Employer Mandate Coverage Requirements Since 2016

Employers with 50 or more full-time and/or FTE employees must offer affordable/minimum value medical coverage to their full-time employees and their dependents up to the end of the month in which they turn age 26, or they may be subject to penalties. The amount of the penalty depends on whether or not the employer offers coverage to at least 95% of its full-time employees and their dependents.

Employers must treat all employees who average 30 hours a week as full-time employees.

Dependents include children up to age 26, excluding stepchildren and foster children. At least one medical plan option must offer coverage for children through the end of the month in which they reach age 26. Spouses are not considered dependents in the legislation, so employers are not required to offer coverage to spouses.

Is There A Penalty For Being Uninsured

No, there is no longer a federal mandate but some states and jurisdictions have enacted their health insurance mandates.

However too often than not, people learn that the personal penalty for not having health insurance is the exorbitant healthcare bills.

For instance, if you get a broken leg from a trip and fall, hospital and doctor bills can quickly reach $7,500 and for more complicated breaks that require surgery, you could owe tens of thousands of dollars.

A three-day stay in the hospital might cost you about $30,000.

If you take a look at more critical illnesses including cancers and strokes, your bill might be running into the hundreds of thousands of dollars. So without a health insurance, you are financially responsible for these bills. Two-thirds of people who file for bankruptcy indicate that medical bills contributed to their financial situation, according to a 2019 study.

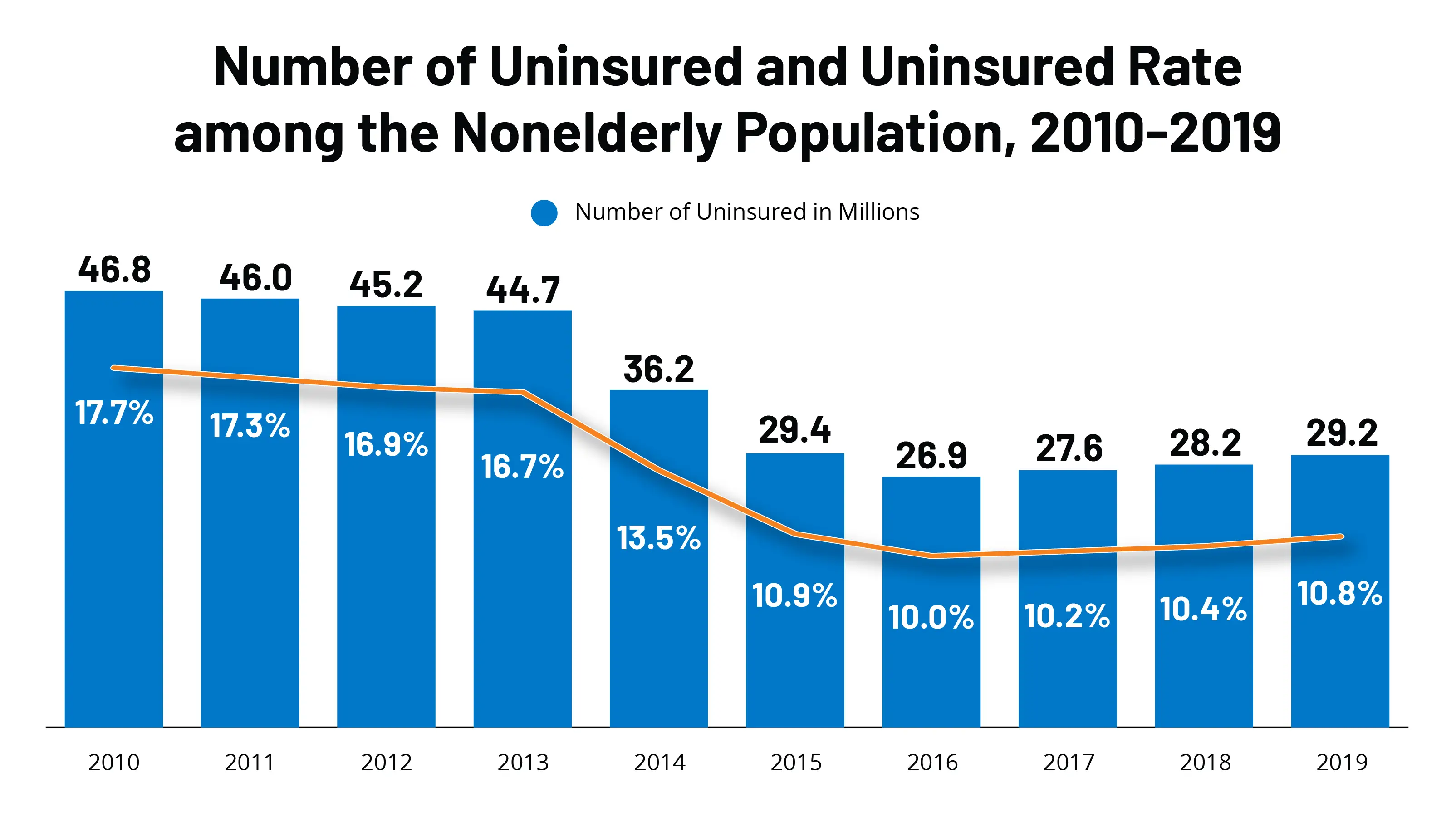

So essentially, the Affordable Care Act increased the number of people with insurance and lowered those who couldnt afford to pay their health bills.

Below are the states that have mandates and penalties in effect for persons without a health insurance cover

- California

Is Health Insurance Compulsory In Ny 2020

The Affordable Care Act and the State of New York require private health plans to provide comprehensive coverage to individuals. The ACA also makes financial assistance available to eligible residents who purchase coverage through NY State of Health.

Is there a penalty for not having health insurance 2019?

In 2017 and 2018, the penalty increases to the greater of $695 per adult and $347.50 per child, plus COLA , or 2.5% of your household taxable income less the federal income tax filing threshold. In 2019, there will be no more sanctions.

You May Like: How Does Employer Health Insurance Work

Improve Affordability And Access To Care For People With Private Coverage

Policymakers should permanently extend the Rescue Plans increases in premium tax credits for ACA marketplace coverage, which are set to expire after 2022. Making these enhancements permanent would make health coverage more affordable for millions while building on the recent historic enrollment levels in the marketplaces. On the other hand, failing to extend these enhancements could lead to steep increases in out-of-pocket premiums for millions of marketplace enrollees and runs the risk of squandering recent advances in coverage.

In addition, policymakers should enact other policies that build on the Rescue Plans improvements in affordability. First, policymakers should fix the family glitch by determining the affordability of employer-based coverage using the family premium rather than the premium for employee-only coverage. This would allow an employees family members to receive a premium tax credit when family coverage is unaffordable, even if the employees self-only premium is affordable.

Why Are Californians Required By Law To Have Health Insurance

What you need to know about the individual mandate â and how it impacts you and your family.

Having health insurance isnât just a good idea â if you live in California, itâs the law. In fact, 2020 marked the first year that Californians are required by state law to have health insurance. This law is referred to as the individual mandate because it means that all individuals in California are mandated to be covered by health insurance. Hereâs what you need to know to understand the individual mandate and how this law can benefit you.

Understanding Health Care Reform

The Patient Protection and Affordable Care Act passed in 2010 with the mission of making quality health care more accessible and affordable nationwide. There were two key points of this act. First, people could no longer be denied or charged more for health insurance due to preexisting conditions. Second, a federal individual mandate was established, which meant that having health insurance that meets specific conditions was a requirement under law. These two aspects worked hand in hand. By making sure everyone paid into the system â young and old, healthy and ill â the sickest members could receive care without premium costs going haywire for everyone. Since the individual mandate went into effect, those who chose to go uninsured faced a financial penalty at tax time.

The Individual Mandate Comes to California

More Financial Help for Californians

What Does This All Mean for Me?

Also Check: Are Parents Required To Provide Health Insurance Until Age 26

Deductions And Reimbursements Under The Act

For the most part, provincial and territorial health care insurance plans meet the requirements of the Canada Health Act. However, some issues and concerns remain. The most prominent of these relate to accessibility issues, and specifically patient charges for medically necessary health services at private clinics. There are also concerns under the portability criterion.

Newfoundland and Labrador

On the basis of its health ministry’s report to Health Canada, a deduction in the amount of $4,521 was taken from the March 2021 Canada Health Transfer payments to Newfoundland and Labrador in respect of user charges for insured health services provided by an enrolled physician at a private ophthalmological clinic in fiscal year 20182019. The province worked collaboratively with Health Canada to implement a mutually agreed-upon Reimbursement Action Plan . Newfoundland and Labrador successfully addressed and eliminated the underlying circumstances that led to these patient charges and has received full reimbursements of its March 2019, 2020, and 2021 deductions. A copy of Newfoundland and Labrador’s RAP as well the January 2022 status update on its implementation are presented in Annex E of this report.

New Brunswick

Ontario

British Columbia

Rhode Island Individual Mandate

- Effective date: January 1, 2020

- Requires individuals and their dependents have ACA-compliant health insurance

- Imposes a penalty on residents who go without health insurance but can afford it

- Provides state subsidies to help lower income residents afford health insurance

The penalty for failure to have ACA-compliant health insurance is the same as it would have been under the federal individual mandate. It will cost a family $695 for each uninsured adult and $347.50 for each uninsured child or 2.5% of the household income, whichever amount is greater. Penalties also increase annually with inflation. However, the maximum a household can be penalized cant be greater than the total annual premium for an average bronze plan in Rhode Island.

Rhode Island allows for exemptions in certain situations. And, as of December 31, 2020, Rhode Island expanded its eligibility criteria to include a COVID hardship exemption. This new exemption recognized the impact that the pandemic may have had on residents ability to afford and get health insurance. If you live in Rhode Island, you may be eligible to file a hardship exemption if, as a result of the COVID pandemic:

- You lost minimum essential coverage in 2020, or

- You experienced a hardship that made you unable to get minimum essential coverage in 2020.

Don’t Miss: Does Health Insurance Cover Vision

Dispute Avoidance And Resolution Process

In an April 2002 letter to her provincial and territorial counterparts, former federal Minister of Health A. Anne McLellan outlined a Canada Health Act Dispute Avoidance and Resolution process, which was agreed to by provinces and territories, except Quebec. The process meets federal, provincial and territorial interests of avoiding disputes related to the interpretation of the criteria of the Act and, when this is not possible, resolving disputes in a fair, transparent and timely manner.

The process includes the dispute avoidance activities of government-to-government information exchange discussions and clarification of issues as they arise active participation of governments in ad hoc federal, provincial and territorial committees on Act-related issues and Canada Health Act advance assessments of proposed provincial and territorial policies, regulations and legislation, upon request.

Where dispute avoidance activities prove unsuccessful, dispute resolution activities may be initiated, beginning with government-to-government fact-finding and negotiations. If these are unsuccessful, either Minister of Health involved may refer the issues to a third-party panel to undertake fact-finding and provide advice and recommendations.

The federal Minister of Health has the final authority to interpret and enforce the Canada Health Act. In deciding whether to invoke the non-compliance provisions of the Act, the Minister will take the panel’s report into consideration.

The Canada Health Act Division

The Canada Health Act Division of Health Canada is responsible for supporting the Minister in the administration of the Canada Health Act. Members of the Division fulfill the following ongoing functions:

Health Canada continues to work with provinces and territories on the integration of virtual care services into their publicly funded health care system, which was accelerated in response to COVID-19 measures that reduced access to in-person care. As provinces and territories add virtual care services to their publicly funded health care insurance plans, Health Canada will work along side them to ensure the requirements of the Canada Health Act are met.

Canada Health Act Compliance

The Canada Health Act Division monitors the operations of provincial and territorial health care insurance plans in order to provide advice to the Minister on possible non-compliance with the Canada Health Act. Sources for this information include: provincial and territorial government officials and publications nongovernmental organizations media reports and correspondence received from the public.

Don’t Miss: How To Transfer Health Insurance From One State To Another

Canada Health Act Compliance From 19841987

During the period 1984 to 1987, subsection 20 of the Act provided for deductions in respect of these charges to be refunded to the province if the charges were eliminated before April 1, 1987.

Deductions and Subsequent Refunds for Extra-Billing and User Charges from 1984-1987| 52,406,000 | 244,732,000 |

In the first three years after the enactment of the Canada Health Act, almost $245 million in deductions were taken against federal health transfers to provinces these deductions were refunded when the provinces effectively eliminated the patient charges that led to them.

Frequently Asked Workers Compensation Questions

Q: What is a loss reserve?

A: Insurance companies use loss reserves to evaluate the monetary worth of each claim. A loss reserve is an estimated amount of money that the insurance company sets aside, or earmarks, to pay for a claim. It is usually up to a claims adjuster to set the loss reserve, utilizing judgment and experience from prior claims that are similar. Adequate loss reserves help determine how much money an insurance company must have in surplus to meet current, emerging, and future claims obligations. Insurance companies must report workers compensation loss reserves, along with other claim reporting information, to the WCIRB, as this information is used by the WCIRB to calculate experience modifications. Poor loss reserve practices can put an insurance company in financial jeopardy, as both overestimating and underestimating loss reserves can lead to a misallocation of funds required to pay out claims, and creates an inaccurate picture of an insurers financial obligations. When there are not enough funds reserved to meet future obligations, an insurers solvency will be negatively impacted.

Conversely, if too many funds are reserved, the experience modification may become inflated, leading to the need to unfairly raise the insureds premiums. Since maintaining insurer solvency is of high importance, loss reserves must be as accurate as possible and revised regularly based on the most current claims information available.

Q: What is a minimum premium?

You May Like: Does Health Insurance Cover Chiropractic Services

States Where There Is Still A Penalty

In 2020, theres a penalty for being uninsured if youre in California, DC, Massachusetts, New Jersey, or Rhode Island. The penalty was assessed on 2019 tax returns in DC, Massachusetts, and New Jersey it will start to be assessed on 2020 tax returns in California and Rhode Island. Massachusetts has had an individual mandate penalty since 2006, although they didnt double penalize people who were uninsured between 2014 and 2018 and subject to the federal penalty. But they started assessing penalties again as of 2019, since there is no longer a federal penalty.

Vermont implemented an individual mandate as of 2020, requiring state residents to maintain coverage. But lawmakers designed the program so that there is currently no penalty for non-compliance with the mandate. Instead, the information people report on their state tax return will be used for the state to conduct targeted outreach to help people obtain coverage and understand what financial assistance might be available to offset the cost.

Recommended Reading: Do Starbucks Employees Get Health Insurance

Waiting Periods To Become Eligible For Coverage

Employers may not impose enrollment waiting periods that exceed 90 days for all plans beginning on or after January 1, 2014. Shorter waiting periods are allowed. Coverage must begin no later than the 91st day after the hire date. All calendar days, including weekends and holidays, are counted in determining the 90-day period.

You May Like: How To Choose Right Health Insurance Plan

What Are The Benefits Of Enrollment In Va Health Care

Enrollment in VA health care means you have:

- Medical care rated among the best in the U.S.

- Immediate benefits of health care coverage. Veterans may apply for VA health care enrollment at any time.

- No enrollment fee, monthly premiums, or deductibles. Most Veterans have no out-of-pocket costs. Some Veterans may have to pay small copayments for health care or prescription drugs.

- More than 1,500 places available to get your care. This means your coverage can go with you if you travel or move.

- Met the new requirement to have health care coverage that meets the minimum standard.

Organization Of The Information

Information in the statistical tables is grouped according to the nine subcategories described below.

Registered Persons: Registered persons are the number of residents registered with the health care insurance plans of each province or territory.

Insured Hospital Services within Own Province or Territory: Statistics in this sub-section relate to the provision of insured hospital services to residents in each province or territory, as well as to visitors from other regions of Canada.

Insured Hospital Services Provided to Residents in Another Province or Territory: This sub-section presents out-of-province or out-of-territory insured hospital services that are paid for by a persons home jurisdiction when they travel to other parts of Canada.

Insured Hospital Services Provided Outside Canada: This represents residents hospital costs incurred while travelling outside of Canada that are paid for by their home province or territory.

Insured Physician Services within Own Province or Territory: Statistics in this sub-section relate to the provision of insured physician services to residents in each province or territory, as well as to visitors from other regions of Canada.

Insured Physician Services Provided to Residents in Another Province or Territory: This sub-section reports on physician services that are paid by a jurisdiction to other provinces or territories for their visiting residents.

You May Like: Does Health Insurance Cover Freezing Eggs

Is It Illegal To Go Without Health Insurance

The federal government no longer requires individuals to have health insurance. However, a handful of states and the District of Columbia have instituted a health insurance coverage mandate, and most carry a penalty for not doing so. If you live in California, Massachusetts, New Jersey, Rhode Island, or Washington, D.C., you must have insurance or pay a penalty. Vermonts mandate does not include a penalty for noncompliance.

Young Adults And The Affordable Care Act: Protecting Young Adults And Eliminating Burdens On Families And Businesses

The Affordable Care Act allows young adults to stay on their parents health care plan until age 26. Before the President signed this landmark Act into law, many health plans and issuers could and did in fact remove young adults from their parents policies because of their age, leaving many college graduates and others with no insurance. This helps to explain problems like

- Young adults have the highest rate of uninsured of any age group. About 30% of young adults are uninsured, representing more than one in five of the uninsured. This rate is higher than any other age group, and is three times higher than the uninsured rate among children.

- Young adults have the lowest rate of access to employer-based insurance. As young adults transition into the job market, they often have entry-level jobs, part-time jobs, or jobs in small businesses, and other employment that typically comes without employer-sponsored health insurance. The uninsured rate among employed young adults is one-third higher than older employed adults.

- Young adults health and finances are at risk. Contrary to the myth that young people dont need health insurance, one in six young adults has a chronic illness like cancer, diabetes or asthma. Nearly half of uninsured young adults report problems paying medical bills.

Providing Relief for Young Adults

Access to Insurance: What Young Adults and Parents Need to Do:

New Tax Benefits for Adult Child Coverage

Key elements include:

Coventry Healthcare, Inc.

Read Also: How Much Is Health Insurance For A 60 Year Old

Federal Tax For Not Having Health Coverage Was Eliminated As Of 2019

In late 2017, the Tax Cuts and Jobs Act was enacted. Its a wide-ranging piece of legislation, but one of its provisions was to reduce the tax for not having health coverage to $0, effective after the end of 2018.2

This means that you will no longer have to pay a fine to the federal government if you choose to go without health insurance. The individual mandate itself is still in effect, but there is no longer an enforcement mechanism, so its essentially irrelevant.

The rest of the Affordable Care Act and its many patient protections remain in effect. But the elimination of the tax associated with the individual mandate is the crux of the Texas v. US lawsuit, in which 20 GOP-led states are working to overturn the entire ACA.