How Does Health Insurance Work In The Netherlands

Firstly, lets start with the basics. The Dutch health insurance is a two-level system:

- Zvw: The Zvw system requires all residents in the Netherlands to take out a basic Dutch public health insurance package known as basisverzekering or basispakket. For a monthly fee, this package will cover most healthcare services, including doctors appointments and hospital trips. All insurance providers must offer the same basic package to everyone and must accept all applicants regardless of medical history.

- Wlz: The Wlz system covers long-term nursing and care treatment, such as dementia and other mental and physical impairments. In this system, the government assesses your situation to determine the necessary care. Residents aged 18 years and older must provide a monetary contribution from their salary. This is calculated depending on income, financial capital, and living situation.

Ppo Or Preferred Provider Organization Plans

With a PPO, you pay lower fees to see certain in-network or preferred providers.

Pros: The insurance network pays more than they might with an indemnity plan or HMO plan. You arent required to see in-network providers, but you save money when you do.

Cons: Youll pay more if you see a provider out of the network. PPO plans often come with a maximum amount theyll reimburse in a calendar year. Some procedures may not be covered or have a waiting period before coverage starts.

This plan is best if: You dont need major dental work right away, but want to be prepared in case you need it in the future. Youd like some flexibility in your choice of dental providers but dont want to pay high premiums.

What To Keep In Mind While Shopping For Family Health Insurance

Family health insurance costs can vary significantly, depending on your circumstances and preferences. While there is no tax penalty for not having health insurance in 2020, it is still important to get your family covered to protect yourself from unexpected healthcare costs that can be substantial in some situations.

To find family coverage thats right for your family and your budget, take a look at eHealths family health insurance options by state. eHealth can help you navigate all of these cost variables and find an affordable plan for you and your family.

Read Also: Do I Have To Have Health Insurance In Florida

Introduction To Health Insurance In The Netherlands

Some quick, important facts about health insurance in the Netherlands:

- The Dutch healthcare system is ranked the second-best in Europe according to the Euro Health Consumer Index.

- Health insurance is mandatory if youre living or working in the Netherlands.

- Costs for a basic package are the same whether youre young or old, in perfect health or with pre-existing conditions.

- Children are covered free of charge under their parents plan until they turn 18.

- If you earn less than 29,500, you may be eligible to receive financial health benefits from the government to help pay for your health insurance premiums.

Health insurance in the Netherlands is a complex but well-built universal system: it is regimented by public policy, but implemented via private companies . Many expats will find that the mandatory basic package provided by Dutch health insurance companies will be sufficient to cover their needs. However, depending on your personal circumstances and eligibility, you may prefer to get additional coverage , or go the route of an international health insurance policy.

How Much Does An Emergency Visit Cost With Health Insurance

The average ER visit cost $1,016 in 2017, according to the Medical Expenditure Panel Survey. With health insurance, a trip to the ER will cost $50 to $150, depending on the copay. If you need tests, youll pay additional fees. These may be a copay or a percentage of the price of the service. X-rays have been found to average $140 at hospitals and CT scans ranged from $442 to $1,146.

You May Like: Uber Driver Health Insurance

Individual Health Insurance Premiums On The Exchanges

The federal insurance plan marketplace at HealthCare.gov, aka Obamacare, is alive and well in 2021, despite years of its political foes’ efforts to kill it. It offers plans from about 175 companies. Some 12 states and the District of Columbia operate their own health exchanges, which basically mirror the federal site but focus on plans available to their residents. People in these areas sign up through their state, rather than the federal exchange.

Each available plan offers four levels of coverage, each with its own price. In order of price from highest to lowest, they are labeled platinum, gold, silver, and bronze. The benchmark plan is the second-lowest-cost silver plan available through the health insurance exchange in a given area, and it can vary even within the state where you live. It’s called the benchmark plan because it’s the plan the government usesalong with your incometo determine your premium subsidy, if any.

The good news is prices are going down a bit. According to the Centers for Medicare & Medicaid Services , the average premium for the second-lowest-cost silver plan decreased by 4% on HealthCare.gov from 2019 to 2020 for a 27-year-old. Six states experienced double-digit percentage declines in average second-lowest-cost silver plan premiums for 27-year-olds, including Delaware , Nebraska , North Dakota , Montana , Oklahoma , and Utah .

Health Insurance For Unemployed And Low Earners

Low-income earners may be eligible to apply for healthcare benefits for support with the payments.

The allowance is offered on a sliding scale to people who earn less than 29,500. The benefit reaches a maximum of 99 a month for people who earn less than 20,500 and falls to just 2 a month for workers earning 29,500.

Allowances are calculated on your individual income or collective income with a partner, and you can find the current rates for 2019 on the tax authority website.

You can apply for the allowance using the My Benefits website.

Read Also: What Benefits Does Starbucks Offer

How Much Do Dental Implants Cost

One of the strongest devices available to replace missing teeth, dental implants are artificial tooth roots that support crowns, bridges, or dentures. You can typically get a single implant to replace a missing tooth, or you can have implants put in that will hold a bridge steady if you have several missing teeth that need replacing. Implants can be expensive, but dentists recommend them because they are considered a reliable and long-lasting replacement for natural teeth.

A single implant can typically cost between $3,000 to $4,500 without insurance. But you may find that implants cost less where you live based on the going rate of dental work and the agreement that your dental insurance company has with the dentist.

Other factors that typically affect the cost of dental implants are things like the metal used for the implant. For decades titanium has been the preferred metal to be used to create an implant. Titanium is easily tolerated by most people and it is biocompatible, meaning it can fuse with your jawbone without your body rejecting it. Its also a relatively low-cost metal. But titanium can also cause an infection at the implant site and provide a pocket where bacteria can because titanium requires a dual post insertion to hold the crown.

Can I Change My Dutch Health Insurance Provider

Yes, but residents of the Netherlands may only change health insurance providers once per year. To do so, you need to declare your intentions to cancel your policy prior to 1 January.

Providers also offer a cooling-off period, allowing you to cancel your premium within a set amount of time after initially signing up. Typically this period is set at 14 days.

Don’t Miss: Does Starbucks Offer Health Insurance To Part Time Employees

How To Choose A Health Insurance Provider

When comparing providers, ask the following questions:

- how much is the premium?

- how does the policy work? There are three types: a policy in kind, where the health insurer has contracts with specific providers and pays the bills directly to them a restitution policy, where you choose your health provider, pay for treatment upfront and get a refund from the insurance afterwards and a combination policy, where the insurer partially covers the bill.

- what is the excess? Increasing your excess payment can be a way to lower your monthly payments.

- can you take out supplementary insurance for any care or treatment thats not included in the standard package?

- some health insurance providers offer additional benefits free of charge, such as dental accident insurance. It is in these extras that insurers compete with their basic Dutch insurance package.

Look carefully at individual packages to find the one that provides the best cover for your circumstances. Consider the following:

- do you have any pre-existing conditions?

- what are the premiums and excess?

- do you have children?

- do you plan to travel abroad regularly and need coverage for any medical emergencies?

How Much Is Aetna Health Insurance

Among eHealth shoppers, the average premium for an ACA-compliant health insurance in 2018 was $465.86 for an individual plan, although insurance costs can vary significantly depending on the kind of plan you choose, the benefits included and your location.In 2017, the last year Aetna sold ACA-compliant individual health insurance plans, premiums for plans not eligible for a subsidy averaged $525.07. Premiums plans that were eligible for a subsidy averaged $374.55, and the average cost of a dental insurance policy from Aetna averaged $64.40

| Year | |

| Obamacare/ACA Coverage without a subsidy | $525.07 |

| Obamacare/ACA Coverage with a subsidy | $374.55 |

Don’t Miss: Starbucks Insurance Plan

How Much Does Health Insurance Cost Per Month In Each State

The national average health insurance premium for a benchmark plan in 2021 is $452, according to the Kaiser Family Foundation. A benchmark plan is the average premium for each states second lowest cost silver plan.

The following data reflects the national average, and each states average, but does not include any reduction in cost from subsidies. Rates will vary by area.

How Much Does Health Insurance Cost In Canada

One of Canadas defining traits is our free healthcare system. No matter what part of Canada you live in, if youre a permanent resident, you have access to free healthcare services. Those services can include anything from physician fees to hospital services and MRIs, but the eligible services vary from province to province.

Comparatively speaking, we have it much better than our friends in the U.S., who dont have universal health insurance. But while we do have coverage for some of the most expensive services, there are other things that arent covered by the provincial plans. Services like massage therapy, and items like glasses, for example, are often excluded from these plans.

There are many Canadians who have a private health insurance plan through their employer, or which they purchased themselves. The beauty of this is that there are mechanisms in place to help people offset the costs for health services or items. Without health insurance, you could potentially face financial hardship if you ever need treatment that isnt covered.

You are likely wondering what kinds of plans are available, and how much do they cost? Health insurance is a very competitive field, so its no surprise that there are many plans to choose from. When choosing a policy, you have to think about what items or services you would like to have covered, and then you start thinking about monthly payments.

Recommended Reading: Starbucks Insurance Part Time

Shopping For Dental Insurance

There are many companies offering dental insurance plans. Top Ten Reviews offers the latest review of the top ten dental insurance providers in the market today. Delta Dental tops the list, followed by Guardian, Humana, Aetna, and Cigna. Completing the top ten are United Healthcare, Physicians Mutual, AARP, Ameritas, and Spirit Dental and Vision. The site will give you an idea about the average monthly premium rates, estimated annual savings, and sample terms and conditions offered by these companies.

It is also better to ask your relatives and friends for their recommended dental insurance providers. You can listen to their actual experiences on availing their plans and services.

Costs Of The Basic Health Insurance Package

Generally speaking, the basic package costs just over 100 per month. However, what you pay exactly will depend on the insurance company you pick, but what is good to know is that the system works on a fair basis of solidarity so your age, gender, pre-existing medical conditions or any other factor will not change that price.

Read Also: Can You Add A Boyfriend To Your Health Insurance

Who Is Blue Cross

Medavie Blue Cross was founded in 1943 and is a carrier that provides health, dental, travel, life and disability benefits to individuals and organizations nationwide. They administer various government-sponsored health programs on behalf of provincial and federal governments, including Veterans Affairs Canada and Immigration, Refugees and Citizenship Canada. They also provide private health insurance.

How Much Does Dental Insurance Cost

In the vast majority of cases, dental insurance costs somewhere between $100 and $600 a year for one person. However, on average, it costs around $350 per person per year.

Generally, you can expect your monthly premiums to be between $10 and $50. Of course, this is dependent largely upon what type of dental plan you choose.

Almost all dental insurance plans come with annual maximums. These maximums specify how much money your insurance will pay for your procedures on a yearly basis. In most cases, dental insurance plans have maximums of between $1,000 and $2,500.

Recommended Reading: How To Enroll In Starbucks Health Insurance

Canadian Costs Versus The World

So where does this leave our average family of four? In their 2015 report, the Canadian Institute of Health Information noted that Canadians were among the highest health care spenders in the world. They estimated the average spend at $5,782 per person.

That put the personal spending above the average but nowhere near the biggest spenders. As it has for years, the average American spent twice as much as $11,916. An average family in Sweden spent slightly more at $6,601 and the same family in the UK spent $5,170.

How Does Health Insurance Work In Ontario

In Ontario, healthcare costs are covered by a mixture of universal public insurance known as OHIP and by private insurance from providers like Manulife, Sun Life, Canada Life or Blue Cross.

Individual health insurance helps pay medical expenses incurred from illness or injury. It can also cover some everyday medical costs like dental, vision and prescriptions. On top of access to universal public health insurance through Ontarios OHIP, one may obtain additional health insurance through ones employer or buy it independently.

Concerning health care for Indigenous peoples, including First Nations, Inuit and Métis, the federal, provincial and territorial levels of government share jurisdiction. The Canadian health system allows Indigenous peoples to access health services. Indigenous Services Canada directly provides services for First Nations and Inuit that supplement the health coverage provided by the government, including coverage such as primary health care.

About the Ontario Health Insurance Plan

OHIP, or the Ontario Health Insurance Plan, is Ontarios public health insurance. It covers many emergency and preventative medical care costs. It is funded through payroll deduction taxes and transfer payments from the federal government.

Many people are aware of the basics covered by OHIP, such as doctor visits and emergency health care. However, costs that are not covered can sometimes cause confusion, frustration and surprise expenses.

Don’t Miss: Evolve Medical Insurance

Dutch Health Insurance Through Employment

Some employers also offer corporate health insurance schemes for employees. This may be cheaper than taking out a policy individually, so be sure to ask your employer if they offer a corporate scheme. Should you need to, you are able to purchase additional coverage from a different insurer. You can use this to top up your health cover.

Choose A Medical Cover Abroad

The Dutch basic health insurance covers emergency medical care abroad up to the Dutch tariffs. Treatments in other countries may be more expensive, meaning you need to pay a percentage of the bill yourself.

To extend your cover, you may choose either Europe or Global cover to get a higher reimbursement for treatments abroad .

Note: every time you select a filter, the comparison program will find the cheapest health providers in your situation, and sort them by monthly premium.

Don’t Miss: Starbucks Health Care Benefits

What Is Individual Health Insurance

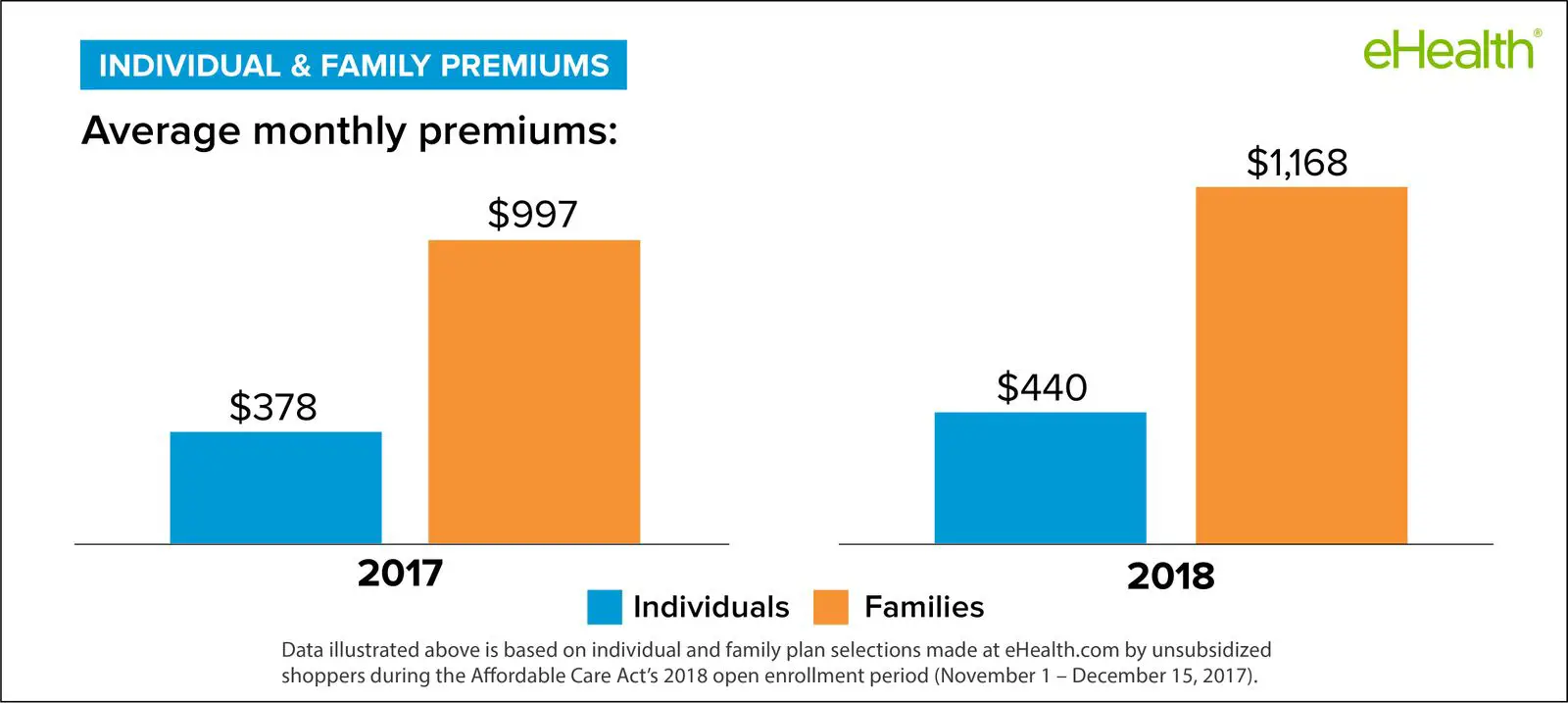

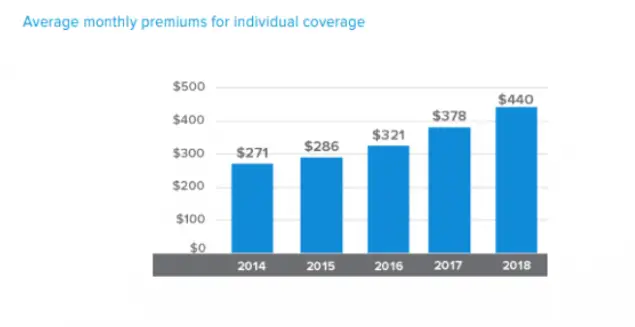

While many people get their health insurance through a group plan sponsored by their employer or union, others buy it themselves. If you are buying your own health insurance, you are purchasing an individual plan, even if you include family members on the plan. If this sounds like what you need, let eHealth show you all of your individual and family health insurance options, and use our free quote comparison tool to find an affordable plan that meets your needs.

Asa result of the Affordable Care Act , people can purchase individualhealth insurance through a government exchange or marketplace , or they can buy health insurance from privateinsurers. You may be restricted to purchasing health insurance through agovernment exchange to certain times of the year. Usually you can purchasehealth coverage from a private insurance company anytime.

ACAplans are a good starting place to understanding individual health insuranceoptions. ACA health plans are categorized by metals. You can learn more aboutthe metallic plans: Bronze, Silver, Gold, and Platinum.

The Different Types Of Dental Insurance Plans And How They Work

With dental health so closely related to your general health, dental insurance is unsurprisingly a lot like health insurance: The insurance company charges a monthly premium, and in return, they help you pay for needed care. Other similarities include:

- Most dental plans have a network of providers

- Theres a deductible you pay before the plan pays for treatment

- You pay for a portion of many procedures via copays or coinsurance

Dental insurance differs from health insurance in the following ways:

- Common preventive treatments checkups, cleanings, and x-rays are usually covered at 100% without out-of-pocket charges.

- The deductible is much lower than a medical plan around $50 for an individual and $150 for a family.

- Most dental plans cap the maximum amount they will pay for care at $1,000-$2,000 per member per year.

- There may be waiting periods applied before plans will cover non-preventive procedures.

You May Like: Starbucks Dental Insurance