Do You Have To Have Health Insurance

The federal government no longer penalizes you for not having health insurance. But a handful of states have an individual mandate that requires residents to have coverage.

When the Affordable Care Act was passed, one of the key parts of the legislature was the individual shared responsibility provision, known more colloquially as the individual mandate. This provision was the closest the United States came to requiring universal health coverage.

Connect With A Navigator

Questions about health insurance? Health insurance navigators are ready to help. Find a location for in-person appointments this open enrollment season.

To schedule an appointment, call 980-256-3782 or visit ncnavigator.net. Walk-ins are welcome at Charlotte Center for Legal Advocacy on Wednesdays and Sundays.

What If My Employer Does Not Have 20 Employees But I Still Want To Explore The Option Of Cobra Coverage

COBRA rules only apply to employers with 20 or more persons, but many states have similar requirements known as Mini-COBRA laws. Employees separating from service from smaller employers should check to see what options are available to them under their state law. These rules can vary widely from state to state.

You May Like: Can You Opt Out Of Health Insurance At Any Time

If You Leave Your Job

You can usually continue your coverage temporarily under COBRA .

Learn more: Need health insurance? How to find a new health plan now.

What is COBRA?

COBRA is a federal law that lets employees continue their health coverage for a period of time after they leave their job. It applies to coverage from employers with 20 or more employees. It doesnt apply to plans offered by the federal government or some church-related groups.

You can get COBRA coverage if:

- You leave your job for any reason other than gross misconduct. Gross misconduct usually means doing something harmful to others, reckless, or illegal.

- You lose your coverage at work because you switch from working full-time to part-time.

If your family was on your health plan, you can continue their coverage under COBRA. Your spouse and children also can continue their coverage if you go on Medicare, you and your spouse divorce, or you die. They must have been on your plan for one year or be younger than 1 year old. Their coverage will end if they get other coverage, dont pay the premiums, or your employer stops offering health insurance.

You have 60 days after you leave your job to decide whether you want COBRA. You must tell your employer in writing that you want it. If you continue your coverage under COBRA, you must pay the premiums yourself. Your employer doesnt have to pay any of your premiums.

For more information about COBRA, call the Employee Benefits Security Administration at 866-444-EBSA .

Is Legal Insurance Worth Having

Like any insurance, we cant say for sure whether this is a worthy expense for you. That depends on your circumstances and needs.

The decision to buy insurance or not is always a gamble. If you dont buy it, youre betting on not incurring costs greater than the premiums youd have paid. If you do buy it, the insurance company is betting on you not incurring costs greater than the premiums you pay.

Some benefits of having legal insurance include:

- Peace of mind. As with any insurance, having it might simply relieve some stress. You know you can pop in and get services when you need them, so the cost of premiums could be worth it even if you never use it.

- Employer benefit. If you can get legal insurance with the premiums covered by your employer, you dont take on the risk signing up.

- Spread out the costs. Even if a legal plan doesnt save you money in the long run, you could benefit from having your costs spread out. Paying $100 to $300 per year might be more feasible for you than paying $5,000 at once when a case comes up.

Some drawbacks of buying legal insurance include:

Recommended Reading: Does Health Insurance Cover Std Testing

Types Of Health Plans

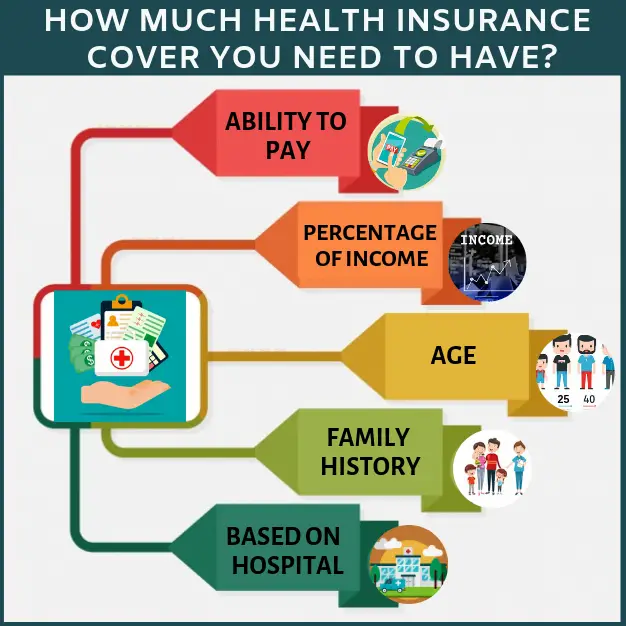

There are four types of major medical health plans in Texas. Major medical plans cover a broad range of health care services. The four types are:

- preferred provider plans.

- point-of-service plans.

All four types are managed care plans. This means they contract with doctors and other health care providers to treat their members at discounted rates. These providers make up a plans network. Managed care plans limit your choice of doctors or encourage you to use doctors in their networks. In return, you pay less out of pocket for your care. The plans differ in the extent to which you can use doctors outside the network and whether you must have a doctor to oversee your care.

Understanding The Health Care Reform

Both houses of Congress decided in 2017 to repeal the shared responsibility penalty, effective in 2019, as a part of the tax reconciliation act. The last year ACAs shared responsibility tax penalty had to be paid to the federal government was on tax returns for the tax year 2018. The 2018 open enrollment period, during which people bought health insurance to cover them for 2019, was the first time in a couple of years that taxpayers did not have to worry about getting an ACA-compliant plan with minimum essential coverage, or else face a tax penalty the following year.

So, is it illegal to not have health insurance since there is no longer a fine? On a federal level, having health insurance is no longer a legal requirement. However, a handful of states in the U.S. require citizens to obtain coverage or pay a tax penalty.

Recommended Reading: How Much To Budget For Health Insurance In Retirement

Is There A Tax Penalty For Having A Gap In My Insurance

A short gap in coverage means that you were uninsured for less than three consecutive months. Even in states and districts that require health insurance, including Vermont, California, New Jersey, Rhode Island, Massachusetts, and Washington D.C., you will likely not be subject to a fine. However, you must accurately document this gap on your state taxes, and keep in mind that only the first short gap in a year will allow you to have no tax penalties. If this occurs again in future years, you would need to file another claim and get exemption again.

No Mandatory Health Insurance: Advantages

The primary upside to health insurance no longer being mandatory at the federal level is the money you dont have to spend on premiums that remains in your pocket. That could be helpful if youre trying to pay off student loans or save money toward a down payment on a home.

Of course, if your employer offers some type of health insurance coverage as part of your benefits package, you may be able to get affordable coverage without having to shop around for it.

Recommended Reading: How Much Aetna Health Insurance Cost

How Does A Legal Insurance Plan Work

How your legal plan works depends on the policies of your insurance provider.

Depending on your policy, you might receive your coverage in the form of straight-up payment , reimbursement or as a discount on legal services.

Some legal insurance providers even provide services themselves thats usually in the form of a law firm or legal services company offering prepaid legal plans.

Most legal plans come with an annual premium or semi-annual premium and cost around $100 to $300 per year.

An employer, union or other membership association might offer a group legal plan as part of your benefits package, similar to health or disability insurance. In that case, how much you pay depends on how much of the premium your employer or association covers.

When you need legal services, you can tap into attorneys in your insurance network for advice and representation. Some things youll encounter:

When Is The Initial Enrollment Period For Medicare

You are eligible to enroll in Medicare when you reach 65 or have a qualifying disability. As you approach 65, you will be able to enroll during a 7-month Initial Enrollment Period that begins at the start of the month three months before the month you turn 65 and ends at the end of the month three months after the month you turn 65.

Also Check: Do Physical Therapists Get Health Insurance

Why You May Still Need Health Insurance

There are many reasons why its important to maintain health insurance. A comprehensive health insurance plan can cover most or all medical and hospital expenses if youre injured, sick or require an operation. It can also offset costs for preventative care like screenings, check-ups and vaccines that are essential for maintaining your health long-term.

A comprehensive health insurance plan can protect you from shouldering thousands of dollars in fees and potential debt. Some types of health insurance pay qualifying costs upfront others will offer you reimbursement. Either way, youre saving a significant amount of money in the event of an expensive emergency, accident or unexpected diagnosis.

Knowing that you or your loved ones wont go bankrupt from receiving the care you may, quite literally, need to survive is a peace of mind only having a good health insurance plan can bring.

Can A New Spouse Add Our Children To Their Health Insurance

A stepchild is eligible to be covered under a new spouses healthcare plan.

If coverage provides benefits for children, federal law states that an employee must be given at least 30 days to enroll a new dependent. Some employers may be much more generous with an enrollment period.

A biological child, adopted child, stepchild or foster child can be eligible to be a part of a new spouses healthcare plan up to age 26.

Read Also: How Much Is Aetna Student Health Insurance

Enroll In Medicaid If You Qualify

Medicaid is a state and federally-run program responsible for providing low-income individuals, of any age, with health insurance. Depending on the size of your household and your total estimated income for the year, you can receive either free or low-cost health coverage Medicaid at any point during the year. The exact services available under Medicaid depend on your state, but all states guarantee essential health care coverage. You can apply for Medicaid through the Health Insurance Marketplace or your states Medicaid agency.

Understanding The Rules For Health Insurance Can Be Confusing

The Affordable Care Act , signed into law in 2010, was designed to make health insurance coverage more affordable for Americans through the creation of tax subsidies while also opening up Medicaid eligibility to more low-income individuals and families. The ACA effectively made having health insurance mandatorynot having it meant you would incur a tax penalty. But what about now? What is the penalty for not having health insurance?

You May Like: Is It Mandatory To Have Health Insurance

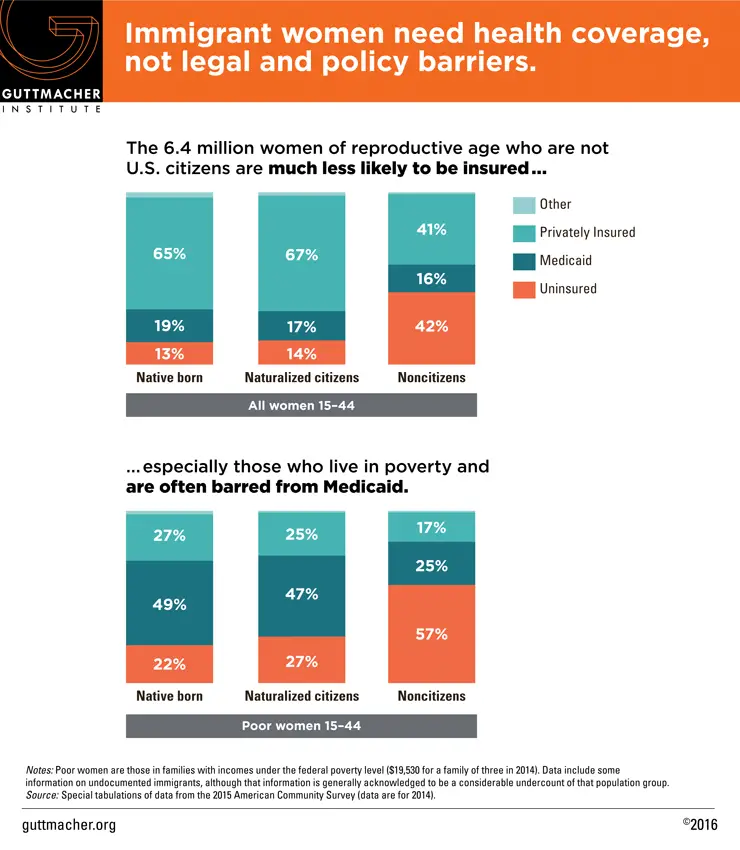

How Does Not Having Coverage Affect Health Care Access

Health insurance makes a difference in whether and when people get necessary medical care, where they get their care, and ultimately, how healthy they are. Uninsured adults are far more likely than those with insurance to postpone health care or forgo it altogether. The consequences can be severe, particularly when preventable conditions or chronic diseases go undetected.

Key Details:

- Studies repeatedly demonstrate that the uninsured are less likely than those with insurance to receive preventive care and services for major health conditions and chronic diseases.8,9,10,11 More than two in five nonelderly uninsured adults reported not seeing a doctor or health care professional in the past 12 months. Three in ten nonelderly adults without coverage said that they went without needed care in the past year because of cost compared to 5.3% of adults with private coverage and 9.5% of adults with public coverage. Part of the reason for poor access among the uninsured is that many do not have a regular place to go when they are sick or need medical advice .

Figure 8: Barriers to Health Care among Nonelderly Adults by Insurance Status, 2019

- More than one in ten uninsured children went without needed care due to cost in 2019 compared to less than 1% of children with private insurance. Furthermore, one in five uninsured children had not seen a doctor in the past year compared to 3.5% for both children with public and private coverage .

Health Insurance Coverage Imposed By State

In many cases, the answer to the question, Is health insurance mandatory? varies based on where you live. When researching whether or not health insurance is required, you need to look at the laws in your specific state.

For example, the penalty in California is at least $800 for adults and $400 for children as of 2022. So, a couple with two children in California could face a penalty of $2,400 for not having health insurance. This is slightly less than the cost of health insurance nationwide, but it is close to the nationwide average.

California is not the only state that mandates health insurance. If you live in any of the following states, you must have health insurance or pay a fine if you dont have coverage.

Read Also: How Much Is Health Insurance In Delaware

Whats Covered & Whats Not

What your legal insurance covers depends on the terms of your policy, so get familiar with it before buying in.

Legal insurance plans typically offer coverage for the cost of consultations, advice, legal assistance and representation, and preparation of legal documents. They cover matters like:

- Estate planning

- Employment disputes

- Employment agreements

Note that an employer-sponsored plan probably wont cover disputes with your employer .

Legal insurance plans dont typically cover criminal defense.

Sometimes legal insurance coverage is included or available as an add-on with another insurance policy, like homeowners, renters or auto insurance.

In that case, it most likely only covers legal matters related to whatever the main policy covers. For example, a legal insurance add-on to homeowners insurance likely covers things like contractor disputes, but not divorce or bankruptcy.

You cant typically get coverage for something thats already happening say, youre in the middle of an adoption and realize the legal costs too late. But legal insurance often covers unsurprising expenses you can expect to incur in the future, like estate planning and contracts.

Exemptions From The Insurance Requirement

Though most people are required to have health insurance, several groups are exempt from the requirement to obtain coverage, including but not limited to:

- people who are uninsured for less than 3 months of the year

- people who would have to pay more than 8% of their income for health insurance

- people with incomes below the threshold required for filing taxes.

- members of a federally recognized tribe or anyone eligible for services through an Indian Health Services provider

- members of a recognized health care sharing ministry

- members of a recognized religious sect with religious objections to insurance, including Social Security and Medicare

- people who are incarcerated, and not awaiting the disposition of charges

- people who are not lawfully present in the U.S.

- people who qualify for a hardship exemption

Coloradans who want to apply for an exemption should submit the appropriate form to the federal government to receive an exemption code. Then Coloradans will need to provide the exemption code into the Connect for Health Colorado website to gain access to catastrophic health plan options.

Get more information about how to apply for an exemption to the individual mandate in Colorado.

Also Check: A Guaranteed Renewable Health Insurance Policy Allows The

How To Enroll And Get Answers To Your Questions

You can learn more about and apply for ACA health care coverage in several ways.

-

Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or you’ll be directed to your state’s health insurance marketplace website. vary by state.

-

Find a local center to apply or ask questions in person.

-

Download an application form to apply by mail

Find the answers to common ACA questions about submitting documents, getting and changing coverage, your total costs for health care, tax options, and more.

What Is The Affordable Care Act

The Obama administration came up with a comprehensive Affordable Care Act generally known as Obamacare to address healthcare concerns of the common public. It was promulgated on March 23, 2010. If you had been asking the question is it illegal to not have health insurance back then, that yes at that time it was illegal. But not today.

Obamacare ensures that Americans have access to good, affordable health care facilities and medications. This was done to control the cost factors related to such situations.

Also Check: What Does A Good Health Insurance Plan Look Like

District Of Columbia Individual Mandate

Effective: January 1, 2019

State Health Care Services:DC Health Link

Known officially as the Washington D.C. Individual Taxpayer Health Insurance Responsibility Requirement, the mandate requires all residents to have health insurance coverage.

Uninsured residents must pay whatever fine is greater: up to $695 per adult and $347.50 per child, or 2.5% of their family income over the federal tax filing threshold. There is a penalty cap of $3,258 per person for households of more than one person. That means a five-person household has a $16,290 penalty cap.

Exemptions, claimed on your tax return or through DC Health Link, are available.

Affordable Care Acts Coverage Mandate

Under the ACA, also called Obamacare, Americans who were not otherwise eligible for an exemption were required to have health insurance coverage for themselves and their families. Failure to have minimum health insurance triggered a tax penalty. At the same time, the ACA allowed for the creation of a premium tax credit to help Americans offset some of the cost of getting health insurance through the Health Insurance Marketplace.

This rule changed in January 2019, when the tax penalty mandate for health insurance was eliminated. While the ACA technically still exists, Americans who choose not to maintain health insurance for themselves or their family members in 2019 and beyond wont be penalized at tax time. Its estimated that as many as four million Americans will choose not to have health insurance coverage this year as a result of the penalty being eliminated.

As a result of the American Rescue Plan Act of 2021, all taxpayers with insurance bought on the ACA Marketplace are now eligible for the ACA premium tax credit. Previously, filers were ineligible if their income exceeded 400% of the federal poverty line.

Read Also: What Is The Penalty For No Health Insurance In California