Healthcare Must Be Affordable

While affordable generally has different meanings to different people, there is a specific threshold that these health insurance premiums must meet in order to be considered affordable for employees.

For 2022, an employees out-of-pocket annual cost for self-only coverage cannot exceed 9.61% of their annual household income. This requirement, down from 9.83% in 2021, only applies to the lowest-priced plan offered.

Because its impossible to know each employees overall household income, there are a few ways that employers can ensure they meet the requirement. They can determine affordability using three different safe harbors:

- The employees W-2 wages

- The employees pay rate

- The federal poverty level

Using the federal poverty level to calculate the affordability of coverage is preferred thats because coverage is automatically deemed affordable if it meets this threshold.

Your Company May Not Need To Provide Coverage But You May Want To Anyway

When California small business owners call one of our experienced group health insurance brokers, one of the first questions they often ask is whether they need to provide employee health insurance for their workforce. Whether to offer insurance proves an important question to ask, because if a company has a legal obligation to offer coverage to its employees and fails to do so, it faces hefty fines and other burdensome headaches.

Avoiding those fines is why you need to understand Californias small business employee health insurance requirements. And, even if your business is small enough that it doesnt need to provide employee health coverage, there are several reasons other than the law why you may want to consider offering your employees a group health insurance plan.

Small Businesses: Employer Healthcare And The Affordable Care Act

Do employers have to offer health insurance for small businesses? As discussed earlier, small businesses with fewer employees arent obligated to provide health insurance.

Ninety-nine percent of U.S. companies are considered small businesses, which means that a vast majority of employers dont have to offer health coverage.

However, even larger employers with over 50 full-time employees have concluded that even with the penalties levied, its still cheaper to either not to offer full healthcare coverage or to invest in alternative health coverage options, such as a Health Reimbursement Arrangement .

While offering employer-provided health insurance is considered best practice, the fact is the majority of businesses arent required to offer this benefit.

Read Also: Do I Need Health Insurance With Medicare

Finding The Right Solution

Regardless of the health insurance you choose to offer, its most important that you find a solution that works for your business and your budget whether that means including spouses or not, with or without an additional surcharge.

Remember that the law requires businesses employing at least 50 FTEs to offer dependent coverage up to the age of 26, so be sure to work with your employee benefits broker to find affordable healthcare options in your area. And if you do choose to offer family health insurance, its normal, acceptable, and expected for employers to pay for a smaller percentage of the premium than with self-only coverage.

Employer Health Insurance Requirements

As a small business employer, you may be wondering what your health insurance requirements are. What are the criteria your small business needs to fulfill in order to offer health insurance, and what are your insurance obligations toward your employees?

Continue reading to learn about small business employer health insurance contribution and participation requirements.

You May Like: How Much Does Health Insurance Cost For Married Couple

Myth : Employers Are Required To Give Equal Benefits To All Employees

Busted. It’s okay to provide employees with different health insurance benefits as long as its based on work-related characteristics things like tenure, full- or part-time status, exempt/nonexempt status.

In fact, companies in competitive industries often base benefits on length of service wherein higher earning, long term employees may pay a smaller contribution towards their health benefits than entry-level employees, who shoulder a disproportionate amount of their health insurance costs.

What Do Employers Typically Contribute To Health Insurance

While many employers choose to offer spousal and family health insurance, most of them opt to pay a smaller portion of the premium. According to the 2017 Kaiser Family Foundations Health Benefits Survey, employers contribute an average of 82 percent of the premium for self-only coverage, but only 70 percent of the premium for family coverage.

The study doesnt get into the breakdown of employer versus employee contributions for employee plus spouse, nor employee plus dependent coverage, but its also common for employers to contribute a smaller percentage of those premiums as well. If youre looking for an average contribution to those plans, its a safe bet to stick between 70 and 82 percent.

Don’t Miss: How To Add Dependent To Health Insurance

Do Small Businesses Have To Provide Health Insurance

Short answer: it depends. In 2020, small business owners with fewer than 50 employees are not generally required by the ACA to offer health insurance. Employers with more than 50 full time employees are not technically required to offer insurance, but they must pay fines of $3,860 per employee per year in 2020 if they dont offer a health plan. To avoid fines under this law, coverage must extend to an employees dependents too, up until they reach 26 years of age.

Note that the 50-employee threshold is just the ACAs limit for when for employers must begin offering insurance. Its also possible for a smaller employer to accidentally stumble into a requirement to offer employee benefits.

For example, if you include benefits as part of an employment offer, you could be held to the terms of that offer if you try to renege. Similarly, if you extend benefits to some employees but not others, a requirement to cover all your employees could arise. If you have any questions about these gray areas, its probably best to check with an employment law specialist.

What Can I Do If I Am Experiencing Issues With An Insurance Carrier

Our department is tasked with overseeing the insurance industry in our state. Our goal is to evaluate a carrier or agents compliance with policy provisions and Missouri insurance laws. One of the ways we accomplish this goal is through our consumer complaint process. If a consumer is experiencing an issue with an insurance carrier or an insurance agent, and the issue is related to a product or agent subject to state regulation, the consumer may file a complaint with our department. You may file a complaint by downloading our Consumer Complaint Form and returning it to our office, or by filing a complaint online through our website. To file a written or online complaint, or to obtain additional information regarding our complaint process , click HERE. If your question is of a general nature, or you are seeking some other type of insurance-related assistance, you may contact our Consumer Hotline at 800-726-7390.

Read Also: How To Get Your Own Health Insurance

Financial Benefits For Employers That Offer Health Insurance

Not only do you make your employees happier by offering health insurance, but it benefits you as personally too. First, you can add yourself to the group plan and make sure youre covered .

In addition, tax credits and deductions can make offering health insurance even more of a win. The Small Business Help Options Program allows for tax credits up to 50% of the contributions paid towards your employee premiums, depending on the size of your company. And, in certain cases, you can deduct health insurance premiums that you pay as the business owner. You should talk to a tax attorney or financial advisor to see if youre eligible for any savings.

Last but not least, you can withhold insurance premiums as pre-tax deductions, lowering your employees taxable income and the related FICA taxes that you both have to pay. Its a win-win!

What Does The Affordable Care Act Require For Businesses

Its important to understand that there are no laws requiring organizations to offer employees health coverage. However, theAffordable Care Act requires businesses with 50 or more full-time employees to provide health insurance coverage or receive a penalty of $2750 annually per employee after your first 30 employees which are exempt.

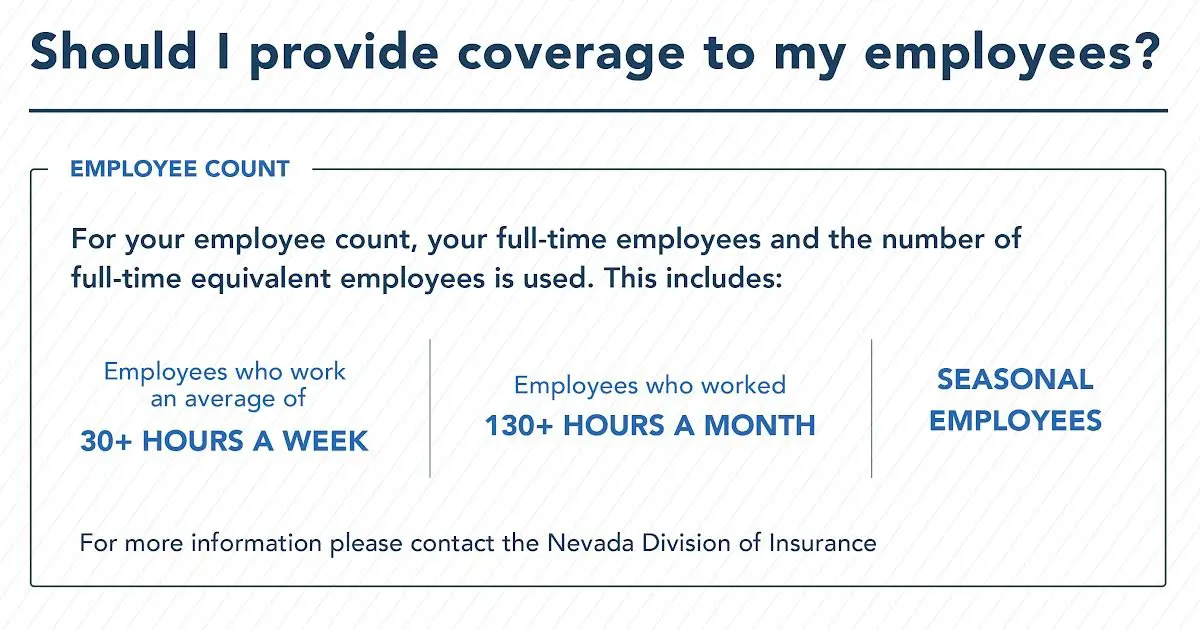

For most organizations, its straightforward to determine the number of full-time employees. However, in organizations with several seasonal or part-time employees, the calculation can be a little complex. The health coverage is offered on an annual basis, which means if your company had more than 50 full-time equivalent employees in the previous year, youre rendered a large employer.

To avoid paying the $2750 penalty per employee after your first 30 employees which are exempt, employers with more than 50 employees should meet health care coverage and affordability requirements. The coverage should also offer health benefits to the employees dependents below 26. However, the coverage doesnt have to extend to the spouses or stepchildren of the employee.

Read Also: Do You Have To Have Health Insurance In 2020

If You Have Fewer Than 50 Full Time Equivalents As An Employer You Do Notneed To Offer Group Health Insurance

Before you breath a sign of relief, lets at some reasons why you may WANT tooffer health insurance to employees if under 50.

The vast majority of companies that offer group health benefits do so notbecause they have to.

They see the benefit in doing so and there are tricks to keep the costs down.

Before we get into the requirements for 50+ employee companies, lets look atthe key reasons most companies offer coverage.

Its tax deductible!

This is a huge advantage to group health coverage. The employer can write offthe premiums paid.

With a POP 125, employees can pay with pre-tax money for their share and theemployer can save on payroll tax.

You can generally cannot deduct employer contribution towards an employeesindividual health plans.

In fact, there can be huge penalties from the IRS for doing so.

$100/day/employee up to $36,500 per year.

Its definitely a message from the IRS that they mean business.

You May Like: Whats The Penalty For Not Having Health Insurance In California

Are Employers Required To Offer Small Business Health Insurance In 2021

While the Affordable Care Act requires employers of 50 or more employees and full-time equivalent employees to offer affordable group health insurance that includes essential benefits or pay a penalty, the ACA never required small business owners to provide group health insurance to their employees. According to the ACA requirements for employers, business owners with fewer than 50 full-time and full-time equivalent employees are considered small businesses. So, if your company falls within the small business classification, you have the option to offer group health insurance or not.

Don’t Miss: What Does Tax Credit For Health Insurance Mean

Do Small Businesses Have To Offer Health Insurance A Guide To Employee Health Benefits

The health insurance mandates of the Affordable Care Act have changed since President Donald Trump took office. Many small business owners are confused and have questions about whether or not they have to offer health insurance to their employees. In 2018, small businesses with fewer than fifty full-time equivalent employees are not required by law to provide health insurance to their workers.

These topics will show you how to determine if you need to provide health insurance and walk you through your health benefits options:

Medical Loss Ratio Rebates

Insurance companies must generally spend at least 80% of premium dollars on medical care. Insurance companies that don’t meet this requirement must provide rebates to policyholders usually an employer who provides a group health plan. Employers who get these premium rebates must allocate the rebate properly. Learn more about federal tax treatment of Medical Loss Ratio rebates from the IRS.

Recommended Reading: How Much Will Health Insurance Cost Me In Retirement

Best Overall: Blue Cross Blue Shield

Blue Cross Blue Shield

- No. Policy Types: Varies from state to state

- No. States Available: 50

As one of the largest health insurance providers in the country, Blue Cross Blue Shield offers ample coverage options for most small business owners. It also offers data-driven healthcare solutions to enable cost-effective options for many companies. It’s the insurance company for those who need flexible options.

-

Limited health plan details on BCBS website

-

Must contact a sales representative

Blue Cross Blue Shield is a nationwide association of 34 independent insurance companies. The association has been around since 1929, and most of its companies have received high ratings from AM Best. The companies earned overall ratings of 2.5 to 4.5 on a scale of 1 to 5 from the National Committee for Quality Assurance, a nonprofit organization that measures and accredits health plans.

BCBS companies also ranked highest on eight of the 21 award-eligible regions on the J.D. Power 2021 U.S. Commercial Member Health Plan Study.

BCBS provides coverage in all 50 states, plus Washington, D.C. and Puerto Rico, and works with more than 90% of the nation’s hospitals and doctors. The company also underwrites international coverage in more than 190 countries through BCBS Global. The company’s large network seeds the data for innovative healthcare solutionslike the ability to compare costs for more than 1,600 procedures.

It Saves You Money At Tax Time

Employer health-care premiums are tax exempt, which can greatly reduce or even erase your tax obligations. Your contributions are also tax deductible, meaning you can write off the cost of employer-sponsored contributions during tax season. By offering employee health insurance, you may also qualify for the Small Business Health Care Tax Credit.

Don’t Miss: Does Health Insurance Cover Hearing Tests

Businesses With 50 Or More Employees

The ACAs employer shared responsibility provisions require that applicable large employers must offer a health plan meeting minimum essential coverage requirements or make an employer shared responsibility payment to the IRS. This includes coverage for employee dependents, as well.

An ALE is any employer with an average of 50 or more full-time employees per year or the equivalent. An employee is considered full time if they work at least 30 hours per week or 130 hours per month. FTEs are computed by taking the total number of hours of all part-time employees for a month and dividing the total by 120.

Employers must provide a summary of benefits and coverage form, which explains the details of the health insurance plan, including the deductible, the health insurance premium costs, and other information. Moreover, new employees must be notified of medical plan options within 90 days of hire and have the option to change plans each year during an open enrollment period.

Do Small Businesses Have To Provide Health Insurance Under The Aca

Small businesses that have fewer than 50 full-time employees do not have to provide health insurance under the ACA, which is sometimes referred to as Obamacare.

Since most small businesses have under 50 employees, this means most are exempt. If you have more than 50 full-time employees, you are required by law to provide health insurance.

The caveat to this is that laws do change, especially as political administrations change, so its important to have measures in place to keep up with the latest regulations. This could mean subscribing to industry publications and newsletters, consulting with legal experts, or even reading your HR software vendors blogs. The HR software Workday even provides training on dealing with the ACA.

Workdays free training can help you get up to speed with the ACA. Image source: Author

You May Like: How Much Is Health Insurance In Arizona

The Sooner The Better

If you are a startup or a small business without health insurance benefits, now is the time to find a plan if you have the budget. The longer you wait, the greater the chance you will lose good talent and hear office mumbling from people who wished you offered health benefits. To keep morale high and build your brand reputation, health insurance benefits have to be a priority.

Offering health benefits may depend on the size of your company. If you only have a handful of employees, you may not be ready to jump in just yet, preferring to grow a bit first. Just remember that benefits have become an expectation, even for employees at the smallest companies. Some companies view their plan as another hire, allocating part of a budget they would spend on a new employee for a health insurance plan to cover all employees. Startups often build in the cost of a benefits package into their financial plan they fund from investors.

Contact An Experienced Employment Law Attorney Today

If you believe that your employer has failed to provide required health coverage due to discrimination, your employment classification, or because an employment contract guaranteed you this right, an experienced employment law attorney can help. Legal issues surrounding employee benefits constitute an extremely complex, and constantly evolving area of law, and it is in your best interest to obtain legal counsel if you believe your rights have been violated in any way.

Read Also: Do Starbucks Employees Get Health Insurance

Also Check: What Is The Best Health Insurance In Texas

How Do Hras And Health Stipends Compare

Both HRAs and health stipends allow your employees to purchase their own individual health insurance coverage from a health insurance marketplace. Employees can then request a reimbursement for their insurance premiums. This allows your employees to get the coverage that works best for them.

The most significant difference between an HRA and a health stipend is its taxability. While HRAs are tax-free for both employers and employees, a health stipend is taxable. If you decide to offer a health stipend, your small business will pay payroll taxes on the reimbursement amount, while employees will have to pay income taxes on the amount received.

This makes health stipends an excellent option for organizations with employees who receive premium tax credits, as a health stipend doesnt impact APTC eligibility.