through further training and education.

In essence, better attitude from employees may result in better results for your bottom line.

And again, as a small business youre probably looking to be as efficient and productive as possible. If you have satisfied employees, youll probably find that theyre more productive.

Who Is Helped By The New Qsehra Reimbursement Rules

For employees who work for small businesses that dont offer health insurance, the availability of premium subsidies in the exchanges depends on income, along with family size and the cost of coverage in the applicants area. In general, subsidies are available in most cases if the applicants household income doesnt exceed 400% of the poverty level.

If youre currently receiving a premium subsidy in the exchange and your employer begins reimbursing premiums under a QSEHRA, the exchange subsidy would be reduced by the amount of the employer reimbursement.

But if youre not eligible for a premium subsidy in the exchange , a QSEHRA could directly benefit you if your employer decides to take advantage of that option.

This article outlines various situations in which a QSEHRA benefit can be helpful, harmful, or neutral to an employees financial situation.

Don’t Miss: Can You Put A Boyfriend On Your Health Insurance

Do I Have To Offer Health Insurance To All Employees

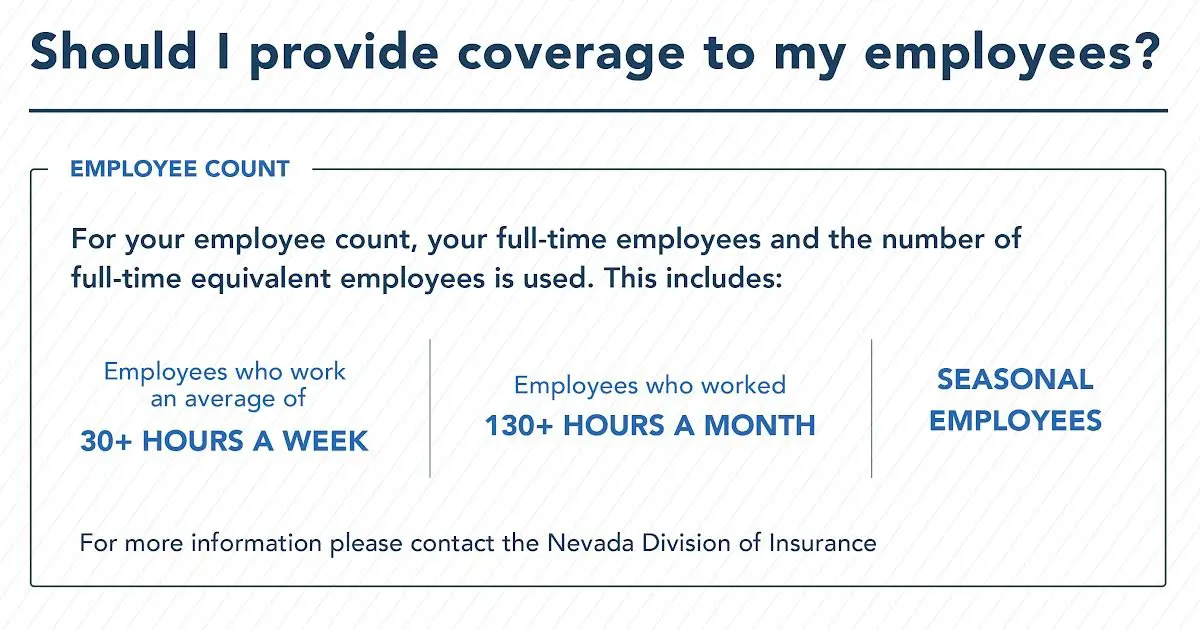

If you offer an employer-sponsored group health plan, generally, all of your full-time employees must be given the opportunity to enroll. Thats because, under the ACA, if you offer health insurance to full-time employees, you must offer it to all similarly situated full-time workers.

However, you can exclude part-time those who work on average less than 30 hours a week and seasonal employees from participation. You can still offer health insurance to part-time and seasonal workers if you want to and, if you do, you can create your own requirements for participation. For example, you may decide that employees only qualify for coverage if they work at least 10 hours a week. At Starbucks, hourly employees are eligible for benefits, including health insurance, once they work 240 hours during a consecutive 3-month period.

Is There A Waiting Period For Coverage

Waiting periods for coverage today typically range from zero to 90 days, says Eric Gulko, president of Innovo Benefits Group, a benefits-management firm. If there is a waiting period before your new coverage kicks in, youll want to make sure you have coverage in place until the period is upeither by extending coverage from your prior employer through COBRA, coverage under your parents plan , or through an individual plan, says Buckey. As part of your offer negotiation, you can ask if the company would be willing to partially fund your COBRA benefits for that period of time.

Read Also: How Much Is Health Insurance In Arizona

Employers Required To Offer Health Insurance

Beginning Jan. 1, 2014, employers with 50 employees or more will be required to provide health insurance coverage to full-time employees or face paying a penalty. The requirement does not apply to employers with fewer than 50 employees. The annual penalty for not offering coverage is $2,000 for every full-time employee beyond the first 30.

Employers that offer coverage to employees may also be subject to penalties if any of their employees choose to buy coverage through the local health insurance exchange instead of participating in the employerâs plan. These employers will be required to pay a $3,000 penalty annually for each of their employees who opt for coverage through the health insurance exchange and receive a premium tax credit for doing so. However, employers will not be subject to penalties if the coverage they offer pays for at least 60% of covered health care expenses for a typical population and employees do not have to pay more than 9.5% of their household income for the coverage. For more information about who can purchase insurance through an exchange and who qualifies for a premium credit, click here. Employers will not be penalized for any employee insured through a spouses employer, Medicaid, or Medicare.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Guide To Providing Health Care Benefits To Employees

Find Cheap Health Insurance Quotes in Your Area

If your business has over 50 employees, you are legally required to provide health insurance to employees due to the Affordable Care Act . If you have fewer than 50 employees, you’ll need to make the decision whether to offer your employees health care benefits. We examined every major decision point to help you make the right decision for your business.

You May Like: Who Pays First Auto Insurance Or Health Insurance

Tip #: Analyze The Risks And Costs Of Offering Health Benefits

Now that you know why offering health benefits is so important, your next step is to consider the risks and costs of the plans available.

Like any new expense youd take on for your organization, investing time to research your available options is essential in finding a plan that meets your organizations needs.

Consider these two areas in particular when researching your options:

How To Claim Health Insurance From Your Employer

2 min read.Navneet Dubey

- Always read the policy document thoroughly when purchasing any policy, not just medical insurance. Corporate health insurance policies frequently include restrictions, such as co-pay clauses and room-rent limitations

NEW DELHI: Amid the pandemic, many companies have rolled out suitable group health insurance policies for their employees. While most employers cover employees under group health insurance, there are a few formalities and profiles to be completed before the insurance kicks in. If not filled in time or correctly, the employer may not pay the claim in time of need. Hence, to make things easier, you must follow these four steps before filing for a group health insurance claim.

1. Update your family’s profile: The first thing you should do after receiving your employee ID is to update your family’s information on the company’s portal. Raghuveer Malik, head- corporate business, Policybazaar.com, said, “You will not make claims if you have not entered the necessary information into the insurance portal. Prioritise this step.”

Liz Truss set to be next UK PM, but why is Rishi Sunak …

4. List of network hospitals: Generally, insurance companies have an agreement with a select group of hospitals to provide cashless services to their customers. These hospitals are referred to as empanelled network hospitals. While reading the policy document, make a list of these hospitals.

How to file a claim

You May Like: How To Go About Getting Health Insurance

Look Into Medicaid And Chip

Medicaid and the Childrens Health Insurance Program programs offer free or low-cost health coverage to qualified low-income individuals and families. If you apply for health insurance through HealthCare.gov or your state marketplace, youll automatically be told if you qualify for one of these programs.

Unlike other health insurance plans and programs, theres no special or open enrollment periods for Medicaid and Chipyou can apply at any time. However, 13 states havent expanded Medicaid coverage, meaning you cant qualify based on having a low-income alone. You may only be able to qualify if you meet the states income and additional requirements, such as being a parent, caregiver, pregnant women, elderly, or disabled.

How To Reimburse Employees For Health Insurance

Keely S.

To avoid the hassle of traditional group insurance plans, you may be wondering how to reimburse your employees for health insurance. Its possible through health reimbursement arrangements, or HRAs. Employers of all sizes now have more flexibility when it comes to reimbursing employees for health insurance, tax-free. This is a huge win for business owners who are looking for a more affordable, efficient way to offer small business health insurance to their teams without having to hassle with a pricey, one-size-fits-all group plan. Lets discuss your options!

Also Check: How Much Does Health And Dental Insurance Cost Per Month

What Is Business Health Insurance

Business health insurance is much like an individual health insurance policy. It pays for a large portion of the cost of various private medical treatments and care, but its taken out by employers to cover employees. When an employee is diagnosed with an illness, they can pay a small excess while the insurer pays for the cost of treatment.

Your business will have one policy to cover everyone and you can choose who you offer it to, as long as this decision isnt made on discriminatory grounds. By spreading the risk across a group, the cost of premiums is generally lower than that of individual polices.

Recommended Reading: Health Insurance Starbucks

Can You Offer Health Insurance To Certain Employees Only

Written by: Josh MinerSeptember 23, 2020 at 8:05 AM

One way small employers rein in health insurance costs is to only offer the benefit to full-time employees. Many employers have asked us whether they can take this approach a step further, and offer different levels of benefits to different employees.

The short answer is yes, as long as the employer does not make these decisions on a discriminatory basis.

In this post, well explore what the law requires, how employers can legally restrict eligibility or offer different benefits to different employees, and some suggested options.

Don’t Miss: How To Get Health Insurance For My Family

How Much Does Private Health Insurance Cost

While many people are scared by the prospect of purchasing their own insurance versus enrolling in an employer-sponsored plan, some studies have shown that it can end up being more affordable than employer-sponsored plans.

A study from the Kaiser Family Foundation found that the average monthly premium for an employer-sponsored insurance plan for individual coverage in 2021 was around $645 and $1,850 for family coverage. If you were to purchase your own insurance outside of an employer-sponsored plan, the average cost of individual health insurance was $438. For families, the average monthly premium was $1,168.

In addition, if you end up purchasing coverage through the Health Insurance Marketplace, you may qualify for a Cost-Sharing Reduction subsidy and Advanced Premium Tax Credits. These can lower your premium payment amounts, your deductible, and any co-payments and co-insurance for which you are responsible.

Protects Your Workers Future

Think about this: lets say one of your best workers ends up getting injured due to the negligence of a coworker. Now, he/she is left with expensive medical bills and has to sit out of work for weeks to recover, losing out on their expected income.

Without you providing workers comp insurance, that workers financial future hangs in the balance. Theyll have to cover the costs themselves in the short-term, digging into their own pockets.

With workers comp coverage, your workers finances are secured. Your workers comp provider will cover all of the lost wages, medical bills, and so forth.

You May Like: Is There A Penalty For Not Having Health Insurance

Tax Credits For Smbs Through Shop

SMBs that provide coverage to their workers under a SHOP plan may be eligible for tax credits, up to half of employer-paid premium costs, if they purchase through these exchanges. To qualify, the business must have less than 25 full-time equivalent employees, whose average salary is no more than $50,000 per year. Employers will need to pay half the employees premium cost to receive a 50% credit against your tax burden. Considering the 25% remaining payments are also a tax deductible business expense, there ultimately could be little cost to the employer to provide coverage.

Know Your Hra Options

QSEHRA: a Qualified Small Employer HRA allows small employers to set aside a fixed amount of money each month that employees can use to purchase individual health insurance or use on medical expenses, tax-free. This means employers get to offer benefits in a tax-efficient manner without the hassle or headache of administering a traditional group plan and employees can choose the plan they want. The key thing to remember here is that all employees must be reimbursed at the same level. The QSEHRA is designed for employers with less than 50 employees to reimburse for premiums and medical expenses if the plan allows.

ICHRA: an Individual Coverage HRA allows employers of any size to reimburse any amount per month for healthcare expenses incurred by employees on a tax-free basis, starting at any time of the year. The distinguishing element of this HRA is that employees can be divided into an unlimited number of classes, like hourly vs. salary or even based on location, and be reimbursed at different levels. The ICHRA is for companies of any size. There are no limits to how much an employer can offer for reimbursement.

Read Also: Can You Drop Your Health Insurance At Any Time

Speak With One Of Our California Small Business Health Insurance Brokers Today

Helping California small business owners navigate the complicated landscape of health insurance coverage is just one way that Preferred Insurance helps them ensure that their workers stay healthy and covered. As an experienced California small business and individual health insurance broker, we can answer your questions and provide practical, affordable coverage options for businesses of all kinds.

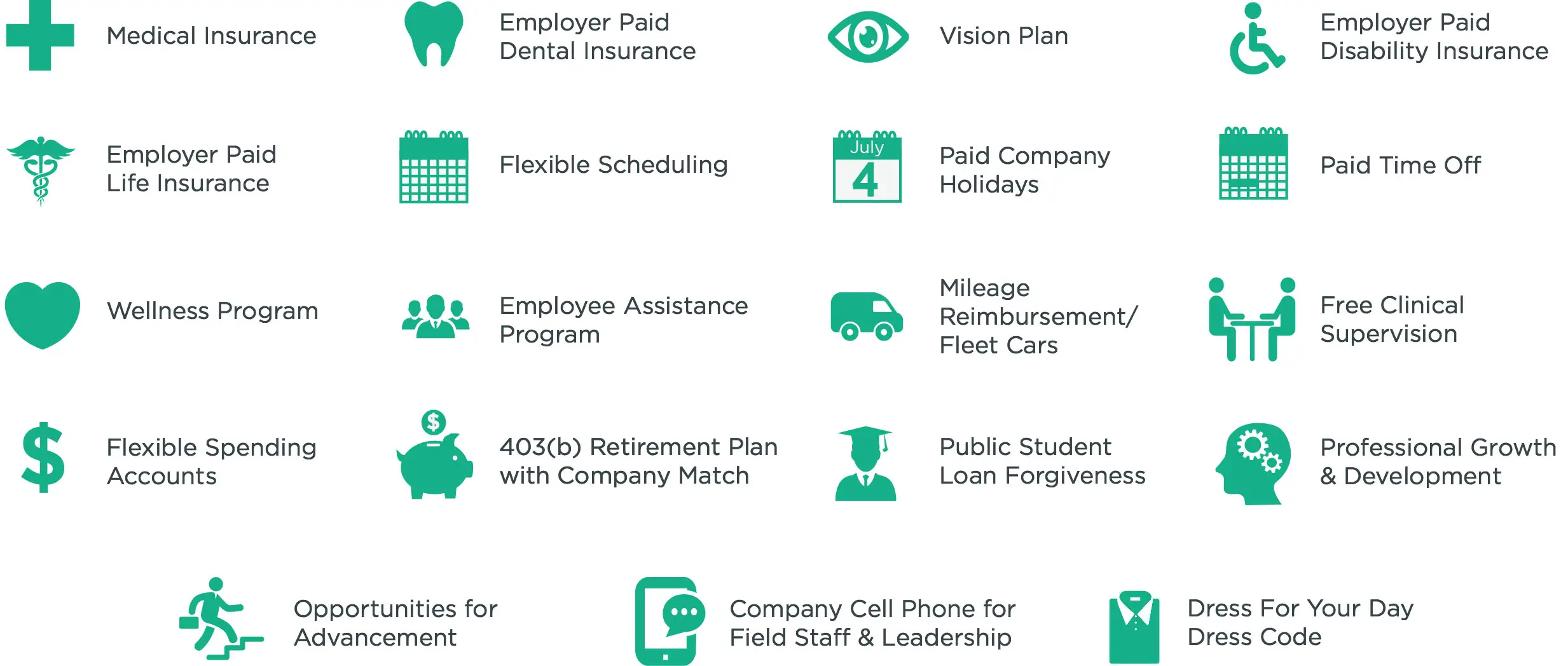

Reasons To Offer Small Business Health Insurance

Keep reading to learn 9 great reasons to offer small business health insurance.

Don’t Miss: How To Have Health Insurance

How Is A Group Health Insurance Premium Calculated

A group health insurance premium is calculated on the basis of the number of employees, their ages, location and number of their dependents you would want to cover within the respective group health insurance plan.& nbsp

A group health insurance premium is calculated on the basis of the number of employees, their ages, location and number of their dependents you would want to cover within the respective group health insurance plan.

What Is Workers Comp Insurance

Perhaps youre constantly worried that one of your staff members will slip and fall, causing a serious injury that will put them out of work for a long period of time.

Maybe you would consider your line of work to be extra risky for injury, and want to make sure that your entire staff has the support they need during an emergency.

Whatever the case might be, workers comp insurance can help you out. By providing workers comp for your staff, youll be giving them the benefits they need.

Its a type of business insurance thats solely dedicated to offering benefits to those workers who have suffered a work-related injury or illness.

It can help protect them and their family from a financial setback by providing coverage for their expensive medical bills, lost wages while they stay home to recover, or the cost of the rehabilitation therapy theyve been assigned.

Workers comp insurance can also provide financial coverage if a work-related injury were to lead to death. That way, their funeral services, and all other expenses are covered.

We offer workers compensation insurance for all employers, regardless of the industry youre in. That way, youll have the peace of mind you seek.

You May Like: How Much Does Health Insurance Cost An Employer